Alabama Minimum Auto Insurance Requirements in 2025 (What AL Drivers Need)

Alabama minimum auto insurance requirements include 25/50/25 of bodily injury and property damage coverage, starting at $36/mo. Failure to meet Alabama car insurance laws could lead to fines or license suspension. We'll help you find cheap coverage that meets Alabama auto insurance requirements.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Nov 14, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 14, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

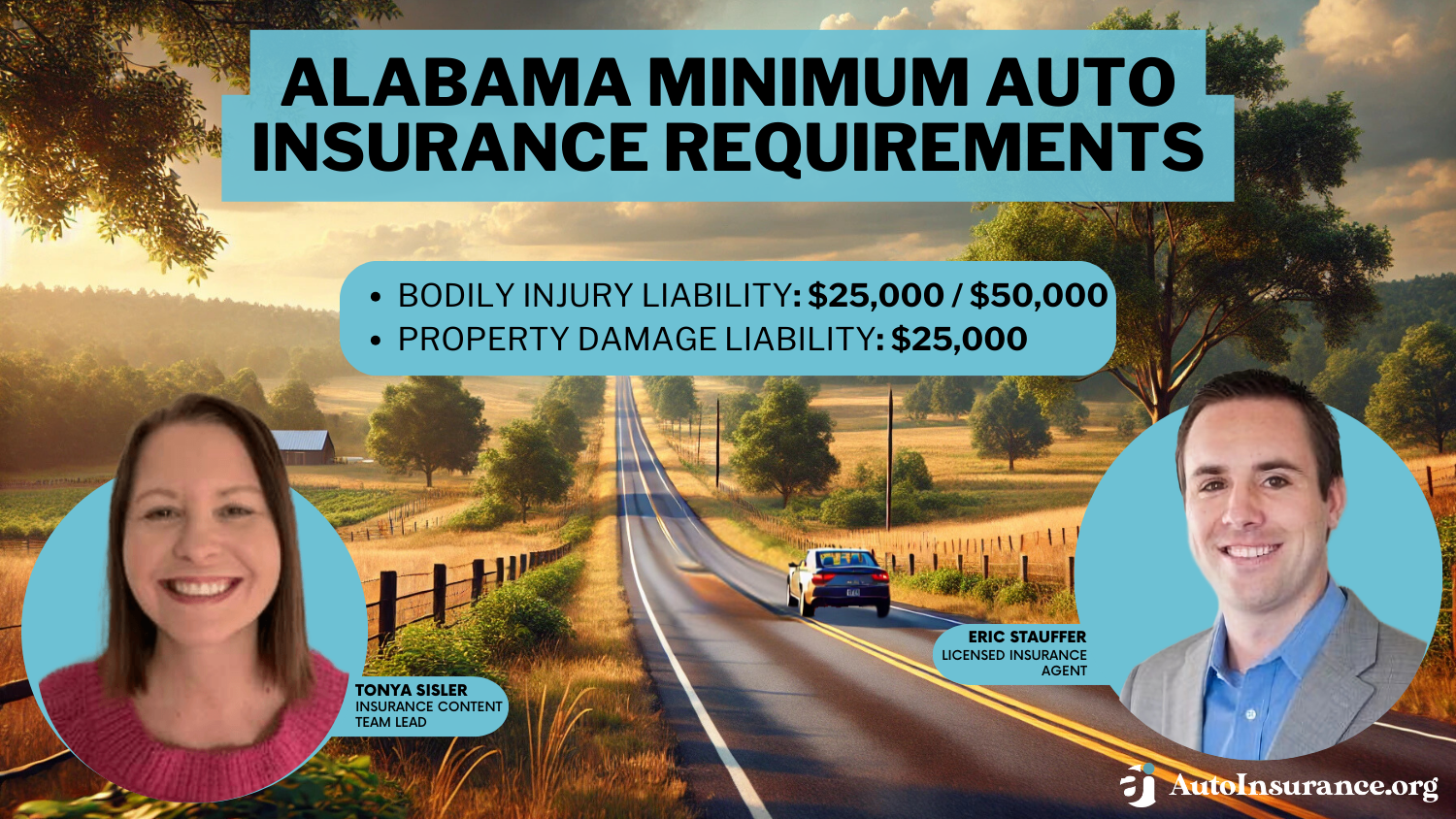

You must carry 25/50/25 in liability insurance coverage to meet Alabama minimum auto insurance requirements, and rates start at just $36 per month.

