Cheapest Teen Driver Auto Insurance in New York (Top 10 Companies for 2025)

Erie, USAA, and Travelers sell the cheapest teen driver auto insurance in New York. Erie has the cheapest rates of $125/mo for young drivers in NY. Teens must adhere to junior license restrictions, and Travelers offers 20% discount for all young drivers who complete a defensive driving course.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Teen Drivers in New York

A.M. Best

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for Teen Drivers in New York

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage for Teen Drivers in New York

A.M. Best

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsThe cheapest teen driver auto insurance in New York comes from Erie, USAA, and Travelers.

Erie is our top pick for the cheapest New York auto insurance for teens. Not only does this company offer affordable teen auto insurance rates, but it also provides excellent customer service that young drivers can rely on.

Our Top 10 Company Picks: Cheapest Teen Driver Auto Insurance in New York

| Company | Rank | Monthly Rates | AM Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $125 | A+ | Teen Training | Erie |

| #2 | $130 | A++ | Military Discounts | USAA | |

| #3 | $135 | A++ | Student School | Travelers | |

| #4 | $140 | A++ | Student Discount | State Farm | |

| #5 | $145 | A+ | Safe Driving | Nationwide |

| #6 | $150 | A+ | Competitive Rates | Progressive | |

| #7 | $152 | A | Policy Discounts | Farmers | |

| #8 | $154 | A | Usage Discounts | American Family | |

| #9 | $155 | A | Online Discounts | Liberty Mutual |

| #10 | $160 | A+ | Driver Program | Allstate |

Read on to explore where you can find the cheapest teen driver auto insurance in New York. When you’re ready, enter your ZIP code into our free tool to see which company has the lowest rates for you.

- Teens pay higher rates in New York because they’re considered riskier drivers

- A parent or guardian can help teens save by adding them to a family policy

- Erie and USAA have the cheapest teen driver rates in New York

#1 – Erie: Top Pick Overall

Pros

- YourTurn: Save up to 30% on your Erie teenage driver insurance costs by enrolling in the usage-based insurance (UBI) program, YourTurn. See what YourTurn tracks in our Erie auto insurance review.

- Rate Lock: As long as you don’t get into at-fault accidents or make serious changes to your policy, Erie will keep your insurance costs the same when you sign up for Rate Lock.

- Superior Customer Service: Erie earns its reputation for excellent customer service by striving to satisfy each of its drivers’ needs.

Cons

- Limited Online Services: Erie is a smaller company, so it doesn’t have all of the digital tools some of its larger competitors offer, i.e., you’ll need to speak with an agent to buy New York auto insurance coverage.

- Fewer Discounts: With just eight discounts, Erie doesn’t have the longest list of discounts available to help young drivers in New York save.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Families

Pros

- Excellent Customer Satisfaction Ratings: Most customers agree that USAA representatives are helpful and friendly. See what customers have to say in our USAA auto insurance review.

- Student Discounts: USAA offers 14 discounts, which include a good student discount for maintaining a GPA of 3.0 or better.

- Affordability: USAA is almost always one of the cheapest ways to insure a new driver, no matter where you live or what type of driver you are.

Cons

- Limited Physical Locations: USAA doesn’t maintain as many storefronts as many other insurance providers.

- Membership Eligibility: You need a USAA membership to get New York auto insurance quotes. Only active and retired military members and their direct families qualify.

#3 – Travelers: Best for Teen Driving Resources

Pros

- IntelliDrive: Travelers takes one of our cheapest picks for teen car insurance partially because of IntelliDrive. With IntelliDrive, you can save up to 30% for your good driving habits.

- Ample Discounts: Get the lowest teenage car insurance cost per month by taking advantage of Travelers’ 17 discounts. Explore your discount options in our Travelers auto insurance review.

- Helpful Representatives: Travelers offers some of the best auto insurance for teens through its helpful representatives, who can answer any questions a new driver might have about insurance.

Cons

- Fewer Digital Tools: Travelers offers a more traditional insurance experience. If you want auto insurance for young drivers that focuses on online management, Travelers might not be the best option.

