Best Hyundai Sonata Hybrid Auto Insurance in 2025 (Check Out the Top 10 Companies)

When looking for the best Hyundai Sonata Hybrid auto insurance, Geico, State Farm, and Progressive offer the most competitive rates starting at $80 per month. These providers excel in affordability and comprehensive coverage, making them ideal choices. Compare Hyundai Sonata insurance cost to find the best deal.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Hyundai Sonata Hybrid

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Hyundai Sonata Hybrid

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Hyundai Sonata Hybrid

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

The best Hyundai Sonata Hybrid auto insurance options are Geico, State Farm, and Progressive, with rates starting at $85 per month. Geico is the top pick overall for its exceptional value in Hyundai Sonata car insurance. These providers offer competitive coverage tailored to your needs.

The article also explores how vehicle year affects auto insurance rates. Older Hyundai Sonata Hybrid models typically cost less to insure due to reduced repair expenses, while newer models with advanced features might have higher premiums. Understanding this can help you make more informed insurance decisions.

Our Top 10 Company Picks: Best Hyundai Sonata Hybrid Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 20% A++ Affordable Premiums Geico

#2 15% B Customer Service State Farm

#3 10% A+ Competitive Rates Progressive

#4 10% A+ Drivewise Program Allstate

#5 25% A++ Military Families USAA

#6 8% A Extensive Discount Liberty Mutual

#7 20% A+ Vanishing Deductible Nationwide

#8 10% A+ Customizable Policies Farmers

#9 8% A++ Financial Stability Travelers

#10 15% A+ Long-Term Coverage Amica

Get fast and cheap auto insurance coverage today with our quote comparison tool above.

- Geico offers the best Hyundai Sonata Hybrid insurance rates

- Enjoy comprehensive coverage tailored for the Hyundai Sonata Hybrid

- Discounts for safe driving can lower Hyundai Sonata insurance costs.

#1 – Geico: Top Overall Pick

Pros

- Affordable Premiums: As mentioned in our Geico auto insurance review, the company offers competitive rates for Hyundai Sonata Hybrid insurance, with a monthly premium of $160, which is lower compared to several other providers. This can be advantageous for budget-conscious drivers seeking cost-effective coverage.

- Extensive Discounts: Geico provides a variety of discounts that can further reduce the cost of insurance for Hyundai Sonata Hybrid owners. These include discounts for good drivers, bundling policies, and having safety features on the vehicle, which can be particularly beneficial for hybrid owners.

- Strong Online Tools: Geico’s user-friendly online tools and mobile app allow Hyundai Sonata Hybrid owners to manage their policies efficiently. Features such as easy quote comparisons and policy management can help streamline the insurance process and keep track of savings.

Cons

- Limited Local Agent Availability: While Geico excels in online services, its network of local agents is relatively limited. This might be a drawback for Hyundai Sonata Hybrid owners who prefer face-to-face consultations and personalized service.

- Potential for Higher Rates for Hybrid Repairs: Geico’s coverage might not be as comprehensive for hybrid-specific repairs and parts, which could result in higher out-of-pocket expenses for Hyundai Sonata Hybrid owners if specialized repairs are needed.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- Lower Monthly Premiums: State Farm offers a monthly rate of $150 for Hyundai Sonata Hybrid insurance, which is among the lowest in the market. This can be particularly appealing to those looking for affordable coverage without sacrificing quality.

- Comprehensive Coverage Options: State Farm offers a range of comprehensive coverage options tailored to the Hyundai Sonata Hybrid, including protection for hybrid-specific components and systems that might not be covered by other insurers.

- Discounts for Hybrid Vehicles: As mentioned in our State Farm auto insurance review, State Farm offers specific discounts for hybrid vehicles, including the Hyundai Sonata Hybrid. These discounts reward eco-friendly driving habits and can lower overall insurance costs.

Cons

- Limited Availability of Hybrid-Specific Coverage: While State Farm provides good overall coverage, its options for hybrid-specific components and repairs might not be as extensive as other providers. This could be a drawback for Hyundai Sonata Hybrid owners needing specialized coverage.

