National Casualty Auto Insurance Review (2025)

National Casualty Auto Insurance Company is a subsidiary of Nationwide. They provide high-risk auto insurance through independent agents and have an A+ financial rating from A.M. Best.

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

National Casualty Insurance

Average Monthly Rate For Good Drivers

N/AA.M. Best Rating:

A+Complaint Level:

Low- National Casualty Auto Insurance Company is a subsidiary of Nationwide Insurance

- National Casualty Company provides high-risk insurance through independent agents

- National Casualty strives to maintain a positive presence in the community

Looking for information about National Casualty Insurance?

National Casualty is a high-risk auto insurance company underwritten by Nationwide. Nationwide, with monthly rates averaging $44 for liability and $115 for full coverage, faces mixed reviews on claims handling. This is why you need to compare insurance companies online. Start with Scottsdale Insurance company reviews and Nationwide insurance reviews.

Most of the time, searching for the best type of auto insurance for your needs would mean hours of research, long phone calls, and internet searches. Imagine, instead, if you had all the information you needed in one easy guide.

That’s exactly what we’ve put together here in this National Casualty auto insurance review. We’ll analyze all the information related to the National Casualty Company of America to give you a better idea of the options available to you.

If you’re ready to start comparing auto insurance rates now, enter your ZIP code into our free quote tool to get started.

What You Should Know About National Casualty

The National Casualty Company parent company is Nationwide Mutual Insurance. Nationwide also writes policies under all of the following company names:

- Western Heritage Insurance Company

- Scottsdale Surplus Lines Insurance Company

- Scottsdale Insurance Company

- Scottsdale Indemnity Company

- National Casualty Company

- Freedom Specialty Insurance Company

Who owns Scottsdale Insurance Company? Nationwide, which also underwrites for National Casualty. There is no relationship between the Nationwide and National General insurance companies. Allstate owns National General. Learn more in our Allstate auto insurance review.

Who is the parent company of Nationwide Insurance? As a mutual company, Nationwide is actually owned by its policyholders and is one of the ten largest auto insurance companies in the U.S.

Who is the National Casualty Company? National Casualty Company is a subsidiary of the Nationwide Casualty Company. Nationwide Insurance has a division under the Scottsdale Insurance Company.

The National Casualty Company in Scottsdale, AZ is a part of the Excess and Surplus Specialty Team of the Nationwide Mutual Insurance Company. It was created in 1982 with only 12 employees. Now there are over 1,300 employees and annual premium sales in excess of $2 billion. National Casualty Company has contributed to the success of Scottsdale as one of its insurance groups.

This National Casualty auto insurance review will look at operations through both the Scottsdale entity and National Casualty.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

National Casualty Auto Insurance Ratings and Reviews

National Casualty Company ratings and rewards include:

- Healthiest Employers in 2011

- Most Admired Companies by Arizona Business Magazine in 2010

- Top 125 businesses in the area of training by Training Magazine

- Corporate Leader by Scottsdale Leadership, Inc., a local nonprofit organization, in 2008

Nationwide property and casualty insurance company is considered one of the largest insurance companies in the United States. It maintains an A+ rating by A.M. Best and an A rating by Standard & Poor’s. Get more company ratings in our Nationwide auto insurance review.

National Casualty Company A.M. Best ratings are the same as Nationwide since it’s the parent company.

National Casualty Auto Insurance Customer Service Review

National Casualty is a member of the Better Business Bureau. The Better Business Bureau has given National Casualty, under the Scottsdale Insurance name, a rating of A+.

National Casualty is also professionally associated with the Wholesale & Specialty Insurance Association (WSIA).

If you need to reach customer service, call the National Casualty Insurance Company phone number at 1-800-423-7675.

National Casualty Insurance Company Employee Review

Jobs for National Casualty are available on the Scottsdale Insurance website. Simply input the job category, location, and any keywords to view all job opportunities.