- Mixed Reviews: Not everyone is satisfied with their Travelers policy. Some customers state that the Travelers claims process is too slow.

#4 – State Farm: Best for Student Driver Discounts

Pros

- Drive Safe & Save: One of the best ways to insure a new drive for an affordable price is to sign up for a UBI program. Drive Safe & Save offers savings of up to 30%

- Teen Safe Driver Program: Complete the program to lower teen driver auto insurance costs. Not only can you earn a discount for completing the program, but it also offers valuable insight into your driving habits.

- Student Discounts: State Farm offers plenty of ways to get cheaper teen auto insurance for student drivers. See which student driver discounts you might qualify for in our State Farm auto insurance review.

Cons

- Limited Coverage Options: Drivers who want to customize their policies will find fewer add-on options with State Farm than they would at some other companies.

- Fewer Digital Tools: State Farm prefers to sell insurance through agents. You can get teen driver auto insurance quotes online, but you’ll have to speak with an agent to purchase a policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for UBI Savings

Pros

- UBI Programs: Nationwide offers two UBI programs to keep new driver auto insurance rates low – SmartRide and SmartMiles. Compare each in our Nationwide auto insurance review.

- Selection of Add-ons: Nationwide is one of the best New York auto insurance companies because of its ample selection of add-ons. Popular choices for teens include accident forgiveness.

- Discount Options: It doesn’t have the longest list of discounts, but Nationwide’s 11 discounts can help you find affordable new driver auto insurance quotes.

Cons

- Average Insurance Costs: While it’s one of the best picks for teen car insurance, Nationwide’s average rates are usually higher.

- Small Digital Presence: Nationwide does not set itself apart with its meager selection of digital tools.

#6 – Progressive: Best for Innovative Digital Tools

Pros

- Snapshot: Snapshot offers safe drivers a way to meet New York auto insurance requirements for 30% cheaper, as long as they drive safely.

- Innovative Digital Tools: Progressive is a car insurance company for the modern age. For example, you can use its Name Your Price tool to find coverage that exactly matches your monthly budget.

- Teen Discounts: With 13 discounts to choose from — many of which are designed for young people — you can keep new driver auto insurance costs low with Progressive.

Cons

- Unexpected Rate Increases: Many drivers report unexpected New York auto insurance increases from Progressive, even when nothing about their policy had changed.

- Customer Loyalty Struggles: Despite affordable New York auto insurance rates, Progressive struggles to hold on to its customers. See how Progressive is trying to fix this problem in our Progressive auto insurance review.

#7 – Farmers: Best Selection of Teen Driver Discounts

Pros

- Friendly Agents: Young drivers in New York City and elsewhere in the state can get the help they need from Farmers’ friendly agents.

- Excellent List of Add-ons: Farmers offers a variety of coverage options if you want more than the bare minimum insurance in New York. Explore all your coverage options in our Farmers auto insurance review.

- Tons of Discounts: Farmers has 23 discounts for drivers to take advantage of, including several designed to help you find affordable auto insurance for new drivers.

Cons

- Fewer Online Opportunities: With a focus on providing face-to-face customer service, Farmers’ digital tools aren’t as modernized as they could be.

- Slow Roadside Service: Farmers offers roadside assistance, but many customers report the service as being excessively slow.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Families With a Costco Membership

Pros

- Teen Safe Driver Program: American Family earns its spot as one of our best picks for teen auto insurance by offering a discount to young drivers who complete this educational program.

- Costco Auto Insurance: The American Family subsidiary CONNECT unwrites Costco insurance, which has cheap rates for families with a Costco membership.

- Young Driver Discounts: American Family offers special discounts for young drivers, including special savings for youths who spend at least 40 hours a year volunteering.

Cons

- Limited Availability: American Family doesn’t sell insurance in New York. Instead, you’ll have to buy a policy through its subsidiary CONNECT.

- Slow Claims: Affordability may come at a cost — customers report the claims process as unexpectedly slow. Get the full ratings in our American Family auto insurance review.