- Regional Variations in Service: The quality of service and coverage options can vary by region. Hyundai Sonata Hybrid owners in some areas may experience less favorable conditions or higher rates due to regional policies and underwriting criteria.

#3 – Progressive: Best for Competitive Rates

Pros

- Competitive Pricing: With a monthly premium of $155, Progressive offers competitive rates for Hyundai Sonata Hybrid insurance. This pricing structure makes it a strong contender for those seeking affordable insurance for their hybrid vehicle.

- Comprehensive Coverage Options: Progressive provides extensive coverage options that can be tailored to the specific needs of Hyundai Sonata Hybrid owners, including coverage for hybrid components and systems that may be unique to hybrid vehicles.

- Discounts for Safety Features: As mention in Progressive auto insurance review, Progressive offers discounts for vehicles equipped with advanced safety features, which are standard in the Hyundai Sonata Hybrid. This can lead to additional savings on your insurance premiums.

Cons

- Higher Premiums for Young Drivers: Progressive’s rates can be higher for younger drivers, which might affect Hyundai Sonata Hybrid owners who are under 25. This demographic might find it challenging to secure affordable coverage compared to other age groups.

- Potential Customer Service Issues: While generally reliable, some customers report occasional issues with Progressive’s customer service. Hyundai Sonata Hybrid owners may experience delays or challenges in handling claims and policy adjustments.

#4 – Allstate: Best for Drivewise Program

Pros

- Broad Coverage Options: Allstate offers a range of coverage options that can be customized for Hyundai Sonata Hybrid owners. This includes comprehensive and collision coverage tailored to the specific needs of hybrid vehicles.

- Discounts for Hybrid Vehicles: Allstate provides discounts specifically for hybrid vehicles, including the Hyundai Sonata Hybrid. These discounts help reduce overall insurance costs while promoting eco-friendly driving practices. Learn more about their discounts in our Allstate auto insurance review.

- Strong Local Agent Network: Allstate’s extensive network of local agents provides personalized service and support. Hyundai Sonata Hybrid owners can benefit from face-to-face interactions and tailored advice on their insurance needs.

Cons

- Higher Premiums: Allstate’s premiums are relatively higher, with a monthly rate of $165 for Hyundai Sonata Hybrid insurance. This could be a concern for budget-conscious drivers looking for more affordable options.

- Less Competitive Discounts for Good Drivers: Although Allstate offers discounts for hybrid vehicles like Hyundai Sonata Hybrid, their discounts for good driving records may not be as competitive as those offered by other insurers, potentially affecting overall savings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Families

Pros

- Lowest Premiums: As outlined in USAA auto insurance review, the company offers the most competitive monthly rate of $145 for Hyundai Sonata Hybrid insurance, making it the most cost-effective option for military families and veterans.

- Excellent Customer Service: Known for its exceptional customer service, USAA provides personalized support and efficient claim processing, which is beneficial for Hyundai Sonata Hybrid owners seeking reliable insurance services.

- Discounts for Safe Driving: USAA offers significant discounts for safe driving, which can be advantageous for Hyundai Sonata Hybrid owners with clean driving records. This can lead to further savings on insurance premiums.

Cons

- Eligibility Restrictions: USAA insurance is only available to military members, veterans, and their families. Hyundai Sonata Hybrid owners who do not meet these criteria will not be able to access USAA’s competitive rates and service.

- Limited Local Agent Network: USAA’s focus on online services may limit access to local agents, which could be a disadvantage for those who prefer in-person consultations and personalized insurance support for Hyundai Sonata Hybrid drivers.

#6 – Liberty Mutual: Best for Extensive Discount

Pros

- Comprehensive Coverage Options: Liberty Mutual offers extensive coverage options for Hyundai Sonata Hybrid owners, including protection for hybrid-specific components and systems.

- Discounts for Hybrid Vehicles: As mentioned in our Liberty Mutual auto insurance review, the company provides discounts for hybrid vehicles, which can help lower the overall insurance costs for Hyundai Sonata Hybrid owners.

- Flexible Payment Plans: Liberty Mutual offers flexible payment plans, allowing Hyundai Sonata Hybrid owners to choose a payment schedule that best fits their financial situation.

