Amica vs. Travelers Auto Insurance in 2026 (Side-by-Side Review)

With Amica vs. Travelers auto insurance, Travelers starts at $49 per month with IntelliDrive tracking and bundling discounts to lower your rate. Amica’s minimum coverage starts at $60 per month, with optional Platinum Choice upgrades like Prestige repairs.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

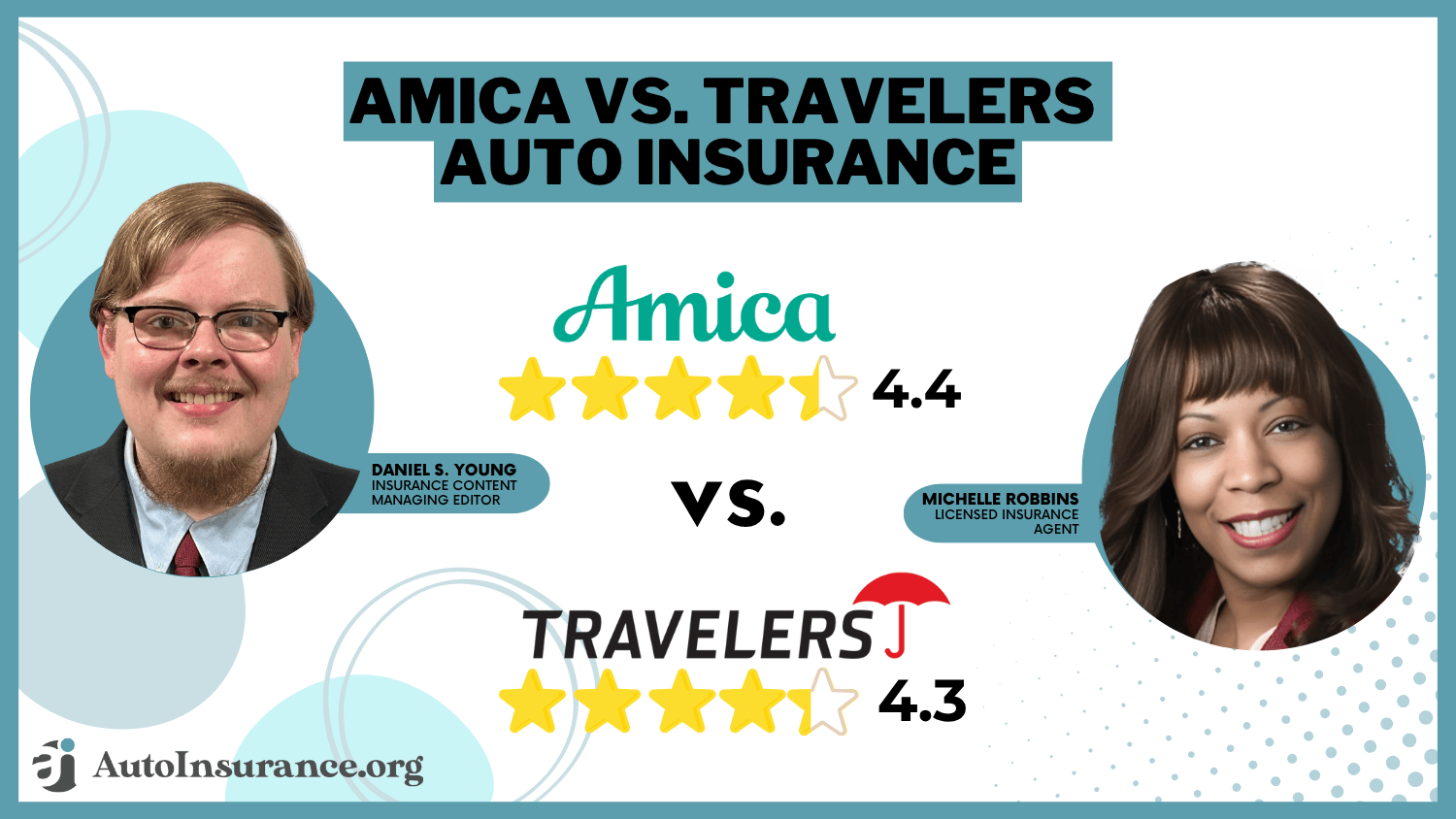

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated July 2025

768 reviews

768 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

768 reviews

768 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviewsWhen comparing Amica vs. Travelers auto insurance, Travelers starts at just $49 per month, making it the cheaper option compared to Amica’s $60 starting rate.

Amica vs. Travelers Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.4 | 4.3 |

| Business Reviews | 4.5 | 4.5 |

| Claim Processing | 4.8 | 4.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.3 | 4.3 |

| Customer Satisfaction | 2.1 | 2.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.0 | 4.1 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 4.1 | 4.1 |

| Savings Potential | 4.4 | 4.4 |

| Amica Review | Travelers Review |

Amica offers added value through its Platinum Choice Auto program, with built-in perks like accident forgiveness and Prestige repair benefits.

Travelers leans on IntelliDrive for usage-based savings and sweetens the deal with bundling discounts and roadside assistance. This comparison walks through their pricing, features, and extras to help you choose the better fit.

