Geico Auto Insurance Review for 2025 (See How Much You Could Save)

Use this Geico auto insurance review to compare rates and coverage options. Average full coverage car insurance costs $114/mo, but Geico offers fewer policy options than Progressive and Allstate. However, Geico has more auto insurance discounts than its competitors, including membership discounts.

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jun 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Geico

Average Monthly Rate For Good Drivers

$114A.M. Best:

A++Complaint Level:

LowPros

- Cheap for safe drivers

- High satisfaction ratings

- Great app and website

- Lots of discounts

- Strong financial backing

Cons

- No gap coverage

- Pricey after a DUI

- Few local agents

- Geico is the second-largest insurance company in America and has the second-lowest average rates

- Although it has standard discounts, Geico offers unique savings for over 500 organizations

- Geico touts an A++ rating from A.M. Best and an A+ from the Better Business Bureau, with customers generally satisfied with their service

Our Geico auto insurance review found that the company offers various coverages, ranging from standard to to cheap usage-based auto insurance, and nearly every driver can find an affordable policy in all 50 states. The company also offers an array of digital tools to help find quotes, manage your policy, and file claims.

Geico prices are some of the lowest among major insurance providers — only USAA offers cheaper rates. Learn more in our USAA vs. Geico auto insurance comparison.

Geico Auto Insurance Ratings

Rating Criteria

Overall Score 4.4

Insurance Cost 4.4

Discounts Available 4.7

Claim Processing 4.8

