Best Glendale, Arizona Auto Insurance in 2025 (Find the Top 10 Companies Here!)

State Farm, USAA, and Progressive stand out as the best Glendale, Arizona auto insurance providers, offering competitive monthly rates as low as $80. These providers combine cost-effective pricing and diverse coverage choices, making them the go-to option for drivers looking for dependable insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated March 2025

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage in Glendale Arizona

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 6,590 reviews

6,590 reviewsCompany Facts

Full Coverage in Glendale Arizona

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage in Glendale Arizona

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsThe best Glendale, Arizona auto insurance providers are State Farm, USAA, and Progressive, offering competitive rates starting at $80 a month, balancing affordability, coverage options, and customer satisfaction.

State Farm emerges as the top pick for its reliable service and competitive pricing. USAA is a strong contender for military families, providing exceptional value and tailored benefits. Gain deeper insights by perusing our article named “Best Phoenix, Arizona Auto Insurance

Our Top 10 Company Picks: Best Glendale, Arizona Auto Insurance| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | B | Extensive Network | State Farm | |

| #2 | 15% | A++ | Military Focus | USAA | |

| #3 | 12% | A+ | Coverage Options | Progressive | |

| #4 | 20% | A | Customizable Policies | Farmers | |

| #5 | 12% | A++ | Personalized Service | Auto-Owners | |

| #6 | 13% | A+ | Full Coverage | Nationwide |

| #7 | 18% | A++ | Versatile Coverage | Travelers | |

| #8 | 8% | A+ | Senior Discounts | The Hartford |

| #9 | 15% | A+ | Robust Programs | Allstate | |

| #10 | 11% | A | Discount Variety | Liberty Mutual |

Progressive stands out for its innovative tools and discount opportunities. These providers excel in delivering quality protection, making them the best choices for drivers in Glendale, Arizona. Use our free comparison tool to see what auto insurance quotes look like in your area.

- State Farm offers the best Glendale, Arizona auto insurance at $85/month

- USAA and Progressive provide tailored coverage and discounts in Glendale, Arizona

- Select the best Glendale, Arizona auto insurance for quality and value

#1 – State Farm: Top Overall Pick

Pros

- Strong Local Presence: State Farm has a significant presence in Glendale, Arizona, providing personalized service and easy access to local agents.

- Comprehensive Coverage Options: State Farm offers a wide range of coverage options tailored to the needs of drivers in Glendale, Arizona.

- Reliable Customer Service: Known for its excellent customer service, State Farm is highly rated by customers in Glendale, Arizona. Gain deeper understanding through our article entitled “State Farm Auto Insurance Review.”

Cons

- Higher Premiums: State Farm’s premiums in Glendale, Arizona, can be higher than those of some competitors.

- Limited Discounts: While discounts are available, they may not be as extensive as those offered by other insurers in Glendale, Arizona.

#2 – USAA: Best for Military Savings

Pros

- Exclusive Military Benefits: USAA offers specialized services and discounts for military members and their families in Glendale, Arizona.

- Highly Rated Customer Satisfaction: USAA consistently receives high marks for customer satisfaction in Glendale, Arizona.

- Competitive Rates: USAA is known for offering competitive rates to eligible members in Glendale, Arizona. Find out more by reading our article titled “USAA Auto Insurance Review.“

Cons

- Eligibility Restrictions: USAA is only available to military members, veterans, and their families in Glendale, Arizona, limiting accessibility.

- Limited Local Offices: USAA may have fewer physical locations in Glendale, Arizona, compared to other insurers.

#3 – Progressive: Best for Innovative Coverage

Pros

- Innovative Online Tools: Progressive offers a variety of online tools and apps, making it easy for Glendale, Arizona, customers to manage their policies.

- Snapshot Program: Glendale, Arizona, drivers can benefit from Progressive’s Snapshot program, which rewards safe driving habits with discounts.

- Wide Range of Discounts: Progressive offers numerous discounts, helping Glendale, Arizona, drivers save on their premiums. Broaden your knowledge with our article named “Progressive Auto Insurance Review.”

Cons

- Mixed Customer Service Reviews: Progressive’s customer service in Glendale, Arizona, can be inconsistent, with some customers reporting dissatisfaction.

- Potentially Higher Rates After Claims: Glendale, Arizona, drivers might see significant rate increases after filing a claim with Progressive.

#4 – Farmers: Best for Personalized Protection

Pros

- Customizable Coverage: Farmers offers highly customizable coverage options, allowing Glendale, Arizona, drivers to tailor their policies.

- Strong Agent Network: Farmers has a robust network of local agents in Glendale, Arizona, providing personalized service. Explore further with our article entitled “Farmers Auto Insurance Review.”

- Accident Forgiveness: Glendale, Arizona, drivers can benefit from Farmers’ Accident Forgiveness program, which helps keep rates stable after an accident.

Cons

- Higher Premiums: Farmers’ policies in Glendale, Arizona, can be more expensive than some competitors.

- Average Claims Satisfaction: Some customers in Glendale, Arizona, report that the claims process with Farmers is average, with room for improvement.

#5 – Auto-Owners: Best for Reliable Service

Pros

- Strong Financial Stability: Auto-Owners is known for its financial strength, providing peace of mind to customers in Glendale, Arizona.

- Excellent Claims Service: Auto-Owners has a reputation for fast and fair claims handling in Glendale, Arizona.

