Best Esurance Auto Insurance Discounts in 2025 (Save Up to 25% With These 10 Companies!)

The best Esurance auto insurance discounts are multi-policy discounts, safe driver discounts, and pay-per-mile discounts with up to 25% savings. Esurance also offers a defensive driving discount for seniors looking to sharpen their road skills and save. Read below to see if the company is right for you.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jun 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The best Esurance auto insurance discounts are multi-policy discounts, safe driver discounts, and pay-per-mile discounts with up to 25% savings.

When comparing insurance providers, like Allstate vs. Esurance or Esurance vs. Progressive auto insurance,consider available discounts. Auto insurance discounts are one of the best ways customers can save on their rates.

Our Top 10 Picks: Best Esurance Auto Insurance Discounts

| Discount | Rank | Savings Potential | Who Qualifies? |

|---|---|---|---|

| Multi-Policy Discount | #1 | 25% | Drivers who bundle auto with another policy |

| Safe Driver Discount | #2 | 20% | Drivers with no recent accidents or violations |

| Pay-Per-Mile Discount | #3 | 20% | Low-mileage drivers in a usage-based program |

| Good Student Discount | #4 | 15% | Full-time students under 25 with good grades |

| Switch & Save Discount | #5 | 15% | New customers switching without a coverage lapse |

| Homeowner Discount | #6 | 10% | Policyholders who own a home |

| Paid-in-Full Discount | #7 | 10% | Customers who pay the full premium upfront |

| Anti-Theft Device Discount | #8 | 10% | Vehicles with approved anti-theft devices |

| Multi-Car Discount | #9 | 10% | Households insuring two or more vehicles |

| Anti-Lock Brake Discount | #10 | 5% | Vehicles with anti-lock braking systems |

When evaluating an Esurance auto insurance review, some drivers ask “is Esurance Allstate?” since it exists under the parent company Allstate and offers similar discounts.

Esurance full coverage auto insurance offers a quick, painless sign-up process and the ability to earn significant savings by switching. Read on to evaluate the Esurance discounts list to determine if the company is right for you or if you qualify for additional savings on an existing Esurance auto insurance policy.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code above.

- You could save up to 25% with the Esurance multi-policy discount

- Other discounts include multiple line, good student, and defensive driving discounts

- Drivers with a clean driving record will find the best Esurance insurance rates

How to Qualify for Esurance Auto Insurance Discounts

Qualifying for Esurance auto insurance discounts can be simple if you know what to look for and how to meet the eligibility requirements.

In this section, we’ll break down the different discounts Esurance offers and guide you through the steps to ensure you qualify. From safe driving habits to bundling policies, we’ll explain how you can maximize your savings on auto insurance with Esurance.

Bundling Auto and Home Insurance Policies

Bundling your auto and home insurance policies is one of the most effective ways to qualify for substantial discounts with Esurance. By combining these two essential types of coverage under one provider, you can simplify your insurance management while also enjoying significant cost savings.

Esurance offers a 25% multi-policy discount for bundling auto and home insurance, making it an affordable option for drivers.

This discount rewards customers for loyalty and encourages them to consolidate their insurance needs. Not only does bundling result in lower premiums, but it also streamlines the process of managing your policies.

Not only does bundling result in lower premiums, but it also streamlines the process of managing your policiesScott W. Johnson Licensed Insurance Agent

With everything under one roof, you’ll have a single point of contact for your insurance needs, which can be particularly convenient when it comes time to renew or change your coverage.

Choose Esurance for your auto and home insurance policies to qualify for this discount. The discount automatically applies when you bundle, so you won’t need to worry about additional paperwork or applications.

If you don’t know how the rate will change when you bundle your insurance, here’s what an auto insurance specialist says about bundling rates.

Maintaining a Clean Driving Record

Maintaining a clean driving record is one of the most effective ways to qualify for auto insurance discounts with Esurance. A clean driving record typically means you have no recent at-fault accidents, traffic violations, or claims on your insurance. Insurance companies, including Esurance, view drivers with clean records as lower risk, which makes them eligible for better rates and discounts.

