Best 3-Month Auto Insurance in 2025 (Top 10 Company Ranking)

The best three-month auto insurance policies come from Travelers, Geico, and State Farm. You can't buy a true temporary three-month car insurance plan, but you can get affordable coverage starting at $25 per month. When you no longer need coverage, simply cancel your car insurance policy.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Jul 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,733 reviews

1,733 reviewsCompany Facts

Full Coverage for 3 Months

A.M. Best

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for 3 Months

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for 3 Months

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsTravelers, Geico, and State Farm have the best three-month auto insurance policies.

Our Top 10 Company Picks: Best 3-Month Auto Insurance

| Company | Rank | Early Cancellation | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | Very High Flexibility | A++ | Accident Forgiveness | Travelers |

|

| #2 | Very High Flexibility | A++ | Cheap Rates | Geico | |

| #3 | High Flexibility | A++ | Personalized Service | State Farm | |

| #4 | High Flexibility | A+ | Online Convenience | Progressive | |

| #5 | High Flexibility | A+ | 24/7 Support | Erie |

| #6 | High Flexibility | A | Customizable Polices | Liberty Mutual |

| #7 | Moderate Flexibility | A | Flexible Payments | Safeco | |

| #8 | Moderate Flexibility | NR | Low-Mileage Drivers | Metromile | |

| #9 | Low Flexibility | A++ | Military Savings | USAA | |

| #10 | Low Flexibility | A+ | Full Coverage | Allstate |

Travelers takes our top spot for temporary car insurance for three months because it offers customizable coverage and several car insurance discounts that apply to short-term coverage.

- Reputable car insurance companies don’t sell insurance in three-month terms

- To get temporary coverage, you can buy a policy and cancel it when you’re done

- Travelers and Geico are the best options for three-month coverage

Read on to learn more about short-term car insurance, including your best options for temporary coverage and where to buy it. Then, enter your ZIP code into our free comparison tool to see the best rates in your area.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

