Allstate vs. Travelers Auto Insurance in 2025 (Side-by-Side Review)

Allstate vs. Travelers auto insurance rates show Travelers at $53 a month, cheaper than Allstate's $87. Travelers' IntelliDrive tracks driving for up to 30% savings, while Allstate's Drivewise monitors habits to lower costs. Travelers is best for budget-conscious drivers, while Allstate benefits those seeking perks.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jun 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

11,638 reviews

11,638 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsAllstate vs. Travelers auto insurance offers distinct advantages—Allstate’s Drivewise rewards safe drivers with up to 40% savings, while Travelers’ IntelliDrive tracks habits for a 30% discount.

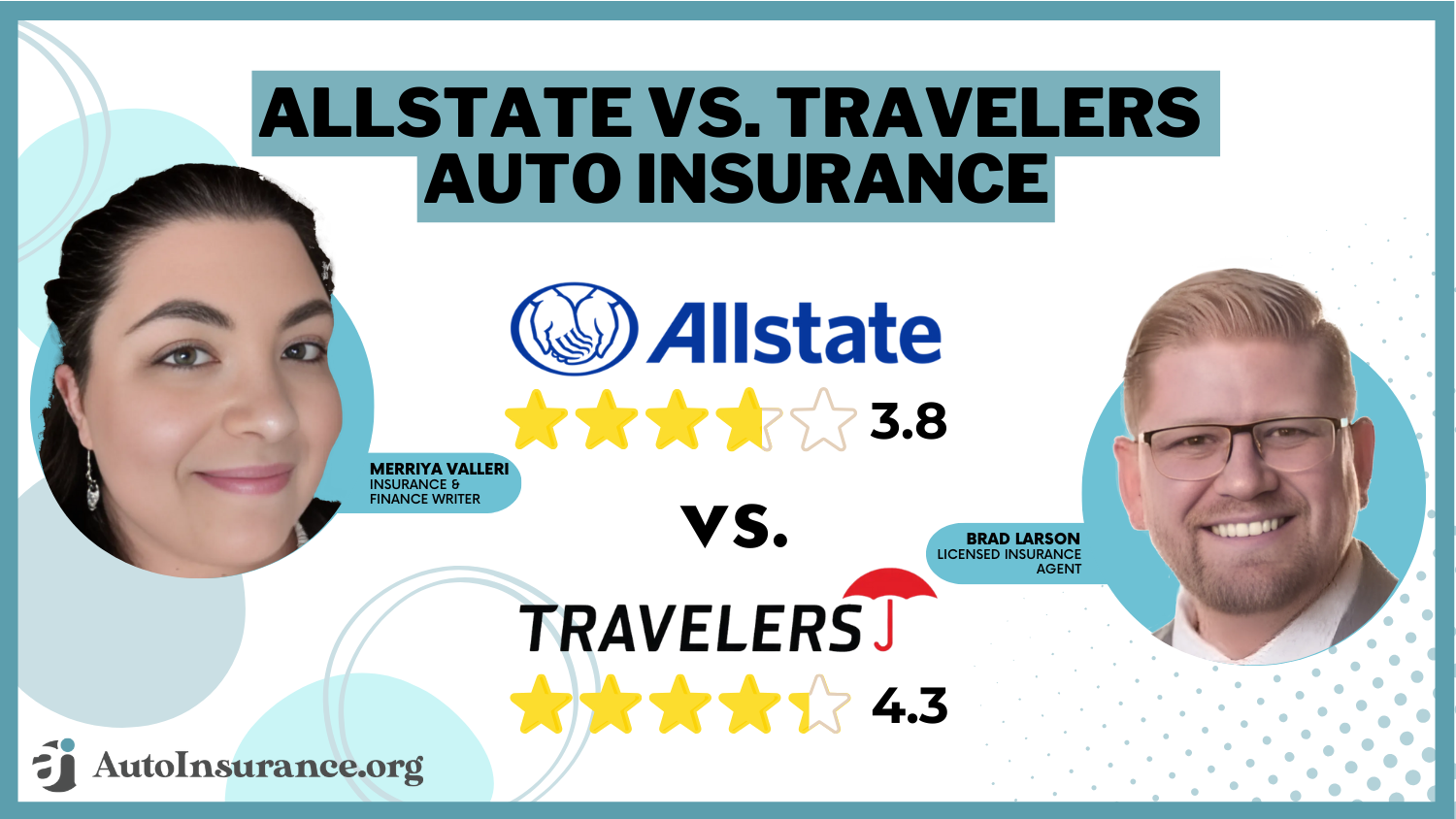

Allstate vs. Travelers Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 3.8 | 4.3 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.0 | 4.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 3.5 | 4.3 |

| Customer Satisfaction | 2.0 | 2.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.4 | 4.1 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.4 | 4.1 |

| Savings Potential | 3.9 | 4.4 |

| Allstate | Travelers |

Travelers has fewer complaints per NAIC data, while Allstate provides accident forgiveness. Travelers is best for budget-conscious drivers, whereas Allstate offers better bundling discounts.

Travelers also has lower rate increases for poor credit, making it a stronger choice for those with financial challenges. Take accident rates, for instance. Travelers charges $199 per month after one accident, while Allstate jumps to $321, creating a $1,464 yearly difference.

- Travelers offers rates as low as $53, while Allstate costs $87 monthly

- Allstate vs. Travelers auto insurance differs in accident forgiveness and perks

- Travelers has fewer NAIC complaints, while Allstate provides vanishing deductibles

Enter your ZIP code to compare affordable vehicle insurance rates in your area if all you’re searching for is coverage to drive lawfully.

Age and Gender Impact on Allstate vs. Travelers Rates

