Best Jaguar X-TYPE Auto Insurance in 2025 (Find the Top 10 Companies Here)

Discover why State Farm, USAA, and Progressive are the top picks for the best Jaguar X-TYPE auto insurance, with rates starting at just $70 monthly. Explore their comprehensive coverage options, tailored benefits, and exceptional value, ensuring your Jaguar receives the protection it deserves.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Jaguar X-TYPE

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Jaguar X-TYPE

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Jaguar X-TYPE

A.M. Best

Complaint Level

Pros & Cons

The top picks for the best Jaguar X-TYPE auto insurance are State Farm, USAA, and Progressive, known for their comprehensive coverage and customer satisfaction.

These providers excel not only in affordability but also in offering extensive protection tailored to the unique needs of Jaguar X-TYPE owners. They stand out in the market with their competitive advantages, such as discounts for safety features and flexible policy options. Learn more in our complete “Types of Auto Insurance.”

Our Top 10 Company Picks: Best Jaguar X-TYPE Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Comprehensive Coverage State Farm

#2 10% A++ Military Discounts USAA

#3 12% A+ Coverage Options Progressive

#4 20% A Customized Policies Liberty Mutual

#5 25% A+ Claim Satisfaction Allstate

#6 20% A+ Vanishing Deductible Nationwide

#7 10% A Diverse Discounts Farmers

#8 13% A++ Policy Flexibility Travelers

#9 29% A Customer Support American Family

#10 5% A+ Senior Benefits The Hartford

Choosing the right insurer is crucial for ensuring your Jaguar is protected under all circumstances, making these companies preferred choices for their reliability and service quality. Just enter your ZIP code above to see fast, free Jaguar X-TYPE insurance quotes right now.

- State Farm leads as the top choice for Jaguar X-TYPE auto insurance

- Tailored coverage meets the specific needs of Jaguar X-TYPE owners

- Focus on safety and performance in policy options for Jaguar X-TYPE

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers significant discounts for bundling Jaguar X-TYPE auto insurance with other policies. Discover insights in our guide titled, State Farm auto insurance review.

- High Low-Mileage Discount: Owners of Jaguar X-TYPEs benefit from substantial savings with State Farm’s low-mileage discounts.

- Wide Coverage: State Farm provides a variety of coverage options specifically tailored to the needs of Jaguar X-TYPE owners.

Cons

- Limited Multi-Policy Discount: While available, State Farm’s multi-policy discount is not as competitive as others, particularly for Jaguar X-TYPE insurance.

- Premium Costs: Even with discounts, the premiums for Jaguar X-TYPE auto insurance at State Farm may still be relatively higher compared to other insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Discounts

Pros

- Tailored Military Benefits: USAA offers exclusive discounts on Jaguar X-TYPE auto insurance for members of the military and their families.

- Superior Financial Rating: With an A++ rating from A.M. Best, USAA promises strong financial stability for Jaguar X-TYPE insurance.

- Competitive Rates: USAA provides some of the most competitive rates for Jaguar X-TYPE insurance, benefiting military families. Unlock details in our guide titled, USAA auto insurance review.

Cons

- Limited Eligibility: USAA’s services, including Jaguar X-TYPE insurance, are only available to military personnel, veterans, and their families.

- Fewer Physical Locations: For Jaguar X-TYPE owners who prefer face-to-face service, USAA has fewer offices compared to larger national insurers.

#3 – Progressive: Best for Coverage Options

Pros

- Customizable Policies: Progressive offers a range of policy options that Jaguar X-TYPE owners can customize to fit their needs.

- Loyalty Rewards: Progressive rewards Jaguar X-TYPE owners with loyalty perks like lower deductibles over time. Delve into our evaluation of Progressive auto insurance review.

- Online Tools: Progressive’s robust online tools help Jaguar X-TYPE owners easily manage their policies and claims.

Cons

- Customer Service Variability: Some Jaguar X-TYPE owners may experience variability in customer service quality with Progressive.

- Rate Fluctuations: Progressive’s rates for Jaguar X-TYPE insurance can fluctuate more than some competitors, affecting budget predictability.

#4 – Liberty Mutual: Best for Customized Policies

Pros

- High Customization: Liberty Mutual offers highly customizable insurance policies for Jaguar X-TYPE, catering to specific owner needs.

- Extensive Discounts: Owners of Jaguar X-TYPE can access a variety of discounts including safety features and good driving. Discover more about offerings in our complete Liberty Mutual auto insurance review.

