Best Scranton, Pennsylvania Auto Insurance in 2025 (Compare the Top 10 Companies)

To get the best Scranton, Pennsylvania auto insurance, compare our three best companies, State Farm, Geico, and Progressive, with rates beginning at $29 per month. Take local factors into account to choose a policy that fits your budget and offers the coverage needed for drivers in Scranton, Pennsylvania.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Scranton Pennsylvania

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Scranton Pennsylvania

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Scranton Pennsylvania

A.M. Best

Complaint Level

Pros & Cons

For the best Scranton, Pennsylvania auto insurance, like State Farm, Geico, and Progressive, offer starting rates as low as $29 per month.

Before you buy Scranton, Pennsylvania auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Scranton, Pennsylvania auto insurance quotes.

- Best auto insurance in Scranton, Pennsylvania, starting at $29/month

- Competitive rates with excellent customer support

- Compare multiple quotes to find coverage tailored to your unique needs

#1 – State Farm: Top Overall Pick

Pros

- Extensive Network of Agents: State Farm provides the best Scranton, Pennsylvania auto insurance through a large network of local agents, ensuring personalized assistance and support. Their agents are highly regarded for their availability and local expertise.

- Discounts for Safe Driving: State Farm offers the best Scranton, Pennsylvania auto insurance with numerous discounts for good driving records and safety features, potentially saving up to 17% for bundling policies. Discounts are available for accident-free driving and advanced safety features.

- Comprehensive Coverage Options: State Farm delivers the best Scranton, Pennsylvania auto insurance with a wide range of coverage options, including unique add-ons like rental car coverage and rideshare insurance, to meet diverse needs. Check out “StateFarm Car Insurance Review” to know more discounts.

Cons

- Higher Premiums for Some Drivers: State Farm may have higher rates for drivers with less-than-perfect records, potentially offsetting savings from discounts. This could impact those seeking the best Scranton, Pennsylvania auto insurance with a history of violations.

- Limited Online Tools: Some users find State Farm’s online experience less user-friendly compared to competitors, with fewer digital management options, which may detract from their search for the best Scranton, Pennsylvania auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Low Rates: Geico is known for offering some of the best Scranton, Pennsylvania auto insurance with competitive pricing, often leading to lower premiums, including up to 25% savings for bundling policies. Geico is recognized for its affordability.

- User-Friendly Online Platform: Provides the best Scranton, Pennsylvania auto insurance with an easy-to-use website and mobile app for managing policies and claims, supported by an A++ rating from A.M. Best. Their digital tools are highly rated for convenience.

- 24/7 Customer Support: Geico ensures the best Scranton, Pennsylvania auto insurance with round-the-clock customer support for assistance and claims, making support readily available whenever needed. To know more about custom plan, check out “Geico Car Insurance Review.”

Cons

- Limited Local Agent Presence: Geico has fewer physical agents compared to competitors, which might limit personalized service for those seeking the best Scranton, Pennsylvania auto insurance. They rely heavily on their digital platform.

- Customer Service Issues: Some users report challenges with Geico’s customer service responsiveness, with occasional delays in claims processing or support, affecting their experience with the best Scranton, Pennsylvania auto insurance.

#3 – Progressive: Best for Customizable Plans

Pros

- Customizable Plans: Progressive offers some of the best Scranton, Pennsylvania auto insurance with extensive customization options, including the Snapshot program. This allows for personalized coverage tailored to individual needs. Discover more at “Progressive Car Insurance Review” to know more cheap prices.

- Competitive Rates: Known for providing affordable rates, Progressive offers some of the best Scranton, Pennsylvania auto insurance, especially for high-risk drivers, supported by an A+ rating from A.M. Best for financial stability.

- Flexible Payment Options: Progressive provides flexible payment plans as part of the best Scranton, Pennsylvania auto insurance, including options such as monthly payments and adjustable billing cycles.

Cons

- Complex Pricing Structure: Progressive’s variety of options and add-ons can complicate the comparison of prices, which might confuse those seeking the best Scranton, Pennsylvania auto insurance. The extensive range of features can make decision-making challenging.