There is even a separate area for “hot job opportunities” that you can click on to view the job description, location, and requirements. The site also provides the ability to do the following:

- Tell a friend about the job

- Save to a job cart to view later

- Apply online

On the website, there’s the ability to establish an account, but it’s not mandatory. By making an account you can save your resume and set up a way for managers to contact you for jobs that fit your experience.

Scottsdale Insurance provides numerous benefits to its employees. For instance, there is profit-sharing, a 401(k), business casual attire permitted, flexible schedules, onsite ATM, professional development, and tuition reimbursement.

A unique attribute to working for National Casualty through Scottsdale Insurance is the associate assistance program, which helps its employees when they need child or elder care.

Should you become employed by Scottsdale, there is even information on the website regarding the area of Scottsdale. There is a brief description of the area and links to learn more about the city.

National Casualty Auto Insurance Claims Review

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

National Casualty Auto Insurance Website Review

The company’s website is well organized and provides information on all the services available through the company, how to find a local agent, how to file a claim and much more.

The company doesn’t offer a mobile app at this time.

National Casualty Insurance Coverage Options

One of the first things you’ll need to do when purchasing your auto insurance policy is to decide how much coverage you need.

If you’re financing your vehicle, your loan company may require you to carry full coverage insurance. Otherwise, you’ll need at least the minimum amount of liability insurance required by your state of residence.

The table below shows some of the different types of policies and coverage available to you, along with what they do, but you can also call an agent via the National Casualty auto insurance phone number to discuss your coverage needs.

Types of Auto Insurance Coverage

| Auto Coverage Type | Purpose of Coverage |

|---|---|

| Bodily injury liability | Part of your liability coverage that pays for medical bills if you've injured someone else in an automobile accident |

| Collision | Covers damage to your car after an automobile accident |

| Comprehensive | Covers damage to your car that happens when you're not driving |

| Personal injury protection | Covers medical expenses for you or your passengers after an automobile accident |

| Property damage liability | The other part of liability coverage that covers the cost of any property damage you've caused in an automobile accident |

| Uninsured/underinsured motorist | Covers the costs if you're in an automobile accident caused by a driver with little or no car insurance |

Business owners may also be interested in National Casualty Company commercial insurance for fleets and business vehicles. There are also National Casualty truck insurance policies depending on what kind of work vehicles you’re using.

If you own a business with employees, you may consider National Casualty Company workers’ comp to protect yourself if employees are injured while on the clock.

Some people may be wondering,”Is National Casualty Company admitted?“Well, the answer is that National Casualty Insurance works on both an admitted and non-admitted basis, using the following company paper for their policies:

- Freedom Specialty Insurance Company

- National Casualty Insurance

- Scottsdale Indemnity Company

- Scottsdale Insurance Company

- Scottsdale Surplus Lines Insurance Company

- Western Heritage Insurance Company

Keep scrolling to learn more about the auto insurance options available to you.

What are National Casualty Insurance’s bundling options?

Many auto insurance providers offer different bundling options. Bundling your insurance refers to purchasing multiple policies from the same company.

For example, you can buy your auto insurance policy as well as your life insurance from the same company, if you choose. Most insurance companies offer a discount of anywhere from 5 percent to 25 percent if you choose to bundle your policies.

Many companies offer multi-car discounts, too. You can think of this as a way of bundling, as well, but in this case, you’re buying auto insurance for multiple vehicles. Auto insurance companies offer up to a 25 percent multi-car discount on combined policies.

Canceling Your National Casualty Auto Insurance Policy

National General Insurance understands that there are many reasons that people need to cancel their auto insurance policy. For this reason, they make it fairly simple to cancel your auto insurance policy if you need to do so.

Keep reading to find out more about policy cancellations and filing claims.

Is there a cancellation fee?

National Casualty Insurance doesn’t charge a cancellation fee if you need to cancel your policy.

Is there a refund?

Whether you can get a refund on your policy depends on the type of policy and when you choose to cancel. If you choose to cancel a refundable policy in the middle of the policy cycle, you’ll receive roughly half of what you paid, assuming that you only paid for that cycle.

