Rideshare Insurance in 2025 (Coverage Details)

Rideshare insurance fills in the gaps in your personal coverage while you’re working for a rideshare company. Auto insurance with rideshare offers valuable protection while you work at an affordable price, with rates as low as $6 per month. The best companies for rideshare insurance offer coverage as an add-on.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Mar 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Rideshare insurance offers valuable protection to drivers who work for rideshare companies like Lyft and Uber by filling in the gaps in their coverage.

Although some rideshare companies offer coverage to their drivers while they’re working, it doesn’t cover everything. With rates starting as low as $6 per month, rideshare coverage fills in the gaps in your insurance at an affordable price.

Read on to explore insurance for rideshare drivers, including the best rideshare insurance companies to purchase from. Then, enter your ZIP code into our free comparison tool to see rideshare rates in your area.

- Rideshare insurance fills in the gaps in your policy to protect you while you work

- The best companies for rideshare insurance offer coverage at low prices

- Rideshare car insurance is different than commercial auto coverage

What Rideshare Insurance Covers

Rideshare insurance is designed to fill the coverage gaps between a driver’s personal auto insurance and the insurance for Uber drivers and Lyft workers provided by the rideshare companies.

Standard personal auto policies typically exclude coverage for commercial driving activities, which can leave drivers unprotected.Jeff Root Licensed Insurance Agent

Rideshare insurance ensures continuous coverage by bridging these gaps. Rideshare insurance can include the following protections:

- Liability Coverage: Liability auto insurance covers injuries and property damage caused to others while driving for a rideshare company.

- Collision Coverage: Collision auto insurance pays for your repair bills after an accident, no matter who was at fault.

- Comprehensive Coverage: Comprehensive auto insurance pays for damage to the driver’s vehicle due to fire, theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Uninsured/underinsured motorist coverage protects the driver if they are hit by someone who lacks sufficient insurance.

- Medical Payments (MedPay) or Personal Injury Protection (PIP): MedPay coverage and personal injury protection insurance help cover medical expenses for the driver and passengers regardless of fault.

By securing a rideshare insurance policy, drivers can protect themselves from unexpected expenses and ensure they have continuous coverage throughout all phases of their rideshare activity.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Rideshare Insurance Costs

Finding cheap rideshare insurance is usually easy when you know which companies offer the best deals. The best rideshare insurance companies offer affordable coverage, but you should still compare quotes before you sign up for a policy. That’s especially true if you need a new car insurance policy.

Take a look below to see how much rideshare insurance might cost you, depending on which company you get your coverage from.

Rideshare Insurance Monthly Cost by Provider

| Insurance Company | Monthly Cost |

|---|---|

| $20 | |

| 15% | |

| $66 | |

| $15 | |

| $25 | |

| $27 | |

| $38 | |

| $10 | |

| 20% | |

| $6 |

The best auto insurance companies offer rideshare insurance as an add-on for your personal policy and only charge you a percentage of your premium, which is why rates are so low. State Farm, American Family, and USAA are among the cheapest rideshare car insurance providers.

To compare companies, you’ll need personalized quotes. Getting a personalized quote is easy—simply visit the website of a company you’re interested in and fill out its quote request form. It takes about 15 minutes, and you’ll need some basic information like your driver’s license number and VIN.

Repeat that process with as many companies as possible to compare rates. If you’d like to save time, you can also enter your ZIP code into our free comparison tool to compare insurance providers in your area.

How Rideshare Insurance Works

Rideshare insurance supplements a driver’s personal auto policy and provides coverage during rideshare activities that would otherwise be excluded. Personal auto insurance does not cover commercial driving, and rideshare companies’ policies have gaps in coverage.