Customer Satisfaction 4.5

Coverage Availability 5.0

Coverage Value 4.4

Digital Experience 5.0

Company Reputation 4.5

Business Reviews 4.5

Plan Personalization 4.5

Policy Options 4.1

Savings Potential 4.5

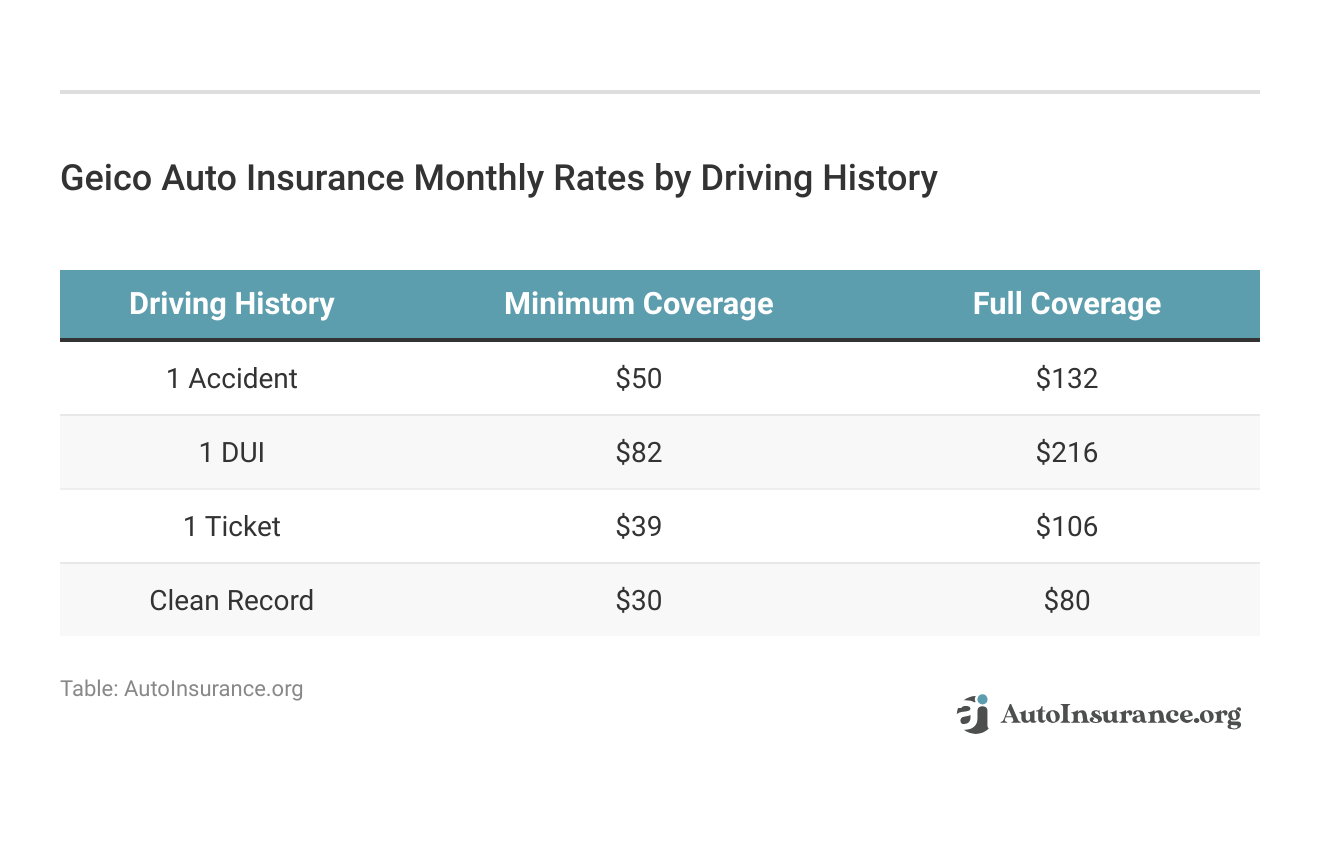

Drivers with a clean record pay as little as $114/mo with Geico, but one accident can drive your rates up to $132/mo. Some reviews on Geico Insurance find that rates increase more than other companies after a citation.

Read on to explore Geico reviews from A.M. Best, Better Business Bureau, and customers. Then, enter your ZIP code above to compare your Geico car insurance quote against top providers near you.

Geico Customer Service Review

Geico is well-known for its affordable policies, top-rated service, and impressive discount list. While everyone has a chance to find affordable rates from Geico, teens and drivers with low credit scores can particularly benefit (Learn More: Best Companies for Credit-Based Auto Insurance).

Geico Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 871 / 1,000 Below Avg. Customer Satisfaction |

|

| Score: A+ Great Complaint Resolution |

|

| Score: 82 / 100 High Customer Satisfaction |

|

| Score: 1.42 More Complaints Than Avg. |

|

| Score: A++ Superior Financial Strength |

The National Association of Insurance Commissioners (NAIC) compares customer complaints every year and scores providers based on the number of complaints. Geico received a 1.42, which means it receives more complaints than other national providers.

In addition, according to J.D. Power’s 2023 claims satisfaction study, Geico has a score of 871 out of 1,000, which is lower than the industry average score of 878.