Cons

- Highest Premiums: With a monthly rate of $170, Liberty Mutual’s premiums are among the highest for Hyundai Sonata Hybrid insurance, which might be a drawback for those seeking more affordable options.

- Customer Service Variability: Some customers have reported inconsistent experiences with Liberty Mutual’s customer service, which could affect the overall satisfaction of Hyundai Sonata Hybrid owners dealing with claims or policy issues.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Affordable Coverage: Nationwide offers a competitive monthly premium of $158 for Hyundai Sonata Hybrid insurance, which is relatively affordable compared to other major providers. For more information, read our Nationwide auto insurance review.

- Discounts for Safety Features: Nationwide provides discounts for vehicles equipped with advanced safety features, which are standard in the Hyundai Sonata Hybrid, helping to reduce insurance costs.

- Good Customer Support: Nationwide has a reputation for good customer support, offering responsive and helpful service to Hyundai Sonata Hybrid owners who need assistance with their policies.

Cons

- Limited Hybrid-Specific Coverage: While Nationwide offers solid coverage, its options for hybrid-specific components and repairs may not be as extensive, which could be a limitation for Hyundai Sonata Hybrid owners needing specialized coverage.

- Potential Regional Variability: The quality of service and coverage options can vary by location, which may impact Hyundai Sonata Hybrid owners depending on their region and local office policies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Customizable Policies

Pros

- Comprehensive Coverage: Farmers provides comprehensive coverage options tailored to the Hyundai Sonata Hybrid, including protection for hybrid-specific components and systems. Check out this page Farmers auto insurance review to know more details.

- Discounts for Bundling: Farmers offers discounts for bundling multiple policies, such as home and auto insurance, which can be advantageous for Hyundai Sonata Hybrid owners looking to save on overall insurance costs.

- Strong Local Agent Network: With a broad network of local agents, Farmers offers personalized service and support, which can be beneficial for Hyundai Sonata Hybrid owners seeking face-to-face consultations.

Cons

- Higher Premiums: Farmers’ monthly premium of $156 is slightly higher compared to some competitors, which could be a consideration for those seeking more budget-friendly options for their Hyundai Sonata Hybrid insurance.

- Less Competitive Discounts for Safe Driving: Farmers’ discounts for good driving records may not be as competitive as those offered by other insurers, potentially affecting savings for Hyundai Sonata Hybrid owners with clean driving histories.

#9 – Travelers: Best for Financial Stability

Pros

- Broad Coverage Options: Travelers offers a wide range of coverage options for Hyundai Sonata Hybrid owners, including protection for hybrid-specific components and systems.

- Discounts for Hybrid Vehicles: Travelers provides discounts for hybrid vehicles, helping to lower insurance costs for Hyundai Sonata Hybrid owners who drive eco-friendly cars.

- Strong Financial Stability: As outlined in our Travelers auto insurance review, Travelers is known for its strong financial stability, ensuring reliable and consistent coverage for Hyundai Sonata Hybrid owners in the event of a claim.

Cons

- Higher Premiums: With a monthly premium of $162, Travelers’ rates are higher than some other providers, which may be a concern for Hyundai Sonata Hybrid owners looking for more affordable options.

- Inconsistent Customer Service: Some customers have reported inconsistent experiences with Travelers’ customer service, which could impact the satisfaction of Hyundai Sonata Hybrid owners dealing with claims or policy issues.

#10 – Amica: Best for Long-Term Coverage

Pros

- Competitive Premiums: As mentioned in our Amica auto insurance review, Amica offers a competitive monthly rate of $155 for Hyundai Sonata Hybrid insurance, making it a cost-effective option for hybrid vehicle owners.

- Discounts for Safe Driving and Hybrid Vehicles: Amica provides discounts for both safe driving and hybrid vehicles, which can help Hyundai Sonata Hybrid owners save on their insurance premiums.

- High Customer Satisfaction: Amica is known for high customer satisfaction and strong service quality, which benefits Hyundai Sonata Hybrid owners who value responsive and effective customer support.

Cons

- Limited Hybrid-Specific Coverage: Amica’s coverage options may not be as extensive for hybrid-specific components and systems, potentially limiting the protection for Hyundai Sonata Hybrid owners.