Alabamians who don’t carry insurance face fines of $1,000 or more and license suspension for up to one year. Unfortunately, 19.5% of AL drivers, nearly one in five, are uninsured (Learn More: Driving Without Insurance).

Alabama Minimum Auto Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

Get the best Alabama car insurance by comparing quotes and coverage options near you. Enter your ZIP code into our free rate tool above to get cheap AL minimum insurance coverage.

- Alabama law requires 25/50/25 in auto insurance coverage

- Checking your credit can help you get lower insurance rates

- You could lose your AL license for driving without insurance

Car Insurance Requirements for Alabama Drivers

Every driver in Alabama must meet insurance requirements to drive legally. The bodily injury minimums are $25,000 per person and $50,000 per accident. Drivers must also carry $25,000 in property damage insurance.

Liability insurance only covers the other drivers' expenses, so consider full coverage if you want your car and medical bills covered too.Michelle Robbins Licensed Insurance Agent

Bodily injury insurance is critical, as it pays the cost of medical bills for other drivers and passengers involved in an accident. Property damage covers the cost of damages to the car of someone else involved in the accident if you are the at-fault driver.

Minimum coverage may not be enough if you have a car lease or loan. Lenders often require full coverage insurance, as the vehicle technically belongs to them until it’s fully paid off. Your lender will also inform you of the required coverage when you buy the car.

If you don’t get the required insurance, your lender will notify you to obtain it immediately. If you still don’t comply, they’ll place their own insurance on the car, which would likely be more expensive and not offer total protection.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Cheap Minimum Coverage Car Insurance in AL

Most drivers will find the cheapest Alabama auto insurance from USAA, Travelers, and Geico, with rates as low as $20 per month. Check out our review of USAA to find low rates and reliable coverage for Alabama military families.

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in Alabama

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage in Alabama

A.M. Best

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Alabama

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsHowever, only military members and their families qualify for USAA. Compare free quotes in your area to find the most affordable Alabama insurance provider now.

Generally, since state requirements are so low, you won’t pay much for Alabama insurance requirements. Check out the table below to compare the cost of minimum coverage in AL by ZIP code:

As you can see, rates in Alabama start at $36 monthly for minimum coverage. You can also see how much you could pay for a policy in your AL city here:

Alabama Min. Coverage Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Alabaster | $75 |

| Anniston | $72 |

| Auburn | $68 |

| Bessemer | $80 |

| Birmingham | $85 |

| Daphne | $70 |

| Decatur | $73 |

| Dothan | $69 |

| Florence | $67 |

| Gadsden | $71 |

| Hoover | $76 |

| Huntsville | $74 |

| Madison | $77 |

| Mobile | $78 |

| Montgomery | $79 |

| Mountain Brook | $65 |

| Northport | $66 |

| Opelika | $64 |

| Phenix City | $63 |

| Prattville | $62 |

| Selma | $61 |

| Sylacauga | $60 |

| Talladega | $59 |

| Troy | $58 |

| Tuscaloosa | $57 |

However, you should still compare car insurance quotes in Alabama to find the cheapest and most reliable coverage near you.

Other Important Coverages AL Drivers Should Know About

You might not be required to purchase more insurance, but you should consider the additional insurance options you’re missing out on when you only buy the bare minimum.

Your liability insurance policy does not cover the following:

- Collision

- Comprehensive

- Uninsured Motorist Coverage

- Your Medical Bills

Collision insurance helps you pay for the cost of repairing your car if it’s damaged in an accident, in a storm, or in any other capacity. Comprehensive coverage protects you from situations outside the realm of your control, such as hurricanes, storms, earthquakes, and fire damage.

You could also consider medical/funeral coverage to cover medical and/or funeral expenses after a wreck, or uninsured motorist coverage to protect you from drivers with inadequate coverage.

If you are involved in an accident with someone who doesn’t carry insurance, you need a way to pay for your vehicle repairs and your medical expenses. This option is going to protect you when someone else is driving illegally.

Penalties for Driving Without Insurance in Alabama

If you don’t have insurance, you’re not making a personal decision. You’re breaking the law in Alabama, and you face serious consequences for driving without insurance.

If you’re caught driving without insurance in Alabama, you’ll face a $500 fine. For a second offense, the fine goes up to $1,000, and you’ll continue to be fined $1,000 each time you’re caught driving without insurance. You could also face license suspension of up to one year.