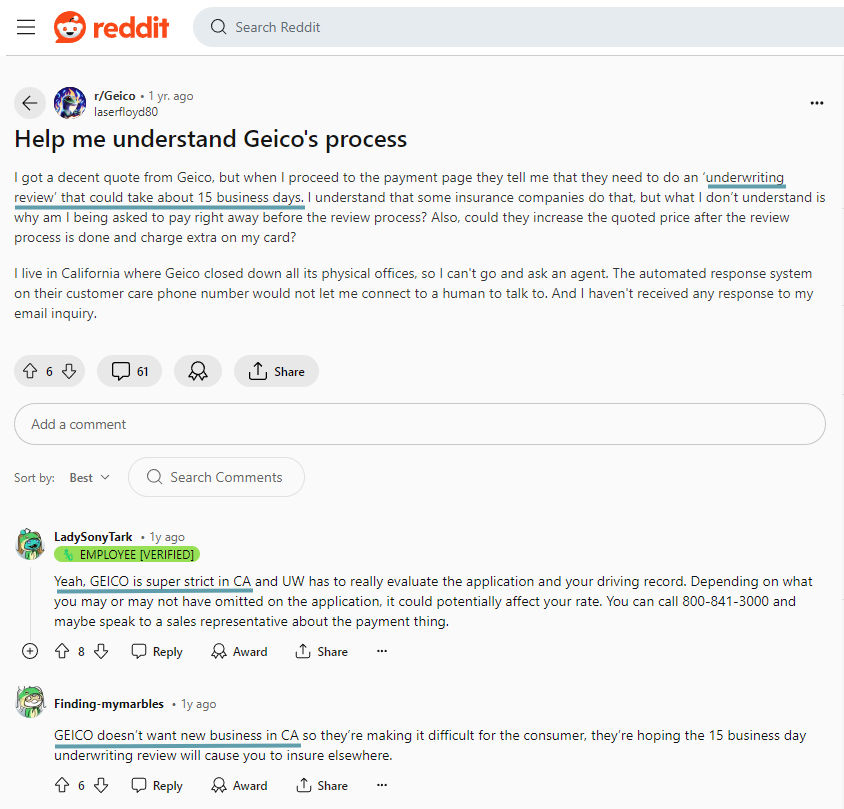

Is Geico leaving California? No, and Geico car insurance in Florida is also still available. Some insurance companies are pulling out of California and Florida, but Geico isn’t one of them. However, while Geico still operates in California, Geico car insurance reviews on Reddit claim that it takes more time to get a policy in the state.

According to Geico reviews and complaints from Reddit users, the company is very strict about the underwriting process in California, and allegedly uses a 15-day underwriting review to discourage CA drivers from buying a policy. Find out more about California auto insurance with Geico here.

DriveEasy, its usage-based insurance program, is among the top three in the country, and Geico received top marks for customer service in the New England area. However, it performed below average in the Central and Southern U.S.

Depending on the state, Geico’s customer service tends to be hit or miss. Some Geico car insurance reviews rave about their experience, while others say they’ve never received such poor service. Interestingly, some reviewers say they were happy with customer service agents until they moved to another state. If you have a complaint, call the Geico 1-800 customer service number at 1-800-270-7847.

Learn More: How to Cancel Geico Auto Insurance

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Geico Claims Reviews

Nobody likes to file an auto insurance claim, but Geico promises to make the claims process as easy and fast as possible. While some companies take weeks to resolve a claim, Geico can complete the process as quickly as 48 hours and issues payouts electronically or by mail, minus your deductible.

You can file a claim with your Geico insurance login or by calling the 24/7 Geico 1-800 number for claims at 1-800-841-3000.

While you’re free to use any mechanic you’d like, you can speed the process up by using Geico’s Auto Repair Xpress tool. This tool will help you locate a mechanic whom Geico partners with to ensure a smooth repair process.Kalyn Johnson Insurance Claims Support & Sr. Adjuster

Customer reviews for Geico’s claims handling are mixed. Some people are satisfied with Geico’s communication, speediness, and overall handling of their claims.

Other Geico auto insurance reviews say the provider is more interested in closing claims quickly than figuring out what happened.

Geico Insurance Review From Independent Raters

A.M. Best gives auto insurance with Geico a superior score of A++ for its financial security. Check out the table below to see what other independent raters think:

A.M. Best Financial Ratings for the Top Auto Insurance Companies

| Insurance Company | Financial Rating |

|---|---|

| A++ | |

| A++ | |

| A+ | |

| A+ |

| A+ |

| A+ | |

| A | |

| A | |

| A |

| A |

Also, Geico insurance reviews from BBB, or the Better Business Bureau, show the company has an A+ rating, though BBB customer reviews aren’t as great.

Geico Insurance Coverage Options

Does Geico offer gap insurance? Unfortunately, one of Geico’s biggest failings is its lack of key policy options, including gap insurance for auto loans.

Geico new car insurance isn’t the best option if you’re financing or leasing a vehicle as it won’t cover what you owe if the car is totaled in an accident or collision.

However, you can buy all the coverage you need to meet your state requirements from Geico, including:

- Liability Auto Insurance: Liability insurance is required in most states and ensures you can pay for damage you cause in an accident. There are two parts to liability insurance: bodily injury and property damage.

- Collision Auto Insurance: Liability doesn’t cover damage to your car — for that, you’ll need collision insurance. Collision insurance helps repair your vehicle after an accident, even if you’re at fault.

- Comprehensive Auto Insurance: Your car can get damaged in a lot of ways outside of accidents. Comprehensive insurance protects against weather, vandalism, animal contact, theft, and fire damage.