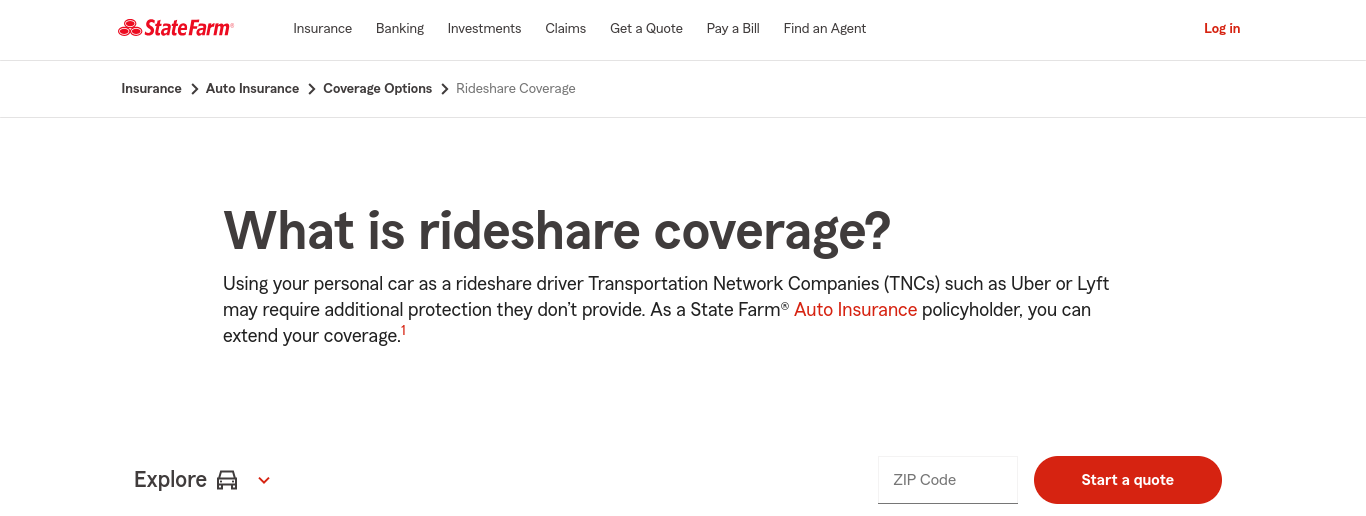

Rideshare insurance bridges these gaps for continuous protection. Rideshare insurance policies typically cover the different phases of a rideshare trip:

- App Off (Personal Driving): When the rideshare app is turned off, the driver’s personal auto insurance policy is in effect.

- App On, No Passenger Matched (Period 1): When a driver is waiting for a request, personal auto policies do not provide coverage. Rideshare companies offer limited liability coverage but don’t often include collision or comprehensive. A rideshare insurance policy can extend coverage during this period.

- En Route to Pick Up (Period 2): Once a driver has accepted a ride request and is on the way to pick up the passenger, the rideshare company’s insurance provides liability coverage, but comprehensive and collision coverage may not apply.

- Passenger in Vehicle (Period 3): When a passenger is in the vehicle, the rideshare company’s policy provides primary liability coverage, but the driver may need additional coverage for personal injury or damage to their own vehicle. A rideshare insurance policy can help ensure full protection.

Some rideshare insurance policies even offer coverage beyond the minimum liability requirements set by rideshare companies, helping drivers avoid potential financial risks in case of accidents or damages.

Drivers can purchase rideshare insurance as an endorsement to their personal policy or as a standalone policy, depending on the insurer. The policy activates when the rideshare app is on and continues to provide protection until the ride ends.

It is important for drivers to check with their insurance provider to understand how their rideshare insurance policy interacts with their personal and rideshare company coverage. This ensures they are adequately protected and not left with unexpected expenses in the event of an incident.

