Best Auto Insurance for Cancer Patients in 2025 (Top 10 Companies)

The best auto insurance for cancer patients starts as low as $32 per month. Top providers include State Farm, Allstate, and Erie. They offer flexible coverage like medical payments and PIP, along with safe driver, low-mileage, and multi-vehicle discounts to support patients during treatment and recovery.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Jul 3, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 3, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Patients

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Patients

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage for Patients

A.M. Best

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsState Farm, Allstate, and Erie offer the best auto insurance for cancer patients, with rates starting at just $32 per month.

Our Top 10 Company Picks: Best Auto Insurance for Cancer Patients

| Insurance Company | Rank | Bundling | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Infrequent Drivers | Allstate | |

| #2 | 25% | A+ | Filing Claims | Erie |

| #3 | 25% | A | Loyalty Discounts | American Family |

| #4 | 25% | A | Specialized Coverage | Liberty Mutual |

| #5 | 20% | A+ | Personalized Service | Nationwide | |

| #6 | 20% | A | Various Discounts | Farmers | |

| #7 | 17% | A++ | Financial Stability | State Farm | |

| #8 | 15% | A | Roadside Assistance | AAA |

| #9 | 13% | A++ | Flexible Policies | Travelers | |

| #10 | 10% | A+ | Extensive Network | Progressive |

These providers stand out for their affordable pricing, reliable service, and coverage options like medical payments and personal injury protection auto insurance.

Allstate ranks highest overall for combining strong discounts with personalized support. This guide explains how each company helps cancer patients stay covered during treatment and recovery.

- Provides MedPay and PIP options for cancer patients’ medical coverage needs

- Offers discounts and low-mileage plans for patients in treatment or recovery

- State Farm ranks as the top pick for affordability and personalized service

If you’re a cancer patient and shopping around for the best car insurance premiums, enter your ZIP code into our free quote comparison tool and compare your rates against the top insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Rates for Cancer Patients

Cancer patients have several strong auto insurance options with varying monthly rates for minimum and full coverage. Erie offers the lowest rates at $32 and $83, while Progressive, State Farm, and Travelers also provide affordable plans starting between $47–$56 for minimum and $123–$150 for full coverage.

Cancer Patient Auto Insurance Monthly Rates

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $52 | $122 |

| $72 | $228 | |

| $48 | $166 |

| $56 | $83 |

| $68 | $198 | |

| $79 | $248 |

| $58 | $164 | |

| $47 | $150 | |

| $61 | $123 | |

| $60 | $141 |

Mid-range options like American Family and Nationwide offer full coverage up to $166, while Farmers and Allstate are pricier, reaching $228. Liberty Mutual is the most expensive at $248, whereas AAA provides a balanced choice at $65 for minimum and $122 for full coverage.

