Umbrella Insurance Explained (+ Buy or Skip in 2026?)

Umbrella insurance provides extra liability coverage beyond standard auto and homeowners policy limits. An umbrella policy can also help business owners protect their assets from liability claims. The best umbrella insurance companies, like State Farm and USAA, offer coverage starting at $10 per month.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated June 2025

Umbrella insurance provides extra liability coverage beyond the limits of standard auto or homeowners insurance policies. It covers significant claims or lawsuits involving defamation, slander, and false arrest. Umbrella coverage is usually added to bodily injury liability insurance, property damage insurance, or other personal policies.

Is umbrella insurance excess? Yes, umbrella policies cover incidents not typically included in standard policies, such as libel or incidents that occur abroad. It’s ideal for individuals with high-value assets or those at increased risk of legal claims, but it doesn’t cover everything.

- Umbrella insurance offers extra liability coverage beyond standard policies

- Umbrella coverage costs around $10 per month for a $1 million policy

- Most umbrella policies offer $1 million in coverage, though you can find up to $10 million

Keep reading for more information on umbrella insurance options that can be tailored to your needs. Then, enter your ZIP code to compare free umbrella quotes.

How Umbrella Insurance Works & What it Covers

Umbrella insurance is a type of extra liability insurance that provides coverage beyond the limits of standard policies like auto, homeowners, or renters insurance. It covers claims such as bodily injury, property damage, defamation, slander, and even some incidents that occur abroad.

Umbrella Insurance Monthly Cost by Coverage Amount

| Company | $1M | $2M | $3M | $4M | $5M | $10M |

|---|---|---|---|---|---|---|

| $15 | $20 | $25 | $30 | $35 | $60 | |

| $20 | $24 | $28 | $32 | $40 | $70 | |

| $18 | $22 | $26 | $30 | $38 | $65 | |

| $12 | $16 | $20 | $24 | $30 | $50 | |

| $16 | $20 | $24 | $28 | $36 | $60 |

| $14 | $18 | $22 | $26 | $34 | $58 | |

| $13 | $18 | $22 | $26 | $32 | $55 | |

| $17 | $21 | $25 | $29 | $37 | $62 | |

| $19 | $23 | $27 | $31 | $39 | $67 | |

| $10 | $14 | $18 | $22 | $25 | $45 |

This type of policy offers financial protection against large claims and lawsuits, ensuring that you don’t have to pay significant amounts out of pocket once your primary insurance limits are exceeded.

There are many factors that affect how much umbrella insurance costs, including what type of policy you want to add it to and how much coverage you need. However, you can get an idea of how affordable umbrella insurance is based on what type of coverage you’re adding it to below.

Umbrella insurance activates once your primary policy, such as auto or homeowners insurance, reaches its coverage limit. For example, if an auto accident results in a $1 million judgment and your auto insurance only covers $500,000, the umbrella policy would cover the remaining balance.