Read more: Best Auto Insurance Discounts for Uber Drivers

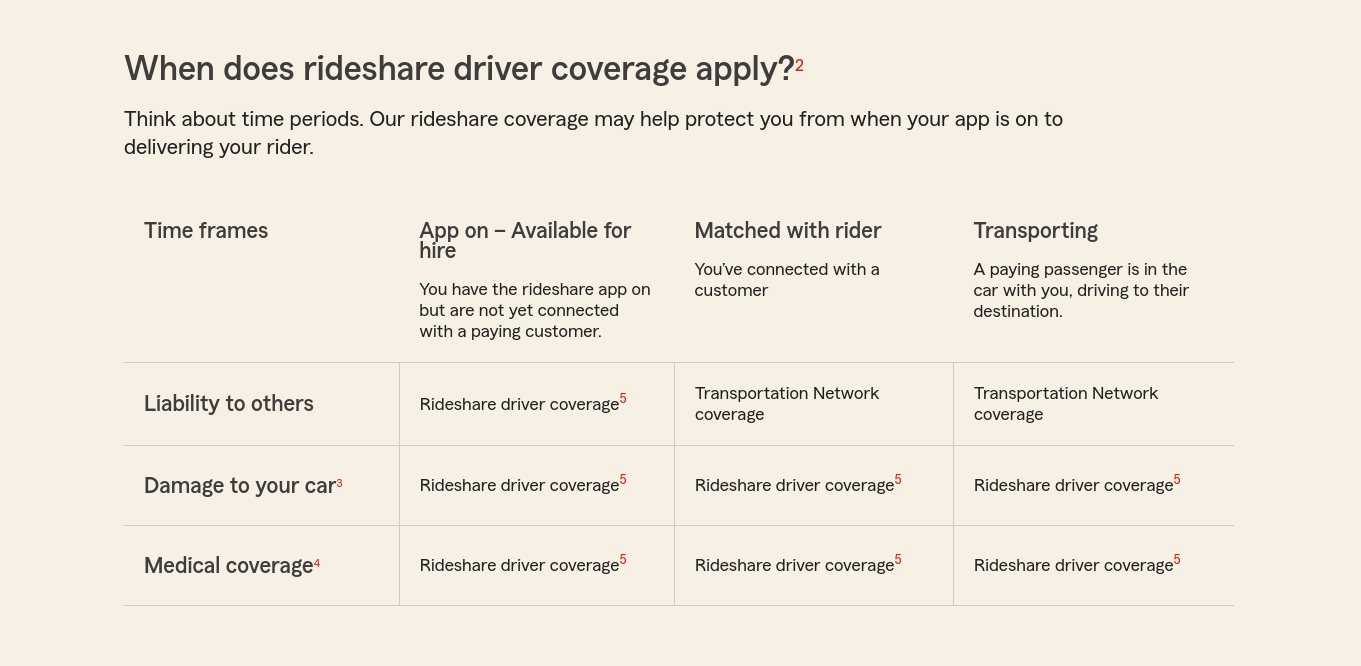

Difference Between Rideshare Insurance and Personal Coverage

The key difference between personal car insurance and rideshare insurance is that personal car insurance only covers private, non-commercial driving, while rideshare insurance fills the gaps when a driver is using their vehicle for a rideshare service like Uber or Lyft.

While there are many types of auto insurance that cover everyday driving, personal insurance typically excludes coverage when the driver is engaged in commercial activities. Rideshare insurance, on the other hand, provides coverage when the rideshare app is on but before a passenger is in the car — important period that is often not covered by either personal insurance or the rideshare company’s policy.

Difference Between Rideshare Insurance and Commercial Insurance

The main difference between commercial car insurance and rideshare insurance is the scope of coverage and intended use.

Commercial car insurance is designed for vehicles used primarily for business purposes, such as delivery services, company-owned fleets, or contractors who rely on their vehicles for work. The best commercial auto insurance companies provide broader coverage, including liability, physical damage, and employee use.

While you often can use commercial car insurance to cover you while you do rideshare work, it usually costs more than rideshare insurance.Michelle Robbins Licensed Insurance Agent

Rideshare insurance for Lyft drivers and Uber workers specifically covers personal vehicles used for ridesharing services. It fills the coverage gaps between personal auto policies and the rideshare company’s insurance, typically covering periods when the app is on but no passenger is in the car. Unlike full commercial insurance, it is tailored for part-time or gig drivers rather than full business operations.