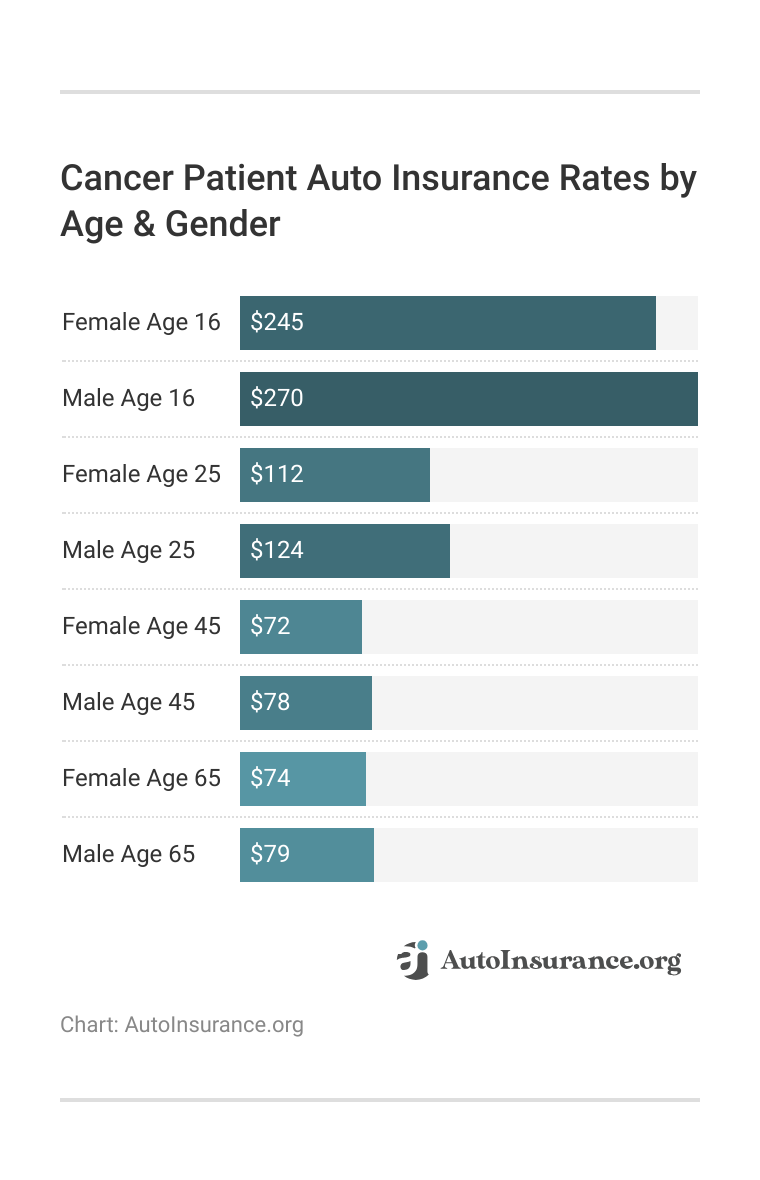

Auto insurance rates for cancer patients decrease with age and are slightly higher for males across all age groups. At 16, females pay about $245 per month, while males pay $270.

Rates drop with age, but men may pay more. For example, cancer patients can save by asking for low-mileage discounts during treatment.Jeff Root Licensed Insurance Agent

By age 25, the average auto insurance premium drops to $112 for females and $124 for males. At 45, premiums decrease further to $72 and $78, respectively, and stay steady at age 65, with females paying $74 and males $79.

Cancer Patient Auto Insurance Rates by Driving History

There is wide variation in auto insurance premiums for cancer patients according to driving record, with the increase in costs accelerating from a clean driving record to a DUI. Progressive has the cheapest monthly rate for those with a clean record at $47, followed by American Family at $48 and AAA at $52.

Cancer Patient Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $52 | $93 | $115 | $71 |

| $72 | $121 | $164 | $96 | |

| $48 | $79 | $106 | $63 |

| $56 | $72 | $91 | $68 |

| $68 | $112 | $138 | $85 | |

| $79 | $127 | $159 | $102 |

| $58 | $83 | $118 | $70 | |

| $47 | $95 | $124 | $66 | |

| $61 | $101 | $134 | $78 | |

| $60 | $89 | $125 | $74 |

Factors that affect auto insurance rates include driving history, and even a single ticket can raise premiums, though American Family and Erie stay relatively low at $63 and $68. Rates increase further after an accident, with Erie still affordable at $72 compared to $121 with Allstate and $127 with Liberty Mutual.

DUIs result in the highest premiums, with Liberty Mutual coming in at $159 and Allstate at $164. Meanwhile, American Family and Erie still offer low rates for a DUI accident history at $106 and $91, respectively, so they’re both great choices for cancer patients who don’t have a perfect driving record.

Auto Insurance Coverage for Cancer Patients

Cancer patients need auto insurance that can be tailored to their health and lifestyle. The right policy can give vital protection and peace of mind during treatment or recovery.

- Medical Payments Coverage (MedPay): This coverage pays medical expenses after an accident, regardless of fault, useful for cancer patients with high healthcare costs.

- Personal Injury Protection (PIP): PIP covers medical bills, lost wages, and essential services, ideal if cancer treatment affects your ability to work or manage daily tasks after an accident.

- Comprehensive Coverage: Comprehensive insurance covers theft, vandalism, and other non-collision damage—useful when your car is parked during treatment visits.

- Roadside Assistance: Cancer patients may face fatigue or side effects that make breakdowns more stressful. Roadside assistance provides quick help, reducing risks and treatment disruptions.

- Usage-Based or Low-Mileage Insurance: If you’re driving less due to treatment or recovery, usage-based insurance can lower your premiums, helpful for cancer patients with limited travel.

Auto insurance for cancer patients should address the challenges of treatment and recovery. The right coverage can help reduce stress, meet medical needs and even support mobility.