- Availability Issues: Amica’s availability and coverage options can vary by region, which may impact Hyundai Sonata Hybrid owners depending on their location and local office policies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Hyundai Sonata Hybrid Insurance Cost

The table below compares monthly rates for minimum and full coverage car insurance for a Sonata Hybrid from various providers.

Hyundai Sonata Hybrid Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $90 $165

Amica $81 $155

Farmers $84 $156

Geico $85 $160

Liberty Mutual $88 $170

Nationwide $83 $158

Progressive $82 $155

State Farm $80 $150

Travelers $86 $162

USAA $75 $145

Comparing Hyundai Sonata Hybrid insurance rates reveals notable differences among providers, with USAA offering the lowest premiums for both minimum and full coverage. Be sure to evaluate these rates and coverage options to find the best fit for your needs.

Hyundai Sonata Hybrid Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Average Rate | $129 |

| Discount Rate | $76 |

| High Deductibles | $111 |

| High Risk Driver | $275 |

| Low Deductibles | $162 |

| Teen Driver | $472 |

The Hyundai Sonata Hybrid insurance rates vary significantly based on deductible levels and driver profiles, with high-risk drivers and teen drivers facing notably higher costs. Carefully consider your deductible and risk factors to optimize your insurance savings and coverage.

Read More: Best Auto Insurance Companies for High-Risk Drivers

Why Hyundai Sonata Hybrids are Expensive to Insure

The chart below details how Hyundai Sonata Hybrid insurance rates compare to other hybrid/electrics like the Buick LaCrosse, Ford Fusion Energi, and Chevrolet Volt.

Hyundai Sonata Hybrid Auto Insurance Monthly Rates vs. Other Vehicle

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Buick LaCrosse | $27 | $47 | $28 | $113 |

| Chevrolet Volt | $31 | $65 | $33 | $142 |

| Chrysler Pacifica Hybrid | $31 | $55 | $28 | $125 |

| Ford Fusion Energi | $28 | $52 | $31 | $124 |

| Hyundai Sonata Hybrid | $27 | $52 | $35 | $129 |

| Lexus GS 450h | $33 | $65 | $33 | $144 |

| Toyota Prius | $26 | $43 | $28 | $107 |

The Hyundai Sonata Hybrid’s insurance costs are relatively high compared to other hybrid and electric vehicles, reflecting its higher comprehensive and collision coverage expenses. Understanding these factors can help Hyundai Sonata Hybrid owners make informed decisions about their insurance options.

Read More: Cheap Chrysler Auto Insurance

What Impacts the Hyundai Sonata Hybrid Insurance Cost

The insurance cost for a Hyundai Sonata Hybrid can be influenced by several factors, including the specific trim and model you choose. Higher trims often come with advanced features and higher repair costs, which can increase your insurance premiums.

For example, a higher trim level with advanced technology and premium materials may lead to higher comprehensive and collision coverage costs due to the increased value and repair expenses.

Newer Hyundai Sonata Hybrid models generally come with updated safety features and technology, which might affect insurance rates.Travis Thompson LICENSED INSURANCE AGENT

Vehicles with advanced safety systems can sometimes benefit from lower premiums due to reduced risk of accidents. Conversely, older models might be less expensive to insure, as they generally have lower repair costs and value, though they may lack the latest safety enhancements.

Overall, the combination of trim level, model year, and the vehicle’s features all play a significant role in determining the insurance costs for your Hyundai Sonata Hybrid.

Age of the Vehicle

Older Hyundai Sonata Hybrid models generally cost less to insure. For example, auto insurance for a 2020 Hyundai Sonata Hybrid costs approximately $129 per month, while insurance for a 2011 Hyundai Sonata Hybrid costs about $108 per month, resulting in a monthly difference of $21.

