Best Mazda CX-5 Auto Insurance in 2025 (Top 10 Companies Ranked)

The best Mazda CX-5 auto insurance includes Progressive, Erie, and Amica, with rates starting at $65 per month. These providers stands out with its top rates and comprehensive coverage options. Check these providers out for affordable insurance and to find optimal coverage for your vehicle Mazda CX-5.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Feb 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Mazda CX-5

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Mazda CX-5

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage Mazda CX-5

A.M. Best Rating

Complaint Level

Pros & Cons

The best Mazda CX-5 auto insurance rates are offered by Progressive, Erie, and Amica, with costs starting as low as $65 per month. For those seeking the cheapest Mazda CX-5 insurance, Progressive is our top pick overall due to its competitive pricing and comprehensive coverage options. Explore the best providers to find affordable and reliable insurance for your Mazda CX-5.

Beyond finding the best rates, understanding Mazda CX-5 insurance cost factors is crucial. The article delves into how vehicle age, driver demographics, and location impact pricing, helping you better anticipate and manage your auto insurance expenses.

Our Top 10 Company Picks: Best Mazda CX-5 Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 12% A+ Competitive Rates Progressive

#2 10% A+ Youth Discounts Erie

#3 20% A+ Claims Service Amica

#4 20% A+ Comprehensive Coverage Nationwide

#5 20% A Customizable Policies Farmers

#6 25% A Flexible Options Liberty Mutual

#7 25% A+ AARP Benefits The Hartford

#8 20% A Personalized Service American Family

#9 25% A+ Strong Reputation Allstate

#10 8% A++ Coverage Variety Travelers

Find the best auto insurance company near you by entering your ZIP code into our free quote tool above.

- Progressive has the best Mazda CX-5 auto insurance rates

- Mazda CX-5 insurance costs vary by vehicle age and driver profile

- Look for safety feature discounts to lower Mazda CX-5 insurance costs

#1 – Progressive: Top Overall Pick

Pros

- Competitive Pricing: As mentioned in Progressive auto insurance review, Progressive offers Mazda CX-5 insurance starting at $165 per month, which is relatively affordable compared to other providers. This competitive rate helps you save on your monthly premiums while ensuring comprehensive coverage for your Mazda CX-5.

- Customization Options: Progressive provides a wide range of customizable coverage options for Mazda CX-5 owners. You can tailor your policy with add-ons such as rental car reimbursement and roadside assistance, ensuring that your insurance fits your specific needs.

- Discount Opportunities: Progressive offers several discounts that can reduce your Mazda CX-5 insurance costs. For example, their Snapshot program allows you to save based on your driving habits, which can be particularly beneficial if you maintain a safe driving record.

Cons

- Higher Rates for Teen Drivers: Progressive’s rates for teenage drivers can be significantly higher, averaging around $5,059 annually. This can be a drawback if you have a young driver in your household, making it essential to compare options for more affordable coverage.

- Mixed Customer Service Reviews: Some customers have reported inconsistent experiences with Progressive’s customer service, which can affect the overall satisfaction with their Mazda CX-5 insurance. Issues with claims processing or customer support may impact your experience.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Erie: Best for Youth Discounts

Pros

- Affordable Rates: As outlined in our Erie auto insurance review, Erie offers competitive rates for Mazda CX-5 insurance, starting at $140 per month. This makes it one of the more budget-friendly options available, providing excellent coverage without breaking the bank.

- Comprehensive Coverage: Erie provides robust coverage options for Mazda CX-5 owners, including extensive liability, collision, and comprehensive coverage. Their policies are designed to protect against various risks, ensuring you are well-covered on the road.

- Excellent Customer Service: Erie is known for its high customer satisfaction ratings and responsive service. Their commitment to quality customer support ensures that Mazda CX-5 owners receive prompt assistance and reliable support when needed.

Cons

- Limited Availability: Erie insurance is not available in all states, which may limit your options if you live outside their service area. This could be a significant drawback if you are looking for coverage in regions where Erie does not operate.

- Fewer Discount Options: Compared to some competitors, Erie may offer fewer discount opportunities. While they provide solid coverage, the lack of extensive discounts could mean higher premiums for certain policyholders.

#3 – Amica: Best for Claims Service

Pros

- Competitive Pricing: Amica offers Mazda CX-5 insurance at a starting rate of $155 per month, which is competitive and offers good value for the level of coverage provided. This pricing helps you manage your budget while ensuring adequate protection.

