Cheap Auto Insurance for Learner’s Permit Drivers in 2025 (Save With These 10 Companies!)

Geico, State Farm, and Auto-Owners have cheap auto insurance for learner’s permit drivers. Geico has the lowest rates at $43 a month, but State Farm gives a 25% discount to good student drivers with permits. Auto insurance discounts are the easiest way to save money on learner's permit insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Apr 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Permit Driver Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Permit Driver Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 563 reviews

563 reviewsCompany Facts

Permit Driver Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

563 reviews

563 reviewsFor cheap auto insurance for learner’s permit drivers, Geico, State Farm, and Auto-Owners are the top insurers, with coverage rates starting at $43 per month.

If you’re trying to figure out how to get car insurance with a permit, take note of the ten cheapest companies for permit driver insurance:

Our Top 10 Company Picks: Cheap Auto Insurance for Learner's Permit Drivers

| Company | Rank | Monthly Rates | Student Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $43 | 15% | Cheap Rates | Geico | |

| #2 | $45 | 25% | Safe Drivers | State Farm | |

| #3 | $47 | 20% | Accidents | Auto-Owners | |

| #4 | $56 | 10% | Loyalty Programs | Progressive | |

| #5 | $63 | 15% | Usage-Based | Nationwide |

| #6 | $65 | 15% | Teen Drivers | AAA |

| #7 | $76 | 15% | Customized Policy | Farmers | |

| #8 | $86 | 20% | High-Risk Drivers | National General | |

| #9 | $87 | 20% | Insurance Discounts | Allstate | |

| #10 | $96 | 15% | Teachers & Students | Liberty Mutual |

Teens and new drivers significantly benefit from car insurance because they’re statistically more likely to get into accidents, but finding cheap auto insurance for teens is challenging.

- New drivers get the cheapest rates from Geico, State Farm, and Auto-Owners

- Save up to 25% by bundling car insurance with another policy

- Permit drivers can lower rates with student discounts and defensive driving classes

Read on to learn more about permit driver insurance and compare quotes with as many companies as possible. Stop overpaying for auto insurance. Enter your ZIP code to find out if you can get a better deal.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