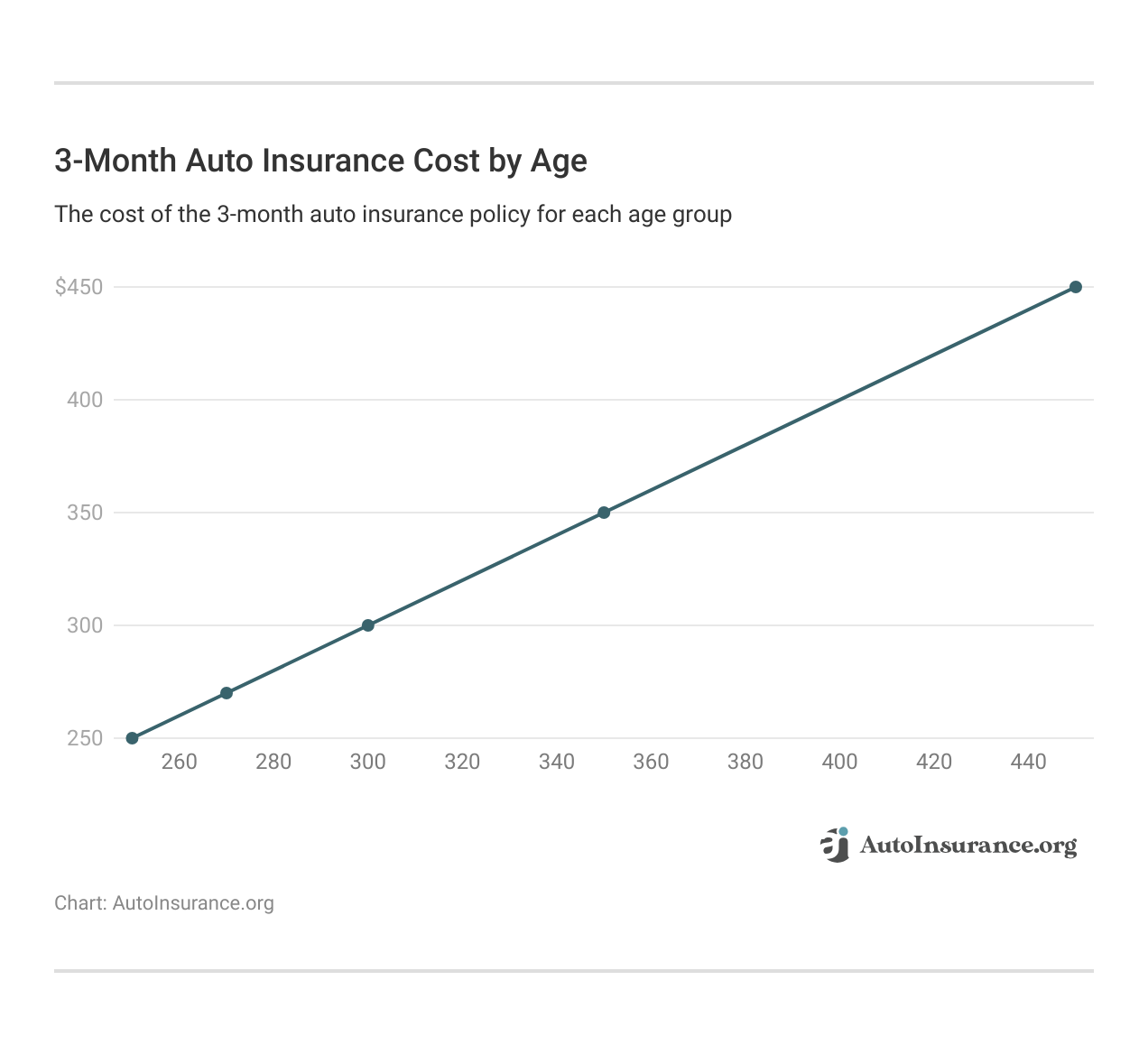

3-Month Auto Insurance Rates

Since you need to purchase a regular policy that you’ll cancel when you no longer need coverage, three-month insurance rates are the same as standard coverage. Check the rates below to see average prices from our top companies.

3-Month Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $44 | $144 | |

| $33 | $92 |

| $25 | $124 | |

| $42 | $107 |

| $29 | $85 | |

| $29 | $93 | |

| $35 | $88 | |

| $40 | $115 | |

| $70 | $130 | |

| $33 | $101 |

Although it can be expensive, driving without insurance comes with serious consequences — it’s always best to get coverage. Luckily, there are several ways to save on your insurance.

For starters, you should look for a company that offers you the most discount possible. Check below to see a selection of discounts people looking for temporary coverage may qualify for from our top providers.

Top Discounts for 3-Month Auto Insurance

| Company | Accident-Free | Bundling | Paid-in-Full | UBI |

|---|---|---|---|---|

| 25% | 25% | 10% | 30% | |

| 25% | 25% | 15% | 30% |

| 22% | 25% | 10% | 25% | |

| 20% | 25% | 12% | 30% |

| 20% | 15% | 10% | 30% | |

| 10% | 10% | 15% | $231/yr | |

| 30% | 10% | 15% | 30% | |

| 17% | 17% | 15% | 30% | |

| 13% | 13% | 15% | 30% | |

| 10% | 10% | 20% | 30% |

You can also take steps like choosing the highest deductible possible, picking the least amount of coverage required in your state, and keeping your driving record clean.

Short-term insurance can help with temporary coverage, but it could affect your future insurance rates since gaps in coverage are a red flag.Scott W. Johnson Licensed Insurance Agent

One of the most important steps to take is comparing car insurance quotes. You’ll find that some companies charge you much more than others, and the only way to be sure you don’t overpay is to compare quotes.

Most companies provide a quote request option on their website, which takes about 10 to 15 minutes to fill out.

If filling out multiple forms doesn’t sound appealing, you can always use our quote comparison tool to look at several quotes at once.

Reasons Drivers Need 3-Month Auto Insurance

There are many reasons you might consider a short-term car insurance policy. These are some possible scenarios where your auto insurance needs can change:

- Student Away at College: You might want to take your student off your policy when they go to college and leave their car at home. However, most companies will give you a discount if you keep them on your policy, and then your student can still drive when they are home.