- Strong Financial Stability: With an A rating from A.M. Best, Liberty Mutual ensures dependable coverage for Jaguar X-TYPE owners.

Cons

- Higher Premiums for Customization: Customized features for Jaguar X-TYPE insurance at Liberty Mutual may lead to higher premiums.

- Complex Policy Options: The extensive options available can be overwhelming and difficult to navigate for some Jaguar X-TYPE owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Claim Satisfaction

Pros

- High Claim Satisfaction: Allstate is renowned for high customer satisfaction in claims handling for Jaguar X-TYPE insurance. Access comprehensive insights into our guide titled Allstate auto insurance review.

- Innovative Tools: Allstate provides innovative tools like Drivewise to help Jaguar X-TYPE owners save on premiums through safe driving.

- Wide Coverage Options: A range of coverage options are available for Jaguar X-TYPE owners, accommodating diverse insurance needs.

Cons

- Higher Rates: Allstate’s rates for Jaguar X-TYPE insurance tend to be higher, particularly without discounts.

- Policy Upselling: There may be a tendency to upsell additional coverages which not all Jaguar X-TYPE owners might need.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers a vanishing deductible that benefits Jaguar X-TYPE owners by reducing the deductible over time.

- Broad Coverage: Nationwide provides broad coverage options that protect Jaguar X-TYPEs under various circumstances.

- Bonus Features: Offers additional perks like accident forgiveness which can be advantageous for Jaguar X-TYPE owners. Read up on the Nationwide auto insurance review for more information.

Cons

- Premium Cost Variability: Premiums can vary widely for Jaguar X-TYPE insurance, affecting budgeting.

- Customer Service Complaints: Some Jaguar X-TYPE owners report inconsistent customer service experiences with Nationwide.

#7 – Farmers: Best for Diverse Discounts

Pros

- Diverse Discount Options: Farmers offers a wide array of discounts that Jaguar X-TYPE owners can benefit from. More information is available about this provider in our Farmers auto insurance review.

- Custom Coverage: Specific coverage options are available for Jaguar X-TYPE that cater to unique owner requirements.

- Helpful Agent Network: Farmers boasts a wide network of agents ready to assist Jaguar X-TYPE owners with their insurance needs.

Cons

- Variable Pricing: Pricing for Jaguar X-TYPE insurance for Farmers can vary significantly based on location and other factors.

- Claims Processing Speed: Some Jaguar X-TYPE owners might find the claims process slower than expected.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Policy Flexibility

Pros

- Flexible Policy Options: Travelers offers flexible policy options that allow Jaguar X-TYPE owners to tailor their coverage extensively.

- Competitive Pricing: Travelers provides competitive pricing on Jaguar X-TYPE auto insurance, making it accessible to many owners.

- Efficient Claims Service: Known for its efficient claims service, ensuring quick and effective resolutions for Jaguar X-TYPE owners. See more details in our guide titled, “Travelers Auto Insurance Review.”

Cons

- Coverage Limitations: Some policy offerings may have limitations that don’t meet all the needs of Jaguar X-TYPE owners.

- Navigational Complexities: The wide range of options can sometimes make navigating policies complex for Jaguar X-TYPE owners.

#9 – American Family: Best for Customer Support

Pros

- Exceptional Customer Support: American Family is recognized for its excellent customer support for Jaguar X-TYPE insurance.

- Loyalty Discounts: Offers loyalty discounts that can significantly reduce premiums for long-term Jaguar X-TYPE owners.

- Comprehensive Coverage: Provides comprehensive coverage that meets the broad needs of Jaguar X-TYPE owners. See more details in our guide titled, “American Family Auto Insurance Review.”

Cons

- Limited Availability: American Family’s services for Jaguar X-TYPE are not available in all states, limiting accessibility.

- Rate Adjustments: Rate increases can occur after claims, which might affect Jaguar X-TYPE owners financially.

#10 – The Hartford: Best for Senior Benefits

Pros

- Senior Specific Benefits: The Hartford offers benefits and discounts tailored specifically for senior Jaguar X-TYPE owners.

- Highly Rated Claim Service: Renowned for its claim service, ensuring a smooth process for Jaguar X-TYPE insurance claims.

- Wide Range of Add-ons: Offers a wide range of add-on coverages that enhance protection for Jaguar X-TYPE vehicles. Learn more in our complete The Hartford auto insurance review.

Cons

- Higher Premiums for Younger Drivers: Younger Jaguar X-TYPE owners may face higher premiums at The Hartford.