- Mixed Customer Service Reviews: While Progressive offers competitive rates, service quality can vary, with some customers reporting issues with responsiveness and support, impacting their experience with the best Scranton, Pennsylvania auto insurance.

#4 – Allstate: Best for Premium Features

Pros

- Local Agent Network: Offers the best Scranton, Pennsylvania auto insurance through a wide network of local agents, ensuring direct and responsive customer care. Allstate’s agents are known for their hands-on approach and local knowledge.

- Multiple Discounts: Provides up to 10% savings on bundling policies and offers other discounts, making it a strong contender for the best Scranton, Pennsylvania auto insurance. These discounts significantly reduce insurance costs.

- Good Roadside Assistance: Allstate’s roadside assistance is part of the best Scranton, Pennsylvania auto insurance, offering reliable support and emergency services, including towing and battery jump-starts. Expound your knowledge by reading “Allstate Car Insurance Review.”

Cons

- Higher Premiums: Allstate’s rates can be higher compared to other providers, especially for drivers with lower credit scores or a history of claims, which may affect those seeking the best Scranton, Pennsylvania auto insurance.

- Limited Digital Tools: Some users find Allstate’s digital tools and app less intuitive compared to competitors, which might impact the ease of managing their best Scranton, Pennsylvania auto insurance online.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Bundling Options

Pros

- Bundling Options: Nationwide offers the best Scranton, Pennsylvania auto insurance with excellent bundling options for auto and home insurance, providing potential savings of up to 20%. Bundling helps reduce overall insurance costs.

- Vanishing Deductible: Features a vanishing deductible program, part of the best Scranton, Pennsylvania auto insurance, which reduces your deductible over time, offering up to $500 in savings for safe driving. Know more about customizable policies at “Nationwide Car Insurance Review.”

- Flexible Coverage Options: Provides a variety of coverage options and add-ons, including unique features tailored to individual needs, as part of the best Scranton, Pennsylvania auto insurance.

Cons

- Higher Rates for Young Drivers: Nationwide’s premiums may be higher for younger drivers, who often face increased insurance costs, which could affect their pursuit of the best Scranton, Pennsylvania auto insurance.

- Customer Service Variation: Service quality can vary by location, with inconsistent experiences reported in different regions, impacting the overall perception of the best Scranton, Pennsylvania auto insurance.

#6 – USAA: Best for Military Families

Pros

- Best for Military Families: USAA provides the best Scranton, Pennsylvania auto insurance for military personnel and their families, with an A++ rating from A.M. Best for financial stability. Their policies are tailored to military needs.

- Low Rates: USAA generally offers lower premiums compared to other providers, making it a cost-effective option for eligible members seeking the best Scranton, Pennsylvania auto insurance. Read “USAA Car Insurance Review” to know more.

- Excellent Customer Service: Known for high customer satisfaction and efficient claims handling, USAA offers some of the best Scranton, Pennsylvania auto insurance with responsive and helpful support.

Cons

- Eligibility Restrictions: USAA’s insurance is only available to military members and their families, limiting access for the general public and excluding many from the best Scranton, Pennsylvania auto insurance.

- Limited Local Presence: With fewer local agents compared to other insurers, USAA relies more on online and phone services, which might impact those seeking in-person support for the best Scranton, Pennsylvania auto insurance.

#7 – Travelers: Best for Flexible Policies

Pros

- Unique Discounts: Provides the best Scranton, Pennsylvania auto insurance with discounts for bundling with other products and for safety features, helping to reduce overall insurance costs.

- Good Claims Process: Known for a straightforward and efficient claims process, Travelers ensures the best Scranton, Pennsylvania auto insurance with timely support and resolution. Discover why there are higher rates for certain drivers at “Travelers Car Insurance Review.”

- Customizable Coverage: Offers numerous optional coverages and enhancements, allowing policyholders to tailor their insurance to specific needs, contributing to the best Scranton, Pennsylvania auto insurance experience.

Cons

- Rates Can Be Higher: Travelers’ premiums might be higher for some drivers, particularly those with a history of claims or poor credit, which could impact their quest for the best Scranton, Pennsylvania auto insurance.