Younger drivers pay the highest rates for auto insurance, which vary by gender and age. Unless you’re a teen or a middle-aged driver, you’ll probably find better prices with Travelers when comparing Allstate and Travelers vehicle insurance.

Allstate vs. Travelers Full Coverage Auto Insurance Monthly Rates

| Age & Gender | ||

|---|---|---|

| 16-Year-Old Female | $868 | $1,026 |

| 16-Year-Old Male | $910 | $1,298 |

| 30-Year-Old Female | $240 | $142 |

| 30-Year-Old Male | $252 | $154 |

| 45-Year-Old Female | $231 | $139 |

| 45-Year-Old Male | $228 | $248 |

| 60-Year-Old Female | $214 | $127 |

| 60-Year-Old Male | $220 | $129 |

Travelers charges $1,298 for 16-year-old men, which is significantly higher than Allstate’s $910. Female teen drivers also pay more with Travelers ($1,026, against $868 with Allstate). By age 30, Travelers is the best price for women at $142 per month, while Allstate costs $240.

For 45-year-old males, Allstate wins with $228 compared to Travelers’ $248, but females still save more with Travelers at $139. Seniors get the best rates with Travelers, with 60-year-old women paying just $127, while Allstate charges $214. The numbers make it clear—Travelers is usually the cheapest, but Allstate has a few pricing advantages depending on your age and gender.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Driving Records Impact Allstate vs. Travelers Rates

Your driving history has a big impact on what you’ll pay for car insurance. Allstate vs. Travelers auto insurance rates show that Allstate is slightly cheaper for safe drivers, but Travelers is the better deal if you have tickets, accidents, or a DUI.

Allstate vs. Travelers Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $228 | $248 |

| One Accident | $321 | $199 |

| One Ticket | $268 | $192 |

| One DUI | $385 | $294 |

Drivers with no violations pay $228 with Allstate, compared to $248 with Travelers, making Allstate the better pick for safe drivers. However, Travelers becomes the cheaper choice for riskier drivers, charging $192 for a ticket versus Allstate’s $268 and $199 for an accident compared to Allstate’s $321.

The biggest gap is for DUIs—Allstate charges $385, while Travelers stays lower at $294. If your record isn’t perfect, Travelers will save you more, but Allstate might be worth it if you want accident forgiveness and bundling discounts.

