Geico vs. Mercury Auto Insurance in 2026 (Compare Rates)

When comparing Geico vs. Mercury auto insurance, Mercury Insurance has lower average rates, starting at $39 per month. However, Geico is available in every state and is cheaper for younger drivers. Geico car insurance also has an A++ rating from A.M. Best for financial stability and higher claims satisfaction.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated August 2025

19,116 reviews

19,116 reviewsCompany Facts

Minimum Coverage

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 675 reviews

675 reviewsCompany Facts

Minimum Coverage

A.M. Best

Complaint Level

Pros & Cons

675 reviews

675 reviewsWhen choosing between Geico vs. Mercury auto insurance, Mercury has cheap auto insurance for a bad driving record, but Government Employees Insurance Company, Geico, is cheaper for good drivers and younger drivers.

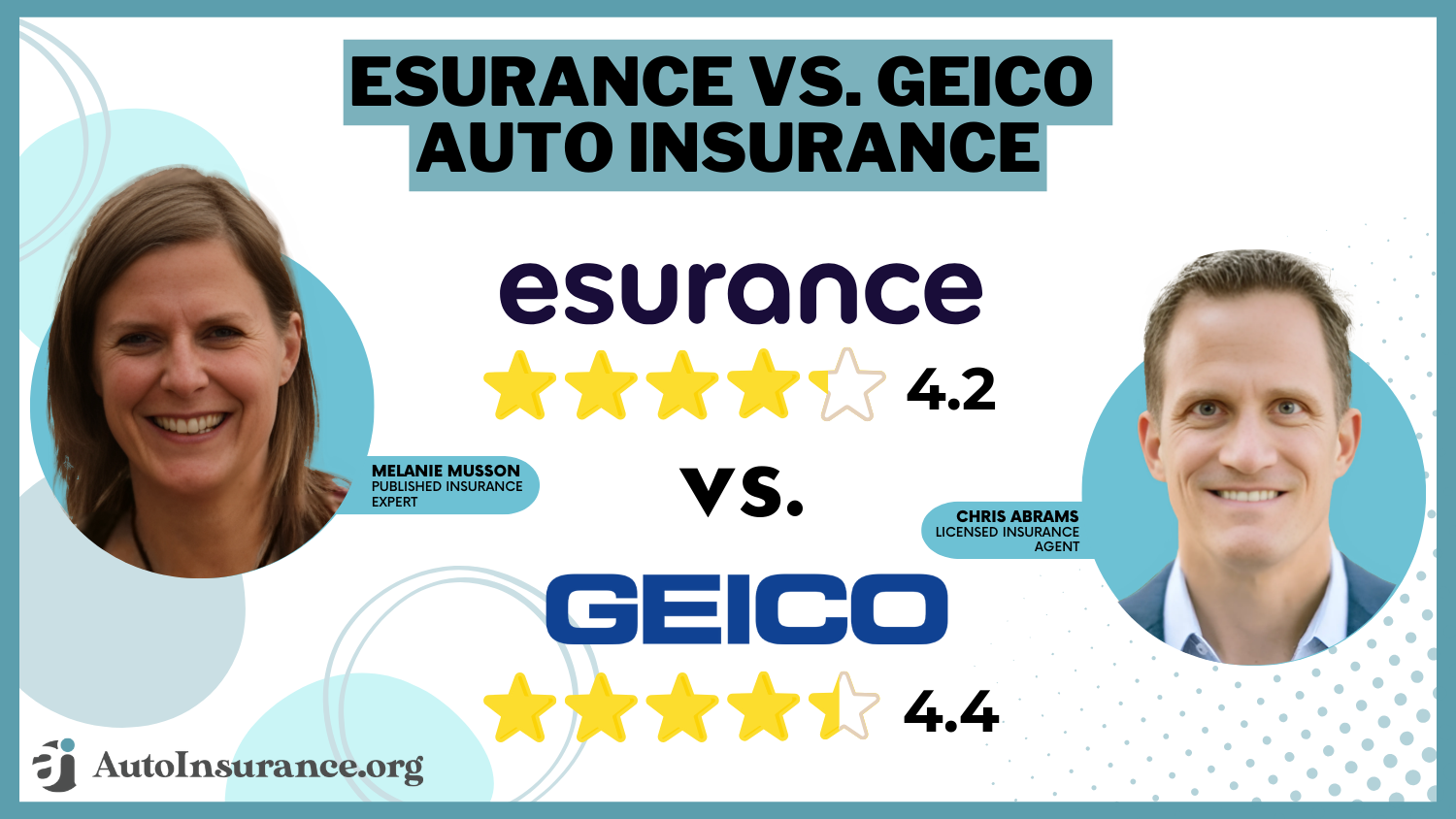

Geico vs. Mercury Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.4 | 4.1 |

| Business Reviews | 4.5 | 4.0 |

| Claim Processing | 4.8 | 3.3 |

| Company Reputation | 4.5 | 4.0 |

| Coverage Availability | 5.0 | 3.1 |

| Coverage Value | 4.4 | 4.1 |

| Customer Satisfaction | 2.3 | 3.7 |

| Digital Experience | 5.0 | 4.0 |

| Discounts Available | 4.7 | 5.0 |

| Insurance Cost | 4.5 | 4.3 |

| Plan Personalization | 4.5 | 4.0 |

| Policy Options | 4.1 | 5.0 |

| Savings Potential | 4.5 | 4.5 |

| Geico Review | Mercury Review |

Geico also has better financial stability ratings and is available in all states, making it the better choice for good drivers.

However, we found that Mercury is a solid option for drivers with poor records.

- Geico has higher ratings from A.M. Best and the BBB

- Mercury Insurance is only available in 11 states

- Both companies offer significant savings with UBI discounts

To help you choose between the two companies, we will go into all aspects of Mercury Insurance and Geico, from rates to customer service reviews. Need to find affordable auto insurance today? Enter your ZIP in our free quote tool to get started.

Geico vs. Mercury Auto Insurance Rates

Price is often one of the most important factors to customers when picking a policy. To see which company is better for affordability, take a look at average minimum coverage rates by age and gender below.

Geico vs. Mercury Auto Insurance Monthly Rates

| Age & Gender | ||

|---|---|---|

| 16-Year-Old Female | $163 | $213 |

| 16-Year-Old Male | $178 | $227 |

| 30-Year-Old Female | $46 | $47 |

| 30-Year-Old Male | $46 | $49 |

| 45-Year-Old Female | $43 | $43 |

