Buying Auto Insurance for a New Car (2025)

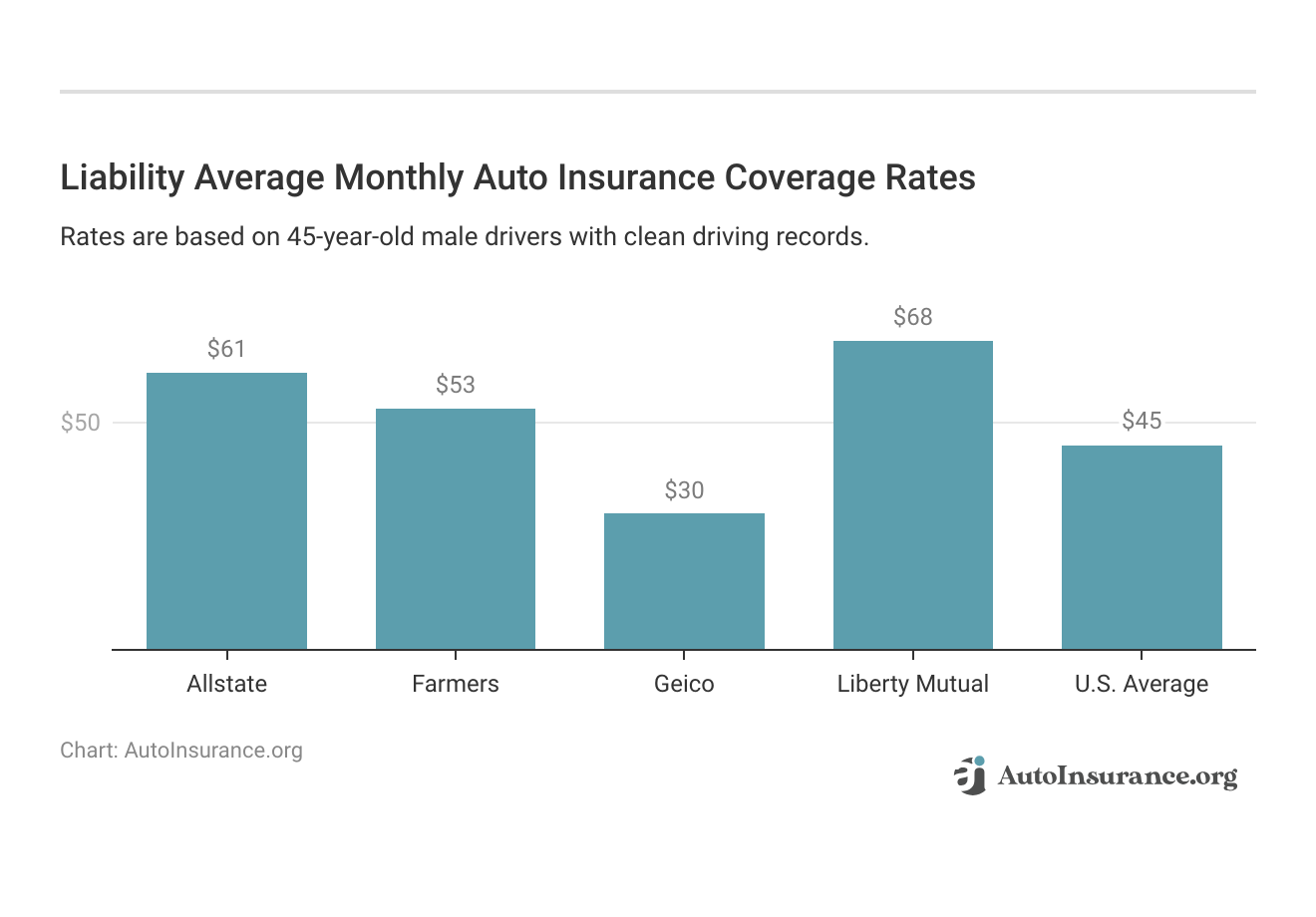

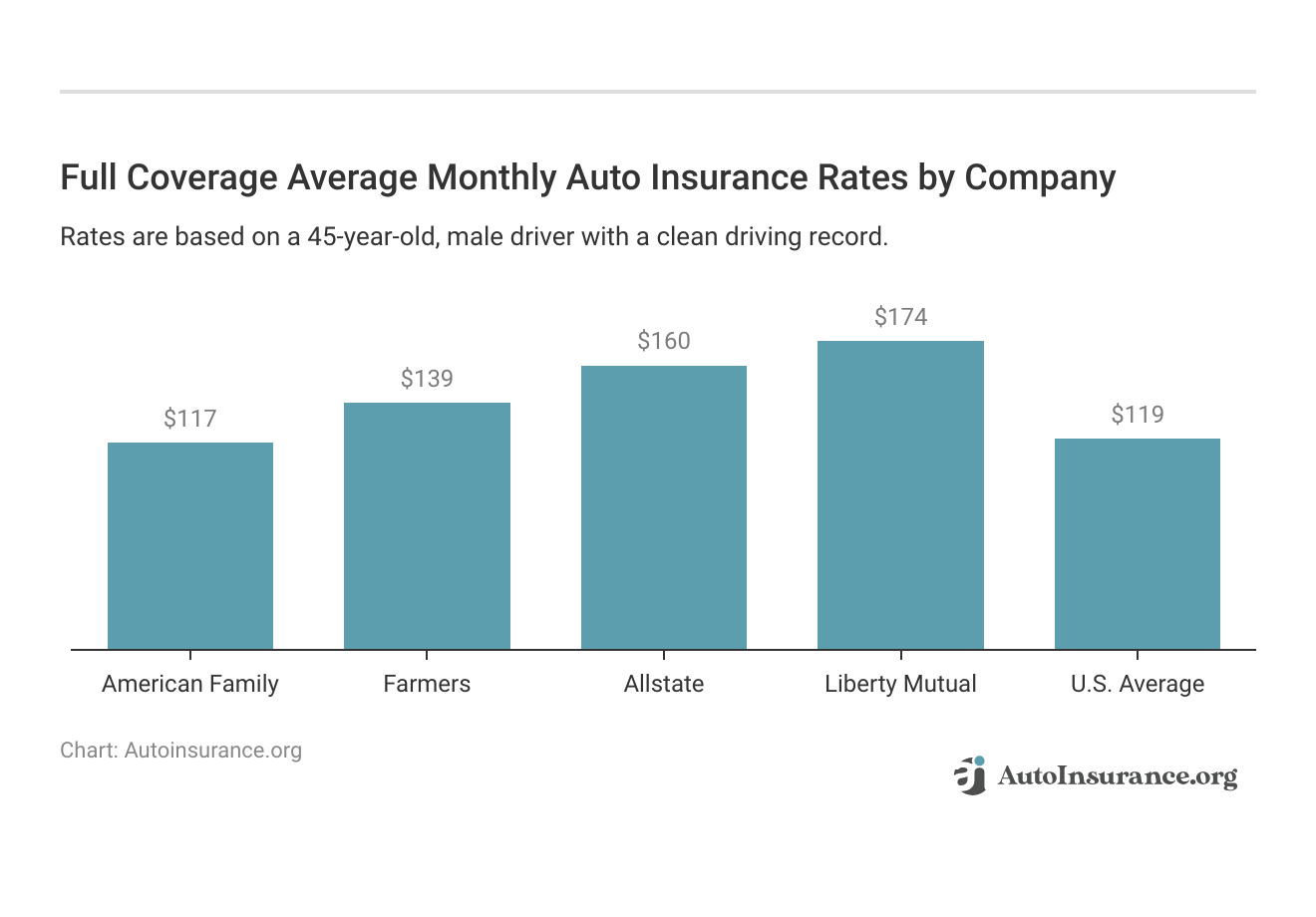

You need to buy insurance before buying a car. Our expert guide on auto insurance for new cars overviews coverage types, savings opportunities, and costs, which average $45/month for minimum coverage and $119/month for full coverage. We also cover grace periods from top providers, including State Farm.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Jul 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Buying a new car can be exciting and fun, but you need the right coverage before driving your new car off the lot. If you have an existing car insurance policy, you may have a grace period with your insurance company, but you’ll need to update your vehicle information as soon as possible.

- You need car insurance on a new vehicle before you drive it home

- Some insurance companies offer a coverage grace period if you have coverage on a different car, but you have to update your information fairly quickly

- The best way to find cheap insurance for a new car is to shop online and compare quotes from multiple providers

If you’re shopping for new car coverage, you can find the best auto insurance companies in your area by comparing online quotes. The rates may be higher than what you’re used to, but there’s a chance you’ll find affordable auto insurance for new cars.