Comparing Allstate vs. Travelers Auto Insurance for Credit-Based Pricing

Not all auto insurers use the same formula to determine your premium; your credit score is a major factor. Travelers Insurance vs. Allstate auto insurance rates show that Travelers is the cheaper option for every credit level, with the biggest savings for drivers with lower scores.

Full Coverage Insurance Monthly Rates by Credit: Allstate vs. Travelers

| Credit Score | ||

|---|---|---|

| Good Credit (670-739) | $172 | $142 |

| Fair Credit (580-669) | $203 | $173 |

| Bad Credit (300-579) | $275 | $231 |

Good-credit drivers save $30 monthly by paying $142 with Travelers instead of $172 with Allstate. Travelers is priced at $173 for those with fair credit, whereas Allstate Insurance Company is priced at $203, a $30 discrepancy. For drivers with bad credit, the difference is even more pronounced: Allstate charges $275, while Travelers charges $231, saving $44 a month or $528 a year.

When comparing insurance, always weigh how a company treats risk factors like age, driving history, and credit—not just the base price.Justin Wright Licensed Insurance Agent

Travelers also increases rates more gradually across credit tiers, making it a better choice for drivers whose scores may fluctuate. Since some states prohibit credit-based auto insurance, check your local laws before selecting a policy.

Best Discount Savings for Allstate vs. Travelers Auto Insurance

Discounts can seriously cut down your auto insurance bill, and Travelers vs. Allstate auto insurance discounts show big differences. Allstate wins with bundling, good driver perks, and military savings, while Travelers offers better deals on anti-theft and pay-in-full auto insurance discounts.

Allstate vs. Travelers Auto Insurance

| Discount Type | ||

|---|---|---|

| Accident-Free | 25% | 13% |

| Anti-Theft | 10% | 15% |

| Bundling | 25% | 13% |

| Claims-Free | 10% | 13% |

| Defensive Driving | 10% | 20% |

| Good Driver | 25% | 10% |

| Good Student | 20% | 8% |

| UBI (Usage-Based Insurance) | 30% | 30% |

| Military | 25% | 10% |

| Multi-Vehicle/Car | 25% | 8% |

| Federal Employee | 10% | 5% |

| Membership | 10% | 10% |

| Pay-in-Full | 10% | 15% |

| Safe Driver | 18% | 17% |

| Loyalty | 15% | 9% |

Allstate Insurance Company offers a 25% bundling discount, making it the better choice for policyholders who combine auto and home insurance, compared to 13% with Travelers. Good drivers save 25% with Allstate, while Travelers only reduces rates by 10%. Travelers provides a 15% discount for anti-theft devices, while Allstate only gives 10%.

Paying in full gets 15% off with Travelers but just 10% with Allstate. Military personnel receive 25% off with Allstate, while Travelers only offers 10% off. If you qualify for multiple discounts, Allstate Corporation is the stronger option, while Travelers may be better for drivers looking for upfront savings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Side-by-Side Comparison of Allstate vs. Travelers Coverage

Allstate and Travelers both give complete range auto insurance plans. They take care of everything starting from what state needs to additional strong features that improve safety and adaptability. The assortment of coverage shown in the table demonstrates their dedication to offering normal as well as unique choices for different driving requirements.

Auto Insurance Coverage Offered by Allstate vs. Travelers

| Coverage Type | ||

|---|---|---|

| Liability | ✅ | ✅ |

| Collision | ✅ | ✅ |

| Comprehensive | ✅ | ✅ |

| Uninsured/Underinsured Motorist | ✅ | ✅ |

| Personal Injury Protection (PIP) | ✅ | ✅ |

| Medical Payments (MedPay) | ✅ | ✅ |

| Rental Reimbursement | ✅ | ✅ |

| Roadside Assistance | ✅ | ✅ |

| Rideshare Insurance | ✅ | ✅ |

| New Car Replacement | ✅ | ✅ |

| Accident Forgiveness | ✅ | ✅ |

| Gap Insurance | ✅ | ✅ |

| Custom Parts & Equipment | ✅ | ✅ |

| Classic Car Insurance | ✅ | ✅ |

| Usage-Based/Telematics Programs | ✅ (Drivewise) | ✅ (IntelliDrive) |

Both insurers include essential coverages like liability, collision, comprehensive, uninsured/underinsured motorist, personal injury protection (PIP), and medical payments (MedPay). When it comes to add-ons, Allstate and Travelers both provide accident forgiveness, new car replacement, roadside assistance, rideshare insurance, rental reimbursement, and gap coverage.