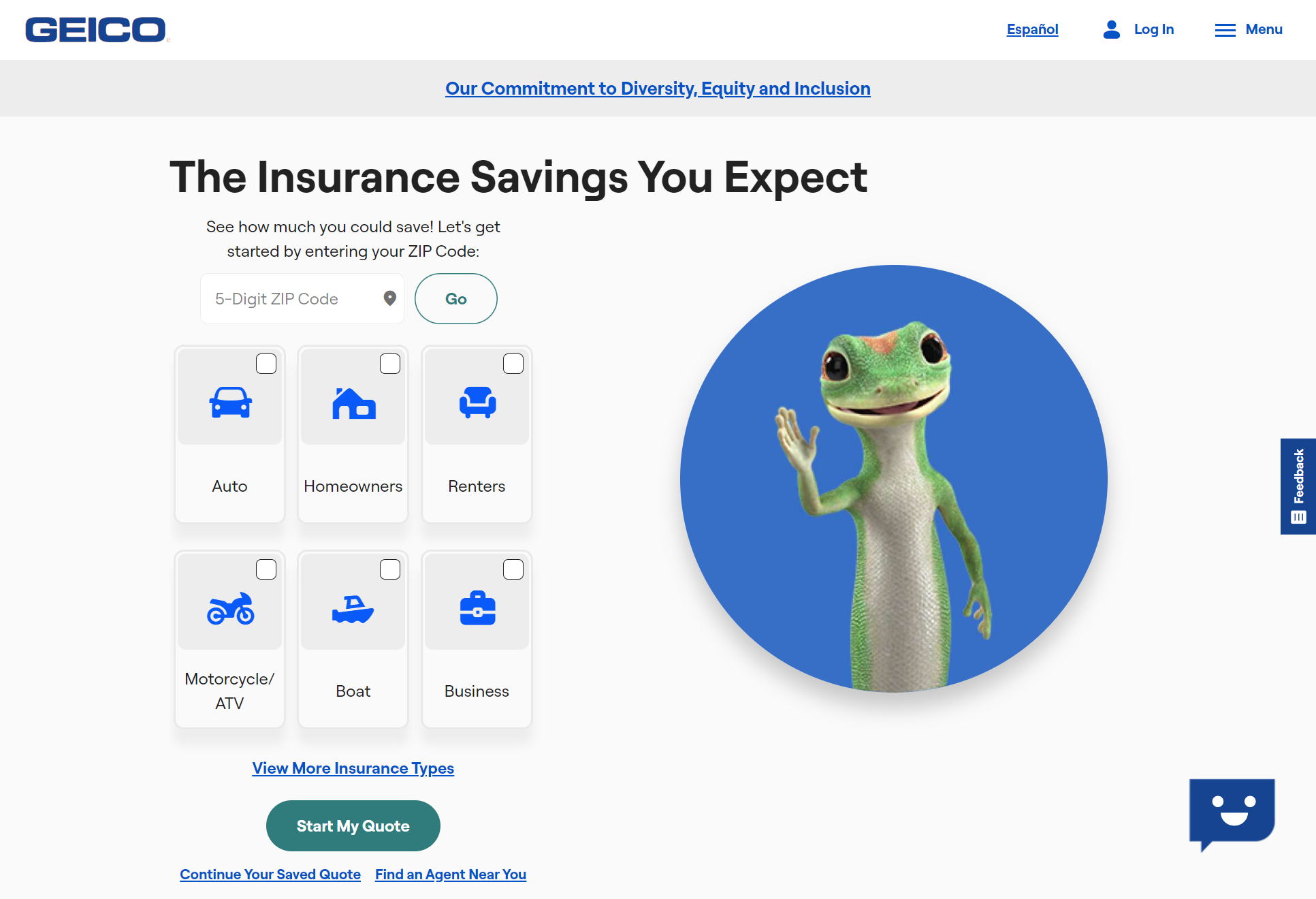

#1 – Geico: Best for Cheap Rates

Pros

- Best Insurance for Permit Drivers: Learner’s permit drivers can access some of the lowest rates in the industry, with policies starting at just $43 monthly.

- Digital Convenience: Learner’s permit drivers benefit from Geico’s app, which simplifies policy management and claims for new drivers. (Read More: Best Auto Insurance for New Drivers).

- Multiple Discount Options: Learner’s permit drivers can stack various discounts, including good student, defensive driving courses, and multi-policy savings to reduce premiums.

Cons

- Limited In-Person Support: Learner’s permit drivers might struggle with fewer local agents compared to other insurers when they need personalized guidance.

- Higher Deductibles: Learner’s permit drivers often face higher deductible requirements to maintain the lowest possible monthly premium rates.

#2 – State Farm: Best for Safe Drivers

Pros

- Drive Safe & Save Program: Learner’s permit drivers can earn up to 30% off premiums by demonstrating safe driving habits through the telematics app.

- Steer Clear Program: Learner’s permit drivers under 25 can complete this specialized training program to receive substantial policy discounts, according to our State Farm auto insurance review.

- Local Agent Guidance: Learner’s permit drivers receive personalized coaching and support from dedicated local agents who understand new driver challenges.

Cons

- Higher Initial Premiums: Learner’s permit drivers may need to establish a driving record before accessing State Farm’s most competitive rates and discounts.

- Limited Online Tools: Learner’s permit drivers sometimes find State Farm’s digital resources less comprehensive than tech-focused competitors’ offerings for new drivers.

#3 – Auto-Owners: Best for Accidents

Pros

- Accident Forgiveness: Learner’s permit drivers won’t see rate increases after their first at-fault accident, providing valuable protection for inexperienced drivers.