Hyundai Sonata Hybrid Auto Insurance Monthly Rates by Model Year

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Hyundai Sonata Hybrid | $28 | $54 | $36 | $132 |

| 2023 Hyundai Sonata Hybrid | $27 | $53 | $36 | $131 |

| 2022 Hyundai Sonata Hybrid | $27 | $52 | $36 | $130 |

| 2021 Hyundai Sonata Hybrid | $26 | $52 | $36 | $129 |

| 2020 Hyundai Sonata Hybrid | $27 | $52 | $35 | $129 |

| 2019 Hyundai Sonata Hybrid | $26 | $50 | $37 | $127 |

| 2018 Hyundai Sonata Hybrid | $25 | $50 | $38 | $127 |

| 2017 Hyundai Sonata Hybrid | $24 | $49 | $39 | $126 |

| 2016 Hyundai Sonata Hybrid | $23 | $47 | $41 | $125 |

| 2015 Hyundai Sonata Hybrid | $22 | $45 | $42 | $123 |

| 2014 Hyundai Sonata Hybrid | $21 | $42 | $43 | $120 |

| 2013 Hyundai Sonata Hybrid | $20 | $39 | $43 | $117 |

| 2012 Hyundai Sonata Hybrid | $19 | $35 | $43 | $113 |

| 2011 Hyundai Sonata Hybrid | $18 | $32 | $43 | $109 |

As the Hyundai Sonata Hybrid ages, its insurance costs tend to decrease, reflecting lower repair and replacement expenses. The data shows a gradual reduction in monthly premiums from newer to older models, highlighting the financial benefit of insuring an older Sonata Hybrid.

Driver Age

Driver age can have a significant impact on the cost of Hyundai Sonata Hybrid auto insurance. For example, 20-year-old drivers pay approximately $158 per month for their Hyundai Sonata Hybrid auto insurance, while 30-year-old drivers pay about $124 per month, resulting in a monthly difference of $34

Hyundai Sonata Hybrid Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $472 |

| Age: 18 | $396 |

| Age: 20 | $292 |

| Age: 30 | $135 |

| Age: 40 | $129 |

| Age: 45 | $124 |

| Age: 50 | $118 |

| Age: 60 | $115 |

Driver age significantly influences Hyundai Sonata Hybrid insurance rates, with younger drivers facing much higher premiums. As drivers age, the cost of insurance typically decreases, reflecting the lower risk associated with more experienced drivers.

Driver Location

Where you live can have a large impact on Hyundai Sonata Hybrid insurance rates. For example, drivers in Houston may pay $95 a month more than drivers in Columbus.

Hyundai Sonata Hybrid Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $170 |

| Columbus, OH | $107 |

| Houston, TX | $202 |

| Indianapolis, IN | $110 |

| Jacksonville, FL | $187 |

| Los Angeles, CA | $221 |

| New York, NY | $204 |

| Philadelphia, PA | $173 |

| Phoenix, AZ | $150 |

| Seattle, WA | $125 |

Driver location plays a crucial role in determining Hyundai Sonata Hybrid insurance rates, with significant variations between cities. For instance, drivers in Houston face much higher premiums compared to those in Columbus, highlighting the importance of considering geographic factors when shopping for insurance.

Read More: Best and Worst Drivers by State

Your Driving Record

Your driving record can have an impact on the cost of Hyundai Sonata Hybrid auto insurance. Teens and drivers in their 20’s see the highest jump in their Hyundai Sonata Hybrid car insurance with violations on their driving record.

Hyundai Sonata Hybrid Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $472 | $518 | $567 | $670 |

| Age: 18 | $396 | $435 | $476 | $566 |

| Age: 20 | $292 | $318 | $349 | $415 |

| Age: 30 | $135 | $147 | $160 | $190 |

| Age: 40 | $129 | $140 | $152 | $180 |

| Age: 45 | $124 | $134 | $146 | $173 |

| Age: 50 | $118 | $128 | $140 | $166 |

| Age: 60 | $115 | $125 | $136 | $162 |

A clean driving record can keep your Hyundai Sonata Hybrid insurance costs lower, but violations and accidents can significantly increase premiums, especially for younger drivers. It’s crucial to maintain a good driving history to help manage insurance expenses effectively.

Crash Test Ratings

Hyundai Sonata Hybrid crash test ratings can impact the cost of your Hyundai Sonata Hybrid car insurance. See Hyundai Sonata Hybrid crash test results below:

Hyundai Sonata Hybrid Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Hyundai Sonata Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Hyundai Sonata Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Hyundai Sonata Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Hyundai Sonata Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Hyundai Sonata Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Hyundai Sonata Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Hyundai Sonata Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Hyundai Sonata Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

The high crash test ratings for the Hyundai Sonata Hybrid reflect its strong safety performance, which can positively influence insurance rates. Consistently excellent scores across various categories help lower premiums and enhance overall coverage.