- Personal Injury Protection (PIP): Personal injury protection helps pay for medical bills, lost wages, and other related health care expenses if you get injured in an accident.

- Uninsured/Underinsured Motorist: Most states require drivers to carry a minimum amount of insurance, but not everyone follows the law. Uninsured/underinsured motorist coverage protects you against drivers with inadequate or no insurance and hit-and-runs.

- Emergency Roadside Assistance: If you find yourself stranded on the side of the road, Geico’s roadside assistance helps with battery jumps, tire changes, fuel delivery, and other related issues.

- Rental Car Reimbursement: Although Geico promises fast claims resolution, your car might get stuck in the shop after an accident. Geico will cover a rental car from Enterprise or reimburse you if you go elsewhere.

The coverage you need depends on various factors. For example, if you own an older car outright and need to keep your payment low, your state’s minimum requirement is probably all you need. Full coverage — including liability, comprehensive, collision, uninsured motorist, and PIP — is typically required if you have a car loan or lease.

Another factor you should consider is your location. For example, it might be best to add comprehensive insurance to your plan if you live in a rural area. If you have Geico and hit a deer, you can only file a claim with comprehensive coverage.

Don’t worry about figuring out which insurance you need by yourself — if you’re not entirely sure, call the 1-800 number for Geico customer service (1-800-270-7847).

Geico DriveEasy Review

The average American drives more than 13,000 miles annually, but many people now work from home or cut back on their drive time. So it doesn’t seem fair to pay for a full insurance policy when you’re not driving as many miles.

To meet the needs of low-mileage drivers, Geico offers the DriveEasy program. DriveEasy is a monitoring program that rewards you for good driving behavior and low mileage. It’s available in 25 states plus Washington, D.C. Read our Geico DriveEasy review to see if it’s available in your state.

The DriveEasy program monitors you through the Geico app and looks at the following while you drive:

- Phone use

- Hard braking

- Rapid acceleration

- Mileage

- Sharp turns

- Time of day

Safe drivers can save up to 25% on their Geico insurance quote simply by using DriveEasy. However, drivers who engage in poor behaviors might see their rates increase.

Other Geico Auto Insurance Options

Does Geico have accident forgiveness? Yes, Geico offers accident forgiveness to loyal, claim-free customers. It also has a few other options for car insurance, all of which can add policy value and increase your car’s protection:

- Rideshare Insurance: Geico rideshare insurance is a hybrid policy replacing your traditional plan. Whether running errands or driving for a rideshare company, your hybrid policy covers you.

- Mechanical Breakdown Insurance: Mechanical breakdown coverage pays for repairs if your car suffers mechanical issues. It doesn’t cover routine wear and tear, so check before filing a claim.

- Classic Car Insurance: If you have a vintage vehicle, you need special classic car insurance to protect it. Geico classic car insurance reviews show it offers agreed value and spare parts coverage.

- Mexican Auto Insurance: American car insurance doesn’t work in Mexico. Geico Mexico insurance will cover your car if you’re planning a trip south of the border.

- Accident Forgiveness: There are two ways to get Geico accident forgiveness: by buying it or earning it for being a safe driver and loyal Geico customer.

Aside from additional products, Geico also offers policyholders an easy-to-use app, 24/7 access to claims handling and tracking, and representatives always ready to help you.

Learn More: Best Mobile Apps for Auto Insurance

More Types of Insurance Offered by Geico

Geico offers a multi-policy discount when you buy two or more plans. Find out how to save money by bundling insurance policies here.

It’s easy to earn this discount because Geico provides insurance for just about anything you might need, including:

Types of Insurance Offered by Geico

| Type |

|---|

| Motorcycle |

| ATV/UTV |

| RV |

| Boat/personal watercraft |

| Homeowners |

| Condo |

| Renters |

| Mobile home |

| Landlord |

| Flood |

| Life |

| Travel |

| Business |

| Commercial auto |

| Umbrella |

Geico does relatively well with its insurance products. For example, Geico RV insurance reviews say that rates are low and the claims process is easy.

