CURE Auto Insurance Review for 2025 (Customer & Financial Ratings)

CURE car insurance offers the basic coverages necessary to drive, starting at $102/mo. Drivers also enjoy CURE auto insurance's 24-hour customer service. Our CURE auto insurance review overviews all you need to know about CURE auto claims handling, average rates, coverage options, and discounts.

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Jun 4, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 4, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

CURE Auto Insurance

Average Monthly Rate For Good Drivers

$102A.M. Best Rating:

NAComplaint Level:

HighPros

- Includes roadside assistance with some policies

- Bases rates on your driving record rather than on your credit score, occupation, or education

- Excellent customer satisfaction ratings

- Competitive rates with a clean record

Cons

- Available only in Pennsylvania, Michigan, and New Jersey

- You can’t file a claim online

- Limited discounts and coverages

- CURE is a small car insurance company that sells coverage in three states

- Unlike other companies, CURE primarily considers your driving record to determine your rates

- While you might see lower rates with CURE, you’ll likely find cheaper prices elsewhere

Our CURE auto insurance review found that this small company primarily considers your driving record when setting rates, while others consider various other factors that affect car insurance rates.

Before deciding on coverage, it’s important to evaluate CURE auto reviews to see how third-party ratings and customers rate the company.

CURE Auto Insurance Rating

Rating Criteria

Overall Score 2.8

Business Reviews 3.0

Claim Processing 1.8

Company Reputation 3.0

Coverage Availability 1.5

Coverage Value 2.9

Customer Satisfaction 2.5

Digital Experience 2.5

Discounts Available 2.0

Insurance Cost 3.7

Plan Personalization 2.5

Policy Options 3.1

Savings Potential 3.2

Our insurance CURE review will help you discover if the company is right for you, and we’ll also overview some CURE insurance reviews from customers and the Better Business Bureau (BBB).

If you’re wondering, “How can I get cheap CURE auto insurance near me?” enter your ZIP code above to get instant car insurance quotes from the top providers.

What You Should Know About Cure Auto Insurance

What is CURE auto insurance? While it’s not as well-known as companies like State Farm or Geico, CURE, also known as Citizens United Reciprocal Exchange, offers affordable coverage for some drivers (Read More: State Farm Auto Insurance Review & Geico Auto Insurance Review).

CURE Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: A- Great Complaint Resolution |

|

| Score: 65/100 Low Customer Satisfaction |

|

| Score: 5.16 More Complaints Than Avg. |

However, you can only buy CURE auto insurance in Michigan, New Jersey, and Pennsylvania. See how much CURE drivers pay for Pennsylvania auto insurance here.

CURE is a good insurance choice for some drivers, but not everyone benefits. Before signing up for a policy with CURE, you should do a little research to ensure the company is a good fit for you. For example, New Jersey drivers should read through NJ CURE auto insurance reviews to see if the company has good claims handling and customer service.

According to CURE auto insurance reviews on Reddit from policyholders in Detroit, MI, the company offers super cheap rates with quality customer service and claims handling.

While CURE is well-known for its low rates, one Reddit user pointed out that CURE is quick to review your policy if you file a claim like other low-cost insurance companies.

Another great place to review is third-party ratings, though CURE is too small to garner attention from many companies. A.M. Best and J.D. Power don’t give CURE a rating.

The National Association of Insurance Commissioners (NAIC) gives CURE a 5.16. The NAIC scores companies on the number of complaints compared to their size. The national average is 1.0, meaning the volume of CURE auto insurance complaints is more than five times higher than the amount of complaints relative to an insurer its size.Michelle Robbins Licensed Insurance Agent

The Better Business Bureau (BBB) rates companies on their ability to resolve customer complaints. CURE auto insurance reviews with the BBB show the company has an A- meaning any complaint you might have will likely be resolved quickly.