Hyundai Sonata Hybrid Safety Features

The safety features of the Hyundai Sonata Hybrid can impact your Hyundai Sonata Hybrid car insurance rates. The Hyundai Sonata Hybrid has the following safety features:

- Comprehensive Safety Features: Includes driver and passenger air bags, front and rear side air bags, and 4-wheel ABS.

- Advanced Driver Assistance: Equipped with blind spot monitor, lane departure warning, and lane keeping assist.

- Enhanced Braking and Stability: Features brake assist, electronic stability control, and 4-wheel disc brakes.

- Visibility and Alerts: Daytime running lights, integrated turn signal mirrors, and cross-traffic alert.

- Child and Passenger Safety: Comes with child safety locks and traction control for added protection.

The Hyundai Sonata Hybrid’s extensive safety features not only enhance driver and passenger protection but can also influence your insurance premiums. Its advanced safety systems contribute to both lower risk and potentially reduced insurance costs.

Loss Probability

The lower percentage means lower Hyundai Sonata Hybrid car insurance rates; higher percentages mean higher Hyundai Sonata Hybrid auto insurance rates. Insurance loss probability on the Hyundai Sonata Hybrid fluctuates between each type of coverage.

Hyundai Sonata Hybrid Insurance Loss Probability

| Coverage | Loss |

|---|---|

| Bodily Injury | 21% |

| Collision | 42% |

| Comprehensive | 19% |

| Medical Payment | 38% |

| Personal Injury | 24% |

| Property Damage | 16% |

Insurance loss probability plays a crucial role in determining Hyundai Sonata Hybrid insurance rates, with varying percentages across different coverage types. Lower loss rates often lead to more affordable premiums, while higher rates can result in increased costs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Hyundai Sonata Hybrid Finance and Insurance Cost

If you are financing a Hyundai Sonata Hybrid, most lenders will require your carry higher Hyundai Sonata Hybrid coverage options including comprehensive coverage, so be sure to shop around and compare Hyundai Sonata Hybrid auto insurance rates from the best companies using our free tool below.

Read More: Is it a good time to refinance an auto loan?

Ways to Save on Hyundai Sonata Hybrid Insurance

There are several ways you can save even more on your Hyundai Sonata Hybrid car insurance rates. Take a look at the following five tips:

- Compare Hyundai Sonata Hybrid quotes online.

- Consider Hyundai Sonata Hybrid insurance costs before buying a Hyundai Sonata Hybrid.

- Compare apples to apples when comparing Hyundai Sonata Hybrid insurance quotes and policies.

- Remove young drivers from Your Hyundai Sonata Hybrid insurance when they move out or go to school.

- Buy winter tires for your Hyundai Sonata Hybrid.

Utilizing these strategies can help you reduce your Hyundai Sonata Hybrid insurance premiums effectively. Stay informed and make adjustments to ensure you are maximizing your savings on Hyundai Sonata Hybrid coverage.