Though you might not see a specific insurance type above, that doesn’t mean Geico doesn’t cover it. For example, avid cyclists looking to cover sports equipment get Geico bicycle insurance included in their homeowners, condo, or renters policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Geico Insurance Rates Breakdown

How much is Geico insurance? Cheap — around $114/mo. One of the most appealing aspects of Geico auto insurance is the low prices. Geico has the overall lowest monthly car insurance average monthly car insurance rates of any company in most states, except for USAA.

Location is one of the most important aspects of your insurance rates — for example, the average minimum coverage for Geico in Hawaii is $23 a month, while Louisianans will see around $111.

How much is full coverage insurance with Geico? To get an idea of what you might pay, consider how Geico compares to other companies for minimum and full coverage below.

Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 | |

| U.S. Average | $61 | $165 |

Monthly full coverage insurance costs around $200 in the U.S., but a Geico full coverage auto insurance policy is only $114/mo with a clean record and good credit score.

While rates tend to be low for everyone, drivers with bad credit and young drivers should consider Geico. On the other hand, drivers looking for high-risk auto insurance after an accident or DUI might find better rates elsewhere. Compare Geico auto insurance quotes online to find the best company based on driving record.

Geico Auto Insurance Rates by Age

One critical aspect of how much you’ll pay for insurance is your age. Young drivers are statistically more likely to get into an accident or drive recklessly, so they see much higher rates than adults. Compare auto insurance rates by age.

Geico Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

Age & Gender Minimum Coverage Full Coverage

Age: 16 Female $163 $425

Age: 16 Male $178 $445

Age: 18 Female $132 $313

Age: 18 Male $153 $362

Age: 25 Female $51 $138

Age: 25 Male $50 $133

Age: 30 Female $46 $128

Age: 30 Male $46 $124

Age: 45 Female $43 $114

Age: 45 Male $43 $114

Age: 60 Female $40 $104

Age: 60 Male $41 $106

Age: 65 Female $42 $112

Age: 65 Male $42 $112

While some companies heavily penalize young drivers, Geico teen car insurance rates are amongst the lowest. The reason providers charge teen drivers more is due to driving inexperience and a higher likelihood of distracted driving.

Consider the prices below to see how much Geico and other top competitors charge drivers of all ages.

Full Coverage Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $468 | $540 | $141 | $147 | $125 | $122 | $122 | $119 |

| $640 | $740 | $240 | $252 | $231 | $228 | $226 | $223 | |

| $435 | $591 | $165 | $195 | $164 | $166 | $161 | $163 |

| $520 | $600 | $200 | $210 | $190 | $185 | $180 | $175 | |

| $853 | $897 | $228 | $239 | $199 | $198 | $194 | $194 | |

| $313 | $362 | $128 | $124 | $114 | $114 | $112 | $112 | |

| $745 | $893 | $249 | $285 | $244 | $248 | $239 | $243 |

| $404 | $454 | $124 | $130 | $112 | $110 | $110 | $108 | |

| $432 | $552 | $177 | $194 | $161 | $164 | $158 | $160 |

| $843 | $944 | $187 | $194 | $159 | $150 | $156 | $147 | |

| $362 | $417 | $109 | $113 | $103 | $101 | $101 | $99 | |

| $327 | $405 | $133 | $147 | $123 | $123 | $120 | $120 | |

| $580 | $670 | $180 | $190 | $164 | $161 | $159 | $156 |

| $757 | $1,056 | $142 | $154 | $139 | $141 | $136 | $138 | |

| $257 | $289 | $106 | $113 | $84 | $84 | $82 | $82 | |

| U.S. Average | $560 | $656 | $182 | $191 | $166 | $165 | $163 | $161 |

As you can see, young drivers generally pay higher car insurance rates, while drivers in their 40s and 50s enjoy much lower premiums.

Let’s examine some specific age groups to see how Geico first-time driver insurance rates compare.