While CURE has a few good third-parting ratings, CURE car insurance reviews from customers aren’t as great. CURE has improved its service recently, but people still say the company is unresponsive and uncoordinated.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

CURE Car Insurance Cost

As stated before, the most important factor for CURE insurance is a clean driving record. If you have minimal infractions on your record, you’ll most likely have a low CURE auto insurance payment. To get an idea of how much you might pay with CURE, consider the following prices below.

CURE Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

Age & Gender Minimum Coverage Full Coverage

Age: 16 Female $310 $410

Age: 16 Male $330 $430

Age: 18 Female $255 $355

Age: 18 Male $275 $375

Age: 25 Female $155 $205

Age: 25 Male $175 $225

Age: 30 Female $135 $175

Age: 30 Male $145 $185

Age: 45 Female $105 $140

Age: 45 Male $108 $143

Age: 60 Female $102 $137

Age: 60 Male $107 $142

Age: 65 Female $112 $147

Age: 65 Male $117 $152

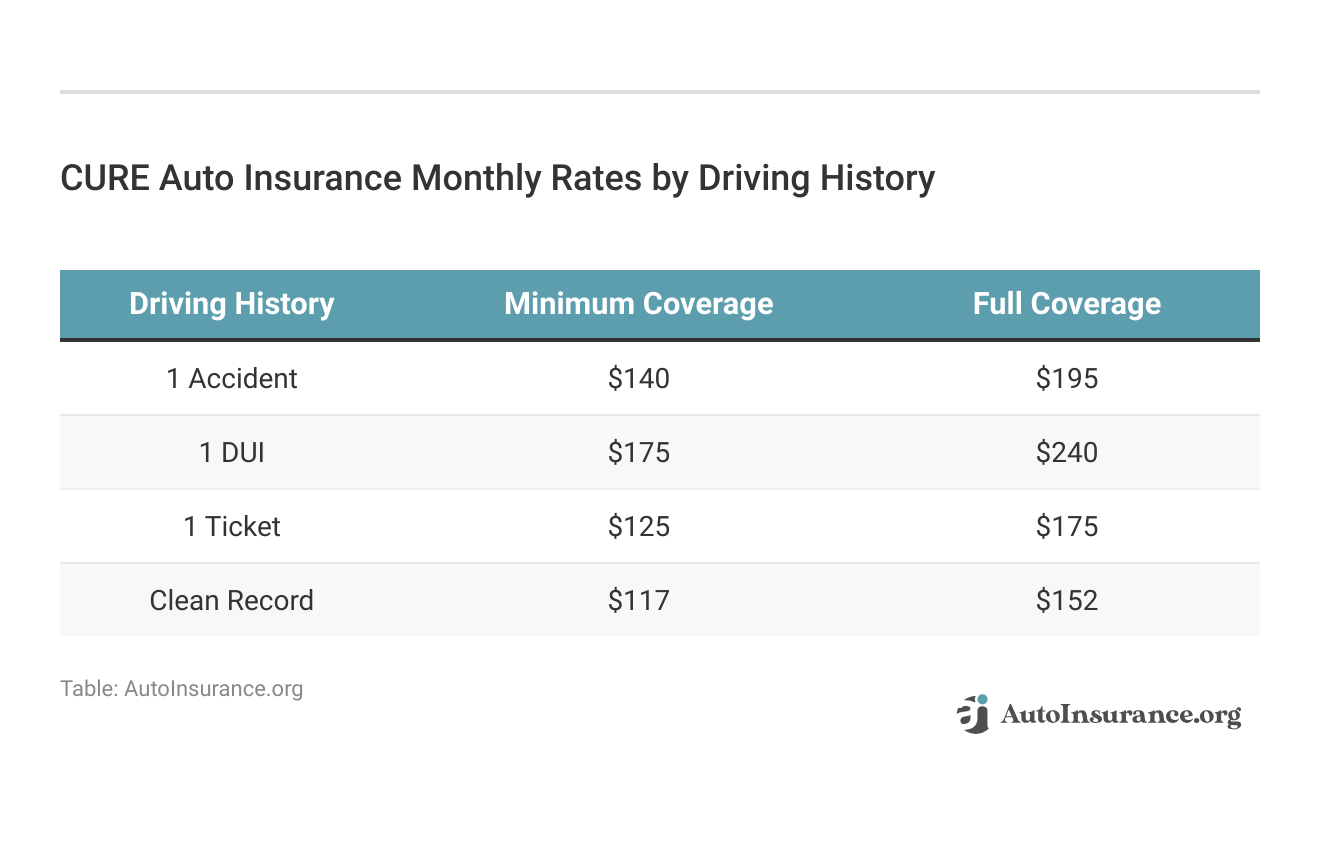

However, if you have infractions on your driving record, you’ll likely see higher rates. Check out the table below to see how much you could pay with CURE based on your driving record:

In addition, CURE car insurance quotes can vary significantly between states. For example, CURE auto insurance of Michigan could be more expensive, especially since Michigan has higher-than-average rates compared to other states.

Read More: Michigan Auto Insurance

CURE Auto Insurance Coverage Options

Most drivers look for two types of car insurance — minimum and full coverage insurance. Minimum car insurance refers to the least amount of coverage you can buy and still legally drive or register a car in your state.

While it’s never required by law, you may want to consider getting CURE auto insurance full coverage if you have a car loan or lease. It costs more, but CURE full coverage offers much better protection.

CURE provides everything drivers in Michigan, Pennsylvania, and New Jersey need to stay protected on the roads, no matter how much coverage they want. CURE sells the following types of insurance:

- Bodily Injury Liability Insurance: As one-half of liability coverage, bodily injury covers injuries you cause to other drivers, passengers, and pedestrians. It does not cover your own injuries.