How do you get auto insurance for new cars?

You have to have insurance on your new car, but knowing what you’re looking for is essential before you get a policy. You can compare auto insurance rates by vehicle make and model to help you narrow down what type of car you want to buy. That way, you should be able to get quotes online that will give you a good idea of how much you’ll pay for coverage for your new vehicle.

Insurance quotes are available online with many providers, and you can get quotes on coverage from your smartphone as you’re shopping for a new vehicle. So be sure to compare quotes from at least three companies to avoid paying too much for coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Do you need insurance before buying a car?

You need auto insurance on any vehicle you own before you drive it, so you will need a policy on your new car before you drive it off the lot.

It’s essential to get proper coverage on your vehicle for many reasons, but people often forget that a lot can happen from the dealership to their home. For example, if you’re in a car accident immediately after purchasing your new car and don’t have proper coverage, you could pay for everything out of pocket.

Fortunately, your insurance company may allow a specific grace period of coverage if you have a current auto insurance policy on another vehicle.

Is there a grace period for insurance after buying a car?

Purchasing a new car without an entirely new insurance policy is possible if you have a vehicle. Most companies offer a grace period that covers a new car under the existing policy, but this only lasts for a short time.

For example, the State Farm grace period is a few weeks and the USAA grace period is up to 30 days, which is the same for Progressive. Still, your best bet is to inform your insurance company about your new vehicle as soon as you purchase it to ensure you’ll be covered in an accident.

Read more:

Anyone who does not have an existing car insurance policy must get coverage before driving the vehicle off the lot. Most dealerships will check your insurance information to ensure you have a policy before allowing you to leave.

If you simply cannot decide which company you want for new car insurance coverage, you can purchase a short-term policy lasting anywhere from seven to 30 days. But because short-term car insurance is much more expensive than a standard policy, you’d still be better off deciding on a six or 12-month policy.

Read more: How many days after purchase do you have to get auto insurance?

How much does new car insurance cost?

Insurance on a new car is often more expensive than coverage on an older vehicle, so you may be surprised at how expensive your car insurance rates are. Luckily, car manufacturers now add a lot of safety features, like lane assist, backup cameras, and warnings for blind spots, that can help you get discounts on coverage.

Factors that affect auto insurance rates include:

- Your driving record

- Your ZIP code

- Your claims history

- Your age

- Your gender

- Your credit score

- The types of coverage you want

You’ll find the best rates on car insurance when you shop online and compare quotes from multiple providers. If you get one quote that seems too expensive, you may find that another company will offer you much more affordable coverage.

Read more: Why is auto insurance for new cars so expensive?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Do I have to get insurance on a new car?

You cannot drive without insurance, so you must have an auto insurance policy on your new car. You can get away with simple liability coverage if you purchase a new car outright. But if you’re financing the vehicle, you’ll likely be required to purchase additional coverage on the car.

Liability Coverage

Liability car insurance coverage pays for damage and injuries you cause to others when you are at fault in an accident.

Here’s a look at the average annual rates for liability insurance in each state.

Requirements for liability coverage vary from one state to the next, but you’ll likely be required to carry the following:

- Bodily injury liability per person

- Bodily injury liability per accident

- Property damage liability

States require drivers to carry different limits of the above coverages, listed as 15/30/20. These numbers mean a driver must have $15,000 in bodily injury coverage per person, $30,000 in bodily injury coverage per accident, and $20,000 in property damage liability.

While most insurance companies ensure their policyholders meet the minimum auto insurance requirements by state, it’s your responsibility to ensure you have proper coverage before driving your vehicle.

When you have a new car, you should consider carrying more than a liability policy, as liability does not offer coverage that helps you or your vehicle. To ensure your vehicle is covered in an accident, you will need to carry additional coverages.

