Universal Auto Insurance Review (2025)

Universal Auto Insurance Company has a B+ rating with A.M. Best and an A+ rating with BBB. Universal auto insurance is affiliated with AAA and sells auto insurance primarily in Georgia and North Carolina. Universal Auto Insurance reviews are often mixed in with reviews of AAA due the company's affiliation with the larger insurer, and Universal auto insurance quotes are offered through that company.

Read moreJimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Universal Auto Insurance

Average Monthly Rate For Good Drivers

$67A.M. Best Rating:

B+Complaint Level:

LowPros

- Universal Auto Insurance Company did well enough in the last few years to receive a B+ rating with A.M. Best and an A+ rating with BBB

- Universal Auto Insurance Company operates its website through AAA’s web services.

Cons

- Universal Auto Insurance Company is available only in Georgia, some parts of South Carolina, and North Carolina

- The website doesn’t list any resources that show the visitor how to receive a quote online

Universal Auto Insurance is a regional auto insurance company located in North Carolina. Its parent company is the Seibels Bruce Group, Inc., which offers property and casualty insurance to individuals and commercial businesses including several types of auto insurance coverage.

Our Universal Auto Insurance review will cover all aspects of this company’s business, including their auto insurance affiliation with AAA and how to find affordable Universal auto insurance.

You’ll mainly see Universal Auto Insurance in NC, where its headquarters are located, but coverage is available in Georgia as well. Universal Auto Insurance Company offers property casualty insurance products cover your home, business, vehicles, and personal property.

If you’re not sure whether or not Universal is the right company for your needs, read on. We’ll cover everything you need to know.

Before you decide on Universal Car Insurance Company, make sure you shop around. To get cheap auto insurance rates today, enter your ZIP code above and compare multiple insurance companies for auto insurance.

What You Should Know About Universal Property & Casualty Insurance Company

This company’s A.M. Best rating is B+ (good), which indicates that the company is solvent. Solvency gives customers the reassurance that their premiums are in financially stable hands.

It’s important to stay aware of your insurance company’s rating, especially if you’re about to renew your policy or sign a new one.

This insurer’s rating was recently downgraded, based on A.M. Best’s outlook for its future. Most recently, the company’s underwriting decisions have come into question. These decisions resulted in huge surplus losses for 2010.

Under the Better Business Bureau, Universal Auto Insurance Company has an A+ rating, despite some poor reviews on the site.

It’s important to note that this company’s reviews should not be confused with Universal North America Insurance Company reviews , or the Universal Insurance Company of North America BBB page, since the Universal of North America Insurance is a different company.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Universal Auto Insurance Company: Auto Insurance History

Universal Auto Insurance Company is an auto insurance company that serves as a private passenger and commercial firm. They offer auto and motorcycle insurance.

Universal Auto Insurance Company also provides accessory, liability, collision, comprehensive, uninsured, and underinsured insurance coverages.

Universal Auto Insurance Company is available in Georgia, some parts of South Carolina, and North Carolina.

How is Universal Auto Insurance Company’s online presence?

There isn’t much information available on Universal Auto Insurance Company. The company appears to be an affiliate of AAA Insurance Company. Universal Auto Insurance Company operates its website through AAA’s web services.

Although AAA has several programs and services available to its clients, a policyholder under Universal Auto Insurance Company may find a limited amount of resources they can pull from regarding auto insurance.

Does Universal Auto Insurance Company have commercials?

Universal Auto Insurance Company does not have any commercials, but its parent company, AAA, does. Let’s look at one of AAA’s commercials.

This general commercial is something most would expect from an insurance provider — a brief description of the service available and the perks one might receive from doing business with this company.

Although it may be behind some of the biggest companies, AAA seems to be doing okay. Just check out AAA auto insurance reviews on BBB to verify it. As an affiliate, Universal Auto Insurance Company shares the benefits of its parent company.

The second commercial displayed below focuses on texting and driving. Watch the video to get an idea of what AAA has to say on this subject.

Distracted driving laws have been implemented across the U.S. and AAA and its affiliates, like Universal Auto Insurance Company, want to treat texting and driving like a DUI/DWI offense.

Is Universal Auto Insurance Company involved in the community?

Because the company is an affiliate of AAA, most likely all of its community involvement is done through its parent company. Universal Auto Insurance Company may do some philanthropy in communities where it operates; most smaller companies do.

What do Universal Auto Insurance Company employees have to say?

Universal Auto Insurance Company has offices in Georgia and North Carolina. You may be able to apply online. This insurer has positions in the following fields: administration, finance, customer service, legal, actuary, underwriting, and management.

Universal Auto Insurance Company representatives will help you navigate the career application process.