- Personalized Service: Auto-Owners offers personalized service through independent agents in Glendale, Arizona. Gain insights by reading our article titled “Auto-Owners Auto Insurance Review.”

Cons

- Limited Online Tools: Auto-Owners may not offer as many online tools and resources as other insurers in Glendale, Arizona.

- Availability: Auto-Owners may have limited availability in certain areas of Glendale, Arizona.

#6 – Nationwide: Best for Flexible Plans

Pros

- Vanishing Deductible: Nationwide offers a vanishing deductible program that benefits safe drivers in Glendale, Arizona.

- Strong Financial Ratings: Nationwide is financially strong, offering security to customers in Glendale, Arizona.

- Wide Range of Discounts: Nationwide provides various discounts that help Glendale, Arizona, drivers save on their premiums. Deepen your understanding with our article called “Nationwide Auto Insurance Review.”

Cons

- Higher Rates for High-Risk Drivers: High-risk drivers in Glendale, Arizona, may face higher premiums with Nationwide.

- Mixed Customer Service: Nationwide’s customer service in Glendale, Arizona, has received mixed reviews, with some customers reporting dissatisfaction.

#7 – Travelers: Best for Securing Insurance

Pros

- Comprehensive Coverage Options: Travelers offers a variety of coverage options for Glendale, Arizona, drivers, including specialized policies. For further details, consult our article named “Travelers Auto Insurance Review.”

- Strong Financial Stability: Travelers is known for its financial strength, providing confidence to customers in Glendale, Arizona.

- Good Discount Programs: Travelers provides several discounts that can help Glendale, Arizona, drivers save money on their policies.

Cons

- Higher Premiums: Travelers’ rates in Glendale, Arizona, may be higher than those of some competitors.

- Limited Local Agent Network: Travelers may have fewer local agents in Glendale, Arizona, compared to other insurers.

#8 – The Hartford: Best for AARP Benefits

Pros

- AARP Partnership: The Hartford offers exclusive benefits and discounts to AARP members in Glendale, Arizona.

- Strong Customer Satisfaction: The Hartford is known for its excellent customer satisfaction ratings in Glendale, Arizona. Discover more by delving into our article entitled “The Hartford Auto Insurance Review.”

- Accident Forgiveness: Glendale, Arizona, drivers can benefit from The Hartford’s accident forgiveness program, which helps prevent rate increases after an accident.

Cons

- Higher Rates for Non-AARP Members: Non-AARP members in Glendale, Arizona, may face higher premiums with The Hartford.

- Limited Availability for Younger Drivers: The Hartford may not be the best option for younger drivers in Glendale, Arizona, as it focuses on older drivers.

#9 – Allstate: Best for Comprehensive Care

Pros

- Extensive Local Agent Network: Allstate has a strong network of local agents in Glendale, Arizona, offering personalized service.

- Innovative Tools: Allstate provides various online tools and apps that make managing insurance policies easy for Glendale, Arizona, customers. Get a better grasp by reading our article titled “Allstate Auto Insurance Review.”

- Accident Forgiveness: Glendale, Arizona, drivers can take advantage of Allstate’s accident forgiveness program, which helps keep rates stable after an accident.

Cons

- Higher Premiums: Allstate’s premiums in Glendale, Arizona, can be higher compared to other insurers.

- Mixed Claims Satisfaction: Some customers in Glendale, Arizona, report dissatisfaction with the claims process at Allstate.

#10 – Liberty Mutual: Best for Custom Coverage

Pros

- Customizable Policies: Liberty Mutual offers a variety of customizable coverage options for Glendale, Arizona, drivers. Uncover additional insights in our article called “Liberty Mutual Auto Insurance Review.”

- Good Discount Programs: Liberty Mutual provides a range of discounts, helping Glendale, Arizona, drivers save on their premiums.

- Strong Financial Stability: Liberty Mutual is financially strong, offering security to customers in Glendale, Arizona.

Cons

- Higher Rates for Some Drivers: Glendale, Arizona, drivers with certain profiles may find Liberty Mutual’s premiums higher than those of competitors.

- Mixed Customer Service Reviews: Liberty Mutual’s customer service in Glendale, Arizona, has received mixed reviews, with some customers reporting issues.

Glendale, Arizona Auto Insurance Monthly Rates by Coverage Level & Provider

Looking for the best auto insurance in Glendale, Arizona? Understanding how rates vary by coverage level and provider is key to finding the right fit. This guide breaks down monthly premiums across top providers, helping you make an informed decision tailored to your needs.

Glendale, Arizona Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $89 | $193 |

| Auto-Owners | $87 | $195 |

| Farmers | $95 | $210 |

| Liberty Mutual | $93 | $205 |

| Nationwide | $88 | $185 |

| Progressive | $90 | $200 |

| State Farm | $85 | $190 |

| The Hartford | $92 | $205 |

| Travelers | $85 | $203 |

| USAA | $80 | $180 |

Discover which companies offer the best value for your coverage preferences in Glendale, Arizona. Dive into the details with our article entitled “Cheap Auto Insurance in Arizona.”

Auto Insurance Discounts From the Top Providers in Glendale, Arizona

Unlocking the best auto insurance discounts can significantly reduce your premiums in Glendale, Arizona. This guide highlights the top providers offering a variety of discounts, helping you save while maintaining quality coverage.

