Liberty Mutual vs. Travelers Auto Insurance in 2025 (Head-to-Head Review)

Liberty Mutual vs. Travelers auto insurance rates vary—Liberty Mutual costs $96 monthly, while Travelers is cheaper at $53. Travelers is best for teen and high-risk drivers, while Liberty Mutual offers more discounts. RightTrack customizes premiums, and IntelliDrive rewards safe driving behavior with savings.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Mar 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,792 reviews

3,792 reviewsCompany Facts

Min Coverage

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min Coverage

A.M. Best

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsLiberty Mutual vs. Travelers auto insurance differs in pricing, discounts, and telematics programs, impacting affordability based on driver profiles.

Liberty Mutual’s RightTrack monitors driving habits, offering up to 30% off, while Travelers’ IntelliDrive provides up to 30% savings for safe drivers.

Liberty Mutual Vs. Travelers Auto Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 4.2 | 4.3 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.3 | 4.5 |

| Company Reputation | 4.0 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.1 | 4.3 |

| Customer Satisfaction | 2.0 | 2.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.3 | 4.1 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 5.0 | 4.1 |

| Savings Potential | 4.5 | 4.4 |

| Liberty Mutual | Travelers |

Travelers is cheaper for teen drivers and DUI cases, while Liberty Mutual offers 17+ discounts, including bundling and military savings.

Liberty Mutual provides a better range of add-on coverages, whereas Travelers excels in affordability across multiple demographics.

- RightTrack offers up to 30% savings, while IntelliDrive gives 30% off

- Travelers is cheaper for DUI and teen drivers; Liberty Mutual has 17+ discounts

- RightTrack and IntelliDrive provide up to 30% savings for safe drivers

These distinctions help drivers select the best coverage for their financial and driving needs. See what local auto insurance prices look like by using our free comparison tool.

Age and Gender Impact on Liberty Mutual vs. Travelers Rates

The Liberty Mutual vs. Travelers auto insurance comparison shows notable price differences by age. Liberty Mutual offers more discounts, but Travelers Insurance Company has lower base rates for most groups. Teen drivers pay the highest premiums, with 16-year-old males at $1,121 with Liberty Mutual Insurance Company and $1,298 with Travelers, and females at $1,031 and $1,026, respectively.

Liberty Mutual vs. Travelers Full Coverage Auto Insurance Monthly Rates

| Age & Gender |  | |

|---|---|---|

| 16-Year-Old Female | $1,031 | $1,026 |

| 16-Year-Old Male | $1,121 | $1,298 |

| 30-Year-Old Female | $249 | $142 |

| 30-Year-Old Male | $285 | $154 |

| 45-Year-Old Female | $244 | $139 |

| 45-Year-Old Male | $248 | $249 |

| 60-Year-Old Female | $211 | $127 |

| 60-Year-Old Male | $227 | $129 |

Travelers is cheaper for 30-year-olds, with females at $142 and males at $154, while Liberty Mutual charges $249 and $285. At 45, male rates are nearly the same, $248 with Liberty Mutual Insurance and $249 with Travelers, but females save $139 at Travelers versus $244 at Liberty Mutual. 60-year-olds get the best rates with Travelers, with females at $127 and males at $129, compared to $211 and $227 from Liberty Mutual.

Liberty Mutual offers more discounts, including bundling, military, and RightTrack, which cuts rates by up to 30%. Travelers Insurance Company provides lower base rates and IntelliDrive, offering a 30% discount for safe drivers. While Travelers is cheaper for most, Liberty Mutual’s discounts can make it competitive.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Liberty Mutual vs. Travelers: Comparing Auto Insurance Discounts

Among the discounts offered by Travelers Insurance vs. Liberty Mutual auto insurance, Liberty Mutual offers bigger percentage savings in more areas, while Travelers provides better benefits in some areas. Knowing these differences helps drivers save the most money possible based on how they drive and their qualifications.