| 45-Year-Old Male | $43 | $42 |

| 60-Year-Old Female | $40 | $39 |

| 60-Year-Old Male | $41 | $40 |

For drivers under 45, Geico will be the cheapest company when you get a Geico quote, even for young drivers in their teens (Read More: Reasons Auto Insurance Costs More for Young Drivers).

However, Mercury Insurance rates are cheaper on average for drivers over 45. Of course, if you choose full coverage at Geico or Mercury Insurance, the rates will be a little higher.

Next, see which company offers the best value on auto insurance if your driving record is less than perfect.

Geico vs. Mercury Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $43 | $42 |

| One Accident | $71 | $62 |

| One DUI | $117 | $70 |

| One Ticket | $56 | $52 |

When comparing rates by driving record, Mercury Insurance offers lower rates on average. If you have an accident, ticket, or DUI on your record, Mercury Insurance will be the better choice price-wise (Learn More: How Auto Insurance Companies Check Driving Records).

Of course, there are other things to consider when evaluating Mercury Insurance and Geico beyond price, such as coverages, discounts, customer service, and much more.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Coverage at Geico and Mercury

Both Mercury Insurance and Geico have plenty of car insurance options for customers to choose from. Some of the common coverage offered by both insurance companies includes:

- Collision: Covers your vehicle damages if you collide with another driver or object.

- Comprehensive: Covers your vehicle damages if you collide with an animal or your car is damaged by weather, vandalism, and more.

- Liability: Pays for other parties’ medical and property damage if you cause an accident.

- Medical Payments (MedPay): Covers your medical bills after an accident.

- Personal Injury Protection (PIP): Covers your medical bills and lost wages after an accident.

- Uninsured/Underinsured Motorist: Covers your accident bills if you are hit by a driver who has insufficient insurance or no insurance.

In addition to the basic coverages, both companies also offer several add-on options. Take a look at what add-on types of auto insurance coverage each company offers below.

Geico vs. Mercury Auto Insurance Coverage Options

| Coverage | ||

|---|---|---|

| Roadside Assistance | ✅ | ✅ |

| Rental Reimbursement | ✅ | ✅ |

| Mechanical Breakdown Insurance | ✅ | ❌ |

| Rideshare | ✅ | ✅ |

| Gap Insurance | ❌ | ✅ |

Geico doesn’t offer gap insurance, and Mercury Insurance doesn’t offer mechanical breakdown insurance. However, not many drivers need or want these coverages.