Explore the options available and find the most valuable savings opportunities from Glendale’s leading insurers. Explore further in our article titled “Best Mesa, Arizona Auto Insurance.”

The Cost of Car Insurance in Glendale

Car insurance rates often increase yearly for various reasons, which can be frustrating for drivers. In Glendale, the average annual premium is reflective of these trends. However, qualifying for discounts can significantly reduce your costs, meaning your financial situation may vary.

The city you live in plays a crucial role in determining your insurance rates, making it important to compare Glendale, Arizona, with other top U.S. metro areas.

It’s not all about the money, though. You might find other aspects of car insurance are essential, such as the types of coverage you need for the most protection. We’ll go over those, together with the biggest factors involved in setting rates. Let’s find out more about them below.

Enhance your knowledge by reading our “Best Flagstaff, Arizona Auto Insurance.”

Male vs. Female vs. Age

Data USA statistics show the average age in Glendale is 34. By then, many drivers have accrued several years of experience and may pay less for car insurance. These states no longer use gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, and North Carolina, Pennsylvania.

But age is still a big factor because young drivers are considered high-risk drivers in Glendale. Arizona does use gender, so check out the average monthly auto insurance rates by age and gender in Glendale, AZ.

Glendale, Arizona auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

Best car insurance company in Glendale

The level of customer service a company offers, together with discounts, coverage options, and reviews, can influence which company you consider to be the best. The cheapest Glendale, AZ auto insurance company can be discovered below.

Let’s look more closely at other factors that can affect your rates and help you find the right car insurance company for your needs. Expand your understanding with our article called “Best Pay-As-You-Go Auto Insurance in Arizona.”

Car Insurance Factors in Glendale

We’ve seen how much some of the major insurance companies emphasize certain aspects of a driver’s life and habits to set their car insurance rates. Now, in this section, we’ll look more closely at other factors, such as the local economy, your earnings, education level, and your job.

Factors affecting auto insurance rates in Glendale, AZ may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Glendale, Arizona auto insurance. Uncover more by delving into our article entitled “Sun City West, AZ Auto Insurance.”

Metro Report: Growth and Prosperity

The Brookings Institution’s Metro Monitor ranks Phoenix-Mesa-Scottsdale 12th for economic growth and 51st for prosperity out of 100 U.S. cities. While growth is strong, productivity, wages, and living standards are closer to the national average and could improve. Deepen your understanding with our article called “Best Prescott Valley, Arizona Auto Insurance.”

Let’s look more closely at the statistics:

Prosperity

Prosperity reflects changes in the average wealth and income an economy generates. When worker productivity drives a metropolitan area’s growth through innovation or training, the value of their labor increases.

From 2007 to 2017, the area experienced modest growth: productivity rose by 0.5% (67th out of 100), the standard of living increased by 1.4% (58th out of 100), and the average annual wage grew by 1.2% (38th out of 100). All sectors of prosperity saw slight improvements, with the standard of living showing the highest gain.

Growth

Growth indicators measure the change in the size of an urban area’s economy and its entrepreneurial activity, creating new opportunities and enhancing metro efficiency.

From 2007 to 2017, the Phoenix-Mesa-Scottsdale area saw notable growth: jobs increased by 2.8% (12th out of 100), gross metropolitan product (GMP) rose by 3.3% (23rd out of 100), and jobs at young firms surged by 7.9% (16th out of 100).

Like prosperity metrics, all sectors showed positive growth, with GMP and jobs at young firms leading the way. Next, we’ll explore how this economic growth influences Glendale residents’ incomes, occupations, and homeownership levels.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

Median Household Income

As of 2017, Data USA reports that Glendale households had a median monthly income of approximately $342 (which was well below the U.S. average of about $5,028). The average monthly income grew 5 percent from approximately $325 in 2016.

Based on the 2017 median monthly income, the average driver in Glendale paid 8.5 percent of their earnings to car insurance. Learn more about our “Glendale, CA Auto Insurance” for a broader perspective.

Homeownership in Glendale

Homeownership shows that a driver may be more reliable and able to pay car insurance premiums. If you own a home, you could pay less for car insurance than if you rent. To save more, homeowners can also bundle their car and home insurance.

Data USA numbers reveal that from 2016 to 2017, 54 percent of the housing units in Glendale were owner-occupied. The percentage of owner-occupation is lower than the national average of 64 percent. Elevate your knowledge with our “Best Arizona Auto Insurance.”

Education in Glendale

In 2016, Glendale’s universities awarded 6,269 degrees, with Glendale Community College leading at 66%. Midwestern University-Glendale and Arizona Automotive Institute followed, contributing to the city’s educational landscape.

Popular majors include liberal arts, business administration, and EMT. Community colleges offer a cost-effective alternative with diverse programs, making higher education accessible to more students in Glendale. Get the full story by checking out our “Best Peoria, Arizona Auto Insurance.”

Wage by Race and Ethnicity in Common Jobs

In 2017, the highest-paid race/ethnicity of Arizona workers was Asian. These workers were paid 1.22 times more than whites, who made the second-highest salary of any race/ethnicity. Here’s how much the top three races/ethnicities earned in Arizona and the percentage of their incomes that paid for car insurance:

| Race or Ethnicity | Monthly Salary | Percentage of Income Going to Car Insurance |

|---|---|---|

| Asian | $4,949 | 7.07% |

| White | $4,071 | 8.59% |

| Native American | $3,403 | 10.28% |

The lowest-paid race/ethnicity, Native Americans, paid more than 10 percent of their wages toward insuring their cars. For further details, consult our article named “Best Auto Insurance for Seniors in Arizona.”