If you can afford a full coverage policy — which includes liability, collision, and comprehensive insurance — it’s a good idea to invest in it. Otherwise, you may end up paying for any damage to your vehicle out of your own pocket. Besides, if you have a lease or loan on a new vehicle, there’s a good chance full coverage will be a requirement included in your contract.Daniel Walker Licensed Insurance Agent

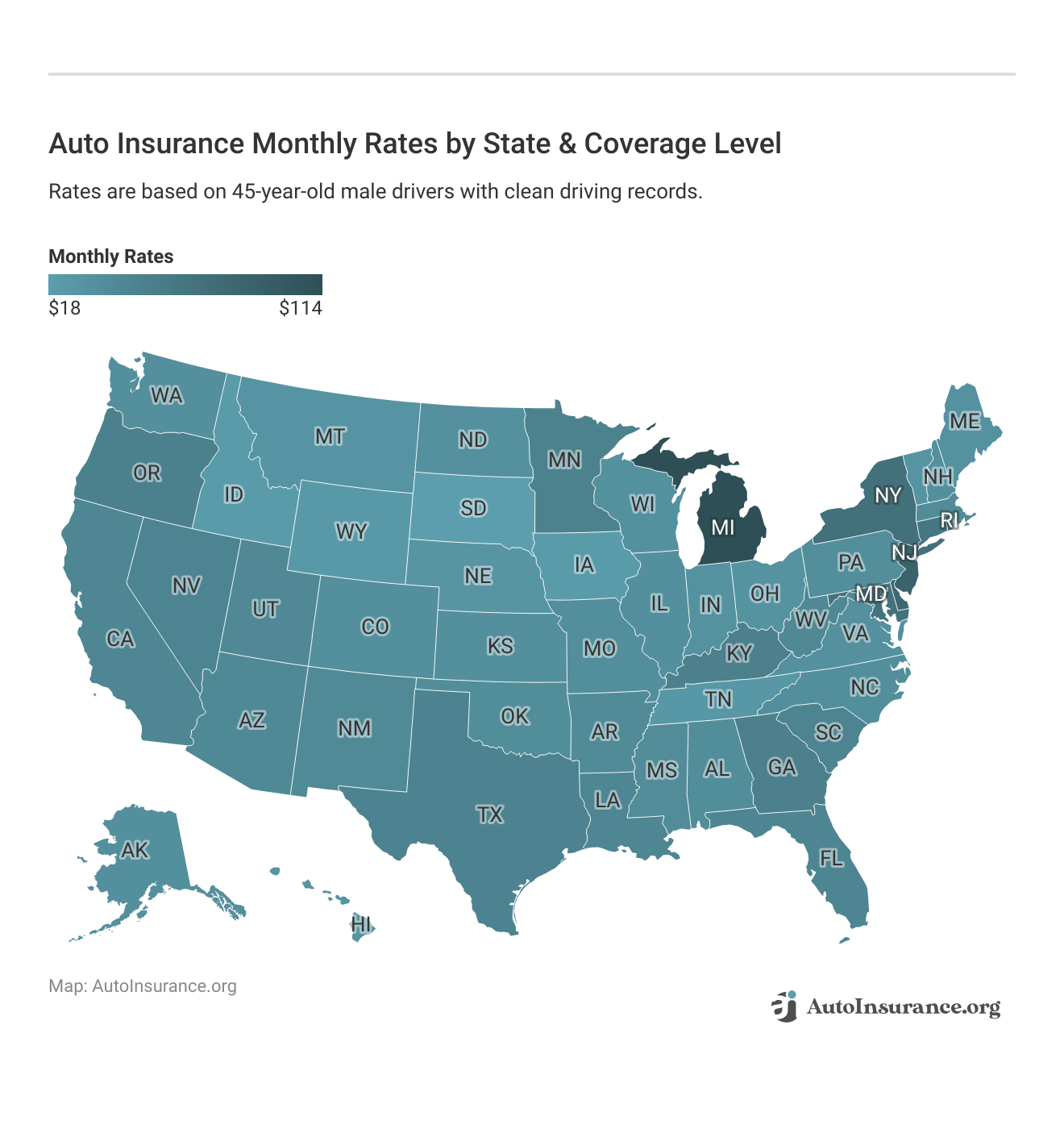

Collision and Comprehensive Coverage

If you’re leasing an automobile or have a loan on your new car, you will probably be required to carry collision and comprehensive insurance.

Check the map below to see the average annual full-coverage auto insurance rate in your state

Collision coverage helps if you’re in an accident. It will pay for repairs that occurred during the accident, even if you were at fault. Comparatively, comprehensive coverage helps to pay for damage to your car that occurred outside of an accident, such as hail damage or vandalism.