- Diminishing Deductible: Learner’s permit drivers can reduce their collision deductible by $100 each year they maintain a clean driving record.

- Claims Handling Excellence: Learner’s permit drivers get personal claims reps to guide them after an incident. See our review of Auto-Owners auto insurance for more details.

Cons

- Limited Availability: Learner’s permit drivers can only access Auto-Owners insurance in 26 states, restricting options for many potential customers.

- Minimal Online Features: Learner’s permit drivers who prefer digital self-service may find Auto-Owners’ technology offerings somewhat outdated compared to competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Loyalty Programs

Pros

- Snapshot Program: Learner’s permit drivers can earn personalized rates based on actual driving habits rather than demographic assumptions through this telematics option.

- Small Accident Forgiveness: Learner’s permit drivers with claims under $500 won’t see rate increases, according to our Progressive auto insurance review.

- Loyalty Rewards: Learner’s permit drivers accumulate benefits the longer they stay with Progressive, including accident forgiveness and custom rate options.

Cons

- Complex Discount Structure: Learner’s permit drivers may find it challenging to navigate the numerous discount options without professional guidance.

- Variable Pricing: Learner’s permit drivers might experience significant rate differences between initial quotes and renewal prices after six months.

#5 – Nationwide: Best for Usage-Based

Pros

- SmartRide Discounts: Learner’s permit drivers can save up to 40% through Nationwide’s usage-based insurance program that monitors actual driving behavior.

- Accident Forgiveness Option: Learner’s permit drivers can add this valuable protection to prevent rate increases after their first at-fault accident.

- Vanishing Deductible: Learner’s permit drivers earn $100 off their deductible annually for safe driving, according to our Nationwide auto insurance review.

Cons

- Higher Base Rates: Learner’s permit drivers typically start with higher premiums before qualifying for Nationwide’s substantial safe driver discounts.

- Additional Monitoring Costs: Learner’s permit drivers must pay extra fees for some telematics programs that could ultimately lead to savings.

#6 – AAA: Best for Teen Drivers

Pros

- Education Discounts: Teen drivers with a learner’s permit can save with AAA’s student discount and driver education incentives. Learn more details in our AAA auto insurance review.

- Roadside Assistance Included: Every policy includes comprehensive roadside help, providing essential support for inexperienced teen drivers with learner’s permits.

- Parent-Teen Driving Contracts: Structured agreements help establish clear expectations and may lead to additional policy discounts for drivers with learner’s permits.

Cons

- Membership Requirement: Teen drivers with learner’s permits must purchase a AAA membership before qualifying for auto insurance options and special rates.

- Geographic Limitations: The availability of AAA’s complete insurance offerings and discount programs may be restricted in certain regions for learner’s permit holders.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Customized Policy

Pros

- Signal App Savings: As mentioned in our Farmers auto insurance review, teen permit drivers can earn discounts through a telematics program that rewards safe driving.

- Customizable Coverage: Policies can be tailored to specific needs, preventing learner’s permit drivers from paying for unnecessary coverage.

- Declining Deductibles: Deductibles decrease by $50-$100 each policy period without claims, helping learner’s permit drivers save money over time.

Cons

- Higher Initial Costs: Base rates for learner’s permit drivers tend to be steeper before qualifying for Farmers’ discount programs.

- Complex Policy Structure: The three-tiered coverage system may confuse learner’s permit drivers when selecting appropriate protection levels.

#8 – National General: Best for High-Risk Drivers

Pros

- Second Chance Policies: Learners permit drivers with prior violations or accidents to still access reasonable rates despite their driving history.

- Low Down Payment Options: Affordable, upfront costs make insurance more accessible for budget-conscious learner’s permit drivers (Read More: National General Auto Insurance Review).

- SmartDiscounts Program: Policies are reviewed every six months to identify new discount opportunities for eligible learner’s permit drivers.

Cons

- Limited Digital Tools: National General’s online and mobile app options may not be as advanced as competitors for learner’s permit drivers.