Esurance rewards safe drivers through its safe driver discount program. If you have maintained a clean driving record for several years, you could see a significant reduction in your premiums. This discount encourages responsible driving habits by offering financial incentives to those who avoid accidents and violations.

To maximize your savings through this discount, it’s important to always practice safe driving. This means adhering to speed limits, avoiding distractions while driving, and being cautious in adverse weather conditions. Additionally, staying informed about traffic laws and regulations can help you avoid unintentional violations that could tarnish your record.

Beyond the immediate financial benefits, maintaining a clean driving record can also lead to long-term savings. Drivers with consistent, safe driving records are often eligible for other discounts and perks, such as accident forgiveness or even lower deductibles.

Esurance vs. Top Competitors: Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $90 | $147 | $170 | $121 | |

| $76 | $109 | $105 | $95 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $56 | $98 | $75 | $74 | |

| $38 | $59 | $67 | $48 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 | |

| $32 | $42 | $58 | $36 |

Driving Less and Opting for the Pay-Per-Mile Plan

Driving less can significantly reduce auto insurance costs, especially when opting for Esurance’s pay-per-mile plan. This plan is specifically designed for drivers who don’t log many miles on their vehicles each month.

Instead of paying a standard premium based on average driving habits, the pay-per-mile plan allows you to pay a lower base rate and a small fee for each mile you drive. This means that the less you drive, the more you save.

The pay-per-mile plan is an excellent option for individuals who work from home, use public transportation frequently, or don’t drive often. By aligning your insurance costs more closely with your driving habits, this plan ensures you’re not overpaying for coverage you don’t fully use.

To qualify for the pay-per-mile plan, you must install a device in your vehicle that tracks your mileage. This device helps Esurance accurately calculate your monthly premium based on the number of miles you drive. Your driving data is securely transmitted to Esurance to ensure accurate rates.

In addition to the financial benefits, driving less also positively impacts the environment and your vehicle’s longevity. Fewer miles mean less wear and tear on your car, potentially reducing maintenance costs and increasing the vehicle’s lifespan.

You can read this article on the best pay-as-you-go auto insurance companies for more options on companies that offer pay-per-mile.

Insuring More Than One Car

Insuring more than one car with Esurance is another effective way to qualify for auto insurance discounts. This multi-car discount is designed for households that own and insure multiple vehicles under the same policy.

The multi-car discount offers a reduced rate for each additional vehicle you insure. Instead of managing separate policies for each car, you’ll have the convenience of a single policy that covers all your vehicles, simplifying your insurance management. This reduces paperwork and billing complexities and ensures that all your vehicles are protected under one comprehensive plan.

To qualify for this discount, you must insure two or more vehicles under the same Esurance policy.

The cars can belong to different family members living in the same household, such as spouses or children, making this discount particularly beneficial for families. The more cars you add to your policy, the greater the potential savings.

In addition to the financial benefits, insuring multiple vehicles under one policy can also provide better overall coverage options. Esurance allows you to customize your policy to meet the needs of each car, ensuring that each one has the appropriate level of protection. This can include liability coverage, collision, and comprehensive auto insurance coverage tailored to each car’s specific use and value.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Esurance Auto Insurance Discounts

When it comes to saving on auto insurance, Esurance offers several valuable discounts that can significantly reduce your premiums. Among the most notable are the multi-policy discount, safe driver discount, and pay-per-mile discount. Each of these discounts caters to different driving habits and insurance needs, making it easier for many customers to find savings that suit their lifestyle.

The multi-policy discount is one of the most generous discounts Esurance offers, allowing you to save up to 25% on your premiums. This discount is available when you bundle your auto insurance with another policy, such as home or renters insurance.

The safe driver discount can save up to 20% for those with a clean driving record. This discount rewards drivers with a good driving history and no recent at-fault accidents or traffic violations. Demonstrating responsible driving habits shows Esurance that you’re a lower risk, which translates into lower premiums.