#9 – Liberty Mutual: Best for Diverse Coverage Options

Pros

- Diverse Coverage Options: Customize your policy to give teen drivers the best protection on the road. Explore what you can add to your policy in our Liberty Mutual auto insurance review.

- RightTrack: Lower your teen driver auto insurance rates by up to 30% with RightTrack, Liberty Mutual’s UBI program.

- Teen Driver Support: Teen drivers can get the support they need whenever they need it by calling Liberty Mutual’s claims support number.

Cons

- Higher Premiums: While it offers great coverage for teens, Liberty Mutual is not always the cheapest choice.

- Reports of Claims Issues: Liberty Mutual reviews often focus on the claims process, with many customers saying it takes an excessively long time to get their claims settled.

#10 – Allstate: Best for Full Coverage Policies

Pros

- Ample Coverage Options: You can customize your policy in a variety of ways with Allstate’s excellent coverage options. Popular choices for teen drivers include accident forgiveness and roadside assistance.

- TeenSMART: Complete the TeenSMART program to lower your rates as a young driver. This program not only offers a discount but also gives you personalized driving tips to help keep you safe on the road.

- Drivewise: Allstate has one of the best UBI discounts on the market with Drivewise. Teens can save up to 40% by enrolling and consistently practicing safe driving habits.

Cons

- Higher Rates: No matter which New York city you call home or what your driving record looks like, Allstate is almost always more expensive. See if you can get cheap rates in our Allstate auto insurance review.

- Claims Satisfaction Problems: Many drivers in New York report feeling unsatisfied with how Allstate resolved their claims.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Meeting Teen Auto Insurance Requirements in New York

New York requires more car insurance than many states, which teens have to meet before they can legally drive. These requirements include:

- 25/50/10 liability insurance

- 25/50 uninsured motorist insurance

- $10,000 personal injury protection coverage

Despite having higher insurance requirements, teenage car insurance averages are about the same as the national average. Check the rates below to see how much the average teen pays in New York.

New York Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $220 | $566 |

| 16-Year-Old Male | $252 | $618 |

| 17-Year-Old Female | $238 | $599 |

| 17-Year-Old Male | $272 | $659 |

| 18-Year-Old Female | $179 | $416 |

| 18-Year-Old Male | $216 | $501 |

| 19-Year-Old Female | $187 | $437 |

| 19-Year-Old Male | $227 | $528 |

| 20-Year-Old Female | $172 | $400 |

| 20-Year-Old Male | $209 | $485 |

| 21-Year-Old Female | $162 | $377 |

| 21-Year-Old Male | $197 | $456 |

Getting cheap auto insurance for 18-year-olds and other teens is more difficult than for older adults, but some companies are more forgiving than others. Check the rates below to see how much our top companies charge for teen insurance.

Auto Insurance Monthly Rates for Teen Driver in New York by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $160 | $370 |

| American Family | $150 | $350 |

| Erie | $125 | $290 |

| Farmers | $150 | $350 |

| Liberty Mutual | $155 | $360 |

| Nationwide | $145 | $330 |

| Progressive | $150 | $350 |

| State Farm | $140 | $320 |

| Travelers | $135 | $310 |

| USAA | $130 | $300 |

Like most states, there are learner’s permit restrictions in New York.

Drivers with permits are on a six-month probationary period after they pass their road test and aren't allowed to drive without a licensed adult in the car with them at all times.David Reischer Licensed Attorney in New York

If you lose your license during your probationary period, it will be difficult to get affordable coverage even if you shop at companies with the cheapest teen auto insurance rates.The following actions will cost you your license for 60 days:

- Speeding or participating in a street race

- Tailgating

- Reckless driving

- Using a cell phone or other electronic device

- Getting two or more moving violations

To avoid expensive high-risk auto insurance, make sure to keep your driving record clean.

Buying Cheap Auto Insurance for Teen Drivers

Several factors affect your auto insurance rates, and age is one of the most important. Finding cheap auto insurance for learner’s permit drivers and teens with their licenses can be difficult, but it’s even more difficult if they have marks in their driving record.