- Excellent Customer Service: Amica is highly rated for customer service, providing efficient support and a smooth claims process. Mazda CX-5 owners can expect responsive and helpful service, enhancing the overall insurance experience.

- Discount Opportunities: As outlined in our Amica auto insurance review, Amica provides various discounts that can help lower your Mazda CX-5 insurance costs. These include multi-policy discounts and good driver discounts, which can significantly reduce your premiums if you qualify.

Cons

- Higher Rates for Certain Drivers: While Amica offers competitive rates for many, insurance costs can be higher for younger drivers or those with a less-than-perfect driving record. This may affect your overall affordability if you fall into these categories.

- Limited Local Agents: Amica’s direct-to-consumer model means fewer local agents, which might limit personalized support options for some customers. If you prefer face-to-face interactions, this could be a drawback.

#4 – Nationwide: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Nationwide provides extensive coverage options for the Mazda CX-5, starting at $173 per month. Their policies include comprehensive and collision coverage, ensuring you have protection against a wide range of risks. For more information, read our Nationwide auto insurance review.

- Discounts for Safety Features: Nationwide offers discounts for vehicles with advanced safety features. Given the Mazda CX-5’s robust safety features, you could benefit from lower rates by qualifying for these safety-related discounts.

- Strong Customer Service: Nationwide is known for its reliable customer service and claims support. Mazda CX-5 owners can expect efficient handling of claims and responsive customer service, enhancing overall satisfaction.

Cons

- Higher Premiums: Nationwide’s starting rate of $173 per month can be higher than some competitors. This could be a disadvantage if you’re looking for more affordable Mazda CX-5 insurance options.

- Fewer Customization Options: Compared to other providers, Nationwide may offer fewer customizable coverage options. If you need specific add-ons or unique coverage features, you might find their offerings less flexible.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Farmers: Best for Customizable Policies

Pros

- Comprehensive Coverage Options: Farmers provides extensive coverage options for the Mazda CX-5, including liability, collision, and comprehensive coverage. Their broad policy offerings ensure that Mazda CX-5 owners are well-protected on the road. Check their rates in our Farmers auto insurance review.

- Discounts for Bundling: Farmers offers substantial discounts for bundling auto insurance with other policies like home or renters insurance. This can help reduce your overall insurance costs, making it a good option for those looking to save by combining policies.

- Strong Customer Support: Farmers is known for its excellent customer service and support. Mazda CX-5 owners can expect prompt assistance and helpful service when dealing with claims or policy questions.

Cons

- Higher Premiums: At $185 per month, Farmers’ rates are on the higher end compared to other insurers. This can be a drawback if you’re seeking more budget-friendly options for Mazda CX-5 insurance.

- Limited Discounts for Safe Driving: Farmers may not offer as many discounts for safe driving compared to some competitors. This could impact your potential savings if you have a clean driving record and are looking for reduced rates.

#6 – Liberty Mutual: Best for Flexible Options

Pros

- Comprehensive Coverage: As mentioned in our Liberty Mutual auto insurance review, Liberty Mutual provides a range of coverage options for Mazda CX-5 owners, starting at $195 per month. Their policies include extensive protection for various scenarios, ensuring you are well-covered.

- Discounts for Safety Features: Liberty Mutual offers discounts for advanced safety features found in the Mazda CX-5, potentially lowering your insurance costs. This can be beneficial if your vehicle has the latest safety technology.

- Customizable Policies: Liberty Mutual allows for extensive customization of coverage options, enabling Mazda CX-5 owners to tailor their insurance to fit specific needs and preferences.

Cons

- High Premiums: Liberty Mutual’s starting rate of $195 per month is among the highest, which might be a disadvantage for those seeking lower insurance costs for their Mazda CX-5.

- Mixed Customer Feedback: Some customers have reported mixed experiences with Liberty Mutual’s customer service. Issues with claims processing and support could impact overall satisfaction with their Mazda CX-5 insurance.

#7 – The Hartford: Best for AARP Benefits

Pros

- Competitive Rates: The Hartford offers Mazda CX-5 insurance at $167 per month, which is competitive and provides good value for the coverage included. This rate helps manage monthly costs while ensuring solid protection.

