How to Sue an Uninsured Driver in 2025 (Take These 4 Steps)

To sue an uninsured driver for losses after a wreck, gather information, file a police report, and contact a lawyer. Since 14% of drivers go uninsured, it's crucial to know how suing someone without car insurance works. We'll explain more about suing an uninsured or underinsured driver here.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Jun 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The steps in how to sue an uninsured driver include gathering important details, filing a police report, and contacting an attorney to increase your odds of getting awarded a fair settlement for an auto accident.

Without the uninsured and underinsured motorist coverage, consider suing for injuries and damages. The number of drivers without auto insurance is high, so it’s important to know how to sue uninsured drivers.

- Step #1: Gather Information – Collect the date, time, location, and driver’s details

- Step #2: Report the Wreck – Police reports provide essential evidence in the case

- Step #3: Get an Attorney – An attorney can explain your legal options and rights

- Step #4: Call Your Insurer – Get uninsured motorist coverage to skip future lawsuits

Learn whether you can sue someone for not having insurance here. Then, enter your ZIP code into our free quote tool to compare quotes.

Bring an Uninsured Driver to Court With These 4 Easy Steps

Can I sue an uninsured driver? Yes, if you are hit by an uninsured driver, you can sue them to get the money you are owed. It is important to follow these four steps to get compensated.

Step #1: Gather Information

Collecting detailed information about your accident is critical to building a strong case if you’re suing an uninsured driver.

Firstly, document the date, time, and location of the accident. Get the uninsured driver’s details, and if they previously had insurance but it lapsed or expired, get their insurance company’s contact information to communicate with the company. Learn how to report a driver without auto insurance here.

Take pictures of the accident scene, vehicle damages, and road signs. Write down details you might forget by the time your case gets to court.Tracey L. Wells Licensed Insurance Agent & Agency Owner

In addition, eyewitness accounts can help establish which driver was at fault. Be sure to ask for any eyewitnesses’ contact information and get a statement from them. These are important steps to take when you’re trying to make an auto insurance claim when not at fault for an accident, and suing an uninsured driver for damages.

Step #2: Report the Accident

A police report is an official record of the incident, making it an essential piece of evidence when suing an underinsured or uninsured motorist.

While you can file an auto insurance claim without a police report, it’s best to get this important document.

So, call the police immediately after your accident, give them your information, and get a copy of the police report to assist with your case in suing the uninsured driver.

Step #3: Consult With an Attorney

Rather than trying to figure out the steps of suing an uninsured driver on Reddit, contacting a car accident lawyer for legal advice will help you understand your rights and the complexities of how to sue someone without car insurance.

Depending on the driver’s finances, you may not get enough money to cover all your losses. So, consulting with an accident lawyer to investigate may help you decide whether or not to sue. After all, if someone can’t buy insurance, they may be unable to pay damages, too.

Even if a driver claims to have nothing or files for bankruptcy, your lawyer can help you take steps to recover your expenses in the future should there ever be an opportunity.

Read More: Does bankruptcy discharge debts from being sued by an insurance company?

So, is it worth suing an uninsured driver? To establish whether it’s feasible or not to sue an uninsured driver, you’ll need to:

- Hire an accident lawyer

- Run a credit and financial check on the driver

- Put a lien on any assets that might be liquidated to pay a court settlement

Often, the best course of action is to make sure your policy covers you for unforeseen events like an accident with an uninsured driver in the first place, rather than researching “Can you sue someone without insurance” after the accident.

Step #4: Contact Your Insurance Company

Inform your insurance company of the accident details, even if you’re not at fault. Find out if your policy covers any damages in an accident with an uninsured driver. If it doesn’t cover the damages, consider adding an uninsured/underinsured motorist policy for future protection.

