Best Windshield Replacement Coverage in Arkansas (Top 10 Companies in 2025)

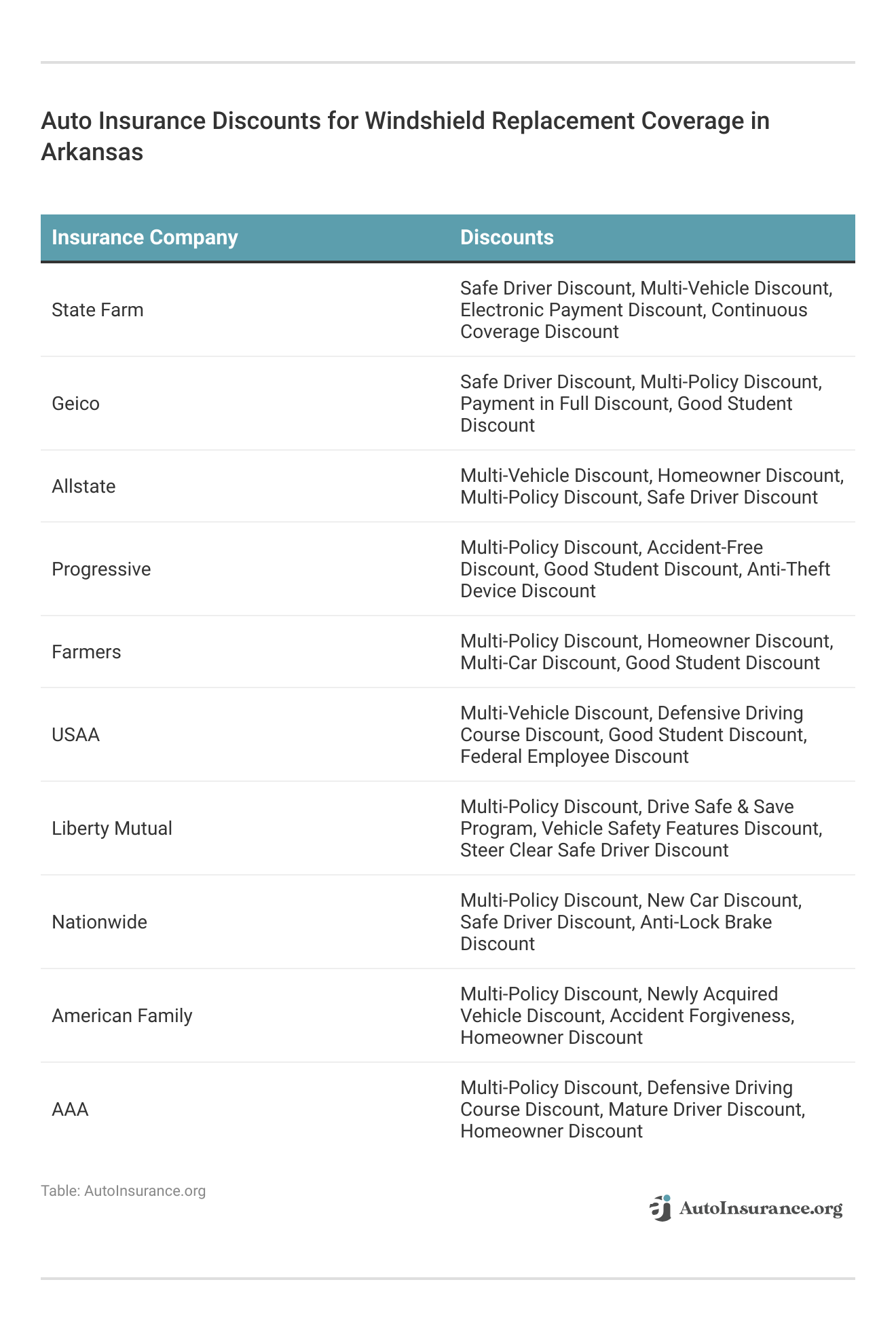

State Farm, Geico, and Allstate provide the best windshield replacement coverage in Arkansas, starting at affordable monthly premiums of $112. Our goal is to aid you in comparing quotes from these providers, ensuring you find the most fitting coverage and personalized discounts for your vehicle.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Apr 20, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 20, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage Windshield Replacement in Arkansas

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage Windshield Replacement in Arkansas

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage Windshield Replacement in Arkansas

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews#1 – State Farm: Top Overall Pick

Pros

- Extensive Network of Agents: State Farm has a large network of local agents, providing personalized service and support to policyholders. Find out more in our State Farm auto insurance review.

- Strong Financial Stability: State Farm consistently receives high ratings for its financial strength, ensuring reliability in coverage and claims processing.