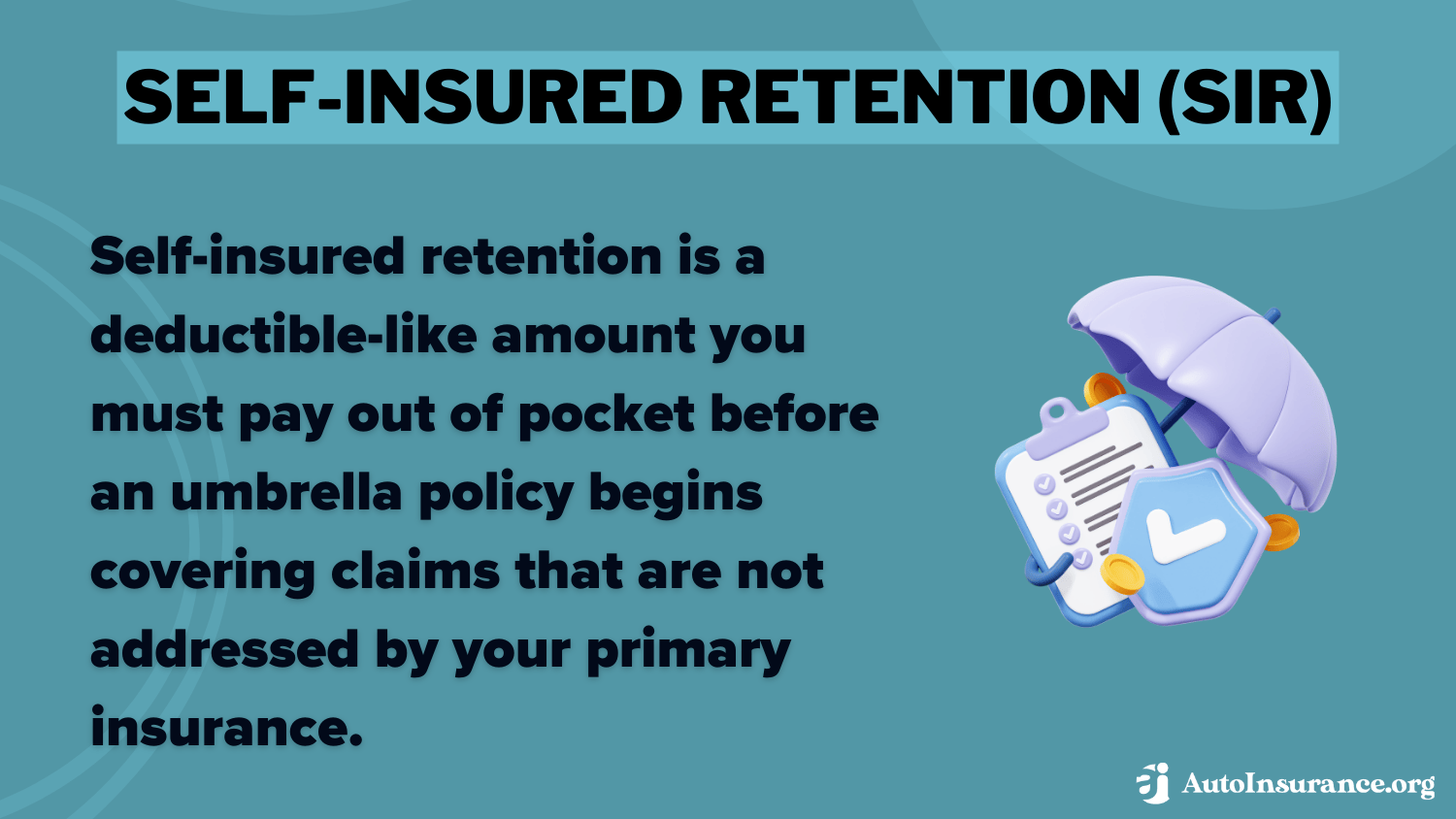

In some cases, umbrella insurance may cover claims not tied to any primary policy (e.g., defamation or incidents abroad). When this happens, the policyholder may need to pay a self-insured retention (SIR) before the umbrella coverage kicks in.

Think of SIR as a deductible that applies only to these types of claims. Understanding how SIR works ensures you are fully prepared for any coverage gaps.

Still confused about why you might need umbrella insurance? Take a look below for common examples of when umbrella insurance is most useful:

- Car Accidents: If you owe $600,000 after a serious accident, but your liability auto insurance only covers $250,000, you’ll be on the hook for the rest. In this situation, umbrella insurance would cover the rest.

- Injury on Your Property: If a guest sues you for $1 million after they injured themselves on your property, but your homeowners insurance only covers $500,000, umbrella insurance would pay the other $500,000.

- Defamation Lawsuit: Suppose a business owner sues you for $750,000 for leaving a bad review online, but your homeowners policy only covers personal liability up to $300,000. Umbrella coverage would pay the rest.

These examples are for auto and homeowners insurance, but you can purchase umbrella coverage for a variety of policies. However, adding umbrella insurance to an auto policy is one of the most popular choices. In this case, umbrella insurance applies to bodily injury insurance and property damage coverage.

Bodily injury liability insurance pays for injuries you cause to other people, including drivers, passengers, and pedestrians. Take a look below to see how umbrella insurance helps bodily injury coverage pay for your financial responsibilities.