- Property Damage Liability: As the second half of liability insurance, property damage covers damage you cause to other people’s property.

- Collision Insurance: While liability insurance is typically required by state law, you’ll need collision coverage to help pay for your car repairs. It also covers you if you hit a stationary object.

- Comprehensive Auto Insurance: Comprehensive coverage covers damage from unexpected events, like fire, vandalism, floods, weather, theft, and animal contact.

- Uninsured/Underinsured Motorist Coverage: Every state CURE operates in requires car insurance, but that doesn’t mean all drivers follow the law. Uninsured motorist pays for damage when a driver with inadequate insurance hits you.

- Personal Injury Protection Insurance: Personal injury protection insurance covers medical bills for you and your passengers after an accident. It also covers you when you’re a passenger in someone else’s car or hit as a pedestrian or bicyclist.

These are the basic insurance options most companies offer. If you want more coverage, you’ll probably need to look elsewhere. CURE is vague about what it offers, so there are no reports about any available add-ons.

However, you’ll get CURE auto roadside assistance for free with every plan. Most companies sell roadside assistance coverage as an add-on, and it can be expensive in some cases. CURE might not offer the most extensive list of add-ons, but free CURE insurance roadside assistance helps drivers save.

Contact the CURE auto insurance roadside assistance phone number at 1-866-522-1991 if you need a tow, fuel delivery, or jump-start services.

CURE’s Basic Auto Insurance Package

CURE auto insurance in New Jersey offers a pre-built package that makes buying coverage easy. Usually, the company’s rates for basic coverage ranges from $25 to $50 monthly, but you should get a NJ CURE quote to know exactly what your monthly NJ CURE payment will be.

Read More: New Jersey Auto Insurance

CURE’s basic package includes the following:

- $5,000 property damage liability insurance

- $15,000 personal injury protection insurance

- $10,000 extended medical expense benefits

Drivers can also choose to add bodily injury liability insurance to their NJ CURE auto insurance policy too.