The pay-per-mile discount is perfect for low-mileage drivers who don’t spend much time on the road. This discount allows you to pay a lower base rate for your insurance and a small fee for each mile you drive. With potential savings of up to 20%, this plan ensures that you only pay for the coverage you need based on your driving habits.

Each discount offers unique benefits tailored to different customer needs, making it easy to find the right savings opportunities with Esurance. Whether bundling policies, maintaining a clean driving record, or driving less, Esurance has a discount that can help you lower your insurance costs while still providing the coverage you need.

If you’re unsure which discount you qualify for, here’s an article on which auto insurance discounts to ask for.

Esurance Auto Insurance Policy Discounts

There are numerous Esurance car insurance discounts available for drivers based on their policies. For example, some policyholders could save if they purchase more than one policy from Esurance or insure more than one vehicle.

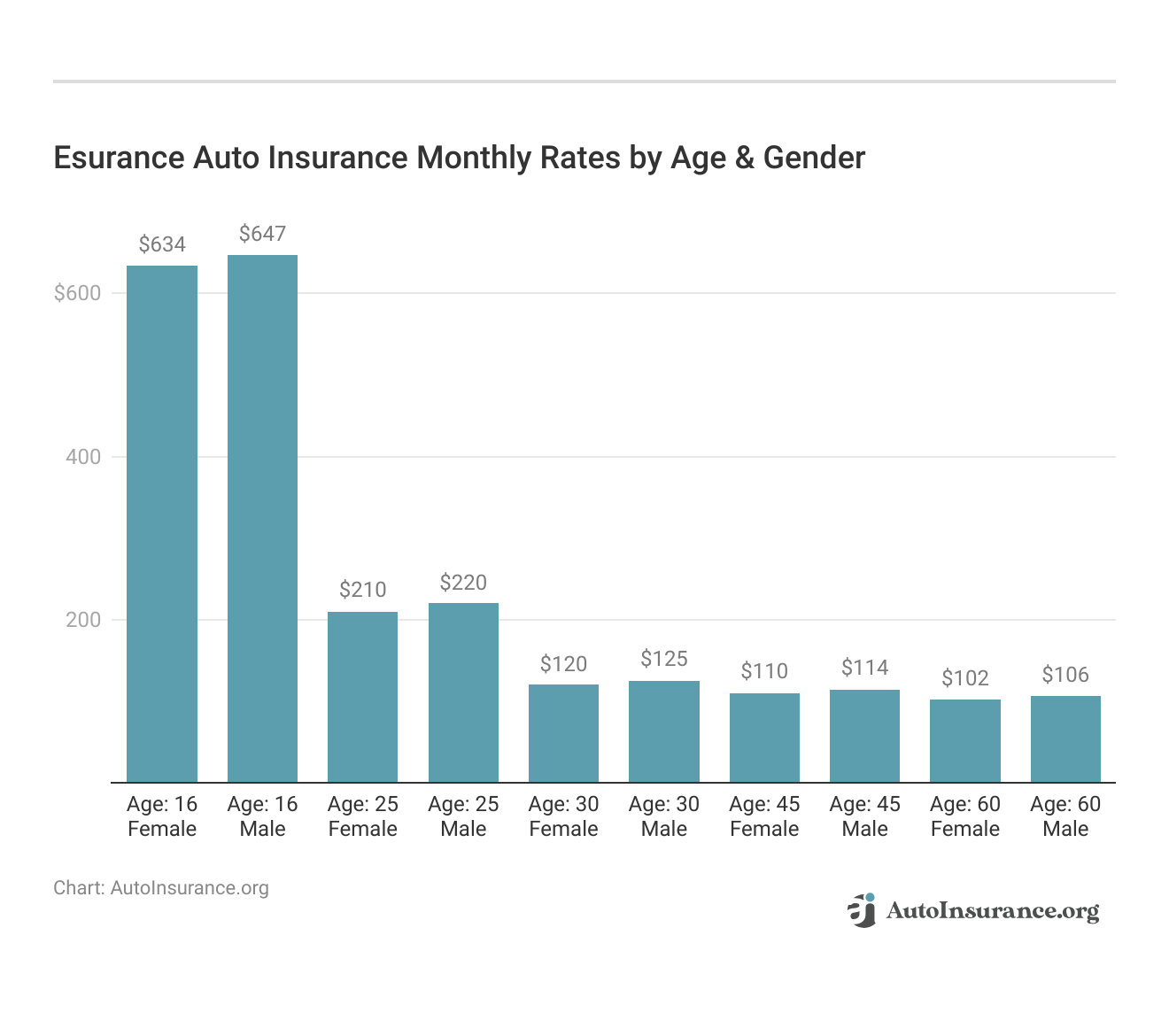

Esurance Auto Insurance Monthly Rates After Discounts

| Discount | Rank | Savings Potential | New Rate |

|---|---|---|---|

| Multi-Policy | #1 | 25% | $68 |

| Safe Driver | #2 | 20% | $72 |

| Pay-Per-Mile | #3 | 20% | $72 |

| Good Student | #4 | 15% | $77 |

| Switch & Save | #5 | 15% | $77 |

| Homeowner | #6 | 10% | $81 |

| Paid-in-Full | #7 | 10% | $81 |

| Anti-Theft Device | #8 | 10% | $81 |

| Multi-Car | #9 | 10% | $81 |

| Anti-Lock Brake | #10 | 5% | $86 |

Below is a list of policy discounts offered by Esurance.

Top Esurance Auto Insurance Discounts by Policy & Payments

| Discount | Description |

|---|---|

| Fast Five Discount | Save 5% on your first-term premium when you buy your policy online, rewarding digital purchases. |

| Full Payment Discount | Earn a discount by paying your entire policy premium upfront instead of in monthly payments, reducing administrative costs. |

| Multi-Car Discount | Insure multiple vehicles with Esurance to get a discount on the premium for each car, encouraging policy consolidation. |