- Bundling Discounts: State Farm offers significant discounts for bundling multiple insurance policies, such as auto and home insurance.

Cons

- Limited Online Tools: Some customers may find State Farm’s online tools and mobile app less advanced compared to other providers.

- Higher Premiums for Certain Demographics: State Farm’s rates may be higher for certain demographic groups, such as younger drivers or those with less-than-perfect driving records.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Cheap Rates

Pros

- Competitive Rates: Geico is known for offering some of the most competitive rates in the industry, making it a popular choice for budget-conscious drivers. Read more through our Geico auto insurance review.

- User-Friendly Online Experience: Geico’s website and mobile app are highly intuitive, providing easy access to policy information, claims filing, and account management.

- Wide Range of Discounts: Geico offers a variety of discounts, including those for safe driving, vehicle safety features, and military service.

Cons

- Limited Agent Availability: Geico primarily operates online and over the phone, so customers seeking in-person support may find options limited.

- Claims Processing may Vary: While many customers report positive experiences with Geico’s claims process, some reviews suggest variability in the speed and efficiency of claims handling.

#3 – Allstate: Best for Add-on Coverages

Pros

- Diverse Coverage Options: Allstate offers a wide range of coverage options and add-ons, allowing customers to tailor their policies to meet their specific needs. Read more through our Allstate auto insurance review.

- Innovative Tools: Allstate provides innovative tools such as the Drivewise program, which offers discounts based on safe driving behavior, and the QuickFoto Claim feature for easy claims submission.

- Strong Customer Support: Allstate is known for its responsive customer service, with 24/7 support available by phone and online chat.

Cons

- Higher Premiums for Some Drivers: Allstate’s rates may be higher than average for certain demographics or geographic areas.

- Limited Availability of Local Agents: While Allstate has a network of agents, they may not be as widely available in some areas compared to other providers.

#4 – Progressive: Best for Loyalty Programs

Pros

- Name Your Price Tool: Progressive offers a unique tool that allows customers to customize their coverage and find a policy that fits their budget.

- Snapshot Program: Progressive’s Snapshot program rewards safe driving habits with potential discounts on premiums.

- Convenient Claims Process: Progressive’s online claims filing system and 24/7 customer support make the claims process quick and convenient.

Cons

- Potentially Higher Rates for Certain Drivers: Progressive’s rates may be higher for drivers with less-than-perfect driving records or specific demographics.

- Limited Availability of Local Agents: In our Progressive auto insurance review, Progressive primarily operates online and through phone support, which may not be suitable for customers who prefer face-to-face interactions with agents.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Farmers: Best for Safety Discounts

Pros

- Personalized Coverage Options: Farmers offers customizable coverage options, allowing customers to tailor their policies to their specific needs.

- Strong Customer Service: Farmers is known for its attentive customer service and dedicated claims representatives.

- Additional Perks: Farmers offers additional perks such as roadside assistance and coverage for rideshare drivers. Read more through our Farmers auto insurance review.

Cons

- Potentially Higher Premiums: Farmers’ rates may be higher compared to some other providers, particularly for certain demographics or geographic areas.

- Limited Online Tools: Farmers’ online tools and mobile app may not be as advanced or user-friendly as those offered by other insurance companies.

#6 – USAA: Best for Military Savings

Pros

- Exclusive to Military Members: USAA provides insurance coverage exclusively to military members, veterans, and their families, with tailored policies and discounts.

- Top-Rated Customer Service: USAA consistently receives high ratings for its customer service and claims handling.

- Financial Stability: USAA is known for its strong financial stability, providing peace of mind to policyholders.

Cons

- Membership Eligibility: USAA’s eligibility requirements limit its availability to military members, veterans, and their families. Read more through our USAA auto insurance review.

- Limited Coverage Options: USAA may not offer as wide a range of coverage options as some other providers, particularly for non-standard policies or add-ons.

#7 – Liberty Mutual: Best for Comprehensive Policies

Pros

- Customizable Coverage: Liberty Mutual offers a range of coverage options that can be tailored to individual needs, allowing customers to create a policy that suits them.

- Multi-Policy Discounts: Customers can save money by bundling multiple insurance policies with Liberty Mutual, such as auto, home, and life insurance.

- Online Resources: Liberty Mutual provides useful online resources and tools to help customers understand their coverage options and manage their policies.

Cons

- Potentially Higher Rates: Some customers may find that Liberty Mutual’s rates are higher compared to other insurance providers, particularly for certain demographics or geographic areas. Read more through our Liberty Mutual auto insurance review.

- Mixed Customer Service Reviews: While many customers report positive experiences with Liberty Mutual’s customer service, some reviews mention challenges with claims handling and communication.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Usage-Based Rates

Pros

- Wide Range of Coverage Options: Nationwide offers a diverse selection of coverage options, including standard policies and specialized coverage for unique needs.