USAA’s 2020 Safe Driving and Technologies Report confirms parents can play a key role in helping teens become safe drivers. Visit https://t.co/aw5z4Nq0UZ to learn more about how you can influence teen driving behaviors. pic.twitter.com/W9m52EUL9G

— USAA (@USAA) October 21, 2020

Teens with clean driving records will pay less than drivers with speeding tickets, at-fault accidents, and other traffic violations. Check below to see how much insurance costs in New York based on your driving record.

New York Auto Insurance Monthly Rates by Age, Gender, & Driving Record

| Age Group & Gender | Clean Record | Speeding Ticket | At-Fault Accident | DUI/DWI |

|---|---|---|---|---|

| 16-Year-Old Female | $285 | $369 | $511 | $511 |

| 16-Year-Old Male | $320 | $410 | $568 | $568 |

| 17-Year-Old Female | $268 | $346 | $479 | $479 |

| 17-Year-Old Male | $300 | $386 | $534 | $534 |

| 18-Year-Old Female | $246 | $318 | $439 | $439 |

| 18-Year-Old Male | $276 | $356 | $492 | $492 |

| 19-Year-Old Female | $229 | $295 | $408 | $408 |

| 19-Year-Old Male | $257 | $331 | $458 | $458 |

| 20-Year-Old Female | $215 | $277 | $383 | $383 |

| 20-Year-Old Male | $241 | $310 | $428 | $428 |

| 21-Year-Old Female | $192 | $248 | $343 | $343 |

| 21-Year-Old Male | $216 | $278 | $384 | $384 |

Another important factor is your ZIP code. Check below for the average teen auto insurance rates in New York’s biggest cities.

New York Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Albany | Buffalo | New York City | Rochester | Syracuse |

|---|---|---|---|---|---|

| 16-Year-Old Female | $325 | $347 | $414 | $336 | $330 |

| 16-Year-Old Male | $358 | $382 | $455 | $369 | $362 |

| 17-Year-Old Female | $304 | $325 | $388 | $314 | $308 |

| 17-Year-Old Male | $337 | $360 | $430 | $348 | $342 |

| 18-Year-Old Female | $283 | $303 | $362 | $294 | $289 |

| 18-Year-Old Male | $315 | $337 | $402 | $326 | $320 |

| 19-Year-Old Female | $259 | $277 | $331 | $269 | $264 |

| 19-Year-Old Male | $289 | $309 | $369 | $299 | $293 |

| 20-Year-Old Female | $237 | $254 | $304 | $247 | $243 |

| 20-Year-Old Male | $265 | $284 | $339 | $275 | $270 |

| 21-Year-Old Female | $214 | $229 | $274 | $222 | $218 |

| 21-Year-Old Male | $240 | $257 | $307 | $249 | $244 |

Many other factors affect your auto insurance, which is why it’s so important to compare quotes from multiple companies.

Other factors that affect your car insurance rates include your marital status, credit score, and what type of car you drive. Teens often fall in the riskiest category for most factors that affect insurance rates, which is why they pay much more for insurance.Scott W. Johnson Licensed Insurance Agent

If you don’t compare quotes from multiple companies, you’ll likely overpay for your insurance.

Adding a Teen to Your New York Auto Insurance Policy

Wondering if you have to add your child to your insurance policy? Most insurance companies require you to add any licensed driver who lives in your house to your policy. However, there are more benefits to adding a teen to your policy, particularly in the form of lower rates.

Get an idea of how much variation in prices there can be for teens below.