Auto Insurance Discounts from Liberty Mutual vs. Travelers

| Discount Type |  | |

|---|---|---|

| Accident-Free | 20% | 13% |

| Anti-Theft | 35% | 15% |

| Auto-Pay | 5% | 8% |

| Bundling | 25% | 13% |

| Claims-Free | 8% | 13% |

| Defensive Driving | 10% | 20% |

| Garaging Discount | 11% | 9% |

| Good Driver | 20% | 10% |

| Good Student | 15% | 8% |

| Low Mileage | 30% | 20% |

| Loyalty | 10% | 9% |

| Membership | 10% | 10% |

| Multi-Car | 25% | 8% |

| Paperless | 3% | 3% |

| Usage-Based Insurance (UBI) | 30% | 30% |

Liberty Mutual offers a 25% bundling discount, higher than Travelers’ 13%. Safe drivers save 20% with Liberty Mutual, while Travelers offers 10% but doubles Liberty Mutual’s defensive driving discount at 20%. Low-mileage drivers get 30% off with Liberty Mutual, versus 20% with Travelers. Anti-theft savings favor Liberty Mutual at 35%, while Travelers provides 15%. Both insurers offer 30% off for usage-based insurance.

Drivers with poor credit can still find affordable coverage by focusing on insurers that weigh credit history less heavily in their rate calculations.Michelle Robbins Licensed Insurance Agent

Despite these differences, both insurers offer 30% discounts for usage-based insurance (UBI)—Liberty Mutual’s RightTrack and Travelers’ IntelliDrive—rewarding safe driving behaviors with significant savings. While Travelers offers some competitive discounts, Liberty Mutual’s broader savings options make it the better choice for drivers looking to stack multiple discounts.

Choosing the Best Auto Insurance for High-Risk Drivers

Driving history plays a major role in Liberty Mutual vs. Travelers auto insurance rates, with substantial differences for drivers with violations. While their premiums for clean records are nearly identical, Travelers Insurance consistently offers lower rates for those with infractions.

Liberty Mutual Vs. Travelers Full Coverage Car Insurance Monthly Rates by Driving Record

| Driving Record |  | |

|---|---|---|

| Clean Record | $248 | $249 |

| Not-At-Fault Accident | $335 | $199 |

| Speeding Ticket | $302 | $192 |

| DUI/DWI | $447 | $294 |

For drivers with a clean record, Liberty Mutual charges $248, while Travelers is slightly higher at $249. However, after a not-at-fault accident, Liberty Mutual’s rate jumps to $335, while Travelers remains much lower at $199, saving policyholders $136 per month. Speeding violations result in Liberty Mutual increasing rates to $302, whereas Travelers only raises it to $192, making Travelers $110 cheaper.

The most significant difference appears for drivers with a DUI/DWI, where Liberty Mutual car insurance charges $447 per month, while Travelers offers a much lower $294 rate, a $153 difference. These rate variations highlight Travelers Insurance as the more budget-friendly option for auto insurance for high-risk drivers, while Liberty Mutual Insurance Company penalizes violations more severely.

Liberty Mutual vs. Travelers: Credit Score Impact on Insurance Rates

Your credit score plays a big role in Liberty Mutual vs. Travelers auto insurance rates, and the difference can be huge. Travelers Insurance Company consistently offers lower rates, while Liberty Mutual tends to charge more—especially for drivers with lower credit scores. Choosing the right insurer can help lower your auto insurance rates significantly.

Full Coverage Insurance Monthly Rates by Credit: Liberty Mutual vs. Travelers

| Credit Score |  | |

|---|---|---|

| Good Credit (670-739) | $366 | $338 |

| Fair Credit (580-669) | $467 | $362 |

| Bad Credit (300-579) | $734 | $430 |

Drivers with good credit pay $366 per month with Liberty Mutual Insurance Company, while Travelers offers a lower rate of $338, saving policyholders $28 monthly. For fair credit, Liberty Mutual auto insurance increases rates to $467, whereas Travelers Insurance Company remains more affordable at $362, a $105 difference.

Poor credit results in the steepest rate hike, as Liberty Mutual charges $734 per month, while Travelers only raises it to $430. Drivers with lower credit save $304 per month with Travelers. These figures indicate that Travelers Insurance is the better option for drivers with fair or poor credit, while Liberty Mutual remains costly across all credit categories.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Liberty Mutual vs. Travelers: Comparing Auto Insurance Coverage

Extensive auto insurance coverage offered by Liberty Mutual and Travelers is meant to cover everything from regular mishaps to specific driving demands. Every company lets policyholders customize protection with add-ons that improve basic coverage.