| Bundling Discount | Combine auto insurance with home or renters insurance under Esurance to receive a discount, benefiting from multiple policies. |

| Switch & Save Discount | Save money when you switch to Esurance from another insurance provider, rewarding your choice to change insurers. |

| Renewal Discount | Receive a discount for renewing your Esurance policy, rewarding customer loyalty. |

| AutoPay Discount | Get a discount by setting up automatic payments for your premiums, ensuring timely payments and reducing the risk of late fees. |

| Paperless Discount | Save on your premium by opting for paperless billing and communication, supporting environmentally-friendly practices. |

Esurance claims drivers save an average of $462 on their car insurance premiums, making it an affordable car insurance policy for most drivers. Most discounts won’t apply if you only purchase temporary Esurance rental car coverage since they’re primarily for owned vehicles. Read on to learn more about how to lower car insurance rates with Esurance discounts.

Furthermore, Esurance Auto Insurance offers a range of benefits and discounts that appeal to a wide variety of customers. When considering an Esurance policy, it’s important to look at the Esurance prices and Esurance rates to find a plan that fits your budget while still providing comprehensive coverage.

One way to save even more is by using an Esurance promo code, which can reduce the overall cost of your insurance.

Many customers appreciate these savings and have shared their experiences in positive Esurance review sections online.

In addition to affordability, the quality and reliability of the service are crucial. People often ask whether Esurance is good when comparing it to other insurance providers. Esurance is backed by a reputable Esurance parent company, which adds trustworthiness to its offerings.

Check out customer reviews and rates in our Esurance car insurance review to see if you can save.

The benefits provided by Esurance extend beyond basic auto insurance, as they also include specialized services, such as working with an Esurance-approved body shop for a Land Rover. This combination of affordability, customer satisfaction, and tailored services makes Esurance a strong option for auto insurance.