Wage by Gender in Common Jobs

In 2017, full-time male employees in Arizona made 1.31 times more than females. Their average monthly earnings amounted to $5,052, while females made $3,847. Based on their incomes and the average monthly cost of car insurance ($349.74), males paid 7 percent of their incomes, and females paid 9 percent for car insurance.

Find out more by reading our “Best Tucson, Arizona Auto Insurance.”

Poverty by Age and Gender

Data USA reports that 20 percent of Glendale residents live below the poverty line, which is higher than the national average of 13 percent. The largest demographic living in poverty are females ages 25-34, followed by females ages 35-44 and young males ages 6-11.

State Farm offers unbeatable value and reliability, making it the top choice for auto insurance in Glendale, Arizona.Heidi Mertlich Licensed Insurance Agent

The U.S. Census Bureau uses a set of money income thresholds that vary by family size and composition to determine who classifies as impoverished. If a family’s total income falls below its limits, the Census Bureau classifies that family as living in poverty.

Employment by Occupations

From 2016 to 2017, per Data USA figures, employment in Glendale grew at a rate of 1 percent. The most common job groups, by the number of people living in Glendale, are office and administrative support occupations (16,649 people), sales and related jobs (12,408 people), and management occupations (9,136 people).

Discover more by delving into our article entitled “Best Windshield Replacement Coverage in Arizona.”

Driving in Glendale

Glendale might not have the most congested traffic, but as you head into Phoenix, you can get stuck in some long lines. Traffic jams can turn an enjoyable drive into an annoying trip pretty quickly.

To reduce your stress, we’ll cover the essential aspects of Glendale’s roadways: major highways, pavement conditions, traffic laws, and popular road trips. Unlock additional information in our “Wickenburg, AZ Auto Insurance.”

Keep reading to find out more.

Roads in Glendale

What are the roads like in Glendale? Will you need to pay tolls? Will a speeding or red light camera catch you? We’ll answer all these questions and more below.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code in our free quote comparison tool.

Major Highways

Arizona has six active highways spanning 1,168.64 miles, with major routes in Glendale including Arizona State Route 101 and U.S. 60. The absence of toll roads in the state reduces travel frustrations, making commuting smoother for residents.