Adding collision and comprehensive coverage to your policy will increase how much you pay for coverage, but you’ll have peace of mind if your car is ever damaged.

Uninsured/Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage helps pay for damage someone else causes to your vehicle in an accident. Unfortunately, not everyone drives with proper coverage. If you’re in an accident with someone who is not insured or does not carry enough coverage, this insurance helps ensure you don’t have to pay for repairs to your vehicle.

Personal Injury Protection (PIP) Coverage

PIP coverage pays for medical bills, lost wages, funeral expenses, and other expenses for drivers and passengers, regardless of the at-fault party.

Several states in the U.S. require PIP coverage, but even if your state does not require it, you may be able to purchase PIP insurance through many companies in your area.

Are there other types of car insurance I may need?

Outside of the coverages listed above, there are other add-on coverages that some people choose to invest in. It is imperative to consider adding levels of coverage to your insurance policy if you’re driving a new car or an expensive vehicle that you wouldn’t want to pay for out of pocket.

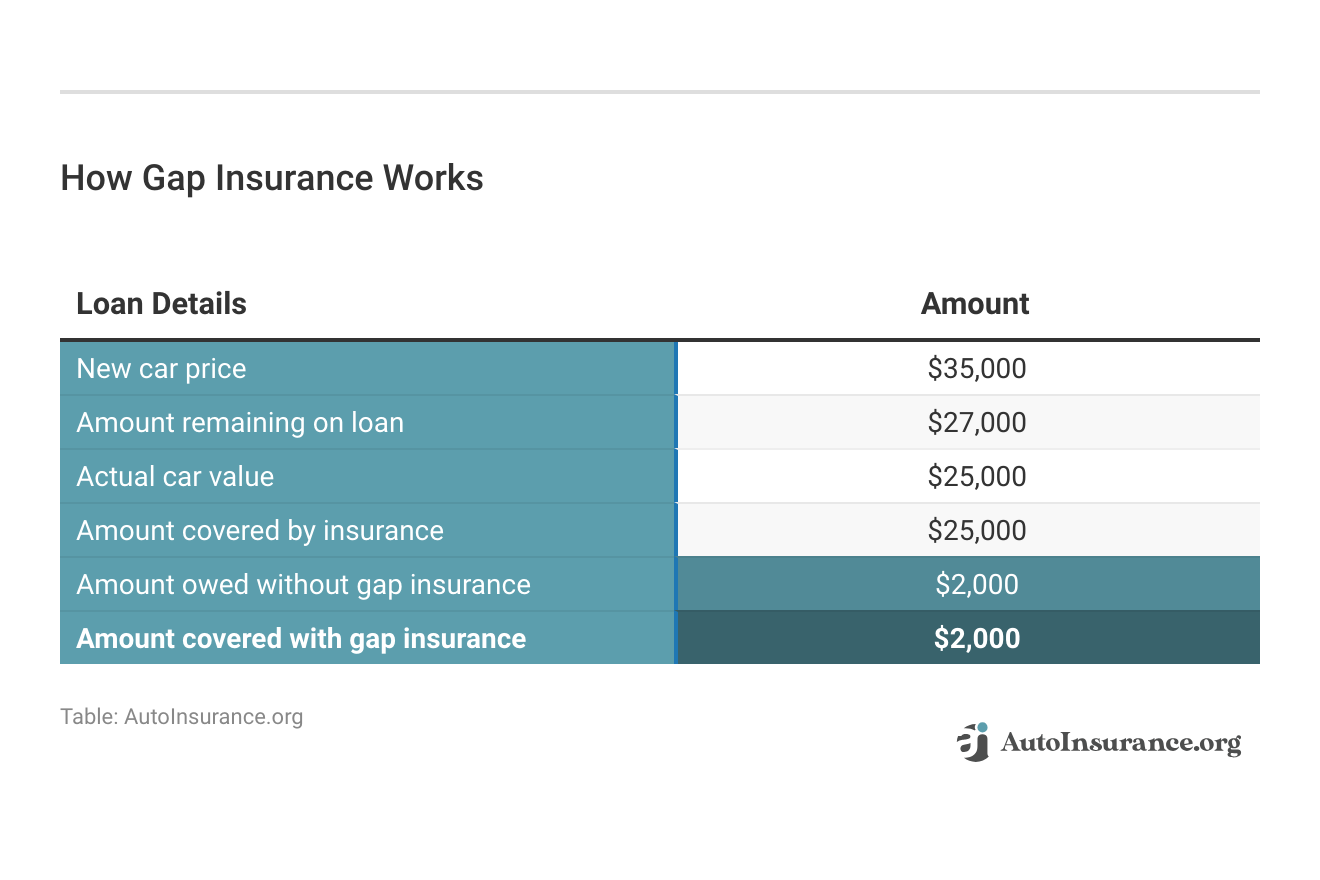

GAP Insurance

If your car is totaled and you owe more on your loan or lease than the vehicle is worth, Guaranteed Auto Protection (GAP) insurance coverage will pay the difference, so you’re not stuck paying hundreds or thousands of dollars out of pocket.

Here’s an example of how gap insurance works.

As you can see above, if you still owe on your recent car purchase, gap insurance can come in handy.

New Car Replacement

What is new car replacement insurance? This coverage pays for a brand-new car that’s the same make and model as yours if yours is totaled in an accident. This is a helpful coverage option for vehicles that quickly depreciate.

Rental Reimbursement Coverage

Rental reimbursement coverage pays for a rental car or another form of transportation if your vehicle is being repaired during a covered loss.

Roadside Assistance Coverage

Roadside assistance coverage pays for towing, lock-out services, battery jump starts, and fuel delivery when you need them.

What information do I need to get insurance on a new car?

To get insurance on a new vehicle, you will need to provide an insurance company with the following information:

- The vehicle identification number (VIN)

- Your driver’s license number

- Your date of birth

- Your address

Insurance companies often ask for this information when you purchase the policy, so ensure you have it ready.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How do I prepare to buy insurance for a new vehicle?

You can’t drive a new car without insurance, so preparing before buying your new car is essential. Because you must buy insurance before buying a car, it’s a good idea to prepare in the following ways:

- Compare quotes from multiple companies to find the best rates.

- Decide on the types of coverage you want.