- Borrowing or Renting a Car: If you are borrowing or renting a car, your traditional car insurance policy might already cover you. If not, consider getting a non-owner auto insurance policy. This allows you to have the coverage you want on a car that isn’t yours. You do not have to start and stop your insurance.

- Storing a Vehicle: If you won’t be driving your car for a few months, you might want to switch to a temporary policy. You should still keep at least comprehensive coverage on your car so that damages will still be covered.

- Driving in Another Country: If you are driving in Mexico or Canada, you might have to add short-term international coverage to your auto insurance policy. Speak with an agent to determine what you will need.

There are many reasons you may need a non-traditional auto insurance policy. Before you make any decisions, find out exactly what you will need and what options are available to you.

Before you find yourself at a rental car counter deciding whether you should buy rental car coverage, here are a few details to keep in mind: https://t.co/y7gciSDtyA #CarInsurance #RentalCar pic.twitter.com/nO6QnEl0jM

— Travelers (@Travelers) August 17, 2022

Some drivers purchase a traditional auto insurance policy and then cancel it when they no longer need it. That can be risky.

Although you can cancel your car insurance policy at any time for any reason, some companies will charge additional fees, so you could wind up paying more than if you just kept your policy to term.

Auto Insurance Companies That Sell Short-Term Policies

Temporary car insurance is available in Texas, New Jersey, and many other states. However, some companies don’t carry short-term auto insurance options. But how can I insure a car for three months? You can get a three-month auto insurance policy if you need it.

What if you need a car for three months? A three-month car insurance plan is a short-term solution, and some companies may penalize you for using car insurance for only three months. It’s all about finding an insurance company that will serve your needs and provides you with the policy that you want, at an affordable price.

You’ve probably seen three months of free car insurance somewhere online, but these free car insurance promises may come with a high down payment.

From an underwriting standpoint, it is very different writing a risk for such a short period as three months.

Traditional auto insurance terms of six-months or one year give you the peace of mind that you know what your rates are and that they won’t change. The car insurance company also knows that they can expect the same amount of money each month. When you get a car insurance policy for a year, the policy rate you pay is expected to cover the risk that you present to that insurer for that period.

When you cut that length of time down to three months, it takes a unique underwriting talent pool to come up with a competitive rate amount based on your present risk.

Niche insurance companies service the temporary auto insurance market because they have the expertise to write such unique car insurance policies. This means that they will be experienced in writing risks such as yours, pricing them competitively, and servicing them.

Short-Term Auto Insurance Price Fluctuations

As an insured, the risk to you when you have a car insurance policy for such a short period is that you face an increased risk of rate fluctuation. When you have an annual insurance policy and get in an accident in month two of the policy, the rate you are paying is not going to increase until the policy is renewed that following year.

With a three-month car insurance policy, though, the rate will increase right after month three when your policy is up for renewal.

This creates an environment for insurers where they can price policies more competitively in terms of rates and then adjust at renewal more frequently so that you as a risk is the price in a way where they are not over-exposed to something outside of their business appetite.

Short-term car insurance policies are certainly available. It’s all about shopping for the online market, though, to find the right policy. This means finding a policy that has a reasonable rate while also providing good value in terms of the coverage it provides.

The market is certainly out there. It all comes down to you and how you’re comparing policies that are available and choosing what gives you the most comfort.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best 3-Month Auto Insurance Companies

Travelers, Geico, and State Farm have the best car insurance policies that last three months. Check out this list of pros and cons to see why we chose these top 10 providers:

#1 – Travelers: Top Pick Overall

Pros

- Customizable Coverage: Travelers gives you the ability to tailor policies to your specific short-term needs.

- Discounts Available: Travelers’ multiple discounts can be applied to even month-by-month auto insurance.

- Strong Financial Stability: With an A++ from A.M. Best, Travelers offers a reliable claims payout history. See more ratings in our Travelers auto insurance review.

Cons

- Limited Availability: Drivers from only 42 states are eligible to purchase coverage from Travelers.

- Complexity in Customization: Customizing three-month insurance policies might require more detailed interaction with agents.

