Best Windshield Replacement Coverage in Missouri (Top 10 Companies Ranked for 2025)

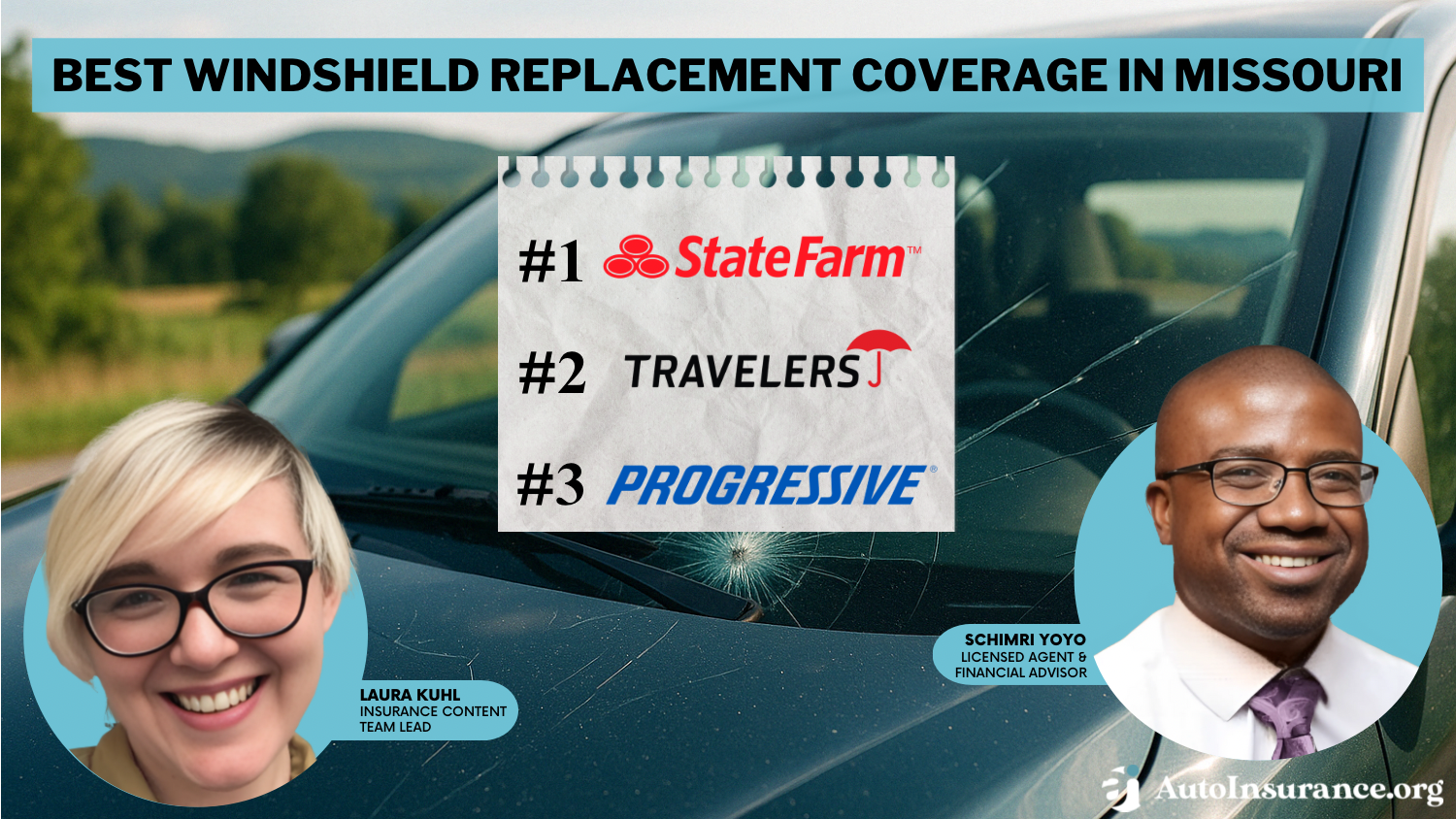

State Farm, Travelers, and Progressive provide the best windshield replacement coverage in Missouri, with rates beginning at just $110 per month. Our goal is to assist you in comparing quotes from these insurers, guaranteeing that you obtain the best coverage and personalized discounts for your vehicle.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Apr 18, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 18, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage Windshield Replacement in Missouri