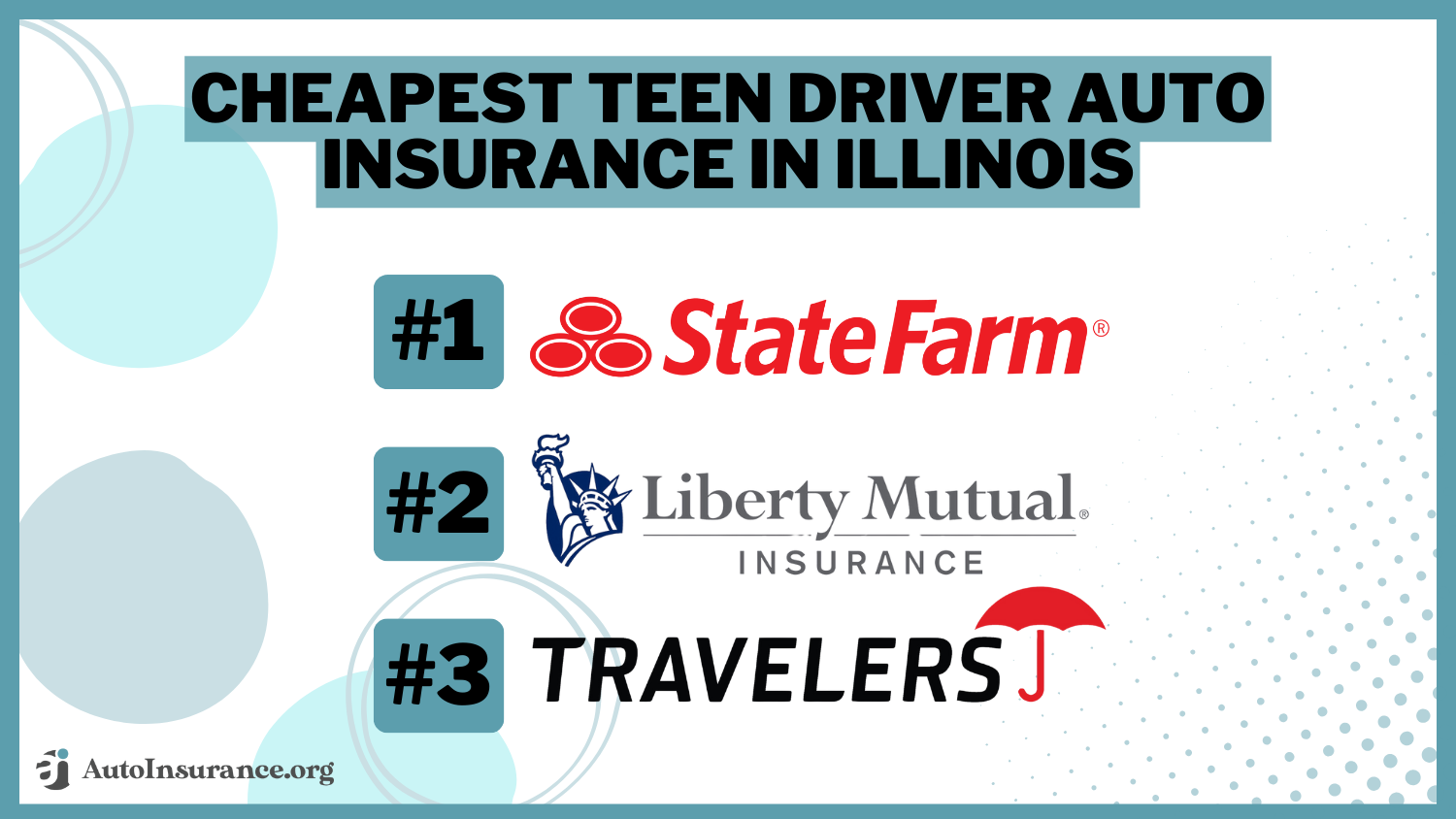

These highways provide crucial connections throughout the state, supporting efficient travel and access to key destinations. Get a better grasp by reading our article titled “Cheapest Teen Driver Auto Insurance in Arizona.”

Popular Road Trips/Sites

As part of the greater Phoenix area, Glendale offers unique experiences such as charming apple orchards, including a local farm featured among Arizona’s best. The city also hosts special events and festivals throughout the year, providing vibrant entertainment options.

From arts and culture to parks and recreation, Glendale offers a diverse range of activities for both visitors and residents to enjoy, making it a dynamic place to explore.

Vehicles in Glendale

Next, we’ll explore the most popular cars owned in the area, providing insights into local preferences and trends. We’ll also delve into car ownership statistics to understand the demographic distribution.

Additionally, we’ll examine crime rates, including vehicle thefts, to give a comprehensive overview of safety and security related to car ownership in the region. This information will offer valuable context for residents and prospective buyers alike.

Unlock additional information in our “Why does auto insurance vary from state to state?“

Most Popular Vehicles Owned

YourMechanic tracks the types of cars it services nationwide and breaks down the information by each major city to show Americans’ car preferences. According to their survey, 47 percent of the cars they repair in nearby Phoenix are American-made. The Nissan 350Z, produced for only six years until the 2009 model year, is the most popular car.

The video below goes into more detail about this car:

The sporty roadster was known for its smooth handling, especially in turns, and its sleek, stylish look. Regarding safety, the National Highway Traffic Safety Administration (NHTSA) gave the 2009 edition four- and five-star ratings in frontal crash tests.

Uncover additional insights in our article called “Maricopa, AZ Auto Insurance.”

How Many Cars Per Household

Data USA statistics reveal that most Glendale households own two cars, followed by one car, aligning with national averages. This pattern reflects a common trend in suburban areas, where multiple vehicle ownership is typical due to commuting needs and family transportation.

Understanding these ownership trends helps paint a clearer picture of local transportation dynamics and can influence decisions on vehicle-related services and policies. Access supplementary details in our “Nogales, AZ Auto Insurance.”

Speed Traps in Glendale

Speedtrap.org, which tracks user-reported speed traps across the U.S., highlights Grand Ave. and 75th Avenue near the 101 Loop in Glendale as the most debated locations. Adhering to speed limits in these areas helps avoid speed traps, potential penalties, and ensures safety for everyone on the road.

Enhance your comprehension with our “Cheap Auto Insurance for High-Risk Drivers in Arizona.”

Vehicle Theft in Glendale

The Federal Bureau of Investigation (FBI) reports that in 2017, 1,163 vehicle thefts occurred in Glendale. Neighborhood Scout also tracks crime statistics for U.S. cities. The site gives Glendale a crime index of five, which means it’s 5 percent safer than other U.S. cities.

In Glendale, your chances of being a victim of a violent crime are one in 203. That’s only slightly worse than the statewide average of one in 197. Obtain further insights from our “Nogales, AZ Auto Insurance.”

Traffic Congestion in Glendale

This section features information about traffic congestion in the Phoenix metropolitan area, the busiest highways, and the safety of the streets and roads. Access the complete picture in our “10 Best Auto Insurance Companies.”

Glendale Traffic Delays

Glendale itself might occasionally experience traffic jams during special events, such as when the Super Bowl was held there in 2015. But, if you wander into Phoenix, it’s a whole different ball game.

Though Phoenix is the fifth-largest U.S. city, it ranks 125th worldwide for congestion. But, it’s not among the worst offenders on Inrix’s Traffic Scorecard. At 73 hours of commute time wasted in traffic, nationwide, the city ranks 25th.

Explore further details in our “Overgaard, AZ Auto Insurance.”

Transportation

On average, Data USA reports that Glendale drivers spend 26.2 minutes on their commutes, which is longer than the typical U.S. worker (25.1 minutes). Additionally, nearly 2 percent of the Glendale workforce faces “super commutes” longer than 90 minutes.

In 2017, most commuters in Glendale drove alone (76 percent), followed by those who carpooled (13 percent). These figures match the U.S. average.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code in our free quote comparison tool.

Ridesharing

Glendale offers a variety of ridesharing services beyond traditional taxis. Blacklane provides luxury vehicles seating one to five people.