In addition, your car registration will be suspended, and you’ll need to pay fees and prove you have insurance if you’d like to reinstate either during the suspension period. The cost is $200 for the first reinstatement fee, and it goes up to $400 if you’re involved in the same situation a second time.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Finding Discount for Alabama Insurance Policies

If you are a driver who doesn’t have insurance in Alabama, it’s time to get insurance. If you’re worried it’s not affordable, you can go through the long list of discounts available for many drivers. These discounts include the following:

- Good Driver

- Bundling

- Multi-Car

- Good Student

- Safety Features

Read More: Auto Insurance Discounts

Getting More Affordable Coverage in Alabama

If you want the most affordable car insurance policy, you must have good credit. Your credit is imperative. Most car insurance companies look at your credit score to determine your risk factor as a driver.

Many agencies feel people with good credit are less risky drivers, and they offer lower rates to those who have better scores. Free reports are issued to all consumers by each of the major credit bureaus annually.

You may also find your insurance policy is less expensive if you are married, if you drive a car that’s considered safe, and if you have a good driving record.

Some companies offer much better rates for certain people, and you never know if you fall into that category until you ask around.

Another way to ensure you’re given more affordable insurance is to raise your deductible. When you choose a high car insurance deductible, you choose a much lower monthly premium. Just be sure you can afford to make the deductible payment if you’re involved in an accident.

It’s not helpful if you’re unable to make the payment and use your insurance should anything happen to you while driving.

Driving Without Alabama Insurance Is a Costly Decision

In Alabama, you must carry 25/50/25 in bodily injury and property damage liability insurance coverage to drive legally, or you face fines and/or license suspension.

In addition to the fees and fines you face if caught driving without insurance, there are additional costs associated with forgoing insurance. If you are involved in an accident and you’re the at-fault driver, you face many financial challenges.

Read More: Can you claim auto insurance if it’s your fault?

The other driver could sue you for damages that include the cost of their medical bills and even their property damage. Driving without insurance could cost you tens of thousands of dollars or more depending on the situation.

Picture this: someone crashes into you😨, and they don’t have auto insurance. Are you out of luck🍀? https://t.co/27f1xf131D says you’ll be OK if you have UMPD coverage. Find out more here👉: https://t.co/wrvoheYwU3 pic.twitter.com/lCAOQGIkMx

— AutoInsurance.org (@AutoInsurance) February 28, 2024

Alabama law requires you are purchase insurance. So, it’s wise to shop around to find the cheapest AL insurance policy in your area. Compare Alabama insurance quotes right here to find the most affordable option for the coverage you desire. Enter your ZIP code below to begin.

Frequently Asked Questions

What is the minimum auto insurance required in Alabama?

In Alabama, the minimum auto insurance requirements are as follows:

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $25,000 property damage liability per accident

Are the minimum coverage limits in Alabama sufficient?

While the minimum coverage limits fulfill Alabama’s legal requirements, they may not provide adequate protection in all situations.

It’s important to consider your individual circumstances, including your assets, the value of your vehicle, and your potential liability, when determining the appropriate level of coverage. Higher coverage limits are often recommended for more comprehensive protection.

Compare auto insurance quotes from the top Alabama providers to get the cheapest coverage.

Can I drive without insurance in Alabama?

No, Alabama auto insurance laws require you to carry insurance. You must carry the minimum auto insurance coverage to meet the state’s requirements. Driving without insurance can result in fines, suspension of your driver’s license, and other penalties.

Does Alabama require SR-22 insurance?

Yes, drivers in Alabama convicted of certain traffic offenses, such as driving without insurance or a DUI, must maintain SR-22 insurance coverage for three years.

Can you drive with a suspended license in Alabama?

No, you can’t legally drive with a suspended license in Alabama, unless you have a hardship driver’s license. If caught driving with a suspended license, you could face fines, a longer suspension, or jail time.

What is a hardship driver’s license in Alabama?

An Alabama hardship driver’s license allows certain individuals with suspended or revoked licenses to drive in certain situations, such as to and from work, school, or doctor’s appointments. Check out our guide titled, “Can you get auto insurance with a suspended license?” to find out more.

How much does it cost to unsuspend your license in Alabama?

According to the Alabama Department of Revenue, you must pay $200 to reinstate your driver’s license for the first suspension. The cost is $400 for second and subsequent suspensions.

What does bodily injury liability cover?

Bodily injury liability coverage helps protect you financially if you are at fault in an accident that causes injuries to other people. It covers their medical expenses, lost wages, and other related costs up to the limits of your policy.

What does property damage liability cover?

Property damage liability (PDL) insurance pays for the repair or replacement of someone else’s property, such as their vehicle or any other damaged property, if you are at fault in an accident. It helps protect you from financial responsibility for the costs associated with the property damage up to your policy limits.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.