A person in an entry-level position with the company could further their career while maintaining their position with the company. Universal Auto Insurance may even offer tuition reimbursement.

Design of Universal Auto Insurance Company Auto Insurance Website/App

As mentioned before, Universal Auto Insurance Company’s online presence operates through AAA’s web interface. Here’s a screenshot of the design of Universal Auto Insurance Company’s webpage.

The design of the website is simple and responsive, which means it can be easily accessed on any device that hosts a web browser.

Universal Property & Casualty Insurance Company Insurance Coverage Options

Universal Auto Insurance’s basic policies for individuals vary from state to state. Business coverage is similar; different businesses will have different insurance requirements.

For example, a car dealership and an import/export business operating out of a dock would be looking for different types of coverage.

A business auto insurance policy for a car dealership requires general liability insurance, as well as the following:

- Property damage liability

- Comprehensive

- Collision

- Bodily injury liability

- Multiple cars or fleet coverage

- Worker’s compensation for policyholders

- Medical Payment (Med Pay)

If the company is self-insured, it will require excess loss coverage. A car dealership will also require a huge comprehensive plan to cover weather conditions, theft, vandalism, and other incidents that may damage the inventory.

The car dealership must also be prepared for collisions that could result from a test drive.

Universal Auto Insurance Company may be able to help you save a few dollars with the multiple cars or fleet discounts offered to dealerships and other businesses with more than four or five vehicles.

A dealership usually has more than five employees that require worker’s compensation, and a healthcare plan as part of the company’s benefits package.

Liability is always necessary when you have a business because there are a variety of occurrences that could potentially land you in court.

What are Universal Auto Insurance Company’s bundling options?

Universal Auto Insurance Company only offers automobile and motorcycle insurance options, despite their connection to AAA, which offers auto, home, and life insurance policies.

Any policyholder hoping for a bundle with Universal Auto Insurance Company may be able to bundle their vehicle and motorcycle in one policy. When policyholders bundle two different insurance policies into one, auto insurance companies often give them a discount.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Universal Property & Casualty Insurance Company Insurance Rates Breakdown

When shopping for Universal car insurance, most people are looking for the most cost-effective option.

Sometimes, there isn’t a lot of readily available information about the smaller insurance providers, and potential customers have to rely on the quote process to get an idea of how much auto insurance will cost.

In this section, we’ll go over what auto insurance policyholders pay for coverage in Georgia and North Carolina, the states where Universal Auto Insurance Company is located.

Before we move onto the rest of the section, let’s look at average auto insurance rates for Georgia and North Carolina. The table below will compare the average rates in Georgia, North Carolina, and nationwide.

Average Annual Auto Insurance Rates by State

| State | Average Annual Liability Coverage Rates | Average Annual Collision Coverage Rates | Average Annual Comprehensive Coverage Rates | Average Annual Full Coverage Rates |

|---|---|---|---|---|

| Georgia | $735 | $382 | $170 | $1,286 |

| North Carolina | $372 | $334 | $133 | $839 |

| U.S. | $611 | $363 | $160 | $1,134 |

This data comes from the National Association Of Insurance Commissioners (NAIC).

Georgia has strict liability coverage requirements, which is why liability is more expensive there compared to North Carolina and the rest of the country. Collision and comprehensive coverage, on the other hand, are roughly the same price in the two states.

Overall, it’s worth noting that North Carolina has the cheapest auto insurance rates in the U.S.

Universal auto insurance rates are not currently offered online.

What is Universal Auto Insurance Company’s availability by state?

While Universal Auto Insurance Company is available in both Georgia and North Carolina, the main base of operations for Universal Insurance Company is Winston Salem, NC.

Although insurance rates vary by person, everyone must have the minimum liability insurance required by their state in order to drive legally.

The video below will outline the requirements for the state of Georgia.

Liability coverage is essential for all motorists driving in the U.S, except for drivers in New Hampshire and Virginia, where auto insurance is not mandatory. Even if a state has lenient insurance laws, auto insurance companies will suggest policyholders enroll in the minimum requirements for auto insurance.

What about the minimum requirements for auto insurance in North Carolina? Take a look at the video below for the details about car insurance in North Carolina.

Minimum liability coverage, regardless of the state, comes at different levels. Each level carries a higher or lower coverage limit, referred to as coverage rules. You will have to pay a higher insurance rate for a greater level of coverage.

Universal Property & Casualty Insurance Company Discounts Available

We couldn’t find any viable information regarding discounts at Universal Auto Insurance Company. So if you’re looking for a discount from this company, your best option is to contact one of its agents.

Although there’s little information available specific to Universal Auto Insurance Company, many providers offer discounts to policyholders who have good credit or a good driving record, and/or those who enroll in a policy with multiple vehicles.