Whether you’re seeking peace of mind on the road or savings that align with a lower-mileage lifestyle, these types of auto insurance offer meaningful support during a difficult time.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Medical Conditions That Affect Auto Insurance

While having a medical condition like a pacemaker may not directly affect your auto insurance rates, it’s important to be transparent with your insurer, especially when considering options like medical payments coverage on auto insurance that can help cover accident-related healthcare costs.

Since insurers are most interested in driving-related risks, you need to disclose conditions that could impact your mental, cognitive, or physical faculties in order to prevent challenges over your coverage. Even if it may not seem like their business, failing to report such conditions could put your policy at risk.

Medical conditions to disclose include arthritis, diabetes, heart issues, epilepsy, dementia, stroke, vision problems, and sleep apnea. When in doubt, inform your insurer to keep your coverage valid and stay protected.

Cancer Patient Auto Insurance Discounts

Cancer patients can reduce auto insurance costs through various discounts offered by top insurers. Good driver and multi-vehicle discounts provide the highest savings—up to 40% with Nationwide and 25% with AAA, Allstate, and Liberty Mutual.

Top Auto Insurance Discounts for Cancer Patients

| Insurance Company | Anti- Theft | Bundling | Defensive Driving | Good Driver | Low Mileage |

|---|---|---|---|---|---|

| 8% | 15% | 14% | 30% | 10% |

| 10% | 25% | 10% | 25% | 30% | |

| 25% | 25% | 5% | 25% | 20% |

| 15% | 25% | 5% | 23% | 30% |

| 10% | 20% | 10% | 30% | 10% | |

| 35% | 25% | 10% | 20% | 30% |

| 5% | 20% | 10% | 40% | 20% | |

| 25% | 10% | 30% | 30% | 30% | |

| 15% | 17% | 15% | 25% | 30% | |

| 15% | 13% | 20% | 10% | 20% |

Safe driver discounts reach up to 20% with Farmers, Liberty Mutual, and State Farm. Anti-theft system savings go as high as 35% with Liberty Mutual, while defensive driving course discounts peak at 30% with Progressive.

These combined savings, featured among the best auto insurance discounts, help cancer patients maintain quality coverage while easing financial burdens.

10 Best Auto Insurance Companies for Cancer Patients

Below are the best auto insurance companies for cancer patients, according to our ranking of insurers based on affordability, reliability, and the ability to accommodate a cancer patient’s medical and lifestyle needs while they are undergoing treatment or in recovery.

These insurers offer MedPay, PIP, roadside assistance, and flexible billing options, along with discounts for safe driving and low mileage, to help cancer patients stay covered, manage treatment costs, and how to lower your auto insurance rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Top-Rated Financial Strength: State Farm relies on its A++ AM Best rating for its stability when you look for the best cancer insurance for patients who require already solid coverage.

- Consistent Rate Stability: Known for stable premiums, State Farm offers consistent cancer insurance rates, helping patients avoid sudden hikes seen with smaller insurers.

- Strong National Presence: Available in all 50 states, ensuring continuity of coverage for cancer patients who may travel for treatment or relocate during care. See our State Farm auto insurance review for more.

Cons

- Accident Surcharges: A single at-fault accident can raise rates by up to 40%, making cheap cancer insurance crucial for patients on fixed incomes.

- Slower Quote Process: Online quote turnaround can be slow, requiring agent contact, less convenient for cancer patients needing quick cancer insurance quotes.

#2 – Allstate: Best for Compassionate Service

Pros

- Strong Customer Satisfaction: Allstate has a J.D. Power customer satisfaction rating of 829/1,000, showing great service performance, which is appealing to cancer patients who need fast service.

- Accident Forgiveness Option: Allstate offers accident forgiveness, which prevents rate increases after your first accident, helpful for cancer patients who may be dealing with treatment-related distractions.

- Drivewise Program for Safer Driving: Allstate offers up to 40% off for safe driving, helping cancer patients who drive carefully save more. Read our Allstate auto insurance review for full details.

Cons

- Higher Monthly Premiums: Allstate’s full coverage averages $228/month, which may be steep for cancer patients with high medical costs.

- Limited Customization for Medical Needs: Allstate doesn’t offer specific policy options that address health-related driving limitations, a gap for cancer patients requiring flexibility.

#3 – Erie: Best for Affordable Rates

Pros

- Lowest Minimum Coverage Rate: Erie also provides minimum coverage starting at just $32/month, a great option for cancer patients who need affordable cars for cancer patients.