They also provide historic auto protection for older models and coverage for customized components and equipment for vehicles that have been modified. Telematics programs—Drivewise from Allstate and IntelliDrive from Travelers—help safe drivers save based on real-time behavior.

While both are closely matched in offerings, Allstate also includes options like sound system insurance and deductible rewards, whereas Travelers provides premier options like accident-free discounts and minor violation forgiveness, depending on your location.

Key Factors to Consider in Allstate vs. Travelers Ratings

Allstate vs. Travelers auto insurance evaluations suggest that Allstate has better business operations and better customer satisfaction, while Travelers leads in stability and less complaints.

Insurance Business Ratings & Consumer Reviews: Allstate vs. Travelers

| Agency | ||

|---|---|---|

| Score: 691 / 1,000 Avg. Satisfaction | Score: 684 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A Good Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 76/100 Good Customer Feedback |

|

| Score: 1.45 Avg. Complaints | Score: 1.12 Avg. Complaints |

|

| Score: A+ Superior Financial Strength | Score: A++ Superior Financial Strength |

Travelers earns 691/1,000 in J.D. Power, slightly above Allstate’s 684/1,000. Consumer Reports rates Travelers 76/100 vs. Allstate’s 74/100, showing stronger feedback. Travelers has fewer complaints, with a 1.12 NAIC complaint index vs. Allstate’s 1.45. A.M. Best gives Travelers an A++ for financial strength, while Allstate holds an A+. Allstate is rated A for superior business practices, while Travelers gets an A for good practices.

Market share shows how big auto insurance companies are compared to their competitors. Allstate vs. Travelers auto insurance data makes it clear that Allstate has a much bigger presence, while Travelers holds a much smaller slice of the pie. Allstate controls 10.37% of the market, making it one of the larger auto insurers.

Travelers, on the other hand, only holds 2.08%, meaning fewer drivers choose them. The majority—87.55%—go with other companies, which shows how competitive the industry is.

Allstate’s size means more brand recognition and a wider customer base, while Travelers focuses more on competitive pricing to attract specific types of drivers. If you’re choosing between them, it helps to consider how company size affects customer service, claims, and pricing.

On Reddit, one user shared their take on the whole Allstate vs. Travelers debate. They said they don’t work for either company but have had a harder time dealing with Allstate and have heard more complaints about them from customers.

Comment

byu/Hffmntyn from discussion

inInsurance

They would therefore recommend looking into comparable businesses with lower prices or lean toward Travelers. Even though every person’s experience is unique, this type of comment serves as a helpful reminder to consider factors other than price. As the Reddit user said, before choosing a company, it’s worthwhile to observe how they manage customer service.

Allstate and Travelers Use Telematics to Cut Costs

Allstate Indemnity Company offers full coverage auto insurance across the country, with add-ons that give drivers extra protection where it counts. You can add accident forgiveness to avoid a rate hike after your first at-fault crash or choose rideshare insurance coverage if you drive for services like Uber or Lyft. There’s also custom parts and equipment coverage, which protects upgrades like custom wheels or sound systems—up to $5,000.

Allstate’s standout program is Drivewise, built into the mobile app, which tracks behaviors like hard braking, speed over 80 mph, and late-night driving between 11 p.m. and 4 a.m. Drivers receive cashback and policy discounts up to 40% for maintaining safe habits. Drivewise also gives immediate feedback through driving reports and tips, making it easy to improve and save over time.

The Travelers Companies, Inc., established in 1853, now operates out of New York City and offers robust auto insurance solutions through digital innovation. Its program, MyTravelers, allows users to manage policies, file claims, and pay premiums all in one place—streamlining the customer experience.