Esurance Auto Insurance Driver Discounts

You could also save on your Esurance auto insurance policy based on your driving. While Esurance doesn’t have car insurance discounts for teachers or other occupations, there are numerous general discounts. Esurance’s discounts based on driving are listed below:

Top Esurance Auto Insurance Discounts Based on the Driver

| Discount | Description |

|---|---|

| Claim-Free Discounts | Rewards drivers who haven’t filed any insurance claims for a certain period with lower premium costs. |

| Defensive Driver Discounts | Offers a discount to drivers who complete an approved defensive driving course, promoting safer driving habits. |

| DriveSense Discounts | A program where drivers can earn discounts on their insurance by demonstrating safe driving through a monitoring app. |

| Good Student Discounts | Provides a discount to full-time students maintaining a "B" average or higher, recognizing responsible behavior both in school and on the road. |

| Young Driver Discount | Offers savings for young drivers who are typically seen as higher risk, by meeting certain criteria such as completing driver education courses. |

| Safe Driver Discount | Provides a discount for maintaining a clean driving record with no traffic violations or accidents over a specified period. |

| Homeowner Discount | Homeowners may receive a discount on their auto insurance as they are statistically seen as more responsible and stable drivers. |

| Military Discount | Offers savings to active-duty military members and veterans in recognition of their service. |

The DriveSense Esurance discount is one of the best ways to save on your auto insurance policy with Esurance since you earn immediate savings and a customized discount based on how safely you drive. These discounts allow policyholders to get add-ons like Esurance roadside assistance coverage.

Furthermore, Esurance auto insurance driver discounts provide a range of savings opportunities for policyholders. One key benefit is the Esurance defensive driving discount, which offers reduced rates to drivers who complete an approved defensive driving course.

Additionally, Esurance student discount rewards young drivers who maintain good grades, making insurance more affordable for students. Tech-savvy drivers can also take advantage of the dash cam insurance discount with Esurance, which offers savings for those who install a dashboard camera in their vehicle, encouraging safer driving.

Moreover, Esurance provides various incentives through its online training programs. Policyholders can use E-Insurance training coupons, coupons for Esurance training, and promotional offers for Esurance training to lower their premiums or receive other benefits.

Policyholders can use E-Insurance training coupons, coupons for Esurance training, and promotional offers to lower their premiums.Schimri Yoyo Licensed Agent & Financial Advisor

Completing these training sessions can also earn rewards for completing Esurance training, making it a worthwhile investment in both safety and savings. Also, customers may find a coupon code for Esurance to apply at checkout for further discounts. For military personnel, the Esurance military discount offers additional savings, acknowledging their service.

These discounts and promotional offers make Esurance an attractive option for those looking to reduce their insurance costs while receiving comprehensive coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Esurance Auto Insurance Vehicle Discounts

Owners of expensive or high-risk vehicles will have higher auto insurance rates than dependable, lower-cost car owners. However, depending on your vehicle type, Esurance will make deductions based on your vehicle’s safety features and ratings, listed below.

Top Esurance Auto Insurance Discounts Based on the Vehicle

| Discount | Description |

|---|---|

| Anti-Theft Device Discount | Receive a discount for having an approved anti-theft device installed in your vehicle, reducing the risk of theft. |

| New Car Discount | Save money if your car is less than three years old, as newer vehicles are often considered safer and more reliable. |

| Safety Feature Discount | Get a discount for vehicles equipped with advanced safety features, such as airbags, electronic stability control, and lane departure warnings. |

| Anti-Lock Brakes Discount | Enjoy savings for vehicles with anti-lock braking systems (ABS), which help prevent skidding during emergency stops. |

| Hybrid/Electric Vehicle Discount | Owners of hybrid or electric vehicles can receive a discount, acknowledging the lower environmental impact and potentially safer driving habits. |

| Daytime Running Lights Discount | Save on your premium if your vehicle is equipped with daytime running lights, which enhance visibility and safety during daylight hours. |

| Vehicle Recovery System Discount | Receive a discount if your vehicle is equipped with a recovery system like LoJack or OnStar, which aids in the quick recovery of stolen vehicles. |

| Garaging Discount | Get a discount if your vehicle is kept in a secure garage, reducing its exposure to theft, vandalism, and environmental damage. |

Insurers such as Esurance usually consider any feature discouraging theft and encouraging safe driving for discounts. Generally, your Esurance quote considers your car’s make and model. If you have an expensive vehicle or one with few safety features, it may cost more to insure.