Auto Insurance Coverage Offered by Liberty Mutual & Travelers

| Coverage Type |  | |

|---|---|---|

| Liability | ✅ | ✅ |

| Collision | ✅ | ✅ |

| Comprehensive | ✅ | ✅ |

| Uninsured/Underinsured Motorist | ✅ | ✅ |

| Medical Payments (MedPay) | ✅ | ✅ |

| Personal Injury Protection (PIP) | ✅ | ✅ |

| Roadside Assistance | ✅ | ✅ |

| Rental Car Reimbursement | ✅ | ✅ |

| Rideshare Insurance | ✅ | ✅ |

| Gap Insurance | ✅ | ✅ |

| Custom Equipment Coverage | ✅ | ✅ |

| New Car Replacement | ✅ | ❌ |

| Better Car Replacement™ | ✅ | ❌ |

Liberty Mutual offers standout protection for newer vehicles, making it a strong choice for drivers concerned with full-value replacement. Travelers emphasizes savings and flexibility through usage-based tracking and rate protection features, appealing to budget-focused and cautious drivers.

- New Car Replacement: Replace a totaled car with a brand-new version of the same model.

- Better Car Replacement: Upgrades you to a newer vehicle with fewer miles after a total loss.

- Gap Insurance: Covers the discrepancy between the value of your car and the amount owed on your loan.

- Rideshare Coverage: Protects drivers when working for rideshare companies like Uber or Lyft.

- Custom Equipment Coverage: Covers non-factory parts like sound systems, rims, or performance upgrades.

Liberty Mutual stands out with added protection for newer vehicles, while Travelers shines for drivers looking to save with safe habits. If you prioritize high-value coverage after a big loss, Liberty Mutual fits best. For those who want types of auto insurance that adapt to their driving and budget, Travelers is a strong alternative.

Liberty Mutual vs. Travelers: Customer Satisfaction and Ratings

When choosing between Liberty Mutual vs. Travelers auto insurance, customer reviews, and business ratings can tell you a lot about overall satisfaction, financial strength, and complaint records. Both companies are among the best auto insurance companies, but key differences affect how they rank.

Insurance Business Ratings & Consumer Reviews: Liberty Mutual Vs. Travelers

| Agency |  | |

|---|---|---|

| Score: 717 / 1,000 Above Avg. Satisfaction | Score: 684 / 1,000 Above Avg. Satisfaction |

|

| Score: A- Good Business Practices | Score: A Good Business Practices |

|

| Score: A- Good Business Practices | Score: 76/100 Good Customer Feedback |

|

| Score: 0.55 Fewer Complaints Than Avg. | Score: 1.12 Avg. Complaints |

|

| Score: A Excellent Financial Strength | Score: A++ Superior Financial Strength |

Liberty Mutual Insurance scores 717/1,000 on J.D. Power, slightly outperforming Travelers Insurance at 684/1,000, suggesting higher customer satisfaction. However, Travelers holds a stronger A++ rating from A.M. Best, compared to Liberty Mutual’s A rating, indicating superior financial stability. Consumer Reports rates Travelers slightly higher at 76/100, while Liberty Mutual follows at 74/100, showing a minor difference in consumer feedback.

Complaint records favor Liberty Mutual, with a 0.55 complaint index, significantly lower than Travelers’ 1.12, meaning Travelers Insurance Company receives more complaints than average. Although both insurers have good reputations, Travelers Insurance has the strongest finances and Liberty Mutual Group has the best customer satisfaction and less complaints.