- Eligibility Restrictions: Some benefits and discounts are restricted to certain age groups, limiting access for younger Jaguar X-TYPE owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jaguar X-TYPE Insurance Cost Analysis

Exploring insurance costs for the Jaguar X-TYPE reveals a range of monthly rates dependent on the chosen level of coverage. The table below provides a comprehensive overview, comparing both minimum and full coverage rates across various providers.

Jaguar X-TYPE Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $100 $180

American Family $87 $152

Farmers $92 $165

Liberty Mutual $95 $170

Nationwide $88 $155

Progressive $90 $160

State Farm $85 $150

The Hartford $93 $160

Travelers $89 $158

USAA $70 $135

The table illustrates the monthly insurance rates for the Jaguar X-TYPE, categorized by minimum and full coverage options from several insurance companies. See more details in our guide titled, “How to Lower Your Auto Insurance Rates.”

For those seeking economical options, USAA presents the lowest rates for both minimum and full coverage at $70 and $135 respectively. In contrast, Allstate’s rates are at the higher end, costing $100 for minimum and $180 for full coverage.

This data is essential for Jaguar X-TYPE owners to assess and find the most suitable and cost-effective insurance coverage based on their specific needs and budget.

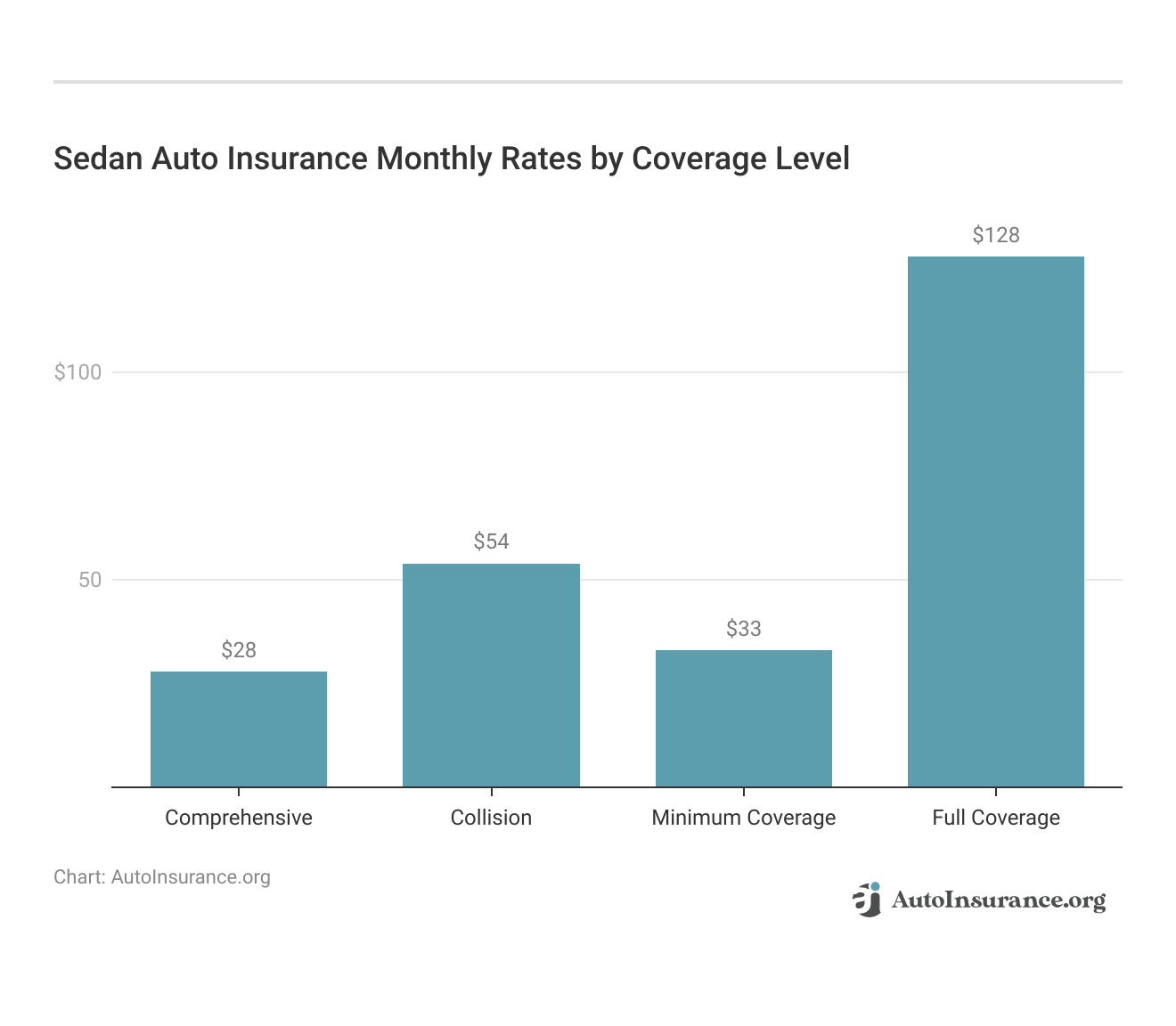

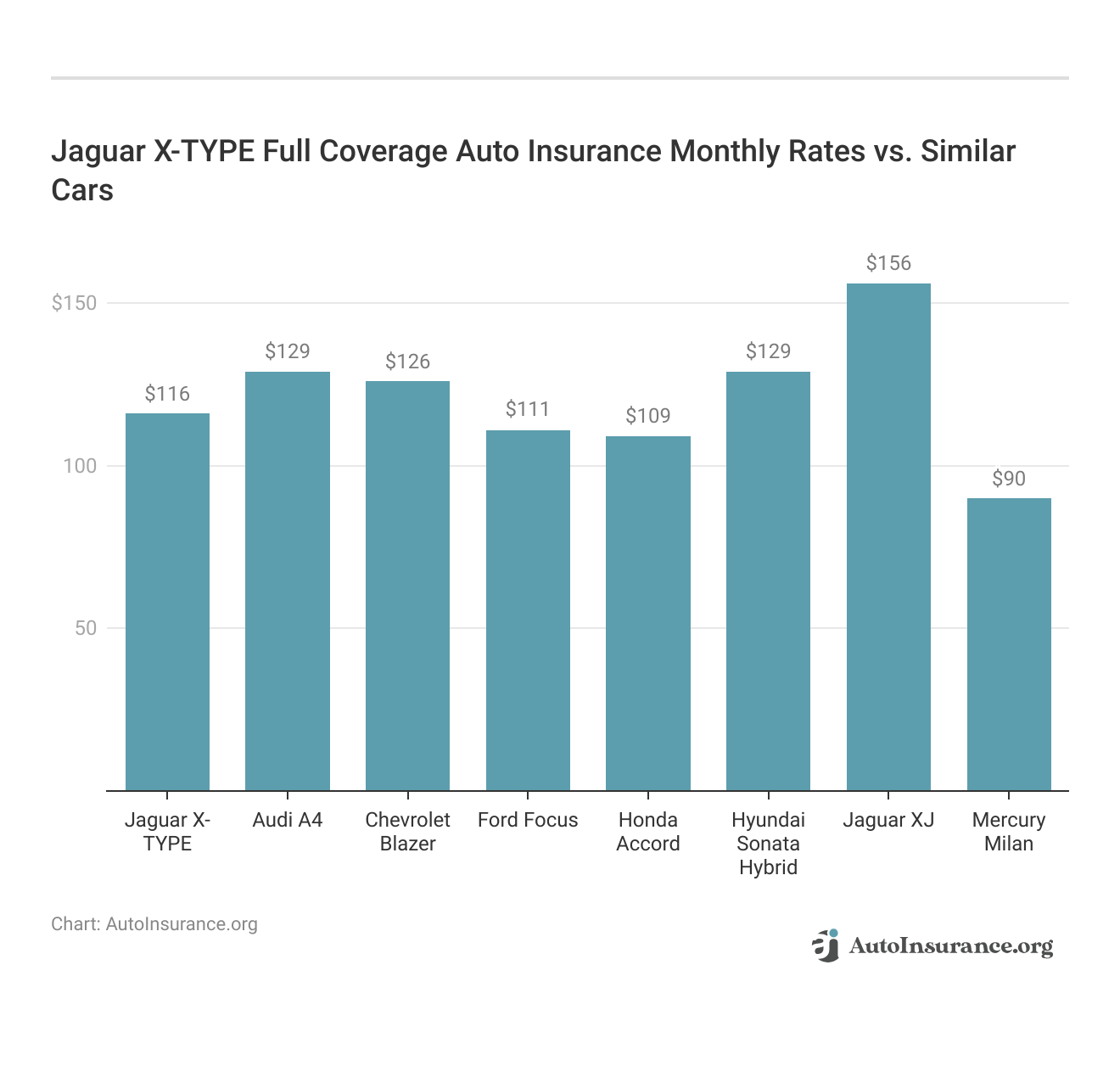

Are Vehicles Like the Jaguar X-TYPE Expensive to Insure

Take a look at how insurance rates for similar models to the Jaguar X-TYPE look. These insurance rates for other sedans like the Acura TL, Volvo S80, and Lexus LS 600h L give you a good idea of what to expect. See more details in our guide titled, “What is the average auto insurance cost per month?“

The average insurance rates for sedans provide a clear picture of what you might expect to pay for comprehensive, collision, and liability coverage.