- Consider optional coverages for your new vehicle.

Once you know what you need and have shopped with multiple providers, you should know which companies will offer you the coverage you want at a rate you can afford.

Read more: How to Evaluate Auto Insurance Quotes

What are the most and least expensive cars to insure?

Sports cars or antique vehicles are typically the most expensive to insure. There are many factors that insurance companies take into consideration when deciding base rates for your specific make and model of vehicle.

Vehicles with high safety ratings, and affordable repair prices tend to be the cheapest to insure. Family cars, vans, and SUVs will always be cheaper to insure compared to sports cars, luxury vehicles, and classic cars.

Read more:

- Auto Insurance for Sports Cars

- Choosing Insurance for a Classic Car

- Which cars have the lowest auto insurance premiums?

Since auto insurance for new cars is usually more expensive than for used cars due to their higher value and higher repair costs, it will pay to be assertive in asking about discounts. In addition to common discounts, each provider has their own percentages and unique discounts. You can stack discounts and ideally save up to 60% on your rate.Alexandra Arcand Insurance and Finance Expert

How can I save money on insurance for my new car?

There are a few ways people can save money when they shop for car insurance.

Compare Quotes

You never know how much you could save on car insurance coverage until you compare quotes from multiple companies. You can get coverage quotes online, over the phone, or face to face with providers in your area. Shopping and comparing quotes can help you save a lot of money, so it’s important not to skip this step.

Get The Right Amount of Coverage

If you’re driving a new car, you may need more than just a liability policy. But if you put enough money down on the vehicle, you may not need something like GAP coverage. Knowing what you do and don’t need before purchasing a policy is good so you don’t waste money on useless coverage.

Ask About Discounts

There are countless auto insurance discounts you may be eligible for that could help you save up to 25% on coverage. Speak with a representative from any company you’re considering to see whether you qualify for discounts that could help you save on your premium.

Improve Your Credit

Credit scores can significantly impact your car insurance rates. If you have a good score, work to keep that number high. If your score is low, improve it by paying off debt and not opening any new lines of credit.

Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $78 | $95 | $142 | |

| $65 | $79 | $118 |

| $70 | $85 | $127 | |

| $52 | $68 | $104 | |

| $88 | $105 | $156 |

| $66 | $80 | $122 | |

| $61 | $75 | $113 | |

| $59 | $72 | $109 | |

| $60 | $74 | $111 | |

| $48 | $58 | $87 |

Drivers with poor credit can pay up to 76% more for coverage because of the associated risk. So while it could take a while to improve your credit, doing so may help insurance companies know you’re less of a risk to cover.

