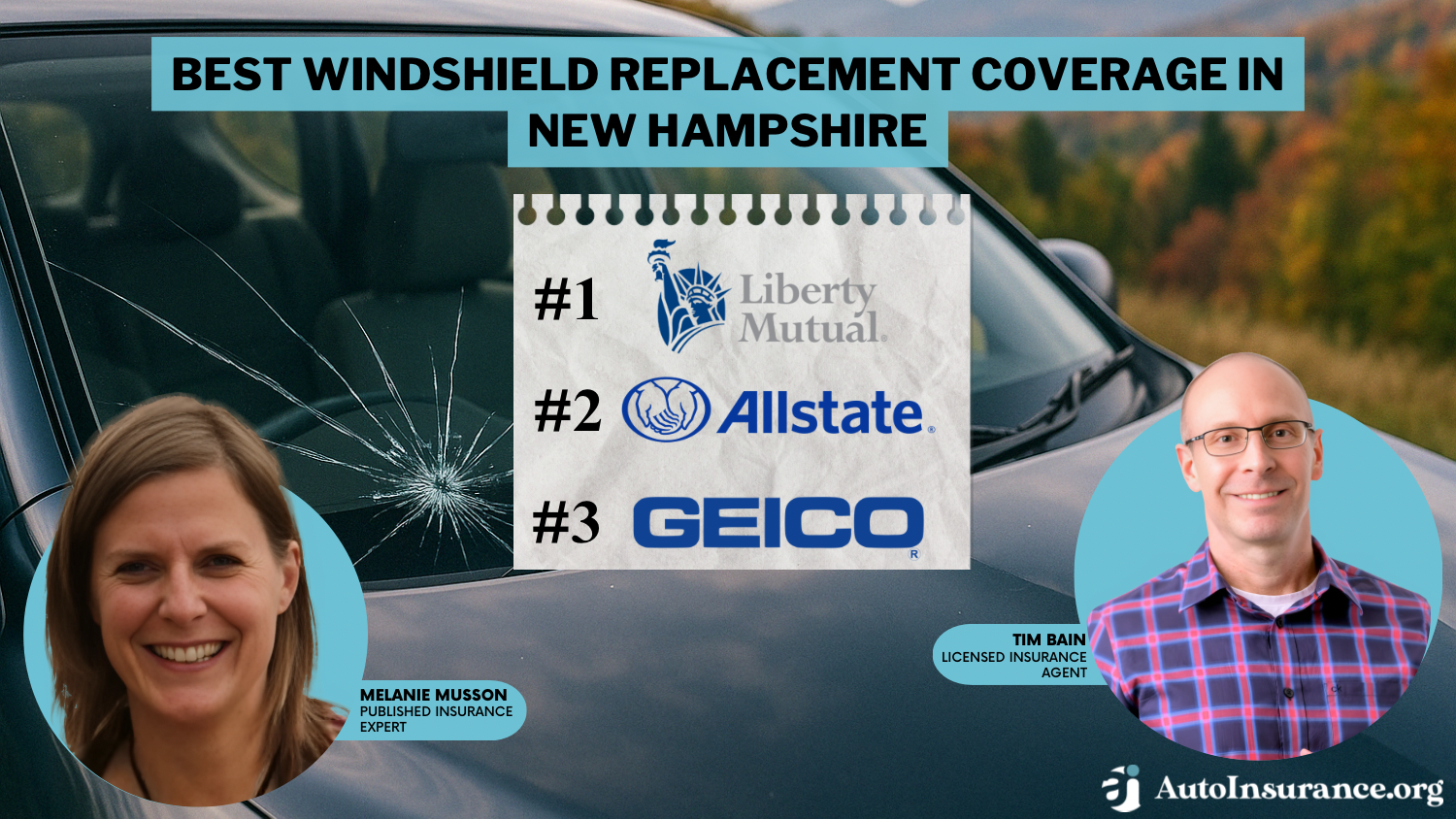

Best Windshield Replacement Coverage in New Hampshire (Top 10 Companies in 2025)

