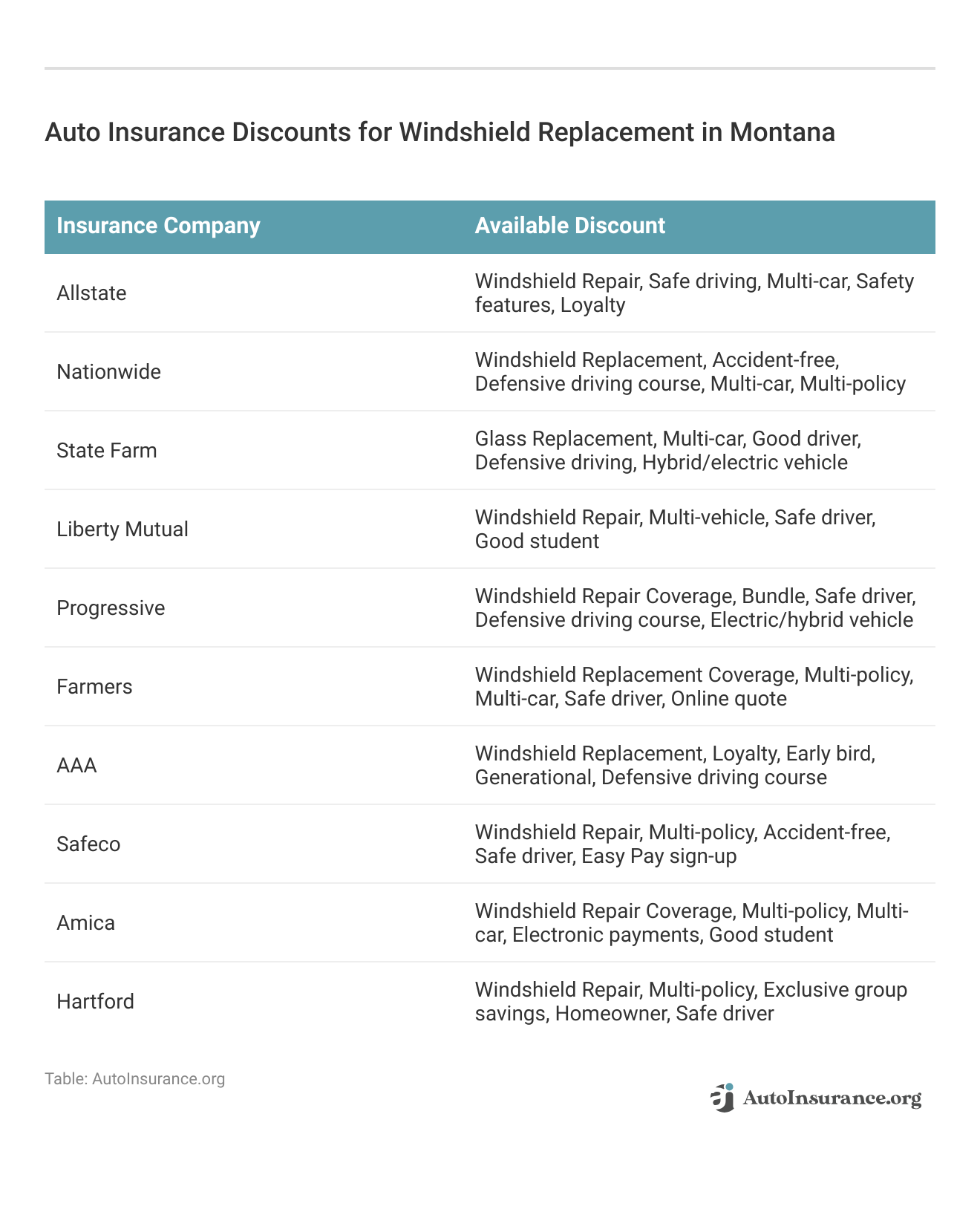

Best Windshield Replacement Coverage in Montana (Top 10 Companies Ranked for 2025)

Allstate, Nationwide, and State Farm offer the best windshield replacement coverage in Montana, starting from a mere $35 per month. We aim to assist you in comparing quotes from these reputable insurers, ensuring you secure the ideal coverage and capitalize on tailored discounts for your vehicle.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Apr 18, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 18, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage Windshield Replacement in Montana

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage Windshield Replacement in Montana

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage Windshield Replacement in Montana

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews- Allstate offers competitive pricing starting from $220 monthly

- Top insurance providers present choices for windshield replacements

- Numerous discounts are accessible for windshield replacement coverage

#1 – Allstate: Top Overall Pick

Pros

- Competitive Rates: Offers comprehensive protection starting at $35 per month.

- Wide Coverage Options: Extensive selection of coverage options to match unique driving needs.

- Customer Service: Known for strong customer support and assistance with claims.

Cons

- Price Variability: Rates can vary significantly based on location and driving history.

- Deductibles: Higher deductibles may apply for some claims. Use our Allstate auto insurance review as your guide.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Glass Protection

Pros

- Glass Protection: Specifically praised for its glass protection policies.

- Discounts: Nationwide, as mentioned in our Nationwide insurance review, offers multiple discounts that can lower overall premiums.

- Customer Satisfaction: Generally high ratings for customer satisfaction and claims handling.

Cons

- Premiums: Monthly premiums can be higher compared to some competitors.

- Coverage Limits: Some policies may have strict limits on glass damage coverage.

#3 – State Farm: Best for Glass Repair

Pros

- Reputation: Strong reputation and reliable service in the insurance industry.