Read more: How Credit Scores Affect Auto Insurance Rates

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Can I buy insurance for my new car at the dealership?

Getting insurance when buying a new car may seem daunting, but it’s not very difficult. You may be able to find options at the dealership, but they will be limited and probably more expensive.

While at the dealership, you can still shop online to find and compare quotes from top companies in your area. Doing so will help you save money, and you’ll probably have more extensive coverage options.

Auto Insurance for New Cars: The Bottom Line

You must carry the proper insurance if you buy a new car. You should shop around and compare quotes from multiple providers to ensure you get the best possible rates on coverage. It’s also important to know what kind of coverage you’re looking for before you start shopping.

You may be able to save money on new car insurance with discounts and by improving your credit score.

Frequently Asked Questions

Do I need car insurance before I buy a new car?

You need car insurance before you drive a car off the lot. You can purchase coverage on your phone after comparing quotes if you cannot do so beforehand. If you have an existing policy on another vehicle, your company may offer you a grace period to inform it that you’ve purchased a new car.

When should I start looking for insurance for my new car?

It’s recommended to start looking for insurance coverage before you take possession of your new car. This way, you can have the policy in place as soon as you drive the car off the dealership lot. If you already have an existing auto insurance policy, contact your insurance provider to inform them about the new car and add it to your coverage.

Can I buy a new car and insurance on the same day?

You can buy a car and purchase coverage for that car on the same day. Don’t forget to compare quotes from multiple companies to avoid overpaying for coverage.

Can I purchase auto insurance for my new car online?

Yes, many insurance companies provide the option to purchase auto insurance online. You can visit the websites of various insurance providers, enter the required information about yourself and your new car, and receive quotes and coverage options online.

If you prefer a more personalized experience, you can also contact insurance agents directly or visit their local offices to discuss your needs and purchase the insurance in person.

Do I need auto insurance for a new car?

Yes, auto insurance is necessary for all vehicles, including new cars. In fact, most lenders and leasing companies require comprehensive and collision coverage if you’re financing or leasing a new car. Even if you purchase the vehicle outright, it’s still essential to have insurance to protect your investment and comply with state laws.

What types of coverage should I consider for my new car?

When insuring a new car, it’s advisable to consider comprehensive coverage and collision coverage in addition to the mandatory liability coverage.

Comprehensive coverage protects against non-collision incidents such as theft, vandalism, and natural disasters, while collision coverage covers damages resulting from accidents with other vehicles or objects.

How much auto insurance coverage do I need for a new car?

The amount of coverage you need for your new car depends on various factors such as the vehicle’s value, your budget, and your risk tolerance. While state-mandated liability limits are the minimum requirement, it’s generally recommended to carry higher limits to adequately protect yourself financially.

Consider your personal circumstances and consult with an insurance professional to determine the appropriate coverage limits.

Can I transfer my existing auto insurance policy to cover my new car?

In most cases, you can transfer your existing auto insurance policy to cover your new car. However, it’s crucial to inform your insurance company promptly to ensure uninterrupted coverage.

Depending on the vehicle’s value and coverage needs, adjustments to your policy may be required, and the premium might be adjusted accordingly.

Will my auto insurance rates increase for a new car?

It’s possible that your auto insurance rates may increase when you purchase a new car. Newer vehicles typically have higher values and may require additional coverage, which can result in higher premiums.

Additionally, certain features and safety ratings of new cars can also affect insurance rates. However, insurance rates are influenced by several factors, including your driving history, location, and insurance company, so it’s best to compare quotes to find the most competitive rates.

Is insurance more expensive for electric cars?

Yes, electric vehicle auto insurance is about 33% higher on average than standard auto insurance. The reasons include electric vehicles having higher price tags and the possibility of requiring specialized repair facilities, so insurers consider these facts when setting rates.

Are there any discounts available for insuring a new car?

Yes, many insurance companies offer discounts specifically for insuring new cars. These discounts can vary among insurers but may include new car discounts, safety feature discounts (such as for anti-lock brakes or airbags), and discounts for vehicles equipped with anti-theft devices. Ask your provider about available discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.