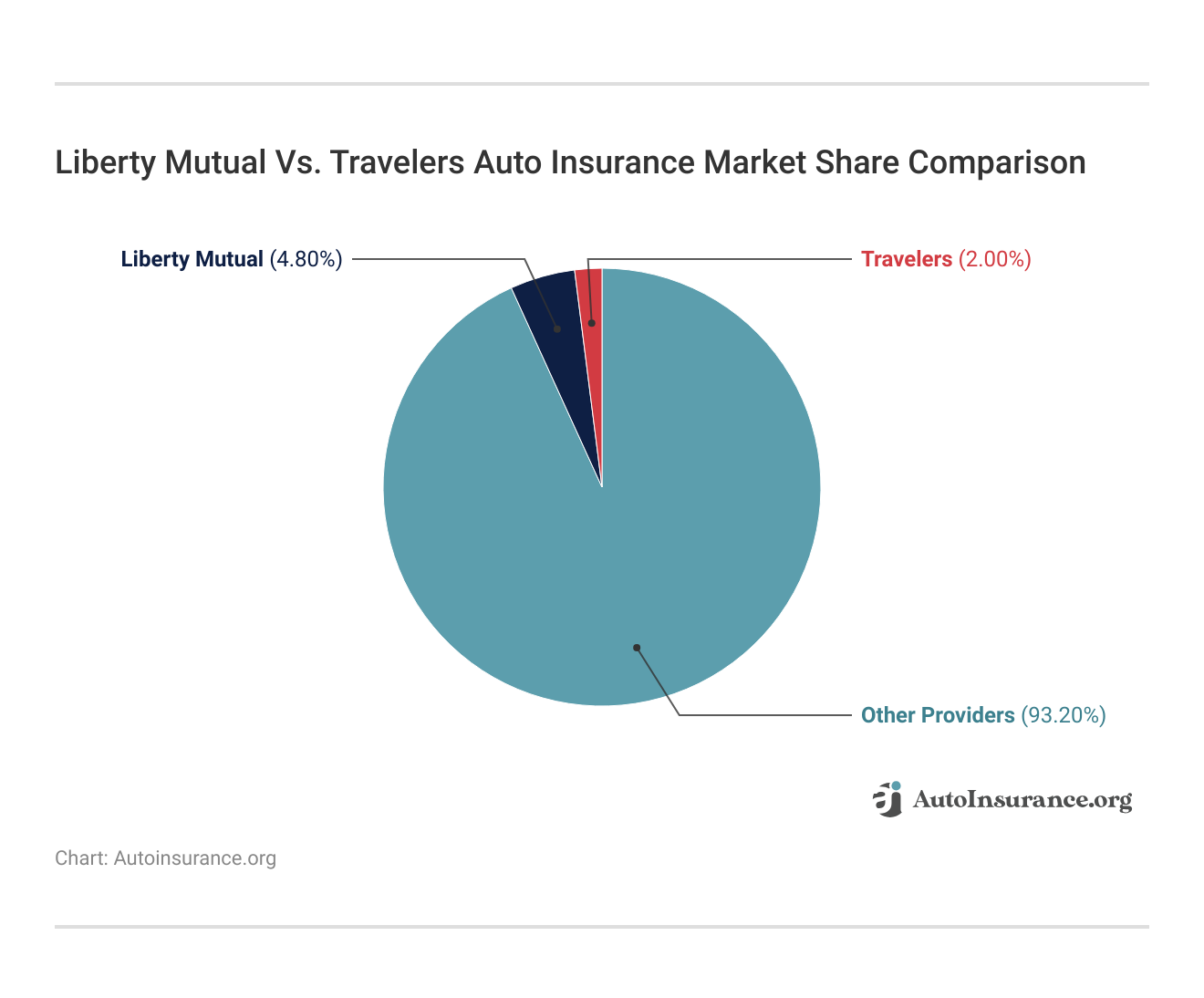

There is a clear difference when comparing the market shares of Liberty Mutual and Travelers for auto insurance. Liberty Mutual Insurance Company holds 4.80% of the market, while Travelers sits at just 2.00%, showing Liberty Mutual’s larger customer base.

The market is extremely saturated, though, as other providers control 93.20% of it. Liberty Mutual’s greater market position may be due to its more extensive coverage options and savings, whereas Travelers concentrates more on commercial insurance and specialist plans. Despite their distinctions, both businesses are among the biggest in their respective industries.

A Reddit user had great things to say about Travelers auto insurance, especially regarding claims handling. They mentioned knowing a few people who’ve filed claims with Travelers and had smooth, hassle-free experiences. One person got rear-ended and said the claims process was fast, easy, and handled with great customer service.

Comment

byu/RoccoBarocco91 from discussion

inInsurance

The user also shared that a Travelers-insured driver hit their dad. Even though he wasn’t a Travelers Insurance Company customer, the company accepted liability within 24 hours and sorted his repairs without any issues. They think Travelers Insurance Company is much better than Allstate, and they’d consider making the switch.

Liberty Mutual vs. Travelers: Key Differences in Insurance Coverage

Liberty Mutual Insurance Company and The Travelers Companies, Inc. are leading providers of auto, home, and business insurance but differ in structure, discounts, and digital tools. Liberty Mutual, founded in 1912 in Boston, MA, operates as a mutual insurance company, meaning policyholders own it. This structure allows Liberty Mutual Group to focus on customer benefits, policyholder value, and personalized service.

It offers auto, home, and business insurance, protecting policyholders from financial losses related to accidents, property damage, theft, and liability risks. Liberty Mutual’s RightTrack rewards safe driving habits like braking, acceleration, and mileage with up to 30% off premiums. It also offers a 25% bundling discount, helping policyholders save more by combining multiple policies.