- Competitive Full Coverage: Offers full coverage for around $83 per month, putting it among the handful of companies with full coverage for less than $100. Learn more in our Erie auto insurance review.

- Reasonable DUI Premiums: Post-DUI coverage costs about $91/month, significantly lower than Liberty Mutual’s $159, offering a second chance to cancer patients with imperfect records.

Cons

- No 24/7 Claims Support: Erie’s claims department is not fully 24/7, which can be stressful for cancer patients who need round-the-clock peace of mind.

- Basic Roadside Assistance: Erie’s roadside coverage is limited and less comprehensive than competitors like Travelers, an important factor for patients experiencing treatment fatigue.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Extensive Network

Pros

- Nationwide Availability: Available in all 50 states, Progressive provides reliable coverage for cancer patients and is a popular option for cancer insurance providers.

- Large Repair Shop Network: Progressive provides cancer patients with fast and reliable service through more than 1,800 approved repair shops.

- Snapshot Program Savings: With usage-based insurance like Snapshot, cancer patients who drive less during treatment could save up to 30% on their policy. See our Progressive auto insurance review.

Cons

- Mixed Claims Satisfaction: J.D. Power scores Progressive slightly below average for claims satisfaction (861/1,000), which may concern cancer patients needing smooth service.

- Rate Increases After Claims: Cancer patients involved in even minor accidents may see premium hikes, especially without accident forgiveness.

#5 – Liberty Mutual: Best for Specialized Coverage

Pros

- High Anti-Theft Discount: Cancer patients can save up to 35% on premiums with Liberty Mutual’s anti-theft discount, useful if their vehicle is parked during extended treatment visits.

- Multiple Custom Coverage Add-Ons: Offers options like roadside assistance, rental reimbursement, and better car replacement, valuable for cancer patients needing flexibility during treatment.

- Strong Online & App Support Tools: Liberty Mutual’s digital tools let cancer patients manage policies and claims easily from home. Find additional info in our Liberty Mutual auto insurance review.

Cons

- Inconsistent Customer Service Ratings: Service quality can vary by region, which could affect cancer patients needing reliable support during health challenges.

- May Lack Personalized Human Support: While online tools are helpful, some cancer patients may prefer in-person assistance that Liberty Mutual doesn’t emphasize.

#6 – Travelers: Best for Flexible Policies

Pros

- Flexible Discount Programs: Offers up to 20% for defensive driving and 17% for safe driving, giving cancer patients multiple ways to reduce premiums. Read our Travelers auto insurance review for more.

- Strong Roadside Assistance Options: Travelers offers solid roadside assistance, which is particularly useful for cancer patients who may experience tiredness or a medical emergency.

- Affordable Starting Rates: Those with cancer can acquire minimum coverage for $53/month, and a maximum of $141/month, making options available for budgets at every range.

Cons

- Modest Multi-Vehicle Discount: At only 8%, the discount for insuring multiple cars is minimal, especially for families or caregivers supporting cancer patients with transportation.

- Lower Good Driver Discount: Only offers a 10% discount, significantly lower than Nationwide’s 40%, reducing savings potential for cancer patients with clean records.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Personalized Insurance

Pros

- Customizable Policy Options: Nationwide offers a variety of policy options, such as add-ons like medical payments coverage that’s important for cancer patients with regular medical bills.

- Up to 40% Good Driver Discount: Cancer patients can save up to 40% with Nationwide’s good driver offer, making it one of the top cancer patient discounts during treatment or recovery.

- Usage-Based Insurance Available: Cancer patients can save with Nationwide’s SmartRide® or SmartMiles® based on mileage. Check out our Nationwide auto insurance review for insights.

Cons

- Higher Rates for Younger Drivers: Premiums for younger cancer patients (e.g., age 25) can be higher than competitors, with average monthly rates around $124 for males.

- Fewer Online Tools Than Competitors: Nationwide’s digital tools are less advanced than Progressive or Geico, which may be less convenient for cancer patients juggling treatment schedules.

#8 – American Family: Best for Empathetic Approach

Pros

- Strong Discount Options: American Family offers up to 25% off for good drivers and 20% for multi-vehicle policies, helping cancer patients lower premiums during treatment-related financial strain.

- Supportive Claims Process: Customers report high claims satisfaction, key for cancer patients needing fast support or exploring free cars for cancer patients.