Since refund amounts may vary and depend on a variety of factors, check with your insurance agent to see what factors apply to you.

How do you cancel?

What should you do if you need to cancel your policy?

You can cancel your policy at any time simply by contacting your auto insurance agent and letting them know that you’d like to cancel your policy. Your agent will let you know when the changes will take effect and whether you’re entitled to a refund of any policy premiums you’ve paid.

When can you cancel?

You can cancel your policy at any time simply by contacting your auto insurance agent and letting them know that you’d like to cancel your policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Make a National Casualty Insurance Auto Insurance Claim

Through Scottsdale Insurance, National Casualty Company policyholders can either report their auto insurance claims through the website or by telephone with the National Casualty insurance claims phone number at 614-249-1545.

If you’re wondering how to file an auto insurance claim on the website, you should have:

- Your policy number

- Information regarding the accident (time, place, and date)

- Names and numbers of other parties involved

- Details of the accident

- Police report information

It takes about five to 10 minutes to report the claim online. The site even provides a claim entry overview in video form for further explanation on filing a claim. The National Casualty claims phone number will also connect you with an agent who can talk you through the process.

If you would like to make a National Casualty or Nationwide loss run request, you can do so by contacting the company at the following phone number: 1-800-228-6700. You can also send an email to [email protected].

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How to Get an Auto Insurance Quote Online

National Casualty writes policies for high-risk drivers who need tips to get that high-risk auto insurance premium under control through wholesale agents, brokers, and program managers.

Excess and surplus line insurers aren’t allowed to sell policies over the internet. Policies are sold only through agents and brokers who are local to the client.

Auto insurance agents can only be found by calling Scottsdale Insurance.

If you’re an insurance professional looking for a National Casualty Agent, Broker, or Program Manager, you can locate the agent by inputting the agency name and state into the website’s toolbox.

If you’re an agent for National Casualty, the Scottsdale website allows you to log in to the site with a username and password.

National Casualty Insurance Rates Breakdown

While the price isn’t always the deciding factor when it comes to choosing an auto insurance policy, it’s usually one of the most important. Customer satisfaction is another thing that drivers look for when choosing auto insurance.

You can look at the table below to get an idea of what you might pay for auto insurance depending on how much coverage you decide to buy. The table shows average annual rates based on coverage levels.

Average Auto Insurance Rates by Coverage

| Coverage Types | Average Annual Auto Insurance Rates | Average Monthly Auto Insurance Rates |

|---|---|---|

| Comprehensive coverage | $150.36 | $12.53 |

| Collision coverage | $299.73 | $24.97 |

| Liability coverage | $516.39 | $43.03 |

| Total Full Coverage Cost | $954.99 | $79.58 |

Keep in mind that these are just guidelines. Actual rates will depend on a variety of factors such as age, driving history, and ZIP code.