In most cases, a full coverage policy with liability, collision, and comprehensive coverage will meet drivers' needs.Daniel Walker Licensed Insurance Agent

Overall, both companies offer a great array of auto insurance coverages for customers to choose from.

Geico vs. Mercury Auto Insurance Discounts

Each company also offers savings to customers with various discount opportunities, from bundling discounts to UBI discounts.

Geico vs. Mercury Auto Insurance Discounts

| Discount | ||

|---|---|---|

| Anti-Theft | 25% | 12% |

| Bundling | 25% | 20% |

| Claims-Free | 12% | 10% |

| Good Driver | 26% | 25% |

| Good Student | 15% | 15% |

| Low Mileage | 30% | 20% |

| Loyalty | 10% | 10% |

| UBI | 25% | 50% |

| Membership | 8% | 5% |

| Safe Driver | 15% | 8% |

Both Mercury Insurance and Geico also offer good student discounts to students with a B average or higher, which is a great way for young drivers to get savings.

You can also get cheap usage-based auto insurance with UBI discounts at Geico and Mercury. To earn a discount, you must join the UBI program and drive for a few months while being tracked on the apps. Geico’s UBI program is DriveEasy, and Mercury’s is MercuryGo.

Neither program will raise your rates for a poor driving score in the program, so they are worth checking out to try to earn a lower rate.

Geico vs. Mercury Auto Insurance Reviews

You can find plenty of customer feedback on sites like Google, Yelp, or Reddit. There is a little more chatter about Geico that can be found when looking at Mercury vs. Geico Reddit reviews, as Geico has a larger market share and serves more customers than Mercury.

However, Mercury also has some customer reviews that can easily be found online (Read More: Auto Insurance Companies With the Best Customer Service).

We want to take a look at a few Geico and Mercury reviews to see what customers are saying online about the companies. For example, see what customers have to say to a consumer considering switching to Geico below.

Customers say that Geico is an affordable option for low-risk drivers, but feedback is mixed on how they handle claims, with some customers having a great experience and others saying Geico was unresponsive. Mercury Insurance also has mixed feedback from customers, as you can see in the Reddit thread below.

Does anyone have any experience with Mercury Car Insurance?

byu/GibsonMaestro inAskLosAngeles

While customers say that Mercury Insurance offers cheap rates that beat out the competition, a common complaint is that the claims department is unresponsive and difficult to deal with.

Both Mercury and Geico have also been rated by several businesses for customer satisfaction, business practices, and more. Take a look at the most important business ratings below.

Insurance Business Ratings & Consumer Reviews: Geico vs. Mercury

| Agency | ||

|---|---|---|

| Score: 692 / 1,000 Below Avg. Satisfaction | Score: 663 / 1,000 Below Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A- Good Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 70/100 Positive Claims Handling |

|

| Score: 0.52 Fewer Complaints Than Avg. | Score: 0.84 Fewer Complaints Than Avg. |

|

| Score: A++ Superior Financial Strength | Score: A Excellent Financial Strength |

Both Geico and Mercury Insurance have lower customer satisfaction scores on J.D. Power, but they also have lower-than-average customer complaint scores on the NAIC. Geico comes out ahead with its A.M. Best and BBB scores, which rate financial strength and business practices.

Geico has a better financial rating from A.M. Best than Mercury does, meaning that its financial management and stability are better.Dani Best Licensed Insurance Producer

Auto insurance companies are rated by the BBB based on transparency, consumer complaints, and other known issues. Financially, Geico is the better company, but both are similar in terms of customer satisfaction and customer complaints (Read More: What makes good auto insurance companies good?).

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Geico Auto Insurance Pros and Cons

Geico is available in all 50 states, meaning more drivers have access to cheap rates than with Mercury General Corporation.

- Availability: Geico car insurance is sold in all U.S. states, so you can keep it as a provider after a move.

- Bundling Discount: Geico offers a 25% discount to customers who bundle auto with either home or renters insurance (Learn More: How to Save Money by Bundling Insurance Policies).

- Coverage Options: Geico has great add-ons like roadside assistance, rental reimbursement, and more.