The Travelers Companies, Inc., established in 1853 in St. Paul, Minnesota, later merged with The Travelers Corporation in 1996 and is now headquartered in New York City. Travelers, a top property and liability insurer, is publicly traded and known for strong financial stability and efficient claims service. It offers auto, home, and business insurance and key programs like IntelliDrive and MyTravelers.

IntelliDrive is a usage-based insurance scheme that tracks driving behavior via a mobile app. It provides up to 30% in discounts for safe driving. An increase in premiums may result from risky driving practices. Simplifying the insurance process, MyTravelers allows policyholders to manage policies, submit claims, and obtain important documentation online.

While both companies offer competitive discounts and strong coverage options, there are key differences between them. Liberty Mutual’s RightTrack is ideal for drivers looking for policyholder-focused savings, while Travelers’ IntelliDrive is beneficial for those comfortable with mobile-based tracking.

The Travelers Companies, Inc. also has higher financial strength ratings, while Liberty Mutual offers more extensive bundling discounts, including 25% off for combining policies. The best choice depends on insurance needs, policy preferences, and telematics comfort. Comparing quotes and benefits ensures the right provider.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of Liberty Mutual Insurance

Pros

- Higher Bundling Discount: Liberty Mutual offers a 25% bundling discount, far exceeding Travelers’ 13%, making it the better option for multi-policyholders.

- Fewer Customer Complaints: With a 0.55 complaint index, Liberty Mutual receives half the complaints of Travelers (1.12), reflecting better customer satisfaction.

- Better Anti-Theft Savings: Liberty Mutual provides a 35% discount for anti-theft devices, significantly higher than Travelers’ 15%, helping drivers with security features lower their premiums.

Cons

- Expensive for Poor Credit: Liberty Mutual charges $734 per month for drivers with poor credit, while Travelers offers a lower $430 rate, making Travelers the better choice for those with lower scores.

- Higher DUI Premiums: Liberty Mutual’s DUI rate is $447 per month, compared to Travelers’ lower $294 rate, making it less affordable for high-risk drivers. Unlock details in our Liberty Mutual insurance review.

Pros and Cons of Travelers Insurance

Pros

- Cheaper DUI Rates: Travelers is the more cost-effective choice for high-risk drivers because its monthly DUI driver fee of $294 is much less than Liberty Mutual’s $447.

- Lower Premiums for Poor Credit: Drivers with poor credit pay $430 per month, much less than Liberty Mutual’s $734, making Travelers the better choice for those with lower credit scores.

- Stronger Financial Stability: Travelers holds an A++ A.M. Best rating, compared to Liberty Mutual’s A rating, meaning Travelers has superior financial strength and claims-paying ability.

Cons

- More Customer Complaints: Travelers has a 1.12 complaint index, nearly double Liberty Mutual’s 0.55, indicating more customer service or claims-related issues. See more details on our Travelers insurance review.

- Smaller Bundling Discount: Travelers offers a 13% bundling discount, much lower than Liberty Mutual’s 25%, making it less appealing for customers bundling home and auto insurance.

Finding the Best Auto Insurance by Comparing Multiple Providers

Auto insurance from Liberty Mutual vs. Travelers offers distinct benefits to meet the needs of various drivers. Liberty Mutual Insurance is the best option for multi-policyholders because it provides a 25% bundling discount, which is far greater than Travelers’ 13%.

However, Liberty Mutual is more expensive for drivers with poor credit, charging $734 per month, while Travelers offers a lower rate at $430 per month. Travelers is the better option for high-risk drivers, with lower DUI rates at $294 per month compared to Liberty Mutual’s $447 per month. However, Travelers’ complaint index is higher at 1.12, compared to Liberty Mutual’s 0.55, indicating more reported service issues.

Both insurers offer up to 30% savings through usage-based programs, RightTrack and Travelers IntelliDrive, rewarding safe driving habits with lower premiums. To secure the best deal, drivers should compare multiple auto insurance companies online and find a policy that fits their specific needs. Get the best auto insurance rates possible by using our free comparison tool today.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Which is better for safe drivers, Nationwide or Travelers?

Travelers’ IntelliDrive offers up to 30% savings for safe drivers, while Nationwide provides accident forgiveness and a vanishing deductible, reducing costs over time. Nationwide also offers a 20% bundling discount, while Travelers provides 13%.