- Customer Service Inconsistencies: Mixed reviews on customer service quality, with occasional delays or issues reported by customers, affecting the overall experience with the best Scranton, Pennsylvania auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Flexible Discounts

Pros

- Flexible Discounts: Liberty Mutual offers the best Scranton, Pennsylvania auto insurance with a variety of discounts, including for multiple policies and new vehicles, helping to lower insurance costs.

- Comprehensive Coverage: Provides extensive coverage options, including new car replacement and accident forgiveness, as part of the best Scranton, Pennsylvania auto insurance package.

- Strong Financial Stability: Backed by an A rating from A.M. Best, Liberty Mutual offers reliable and stable coverage options, ensuring the best Scranton, Pennsylvania auto insurance.

Cons

- Higher Premiums: Some drivers may find Liberty Mutual’s rates to be on the higher side, particularly for younger or high-risk drivers, impacting their search for the best Scranton, Pennsylvania auto insurance.

- Limited Local Agent Support: Fewer local agents compared to competitors may affect personalized service for those looking for the best Scranton, Pennsylvania auto insurance experience. Learn more through our Liberty Mutual auto insurance review.

#9 – Farmers: Best for Customer Support

Pros

- Broad Range of Discounts: Provides up to 18% savings through bundling policies and other discounts, making it a top choice for the best Scranton, Pennsylvania auto insurance. Discounts are available for various safety features and multi-policy bundles.

- Customizable Coverage Options: Farmers offers flexible coverage options, including unique add-ons like ride-sharing coverage and customizable policies, contributing to the best Scranton, Pennsylvania auto insurance experience.

- Strong Local Presence: With a substantial network of local agents, Farmers provides the best Scranton, Pennsylvania auto insurance with direct, face-to-face support, ensuring personalized assistance and local expertise.

Cons

- Higher Premiums for Some Drivers: Farmers may have higher premiums for drivers with less-than-perfect records or credit scores, potentially impacting their search for the best Scranton, Pennsylvania auto insurance. This can lead to higher costs for high-risk drivers.

- Mixed Reviews on Claims Handling: Some customers report issues with the speed and efficiency of claims processing, which can affect their overall satisfaction with the best Scranton, Pennsylvania auto insurance. Discover more potentially higher premiums by checking out “Farmers Car Insurance Review.”

#10 – The Hartford: Best for AARP Members

Pros

- Strong Financial Stability: Known for its solid financial standing, The Hartford offers some of the best Scranton, Pennsylvania auto insurance with a strong A+ rating from A.M. Best, ensuring reliable coverage and stability. Learn more through our The Hartford auto insurance review.

- Comprehensive Coverage Options: Offers extensive coverage options including accident forgiveness and new car replacement, contributing to the best Scranton, Pennsylvania auto insurance with a broad range of protection features.

- User-Friendly Online Tools: Provides easy-to-use online tools and an app for managing policies and claims, enhancing the overall customer experience for those seeking the best Scranton, Pennsylvania auto insurance.

Cons

- Higher Rates for Young Drivers: The Hartford’s premiums may be higher for younger drivers or those with limited driving experience, which could affect their quest for the best Scranton, Pennsylvania auto insurance.

- Limited Discount Options: Compared to some competitors, The Hartford offers fewer discount opportunities, which may limit savings for those looking for the best Scranton, Pennsylvania auto insurance with multiple discount options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