How Umbrella Insurance Covers Excess Bodily Injury Liability Costs

| Description | Amount |

|---|---|

| Total Cost of Car Accident | $500,000 |

| Auto Insurance: Bodily Injury Limit | $300,000 |

| Umbrella Insurance | $200,000 |

Property damage liability insurance pays for any property you damage. This can include other vehicles, fences, buildings, and road signs. Umbrella insurance can be crucial to protecting your finances from costly car accidents.

Read More: What are the recommended auto insurance coverage levels?

Common Scenarios Covered by Umbrella Insurance

Umbrella insurance provides an extra layer of protection for situations where standard insurance policies fall short. It’s designed to cover a wide range of high-risk scenarios that could lead to costly lawsuits or claims.

What is an umbrella policy example? These scenarios highlight how umbrella insurance can provide peace of mind by protecting against unexpected financial risks. Some of the most common umbrella coverage definitions include:

- Injuries on Your Property: Covers medical costs and legal fees for injuries that exceed insurance, such as a visitor slipping and falling.

- Defamation Claims: Provides protection for lawsuits related to libel or slander, especially from social media comments, which are often not covered by standard policies.

- Dog Bites: Covers legal expenses and compensation for lawsuits resulting from dog bites that surpass the limits of your primary insurance.

- Incidents Abroad: Extends coverage for accidents that occur outside the country, which are typically excluded from regular policies (Read More: Does auto insurance cover you when driving abroad?).

Having this extra layer of protection helps cover large claims or lawsuits that might otherwise leave you vulnerable to significant out-of-pocket expenses.