Geico Car Insurance Costs for Teens

Auto insurance rates for teenagers tend to be higher than average due to their lack of experience behind the wheel. Check out the table below to compare Geico teen rates vs. other top competitors:

Teen Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male |

|---|---|---|---|---|

| $868 | $910 | $640 | $740 | |

| $452 | $456 | $333 | $371 | |

| $1,156 | $1,103 | $853 | $897 | |

| $425 | $445 | $313 | $362 | |

| $1,031 | $1,121 | $745 | $893 |

| $586 | $679 | $432 | $552 |

| $1,144 | $1,161 | $843 | $944 | |

| $444 | $498 | $327 | $405 | |

| $1,026 | $1,298 | $757 | $1,056 |

As you can see, Geico car insurance for an 18-year-old male is over $250, a significant increase compared to adult driver rates. While these rates are expensive, Geico offers the most affordable option for teens.

Geico Car Insurance Costs for Seniors

As drivers age, insurance rates start going down. However, in later years, insurance rates may take a slight upturn. Here’s a look at rates for senior drivers. Find tips for buying senior auto insurance.

Auto Insurance Monthly Rates for Seniors by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $43 | $111 |

| $58 | $150 | |

| $45 | $115 | |

| $31 | $78 |

| $72 | $183 | |

| $41 | $106 | |

| $91 | $227 |

| $59 | $149 |

| $124 | $316 | |

| $58 | $147 |

| $50 | $129 | |

| U.S. Average | $59 | $152 |

Since Geico quotes vary based on age, it’s important to shop for new policies every year to see which is the cheapest or if you need to switch companies.

Geico Auto Insurance Rates by Driving Record

Like age, your driving history also has an effect on your insurance rates. People with clean records pay less than drivers with at-fault accidents, speeding tickets, or DUIs. Now, let’s look at how traffic tickets and accidents can impact your auto insurance rates.

How much does insurance go up after an accident with Geico? As you can see, your rates could go up by 65% after a car accident. Staying safe and keeping your record clean will help keep your car insurance rates low. Find out how a speeding ticket affects your auto insurance rates.

In addition, while Geico still offers relatively low rates to drivers with an accident, other companies might offer a better price. Find out how long an accident affects your auto insurance rates.

Full Coverage Auto Insurance Monthly Rates by Provider: One Ticket vs. Clean Record

| Insurance Company | One Ticket | Clean Record |

|---|---|---|

| $154 | $122 |

| $268 | $228 | |

| $194 | $166 |

| $150 | $124 | |

| $170 | $138 | |

| $100 | $83 |

| $247 | $198 | |

| $151 | $114 | |

| $302 | $248 |

| $196 | $164 |

| $199 | $150 | |

| $137 | $123 | |

| $396 | $331 | |

| $194 | $161 |

| $192 | $141 | |

| $148 | $118 | |

| U.S. Average | $203 | $165 |

People with an accident on their record may benefit from looking at quotes from State Farm or USAA. However, Geico still offers relatively low rates with a bad driving record. Learn how to find cheap auto insurance after an accident.

Having a DUI on your record is another factor that may cause your insurance rates to go up. Not only will drinking and driving increase your rates, but it will also endanger you, your passengers, other drivers, and pedestrians.

How to Get Geico to Lower Your Rate

If you’re dealing with expensive insurance, there are many ways you can reduce your premiums with Geico, including:

- Ask for Discounts: Most of the top providers, including Geico, offer discounts to help policyholders lower their car insurance rates. Ask a representative what discounts they offer to save.

- Increase Your Deductible: A car insurance deductible is the amount you must pay before insurance kicks in. The higher your deductible, the lower your rates. However, don’t increase it to an amount you can’t afford to pay.

- Drive Safely: Generally, insurers reward safe drivers with lower rates and additional savings. Avoid traffic violations and accidents to get cheaper premiums (Learn More: Best Auto Insurance for Good Drivers).

- Evaluate Coverages: If your car is older, you could opt to drop certain types of auto insurance coverage, such as comprehensive or collision coverage.

As you can see, you won’t be stuck with lower rates forever with Geico. There are many ways to get affordable Geico rates.

Geico Discounts Available

Geico is well-known for its affordable rates, and one of the ways it offers such low prices is through extensive discounts. Geico auto insurance discounts offer something for just about everyone.