With costs like $1,539 for full coverage, understanding these figures helps in making an informed decision when insuring vehicles similar to the Jaguar X-TYPE.

This comparison of insurance rates highlights the diverse cost landscape for models akin to the Jaguar X-Type. Potential and current owners can use this information to better understand the financial implications of their vehicle choice relative to similar models in the market.

Insurance Rates for Vehicles Similar to the Jaguar X-TYPE

Comparing insurance rates for vehicles similar to the Jaguar X-TYPE can provide valuable insights for potential buyers and current owners looking to understand how costs vary across different models.

This analysis includes comprehensive, collision, and liability coverages to offer a complete overview of total insurance expenses.

Jaguar X-TYPE Auto Insurance Monthly Rates vs. Similar Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Jaguar X-TYPE | $26 | 43 | $35 | $116 |

| Infiniti Q70 | $31 | $65 | $28 | $135 |

| Acura TL | $22 | $42 | $38 | $114 |

| Subaru Impreza | $28 | $47 | $31 | $119 |

| Nissan Sentra | $22 | $50 | $31 | $116 |

| Dodge Avenger | $20 | $40 | $43 | $117 |

| Jaguar XF | $34 | $67 | $33 | $147 |

| Nissan Maxima | $33 | $55 | $31 | $131 |

| Chevrolet Cobalt | $17 | $30 | $48 | $112 |

The data clearly shows a range of insurance costs for vehicles akin to the Jaguar X-TYPE, highlighting factors such as model-specific risk assessments and repair costs. Understanding these rates aids in making informed decisions about vehicle purchase and insurance, ensuring financial preparedness for potential owners.

What Impacts the Cost of Jaguar X-TYPE Insurance

The average annual rate for the Jaguar X-TYPE is just that, an average. Your insurance rates for a Jaguar X-TYPE can be higher or lower depending on the trim level and personal factors. Those factors include your age, home address, driving history, and the model year of your Jaguar X-TYPE.

Learn more by reading our guide: Factors That Affect Auto Insurance Rates

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Jaguar X-TYPE Insurance

There are several ways you can save even more on your Jaguar X-TYPE car insurance rates. Take a look at the following five tips:

- Ask about welcome discounts.

- If you’re a young driver living at home, add yourself to your parent’s plan.

- Buy your Jaguar X-TYPE with cash, or get a shorter-term loan.

- Don’t skimp on Jaguar X-TYPE liability coverage.

- Ask your insurance company about Jaguar X-TYPE discounts.

By implementing these strategies, you can achieve more affordable insurance rates for your Jaguar X-TYPE. Remember, the key to maximizing savings lies in understanding your policy options and actively seeking applicable discounts. Learn more in our complete “Types of Auto Insurance.”