- Defensive Driving Discounts: Cancer patients can get a 5% discount by completing a defensive driving course, a simple way to save. Get a complete view in our American Family auto insurance review.

Cons

- Fewer High-Risk Options: Cancer patients with complicated health or driving histories may find coverage options more limited compared to broader insurers like Progressive.

- Modest Safe Driver Discount: Offers an 18% safe driver discount, slightly lower than competitors like Progressive, reducing long-term savings potential for low-risk cancer patients.

#9 – AAA: Best for Transparent Policies

Pros

- Competitive Discounts: Offers up to 30% good driver and 25% multi-vehicle discounts, helping ease costs for patients with medical expenses. Explore our AAA auto insurance review.

- Easy-to-Navigate Online Tools: Cancer patients can manage coverage via the AAA app (rated 4.5/5), easing stress during treatment, a benefit noted in cancer insurance reviews.

- Clear Coverage Details: With clear insurance policy terms, cancer patients know their coverage. It also received 827/1,000 on J.D. Power’s policy clarity satisfaction rating.

Cons

- Limited Availability by Region: AAA operates through regional clubs, and policy offerings vary. A cancer patient in one state may not have access to the same benefits as another.

- Membership Required: To access insurance, patients must also maintain a AAA membership, which can cost $50–$130/year, adding to ongoing expenses.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best for Comprehensive Coverage

Pros

- Broad Coverage Options: Farmers provides extensive coverage which is inclusive of PIP and medical payment coverages for cancer patients incurring recurring medical costs.

- Discounts for Defensive Driving: Cancer patients who take a defensive driving course qualify for a 10% discount which could add to the savings on car insurance. Explore our Farmers auto insurance review.

- High Safe Driver Discount: Farmers offers up to 20% off for safe drivers, making it a strong option for cancer patients with clean records looking to lower premiums.

Cons

- Fewer Multi-Vehicle Savings: Farmers offers 20% off for multi-vehicle policies, while AAA and Allstate offer 25%, giving more savings for households needing insurance for people with cancer.

- Availability Varies by Region: Certain Farmers features and discounts may not be available in all states, which could affect accessibility for some cancer patients.

Get the Best Auto Insurance for Cancer Patients

Cancer patients may obtain specialized auto insurance policies that focused on affordability, flexibility, and medical benefits. With plans starting at just $32 per month from trusted providers like State Farm, Allstate, and Erie, the best auto insurance for cancer patients helps ease financial stress during treatment.

Features such as personal injury protection, usage-based insurance pricing, and specialized discounts ensure coverage fits both health challenges and lifestyle changes.

Cancer patients can find affordable auto insurance, regardless of driving record, by entering their ZIP code into our free quote comparison tool.

Frequently Asked Questions

Do I need to tell car insurance about cancer diagnosis?

You don’t need to disclose your cancer diagnosis when applying for auto insurance. Providers focus on driving history and vehicle details. In most cases, a car insurance cancer diagnosis won’t affect your coverage unless it impacts your ability to drive safely.

Does having cancer affect car insurance?

Car insurance and a cancer diagnosis typically don’t directly affect each other, but factors like driving ability should be disclosed. A proper cancer insurance comparison can help find providers that accommodate medical needs.

Avoid expensive auto insurance premiums by entering your ZIP code to see the cheapest rates for cancer patients.

What insurance should I get if I have cancer and experience fatigue or treatment side effects?

For cancer patients facing fatigue or side effects, adding one of the best roadside assistance plans ensures quick help during breakdowns or emergencies, reducing disruptions to treatment and travel.

What is the best insurance for cancer patients who are currently undergoing treatment?

The best cancer insurance policy should have flexible plans, no hassle claims processing and optional features like Medical Payments Coverage (MedPay) or Personal Injury Protection (PIP). And companies such as Travelers and Farmers Insurance offer policies that can be tailored to the specific medical and scheduling requirements of cancer patients.

Is Farmers Insurance for cancer patients more affordable than other providers?

Farmers cancer insurance has minimum coverage rates as low as $76 per month or maximum coverage for $198 per month. Not the most affordable option, it offers tailor-made plans and quality service, and is an excellent option for who need flexible coverage for cancer survivors.

Which policy is best for cancer patients with high medical costs?

Policies that include Medical Payments Coverage (MedPay) or Personal Injury Protection (PIP) are best for cancer patients managing high medical bills. These cover expenses like hospital visits, rehabilitation, or lost wages after an accident—regardless of who’s at fault.