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage Windshield Replacement in Missouri

A.M. Best

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage Windshield Replacement in Missouri

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews- State Farm offers affordable rates starting from $130 per month

- Top insurance providers present options for windshield replacements

- There are plentiful opportunities for saving on windshield replacement coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

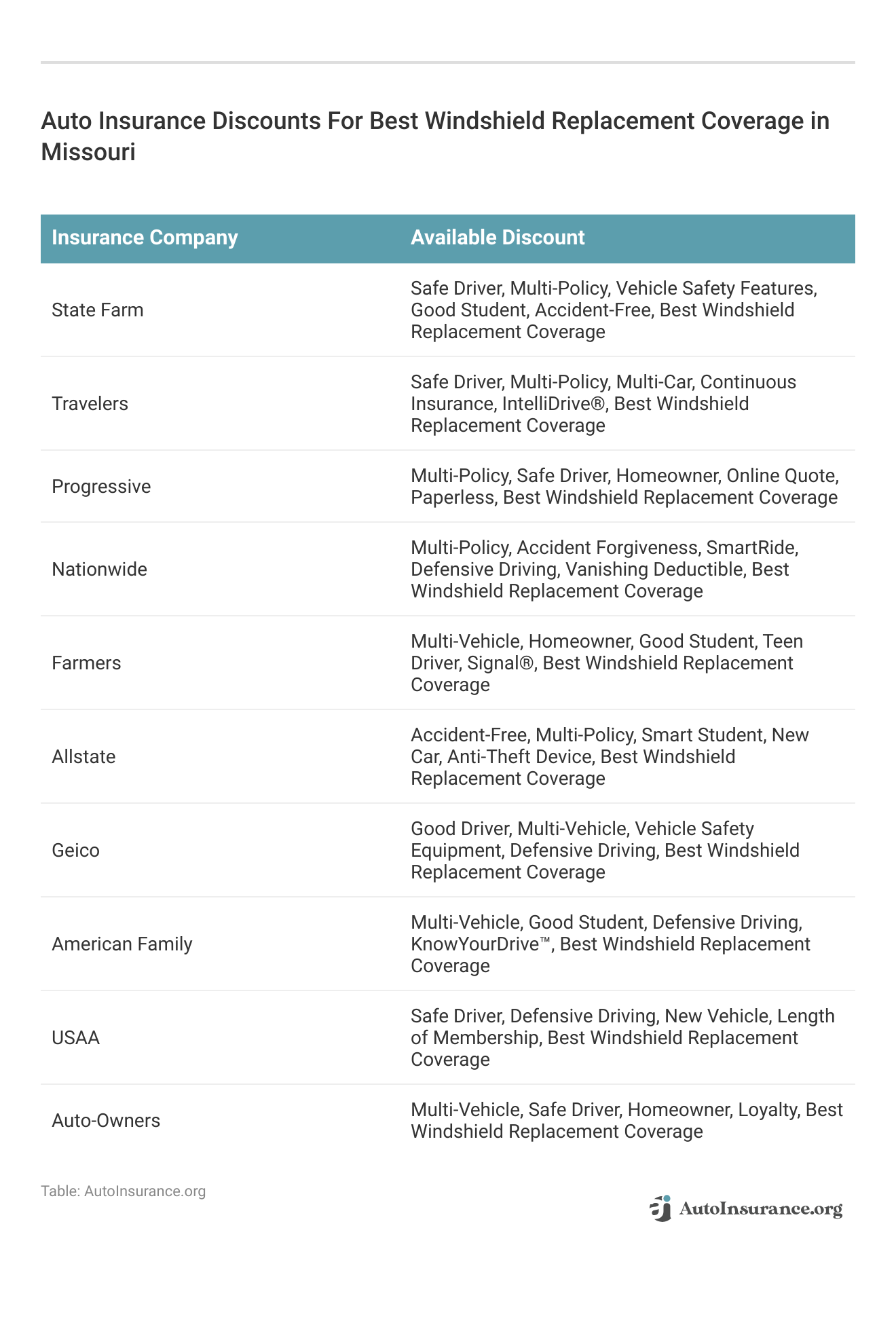

#1 – State Farm: Top Overall Pick

Pros

- Extensive Coverage Options: State Farm offers a wide array of coverage options, including comprehensive windshield replacement coverage, ensuring that customers can find a policy tailored to their specific needs. Find out more in our State Farm auto insurance review.

- Strong Financial Stability: With a solid financial standing and high ratings from agencies like A.M. Best, State Farm provides peace of mind to policyholders regarding the company’s ability to fulfill claims and commitments.

- Excellent Customer Service: State Farm is known for its responsive customer service, with agents readily available to assist policyholders throughout the claims process and answer any questions they may have.

Cons

- Potentially Higher Premiums: While State Farm offers comprehensive coverage, its premiums may be slightly higher compared to some other insurers, which could be a drawback for budget-conscious customers.

- Limited Discounts: State Farm’s discount offerings may not be as extensive as those of some competitors, meaning policyholders might miss out on potential savings opportunities.

#2 – Travelers: Best for Unique Coverage

Pros

- Customizable Policies: Travelers provides flexible policy options, allowing customers to tailor their coverage to suit their individual needs and budget, ensuring they only pay for what they need.

- Innovative Coverage Solutions: Our Travelers auto insurance review reveals that Travelers offers unique coverage options, such as special windshield coverage riders, providing added protection specifically for windshield damage.

- Multi-Policy Discounts: Travelers offers significant discounts for customers who bundle multiple insurance policies, such as auto and home insurance, helping them save on overall premiums.