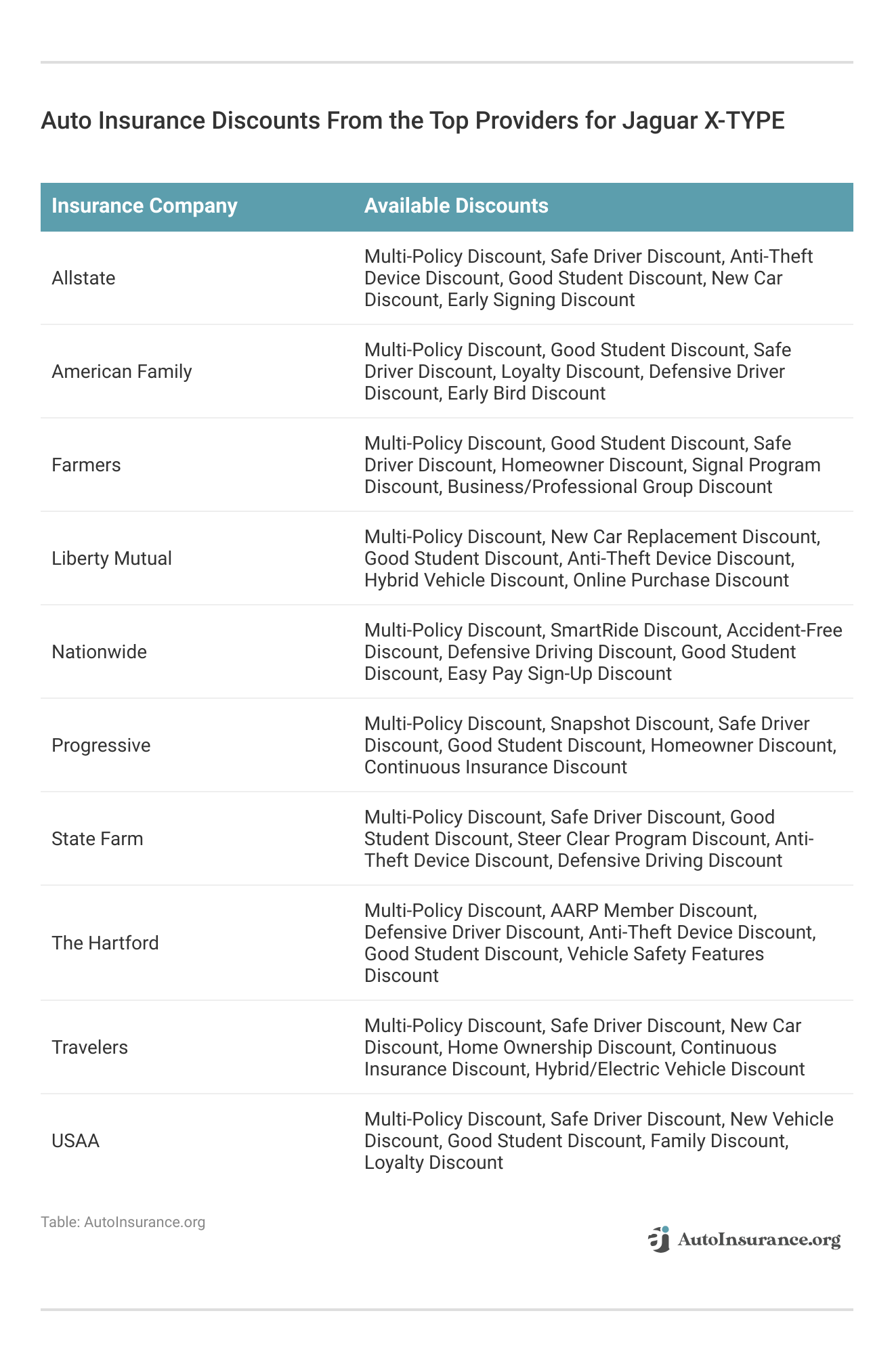

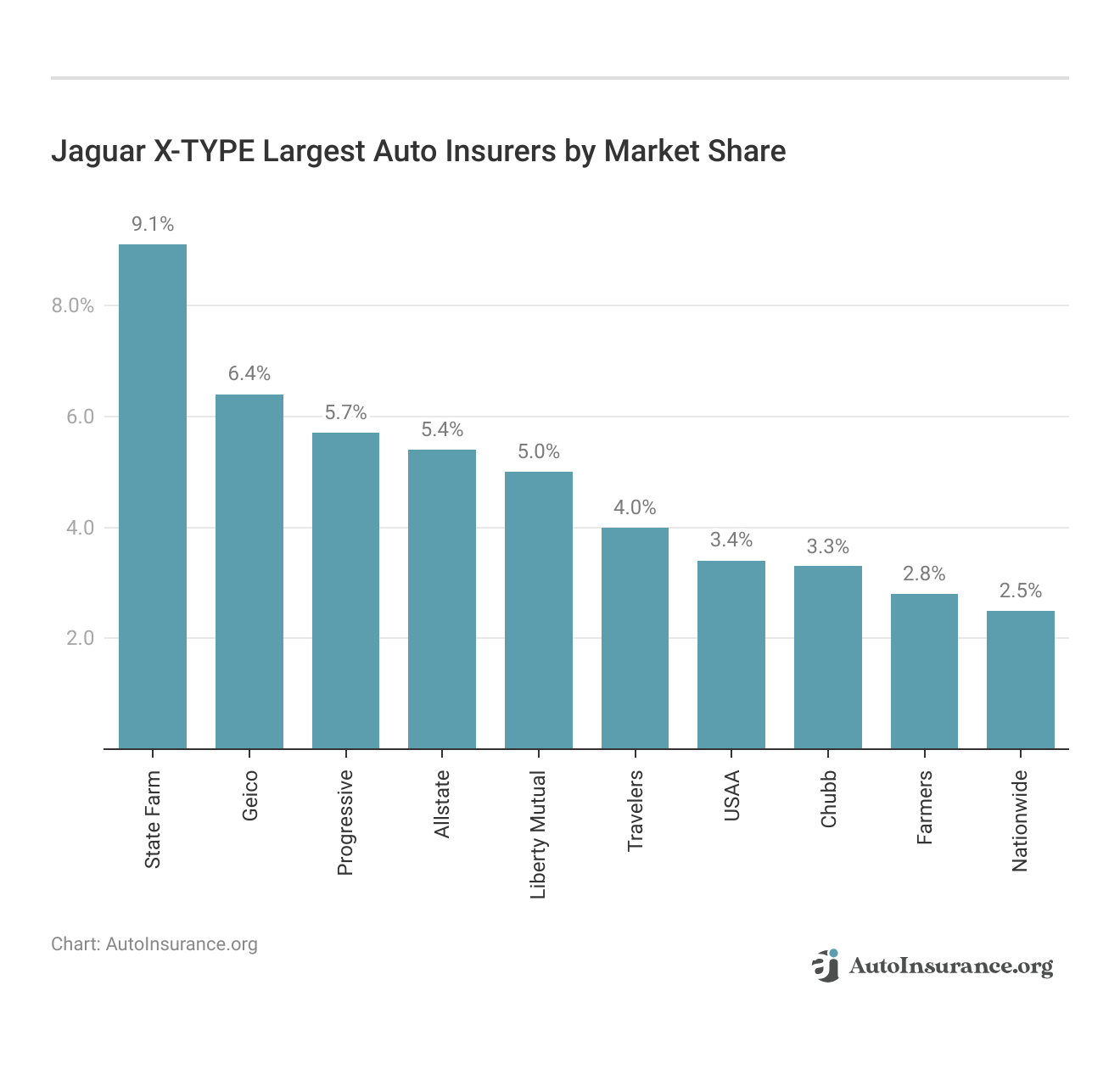

Top Jaguar X-TYPE Insurance Companies

What is the best company for affordable Jaguar X-TYPE insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Jaguar X-TYPE insurance coverage (ordered by market share).

Choosing State Farm means securing top-tier auto insurance for your Jaguar X-TYPE with confidence.Chris Abrams Licensed Insurance Agent

Many of these companies offer discounts for security systems and other safety features found on the Jaguar X-TYPE.

Understanding the market share and specialties of these leading insurers can greatly assist in making an informed decision for insuring your Jaguar X-TYPE. Remember, the best policy should offer a balance of cost, coverage, and customer service to meet your specific needs.

Largest Auto Insurers by Market Share

Understanding the landscape of the auto insurance market can be pivotal for consumers looking to make informed decisions. This list highlights the largest auto insurers by market share, showcasing their dominance and impact within the industry. See more details in our guide titled “Best Auto Insurance Companies.”

Top Jaguar X-TYPE Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9.1% |

| #2 | Geico | $46,358,896 | 6.4% |

| #3 | Progressive | $41,737,283 | 5.7% |

| #4 | Allstate | $39,210,020 | 5.4% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3.4% |

| #8 | Chubb | $24,199,582 | 3.3% |

| #9 | Farmers | $20,083,339 | 2.8% |

| #10 | Nationwide | $18,499,967 | 2.5% |

The rankings above not only reflect the significant presence these companies hold in the market but also guide potential customers in identifying insurers with substantial resources and customer reach. Such information is crucial for evaluating reliability and service quality when choosing an auto insurance provider.

You can compare quotes for Jaguar X-TYPE auto insurance rates from some of the best auto insurance companies by using our free online tool now.

Frequently Asked Questions

Are vehicles like the Jaguar X-Type expensive to insure?

Insurance rates for vehicles like the Jaguar X-Type can vary. To get an idea of the insurance costs, you can look at the rates for similar sedan models such as the Acura TL, Volvo S80, and Lexus LS 600h L.

For additional details, explore our comprehensive resource titled, “How do auto insurance payments work?“

What factors impact the cost of Jaguar X-Type insurance?

The cost of Jaguar X-Type insurance can be influenced by various factors. These include your age, home address, driving history, the model year of your Jaguar X-Type, and the specific trim level.

How can I save on Jaguar X-Type insurance?