Furthermore, when comparing insurance options, many people weigh AAA vs. Esurance to determine which provider offers the best value and coverage. Esurance auto insurance stands out for its competitive pricing and customizable plans.

To get a clear idea of what Esurance offers, you can start by getting an auto insurance quote from Esurance. This quote will help you understand your potential premiums and coverage options.

To get a clear idea of what Esurance offers, you should get an auto insurance quote. This will help you understand your options.Daniel Walker Licensed Auto Insurance Agent

One of the key features of Esurance car insurance is its DriveSense by Esurance program. This initiative uses a telematics device to track driving habits and reward safe driving with discounts on your insurance. For residents in specific areas, such as Esurance in New Jersey, this can be particularly beneficial as it provides tailored options and savings based on local driving conditions.

In addition to auto insurance, Esurance also provides other types of auto insurance coverage. For instance, if you need protection for your belongings, you can request an Esurance renters insurance quote. This allows you to explore affordable coverage options for your rental property.

With its range of discounts and comprehensive insurance solutions, Esurance is a strong choice for managing both auto and renters insurance needs.

How to Lower Auto Insurance Rates With Esurance Discounts

Esurance insurance company doesn’t offer as many discounts as the best auto insurance companies since it’s already designed to be cheaper than its competitors to get full coverage with Esurance. So, check out the Esurance discounts list and compare quotes from various insurers to decide if the company works for you.

How much difference can car insurance discounts 💰make in your premiums? How do you get the discounts you deserve? https://t.co/27f1xf1ARb has written a guide 📰to make it easy. For all things discount, check out👉: https://t.co/JEnTbtVTG3 pic.twitter.com/7jqUU0ejiP

— AutoInsurance.org (@AutoInsurance) August 10, 2023

Additionally, to lower your auto insurance rates effectively, it’s essential to explore the various discounts available. Comparing Allstate vs. Esurance can reveal how Esurance may offer more attractive discounts. For example, Esurance services in Colorado and Esurance services in Florida provide localized discounts that can help reduce your premiums based on regional factors.

Obtaining a free quote from Esurance is a key step in understanding how much you could save with their discounts. Esurance offers a variety of coverage options, including comprehensive coverage offered by Esurance, which might come with additional savings if you bundle multiple policies.

Additionally, if you need specific coverage like Esurance rental insurance, checking for available discounts can further lower your overall insurance costs.

Unlocking the Best Esurance Discounts: A Summary for Smart Savers

Esurance offers a range of discounts that can help significantly reduce your auto insurance rates, making it a strong contender among insurance providers. When comparing Liberty Mutual vs. Esurance, it’s important to consider how each company’s discounts fit your specific needs.

Esurance provides valuable options like gap insurance offered by Esurance and other specialized coverage. To get a clearer picture of potential savings, use the our online quote tool to see what discounts might apply to you.

Esurance also accommodates various needs with its diverse policy options. If you’re interested in Esurance renters insurance or Esurance temporary auto insurance, these policies come with their own set of discounts and benefits.

For residents in places like Esurance in North Carolina, localized discounts can make a big difference.

Make sure to use the Esurance login to manage your policy and check for any applicable discounts or updates.

Overall, evaluating Esurance’s discounts and coverage options, including those for Esurance rental insurance, can help you find affordable and comprehensive insurance solutions. By comparing these offers with other providers and understanding the full range of available discounts, you can make a well-informed decision and ensure you get the best value for your insurance.