- AARP Discounts: As mentioned in our The Hartford auto insurance review, The Hartford provides exclusive discounts for AARP members, which can be beneficial if you are eligible. This can significantly reduce the cost of insurance for Mazda CX-5 owners who are AARP members.

- Strong Claims Handling: The Hartford is known for efficient and reliable claims processing, offering peace of mind for Mazda CX-5 owners. Their strong reputation in handling claims ensures prompt and effective support when needed.

Cons

- Limited Discount Options: The Hartford may offer fewer discount opportunities compared to some competitors. This could mean fewer ways to reduce your Mazda CX-5 insurance costs beyond the standard options.

- Variable Customer Service: Customer service experiences with The Hartford can vary, with some users reporting delays or issues. This variability may affect your overall satisfaction with their Mazda CX-5 insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Personalized Service

Pros

- Affordable Rates: As outlined in our American Family auto insurance review, American Family offers Mazda CX-5 insurance starting at $158 per month, providing competitive rates that make it a cost-effective option for comprehensive coverage.

- Discounts for Safety Features: American Family provides discounts for vehicles with advanced safety features, including the Mazda CX-5’s robust safety technology. This can help lower your insurance premiums.

- Flexible Coverage Options: American Family offers a range of flexible coverage options, allowing you to customize your policy to meet your specific needs. This ensures you get tailored protection for your Mazda CX-5.

Cons

- Higher Rates for Younger Drivers: Insurance costs for younger drivers can be higher with American Family, which might affect overall affordability if you have a young driver in your household.

- Limited Local Agent Availability: American Family’s network of local agents may be limited in some areas, which can impact the availability of personalized support and service for Mazda CX-5 owners.

#9 – Allstate: Best for Strong Reputation

Pros

- Comprehensive Coverage: Allstate provides extensive coverage options for the Mazda CX-5, starting at $185 per month. Their policies include a wide range of protections, ensuring comprehensive coverage for various risks.

- Discounts for Safe Driving: Allstate offers discounts for safe driving behaviors and advanced safety features in the Mazda CX-5. This can help reduce insurance costs if you maintain a clean driving record.

- Customizable Policies: As mentioned in our Allstate auto insurance review, Allstate allows for significant customization of coverage options, enabling Mazda CX-5 owners to tailor their insurance to fit specific needs and preferences.

Cons

- Higher Premiums: Allstate’s starting rate of $185 per month is on the higher end, which could be a drawback if you are looking for more affordable Mazda CX-5 insurance options.

- Mixed Customer Service Feedback: Customer feedback on Allstate’s service can be mixed, with some reporting issues with claims processing or customer support. This could affect your overall satisfaction with their Mazda CX-5 insurance.

#10 – Travelers: Best for Coverage Variety

Pros

- Competitive Pricing: Travelers offers Mazda CX-5 insurance at $175 per month, which is competitive and provides good value for comprehensive coverage. This pricing helps manage your insurance costs while ensuring solid protection.

- Wide Range of Discounts: As mentioned in Travelers Auto insurance review, Travelers provides various discounts for Mazda CX-5 owners, including those for safety features and bundling policies. This can help lower your premiums and maximize savings.

- Strong Claims Service: Travelers is known for efficient claims processing and responsive customer service, offering peace of mind for Mazda CX-5 owners when handling claims or policy inquiries.

Cons

- Higher Premiums for Some Drivers: While competitive, Travelers’ rates may be higher for certain drivers, including younger or less experienced drivers. This can impact affordability if you fall into these categories.

- Limited Local Agent Network: Travelers’ local agent network may be less extensive compared to some competitors, which can affect the availability of personalized support and service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cost of Mazda CX-5 Auto Insurance

Understanding the insurance costs for your Mazda CX-5 is crucial in managing your overall vehicle expenses. Find the best deal on auto insurance by comparing monthly rates for minimum and full coverage policies from different providers in the table below.

Mazda CX-5 Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $85 $185

American Family $73 $158

Amica $70 $155

Erie $65 $140

Farmers $85 $185

Liberty Mutual $90 $195

Nationwide $79 $173

Progressive $75 $165

The Hartford $78 $167

Travelers $80 $175

When you shop around and compare prices, you can find the best policy for your Mazda CX-5 that fits your budget and covers all of your needs. This information allows you to make informed decisions and potentially save on your monthly insurance costs.