Getting auto insurance isn’t hard. But how about getting the best 🏆coverage? You might need some inside tips💡. https://t.co/27f1xf1ARb has the info you need to know you’re getting a good deal. Check it out here👉: https://t.co/U1DDipUs78 pic.twitter.com/9DIzt8sawL

— AutoInsurance.org (@AutoInsurance) January 14, 2024

If you buy the basic package, you’ll need to supplement it with more coverage. New Jersey’s insurance laws require a 15,000/30,000/5,000 plan, which CURE’s basic package does not meet. You can also add additional coverage to your NJ CURE car insurance plan, like comprehensive or collision insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

CURE Auto Insurance Rates Breakdown

Most companies use a variety of factors when determining your rates. When you shop at a standard insurance company, it will look at the following factors:

- Age and Gender

- Location and Occupation

- Credit Score and Marital status

- Make and Model of Your

- Driving History and Previous Claims

Compared to other companies, CURE auto insurance quotes are often on par with the national average. However, some drivers will see lower rates than other demographics. For example, CURE tends to be cheaper for auto insurance for young adults, whereas older adults usually see higher prices.

Unlike standard insurance companies, CURE focuses primarily on your driving score. Drivers with minimal incidents in their driving history will see the lowest rates at CURE.

CURE Car Insurance Discounts

One thing often noted as lacking in CURE auto insurance reviews is discounts.

Insurance companies offer discounts to help customers save money and reward them for safe driving habits. Finding a company with multiple discounts you can take advantage of can help lower your monthly costs significantly. While CURE has a few discounts, it doesn’t compare with bigger companies.

When you shop at CURE, you might be eligible for the following car insurance discounts:

- Defensive Driving: Earn a 5% discount on your liability, collision, and personal injury protection insurance by taking a defensive driving course approved by CURE.

- Loss-Free: If you go two years without making a claim, CURE will discount your comprehensive and collision insurance by 5%. The longer you go, the more you can save. This discount maxes out at 20% after five years.

- Safe Parking: Insurance companies prefer that you park your car in a secure location. You’ll earn 10% off your comprehensive insurance by parking off-street and 25% off for parking in a secure garage.

While this isn’t the longest list of discounts, CURE still offers decent options to save. For instance, drivers who complete a CURE-approved defensive driving course could save 5%.

However, you should check with a representative when you sign up for a policy since options and availability change by state.

How Cure Auto Insurance Ranks Among Providers

Although CURE offers lower rates for some drivers, you’ll probably find better prices elsewhere. Companies like Geico, Progressive, and State Farm usually offer lower rates than CURE. Check below to see how CURE’s rates compare to other companies:

Full Coverage Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $468 | $540 | $141 | $147 | $125 | $122 | $122 | $119 |

| $640 | $740 | $240 | $252 | $231 | $228 | $226 | $223 | |

| $435 | $591 | $165 | $195 | $164 | $166 | $161 | $163 |

| $520 | $600 | $200 | $210 | $190 | $185 | $180 | $175 | |

| $853 | $897 | $228 | $239 | $199 | $198 | $194 | $194 | |

| $313 | $362 | $128 | $124 | $114 | $114 | $112 | $112 | |

| $745 | $893 | $249 | $285 | $244 | $248 | $239 | $243 |

| $404 | $454 | $124 | $130 | $112 | $110 | $110 | $108 | |

| $432 | $552 | $177 | $194 | $161 | $164 | $158 | $160 |

| $843 | $944 | $187 | $194 | $159 | $150 | $156 | $147 | |

| $362 | $417 | $109 | $113 | $103 | $101 | $101 | $99 | |

| $327 | $405 | $133 | $147 | $123 | $123 | $120 | $120 | |

| $580 | $670 | $180 | $190 | $164 | $161 | $159 | $156 |

| $757 | $1,056 | $142 | $154 | $139 | $141 | $136 | $138 | |

| $257 | $289 | $106 | $113 | $84 | $84 | $82 | $82 | |

| U.S. Average | $560 | $656 | $182 | $191 | $166 | $165 | $163 | $161 |

Factors such as driving record, age, and gender impact your CURE insurance cost. You can also compare CURE insurance rates vs. other top providers by driving record in the table below:

Social Worker Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $87 | $103 | $124 | $152 | |

| $62 | $73 | $94 | $104 |

| $76 | $95 | $109 | $105 | |

| $43 | $56 | $71 | $117 | |

| $96 | $116 | $129 | $178 |

| $63 | $75 | $88 | $129 | |

| $56 | $74 | $98 | $75 | |

| $47 | $53 | $57 | $65 | |

| $53 | $72 | $76 | $112 | |

| $32 | $36 | $42 | $58 |

As you can see, CURE is better suited for younger drivers, whereas companies like Geico and Progressive provide better rates for older adults. Discover how to find the best auto insurance for seniors here.

Although its average rates are higher, CURE still might be the best option if you have a clean driving history. However, you might see a much higher increase in your rates if you get into an accident than you would at another company.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

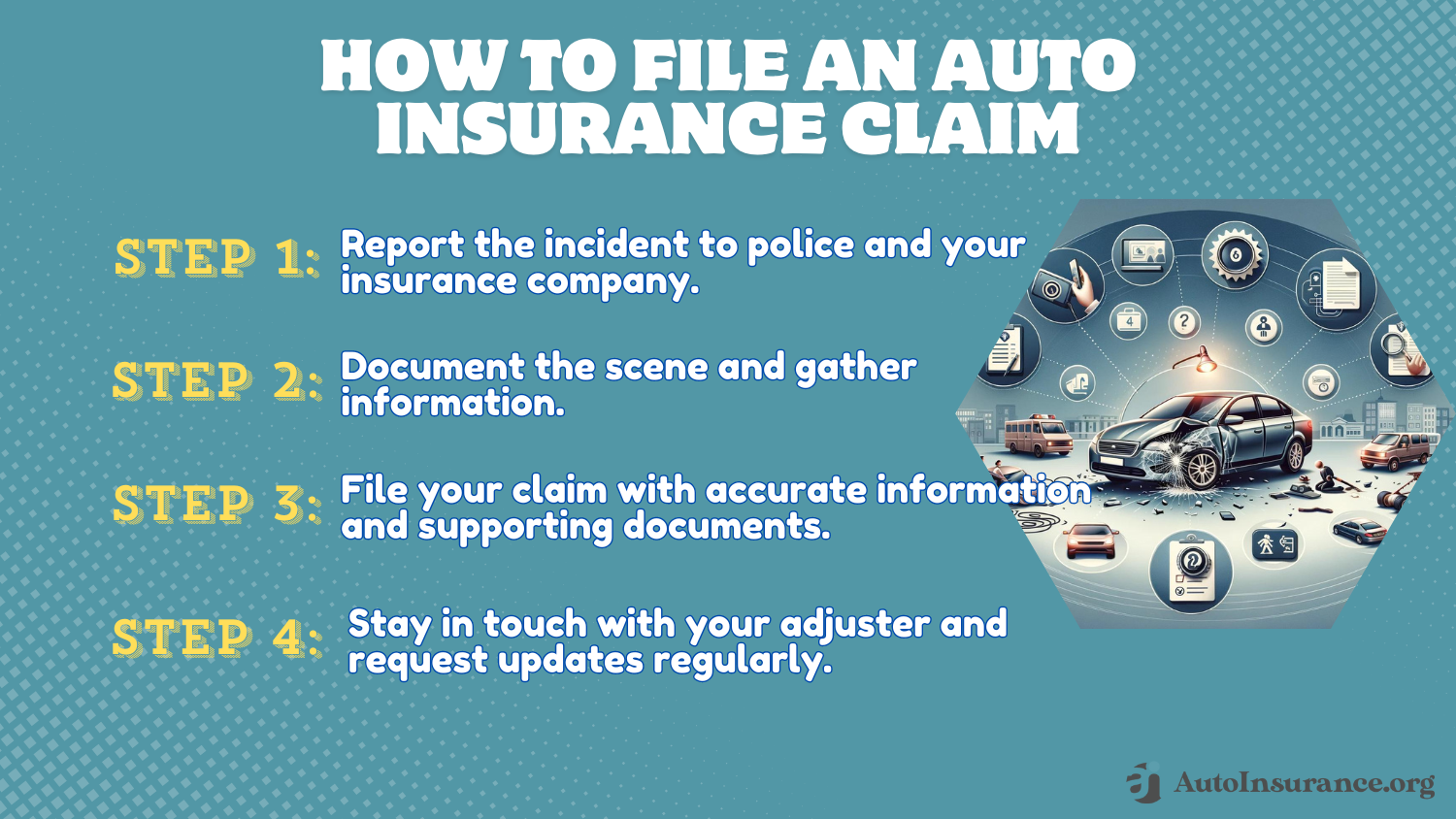

How to File an Auto Insurance Claim With CURE

While most companies offer their customers multiple online options to file claims, CURE has fewer options. When you need to file a car insurance claim with CURE, you’ll need to call and speak with a claims representative.

Fortunately, 24/7 customer service is one of the great CURE auto insurance services ensuring drivers can get assistance with their claims whenever they need it.

Find Out If The CURE Car Insurance Company Is Right for You

CURE might have the cheapest car insurance rates if you live in New Jersey, Pennsylvania, or Michigan. However, CURE is best for those without driving infractions. For example, drivers in Michigan with a clean record could see cheap CURE Michigan auto insurance rates.

Real savings on car insurance have arrived in Michigan! CURE is a no-fault specialist and can save drivers up to 60%!

Watch our Super Bowl ad to find out how CURE can bring you real savings!#SuperBowl #superbowlcommercials #cureautoinsurance #cureinsurance #realsavings pic.twitter.com/QU14Peba5B

— CURE Auto Insurance (@CUREInsurance) February 11, 2022

When you’re in the market for vehicle coverage, check out multiple reviews on CURE auto insurance to see if the company is right for you. You should also compare your CURE insurance quote with as many competitors as possible.

Learn More: Where to Compare Auto Insurance Rates