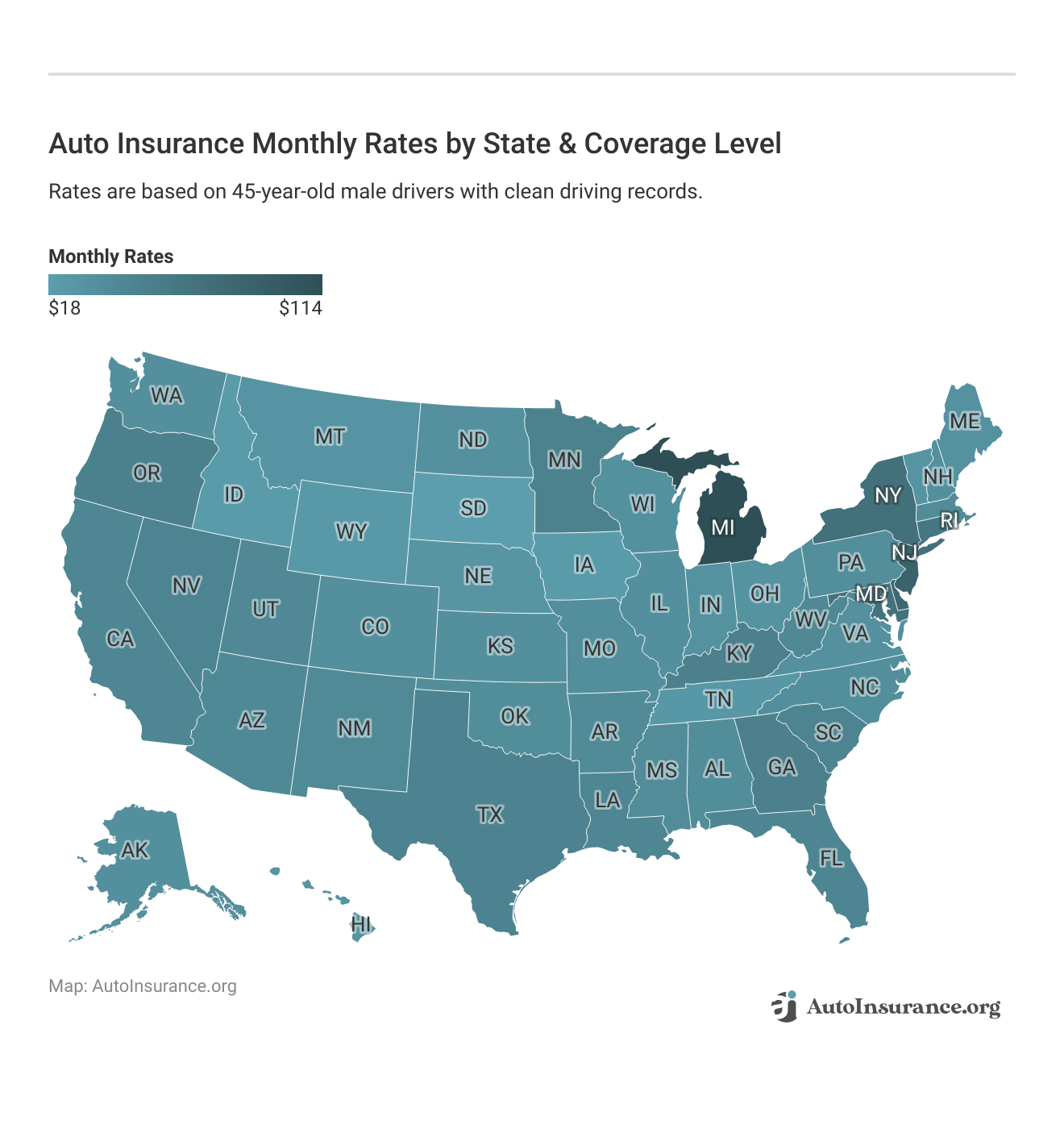

What is National Casualty Insurance’s availability by state?

National Casualty Insurance, sometimes referred to as National Mutual Insurance Co., is available in all 50 states and the District of Columbia.

Chances are, no matter where you’re in the United States, National Casualty and its parent company, the Nationwide Mutual Insurance Company, have you covered.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

National Casualty Discounts Available

Generally, your discount options through the company depend on what each provider has to offer, but many discounts are standard throughout the industry.

The table below shows some of the most common auto insurance discounts available and an estimate of how much money each can save you, as well as the major auto insurance companies that offer the discount.

Standard Auto Insurance Discounts Offered by Major Companies

| Discounts Offered | Average Savings | Available With |

|---|---|---|

| Low mileage/Low usage discount | Up to 20% | State Farm, Allstate, Travelers, Nationwide, Progressive |

| Defensive driving discount | 10%–15% | State Farm, Geico, Allstate, Travelers, Nationwide, Progressive, Farmers |

| Safe driver discount | 10% | State Farm, Geico, Allstate, Travelers, Nationwide, Progressive, Liberty Mutual, State National |

| Military and federal employee discount | 8%–15% | Geico, Esurance, USAA |

| Good student discount | 5%–25% | State Farm, Geico, Allstate, Travelers, Nationwide, Progressive, Liberty Mutual, State National |

| Senior/Mature driver discount | 5%–10% | Geico, Allstate, Liberty Mutual, State National |

| Homeowner discount | 3% | State Farm, Geico, Allstate, Travelers, Nationwide, Progressive, Farmers |

As you can see, it’s always a good idea to check with your insurance provider to see what types of discounts you may qualify for as they can save you a lot of money on your auto insurance.