Cons

- Average Customer Service: While Travelers provides solid coverage options, its customer service may not always meet expectations, with some customers reporting longer wait times and less personalized support.

- Limited Availability: Travelers’ coverage may not be available in all areas, limiting options for customers who reside in regions where the company does not operate.

#3 – Progressive: Best for Loyalty Programs

Pros

- Competitive Rates: In our Progressive auto insurance review, Progressive offers competitive rates for windshield replacement coverage, making it an attractive option for budget-conscious customers.

- Innovative Tools and Technology: Progressive provides innovative tools and technology, such as its Name Your Price® tool and Snapshot® program, empowering customers to find the right coverage and potentially save on premiums through safe driving habits.

- Wide Range of Coverage Options: Progressive offers a comprehensive selection of coverage options beyond windshield replacement, allowing customers to tailor their policies to their specific needs and preferences.

Cons

- Complex Claims Process: Some customers may find Progressive’s claims process to be more complex compared to other insurers, potentially leading to frustration and longer wait times for claim resolution.

- Limited Coverage Options: While Progressive offers solid coverage options, its selection may not be as extensive as some other insurers, leaving customers with fewer choices for customizing their policies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Bundling Discounts

Pros

- Bundling Discounts: Nationwide offers significant discounts for customers who bundle multiple insurance policies, such as auto and home insurance, providing an opportunity for substantial savings on premiums.

- Wide Network of Agents: Nationwide boasts a vast network of agents across the country, offering personalized assistance and support to policyholders, whether they prefer in-person or online interactions. Read more through our Nationwide auto insurance review.

- Customizable Policies: Nationwide provides flexible policy options, allowing customers to tailor their coverage to suit their individual needs and budget, ensuring they only pay for what they need.