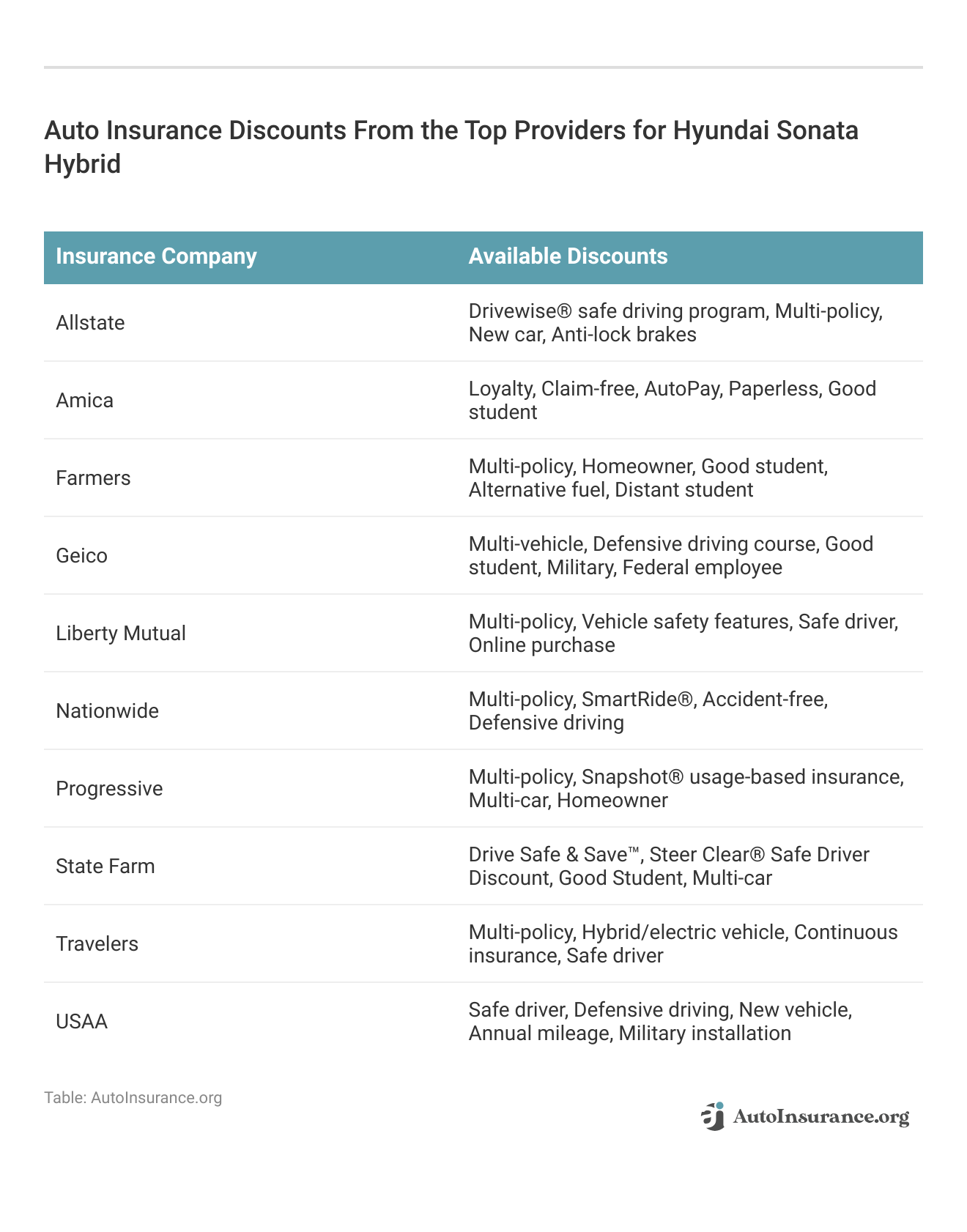

These discounts from top insurance providers for Hyundai Sonata Hybrid offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road. By exploring options such as the multi-car auto insurance discount, you can further reduce your premiums if you insure multiple vehicles with the same provider.

Additionally, taking advantage of discounts for safety features, good driving records, and bundling policies can also lead to significant savings, ensuring you get the best value for your Hyundai Sonata Hybrid insurance.

Top Hyundai Sonata Hybrid Insurance Companies

Who is the top auto insurance company for Hyundai Sonata Hybrid insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Hyundai Sonata Hybrid auto insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features that the Hyundai Sonata Hybrid offers.

Top 10 Hyundai Sonata Hybrid Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9% |

| #2 | Geico | $46.3 million | 6% |

| #3 | Progressive | $41.7 million | 5% |

| #4 | Liberty Mutual | $39.2 million | 5% |

| #5 | Allstate | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3% |

| #8 | Chubb | $24.1 million | 3% |

| #9 | Farmers | $20.0 million | 2% |

| #10 | Nationwide | $18.4 million | 2% |

When choosing an insurance provider for your Hyundai Sonata Hybrid, consider top companies like State Farm, Geico, and Progressive for competitive rates and comprehensive coverage. Many of these insurers also offer discounts based on the Sonata Hybrid’s advanced safety features.