Find the Best Rideshare Insurance Coverage Today

Working for a rideshare company is a great way to earn extra money, but you should ensure you’re covered while you’re driving. Rideshare insurance keeps you safe while you’re driving, no matter who you have — or don’t have — in your vehicle, all for an affordable price.

Thinking about becoming a driver for a rideshare service? These tips may help you prepare for the job: https://t.co/eCtGzBef6b pic.twitter.com/eUuK28cgcl

— Allstate (@Allstate) July 15, 2017

Although rideshare insurance is usually cheap, you’ll need an existing policy to add rideshare coverage. To get multiple auto insurance quotes for a personal policy with rideshare auto insurance, enter your ZIP code into our free tool today.

Frequently Asked Questions

What is rideshare insurance?

Rideshare insurance is a specialized policy that fills the coverage gaps between a driver’s personal auto insurance and the insurance provided by rideshare companies like Uber and Lyft. It ensures continuous protection during all phases of a rideshare trip, covering periods that may not be included in other policies.

Is rideshare insurance worth it?

Yes, if you drive for a rideshare company, rideshare insurance is worth purchasing to cover periods when your personal auto policy won’t apply, and the rideshare company’s coverage is limited. Without it, you could face coverage gaps that leave you financially vulnerable in case of an accident.

Does Uber provide insurance for its drivers?

Yes, there is Uber car insurance provided to drivers, but coverage varies depending on whether the app is on, a ride request has been accepted, or a passenger is in the vehicle. Uber doesn’t have additional rideshare insurance requirements, but most drivers still need additional coverage, as Uber’s policy does not cover all damages in every situation. You’ll also need to meet Uber’s car requirements before you can drive.

How much is Progressive rideshare insurance per month?

Progressive offers rideshare insurance in many states, with rates starting as low as $38 per month. Progressive’s rideshare insurance provides coverage for drivers during the time when the rideshare app is on but before a passenger is in the car. This helps eliminate gaps between personal and rideshare company-provided coverage. See other types of coverage you can purchase in our Progressive auto insurance review.

How much is rideshare insurance?

Rideshare insurance typically costs an additional $10 to $30 per month, depending on the insurer, location, and coverage level. The exact price varies based on factors such as driving history, vehicle type, and state regulations. To see how much rideshare insurance will cost you, enter your ZIP code into our free comparison tool.

Which companies offer the best rideshare insurance?

Some of the top rideshare insurance providers include Geico, State Farm, Progressive, Allstate, and Farmers. The best option depends on factors like coverage availability in your state, cost, and policy flexibility. For example, Geico rideshare insurance is a great option for drivers looking for cheap auto insurance, while Allstate rideshare insurance is best if you need full coverage.

Does State Farm offer rideshare insurance?

State Farm rideshare insurance is an endorsement that extends a driver’s personal auto policy to cover certain rideshare activities. This helps drivers avoid coverage gaps when using their vehicles for both personal and commercial purposes. Check out our State Farm auto insurance review to learn more.

Do you need to tell your insurance company that you’re a rideshare driver?

Yes, you should inform your insurance company if you drive for a rideshare service, as failing to do so could result in denied claims or policy cancellation. Many insurers offer rideshare endorsements to ensure proper coverage.

Does personal insurance cover you while you’re driving for rideshare?

No, personal auto insurance typically does not cover rideshare activities because they are considered commercial use. Most policies exclude coverage once you turn on the rideshare app, making additional rideshare insurance necessary.

What is commercial auto insurance?

Commercial auto insurance is a type of policy designed for vehicles used for business purposes, including rideshare and delivery driving. It provides higher liability limits and broader coverage than personal auto insurance to protect businesses and independent contractors.

Can you drive for Lyft without rideshare insurance?

While there are Lyft vehicle requirements you need to be aware of, there are no additional Lyft car insurance requirements. You’ll need a personal insurance policy to drive, and Lyft provides a small amount of insurance to protect itself in case you injure one of its customers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.