Cons

- Limited Availability of Coverage: Nationwide’s coverage options may not be available in all areas, potentially limiting options for customers who reside in regions where the company does not operate.

- Mixed Customer Satisfaction: While Nationwide has a strong reputation for financial stability, some customers have reported mixed experiences with the company’s customer service, including delays in claims processing and communication issues.

#5 – Farmers: Best for Various Discounts

Pros

- Variety of Discounts: Farmers, as mentioned in our Farmers auto insurance review, offers a wide range of discounts, including multi-policy, safe driver, and loyalty discounts, providing opportunities for customers to save on their premiums.

- Personalized Coverage: Farmers provides personalized coverage options, allowing customers to tailor their policies to meet their unique needs and preferences, ensuring they have the right level of protection for their vehicles.

- Strong Financial Stability: Farmers has a solid financial standing, providing reassurance to policyholders that the company can fulfill its obligations and commitments.

Cons

- Higher Premiums for Some Customers: While Farmers offers comprehensive coverage options, some customers may find that their premiums are higher compared to other insurers, particularly if they do not qualify for many discounts.

- Limited Availability of Agents: Farmers’ network of agents may be limited in some areas, potentially leading to challenges in accessing personalized assistance and support for policyholders.

#6 – Allstate: Best for Multi-Policies

Pros

- Multiple Policy Discounts: Allstate offers significant discounts for customers who bundle multiple insurance policies, such as auto and home insurance, providing an opportunity for substantial savings on premiums. Use our Allstate auto insurance review as your guide.

- User-Friendly Digital Tools: Allstate provides easy-to-use digital tools and resources, including the Allstate mobile app, allowing customers to manage their policies, file claims, and access support conveniently from their smartphones.

- Solid Financial Standing: Allstate has a strong financial stability rating, assuring customers of the company’s ability to meet its financial obligations and handle claims effectively.

Cons

- Potentially Higher Premiums for Some: While Allstate offers comprehensive coverage options, some customers may find that their premiums are higher compared to other insurers, particularly if they do not qualify for many discounts.

- Mixed Customer Service Reviews: Allstate’s customer service has received mixed reviews from customers, with some reporting issues with responsiveness and claims processing times.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Geico: Best for Federal Discounts

Pros

- Competitive Rates: Geico is known for offering competitive rates for auto insurance, including windshield replacement coverage, making it an attractive option for budget-conscious customers.

- Convenient Online Experience: Geico provides a streamlined online experience for policy management, claims filing, and customer support, allowing customers to handle their insurance needs conveniently from their computers or mobile devices.

- Strong Financial Stability: Geico has a strong financial standing, providing reassurance to policyholders that the company can fulfill its obligations and commitments.

Cons

- Limited Coverage Options: While Geico offers solid coverage options, its selection may not be as extensive as some other insurers, leaving customers with fewer choices for customizing their policies. Read more through our Geico auto insurance review.

- Less Personalized Service: Geico’s customer service may feel less personalized compared to some other insurers, with limited opportunities for in-person interactions and assistance from local agents.

#8 – American Family: Best for KnowYourDrive Program

Pros

- KnowYourDrive Program: American Family offers the KnowYourDrive program, which rewards safe driving behavior with potential discounts on premiums, encouraging policyholders to drive responsibly and save money.

- Strong Community Involvement: American Family is actively involved in supporting local communities through various initiatives and programs, fostering a sense of trust and goodwill among policyholders.

- Solid Financial Stability: American Family has a strong financial standing, providing assurance to policyholders that the company can fulfill its financial obligations and handle claims effectively.

Cons

- Limited Availability: American Family’s coverage may not be available in all areas, potentially limiting options for customers who reside in regions where the company does not operate.

- Average Digital Experience: While American Family provides online tools for managing policies and accessing resources, some customers may find the digital experience to be less user-friendly or robust compared to other insurers. Use our American Family auto insurance review as your guide.