#2 – Geico: Best for Affordable Short-Term Policies

Pros

- Affordable Rates: Geico offers competitive pricing, even for three-month temporary car insurance.

- Easy Online Management: Geico’s convenient online tools make policy management easy, no matter where you are.

- Customer Service: Geico’s representatives have a reputation for providing strong customer support for policy adjustments.

Cons

- Coverage Gaps: Some specialized coverages may not be available for car insurance for three months from Geico.

- Claims Process: Many customers report that Geico’s claim process can be slower than that of some competitors. Learn more about the claims process in our Geico auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#3 – State Farm: Best for Personalized Service

Pros

- Extensive Agent Network: State Farm has a large network of local agents for personalized service.

- Strong Reputation: Most drivers report that State Farm offers high customer satisfaction and reliable coverage. See what more customers have to say in our State Farm car insurance review.

- Customizable Policies: State Farm has flexible policy terms to suit temporary needs.

Cons

- Pricing Transparency: Doing a short-term car insurance comparison with State Farm can be difficult as its premiums can be less transparent.

- Less Competitive Rates: State Farm typically has higher rates for month-by-month car insurance.

#4 – Progressive: Best for Immediate Auto Insurance Coverage

Pros

- Snapshot: The Snapshot program is Progressive’s usage-based insurance (UBI) option for potential discounts based on driving habits. See if Snapshot could help you save in our Progressive auto insurance review.

- Rapid Quote Process: Progressive’s focus on a digital insurance experience has led to a fast and efficient online quoting system. If you need three-month insurance fast, Progressive may be your best choice.

- Flexible Payment Options: Progressive offers multiple payment plans for short-term coverage.

Cons

- Limited Physical Locations: Progressive doesn’t have as many local officers, which means there are fewer local agents for in-person support.

- Discount Restrictions: Some discounts may not apply to Progressive temporary car insurance policies.

#5 – Erie: Best for Customer Service

Pros

- Excellent Customer Service: Erie’s primary focus is on its customers, which has led to a highly-rated customer experience.

- Flexible Coverage: Get customizable short-term policies with Erie that include a variety of specialty coverage, like roadside assistance and pet insurance.

- Customer Service: Erie has a strong reputation for excellence in customer service, with plenty of local agents for personalized support.

Cons

- Availability: Erie insurance is limited to 12 states, mostly on the East Coast. See if you live in one of those states in our Erie auto insurance review.

- Premium Costs: Erie is not the cheapest option for temporary car insurance policies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#6 – Liberty Mutual: Best for Unique Coverage Options

Pros

- Diverse Coverage Options: Liberty Mutual offers coverage options that can be hard to find elsewhere, like better car replacement insurance. Explore your coverage options in our Liberty Mutual auto insurance review.

- Accident Forgiveness: Liberty Mutual’s accident forgiveness is usually available for short-term plans.

- Easy Claims Process: Most customers agree that Liberty Mutual’s streamlined claims handling process is fast and efficient.

Cons

- Discount Availability: Liberty Mutual may offer 17 discounts, but you won’t have access to all of them if you want three-month coverage.

- Policy Complexity: You’ll face more complex terms and conditions for temporary car insurance for three months from Liberty Mutual.

#7 – Safeco: Best for Flexible Payment Options

Pros

- Customizable Plans: Safeco offers the chance to customize policies for three-month car insurance. Explore all of your coverage options to make the perfect policy in our Safeco auto insurance review.

- Strong Support: Even if you’re buying auto insurance month-to-month, Safeco promises good customer service and support.

- Flexible Payment Plans: Safeco makes it easy to pay for a three-month auto insurance policy with its various payment options.

Cons

- Higher Rates: Although it has flexible payment options, Safeco’s premiums can be higher for short-term policies.

- Discount Limitations: Not all of Safeco’s 10 discounts are available for temporary policies.

#8 – Metromile: Best for Low-Mileage Drivers

Pros

- Pay-Per-Mile Coverage: Metromile’s pay-per-mile model helps low-mileage drivers save money on car insurance for three months.

- Flexible Insurance Options: With a Metromile policy, you can easily adjust your plan to fit month-to-month car insurance needs.