Which company offers better discounts, Travelers or Liberty Mutual?

Liberty Mutual offers a 25% bundling discount and a 35% anti-theft discount. At the same time, Travelers provides better rates for high-risk auto insurance, including DUI coverage at $294 per month compared to Liberty Mutual’s $447 per month.

Which company has better rates and customer service, Liberty Mutual or Erie?

Erie offers lower base rates and ranks higher in J.D. Power’s customer satisfaction survey at 857/1,000, while Liberty Mutual provides more discounts and nationwide availability. Erie operates in only 12 states, limiting its accessibility.

Which is better for high-risk drivers, Liberty Mutual or The General?

The General specializes in high-risk drivers needing SR-22 filings but has higher rates. Liberty Mutual offers more discounts, better financial strength with an A rating from A.M. Best, and more coverage options.

Is The Hartford a better choice than Liberty Mutual for seniors?

The Hartford specializes in AARP auto insurance with exclusive discounts, accident forgiveness, and lifetime renewability. Liberty Mutual offers a wider range of discounts, including military savings and a 30% RightTrack discount for safe drivers.

Which company offers better coverage options, Erie or Liberty Mutual?

Liberty Mutual provides more customizable policies, including new car replacements and better bundling discounts. At the same time, Erie is known for lower base rates and excellent customer service but is limited to 12 states.

Which company provides better bundling discounts, Liberty Mutual or Farmers?

Liberty Mutual offers a 25% bundling discount, significantly higher than Farmers’ 10%. Farmers provides more policy customization, including new car replacement and accident forgiveness.

Which company offers better telematics savings, Geico or Travelers?

Travelers’ IntelliDrive offers up to 30% savings for safe drivers, while Geico’s DriveEasy program varies by state and may not provide as much savings. Travelers also holds a stronger A++ A.M. Best rating for financial stability.

Which company has better customer satisfaction, Liberty Mutual or Amica?

Amica ranks higher in J.D. Power’s customer service ratings, offering dividend policies that return a portion of premiums. Liberty Mutual offers more discounts, a stronger bundling option, and broader national availability.

Should military families choose USAA or Travelers for auto insurance?

USAA offers exclusive military discounts, the lowest average premiums, and a 60% vehicle storage discount. Travelers is available to all drivers and offers IntelliDrive for safe driving savings, but it does not match USAA’s military benefits.

Which company is better for accident-prone drivers, Progressive or Travelers?

Progressive auto insurance review highlights accident forgiveness and small-accident protection, while Travelers offers lower rates for high-risk drivers. Travelers’ DUI rates are $294 per month, significantly lower than Progressive’s average of $340 monthly.

Which company has stronger financial stability, Travelers or Safeco?

Travelers holds an A++ rating from A.M. Best, indicating superior financial strength, while Safeco has an A rating. Travelers also offers better pricing for high-risk drivers and a stronger telematics program.

Which company is better for digital policy management, Esurance or Travelers?

Esurance, an online-only insurer, provides quick quotes and fast claims processing, while Travelers offers stronger financial stability and IntelliDrive, which can lower premiums by 30%.

Which company is better for budget-conscious drivers, Liberty Mutual or Safe Auto?

Safe Auto focuses on minimum liability policies for high-risk drivers but lacks comprehensive discount options. Liberty Mutual offers broader coverage, a 25% bundling discount, and a 35% anti-theft auto insurance discount.

Which company is better for high-risk drivers needing SR-22 insurance, Liberty Mutual or Infinity?

Infinity specializes in high-risk drivers and SR-22 filings but has higher premiums. Liberty Mutual provides better discount opportunities and a stronger A.M. Best financial rating.

Which company is financially stronger, Travelers or Liberty Mutual?

Travelers holds an A++ rating from A.M. Best, indicating superior financial stability, while Liberty Mutual has an A rating. Travelers is more able to pay claims.

Which company offers better safe driver rewards, Liberty Mutual or Nationwide?

Nationwide offers SmartRide for usage-based savings and a vanishing deductible, while Liberty Mutual’s RightTrack program offers up to 30% off for safe drivers.

Which company offers better policy flexibility, Farmers or Travelers?

Farmers allows more customization, offering add-ons like new car replacement and accident forgiveness. Travelers provides lower rates for high-risk drivers and offers IntelliDrive for additional savings.

Shopping for insurance can feel overwhelming, but you don’t have to do it alone. Enter your ZIP code into our free comparison tool to get started.

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.