However, Geico doesn’t sell all types of policies and receives relatively low ratings for customer service and claims handling, despite its easy-to-use mobile app and website.

- No Gap Insurance: Geico doesn’t sell gap insurance, which covers the difference between the depreciated value and the loan or lease on a new car that’s totaled.

- Claims Satisfaction: Geico has a 692/1,000 score from J.D. Power, which is higher than Mercury’s but still below average.

Overall, Geico is a good choice for most customers, but it may not be right for everyone.

Mercury Auto Insurance Pros and Cons

Compared to Geico, Mercury auto insurance offers larger discounts and lower rates, ultimately saving drivers more money on their coverage.

- UBI Discount: Customers can join MercuryGo to potentially save up to 50%, with a discount of up to 10% for signing up and up to 40% off at renewal.

- Coverage Options: Mercury Insurance has add-ons like rideshare insurance, roadside assistance, and more (Read More: Best Roadside Assistance Plans).

- Poor Driver Rates: Mercury auto insurance rates for drivers with bad driving records are on the cheaper end.

The catch is that Mercury is only available in select states, and drivers in these states may not have access to usage-based or other types of discounts based on state law.

- Availability: Mercury is only available in 11 states: Arizona, California, Florida, Georgia, Illinois, Nevada, New Jersey, New York, Oklahoma, Texas, and Virginia.

- Claims Satisfaction: Mercury Insurance has a 663/1,000 score from J.D. Power, which is below average for satisfaction.

The easiest way to choose between Geico vs. Mercury car insurance is by comparing quotes online to see which provider offers the best policy options at the best price in your area.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Choosing Between Geico and Mercury Auto Insurance

It can be hard to choose between two companies. When considering Geico vs. Mercury auto insurance, make sure to take into account your auto insurance needs, from prices to coverage options. For most drivers, Geico will be the better choice, due to its widespread availability and affordable rates.

Read More: How to Choose an Auto Insurance Company

However, Mercury Insurance is more affordable for drivers with poor records, so you may want to get a quote from Mercury if it’s available in your state.

No matter what companies you are considering, you can find the best deal for your situation by shopping around for quotes from companies in your area. Compare rates with our free quote tool to get started.

Frequently Asked Questions

Is Mercury reputable?

Wondering is Mercury auto insurance good? Mercury has an A score from A.M. Best for financial stability and an A- from the BBB for business practices, so it is a reputable company.

Is Geico or Mercury insurance better?

Mercury is the cheaper choice for bad drivers, as its minimum rate for a DUI driver averages $70 per month compared to Geico’s rate of $117 per month. However, Geico has a better financial stability score of A++ from A.M. Best and is available in all states, whereas Mercury is only sold in 11 states.

Why is Mercury so cheap?

Mercury General Corporation auto insurance rates start at $39 per month. Part of the reason Mercury rates may be so cheap for you is due to discounts that can be applied to your policy, such as the anti-theft discount (Read More: Best Anti-Theft Auto Insurance Discounts).

Is Geico a good auto insurance company?

Yes, Geico is a good car insurance company, with an A+ rating from BBB for business practices and low rates starting at $40 per month.

Is Geico good at paying claims?

Geico has a 692/1,000 score from J.D. Power for customer claims satisfaction, indicating its claim satisfaction is slightly below average. However, its financial stability rating of A++ from A.M. Best shows it is financially capable of paying out customer claims.

Is there Geico home insurance?

Yes, Geico also sells home insurance. If you buy both your home and auto insurance from Geico, you can get a 25% discount (Learn More: Best Home and Auto Insurance Bundling Discounts).

Is Geico the most expensive auto insurance?

No, Geico is not the most expensive car insurance company. Some of the most expensive companies are Allstate, Liberty Mutual, and Progressive.

What insurance is better than Mercury?

If Mercury Insurance is not the right fit for you, other great choices include Geico, State Farm, and USAA. To compare auto insurance rates from multiple companies quickly, enter your ZIP in our free quote tool.

How much does Mercury Insurance go up after an accident?

Mercury minimum coverage insurance rates jump from $42 per month for a clean driving record to $62 per month after one accident (Read More: How long does an accident affect your auto insurance rate?).

Who is cheaper than Mercury?

Geico is cheaper than Mercury for drivers under 45. For example, minimum coverage rates for 16-year-old female drivers start at $163 per month at Geico, compared to $213 per month at Mercury.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.