New York Auto Insurance Monthly Rates by Age, Gender, & Policy Type

| Age & Gender | Individual Policy | Parent's Policy |

|---|---|---|

| 16-Year-Old Female | $420 | $325 |

| 16-Year-Old Male | $465 | $358 |

| 17-Year-Old Female | $390 | $304 |

| 17-Year-Old Male | $435 | $337 |

| 18-Year-Old Female | $360 | $283 |

| 18-Year-Old Male | $400 | $315 |

| 19-Year-Old Female | $330 | $259 |

| 19-Year-Old Male | $370 | $289 |

| 20-Year-Old Female | $300 | $237 |

| 20-Year-Old Male | $335 | $265 |

| 21-Year-Old Female | $270 | $214 |

| 21-Year-Old Male | $300 | $240 |

As you can see, adding a driver to your auto insurance policy can save teens up to 50% on their coverage. Just be careful about adding a teen — whatever they do behind the wheel can impact your insurance rates for years.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Lowering Teen Auto Insurance Rates

Getting the best auto insurance for drivers under 25 requires more research than older adults have to do. However, there are a few easy steps you can take to get affordable teen auto insurance.

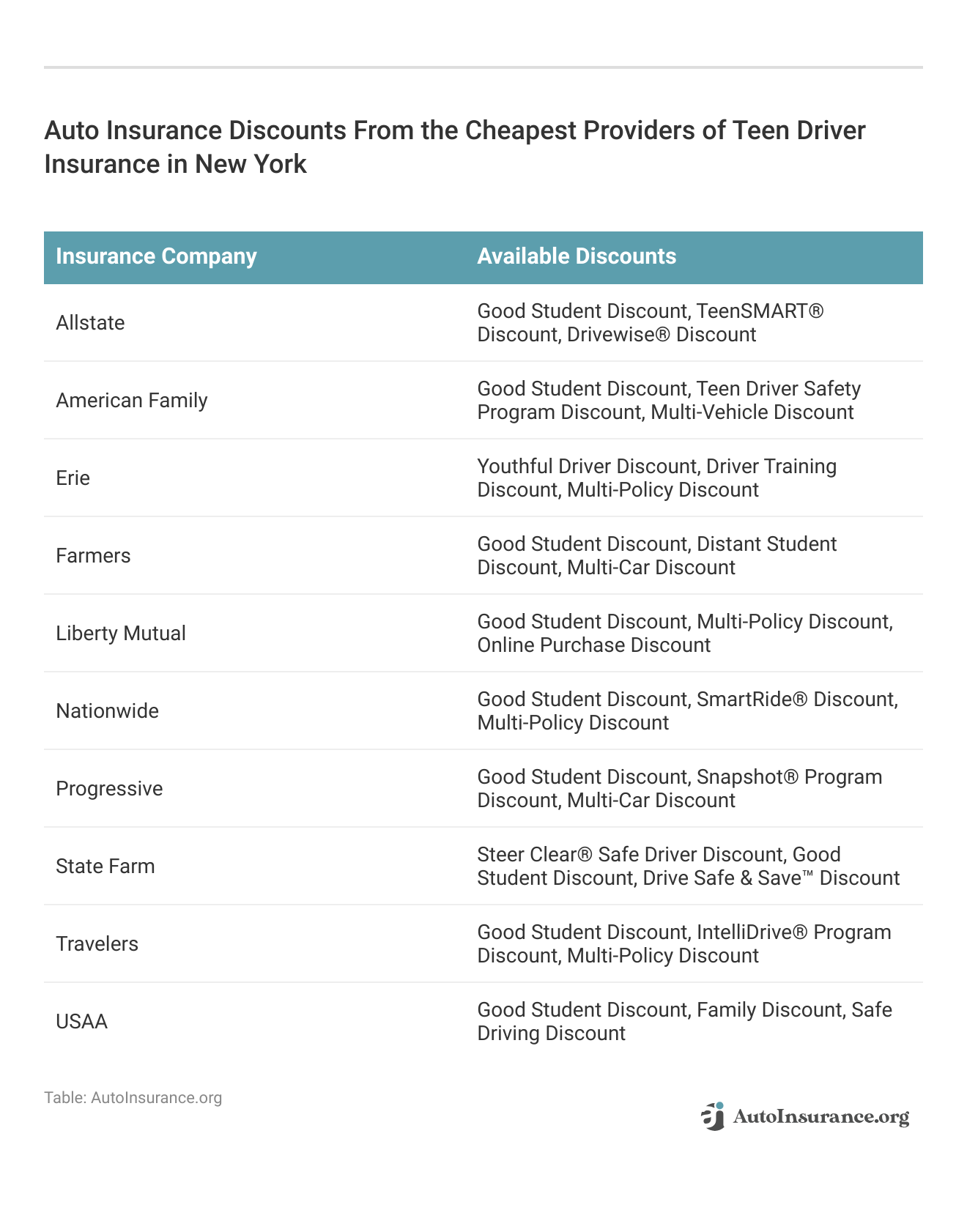

For starters, you should look for as many discounts as possible. Take a look below to see discount options from our top companies that can help teens save.