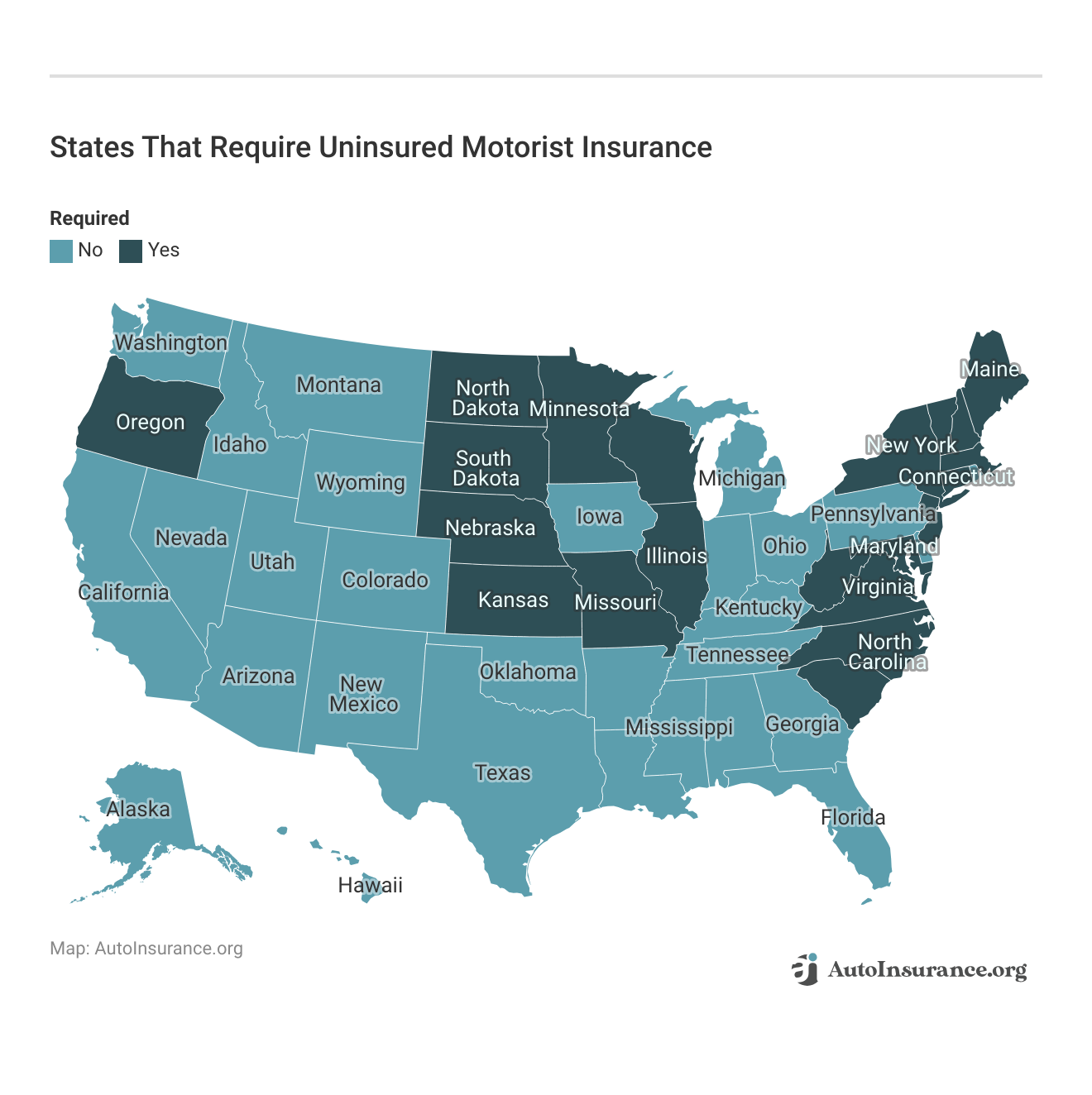

Several states require drivers to carry uninsured motorist coverage on their auto insurance policy, as you can see in the state map below.

However, we still recommend uninsured and underinsured coverage even if they are not required, especially if you live in a high-risk state for uninsured drivers.

If you’re the victim of a hit-and-run accident, you can file a claim against your UM or UIM motorist coverage.

Highest Percentage of Uninsured Motorists by State

| Rank | State | Percentage |

|---|---|---|

| #1 | Florida | 27% |

| #2 | Mississippi | 24% |

| #3 | New Mexico | 21% |

| #4 | Michigan | 20% |

| #5 | Tennessee | 20% |

| #6 | Alabama | 18% |

| #7 | Washington | 17% |

| #8 | Indiana | 17% |

| #9 | Arkansas | 17% |

| #10 | Washington, D.C. | 16% |

If the uninsured driver has an insurance provider, contact it too. However, don’t give a statement to any insurance company unless your lawyer is present, especially if you are suing the underinsured motorist.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

More Options if You Get in an Accident With an Uninsured Driver

Now that you know the answer to “Can I sue someone without insurance?” we want to go over some other options. A basic auto insurance policy may not cover damages in an accident where an uninsured driver is at fault, unless you have uninsured coverage.