Can I adjust my coverage for car insurance during chemotherapy?

Absolutely. Many insurers will let you adjust your policy to meet your needs. During chemotherapy, if you’re not commuting or traveling as much, you may reduce optional coverages like collision or switch to a more affordable plan. Call your provider to inquire about flexible coverage options according to your treatment routine.

Do you have to tell your car insurance if you have cancer?

No, you are not required to disclose to your car insurance company that you have cancer. Auto insurers primarily assess your driving history, vehicle details, and location, not your medical diagnosis. However, if your cancer or treatment affects your driving and makes it unsafe to do so, staff say you should declare this so there are no problems with your cover or a claim.

Are there any Geico cancer insurance discounts or accommodations for cancer patients?

While Geico doesn’t offer cancer-specific discounts, cancer patients may still benefit from safe driver, multi-policy, and best low-mileage auto insurance discounts, especially through programs like DriveEasy for reduced driving during treatment.

How can cancer patients lower their Farmers car insurance quotes?

Cancer patients can reduce their Farmers car insurance costs by requesting a quote for cancer patients and using discounts like safe driver, anti-theft, and multi-vehicle. Farmers offers up to 30% off for good driving and 20% for safe drivers, ideal for those with low-risk habits during treatment.

Can you drive after chemo and radiation?

Yes, but it depends on how the treatment affects your physical and cognitive abilities. Some patients may experience fatigue, dizziness, or slowed reaction time, which can impact driving safety. Always consult your doctor before getting behind the wheel, especially after a recent treatment session.

What is the best method of protection against cancer-related financial stress with car insurance?

Choosing insurers that offer the best multi-vehicle auto insurance discounts, multi-policy savings, usage-based plans, and safe driving rewards can significantly reduce premiums. These savings make affordable cancer coverage possible, reducing the financial cost of much-needed care.

Can I use the Allstate cancer insurance claim form to file auto insurance claims related to cancer treatment?

No, the Allstate cancer insurance claim form is specifically designed for supplemental health claims related to cancer, not auto insurance. If you are a cancer patient seeking reimbursement for medically related driving needs, such as transportation to treatment or adapted vehicle equipment, those would fall under different policies or coverage types and require separate claim forms.

How long after chemotherapy can I drive?

The time to get back behind the wheel after chemo differs for person to person and by chemo type. Many patients can resume driving within a few days if they feel alert and physically capable. However, side effects such as fatigue, dizziness, or cognitive fog may last longer. Always consult your doctor before returning to the road to ensure you’re fit to drive safely and legally.

Are there specific car rental discounts for cancer patients?

While few rental companies offer cancer-specific discounts, some listed among the best companies for cheap rental car insurance may offer reduced rates through hospitals or medical partners. Patients should ask about hardship rates or check with their treatment centers.

What is the cancer secure policy, and can it help maintain auto insurance during a health crisis?

Yes, the cancer secure policy can be a good source of money in a health crisis. And it provides the money to patients in big chunk payments, not in small ones each time a bill comes in, so they can use the money for other things that need paying, such as rent, food, utility and automobile insurance.

Can I buy insurance if I have cancer and my license is suspended due to treatment side effects?

You may still be able to purchase or maintain insurance, but you cannot legally drive until your license is reinstated. Some insurers allow you to keep a non-owner or parked vehicle policy during suspension, which helps maintain continuous coverage and avoid future rate hikes.

Can you drive with terminal cancer and still get auto insurance?

Yes, cancer patients with a terminal diagnosis can still get auto insurance. Coverage isn’t denied unless the condition affects driving ability. Maintaining a valid license and clean record is key, and checking cancer insurance companies ratings can help find supportive, fair providers.

Is there insurance that covers cancer and can be bundled with auto insurance?

While cancer-specific health insurance and auto insurance are sold separately, some major insurers like Allstate and Nationwide allow you to bundle life, health, and auto policies for a discount. Bundling won’t make your auto policy cover cancer treatment, but it can provide cost savings and streamlined service.

What insurance pays out if you have cancer and your driving ability is affected?

If cancer or its treatment impairs your driving, auto insurance won’t pay directly unless you’re involved in an accident. However, disability or critical illness insurance may provide financial support to cover alternative transportation or vehicle modifications, such as hand controls, making it safer for you to drive or ride as a passenger.

Cancer patients can get the best auto insurance rates possible by entering their ZIP code into our free comparison tool today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.