- Tech Integration: Metromile has a robust mobile app for policy management and mileage tracking. See how the app works in our Metromile auto insurance review.

Cons

- Mileage Caps: If you’re a high-mileage driver, Metromile probably isn’t the best choice. Metromile has higher rates if your driving exceeds certain mileage limits.

- Restricted Availability: Metromile sells insurance in just eight states: Arizona, California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia, and Washington.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#9 – Allstate: Best for Full Coverage Policies

Pros

- Broad Coverage Options: Get extensive coverage through Allstate’s full coverage policies, even if you just need short-term car insurance for three months.

- Solid Discounts: Allstate offers 12 discounts to help drivers save, many of which can beaded to a three-month insurance policy.

- Strong Customer Service Ratings: Allstate earns its spot as one of the best insurance companies in the country by offering friendly and helpful customer service.

Cons

- Higher Costs: Allstate is almost always the most expensive option for car insurance, whether you need long-term or short-term coverage. See what your premiums might look like in our Allstate auto insurance review.

- Complex Policies: Whether you want a traditional policy or a three-month car insurance plan, customizing your Allstate policy can be complex.

#10 – USAA: Best for Military Families

Pros

- Competitive Rates: USAA is almost always the most affordable option on the market, even if you plan on buying three months of car insurance.

- Customer Service Reputation: USAA consistently earns high customer satisfaction ratings. See how USAA keeps its customers happy in our USAA auto insurance review.

- Member Benefits: As a company focused on serving military personnel and their families, USAA offers exclusive benefits for military members.

Cons

- Membership Restrictions: You can’t purchase USAA car insurance without a membership, and membership is limited to military members and their families.

- Lacking Coverage Options: USAA doesn’t offer as many coverage options as some of its competitors. For example, you can’t purchase gap insurance at USAA.

Find the Best 3-Month Auto Insurance Today

Before you buy three-month auto insurance, be sure to shop around for the best deals. Each company will charge different temporary auto insurance rates.

If you need auto insurance for three months, start by entering your ZIP code in the free comparison tool below.

Frequently Asked Questions

Can you get car insurance for three months?

Yes, some insurance companies offer three-month car insurance policies. However, most do not. It’s important to shop around and compare quotes to find the best coverage options for your needs. You should also know how to manage your auto insurance policy so you can get the right coverage.

Which companies sell short-term auto insurance?

While not all insurance companies offer short-term auto insurance, there are niche insurance companies that specialize in providing coverage for shorter periods, such as three months. These companies have expertise in writing unique policies to cater to specific needs.

Why would I need auto insurance for three months?

There are various reasons why you might need a short-term car insurance policy. For example, if you’re borrowing a vehicle for a few months or if you’re in between longer-term policies. It’s important to assess your specific situation, and to learn how to get auto insurance on a month-to-month basis.

Do short-term auto insurance policies have more fluctuation in rates?

Short-term auto insurance policies can be subject to more rate fluctuation compared to longer-term policies. Insurers may adjust rates more frequently with short-term policies, which could result in changes to your premium when the policy is up for renewal.

Can I cancel my auto insurance if I pay monthly?

Learning how to cancel your auto insurance depends on the terms and conditions set by your insurance provider. Some companies allow cancellation with proper notice, while others may charge additional fees for early cancellation. It’s important to review your policy and contact your insurer for specific details.

Can I suspend my auto insurance for three months?

You can’t suspend a car insurance policy. You can only cancel or renew. If you cancel your car insurance policy after three months, you could pay a fine.

Some car insurance companies have short-term car insurance options. Enter your ZIP code into our free comparison tool to see which companies offer temporary car insurance.

What is the best month to buy auto insurance?

The best time to buy car insurance is in February and August.

What is the average cost of monthly auto insurance?

The average monthly car insurance cost is $86 per month for full coverage, according to the NAIC.

Can you buy one-month auto insurance?

No. If you happen to carry auto insurance for one month and cancel, you could be fined by the auto insurance company.

Can I cancel my auto insurance if I pay monthly?

It depends on your terms of service. Auto insurance companies prefer that you set a date 15 to 60 days after you want to cancel.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.