Check out the table below to compare average rates for uninsured motorist coverage by state:

Uninsured/Underinsured Motorist Coverage: Monthly Cost by State

| State | Rates |

|---|---|

| Alabama | $139 |

| Alaska | $147 |

| Arizona | $156 |

| Arkansas | $162 |

| California | $219 |

| Colorado | $169 |

| Connecticut | $169 |

| Delaware | $183 |

| Florida | $190 |

| Georgia | $179 |

| Hawaii | $100 |

| Idaho | $106 |

| Illinois | $150 |

| Indiana | $143 |

| Iowa | $104 |

| Kansas | $135 |

| Kentucky | $176 |

| Louisiana | $201 |

| Maine | $115 |

| Maryland | $237 |

| Massachusetts | $144 |

| Michigan | $339 |

| Minnesota | $220 |

| Mississippi | $142 |

| Missouri | $156 |

| Montana | $153 |

| Nebraska | $148 |

| Nevada | $144 |

| New Hampshire | $122 |

| New Jersey | $197 |

| New Mexico | $142 |

| New York | $174 |

| North Carolina | $131 |

| North Dakota | $177 |

| Ohio | $114 |

| Oklahoma | $160 |

| Oregon | $147 |

| Pennsylvania | $179 |

| Rhode Island | $143 |

| South Carolina | $191 |

| South Dakota | $127 |

| Tennessee | $130 |

| Texas | $207 |

| Utah | $147 |

| Vermont | $133 |

| Virginia | $132 |

| Washington | $104 |

| Washington, D.C. | $192 |

| West Virginia | $141 |

| Wisconsin | $133 |

| Wyoming | $105 |

You can purchase the right types of auto insurance coverage as an add-on to your policy for situations like that.

Keep in mind that the amount of coverage varies, so talk to your insurance provider to determine how much coverage you’ll get. Vehicle damage and medical bills can quickly drain available coverage, so ask about options available to ensure you’re completely protected.

Understanding the Steps to Seek Compensation From an Uninsured Driver

So, can you sue someone for not having car insurance if they hit you? Yes, and now that you know you can sue a driver who hit you with no insurance, it’s critical to follow the right steps to collect damages.

Hire an accident lawyer if a lawsuit is the best option. It’s always better to be covered against uninsured drivers, so talk to your insurance provider about uninsured motorist coverage (Read More: Uninsured Motorist Property Damage (UMPD) Coverage).

Shop around for uninsured motorist coverage from the best auto insurance companies to ensure you and your family are protected from people driving without auto insurance. Start comparing quotes today with our free tool.

Frequently Asked Questions

How do I sue an uninsured driver?

Wondering, “Can you sue an uninsured driver?” You may choose to sue if you were hit. If you’ve been involved in an accident with an uninsured driver, there are several steps you can take:

- Gather Information: Collect as much information as possible about the accident, including the other driver’s license plate number, contact details, and any relevant details about the incident.

- Contact the Police: Report the accident to the police, providing them with all the necessary details and any evidence you have.

- Consult an Attorney: For legal advice, it’s advisable to consult with a personal injury attorney who specializes in uninsured motorist claims.

- Notify your Insurance Company: Inform your insurance company about the accident, even if the other driver is uninsured. They can guide you on the next steps and potential coverage options.

However, it’s important to consider getting uninsured insurance in the event you get in an accident with an uninsured driver.

Can you sue someone who doesn’t have car insurance?

Wondering, can you sue someone for not having insurance if they hit you? You can sue an uninsured driver for damages resulting from an accident.

However, it’s important to consider that even if you win a lawsuit, the uninsured driver may not have the means to pay the damages awarded by the court. It’s recommended to consult with an attorney to assess the feasibility of pursuing legal action.

Looking to avoid suing uninsured drivers in the future? Instead of wondering, “Can you sue uninsured motorists?”, purchase uninsured motorist coverage for financial protection. Enter your ZIP code to compare quotes for uninsured motorist coverage from top providers in your area.

What are my options if the uninsured driver cannot afford to pay the damages?

If the uninsured driver cannot afford to pay the damages, it can be challenging to recover the full amount, even if you fully follow the steps. However, there are a few potential options you can explore:

- Uninsured Motorist Coverage: If you have uninsured motorist coverage as part of your own auto insurance policy, it may cover some or all of the damages.