Lyft offers multiple options, including the budget-friendly Lyft for regular four-seat cars, Lyft Lux and Lyft Lux SUV for premium black car and SUV services, and Lyft Plus for larger groups with seating for six or more passengers. Lyft Premier is their luxury service, providing high-end four-seat cars.

Uber also has a range of options: Uber Black is the original luxury service with high-end sedans for up to four passengers, Uber Select offers a similar service with non-black cars at a slightly lower cost, Uber X is the budget option with four-seat cars, and Uber XL accommodates larger groups with seating for up to six.

E-star Repair Shops

A program from Esurance, E-star helps drivers find the best repair shops in their areas. According to E-star, these are the top 10 repair shops in and around Glendale:

- GERBER — TEMPE/UNIVERSITY DRIVE

2100 W. UNIVERSITY DR.

TEMPE, AZ 85281

email: [email protected]

P: (480) 774-9999

F: (480) 774-9997 - SERVICE KING 75th AVE.

16000 North 75th Ave.

PEORIA, AZ 85382

email: [email protected]

P: (623) 486-4810

F: (623) 486-3334

When your car needs repair, check out E-star shops to ensure you get quality service. Gain a deeper understanding through our “Does car insurance cover hurricane damage?“

Public Transit

The City of Glendale offers a range of convenient, low-cost transportation options that include fixed-route bus service (Glendale Dial-A-Ride), the Glendale Urban Shuttle (GUS), and a taxi voucher program. Transit hours are Monday through Friday, from 8 a.m. to 5 p.m.

Glendale Dial-A-Ride

Dial-A-Ride in Glendale offers transportation seven days a week, with same-day and reservation services available Monday through Friday. On weekends and holidays, service is by reservation only, and requests must be made by noon on the prior business day.

This service is limited to Glendale, and for travel to other cities in the region, passengers must use the Valley Metro Regional paratransit service, requiring eligibility through Valley Metro. Passengers must pay the exact fare in cash when boarding, as drivers do not carry change.

The fares for one-way rides are as follows: $5 for the general public (ages 14-64), $3 for paratransit or paratransit companions, $2 for seniors (65+), riders with disabilities, and juniors (ages 6-13), and free for children ages 0-5. Regional paratransit fares are $4.

Groups of four or more paying passengers can benefit from reduced rates, with the general public fare at $3 and $1 for seniors, disabled riders, and juniors. Riders must bring photo identification, and those eligible for reduced fares must present the Glendale Transit Reduced Fare Application signed by a physician.

Alternate Transportation

Pedago Electric Bikes offers convenient bicycle rentals across the area, allowing you to explore Glendale at your own pace. Prices vary by hour and day depending on the type of bike you choose, with options ranging from standard models to more advanced electric bikes.

Whether you’re planning a quick ride around town or a full day of sightseeing, Pedago has a bike rental option to suit your needs. Additionally, their fleet includes a variety of bikes suitable for different terrains, ensuring a comfortable and enjoyable ride for all.

Obtain further insights from our “Minimum Auto Insurance Requirements by State.”

Parking in Metro Areas

Several parking lots and garages are available throughout Glendale. ChargeHub lists the most popular electric car charging stations within 10 miles of Glendale. Some of them are free. Most of them are Level 2; however, some Level 3 charging stations are also available. The main charging networks are Blink and Volta.

Air Quality in Glendale

Vehicle exhaust pollution contributes to health issues and climate change, worsening when it interacts with other pollutants. Children and those with chronic illnesses are particularly at risk.

Below are the EPA air quality levels for Maricopa County (2016-2018), based on the Air Quality Index (AQI) for major pollutants, with standards designed to protect public health.

Air Quality (Maricopa County) - Glendale, Arizona| Maricopa County Air Quality Index (AQI) | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|

| Days with AQI | 366 | 365 | 365 | 365 | 366 | 365 | 365 | 365 | 365 |

| Days good | 59 | 51 | 54 | 47 | 48 | 54 | 50 | 44 | 51 |

| Days moderate | 270 | 250 | 247 | 233 | 224 | 250 | 255 | 280 | 272 |

| Days unhealthy for sensitive groups | 36 | 50 | 57 | 61 | 58 | 41 | 36 | 39 | 32 |

| Days unhealthy | 0 | 5 | 4 | 5 | 4 | 3 | 1 | 1 | 0 |

| Days very unhealthy | 1 | 0 | 3 | 2 | 1 | 0 | 0 | 0 | 0 |

AQI levels were steady, but unhealthy days for sensitive groups more than doubled. To improve air quality, ADEQ enforces the Vehicle Emissions Inspection Program (VEIP). Vehicles outside Phoenix and Tucson, new cars (for five years), and out-of-state vehicles may be exempt, as well as military members stationed elsewhere with proof.

Military/Veterans

If you’re an active member of the military or a veteran, it can be hard to find time to research car insurance discounts that may apply to you. What’s available, and with whom? To ease the task, we’ve collected the most crucial information you need about military discounts together with some facts about the military in Glendale.

Veterans by Service Period

Data USA figures show Glendale has a large population of military personnel who served in Vietnam, nearly two times more than any other conflict. Veterans of the recent Gulf War follow them. These statistics closely match the national numbers.