Excess Liability vs. Umbrella Coverage Explained

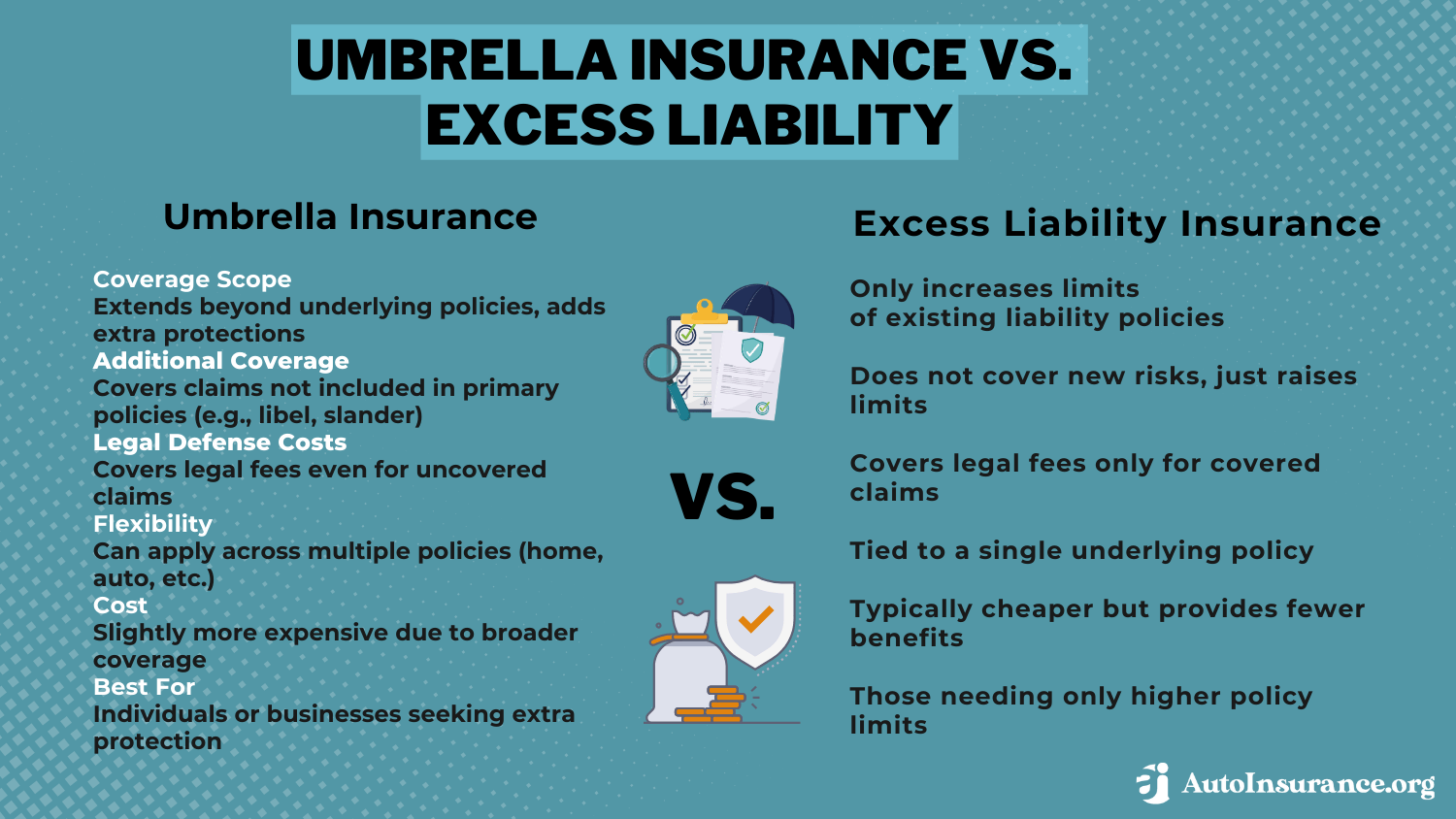

While both umbrella policies and excess liability insurance provide additional protection, they are not the same. Umbrella insurance extends to areas not covered by primary policies (e.g., defamation).

Excess liability coverage simply increases the limits on an existing policy but doesn’t broaden coverage. Knowing the difference helps in selecting the right protection.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Who Benefits Most from Umbrella Insurance

What are the benefits of an umbrella policy? Umbrella insurance is valuable for individuals who want extra liability protection beyond the limits of their existing policies. It’s especially beneficial for the following groups:

- High-Net-Worth Individuals: Umbrella insurance protects large assets from being seized to settle large claims. For example, the best auto insurance for the wealthy often includes umbrella insurance.

- Landlords: Property owners may face legal liability for tenant injuries or property damage. Umbrella insurance for landlords can cover costs if claims exceed the limits of standard landlord policies.

- Business Owners: Business owners or sole proprietors at risk of personal liability for business-related incidents can benefit from the added protection that umbrella insurance for businesses offers.

- Parents of Teenage Drivers: Young drivers are statistically more likely to be involved in accidents. Umbrella coverage can protect your family if a teen driver does extensive damage with a car.

- Individuals with High-Risk Hobbies: Activities like boating, skiing, or owning dogs can increase liability exposure. Umbrella insurance offers peace of mind in case of accidents or injuries.

Even individuals without significant assets may want umbrella coverage for its affordability and broad protection against unexpected claims.

In most cases, an umbrella policy is worth it for the extra peace of mind it provides, ensuring you’re protected from life’s unpredictable legal and financial challenges.

Make sure to buy an umbrella insurance for all the assets you want covered because your coverage only extends to liabilities specified in your policy.Laura Berry Former Licensed Insurance Producer

You should make sure to compare umbrella insurance options. For example, the best umbrella insurance in Delaware is probably not the same company as the best coverage option in Arizona. Comparing quotes is the easiest way to ensure you get the best policy possible.

Read More: High-Risk Auto Insurance

How to Choose the Right Umbrella Insurance Limit

Choosing the best umbrella liability insurance options is essential to ensure sufficient financial protection. Start by evaluating your total assets, including savings, investments, and property. Ensure that your coverage limit is enough to protect these assets from potential lawsuits or claims.

Consider your income and future earnings as well, since high claims could target your earning potential.

Umbrella policies typically start at $1 million, with options to increase in $1 million increments. If you own multiple properties, have high-value vehicles, or engage in activities like hosting events or owning pets, you may be at greater risk for liability claims. Those in professions or social situations where defamation claims are more likely should also consider higher limits.