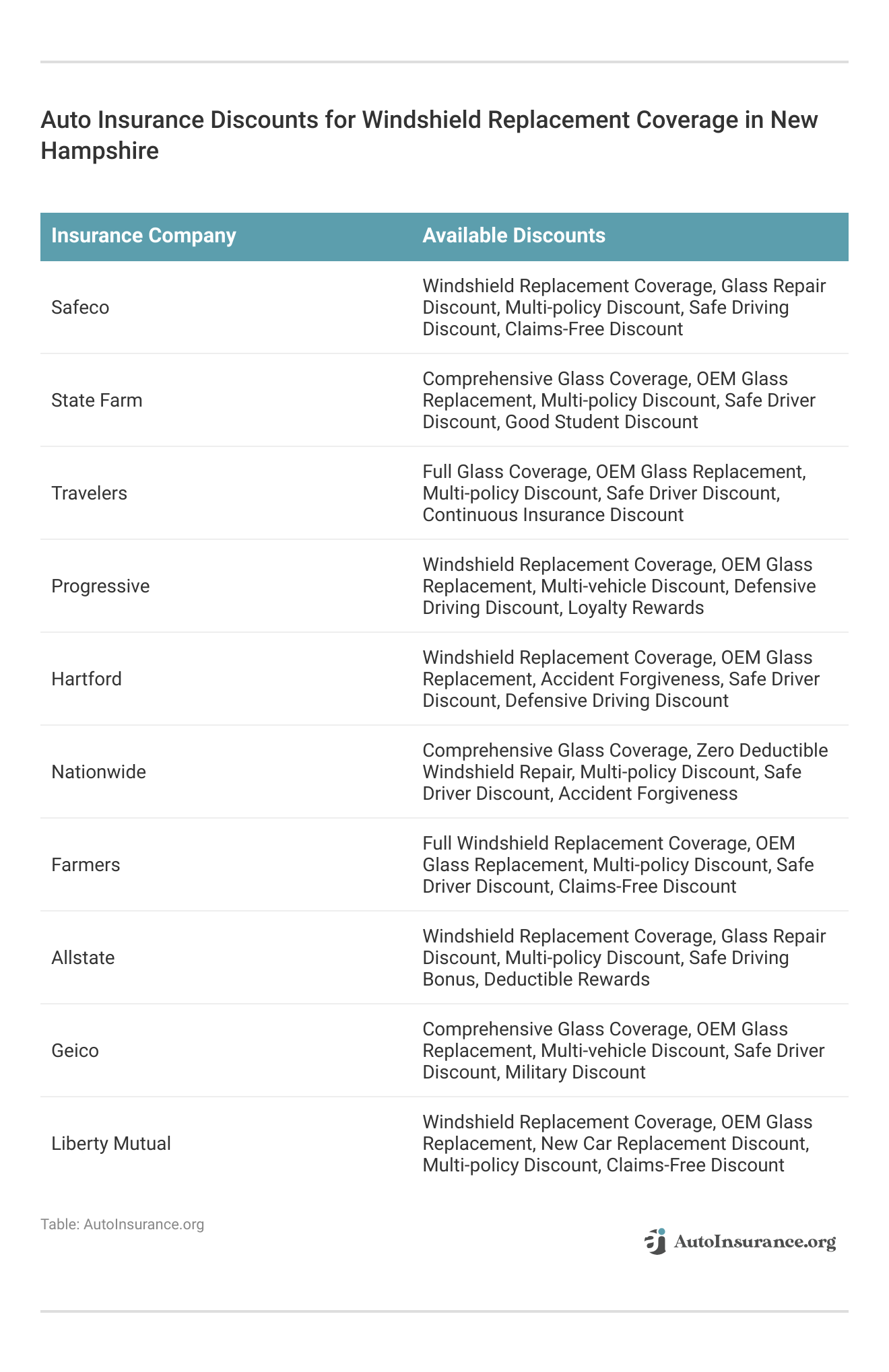

Liberty Mutual, Allstate, and Geico provide the best windshield replacement coverage in New Hampshire, with premiums beginning at $45 per month. Our goal is to help you compare quotes from these reliable insurers, ensuring you get the best coverage along with personalized discounts for your vehicle.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,792 reviews

3,792 reviewsCompany Facts

Full Coverage Windshield Replacement in New Hampshire

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage Windshield Replacement in New Hampshire

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage Windshield Replacement in New Hampshire

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews- Liberty Mutual offers competitive rates starting at $283 per month

- Leading insurance providers provide opportunities on windshield replacements

- Multiple discount options are available for windshield replacement coverage

#1 – Liberty Mutual: Top Overall Pick

Pros

- Comprehensive Coverage Options: Liberty Mutual offers a wide range of coverage options tailored to meet various needs, ensuring customers can find a policy that suits them.

- Strong Financial Stability: With a solid financial standing, Liberty Mutual provides reassurance to policyholders that their claims will be handled efficiently and effectively.

- Competitive Premiums: Despite offering extensive coverage, Liberty Mutual maintains competitive premiums, providing good value for money. For further insights, refer to our Liberty Mutual auto insurance review.

Cons

- Limited Discounts: While Liberty Mutual offers some discounts, they may be less extensive compared to other providers, potentially resulting in higher premiums for some customers.

- Mixed Customer Service Reviews: Reviews of Liberty Mutual’s customer service are varied, with some customers reporting positive experiences while others have encountered issues with communication or claims processing.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Allstate: Best for Extensive Coverage

Pros

- Extensive Coverage Options: Allstate provides a wide array of coverage options, allowing customers to customize their policies to suit their specific needs and preferences.