Military Bases Within an Hour

Luke Air Force Base’s mission is to train the world’s greatest F-16 fighter pilots and maintainers while it deploys air combat troops. It was named for Second Lieutenant Frank Luke Junior, the first aviator to be awarded the Medal of Honor. Luke’s 56th Fighter Wing was first activated on January 15, 1941, as the 56th Pursuit Group.

The 56th left for England on January 6, 1943. During the next two years, pilots of the 56th destroyed more enemy planes and listed more champions than any other group in the 8th Air Force, including the top two aces in Europe.

Military Discounts by Providers

If you are or were in the U.S. military, most car insurance companies will want to give back by serving you. Many of them offer military discounts. Below is a list of known providers who give military discounts. We excluded those who offer military discounts only to certain states.

Military Auto Insurance Discounts| Insurance Company | Savings Amount |

|---|---|

| 5% | |

| 15% | |

| 4% |

| 15% | |

| 60% off when deployed 15% for garaging on base |

USAA gives a 15 percent military garage discount for garaging cars on a military base. Access the complete picture in our “Auto Insurance Laws.”

Unique City Laws

With lots of laws on the books, it’s impossible to remember all of them. What you don’t know could hurt you. If you’re not aware of the most important ones, you could break a law without realizing it.

To help you obey the rules, we’ll go over some laws specific to Glendale: hands-free laws, food truck laws, tiny home laws, and parking regulations. Discover what lies beyond with our “Compare Cheap Online Auto Insurance Quotes.”

Keep reading to find out what’s legal and illegal in Glendale.

Hands-Free Laws

The IIHS reports that Arizona currently only bans new drivers from using hand-held devices during the first six months after licensing.

Regardless, the City of Glendale passed a law in January 2019 that lets law enforcement officers pull drivers over for using handheld devices, even if they’re stopped at a red light. Fines can cost offenders as much as $250.

Food Trucks

Food truck operators must get a peddler’s license and a vending permit. They also need to have a fire department inspect their vehicle before they open for business unless they have already passed inspection in another Arizona city within the past year.

Vendors who operate in city parks and downtown must also follow certain guidelines, which include only selling food for immediate consumption, fresh-cut flowers, or inflated balloons. They must also show their license, permit, and identification card.

Tiny Homes

Tiny homes appeal to people who want to simplify their lives. Before you abandon standard housing, you should be aware that these homes often must meet specific regulations.

A tiny house is often considered a mobile home and must comply with the same laws. Glendale city codes include standards for manufactured homes and limits on the location and parking of mobile homes or recreational vehicles.

Parking Laws

Glendale requires drivers to park vehicles parallel to the edge of the roadway facing traffic, with the right wheels within 18 inches of the curb or side of the road.