For those seeking affordable options, these providers can also help you find cheap Hyundai auto insurance while ensuring you receive quality protection for your vehicle.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Compare Free Hyundai Sonata Hybrid Insurance Quotes Online

Save money on your Hyundai Sonata Hybrid insurance by comparing rates with free online auto insurance quotes. By evaluating quotes from multiple providers, you can find the best coverage options tailored to your Hyundai Sonata Hybrid’s unique safety features and trim levels.

This comparison helps you identify potential discounts and secure the most competitive rates for your specific model, ensuring you get the best value for your insurance investment.

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Frequently Asked Questions

Can I transfer my current auto insurance policy to cover a Hyundai Sonata Hybrid?

Yes, you can typically transfer your current auto insurance policy to cover a Hyundai Sonata Hybrid. However, it’s important to inform your insurance provider about the change in vehicle to ensure accurate coverage.

Depending on the specifics of your policy and the insurance company’s guidelines, there may be adjustments in premiums based on factors such as the value of the new vehicle, safety features, and any additional coverage requirements specific to hybrid vehicles.

Read More: How to Manage Your Auto Insurance Policy

What factors contribute to finding the best insurance for a Hyundai Sonata Hybrid?

Key factors include competitive rates, comprehensive coverage, discounts for hybrids, and the insurer’s reputation. Comparing quotes from top providers can help find the best option.

How do discounts for hybrid vehicles impact Hyundai Sonata Hybrid insurance rates?

Discounts for hybrid vehicles can lower insurance rates due to reduced emissions and advanced safety features. Insurers may offer savings specifically for hybrid models.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Are there any specific maintenance requirements for the Hyundai Sonata Hybrid to ensure insurance coverage?

While there are no specific maintenance requirements mandated by insurance companies for coverage on the Hyundai Sonata Hybrid, it’s generally recommended to follow the manufacturer’s recommended maintenance schedule.

Regular maintenance helps ensure the vehicle remains in good condition and reduces the risk of mechanical failures or malfunctions. In the event of an accident caused by neglected maintenance, an insurance claim could be affected. It’s always a good practice to properly maintain your vehicle to ensure safety and eligibility for insurance coverage.

Can I get specialized insurance coverage for my Hyundai Sonata Hybrid’s hybrid components?

Some insurance companies offer specialized coverage options for hybrid vehicles, including coverage for hybrid components. This coverage can help protect against potential damages or malfunctions specific to hybrid technology. It’s recommended to inquire with insurance providers about any available coverage options tailored for hybrid vehicles like the Hyundai Sonata Hybrid.

Does owning a Hyundai Sonata Hybrid affect my auto insurance premiums?

Owning a Hyundai Sonata Hybrid can potentially affect your auto insurance premiums. Hybrid vehicles are generally considered more environmentally friendly, which may make you eligible for certain insurance discounts. However, the specific impact on your premiums will depend on various factors, including your location, driving history, and the insurance provider’s policies.

How can drivers reduce their Hyundai Sonata Hybrid insurance premiums?

Drivers can lower premiums by using available discounts, maintaining a clean driving record, opting for higher deductibles, and bundling policies. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Does the Hyundai Sonata Hybrid qualify for any green or eco-friendly vehicle discounts?

Yes, the Hyundai Sonata Hybrid is considered a green or eco-friendly vehicle, and many insurance companies offer discounts for such vehicles. These discounts are usually aimed at promoting environmentally conscious driving and reducing carbon emissions.

When shopping for auto insurance, inquire with insurance providers about any available green vehicle discounts specifically tailored for hybrid or eco-friendly cars like the Sonata Hybrid.

Read More: Best Green Vehicle Auto Insurance Discounts

How does the choice of insurance company affect the cost of coverage for a Hyundai Sonata Hybrid?

Different insurers offer varying rates and coverage options. Companies like Geico, State Farm, and Progressive are known for competitive rates for hybrids.

How can drivers reduce their Hyundai Sonata Hybrid insurance premiums?

Drivers can reduce premiums by using available discounts, maintaining a clean driving record, and bundling insurance policies. Higher deductibles can also lower costs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.