You can also try the following methods:

- Lower your coverage levels to the state minimum requirements

- Increase your deductible to the maximum your company offers

- Take a driver’s education course

- Work to increase your credit

- Keep your driving record clean

One of the most important steps in finding cheap teen insurance is comparing quotes. Most companies make it easy to request a quote on their home page.

Getting individual quotes can be time-consuming. If you want to streamline the process and see as many quotes as possible, try an online quote comparison tool.

Get the Cheapest Teen Driver Auto Insurance in New York

Whether you need New York City auto insurance or coverage for a more rural setting, finding teen auto insurance at an affordable price can be a challenge. Luckily, there are several steps you can take to find inexpensive coverage.

When you’re ready to start comparing rates, enter your ZIP code into our free comparison tool below to see auto insurance rates in your area.

Frequently Asked Questions

Why is auto insurance so expensive in New York?

Auto insurance in New York is expensive for several reasons, but one of the main factors is that there are more insurance requirements drivers have to meet. Some areas in New York – like New York City and Buffalo – have higher rates due to increased traffic and vehicle crime rates.

What is the cheapest way to get car insurance for a teenager?

One of the easiest ways to save on your car insurance as a teenager is to find discounts. Most companies offer special savings for teens, especially when they’re students. Learning how to get a student auto insurance discount can help you save a significant amount.

Can a 17-year-old get their own auto insurance in New York?

Insurance companies won’t sell New York auto insurance plans to a 17-year-old unless they’ve been legally emancipated from their parents or guardians.

How much is car insurance in New York for a 17-year-old?

Finding cheap auto insurance for a 17-year-old can be difficult. The average 17-year-old driver in New York pays $255 per month for minimum insurance and $629 for full coverage.

At what age is New York auto insurance cheapest?

While rates vary for every driver, most New Yorkers will see their cheapest rates when they’re between the ages of 30 and 60.

What is the best auto insurance for first-time drivers?

The best auto insurance for first-time drivers in New York comes from Erie, USAA, and Travelers.

How much is auto insurance for a 16-year-old in New York?

Finding cheap auto insurance for a 16-year-old in New York is a challenge, with average teens paying $236 for minimum insurance and $592 for full coverage.

What is the minimum auto insurance in New York?

Minimum auto insurance requirements in New York include 25/50/10 liability, 25/50 uninsured motorist coverage, and $10,000 worth of personal injury protection insurance.

Who is the cheapest teen driver auto insurance in New York, Geico or Progressive?

In New York, Progressive tends to be cheaper than Geico. While Geico is typically an affordable option for cheap car insurance, it did not make our list of the cheapest providers for teens in New York.

However, Geico and Progressive are usually close enough in prices that you should compare quotes between the companies. Enter your ZIP code to find out which company has the lowest rates for you.

Who is cheaper for New York teen auto insurance, Allstate or Progressive?

Progressive is cheaper than Allstate, not only in New York but also in most states. Allstate tends to be one of the most expensive insurance providers in the country.

How much is car insurance in New York for a 21-year-old?

Finding cheap auto insurance for a 21-year-old is much easier than it is for younger teens because they usually have a little more driving experience. However, they still pay higher rates, with the average 21-year-old driver paying $204 per month.

How long can you stay on your parent’s car insurance in New York?

As long as you live under the same roof, you can stay on your parent’s insurance policy indefinitely. However, you’ll probably have to get a new policy if you move out. If you have a permit instead of a license, you’ll need to fill all junior license restrictions in New York regardless of where you live.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.