Just about every provider offers discounts in some form or another, so make sure you ask about this when you talk to someone from Universal Auto Insurance to set up your policy.

What programs are available from Universal Auto Insurance Company?

Inland marine coverage is a commercial category of plans that cover several industries related to inland marine fisheries and import docks, as well as those that include exporting.

These types of businesses may or may not include dry dock transportation or water transport.

A business like this needs policy inclusions such as:

- Cargo protection

- Surety bonding management

- Damage liability

- General liability

- Basic auto coverage

- Boat coverage

- Worker’s compensation

Depending on size, this type of business may or may not offer a group healthcare plan to its workers. Smaller businesses often do not.

Many insurance companies such as Universal Auto Insurance offer specialty coverage as well as standard coverage. Specialty coverage provides classic car auto insurance within a niche for antique vehicles, hot rods, and other similar vehicles.

Owners of specialty vehicles usually drive them infrequently, to trade shows or other special events, or on the occasional Sunday drive.

Therefore, they can opt for coverage intended for vehicles driven fewer than 25,000 miles per year. Insurance for these vehicles places emphasis on comprehensive coverage rather than liability coverage.

Canceling Your Universal Auto Insurance Company Auto Insurance Policy

Policyholders pursue cancellation for many reasons. Auto insurance companies will do what they can to keep you enrolled, such as informing you of any discounts you may be eligible for. Canceling your policy while under contract or while your policy is ongoing could be complicated.

What is Universal Auto Insurance Company’s policy on cancellations? Let’s take a closer look at the cancellation process.

Is there a cancellation fee with Universal Auto Insurance?

There’s always a possibility that you could be required to pay a cancellation fee when you cancel an auto insurance policy, and you may be bound by the terms of the contract you signed.

For example, if you agreed to a six-month policy, you may have to pay for the policy in full before you get another policy at another company.

Is there a refund after canceling a Universal Auto Insurance policy?

You may be entitled to a refund if you prepaid for an auto insurance policy. An auto insurance provider will have to refund you money for auto insurance that you didn’t use.

If you have questions to ask an agent, call the Universal Insurance Company phone number toll-free at 1-800-258-0143.

How do you cancel a Universal Auto Insurance Company policy?

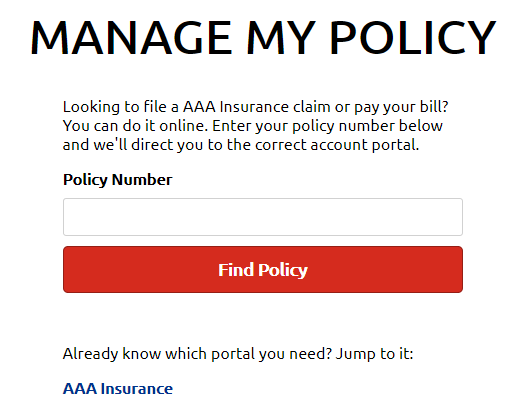

Universal Auto Insurance Company customers may be able to cancel online by entering their policy number in the dialog box on the website. The best way to cancel with Universal Auto Insurance is by calling the Universal Insurance Company phone number above.

Be sure to have your policy number and vehicle information handy when you call. Keep in mind that some policies can’t be canceled right away, and if you are able to cancel immediately, it may take several days for a cancellation to finalize.

When can I cancel my Universal Auto Insurance Company policy?

Anyone can cancel their policy at any time; however, there may be penalties if you cancel before finishing the policy you agreed to.

There can be a lot of gray areas when canceling, so be sure to ask about the cancellation policy with any auto insurance company you consider doing business with.

What about canceling auto insurance after you’ve made a claim? This video will explain the details.

Every situation is different, and auto insurance providers are prepared to handle all eventualities. But if you’re going to cancel your policy, be sure to have another policy lined up to replace it.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Make a Universal Auto Insurance Company Auto Insurance Claim

Universal Auto Insurance Company claims can only be filed online by policyholders who are logged into the claims area. The only way to access the claims area is to have a policy number with AAA. If you need to know how to find your AAA policy number, you can contact your insurance agent.

Make sure you follow the AAA insurance claim process to minimize the chances of your claim being denied.

There are three ways Universal Auto Insurance Company policyholders can file a claim.

- By phone: 1-800-258-0143

- Online: File a Claim webpage

- In person with an agent

The sooner you file your claim after an accident or other incident, the better.

Do you still want to reach the “file a claim” area on the website? Here’s how you can do it. First, navigate to the Universal Auto Insurance Company website.

Click on “File a Claim” to get to the Manage My Policy page.

This is where you’ll need to enter your policy number so you can proceed to the next page and file your claim.