If Esurance isn’t right for you, one of the best ways to find a cheap company is to learn how to lower your auto insurance rates and to compare rates between companies. Enter your ZIP code into our free quote comparison tool below to find the best auto insurance rates from companies in your area.

Frequently Asked Questions

What discounts does Esurance offer for auto insurance?

Esurance offers various discounts to help customers save on their auto insurance premiums. Some common Esurance discounts include:

- Multi-Policy: Save when you bundle your Esurance auto insurance with other policies, such as home or renters insurance.

- Safe Driver: Receive a discount for maintaining a clean driving record with no accidents or violations.

- Defensive Driving: Complete an approved defensive driving course and qualify for a discount.

- Good Student: Get rewarded with a discount if you maintain good grades in high school or college.

- Anti-Theft: If your car has an anti-theft system installed, you may be eligible for additional savings.

In addition to these discounts, Esurance also offers benefits for customers who pay their premium in full rather than monthly installments. Insuring multiple vehicles with Esurance can also lead to savings. Finally, if you switch to Esurance from another provider, you may be able to take advantage of a “switch & save” discount.

How can I determine which discounts I qualify for with Esurance?

When getting a quote or purchasing a policy with Esurance, the company will ask you various questions to determine your eligibility for discounts. They’ll consider factors such as your driving history, vehicle features, and personal information to identify any applicable Esurance discounts.

You can also contact Esurance directly to inquire about specific discounts and their eligibility requirements.

Can I combine multiple discounts to save even more on my Esurance auto insurance?

Yes, in many cases, you can combine multiple discounts to maximize your savings on Esurance auto insurance. However, keep in mind that the availability and specific rules for combining discounts may vary.

Speak with an Esurance representative or review the terms and conditions to understand the options for combining discounts.

Can I get discounts on my Esurance auto insurance if I have multiple vehicles?

Yes, Esurance offers a multi-car discount for insuring multiple vehicles on the same policy. By insuring multiple cars with Esurance, you can enjoy additional savings on your premiums. This discount can be beneficial for households with multiple drivers and vehicles. Learn more on how to get a multi-vehicle auto insurance discount.

Do Esurance auto insurance discounts vary by state?

Yes, Esurance auto insurance discounts can vary by state. Each state has its own regulations and guidelines regarding insurance discounts, and Esurance tailors its offerings to comply with these requirements.

Some discounts may not be available in certain states or may have different eligibility criteria. When obtaining a quote or purchasing a policy, you can ask for an Esurance discounts list for your specific state.

How can I apply for Esurance auto insurance discounts?

When you get a quote or purchase a policy with Esurance, they’ll automatically assess your eligibility for applicable discounts based on the information you provide. If you qualify for any discounts, they get applied to your premium.

You can also contact Esurance directly to inquire about discounts, update your policy to ensure you are receiving all eligible discounts, or learn how to lower your Esurance car insurance.

Are there any loyalty or renewal discounts available with Esurance auto insurance?

Esurance car insurance may offer loyalty or renewal discounts to reward customers who continue to renew their policies with them. These discounts are designed to encourage customer loyalty and may provide a reduction in premiums or other benefits. It’s recommended to inquire with Esurance about any loyalty or renewal discounts that may be available to you.

Does Esurance offer gap insurance?

Yes, Esurance provides gap insurance, which is designed to cover the difference between the amount you owe on your auto loan and the actual cash value of your vehicle if it is totaled in an accident. This can be particularly useful if you owe more on your car loan than the car’s market value.

Does Esurance cover rental cars?

Yes, Esurance provides coverage for rental cars through its esurance rental insurance. This type of coverage is designed to protect you if you’re involved in an accident or your rental car is damaged while you’re driving it. It’s important to check the specific details and limits of this coverage with Esurance to ensure it fits your needs, as coverage details can vary.

Does Esurance offer homeowners insurance?