Insurance rates for the Mazda CX-5 can vary significantly based on several factors. Understanding these variations can help you choose the best policy for your needs.

Progressive offers unbeatable rates and comprehensive coverage, making it the top choice for Mazda CX-5 insurance.Jeff Root LICENSED INSURANCE AGENT

The graph below compares the average rates based on different deductibles and driver profiles, including high-risk and teen drivers. Learn more by reading our guide, “What is the average auto insurance cost per month?“

Mazda CX-5 Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Average Rate | $115 |

| Discount Rate | $68 |

| High Deductibles | $99 |

| High Risk Driver | $246 |

| Low Deductibles | $145 |

| Teen Driver | $422 |

Analyzing these rates can provide insight into how different factors influence your insurance costs. By adjusting your deductible and understanding the impact of your driver profile, you can make informed decisions to optimize your insurance expenses.

When considering insurance costs for your Mazda CX-5, it’s helpful to compare rates with other similar crossovers. The chart below details how Mazda CX-5 insurance rates stack up against other vehicles like the MINI Clubman, Hyundai Kona, and Nissan Rogue.

Mazda CX-5 Auto Insurance Monthly Rates vs. Other Vehicles by Coverage Type

| Vehicle | Liability | Collision | Comprehensive | Full Coverage |

|---|---|---|---|---|

| BMW X6 | $33 | $70 | $36 | $152 |

| Chevrolet Equinox | $31 | $44 | $26 | $114 |

| Ford Escape | $26 | $37 | $23 | $98 |

| Hyundai Kona | $26 | $42 | $23 | $103 |

| Mazda CX-5 | $31 | $44 | $27 | $115 |

| MINI Clubman | $33 | $42 | $27 | $115 |

| Nissan Rogue | $37 | $43 | $22 | $117 |

While the Mazda CX-5 has competitive insurance rates compared to other crossovers, there are several strategies you can employ to find the cheapest Mazda insurance rates online. Learn more by reading our guide titled, “What are the benefits of auto insurance?“

Cost Affecting Mazda CX-5 Insurance Rates

The Mazda CX-5 trim and model you choose will affect the total price you will pay for Mazda CX-5 insurance coverage.

Age of the Vehicle

Insuring an older Mazda CX-5 typically results in a lower premium. A monthly premium of $115 covers a 2020 Mazda CX-5, whereas a premium of $105 covers a 2013 model, a difference of $10.

Mazda CX-5 Auto Insurance Monthly Rates by Age of the Vehicle

| Model Year | Liability | Collision | Comprehensive | Full Coverage |

|---|---|---|---|---|

| 2024 Mazda CX-5 | $32 | $46 | $29 | $117 |

| 2023 Mazda CX-5 | $32 | $45 | $28 | $116 |

| 2022 Mazda CX-5 | $32 | $45 | $28 | $116 |

| 2021 Mazda CX-5 | $31 | $44 | $27 | $115 |

| 2020 Mazda CX-5 | $31 | $44 | $27 | $115 |

| 2019 Mazda CX-5 | $33 | $43 | $26 | $114 |

| 2018 Mazda CX-5 | $33 | $42 | $25 | $113 |

| 2017 Mazda CX-5 | $35 | $41 | $24 | $113 |

| 2016 Mazda CX-5 | $36 | $40 | $23 | $111 |

| 2015 Mazda CX-5 | $37 | $38 | $22 | $110 |

| 2014 Mazda CX-5 | $38 | $35 | $21 | $107 |

| 2013 Mazda CX-5 | $38 | $33 | $20 | $105 |

Understanding how the age of your Mazda CX-5 affects insurance rates can help you make an informed decision when choosing between newer and older models.

Driver Age

Depending on the age of the policyholder, the auto insurance rates by age for a Mazda CX-5 vehicle might differ significantly. As an example, a 40-year-old driver could pay $146 less each month for their Mazda CX-5 auto insurance compared to a 20-year-old driver.

Mazda CX-5 Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $422 |

| Age: 18 | $374 |

| Age: 20 | $262 |

| Age: 30 | $120 |

| Age: 40 | $115 |

| Age: 45 | $110 |

| Age: 50 | $105 |

| Age: 60 | $103 |

Being aware of how age impacts insurance rates can help younger drivers plan their budgets more effectively and seek out possible discounts.