The signature telematics offering from Travelers is IntelliDrive, a 90-day tracking program that records acceleration, braking, speed, time of day, and mobile device usage. Based on this data, drivers can earn up to a 30% premium discount, though poor driving can also raise rates in some states. IntelliDrive appeals to consistently safe drivers seeking long-term savings and personalized feedback.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of Allstate Insurance

Pros

- Benefits of the Drivewise App: Just by tracking safe practices like smooth braking and avoiding late-night trips, Allstate’s Drivewise program can knock up to 40% off your rate.

- First Accident Forgiveness: This add-on is a good fallback in case things don’t work out because it prevents your rate from increasing following your first at-fault collision.

- Covers Custom Upgrades: Allstate will pay up to $5,000 for aftermarket equipment if your vehicle has extras like a sound system or custom rims.

Cons

- Tough on Low Credit: If your credit isn’t great, expect to pay more—$275 per month, which is $44 higher than Travelers for similar coverage.

- Expensive Teen Rates: A 16-year-old male driver pays $910 per month, which, while cheaper than Travelers, remains a significant expense for families. Find more details in our Allstate insurance review.

Pros and Cons of Travelers Insurance

Pros

- Reduced Penalties for Driving Violations: High-risk drivers save more than $1,400 annually because Travelers only costs $199 for drivers with one accident, whereas Allstate charges $321.

- IntelliDrive Discounts: After just ninety days of tracking, IntelliDrive offers discounts of up to 30% on mobile use, speed, and braking.

- Better for Low Credit: Travelers charges $231 per month for drivers with poor credit and keeps price hikes between credit tiers pretty reasonable.

Cons

- Pricey for Teen Males: If you’ve got a 16-year-old son, Travelers will charge around $1,298 per month, making it the more expensive pick for families.

- Fewer Coverage Add-Ons: Unlike Allstate, Travelers doesn’t offer extras like custom parts coverage, so there’s less flexibility for modified cars. Learn more in our Travelers insurance review.

Comparing Features and Savings Between Allstate and Travelers

Allstate vs. Travelers auto insurance shows a clear difference between extra features and affordable pricing for riskier drivers. Allstate Insurance is great if you want perks like custom parts coverage up to $5,000 and accident forgiveness, but it charges $275 per month for poor credit, which is $44 more than Travelers.

Travelers benefits drivers needing high-risk auto insurance, offering $199 per month after one accident, compared to Allstate’s $321, a $1,464 annual difference. Safe drivers also save more with IntelliDrive, which provides up to 30% off after a 90-day tracking period.

If you want lower rates and don’t need a lot of extras, Travelers fits the bill. Comparing Allstate and Travelers home insurance is also worthwhile, particularly if you’re considering combining plans to save more money. Travelers is a good option if you desire cheaper prices and don’t need many features.

Make careful to check online quotes from several insurance providers to obtain the greatest bargain. Use our free comparison tool to see which companies offer the lowest minimum auto insurance prices.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

How do rates and features compare in Allstate vs. Travelers?

In the Allstate vs Travelers comparison, Travelers offers lower rates for high-risk drivers—charging $199 per month after one accident compared to Allstate’s $321. Allstate, however, includes unique add-ons like custom parts coverage up to $5,000 and accident forgiveness, which Travelers lacks.

What is included in an Allstate auto quote?

An Allstate auto quote includes standard coverages like liability, collision, and comprehensive, with the option to add Drivewise® for up to 40% in discounts, rideshare insurance, and vanishing deductibles. It also factors in your ZIP code, driving history, and credit score.

Which is better for auto insurance, Progressive vs. Travelers?

Progressive vs Travelers reveals Progressive’s Snapshot program gives safe drivers personalized discounts, but Travelers’ IntelliDrive offers up to 30% off after 90 days of monitoring. Travelers is cheaper for drivers with violations, while Progressive may favor bundlers and drivers with strong credit.

What does Allstate travel insurance cover?

Allstate travel insurance provides coverage for trip cancellation, emergency medical, baggage loss, and trip delay. It includes 24/7 travel assistance, with reimbursement limits varying by plan—for example, up to $100,000 for medical emergencies and $1,500 for baggage loss.