Yes, Esurance offers homeowners insurance policies that provide protection for your home and personal property against various risks such as fire, theft, and natural disasters. This coverage includes liability protection and can be customized based on your needs. You can obtain a quote and explore policy options directly on Esurance’s website or by contacting their customer service.

Does Esurance provide renters insurance?

Yes, Esurance offers renters insurance to protect tenants’ personal belongings and provide liability coverage. This policy helps cover losses due to events like fire, theft, or vandalism and includes protection against personal liability claims. You can get a quote and more information about the coverage through Esurance’s online platform.

How do Esurance and State Farm compare in terms of coverage options and customer service?

How do Esurance and State Farm compare in terms of coverage options and customer service? Esurance offers a range of coverage options with a focus on digital tools and online management. State Farm, with its extensive network of agents, provides more personalized customer service and local support. While Esurance emphasizes convenience and technology, State Farm offers a traditional approach with face-to-face interactions and potentially broader coverage options. Read more about State Farm on our review of State Farm.

Why is Esurance so cheap?

Esurance is known for offering competitive rates primarily due to its digital-first business model. By leveraging technology and online tools, Esurance minimizes overhead costs associated with traditional insurance agents and physical offices. Additionally, Esurance provides a range of discounts and cost-saving features, contributing to its affordability.

How do you upload a defensive driving certificate to Esurance?

To upload a defensive driving certificate to Esurance, first, log in to your account on the Esurance login page. Once logged in, navigate to the section where you can manage documents or policy details. Follow the instructions to upload your certificate. This step is crucial for applying any associated discounts to your policy.

What are the main differences between Esurance and The General regarding auto insurance rates and coverage?

Esurance generally provides competitive rates with various discounts for safe driving and bundling policies. The General is known for offering coverage to high-risk drivers (Learn more: The General Auto Insurance Review), which might result in higher premiums but provides flexibility for those with less-than-perfect driving records. Esurance often focuses on technology-driven solutions, while The General caters to a niche market of drivers needing more specialized coverage.

How do Esurance and Travelers compare in terms of their claims process and available discounts?

Esurance is known for its user-friendly online claims process, allowing policyholders to easily file and track claims digitally. Travelers also offers a robust claims process but may provide additional support through agents and representatives. Both companies offer a variety of discounts, but Esurance tends to emphasize digital and usage-based discounts, while Travelers might offer more traditional options.

Which company, Esurance or Geico, generally offers better rates for auto insurance?

Both Esurance and Geico are known for their competitive pricing. Geico is often recognized for its low rates due to its extensive discount offerings and large customer base. Esurance also provides competitive rates and unique discounts, such as those for safe driving through its DriveSense program. The best option can depend on your specific driving profile and the discounts you qualify for.

What are the differences between Esurance and MetLife in terms of coverage and customer satisfaction?

Esurance offers a digital-first approach with a focus on affordability and ease of use. In contrast, MetLife provides a more traditional insurance experience with a wide range of coverage options and high customer satisfaction ratings, particularly in personalized service and claims handling. MetLife may offer more comprehensive coverage options but at a potentially higher cost compared to Esurance’s tech-driven savings.

How do Esurance and Progressive compare regarding pricing and policy options?

Both Esurance and Progressive offer competitive pricing and a range of policy options. Progressive is known for its innovative tools, such as the Name Your Price tool and Snapshot program, which can help customize and lower premiums based on driving habits. Our complete Progressive review goes over this in more detail. Esurance offers discounts through its DriveSense program and other digital tools, making both companies strong contenders in terms of pricing and policy flexibility.

What are the main distinctions between Esurance and Allstate in terms of coverage and customer service?

Esurance, a subsidiary of Allstate, focuses on digital efficiency and cost savings with a strong emphasis on online tools and discounts. Allstate, on the other hand, provides a more traditional insurance experience with extensive local agent support and personalized service. Read more about this provider in our (Allstate auto insurance review). While both companies offer similar coverage options, the key difference lies in Esurance’s tech-driven approach versus Allstate’s more hands-on service model.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.