- Personal Assets: If the uninsured driver has personal assets, you may be able to pursue a judgment against those assets to recover the damages.

- Installment Payments: If the uninsured driver cannot pay the full amount upfront, you can explore the possibility of setting up a payment plan, allowing them to make regular installment payments.

Having the best uninsured and underinsured motorist coverage will help make sure you are compensated. You should also speak with an insurance attorney to discuss your options further.

Can an insurance company sue the uninsured driver?

Can an insurance company sue an uninsured driver? Yes, in some cases, an insurance company may go after an uninsured driver. We do not recommend looking into how to sue a car insurance company without a lawyer, as lawyers provide expert advice on how to navigate claim cases.

Are there any alternatives to suing an uninsured driver?

Yes, there are alternatives to suing an uninsured driver, such as going to small claims court with an uninsured driver. Depending on your insurance coverage and the circumstances of the accident, you may have the following options:

- Uninsured Motorist Coverage: If you have uninsured motorist coverage as part of your auto insurance policy, it can help cover your damages, medical expenses, and other losses resulting from the accident.

- Mediation or Arbitration: Instead of going through the court system, you can explore mediation or arbitration with a neutral third party helping you and the uninsured driver reach a settlement.

- Small Claims Court: If the damages are within the limits of your local small claims court, go to small claims court for an uninsured driver accident without the need for an attorney.

Ready to compare rates for uninsured motorist coverage? Enter your ZIP code into our free quote tool below to get started today.

Can I file a lawsuit against an uninsured driver for personal injuries?

Can you sue someone who doesn’t have car insurance for personal injuries? Yes, you can file a lawsuit against an uninsured driver for personal injuries you have sustained in an accident. However, it’s important to consider that even if you win the lawsuit and are awarded damages, the uninsured driver may not have the financial resources to pay.

Consulting with a personal injury attorney experienced in handling uninsured motorist cases will help you understand the potential outcomes and options available to you.

What is uninsured motorist coverage, and how does it work?

Uninsured motorist coverage is an optional insurance coverage that can be added to your auto insurance policy. It provides protection in the event you are involved in an accident with an uninsured or underinsured driver.

If you have uninsured motorist coverage, instead of asking “Can I sue someone who hit my car without insurance,” your own insurance company will step in to cover your damages, medical expenses, and other losses up to the limits specified in your policy.

The specific terms and conditions of uninsured motorist coverage can vary, so it’s advisable to review your policy and consult your insurance provider for detailed information. To find cheap uninsured motorist coverage, use our free quote comparison tool to get started.

How often do people drive without car insurance?

How many drivers don’t have auto insurance? According to the Insurance Research Council, 13% of drivers in the United States are uninsured.

What happens if the person at fault in an accident has no insurance in California?

You must pay the other drivers’ damages and medical bills if you’re at fault in California. Check out our article on California auto insurance to learn more.

What happens if you get in an accident without insurance in Michigan?

Michigan law requires drivers to carry auto insurance. Uninsured motorists face up to a $500 fine and/or a year in jail. You may also be sent to small claims court for a car accident with no insurance.

Read More: Michigan Auto Insurance

How many uninsured drivers are in Texas?

Curious how many drivers are uninsured in the state of Texas? The III estimates that 14% of drivers in Texas are uninsured.

Can an uninsured motorist sue you?

Yes, if you caused an accident, the uninsured motorist may sue you if you don’t have the proper auto insurance coverage.

Can you sue an uninsured driver in Texas?

Wondering, “Can I sue an uninsured motorist in Texas?” Yes, you can sue the uninsured driver who hit you in Texas. Texas drivers may be penalized with a citation or license suspension if they get in an accident without insurance. Find out more about Texas auto insurance laws here.

Can you sue an uninsured driver in New York?

Can you sue an uninsured motorist in New York? Yes, if you were in an accident with an uninsured driver, you may choose to sue. However, make sure to follow the proper steps on how to sue the uninsured motorist.

Can I sue if I don’t have car insurance?

Can you sue someone without car insurance? While it’s a more complex case if you yourself are also uninsured according to the underinsured definition, if the other driver caused the accident, you can still sue. Make sure to properly follow the steps of suing someone with no bodily injury coverage or property damage coverage with the help of a lawyer.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.