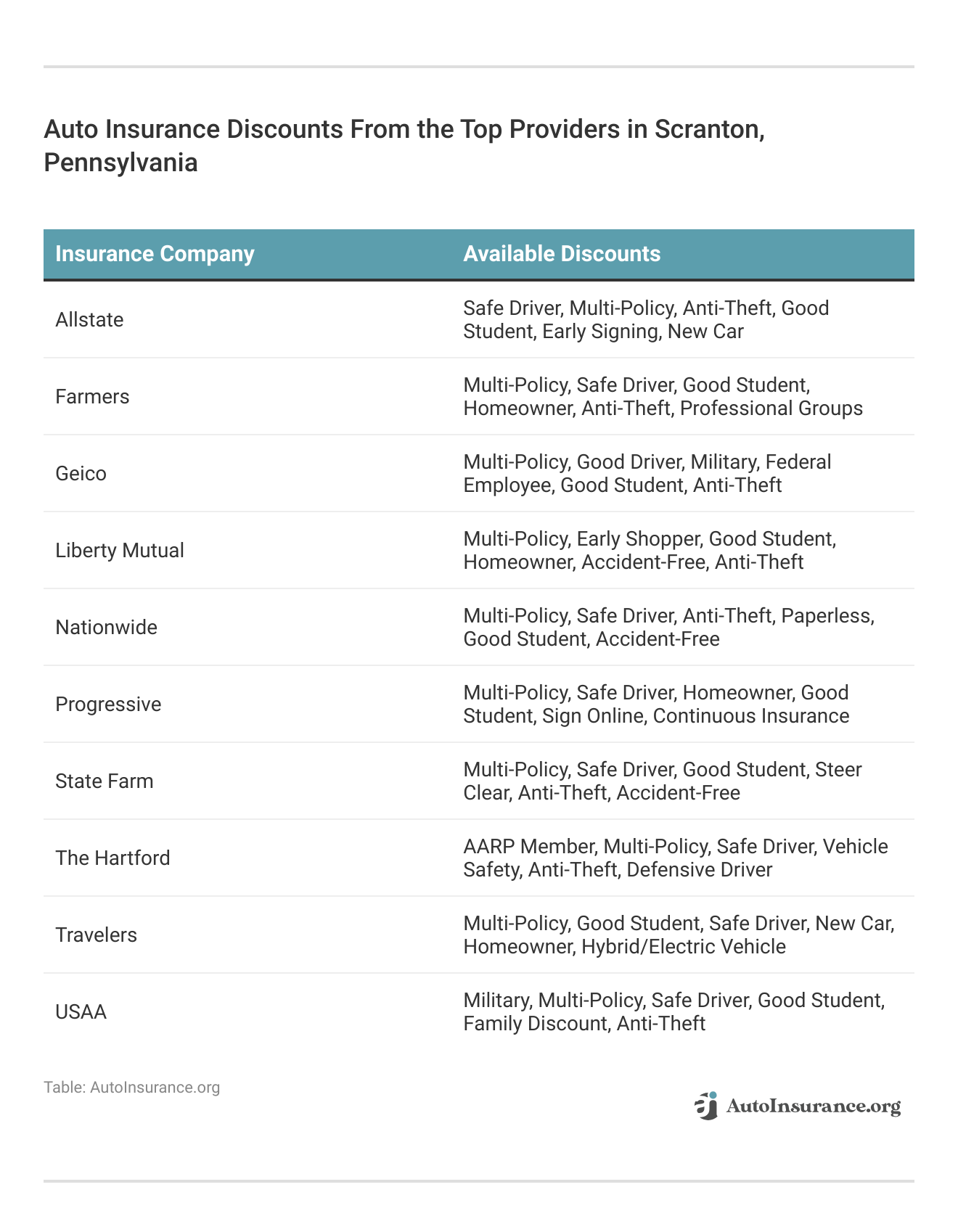

Most Affordable Auto Insurance Providers in Scranton, Pennsylvania

When searching for the most affordable auto insurance companies in Scranton, Pennsylvania, it’s essential to compare the top providers to identify the best annual rates available.

Each company offers different types of auto insurance, and rates vary based on factors such as driving history, vehicle type, and coverage options.

Scranton, Pennsylvania Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $41 $120

Farmers $44 $118

Geico $35 $112

Liberty Mutual $42 $121

Nationwide $38 $113

Progressive $37 $115

State Farm $39 $117

The Hartford $36 $110

Travelers $40 $119

USAA $29 $101

To determine which insurer can provide the cheapest auto insurance in Scranton, consider obtaining quotes from multiple companies and evaluating their offerings.

Look for companies that offer competitive rates and various types of auto insurance, such as liability, collision, and comprehensive coverage, along with discounts for safe driving, bundling policies, or having safety features in your vehicle.

By carefully comparing these options, you can secure the most cost-effective insurance coverage that meets your needs while ensuring you’re getting the best value for your money.