- Fewer Local Agents: Learner’s permit drivers may have difficulty finding in-person support for complex policy questions.

#9 – Allstate: Best for Insurance Discounts

Pros

- Drivewise Program: Learner’s permit drivers can earn discounts immediately upon enrollment and receive ongoing savings for safe driving.

- Milestone Rewards: For learner’s permit drivers, special discounts are available at key milestones as part of Allstate’s loyalty program.

- Safe Driving Bonus: Learner’s permit drivers can receive cashback rewards every six months if they remain accident-free.

Cons

- Above-Average Base Rates: Initial premiums for learner’s permit drivers are higher before Allstate discounts apply. Find more information about Allstate’s rates in our review of Allstate insurance.

- Add-On Costs for Learner’s Permit Drivers: Features like accident forgiveness require additional fees instead of being included as standard.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Teachers & Students

Pros

- Teacher and Student Benefits: Exclusive discounts are available for teen drivers with learner’s permits connected to the education sector.

- RightTrack Discounts: Learner’s permit drivers can save up to 30% with Liberty Mutual’s telematics program. To see monthly premiums and honest rankings, read our Liberty Mutual review.

- New Graduate Programs: Special rates help learner’s permit drivers transitioning from student to working professionals maintain affordable coverage.

Cons

- Limited Bundle Options: Fewer opportunities to combine policies for maximum savings compared to other major insurers for learner’s permit drivers.

- Stricter Eligibility Requirements: Teen drivers with learner’s permits must meet more stringent criteria to qualify for Liberty Mutual’s best rates.

Comparing Insurance With a Learner’s Permit

Be prepared to pay high rates when getting insurance with a learner’s permit. Due to your lack of experience behind the wheel, insurers will consider you a higher risk and charge you for it.

Consider being added to a parent’s policy instead of purchasing your own, as it’s usually much cheaper for learner’s permit drivers.Jeff Root LICENSED INSURANCE AGENT

Finding the best car insurance for permit drivers can be costly, as insurers view inexperienced drivers as high-risk. However, some car insurance companies that accept permits offer affordable options. The table below compares monthly premiums for learner’s permit drivers across different providers.

Learner’s Permit Drivers Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $87 | $228 | |

| $47 | $124 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $86 | $230 | |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 |

If you’re wondering, “Can you get Geico insurance with a permit?”—yes, Geico and other major insurers provide insurance with a permit at competitive rates.

While other various factors affect auto insurance rates, the most common reasons why permit drivers pay more for insurance are:

- Driving Experience: New drivers don’t have the experience to rely on in tricky situations on the road, such as bad weather, construction, or other obstacles.

- Distracted Driving: Teenagers and new drivers are more likely to drive while distracted, primarily because of passengers and phone use.

- Reckless Driving: New drivers — especially males — are statistically more likely to speed or act impulsively.

- More Accidents: Lack of experience and impulsive driving behavior culminate in three times as many accidents as older drivers.

Due to these risks, companies charge much higher rates for permit driver insurance. The good news is that your rates won’t stay high forever. Rates tend to drop around 25 if your driving record is clean, and there are also plenty of car insurance discounts to help new drivers save money.

Permit Driver Insurance Rates by Age

Teens pay the highest rates on average, but even older drivers with a permit get stuck with higher costs due to lack of experience. Below is a breakdown of monthly rates by insurance provider and age group.

Learner's Permit Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | 16-Year-Old | 18-Year-Old | 21-Year-Old | 25-Year-Old | 35-Year-Old | 45-Year-Old |

|---|---|---|---|---|---|---|

| $664 | $540 | $528 | $158 | $237 | $122 |

| $910 | $740 | $843 | $271 | $368 | $228 | |

| $638 | $610 | $597 | $159 | $276 | $125 | |

| $1,103 | $897 | $957 | $256 | $654 | $198 | |

| $445 | $362 | $328 | $133 | $176 | $115 | |

| $1,120 | $893 | $954 | $306 | 275 | $248 |

| $893 | $726 | $328 | $268 | $239 | $230 | |

| $679 | $552 | $528 | $213 | $179 | $164 |

| $1,161 | $944 | $864 | $209 | $197 | $150 | |

| $498 | $405 | $397 | $158 | $176 | $123 |

The cost of auto insurance with a learner’s permit varies widely by provider and age, with monthly rates starting as low as $115 for a 45-year-old learner’s permit holder.