Car Insurance You Need in Glendale

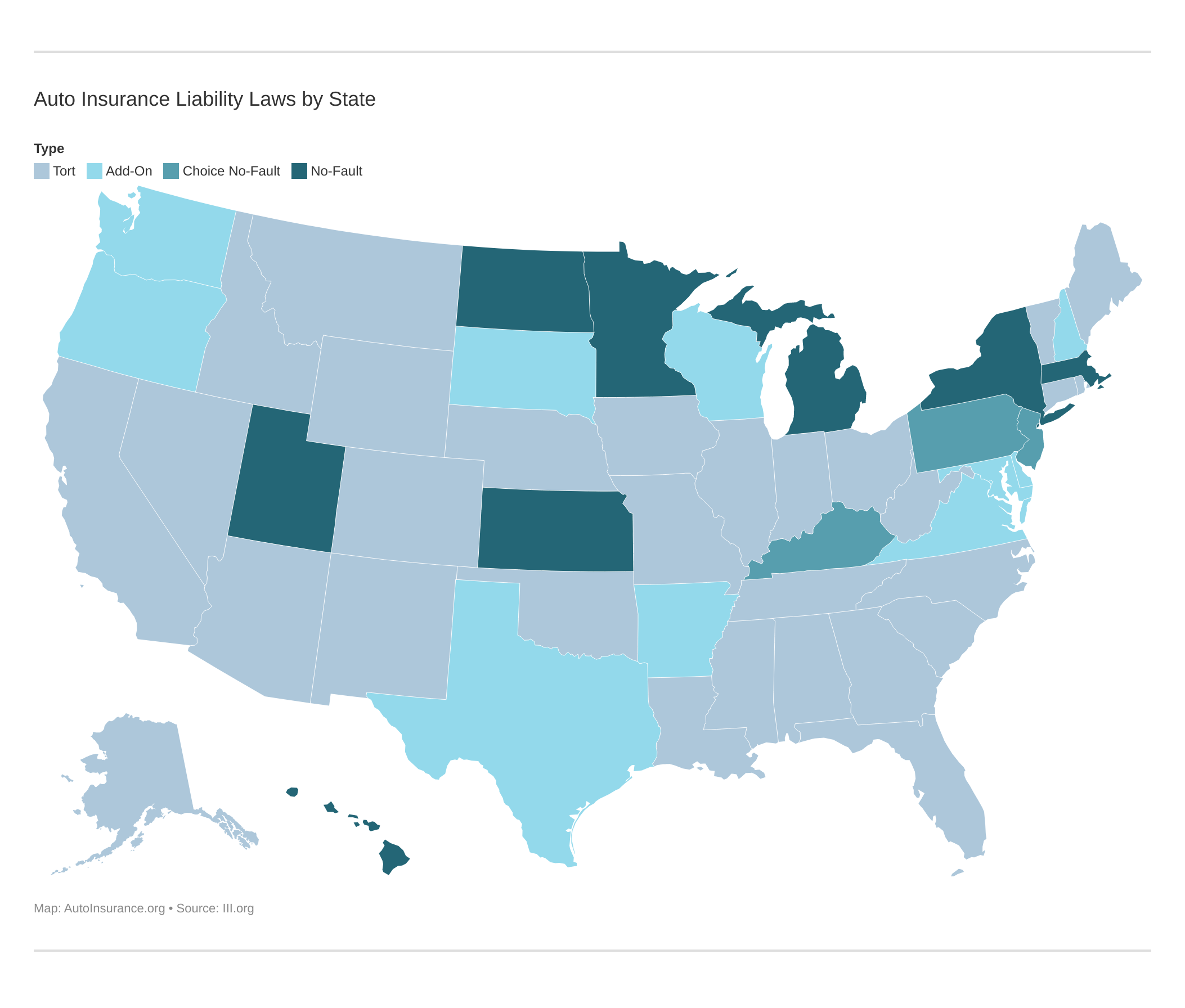

When driving in Glendale, having the right car insurance is crucial to protect yourself and your vehicle. California law requires all drivers to carry liability insurance, which covers the costs of injuries or property damage you may cause to others in an accident.

However, given Glendale’s busy roads and high rate of car ownership, you might also want to consider additional coverage options.

Comprehensive insurance can protect your vehicle against non-collision-related incidents like theft, vandalism, or natural disasters, while collision insurance covers the cost of repairs if you’re involved in an accident, regardless of fault.

Uninsured/underinsured motorist coverage is also valuable, as it protects you if you’re hit by a driver who lacks adequate insurance. Ensuring you have the right mix of coverage can give you peace of mind as you navigate Glendale’s streets.

Discover what lies beyond with our “Best Auto Insurance for Out-of-State Drivers.”

Penalties for Driving Without Insurance in Glendale

Driving without insurance in Glendale can result in serious penalties that go beyond just a slap on the wrist. If you’re caught without the required liability insurance, you could face fines ranging from $100 to $200 for a first offense, and these fines can increase with subsequent violations.

Additionally, your vehicle may be impounded, and you’ll have to pay fees to retrieve it. The state can also suspend your driver’s license and registration, making it illegal to drive until you provide proof of insurance and pay any associated reinstatement fees.

In some cases, you may even be required to file an SR-22, a certificate of financial responsibility, which can lead to higher insurance premiums. To avoid these costly and inconvenient penalties, it’s essential to maintain at least the minimum required insurance coverage while driving in Glendale.

Gain a deeper understanding through our “8 Best Auto Insurance Companies for Multiple Vehicles.”

How to Get Cheap Car Insurance in Glendale, Arizona

One of the best ways is to build a strong record of safe driving. As we explained earlier, a decent credit score and living in the right neighborhood can also lower your rates. Depending on the insurer, discounts for safe driving and other attributes can help you save even more.

Obtain a more nuanced perspective with our “8 Best Auto Insurance Companies That Don’t Penalize for a Lapse in Coverage.” Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code to find the most affordable quotes in your area.

Frequently Asked Questions

What is the best auto insurance in Glendale, AZ?

It depends on your needs, but USAA, Geico, and Progressive are top choices. Elevate your knowledge with our “Cheap Auto Insurance When Homeless.”

How can I find cheap auto insurance in Glendale, AZ?

Compare quotes from multiple insurers to find the best rate.

What factors affect auto insurance rates in Glendale?

Factors include your age, driving record, vehicle type, and coverage level. Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today.

Is there a minimum auto insurance requirement in Glendale?

Yes, Arizona requires minimum liability coverage of 25/50/15. Learn more about our “How to Report a Driver Without Auto Insurance” for a broader perspective.

Can I get discounts on auto insurance in Glendale, AZ?

Yes, common discounts include safe driver, multi-policy, and good student.

How do I compare auto insurance rates in Glendale, AZ?

Use online comparison tools or work with an insurance agent. Avoid expensive auto insurance premiums by entering your ZIP code to see the cheapest rates for you.

Which company offers the best customer service in Glendale, AZ?

USAA and State Farm are known for excellent customer service. Gain deeper insights by exploring our “Government Assistance Programs for Low-Income Drivers.”

Can I bundle my auto and home insurance in Glendale, AZ?

Yes, many insurers offer discounts for bundling policies.

What is the average cost of auto insurance in Glendale, AZ?

The average cost is around $1,500 annually, but it varies by driver.

Are there any specific requirements for teen drivers in Glendale, AZ?

Teens must have minimum liability coverage and may face higher rates. Expand your understanding with our “When did auto insurance become mandatory?“

Can I get roadside assistance with my auto insurance in Glendale, AZ?

What should I do if I’m in an accident in Glendale, AZ?

Is uninsured motorist coverage required in Glendale, AZ?

How do I lower my auto insurance premium in Glendale, AZ?

Can I insure a leased vehicle in Glendale, AZ?

What coverage options are available for auto insurance in Glendale, AZ?

How often should I review my auto insurance policy in Glendale, AZ?

Can I get auto insurance with a bad driving record in Glendale, AZ?

Do auto insurance rates in Glendale, AZ change over time?

What happens if I drive without insurance in Glendale, AZ?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.