Read More: 10 Cheapest Auto Insurance Companies

Tips for Reducing the Cost of Umbrella Insurance

Umbrella insurance provides valuable protection at a much higher cost than standard insurance, but you can take steps to reduce premiums without sacrificing your coverage. Here are practical tips to help you save on your policy:

- Bundle Your Policies: Purchase umbrella coverage from the same insurer that handles your auto or homeowners policies and save money by bundling your insurance.

- Raise Underlying Policy Limits: Increasing the liability limits on your primary policies (e.g., auto or homeowners) may reduce your umbrella premiums, as it lowers the risk for the insurer.

- Shop Around: Compare quotes to find the best coverage. For example, USAA umbrella insurance is cheap, but only members qualify, while umbrella insurance from Geico is available to everyone.

- Maintain a Clean Record: Avoid traffic violations or claims that could raise your risk profile, as a clean record can help keep premiums low.

- Choose a Higher Self-Insured Retention (SIR): Opting for a higher SIR (similar to a deductible) can lead to lower premiums by assuming more initial risk before the umbrella policy kicks in.

You can make the most of your umbrella insurance while managing costs effectively by following these practical tips, especially if you live in a high-risk state like the person in this State Farm umbrella insurance review on Reddit.

What are the problems with umbrellas policies? Umbrella policies come with higher rates than standard insurance, but by taking a proactive approach to coverage and premiums, you can ensure you’re fully protected in case of a lawsuit or major liability event without overspending.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Makes Umbrella Insurance Worth Considering

Umbrella insurance plays a vital role in safeguarding your financial security. It extends your liability coverage beyond the limits of your standard policies, such as auto, homeowners, or renters insurance.

Umbrella insurance isn’t just for the wealthy—it safeguards your assets when standard policies fall short, especially in costly lawsuits.Joel Ohman Certified Financial Planner

Whether you have significant assets or want protection from potential risks, umbrella insurance ensures you’re covered when your primary auto insurance falls short. Enter your ZIP code to explore umbrella insurance policies tailored to your needs and maximize your financial protection.

Frequently Asked Questions

What is umbrella insurance?

A simple umbrella insurance definition is that it offers excess liability coverage beyond the limits of primary insurance policies.

What does umbrella insurance cover?

Umbrella insurance provides additional liability coverage beyond your existing policies, such as auto, homeowners, or renters insurance. It typically covers bodily injury, property damage, and certain lawsuits, including defamation or slander.

Read More: 10 Best Property Damage Liability (PDL) Auto Insurance Companies

Why is it called an umbrella policy?

Looking for an umbrella policy definition? It is called an umbrella policy because it acts as a protective layer over your existing insurance, covering a broad range of potential liabilities.

Is umbrella insurance worth having?

Is an umbrella policy a waste of money or is it worth adding to your insurance? An umbrella policy is beneficial for individuals with significant assets, high-risk occupations, or those seeking peace of mind against large liability claims.

What are the disadvantages of umbrella insurance?

Disadvantages may include additional premium costs, coverage gaps if the underlying policies do not meet state minimum requirements, and exclusions for certain events like criminal or intentional acts.

How expensive is an umbrella policy?

How much does an umbrella usually cost? The cost typically ranges from $10 to $20 monthly for $1 million in coverage, but premiums vary based on risk factors and coverage limits.

What is not covered by an umbrella policy?

Common exclusions include intentional acts, business-related liabilities, contract disputes, and certain recreational activities.

What is a lifetime limit on umbrella coverage?

A lifetime limit is the maximum amount an insurance company will pay out over the life of an insurance policyholder, though not commonly associated with umbrella policies.

Why should you use umbrella insurance?

Using an umbrella policy provides financial protection from large or unexpected claims that exceed your standard insurance coverage.

For tailored information and quotes, enter your ZIP code to see which company offers the most affordable umbrella insurance.

How much does a $1 million umbrella policy cost?

An umbrella insurance policy with a $1 million limit can cost as little as $10 per month. However, it depends on where you get your insurance. Regardless, umbrella insurance with a $1 million limit is usually affordable.

Who really needs umbrella insurance?

At what net worth should you have an umbrella policy?

Can I buy umbrella insurance separately?

What is an umbrella fee?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.