The average monthly rate for teen auto insurance with a learner’s permit is more expensive, but costs can double or triple if you’re caught speeding or in an accident and traffic violations. However, a parent or guardian who adds a teen to an existing auto insurance policy can cut their rates in half.

It’s crucial to compare quotes when looking for cheap auto insurance for learner’s permit drivers — rates vary dramatically, and you might overpay by selecting the first company you find. Check our guide to the best auto insurance companies for teens to compare quotes head-to-head.

Insurance Tips for Older Drivers With Learner’s Permits

While joining a parent or guardian’s insurance policy is the best way to save money on permit driver insurance, not all new drivers are teens. People learn how to drive at all stages of life, and there are ways to find cheap car insurance no matter your age:

- Get Added to a Partner’s Policy: A partner or spouse you live with can likely add you to their policy. Their rates might increase, but most insurance companies offer discounts to married couples. Compare auto insurance rates for married vs. single drivers to learn more.

- Drive an Older Vehicle: Older cars are cheaper to insure because replacement parts are less expensive, and you can also lower your rates by carrying less coverage. For example, you might get away with liability-only coverage on an old vehicle that would cost more to repair than it’s worth.

- Take a Defensive Driving Class. Both Geico and State Farm offer 15% off to new drivers who take an approved course, and you’ll find many other auto insurance companies with this kind of discount. Learn how to get a defensive driver auto insurance discount.

You’ll always find the lowest rates on auto insurance when you compare online. Use our comparison tool above to get free car insurance quotes from insurance companies that accept permitted drivers in your city.

Auto Insurance Discounts for Learner’s Permit Drivers

It’s important to look at car insurance discounts when considering a company, and most offer discounts to help new drivers save. Whether you’re buying a new policy or adding a teen to an existing plan, check for the following discounts:

Learner’s Permit Drivers Auto Insurance Discounts From the Top Providers

| Insurance Company | Bundling | Safe Driver | Good Student | New Driver | Loyalty |

|---|---|---|---|---|---|

| 15% | 10% | 30% | 10% | 12% |

| 25% | 18% | 20% | 10% | 15% | |

| 16% | 8% | 20% | 8% | 10% | |

| 20% | 20% | 15% | 9% | 12% | |

| 25% | 15% | 15% | 10% | 10% | |

| 25% | 20% | 15% | 9% | 10% |

| 15% | 12% | 15% | 10% | 8% | |

| 20% | 12% | 15% | 9% | 8% |

| 10% | 10% | 10% | 13% | 13% | |

| 17% | 20% | 25% | 6% | 6% |

Students with a 3.0+ GPA can qualify for a good student discount, while completing a driver education course may reduce rates for up to three years. Usage-based insurance discounts reward safe driving habits, and students living 100+ miles from home without a car may save on premiums. Paying the full policy upfront can also lower costs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Permit Driver Insurance Requirements

A permit-holder driver can’t legally drive without the minimum insurance required by the state. The good news is that most drivers don’t need individual permit driver insurance. Instead, the policy of the car they practice in often covers them.

Check with your insurer about listing permit drivers. Unlisted drivers can lead to denied claims and out-of-pocket costs.Tim Bain Licensed Insurance Agent

Usually, insurance companies don’t require you to add a new driver to your family policy until they officially have a license. However, you may need to notify your insurer when a permit driver is about to start using your car. Regardless of whether you need to list a permit driver on your policy, your rates won’t change until the new driver gets their license.