Top Choice by Category: Most Affordable Auto Insurance in Scranton, Pennsylvania

This comparative approach ensures that you not only secure the cheapest auto insurance but also choose a policy that aligns with your individual requirements, providing both cost-effectiveness and comprehensive protection. Enter your ZIP code now.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Compare Auto Insurance Quotes in Scranton, Pennsylvania

When shopping for auto insurance in Scranton, Pennsylvania, it’s essential to compare rates from various insurance providers to ensure you’re getting the best deal, especially when considering collision auto insurance.

Insurance premiums can vary significantly between companies, and collision auto insurance is a crucial component of coverage that protects you in the event of a collision with another vehicle or object.

Tim Bain

Licensed Insurance Agent

This will give you a clearer picture of your options, including the costs associated with collision auto insurance, and help you make an informed decision that could save you money on your auto insurance policy.

To start the comparison process, simply enter your ZIP code below to receive free, no-obligation auto insurance quotes specific to Scranton.

Frequently Asked Questions

What are the minimum auto insurance requirements in Scranton, Pennsylvania?

Scranton, Pennsylvania auto insurance laws require a minimum coverage of 15/30/5.

This means you must have at least $15,000 bodily injury liability coverage per person, $30,000 bodily injury liability coverage per accident, and $5,000 property damage liability coverage.

What factors can affect auto insurance rates in Scranton, Pennsylvania?

Several factors can influence auto insurance rates in Scranton, Pennsylvania. These include your driving record, credit history, age, gender, marital status, commute time, ZIP code, and coverage level. Enter your ZIP code now to begin.

How can I find cheap auto insurance in Scranton, Pennsylvania?

To find the best cheap auto insurance in Scranton, Pennsylvania, it’s essential to focus on finding affordable auto insurance rates.

Comparing quotes from multiple insurance companies allows you to evaluate different options and select the most cost-effective coverage that fits your needs.

By shopping around, you can ensure you are getting the best value for your auto insurance policy.

How does age, gender, and marital status impact auto insurance rates in Scranton, Pennsylvania?

Age, gender, and marital status can affect auto insurance rates in Scranton, Pennsylvania. Generally, younger drivers, particularly teenagers, tend to have higher rates.

Additionally, males typically have higher rates than females. Marital status can also play a role, as married individuals often receive lower rates compared to single individuals.

Are there any special considerations for teen drivers in Scranton, Pennsylvania?

Teen drivers in Scranton, Pennsylvania usually face higher auto insurance rates due to their lack of driving experience.

It’s advisable for parents or guardians to add their teen drivers to their existing policy or explore options for teen driver discounts to help mitigate the higher costs. Enter your ZIP code now to begin.

Which company is ranked #1 for the best auto insurance in Scranton, Pennsylvania?

State Farm is ranked #1 for the best auto insurance in Scranton, Pennsylvania. It is recognized for its reliable service and offers a bundling discount of up to 17%.

For those seeking cheap auto insurance for smart cars, State Farm’s competitive rates and bundling discounts can provide significant savings.

Additionally, their extensive network of agents ensures personalized service to find the best coverage options for your smart car.

What is the maximum bundling discount offered by Geico?

Geico offers a maximum bundling discount of 25%. This discount contributes to its reputation for providing affordable rates.

Which insurance provider is highlighted for its premium features in Scranton, Pennsylvania?

Allstate is highlighted for its premium features in Scranton, Pennsylvania.

It is known for offering extensive coverage options and a bundling discount of 10%. Enter your ZIP code now to begin.

How does USAA’s discount for military families compare to the bundling discount offered by Nationwide?

USAA offers a 15% discount for military families, while Nationwide provides a 20% discount for bundling policies. Both discounts are designed to offer significant savings to their respective customer bases.

When choosing between these options, it’s also essential to consider checking auto insurance claims history.

This can help you understand how often claims are filed and their impact on future premiums, ensuring you get the best value alongside these discounts.

What rating does Liberty Mutual have from A.M. Best for the best Scranton, Pennsylvania auto insurance?

Liberty Mutual has an A rating from A.M. Best for the best Scranton, Pennsylvania auto insurance.

This rating reflects its strong financial stability and reliable service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.