- Innovative Features: Allstate offers innovative features such as the Drivewise program, which rewards safe driving behavior, providing added value to policyholders.

- Strong Online Presence: With user-friendly online tools and resources, Allstate makes it easy for customers to manage their policies and access support when needed.

Cons

- Higher Premiums: Allstate’s premiums may be higher compared to some other insurers, potentially making it less affordable for budget-conscious customers. Use our Allstate auto insurance review as your guide.

- Mixed Claims Experience: While many customers report positive experiences with Allstate’s claims process, some have encountered delays or difficulties in getting claims resolved, leading to frustration.

#3 – Geico: Best for Excellent Service

Pros

- Excellent Customer Service: Geico is renowned for its exceptional customer service, with friendly and knowledgeable representatives available to assist customers with their inquiries and claims.

- Competitive Rates: Geico offers some of the most competitive rates in the industry, making it an attractive option for budget-conscious individuals seeking affordable coverage.

- Convenient Online Tools: Geico’s user-friendly website and mobile app make it easy for customers to manage their policies, file claims, and access important information anytime, anywhere.

Cons

- Limited Coverage Options: While Geico offers basic coverage options, it may not provide as many customizable options as some other insurers, potentially limiting choices for customers with specific needs.

- Complex Claims Process: Some customers have reported experiencing complexities or delays in the claims process with Geico, which could lead to frustration and inconvenience. Read more through our Geico auto insurance review.

#4 – State Farm: Best for Trusted Reputation

Pros

- Trusted Reputation: State Farm is well-known for its long-standing reputation and reliability in the insurance industry, instilling confidence in policyholders.

- Excellent Customer Service: State Farm prides itself on its personalized customer service, with dedicated agents available to assist policyholders with their needs.

- Wide Network of Agents: With a vast network of local agents, State Farm offers personalized assistance and support to customers across the country. Find out more in our State Farm auto insurance review.

Cons

- Potentially Higher Premiums: While State Farm offers quality coverage, its premiums may be higher compared to some competitors, potentially making it less affordable for certain individuals.

- Limited Online Tools: State Farm’s online tools and mobile app may be less advanced compared to some other insurers, potentially limiting convenience for customers who prefer digital management.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Travelers: Best for Financial Stability

Pros

- Financial Stability: Our Travelers auto insurance review reveals that Travelers boasts strong financial stability, providing assurance to policyholders that their claims will be paid promptly and efficiently.

- Flexible Coverage Options: Travelers offers a variety of coverage options and customizable policies, allowing customers to tailor their coverage to meet their specific needs.

- Discount Opportunities: Travelers provides various discount opportunities, helping policyholders save money on their premiums through safe driving habits, bundled policies, and more.

Cons

- Mixed Customer Service Reviews: Reviews of Travelers’ customer service are mixed, with some customers reporting positive experiences while others have encountered difficulties with claims processing or communication.

- Higher Premiums for Certain Coverages: While Travelers offers competitive rates for some policies, premiums for certain coverages may be higher compared to other insurers, potentially affecting affordability for some customers.

#6 – Nationwide: Best for Nationwide Coverage

Pros

- Nationwide Coverage: Nationwide offers coverage options in all 50 states, providing accessibility and convenience for customers no matter where they reside. Read more through our Nationwide auto insurance review.

- Bundle Discounts: Nationwide offers discounts for bundling multiple policies, such as auto and homeowners insurance, helping customers save money on their overall insurance costs.

- Strong Financial Stability: Nationwide’s strong financial stability ensures that policyholders can rely on the company to fulfill its obligations and pay claims promptly and fairly.

Cons

- Limited Discounts for Single Policies: While Nationwide offers bundle discounts, discounts for single policies may be limited compared to some other insurers, potentially resulting in higher premiums for individual coverage.

- Mixed Claims Experience: Some customers have reported mixed experiences with Nationwide’s claims process, with issues such as delays or difficulty in communication, impacting overall satisfaction.

#7 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: In our Progressive auto insurance review, Progressive is known for offering competitive rates, making it an attractive option for budget-conscious customers seeking affordable coverage.

- Wide Range of Discounts: Progressive provides numerous discount opportunities, including safe driving discounts, multi-policy discounts, and more, helping policyholders save money on their premiums.

- Convenient Online Tools: Progressive offers a user-friendly website and mobile app, allowing customers to manage their policies, file claims, and access important information with ease.

Cons

- Complex Claims Process: Some customers have reported experiencing complexities or delays in Progressive’s claims process, which could lead to frustration and inconvenience.