Learn More:

- How much car insurance do I need?

- Do you have to have auto insurance in every state?

- Minimum Auto Insurance by State

- What are the recommended car insurance levels?

Find Cheap Auto Insurance for Learner’s Permit Drivers Today

The most common and cheapest way to insure a new driver is to add them to a partner’s, roommate’s, or guardian’s policy. Allowing new drivers to join your policy rather than start their own can cut their insurance rates in half.

However, not everyone has the opportunity to join someone else’s policy. If that’s the case, companies like Geico, State Farm, and Auto-Owners are the go-to for affordable coverage rates. You can read our Geico vs. State Farm auto insurance review to see which offers the lowest rates for new drivers.

Comparing companies is integral to finding affordable rates if you need to find a new policy. Whether you want to add a teen driver to your policy or you need new insurance for yourself, looking at rates from multiple companies will help you find the lowest price. Enter your ZIP code to explore which companies have the cheapest auto insurance rates for you.

Frequently Asked Questions

Does learner’s insurance cover driving tests?

Insurance will cover you while taking your test if you’re on the policy. If you borrow a friend or family member’s car, their insurance will probably cover you for a single occasion.

However, you should always check with an insurance representative to make sure. Cheap auto insurance for driving tests is available from various providers, so comparing rates can help you find the most affordable option.

Can you get auto insurance with a permit?

Yes, insurance companies that accept permits include Geico and State Farm, but you’ll likely get cheaper rates if a roommate or guardian adds you to their policy instead. Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today.

How much car insurance does a permit driver need?

The coverage amount you need depends on your state but usually includes liability coverage. Since new drivers are more likely to get into an accident or file other claims, having more coverage is never bad.

Can you add a driver with a permit to your car insurance policy?

Most insurance companies will let you add a driver with a permit to your policy without raising your rates. Some companies require parents or guardians to add teen drivers to a policy as soon as they get their permits.

Does auto insurance for learner’s permit drivers automatically go down at 25?

Some permit driver insurance rates will drop after turning 25, depending on how long you’ve been driving and if you have any accidents or tickets.

How much does insurance for a learner’s permit driver cost?

The cost of insurance for a learner’s permit driver can vary depending on several factors, including the insurance company, the driver’s age, the type of vehicle, and the coverage options selected. Generally, adding a learner’s permit driver to an existing policy is more affordable than purchasing a separate policy.

Read More: What is the difference between car make and car model?

Can I get car insurance with a learner’s permit in New York?

Yes, you can get car insurance with a permit only in New York. Many insurance companies that accept permits in NY provide coverage for new drivers, though rates can be higher due to inexperience. The top 10 companies are on the same list of insurance companies that accept permits in NY, so compare options to find the best rates.

Is it mandatory for learner’s permit drivers to have insurance?

Insurance requirements for learner’s permit drivers vary depending on the jurisdiction. Some regions may require learner’s permit drivers to have insurance coverage, while others may not. It’s important to check with your local Department of Motor Vehicles (DMV) or equivalent authority to understand the specific legal requirements in your area.

What types of coverage are available for learner’s permit drivers?

Learner’s permit drivers can typically access the same types of auto insurance coverage as licensed drivers, including liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. The availability and specific terms of coverage may depend on the insurance provider.

Are there any restrictions or limitations for learner’s permit drivers with insurance?

Insurance companies may impose certain restrictions or limitations for learner’s permit drivers. Common restrictions include driving only with a licensed adult in the vehicle, maintaining a clean driving record, and adhering to any specific conditions outlined by the insurance provider. It’s important to review the terms and conditions of your insurance policy to understand any applicable restrictions.

Can you buy a car with just a permit?

Drivers with a permit can certainly buy a car. However, you won’t be able to take out a car loan or lease if you’re under 18 because minors can’t legally enter a contract. However, you can buy a car if you pay cash. Avoid expensive auto insurance premiums by entering your ZIP code to see the cheapest rates for you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.