- Glass Repair Coverage: Known for excellent glass repair services. Find out more in our State Farm auto insurance review.

- Local Agents: Wide network of local agents providing personalized service.

Cons

- Cost: Generally more expensive compared to some other providers.

- Policy Options: Limited customization options for specific needs.

#4 – Liberty Mutual: Best for Glass Coverage

Pros

- Comprehensive Coverage: Offers extensive glass coverage options.

- Customer Service: High ratings for customer service and support.

- Discount Programs: Various discount programs available for different customer profiles.

Cons

- Price: Premiums can be higher than average. For further insights, refer to our Liberty Mutual auto insurance review.

- Deductibles: Deductible amounts may be higher for some types of coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Windshield Repair Coverage

Pros

- Affordable Rates: Offers competitive pricing, particularly for windshield repair.

- Online Tools: Excellent online tools and resources for policy management.

- Flexible Policies: Offers customizable policy options to fit individual needs.

Cons

- Customer Service: Mixed reviews on customer service and claims support.

- Coverage Specificity: In our Progressive auto insurance review, some coverage options can be limited in scope.

#6 – Farmers: Best for Glass Replacement

Pros

- Specialized Glass Replacement: Known for thorough glass replacement coverage.

- Strong Customer Support: High ratings for customer service and claims handling.

- Policy Options: Farmers, as mentioned in our Farmers auto insurance review, offers a variety of policy options tailored to different needs.

Cons

- Premium Cost: Can be more expensive than some other providers.

- Discount Limitations: Fewer discount options compared to competitors.

#7 – AAA: Best for Windshield Protection

Pros

- Wide Coverage: Known for good windshield protection options.

- Member Benefits: Additional benefits for AAA members.

- Reliable Service: Strong reputation for reliable service and support.

Cons

- Membership Requirement: Some benefits require AAA membership.

- Price: Higher premiums compared to some other providers. Read more through our AAA auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Safeco: Best for Windshield Replacement

Pros

- Specialized Windshield Replacement: Focus on quality windshield replacement services.

- Affordable Premiums: Competitive pricing for comprehensive coverage.

- Customer Service: Good ratings for customer support and claims handling.

Cons

- Coverage Availability: Some coverage options may not be available in all areas.

- Policy Terms: Policies can have complex terms and conditions. Follow us more on our Safeco auto insurance review.

#9 – Amica: Best for Windshield Coverage

Pros

- Comprehensive Windshield Coverage: Offers extensive coverage for windshield damage.

- Customer Satisfaction: High customer satisfaction ratings.

- Claims Process: Streamlined and efficient claims process.

Cons

- Premium Costs: Generally higher premiums compared to other providers.

- Discounts: Fewer discount opportunities available. Read more through our Amica auto insurance review.

#10 – The Hartford: Best for Glass Replacement

Pros

- Glass Replacement: Excellent coverage for glass replacement, especially for older drivers.

- Customer Support: High ratings for customer service.

- Reputation: Strong reputation in the insurance industry.

Cons

- Price: Higher premiums for comprehensive coverage. Use our The Hartford auto insurance review as your guide.

- Limited Discounts: Fewer discounts compared to some other providers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Driving with a Cracked Windshield in Montana

Montana’s Laws for Zero-Deductible Full Glass Replacement

The Decision to File a Montana Windshield Replacement Claim or Pay Cash

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Type of Auto Glass Used By a Montana Glass Replacement Company

Montana Windshield Replacement Coverage: The Bottom Line

Frequently Asked Questions

Does auto insurance in Montana cover windshield replacement?

Yes, auto insurance policies in Montana often include coverage for windshield replacement. However, the specific coverage and terms can vary depending on the insurance company and the policy you have.

What type of auto insurance coverage typically includes windshield replacement?

Windshield replacement coverage is usually part of comprehensive coverage. Comprehensive coverage helps protect against non-collision-related damages to your vehicle, including damage caused by factors like theft, vandalism, weather events, and falling objects, such as rocks or debris that can damage your windshield. Enter your ZIP code to start comparing.

Is windshield replacement covered under Montana’s mandatory auto insurance requirements?

Do I need to pay a deductible for windshield replacement?

The deductible is the portion of the repair or replacement cost that you are responsible for paying out of pocket. For windshield replacement coverage, some insurance policies have a separate deductible specifically for glass damage, while others may include a deductible that applies to all comprehensive claims. Review your policy documents or contact your insurance provider to determine the deductible amount and how it applies to windshield replacement.

Can I choose any windshield repair or replacement service provider?

Insurance policies may have preferred service providers or networks with which they work for windshield repair or replacement. These preferred providers often offer direct billing to the insurance company, making the process more convenient for policyholders. However, some policies may allow you to choose any reputable service provider, and you may need to submit the claim for reimbursement. Check your policy or contact your insurance provider for details on approved service providers. Enter your ZIP code now to start.

Will filing a claim for windshield replacement affect my insurance rates?

What are the starting monthly rates for Allstate’s windshield replacement coverage in Montana?

The starting monthly rates for Allstate’s windshield replacement coverage in Montana are $220 per month.

Which insurance company is noted for having the best glass protection policies?

Nationwide is noted for having the best glass protection policies. Enter your ZIP code now to assess and compare.

Does Montana law require insurers to offer zero-deductible full glass replacement coverage?

What factors should you consider when deciding whether to file a windshield replacement claim or pay out of pocket?

When deciding whether to file a windshield replacement claim or pay out of pocket, you should consider your deductible amount, the cost of replacement quotes, and the specific coverage and benefits of your insurance policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.