If you’re still wondering, “How do I find CURE insurance near me?” enter your ZIP code into our free quote comparison tool below to see whether you should go with the CURE auto insurance company.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

How much is CURE auto insurance?

The amount you pay for insurance at CURE depends on your situation. However, you’ll usually pay around $25 to $50 monthly for liability-only auto insurance.

Unlike standard companies, CURE looks primarily at your driving history to determine your rates. If you have a clean driving record, you’ll see much lower rates with CURE. However, drivers with speeding tickets, at-fault accidents, or other incidents will pay much more at CURE.

Does CURE offer good coverage options?

While CURE can cover your basic insurance needs, it doesn’t have options for modification. However, you’ll get free CURE roadside assistance with every plan if you get stranded on the road. Simply call the CURE auto insurance roadside assistance number at 1-866-522-1991 to get help.

Read More: Roadside Assistance Coverage

How do you file a claim with CURE?

To file a car insurance claim, contact the CURE auto insurance phone number for claims at 1-800-229-9151.

Is CURE insurance legit?

CURE is a legitimate option for car coverage even though it doesn’t work quite the same way as standard insurance policies. While it’s a legit option for insurance, CURE is best for people with a clean driving record.

What states does CURE sell insurance in?

A top question readers ask is, “What states have CURE auto insurance?” CURE originally sold insurance in Pennsylvania and New Jersey but recently added Michigan to its roster. While CURE is usually good for drivers with a clean record, rates vary by state. For example, CURE auto insurance reviews in Michigan state rates are low, but the customer service is poor.

Enter your ZIP code into our free quote tool below to see how much CURE insurance costs in your area.

What is CURE insurance?

CURE, also known as Citizens United Reciprocal Exchange, is a not-for-profit auto insurance company that provides coverage to drivers in select states. They aim to offer affordable insurance rates while focusing on safe driving and rewarding responsible behavior on the road.