- Limited Coverage Options for High-Risk Drivers: Progressive may offer limited coverage options for high-risk drivers, potentially resulting in higher premiums or less comprehensive coverage for these individuals.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Personalized Service

Pros

- Personalized Service: American Family is known for its personalized service, with dedicated agents available to assist customers with their insurance needs and provide tailored recommendations. Read more through our American Family auto insurance review.

- Discount Opportunities: American Family offers various discount opportunities, such as safe driving discounts, bundling discounts, and more, helping customers save money on their premiums.

- Strong Community Involvement: American Family is actively involved in supporting local communities through various initiatives and programs, demonstrating a commitment to social responsibility.

Cons

- Potentially Higher Premiums: While American Family offers quality coverage and personalized service, its premiums may be higher compared to some competitors, potentially making it less affordable for certain individuals.

- Limited Availability: American Family may have limited availability in certain regions, which could restrict access to coverage for customers in those areas.

#9 – Farmers: Best for Strong Benefits

Pros

- Wide Range of Coverage Options: Farmers, as mentioned in our Farmers auto insurance review, offers a wide range of coverage options, allowing customers to tailor their policies to meet their specific needs and preferences.

- Strong Claims Handling: Farmers is known for its efficient claims handling process, with dedicated claims representatives available to assist customers throughout the claims process.

- Discount Opportunities: Farmers provides various discount opportunities, including safe driving discounts, multi-policy discounts, and more, helping customers save money on their premiums.

Cons

- Potentially Higher Premiums: While Farmers offers comprehensive coverage options, its premiums may be higher compared to some other insurers, potentially affecting affordability for certain individuals.

- Limited Online Tools: Farmers’ online tools and digital resources may be less advanced compared to some other insurers, potentially limiting convenience for customers who prefer digital management.

#10 – The General: Best for High-Risk Coverage

Pros

- Specialized High-Risk Coverage: The General specializes in providing coverage for high-risk drivers who may have difficulty obtaining insurance from traditional insurers, offering options for those with less-than-perfect driving records.

- Quick and Easy Quotes: The General offers quick and easy online quotes, allowing customers to get a preliminary estimate of their insurance costs without the need for extensive paperwork or phone calls.

- Accessible Customer Service: The General provides accessible customer service options, including online chat and phone support, making it easy for customers to get assistance when needed.

Cons

- Higher Premiums: The General’s premiums may be higher compared to traditional insurers, reflecting the increased risk associated with insuring high-risk drivers. Read more through our The General auto insurance review.

- Limited Coverage Options: The General may offer limited coverage options compared to traditional insurers, potentially resulting in less comprehensive coverage for policyholders.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Zero-Deductible Full Glass Coverage Laws in New Hampshire

Laws Concerning Replacement Parts in New Hampshire

Laws Governing Choice of Repair Vendor in New Hampshire

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheap Auto Insurance in New Hampshire: The Bottom Line

Frequently Asked Questions

Is it illegal to drive with any windshield damage in New Hampshire?

Yes, it is illegal to drive with any windshield damage, including minor chips, in New Hampshire.

Can I get $0 deductible options for windshield replacement insurance in New Hampshire?

You can inquire with your insurance provider about $0 deductible options for windshield replacement insurance in New Hampshire. Enter your ZIP code now to begin.

Are there laws in New Hampshire regarding zero-deductible full-glass coverage for windshields?

What should I do to fix a windshield with a chip?

The appropriate fix for a windshield chip depends on its severity. Minor cracks can be repaired with a patch-job, while significant cracks may require windshield replacement. If you have cracked windshield insurance, you may be able to file a claim to cover the costs.

What are the laws in New Hampshire regarding cracked windshields?

In New Hampshire, driving a vehicle with any cracks in the windshield is prohibited by law, and violators may face a fine of at least $75. It is important to be aware of these laws and potential citations and fines. Enter your ZIP code now to begin.

What are the top three companies offering the best windshield replacement coverage in New Hampshire?

What is the average monthly rate for windshield replacement coverage with Liberty Mutual, Allstate, and Geico?

The average monthly rate for windshield replacement coverage with Liberty Mutual, Allstate, and Geico starts at $45 per month.

Does New Hampshire have laws mandating zero-deductible provisions for windshield cracks in all insurance policies?

No, New Hampshire does not have laws mandating zero-deductible provisions for windshield cracks in all insurance policies. However, certain policies may offer this provision. Enter your ZIP code now to begin.

What are some key factors to consider when opting for windshield replacement coverage in New Hampshire?

How does New Hampshire law regulate the use of aftermarket parts for windshield repairs?

New Hampshire law allows aftermarket parts for repairs but regulates their use. Aftermarket parts can’t be used if the vehicle is two years old or less, has 30,000 miles or fewer, or the owner requests OEM parts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.