- Member Discounts: Nationwide provides discounts for members of certain organizations, such as alumni associations or professional groups. Read more through our Nationwide auto insurance review.

- Good Customer Service: Nationwide is known for its responsive customer service and claims handling, with support available 24/7.

Cons

- Potentially Higher Premiums: Some customers may find Nationwide’s premiums to be higher compared to other providers, particularly for certain demographics or geographic areas.

- Limited Availability of Agents: Nationwide’s network of agents may not be as extensive as some other providers, which could affect accessibility for some customers.

#9 – American Family: Best for Claims Service

Pros

- Customizable Policies: American Family offers customizable policies that allow customers to tailor their coverage to their specific needs. Read more through our American Family auto insurance review.

- Discount Opportunities: American Family provides various discounts, such as those for safe driving, bundling policies, and installing safety features in vehicles.

- Strong Community Involvement: American Family is involved in various community initiatives and offers resources to support customers and their communities.

Cons

- Potentially Higher Rates: Some customers may find that American Family’s rates are higher compared to other providers, particularly for certain demographics or geographic areas.

- Limited Availability in Some Regions: American Family may not be as widely available in certain regions compared to larger national providers, which could affect accessibility for some customers.

#10 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA offers extensive roadside assistance coverage, providing peace of mind to drivers in case of emergencies such as breakdowns or flat tires.

- Member Benefits: AAA members enjoy additional benefits beyond insurance, including discounts on travel, retail, and services. Read more through our AAA auto insurance review.

- Local Presence: AAA has a strong local presence with clubs across the country, offering personalized service and support to members.

Cons

- Membership Fees: AAA requires membership dues, which may be an additional cost for customers seeking insurance coverage.

- Limited Coverage Options: AAA’s insurance offerings may be more limited compared to other providers, particularly for those with specialized needs or preferences.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Fixing my Cracked Windshield in Arkansas

“Will my insurance cover a cracked windshield?” is a common concern for drivers. While standard liability insurance in Arkansas doesn’t cover glass replacement, comprehensive auto insurance typically does.

Windshield Replacement Coverage in Arkansas Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$100 $225

$78 $226

$66 $191

$79 $231

$43 $126

$48 $138

$61 $178

$63 $183

$38 $112

$26 $76

However, comprehensive coverage may not always include zero deductible full glass coverage. It’s essential to research coverage options thoroughly to ensure comprehensive protection.

No Deductible Glass Coverage in Arkansas

Selecting a Glass Repair Vendor in Arkansas

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Arkansas Windshield Replacement: The Bottom Line

Frequently Asked Questions

Do auto insurance policies in Arkansas cover windshield replacement?

Yes, most comprehensive auto insurance policies in Arkansas cover windshield replacement. Comprehensive coverage typically includes coverage for damages caused by factors other than collisions, such as vandalism, theft, and weather-related incidents like windshield damage caused by wind, hail, or falling objects.

Do I need to have comprehensive coverage to get my windshield replaced in Arkansas?

Yes, comprehensive coverage is typically required to have your windshield replaced through your auto insurance policy. If you only have liability insurance, it generally does not cover windshield damage. However, it is always best to review your specific policy or consult with your insurance provider to understand your coverage details accurately. Enter your ZIP code now to begin.

Will I have to pay a deductible for windshield replacement in Arkansas?

Can I choose any auto glass repair shop for my windshield replacement in Arkansas?

Most insurance policies allow you to choose an auto glass repair shop of your preference for windshield replacement. However, it is recommended to check with your insurance provider or review your policy to ensure that the chosen repair shop is within the network of approved vendors or if any specific requirements need to be met.

Is there a limit on the number of windshield replacements covered by insurance in Arkansas?

The number of windshield replacements covered by insurance in Arkansas can vary depending on your policy. Some policies may have a specific limit on the number of replacements allowed within a certain period, while others may not impose such limitations. It is advisable to consult your insurance provider or review your policy to understand any restrictions or limitations on windshield replacements. Enter your ZIP code now to start.

Which insurance providers offer the best windshield replacement coverage in Arkansas?

What are some factors to consider when dealing with a cracked windshield in Arkansas?

Factors to consider when dealing with a cracked windshield in Arkansas include state laws, insurance policies, repair options, and costs.

Does comprehensive auto insurance in Arkansas typically cover windshield replacement?

Yes, most comprehensive auto insurance policies in Arkansas typically cover windshield replacement. Enter your ZIP code now to start comparing.

What are some considerations regarding deductible and glass coverage in Arkansas?

What are some options for choosing a glass repair vendor in Arkansas?

In Arkansas, motorists have the freedom to choose their vendor for windshield replacement, focusing on factors such as cost and the quality of replacement parts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.