#9 – USAA: Best for Military Students

Pros

- Military-Focused Benefits: USAA offers specialized benefits and discounts for military members and their families, including deployed vehicle storage discounts and flexible payment options, catering to the unique needs of military personnel. Read more through our USAA auto insurance review.

- High Customer Satisfaction: USAA consistently receives high ratings for customer satisfaction, with many policyholders praising the company’s responsive customer service and claims handling process.

- Comprehensive Coverage Options: USAA provides a wide range of coverage options, including windshield replacement coverage, ensuring that military members and their families can find policies tailored to their specific needs.

Cons

- Membership Requirements: USAA membership is limited to military members, veterans, and their families, excluding eligibility for the general public, which may restrict access to USAA’s insurance products for some individuals.

- Limited Coverage Options in Certain Areas: While USAA offers comprehensive coverage, its availability may be limited in certain regions, potentially restricting options for customers who reside outside of the company’s service area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Auto-Owners: Best for Add-Ons

Pros

- Add-On Coverage Options: Auto-Owners offers a variety of add-on coverage options, such as roadside assistance and rental reimbursement, allowing customers to enhance their policies with additional protection as needed.

- Strong Financial Stability: Auto-Owners has a long-standing history of financial stability and reliability, providing reassurance to policyholders that the company can fulfill its obligations and commitments.

- Personalized Service: Auto-Owners prides itself on providing personalized service to its customers, with local agents available to offer assistance and support tailored to individual needs.

Cons

- Limited Availability: Auto-Owners’ coverage may be limited in certain regions, potentially restricting options for customers who reside outside of the company’s service area.

- Potentially Higher Premiums for Some: While Auto-Owners offers comprehensive coverage options, some customers may find that their premiums are higher compared to other insurers, particularly if they do not qualify for many discounts. Read more through our Auto-Owners auto insurance review.

Missouri’s Full Glass Coverage Laws

Zero-Deductible Full Glass Policies In Missouri

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Choosing your Full Glass Repair or Replacement Service

Summing Things Up on Missouri Windshield Replacement Laws

Frequently Asked Questions

Do Missouri full glass coverage laws require insurance companies to replace windshields without a deductible?

No, Missouri full glass coverage laws do not require insurance companies to replace windshields without a deductible. Windshield repair and replacement are typically covered by comprehensive insurance.

Are zero-deductible full glass policies mandatory in Missouri?

No, zero-deductible full glass policies are not mandatory in Missouri. Insurance companies in the state are allowed to charge a deductible for windshield replacement claims. Enter your ZIP code now to start.

Do you have to file a full glass claim for a broken windshield in Missouri?

Can you choose your full glass repair or replacement service in Missouri?

Under Missouri’s full glass coverage laws, insurance companies have the right to select the repair service that fixes or replaces your windshield. In some cases, your insurance contract may allow you to choose a different repair service, but you may be financially responsible if it’s more expensive.

Can insurance companies provide aftermarket and used glass for windshield replacement in Missouri?

Yes, insurance companies in Missouri can provide aftermarket and used glass for windshield replacement. State law requires the replacement glass to be comparable to the original, and you should be notified in advance if used or aftermarket glass is used. Enter your ZIP code now to start.

What are the top three insurance providers for windshield replacement coverage in Missouri?

Does Missouri mandate insurance companies to provide full glass coverage?

No, Missouri does not mandate insurance companies to provide full glass coverage.

What are some factors to consider before filing a windshield replacement claim in Missouri?

Some factors to consider before filing a windshield replacement claim in Missouri include assessing the deductible, out-of-pocket costs, and repair time, as they may impact future rates. Enter your ZIP code now to begin.

How do insurance companies typically select the repair service for windshield replacement in Missouri?

What unique benefits does USAA offer to military members and their families?

USAA offers specialized benefits and discounts for military members and their families, including deployed vehicle storage discounts and flexible payment options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.