Does CURE auto insurance offer any discounts or rewards?

Yes, CURE insurance offers various discounts and rewards to policyholders. These may include discounts for safe driving, low mileage, having a good credit score, and being a homeowner. CURE also has a unique program called the “CURE Good Driver Plan” that rewards safe driving behavior with potential discounts on premiums.

Is CURE auto insurance in Michigan?

Yes, you can get CURE auto insurance in Michigan. Wondering how much it costs for CURE auto insurance in Detroit? Read our comprehensive guide titled “Detroit, MI Auto Insurance” to learn more.

Can I manage my CURE auto insurance policy online?

Yes, you can use your CURE auto insurance login to manage your policy online. Through CURE.com, policyholders can access policy details, pay premiums, update personal information, and manage their claims.

Can I cancel my CURE auto insurance policy?

Yes, you have the option to cancel your CURE auto insurance policy. If you’re wondering how to cancel CURE auto insurance, simply contact the CURE insurance phone number at 1-800-535-2873.

It’s important to review the cancellation terms and any potential fees or penalties before proceeding with the cancellation. Consider the implications and ensure you have alternative insurance coverage in place, if necessary.

Is CURE auto insurance good?

Is CURE insurance good? CURE.com reviews on the BBB site are poor, though only 38 customers submitted a review. However, while CURE auto insurance BBB accreditation isn’t available, it carries an A- rating from the BBB.

On the other hand, the company’s complaint index from the National Association of Insurance Commissioners is more than five times higher than average, meaning many customers have complained about the services offered by CURE auto insurance.

Who owns CURE auto insurance?

Auto insurance policyholders own the CURE insurance company, operating as a member-owned reciprocal exchange.

Does CURE auto insurance have a grace period?

Generally, you’ll receive a grace period to make a CURE auto insurance late payment. Grace periods range from 7-30 days, but you should contact the CURE car insurance phone number at 1-800-535-2873 to find out the company’s specific period.

Is CURE auto insurance legit in Michigan?

CURE insurance in Michigan is legitimate company with an A- rating from the BBB. However, CURE auto insurance Michigan reviews complain of poor claims handling and unnecessary fees. Check out CURE insurance Michigan reviews to see if the company is right for you.

Contact the CURE auto insurance Michigan phone number at 1-800-535-2873 for questions about claims and coverage options.

Can you get a CURE home insurance policy?

You may be wondering, “Does CURE have home insurance?” Since CURE only specializes in auto insurance coverage, you won’t be able to get CURE homeowners insurance. See how owning a home affects auto insurance rates here.

How do I contact CURE?

Call the CURE auto insurance 24-hour customer service phone number at 1-800-535-2873 to speak with a representative.

How do I contact CURE auto insurance in Michigan?

Simply call CURE’s customer service at 1-800-535-2873 if you’re a Michigan driver who needs to speak with a representative. You can also use your CURE auto insurance Michigan login at CURE.com to chat with customer service.

Is there a CURE auto insurance grace period?

Yes, CURE policyholders have at least 10 days after their payment due date to submit a payment before policy cancellation.

Does CURE auto insurance cover rental cars?

Your CURE insurance may extend to rental cars, but check with a representative to know for sure.

Find Out More: Does my auto insurance cover rental cars?

What are the CURE auto insurance hours?

You can contact CURE insurance Monday through Friday from 8 a.m. to 7 p.m. (EST) and Saturday from 9:30 a.m. to 4 p.m. (EST).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Julie Hope

Cure Auto Insurance review

Edgar Garcia

Cure Auto Insurance review

hhdhdd hsgdvdvd

CURE Auto Insurance review

Customer_Mad

Worst Customer Service

Awilli1989

The worst

noneofyourbiz44_yahoo_com

Worst experience

Mese

Worst Ever

Jass10

Great rate and service

Jass10

Very affordable & great service

sj1023

CURE SUCKS and is a scam