Frequently Asked Questions

Does National Casualty Insurance offer SR-22 insurance?

If you’ve had more than your fair share of traffic citations, automobile accidents, and auto insurance claims, you may be considered a high-risk driver. Normally, high-risk drivers are required to purchase SR-22 insurance, which is available with National Casualty Company insurance policies.

The filing fee to get SR-22 insurance is only $15–$35, but the increase in rates for SR-22 insurance when compared to rates for drivers without any driving violations on their records is definitely not pocket change. Rate increases for driving violations that result in a driver being forced to carry SR-22 insurance can be as much as $541 a month.

How do I contact the National Casualty insurance company?

Call the National Casualty insurance phone number at 800-423-7675 or visit the Nationwide or National Casualty Company websites for more information, policy inquiries, or assistance with claims.

You can also reach out to the National Casualty Company address:

National Casualty Co.

1 W Nationwide Blvd. 1-14-301

Columbus, OH 43215

Their customer service representatives are available to address your queries and provide support.

How do I file National Casualty insurance claims?

National Casualty Company auto claims can be filed online at Nationwide.com, but you can always call the National Casualty auto insurance claims phone number at 614-249-1545 to file with an agent. If you have questions regarding a claim, call the National Casualty Company phone number for customer service toll-free at 1-800-423-7675.

Are there any discounts available with National Casualty auto insurance?

National Casualty Company offers discounts to policyholders, but they can vary depending on factors such as your driving record, vehicle safety features, multi-policy discounts, good student discounts, and more. It’s recommended to inquire about available discounts when obtaining a quote or speaking with their representatives.

Is National Casualty Insurance involved in the community?

National Casualty believes in giving back to the community. They are active in the United Way campaign in Arizona and contribute yearly to local organizations.

The company also encourages its employees to be involved in local charities such as:

- St. Mary’s Food Bank Alliance

- American Red Cross

- The Boys and Girls Clubs of Greater Scottsdale

In addition to community involvement, National Casualty believes in making a difference within its organization. They have implemented campaigns to cut water usage, recycle, conserve energy, implement organized carpooling, and conserve paper usage.

How is National Casualty Insurance’s online presence?

National Casualty Insurance does provide its customers with a website where they can find a local agent, make a payment, file a claim, and do a variety of other insurance-related tasks.

You can also use the National Casualty website to request an ID card, a certificate of insurance, or a policy change.

Does National Casualty Insurance have commercials?

While the company doesn’t run commercials under the name National Casualty, they do run television commercials for their parent company, Nationwide Insurance.

What are examples of casualty insurance?

What falls under casualty insurance includes any policy that protects what you own, such as business insurance, homeowners insurance, auto insurance, and umbrella coverage.

Is auto insurance casualty insurance?

Auto insurance is a type of casualty insurance since it protects a vehicle you own or lease.

Who owns National Casualty insurance company?

Nationwide owns National Casualty along with many other property and casualty insurance, life insurance, and investment companies.

Who owns Nationwide?

Nationwide is a mutual company and owned by its policyholders. Shares in the company are not available on the public market.

Does Nationwide have good customer service?

While claims service is around average, Nationwide customer service performs below average in most regions in J.D. Power’s annual surveys.

Is Nationwide good at paying out claims?

Nationwide is equipped to pay out on claims with superior financial ratings from A.M. Best but performs around average in customer service surveys. Many Nationwide car insurance reviews complain about the company dropping loyal customers after their first claim.

Who underwrites Nationwide insurance?

Royal & Sun Alliance Insurance Ltd. underwrites Nationwide property and casualty insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

no image available 0 reviews