There are several ways to potentially save on Jaguar X-Type car insurance rates. Here are five tips to consider:

- Shop around and compare quotes from different insurance companies

- Maintain a clean driving record and avoid accidents or traffic violations

- Take advantage of available discounts, such as those for safety features on the Jaguar X-Type

- Consider increasing your deductibles to lower your premium

- Bundle your auto insurance with other policies, like homeowners or renters insurance, to potentially get a discount

By implementing these tips, you can find more affordable insurance for your Jaguar X-Type. Each strategy offers a potential path to savings, enhancing your financial flexibility while keeping your vehicle well-protected.

Which companies offer affordable Jaguar X-Type insurance rates?

While the rates you’ll pay for Jaguar X-Type insurance depend on several factors, here are some of the top insurance companies that offer coverage for the Jaguar X-Type (ordered by market share). Many of these companies provide discounts for security systems and other safety features found on the Jaguar X-Type.

How can I compare free Jaguar X-Type insurance quotes online?

To compare quotes for Jaguar X-Type auto insurance rates from various companies, you can use our free online tool. Simply enter your ZIP code, and we’ll provide you with personalized insurance rates from top companies.

To find out more, explore our guide titled “Where to Buy Auto Insurance Online.”

What is the cheapest Jaguar X-TYPE model to insure monthly?

Insurance costs for the Jaguar X-TYPE can vary, with newer models generally costing more to insure due to their higher value and repair costs.

How does the potential classic status of the Jaguar X-TYPE affect its insurance rates?

If the Jaguar X-TYPE is considered a classic, it may qualify for lower insurance rates through classic car insurance policies, which recognize the car’s collectible status.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Which car has lower insurance costs, the Jaguar X-TYPE or Mercedes-Benz models?

Insurance costs between the Jaguar X-TYPE and Mercedes-Benz models can vary; however, luxury brands like these typically have higher insurance rates due to repair costs.

Are insurance premiums higher due to the cost of parts for the Jaguar X-TYPE?

Yes, the high cost of parts for the Jaguar X-TYPE can contribute to higher insurance premiums as insurers factor in the potential cost of repairs.

Access comprehensive insights into our guide titled, “Understanding Auto Insurance Premiums.”

What impact does the life expectancy of a Jaguar X-TYPE have on its insurance rates?

A longer life expectancy can lower insurance rates for a Jaguar X-TYPE as it suggests reliability, which reduces the risk and potential cost to insurers.

Is insuring a Jaguar X-TYPE considered expensive?

Insuring a Jaguar X-TYPE can be expensive relative to less luxurious vehicles due to its classification as a luxury car, which increases perceived risk and repair costs.

Does the Jaguar X-TYPE’s status as a luxury car influence its insurance premiums?

Yes, as a luxury vehicle, the Jaguar X-TYPE typically has higher insurance premiums due to higher repair and replacement costs.

How does the use of a Ford engine in the Jaguar X-TYPE affect its insurance?

The use of a Ford engine in some Jaguar X-TYPE models might lower insurance costs due to the availability and potentially lower cost of Ford parts.

Learn more by reading our guide titled, “What to Do When Your Engine Overheats.”

Why do Jaguar X-TYPEs depreciate so much, and how does this affect insurance costs?

The significant depreciation of the Jaguar X-TYPE can affect insurance costs by potentially lowering the comprehensive and collision coverage costs as the vehicle’s value decreases.

Is insuring a Jaguar X-TYPE more expensive than insuring a BMW?

Insuring a Jaguar X-TYPE might be comparably expensive to insuring a BMW, as both are luxury brands with high repair costs and enhanced features that can increase insurance premiums.

What factors affect Jaguar auto insurance rates?

Jaguar auto insurance rates are influenced by the model, age of the vehicle, driver’s history, and chosen coverage levels.

How can I find the best Jaguar car insurance?

To find the best jaguar car insurance, compare quotes from multiple providers, consider coverage options, and check customer reviews for insurer reliability.

To learn more, explore our comprehensive resource on “Where to Compare Auto Insurance Rates.”

What is the average Jaguar X-TYPE insurance cost per month?

The average monthly cost for Jaguar X-TYPE insurance varies based on factors such as location, driving record, and insurance provider.

Which Jaguar X-TYPE insurance group does this model fall into?

The Jaguar X-TYPE typically falls into higher insurance groups due to its luxury status and repair costs.

Is Lexus LS 600h l car insurance more expensive than other luxury cars?

Lexus LS 600h L car insurance may be higher than average luxury cars due to its advanced hybrid technology and the cost of replacement parts.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.