Driver Location

Where you live can really impact how much you pay for insurance on your Mazda CX-5. Los Angeles drivers might end up paying $99 more per month than their Indianapolis counterparts.

Mazda CX-5 Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $152 |

| Columbus, OH | $96 |

| Houston, TX | $181 |

| Indianapolis, IN | $98 |

| Jacksonville, FL | $167 |

| Los Angeles, CA | $197 |

| New York, NY | $182 |

| Philadelphia, PA | $155 |

| Phoenix, AZ | $134 |

| Seattle, WA | $112 |

Thinking about where you live can give you a heads-up on insurance costs and help you find local insurance companies with better deals.

Your Driving Record

The way you drive can change what you pay for your Mazda CX-5 insurance. Young folks, those just out of their teens and in their twenties, they get hit the hardest when they have marks on their driving record.

Mazda CX-5 Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $422 | $464 | $528 | $684 |

| Age: 18 | $374 | $410 | $467 | $604 |

| Age: 20 | $262 | $285 | $340 | $484 |

| Age: 30 | $120 | $131 | $157 | $284 |

| Age: 40 | $115 | $126 | $151 | $271 |

| Age: 45 | $110 | $120 | $145 | $264 |

| Age: 50 | $105 | $114 | $138 | $255 |

| Age: 60 | $103 | $112 | $135 | $249 |

Maintaining a clean driving record can help keep your insurance costs lower, while violations can significantly increase your premiums.

Safety Ratings

The Mazda CX-5’s safety ratings have an impact on your auto insurance rates. Vehicles with high safety ratings often receive lower insurance premiums due to the reduced risk of injury and damage in the event of an accident.

Mazda CX-5 Safety Ratings

| Test | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

As you can see from the breakdown above, Higher safety ratings can help reduce your insurance costs by ensuring better protection in case of a crash.

Crash Test Ratings

Not only do good Mazda CX-5 crash test ratings mean you are better protected in a crash, but good crash ratings also mean cheaper Mazda CX-5 auto insurance rates. The table below details the crash test ratings for various Mazda CX-5 models:

Mazda CX-5 Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Mazda CX-5 SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2024 Mazda CX-5 SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Mazda CX-5 SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Mazda CX-5 SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Mazda CX-5 SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Mazda CX-5 SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Mazda CX-5 SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Mazda CX-5 SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Mazda CX-5 SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Mazda CX-5 SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Mazda CX-5 SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Mazda CX-5 SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Mazda CX-5 SUV FWD Later Release | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Mazda CX-5 SUV FWD Early Release | 4 stars | 5 stars | 5 stars | 4 stars |

| 2018 Mazda CX-5 SUV AWD Later Release | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Mazda CX-5 SUV AWD Early Release | 4 stars | 5 stars | 5 stars | 4 stars |

| 2017 Mazda CX-5 SUV FWD | 4 stars | 5 stars | 5 stars | 4 stars |

| 2017 Mazda CX-5 SUV AWD | 4 stars | 5 stars | 5 stars | 4 stars |

| 2016 Mazda CX-5 SUV FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2016 Mazda CX-5 SUV AWD | 4 stars | 4 stars | 5 stars | 4 stars |

Understanding crash test ratings can help you evaluate the safety of your Mazda CX-5 and potentially lower your insurance premiums by choosing a model with better ratings.

Mazda CX-5 Safety Features

The Mazda CX-5 safety features can help lower insurance costs. According to US News, the 2020 Mazda CX-5 has the following safety features:

- Comprehensive air bag system including driver, passenger, front, rear, and side air bags

- Advanced safety features like blind spot monitor, lane departure warning, and cross-traffic alert

- Enhanced braking with 4-wheel ABS, disc brakes, and brake assist

- Electronic stability control and traction control for improved handling

- Daytime running lights, integrated turn signal mirrors, and child safety locks for added safety

These advanced safety features not only enhance your driving experience but also contribute to lower insurance premiums. Ensure you leverage these benefits when comparing insurance options for your Mazda CX-5.

Mazda CX-5 Insurance Loss Probability

The Mazda CX-5’s insurance loss probability varies for each form of coverage. The lower percentage means lower Mazda CX-5 auto insurance rates; higher percentages mean higher Mazda CX-5 car insurance rates.

Understanding the Mazda CX-5’s insurance loss probabilities can help you choose the most cost-effective coverage.

For instance, lower loss rates in categories like personal injury protection and collision can significantly reduce your overall insurance costs.