Take a look at Geico auto insurance discounts below:

Geico Auto Insurance Discounts by Savings Amount

| Discount Name | Potential Savings |

|---|---|

| Accident Free | 26% |

| Air Bags | 23% |

| Anti-Lock Brakes | 5% |

| Anti-Theft Features | 25% |

| Daytime Running Lights | 1% |

| Defensive Driving Course | 15% |

| Driver's Education | 10% |

| Emergency Deployment | 25% |

| Federal Employee | 8% |

| Good Driver | 26% |

| Good Student | 15% |

| Multi-Policy | 25% |

| Multi-Vehicle | 25% |

| Military | 15% |

| New Vehicle | 15% |

| Seat Belt Use | 30% |

Some of these discounts are small, while others are more considerable. For instance, drivers who qualify for a multi-vehicle car insurance discount could save 25%. However, you’ll only save around 5% if you have anti-lock brakes.

We make saving on home and auto insurance easier than… well, a lot easier than whipping up the perfect metaphor, we’ll tell you that much. #BundlingMadeEasy pic.twitter.com/tZroXEaHZA

— GEICO (@GEICO) February 1, 2022

However, where you live will influence which discounts you qualify for. For example, Geico car insurance in Florida isn’t eligible for loyalty discounts since state law doesn’t allow companies to adjust rates to stop drivers from switching.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Geico Ranks Among Providers

Is Geico a good insurance company? Yes, from lower rates to great discount options, Geico has a lot to offer when compared to other insurers.

To find out if it’s the right insurer for you, get Geico quotes and compare policies and prices to the other providers below.

Nationwide vs. Geico Auto Insurance

Geico and Nationwide are similarly rated in many ways, but each company outperforms the other in key areas.

Geico tends to offer lower rates, with the average Geico customer saving nearly $200 a year compared to Nationwide policies.

However, Nationwide is rated higher for customer service, claims handling, and overall customer satisfaction.

Learn More: Nationwide Auto Insurance Review

Progressive vs. Geico Auto Insurance

Is Geico or Progressive better? In most other categories, Geico does better than Progressive. Geico offers better rates, has a better customer experience, and an overall stronger reputation.

Progressive does better in one category – coverage options. While both companies offer much of the same insurance, only Progressive offers gap coverage and custom parts and equipment insurance.

Find the Best Provider for You: Geico vs. Progressive Auto Insurance Review

Allstate vs. Geico Auto Insurance

Geico ratings are better than Allstate in many areas, including claims handling, customer service, and customer renewal rates. Average Geico car insurance costs less Allstate, except for drivers with a DUI on their record. In general, more customers are happy with Geico insurance compared to Allstate.

However, Allstate does better than Geico for its usage-based insurance. Geico DriveEasy is not as user-friendly as Allstate’s Drivewise.

Read More: Geico vs. Allstate Auto Insurance Review

Choose Geico for Affordable Coverage and Reliable Service

Geico car insurance quotes stand out to customers since they’re so low for many drivers. With competitive pricing starting at $114 per month for drivers with a clean record, Geico is the cheapest auto insurance company in America, making it a compelling option for budget-conscious individuals seeking reliable coverage.

There are numerous positive Geico insurance ratings from J.D. Power, A.M. Best, and Better Business Bureau, but it's essential to note that while Geico excels in affordability and customer satisfaction, it may lack certain policy coverages that are available at other insurance companies.Travis Thompson Licensed Insurance Agent

One notable omission is gap insurance, which can be crucial for individuals with leased or financed vehicles. Despite this limitation, Geico car insurance reviews continue to praise the provider for its streamlined claims process, user-friendly mobile app, and responsive customer service.

View this post on Instagram

The Geico auto insurance customer service commitment to providing excellent service and competitive rates has contributed to their strong Geico rating and solid reputation.

Ultimately, when considering Geico auto insurance ratings, it’s crucial to weigh the affordability against the coverage options and ensure that the policy aligns with your specific requirements. Comparing quotes online and exploring additional coverage options is the only way to guarantee you make the best decision.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Who should buy Geico auto insurance?