How to Get a Universal Auto Insurance Company Auto Insurance Quote Online

The website doesn’t list any resources that show the visitor how to receive a quote online. All quotes from the Universal Auto Insurance Company go through AAA Insurance’s quote generator. You may be able to buy Universal auto insurance online that way.

The best way to get Universal auto insurance quotes is to contact an agent by phone or meet them in person at their office. You can also use the Universal Insurance Company phone number found at the top of this page.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Where can I find a Universal Auto Insurance agent in my area?

Whether you are looking for an agent for Universal Auto Insurance Company in Raleigh, NC, or in Atlanta, the main company contact number is your best bet. You may want to read some Universal Insurance agency reviews to decide which agent is best for you. There is no Universal Auto Insurance in Puerto Rico, at least not from this company.

Is AAA a good insurance company?

AAA has a lot of brand name recognition and is considered to be a solid company. They are among the largest insurance companies in some states, including California.

But is AAA auto insurance good? Well, the question of what makes a good insurance company depends on a lot of factors, including your needs and where you live.

So, again, is AAA good auto insurance? That’s a question only you can answer for yourself.

Does Universal bundle home insurance?

Based on what we’ve seen, you will not be able to get home insurance with Universal. However, they are affiliated with AAA. They may be able to refer you to their parent company.

You can also check out AAA home and auto insurance reviews to find out what other customers are saying about the coverage.

Does Universal Auto Insurance Company provide additional liability coverages?

It depends on the requirements of the state, but policyholders will likely have the option of additional liability coverages like personal injury protection and medical payment (Med Pay) coverage on their auto insurance.

What’s the difference between collision and comprehensive coverage?

There is a difference between collision and comprehensive auto insurance. Collision coverage pays for property damage regardless of who is at fault during an accident.

Any damage done to a vehicle that does not involve a collision is covered by comprehensive coverage. Therefore, damage from vehicle theft, a falling object, fire, or storm would be considered comprehensive damage.

Check out comprehensive car insurance reviews if you’re interested in reading personal stories about the benefits of that coverage.

Should I be worried about Universal Property and Casualty denying claims?

Not if you’re a Universal Auto Insurance Company customer. The two are different companies. If you need to file Universal Property and Casualty claims, use the Universal Property and Casualty claims phone number which you can find on their website.

And if you’re wondering is Universal Property a good insurance company, you can check out Universal Property and Casualty Insurance Company reviews.

What is the rating for auto owners insurance?

There are a multitude of auto insurance companies out there, all offering the best rates. Walmart auto insurance can even be found in some areas. Check out their website to see if Walmart insurance is available in your state.

You can also check Walmart car insurance reviews on BBB to see what other consumers say to answer the question, is Walmart car insurance any good?

With all forms of auto insurance, including Walmart car insurance, it is important to compare other rates before deciding on one company. There is no connection between Universal Auto Insurance and Walmart.

How do I file with Universal Insurance claims?

To file a claim, you should contact the Universal Insurance Company claims department directly. They will guide you through the process and provide you with the necessary forms and information required to file your claim.

It’s important to have all the relevant details, such as the date, time, and location of the incident, as well as any relevant photos or documentation before you start dialing Universal Insurance Company’s auto claims phone number.

Can I manage my Universal Auto Insurance policy online?

Yes, Universal Auto Insurance typically offers an online platform or customer portal where you can manage your policy. Through this portal, you can make payments, view policy details, access digital ID cards, initiate changes to your coverage, and sometimes even file claims. Visit their website or contact their customer service to inquire about their online policy management options.

What factors can affect the cost of my auto insurance with Universal?

Several factors can influence the cost of your auto insurance policy with Universal Auto Insurance. Common factors include your driving record, the type of vehicle you drive, your age and gender, your location, your credit history, and the coverage options you select. Universal Auto Insurance utilizes its own rating system, so it’s best to contact them directly or obtain a quote to get accurate pricing based on your specific circumstances.

Where is my policy number?

So you are asking yourself, how do I know my policy number? You don’t have to find yourself worrying about where to find my policy number. Just contact your insurance provider, and they will be able to tell you what your auto insurance policy number is.

Is AAA an insurance company?

Yes, AAA is an insurance company. You can purchase various kinds of insurance coverage from buying car insurance with AAA, to AAA universal life insurance policy.

If you’re asking how good is AAA auto insurance or is AAA a good home insurance company, you should look at reviews of AAA auto insurance. You can also check out AAA home insurance reviews on BBB.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Yuliana

Best Insurance Ever

Alex9753

Review Universal

ExzoOrozco

First big wreck! but it was easy. :)

edleonstgo

Automotive Insurance Review

tee

insurance

Elsa Gibbons

Universal review

Hedin Ray Mitchell

Universal review

Charity McNeely

Universal review