Reducing Mazda CX-5 Insurance

Reducing your Mazda CX-5 insurance costs can be achieved through various practical strategies. By taking advantage of discounts and making informed decisions, you can significantly lower your insurance premiums. Here are some effective tips to help you save on your Mazda CX-5 insurance:

- Pay your Mazda CX-5 insurance upfront.

- Spy on your teen driver.

- Reduce your coverage on an older Mazda CX-5.

- Ask about Mazda CX-5 low mileage discounts.

- Move to the countryside.

Implementing these strategies can help you lower your insurance premiums and make your Mazda CX-5 ownership more affordable.

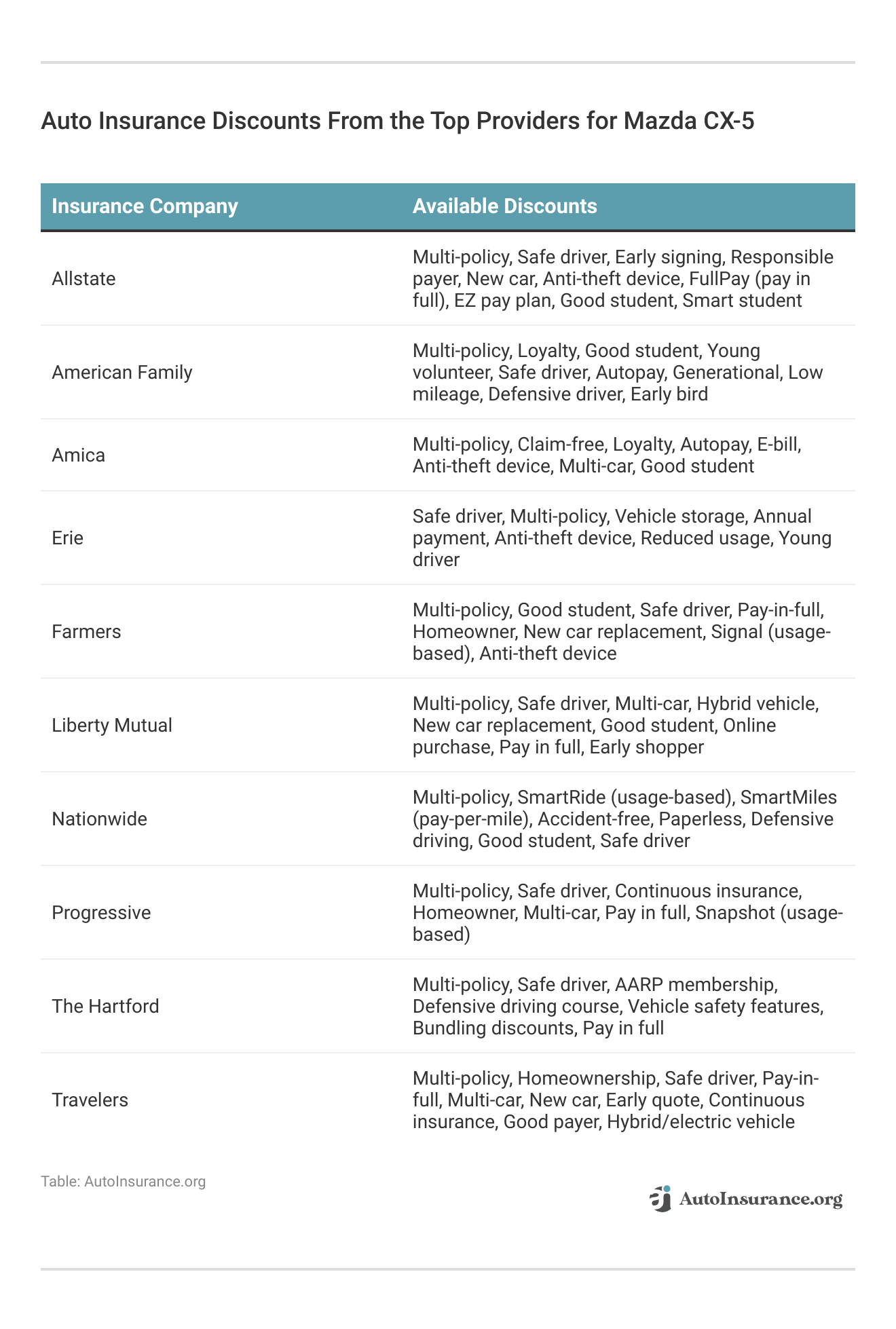

Taking advantage of available discounts can significantly reduce your Mazda CX-5 auto insurance premiums. Below is a table listing some of the discounts offered by top insurance providers.