Geico is a good option for anyone looking for affordable coverage, especially young drivers and people with low credit scores. However, people with accidents or DUIs might want to look elsewhere.

Learn More: Cheap Auto Insurance After an Accident

Is Geico insurance good?

Yes, Geico ratings and reviews are positive. It has A++ financial ratings from A.M. Best and A+ customer service ratings from Better Business Bureau.

What is Geico’s customer satisfaction rating?

Geico earned an A+ for customer service from the Better Business Bureau, and J.D. Power ranks Geico above average in most regions for customer satisfaction.

Ready to shop around for auto insurance companies with the best customer service? Enter your ZIP code into our free comparison tool below to shop for quotes from the top providers near you.

Who are the biggest Geico competitors?

State Farm and Progressive are its biggest competitors based on rates and policy offerings.

Who is better for auto insurance, Geico or Progressive?

Is Geico cheaper than Progressive? Geico offers much lower auto insurance rates than Progressive but has fewer policy options. Check out our Progressive auto insurance review to learn about this top provider’s large list of coverage options.

Read More: Geico vs. Progressive Auto Insurance Review

Is Allstate or Geico auto insurance better?

Geico customers are more satisfied with their coverage than Allstate customers. Check out our comparison of Allstate vs. Geico auto insurance to pick the best provider for you.

Is Geico or Liberty Mutual better for auto insurance?

Geico auto insurance rates are cheaper than Liberty Mutual, but drivers have more customizable policy options with Liberty Mutual.

Read More: Liberty Mutual Auto Insurance Review

What is Geico’s weakness?

Geico’s biggest downfall is its lack of diverse and customizable policy options.

Does Geico look at credit scores?

If state insurance laws allow, Geico will consider your credit score when checking rates. Understand more about how credit scores affect auto insurance rates here.

How can you file a Geico auto insurance claim?

Wondering how to file an auto insurance claim with Geico? File online, using the mobile app, or by calling the 24/7 claims Geico phone number. Geico will send a payment for your claim via mail or directly deposit it into your bank account.

Will Geico raise my rates after a claim?

That depends on the type of claim. Most Geico comprehensive claims will not raise rates. But if you file a claim after an at-fault accident, you could see a monthly rate increase of $40-$50.

Is Geico good at paying auto insurance claims?

Geico is one of the fastest companies when paying out claims, advertising that it can settle claims as quickly as 48 hours.

How long do Geico auto insurance quotes last?

Geico doesn’t specify how long a quote lasts, but most companies allow you 30 days to decide. Remember that just because a quote is still active doesn’t mean the price will remain the same.

How do you contact Geico auto insurance?

You can visit the Geico website, send an email, or call the customer service number at 1-800-207-7847.

Can you cancel Geico auto insurance online?

You can’t cancel your Geico insurance online. You must call an agent to cancel your policy.

Learn More: How to Cancel Your Geico Auto Insurance

Does Geico charge a cancellation fee?

There is no fee if you decide to cancel Geico auto insurance. Find out more about how to cancel Geico auto insurance here.

How long does Geico take to issue an auto insurance refund?

Refunds for personal checks can take up to 30 days, while credit or debit payments will likely get refunded in one to two weeks.

Can you negotiate auto insurance rates with Geico?

You can’t negotiate auto insurance rates directly with Geico, but you can compare car insurance quotes online from multiple companies to see if Geico is actually your cheapest option. Still wondering where to compare auto insurance rates? All you need to do is enter your ZIP code into our free quote tool below to instantly compare rates from the top providers near you.

Why is Geico insurance so low?

Geico’s direct sales model allows it to sell directly to consumers online, and cuts out the middleman of insurance agents.

What is the Geico car insurance phone number?

The Geico 800 number is 1-800-207-7847.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Geico SuckIT

Geico review

Tomer Ravid

GEICO review

Volodymyr_Korolevych

Adjuster stopped responding

Sergei_K

Can't get rid of them

vscore16

BAIT AND SWITCH

Trinidad2_

geico is the best

Jotwox

Not recommend

Waycross43_

Helpful

Babanana

Geico is amazing

Justin_Kim

Filing a claim at geico