What’s the difference in coverage for Travelers vs. Allstate home insurance?

Travelers vs Allstate home insurance shows Allstate covers yard and landscaping damage, green improvements, and identity theft restoration, while Travelers focuses on core structure, personal property, and optional water backup protection. Allstate’s extra features suit homeowners with custom needs; Travelers is often cheaper.

How do coverage and pricing differ in State Farm vs. Travelers?

In State Farm vs Travelers, State Farm offers Steer Clear for drivers under 25 and Drive Safe & Save for telematics savings, while Travelers’ IntelliDrive program is better for tracking performance over a shorter period. Travelers generally offers lower rates for poor credit and accident histories.

What do Travelers insurance review consumer reports say about satisfaction?

Travelers insurance reviews consumer reports highlight a solid claims satisfaction score, ranking above the industry average. Travelers had less complaints on the NAIC Complaint Index (below 1.0 average), and they scored highly on prompt payouts and convenience of submitting claims, according to the most recent data from Consumer Reports.

Why is Travelers insurance so cheap for some drivers?

Why is Travelers insurance so cheap? Their rates stay low for drivers who perform well in the IntelliDrive program, with up to 30% off for safe behavior like gentle braking and avoiding phone use. Also, Travelers increases premiums less sharply for poor credit, keeping it accessible for more drivers.

What are the key differences in Travelers vs. USAA auto insurance?

Travelers vs USAA shows USAA is exclusive to military members and families, offering consistently lower rates and perks like free roadside assistance plans. Travelers is available to all drivers, offers more flexible telematics discounts, and is better suited for high-risk or young drivers who aren’t eligible for USAA.

How expensive are Allstate DUI insurance rates?

Allstate DUI insurance rates average $385 per month, which is $91 more than Travelers’ $294. Allstate may also require an SR-22 in applicable states and apply larger surcharges for high-risk drivers, making it a costlier option after a DUI compared to other major insurers.

Is Travelers insurance better than Progressive?

Travelers insurance is better than Progressive for high-risk drivers, offering lower post-accident rates—$199 per month after one accident versus higher averages with Progressive—while Progressive may be better for bundling and multi-vehicle discounts.

Is Allstate better than State Farm?

Allstate is better than State Farm if you want policy extras like vanishing deductibles and custom parts coverage, while State Farm is better for teen drivers, offering up to 15% off through the Steer Clear program from State Farm and often lower base rates for families with young drivers.

Is Travelers Insurance a good company?

Travelers insurance is a good company, backed by an A++ rating from A.M. Best and a low NAIC complaint index under 1.0, meaning fewer complaints than the national average. It offers strong value for safe drivers, especially through its IntelliDrive program, which gives up to 30% off after 90 days of tracking driving behavior.

Does Allstate pay well on claims?

Allstate pays well on claims in many cases, but according to Consumer Reports and J.D. Power, it scores around average in customer satisfaction. It receives more claims-related complaints than Travelers, especially for delays in payout and settlement amounts, as reflected in NAIC complaint data.

Is Allstate a good auto insurance?

Allstate’s rates are high because it adds surcharges for risk factors like poor credit (up to $275 per month) and DUIs (up to $385 per month). Its pricing reflects access to premium features like Drivewise, roadside assistance, and broader optional coverages that raise the total cost.

For drivers looking for cheap auto insurance after DUI, Allstate may not be the most budget-friendly option compared to competitors with lower penalty increases.

Why are Allstate’s rates so high?

Allstate’s rates are high because it adds surcharges for risk factors like poor credit (up to $275 per month) and DUIs (up to $385 per month). Its rates reflect access to premium features like Drivewise, roadside assistance, and more comprehensive optional coverages that increase overall cost.

Does Travelers cover windshield repair?

Travelers covers windshield repair through its comprehensive coverage, and in many states, repairs for small chips or cracks are fully covered with no deductible. Full windshield replacement may still require a deductible, but the Glass Repair Program helps coordinate quick service with approved shops.

Use our quote comparison tool to get quick and affordable auto insurance coverage right now.

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.