Exploring and utilizing these discounts can help you get the best value for your Mazda CX-5 insurance policy. Be sure to ask your insurance provider about the specific discounts you may be eligible for and how they can be applied to your premium.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Leading Mazda CX-5 Companies

For a Mazda CX-5, which insurance company is the best bet? Here are a few of the best providers of Mazda CX-5 auto insurance, ranked by market share, though your actual rates may vary depending on a number of factors.

Top Mazda CX-5 Insurance Companies

| Rank | Insurance Company | Premium Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9.3% |

| #2 | Geico | $46.3 million | 6.6% |

| #3 | Progressive | $41.7 million | 5.6% |

| #4 | Liberty Mutual | $39.2 million | 5.1% |

| #5 | Allstate | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3.3% |

| #8 | Chubb | $24.1 million | 3.3% |

| #9 | Farmers | $20 million | 2.9% |

| #10 | Nationwide | $18.4 million | 2.6% |

Choosing the right insurance company can help you get the best coverage for your Mazda CX-5 at a competitive rate. To get the most bang for your buck, shop around by comparing quotes and asking about discounts. Check out our guide “Where to Compare Auto Insurance Rates.“

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Frequently Asked Questions

How much does auto insurance for a Mazda CX-5 typically cost?

The cost of auto insurance for a Mazda CX-5 can vary depending on various factors, including your location, driving history, age, coverage options, and insurance provider. It’s best to obtain quotes from different insurers to get an accurate idea of the cost for your specific circumstances.

What factors can affect the insurance premium for a Mazda CX-5?

Several factors can impact the insurance premium for a Mazda CX-5, such as the vehicle’s age, the driver’s demographics, location, driving history, and the chosen coverage options.

Read More: How to Lower Your Auto Insurance Rates

Are Mazdas generally expensive to insure compared to other vehicles?

Insurance rates can vary between different vehicle makes and models, and while Mazdas generally offer good safety ratings and reasonable repair costs, insurance premiums can still be influenced by factors such as the vehicle’s popularity, performance, and theft rates. It’s advisable to compare insurance quotes from multiple providers to determine the best rate for your Mazda CX-5.

What type of insurance coverage is recommended for a Mazda CX-5?

It’s generally recommended to have the following types of coverage for a Mazda CX-5: liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

Can I get discounts on insurance for my Mazda CX-5?

Yes, insurance companies often offer various auto insurance discounts that you may qualify for when insuring a Mazda CX-5. These can include safe driver discounts, multi-policy discounts, good student discounts, and discounts for vehicles equipped with safety features.

Can I transfer my current auto insurance to my new Mazda CX-5?

If you already have an auto insurance policy, you can typically contact your insurance provider to update your policy with the details of your new Mazda CX-5. They will adjust the coverage and premium accordingly. However, it’s always a good idea to compare quotes from other insurers to ensure you’re getting the best coverage and rates for your new vehicle.

Are there any specific Mazda CX-5 insurance considerations I should be aware of?

While insurance considerations can vary based on your location and insurer, there are a few specific factors to be aware of for a Mazda CX-5, such as the availability of discounts for safety features, the impact of the vehicle’s trim and model on insurance costs, and the importance of maintaining a clean driving record to secure lower premiums.

How can I lower my Mazda CX-5 insurance premium?

You can lower your Mazda CX-5 insurance premium by maintaining a clean driving record, opting for higher deductibles, bundling your auto insurance with other policies, and taking advantage of available discounts such as safe driver and multi-policy discounts. Check out our guide “Why You Should Take a Defensive Driving Class.”

What is the average cost of full coverage insurance for a Mazda CX-5?

The average cost of full coverage insurance for a Mazda CX-5 can vary widely based on factors like the driver’s age, location, and driving history, but typically ranges between $120 and $180 per month.

Does the color of my Mazda CX-5 affect my insurance rates?

The color of your Mazda CX-5 does not directly affect your insurance rates. Insurers focus more on factors such as the vehicle’s make, model, age, safety features, and your personal driving history.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.