- Amica’s $60 monthly plan includes accident forgiveness and Prestige repair benefits

- Travelers $49 monthly policy features IntelliDrive tracking and early quote discounts

- Amica Insurance scores higher for better customer service and claims satisfaction

If you want to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

Compare Amica vs. Travelers Auto Insurance Costs

When looking at full and minimum coverage rates, Travelers clearly undercuts Amica. Travelers offers minimum coverage for $53 a month and full coverage for $141 per month, while Amica’s monthly plans come in at $65 and $215, respectively.

The rate comparison between Amica vs. Travelers Insurance also shows clear differences by age and gender. Travelers consistently offers lower monthly premiums, especially for teens, charging $517 for a 16-year-old male compared to Amica’s $339 monthly rate.

Amica vs. Travelers Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| 16-Year-Old Female | $306 | $392 |

| 16-Year-Old Male | $339 | $517 |

| 30-Year-Old Female | $72 | $53 |

| 30-Year-Old Male | $76 | $58 |

| 45-Year-Old Female | $72 | $54 |

| 45-Year-Old Male | $65 | $53 |

| 60-Year-Old Female | $60 | $49 |

| 60-Year-Old Male | $62 | $50 |

That pricing gap tightens with age. For example, a 30-year-old female pays $53 with Travelers and $72 with Amica, making Travelers more affordable across nearly every age bracket. For drivers in their 60s, the rates are closer, but Travelers still holds a slight edge.

Compared to the average cost of car insurance, Amica tends to run higher, but it offers added value through perks like accident forgiveness and repair flexibility. If your main concern is low monthly cost, especially as a younger driver, Travelers may be the better fit.

Travelers offers some of the most affordable coverage, starting at $53 per month for minimum coverage and $141 for full coverage.

Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $215 | |

| $53 | $141 | |

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $50 | $150 | |

| $47 | $123 |

In comparison, Amica’s rates land higher—$65 for minimum and $215 for full coverage. That gap in full coverage pricing alone is nearly $75 per month, which adds up fast over a year. If your main priority is keeping costs low, Travelers stands out as the better-priced option.

Amica tends to justify its higher rates with added service perks and fewer customer complaints, so that extra cost might feel worth it if you value smoother claims and stronger support. On the flip side, Travelers leans into technology-driven savings like IntelliDrive and offers broader multi-policy discounts.

In short, Travelers is built for price-conscious drivers, while Amica might appeal more to those who want consistent service and fewer billing issues over time.

Learn More: How to Get a Quote From an Auto Insurance Company

Amica vs. Travelers: Rates by Driving Record

If your driving history includes a few bumps, Travelers generally offers lower monthly premiums than Amica across the board. Even after a not-at-fault accident or speeding ticket, Travelers remains more affordable, charging $76 and $72, respectively, while Amica charges $99 and $81.

Amica vs. Travelers Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $65 | $53 |

| Not-At-Fault Accident | $99 | $76 |

| Speeding Ticket | $81 | $72 |

| DUI/DWI | $123 | $112 |

For drivers with a DUI or DWI, Travelers auto insurance is still slightly cheaper at $112 per month versus Amica’s $123 a month. While the rate differences aren’t massive, they can add up over time.

Amica vs. Travelers: Rates by Credit Score

Credit score plays a big role in pricing, and this table shows a surprising twist — Amica charges drivers with excellent credit less than average at $60 per month, while Travelers auto insurance is still cheaper at $53 per month.

Amica vs. Travelers Auto Insurance Monthly Rates by Credit Score

| Credit Score | ||

|---|---|---|

| Excellent (800-850) | $60 | $53 |

| Very Good (740-799) | $140 | $105 |

| Good (670-739) | $323.00 | $157 |

| Fair (580-669) | $734 | $200 |

| Poor (300-579) | $950 | $285 |

If your credit is excellent, Amica gives you the best value. But for everyone else, Travelers is much more forgiving and consistent, making it the smarter pick if your score isn’t ideal. Understanding how credit scores affect auto insurance rates helps explain this gap.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Save on Amica and Travelers Auto Insurance

When it comes to discounts, Amica offers higher savings in most core categories: 25% off for good drivers, low mileage, and multi-car policies, and an impressive 30% bundling discount.

Amica vs. Travelers Auto Insurance Discounts

| Discount | ||

|---|---|---|

| Anti-Theft | 18% | 15% |

| Auto Pay | 7% | 6% |

| Bundling | 30% | 13% |

| Defensive Driving | 12% | 20% |

| Good Driver | 25% | 10% |

| Good Student | 15% | 8% |

| Low Mileage | 25% | 20% |

| Multi-Car | 25% | 25% |

| Pay-in-Full | 10% | 15% |

| Safe Driver | 15% | 17% |

| UBI | 20% | 30% |

Travelers, however, outperforms Amica in a few targeted areas like usage-based insurance (UBI) with a 30% savings potential, and slightly higher rewards for safe drivers and pay-in-full options.

If you’re the kind of driver who bundles policies or qualifies for multiple discounts at once, Amica’s structure may result in deeper savings overall. On the other hand, if you’re open to telematics like IntelliDrive and want to earn larger rewards based on driving behavior, Travelers may be the better long-term value.

Amica vs. Travelers Auto Insurance Coverage Options

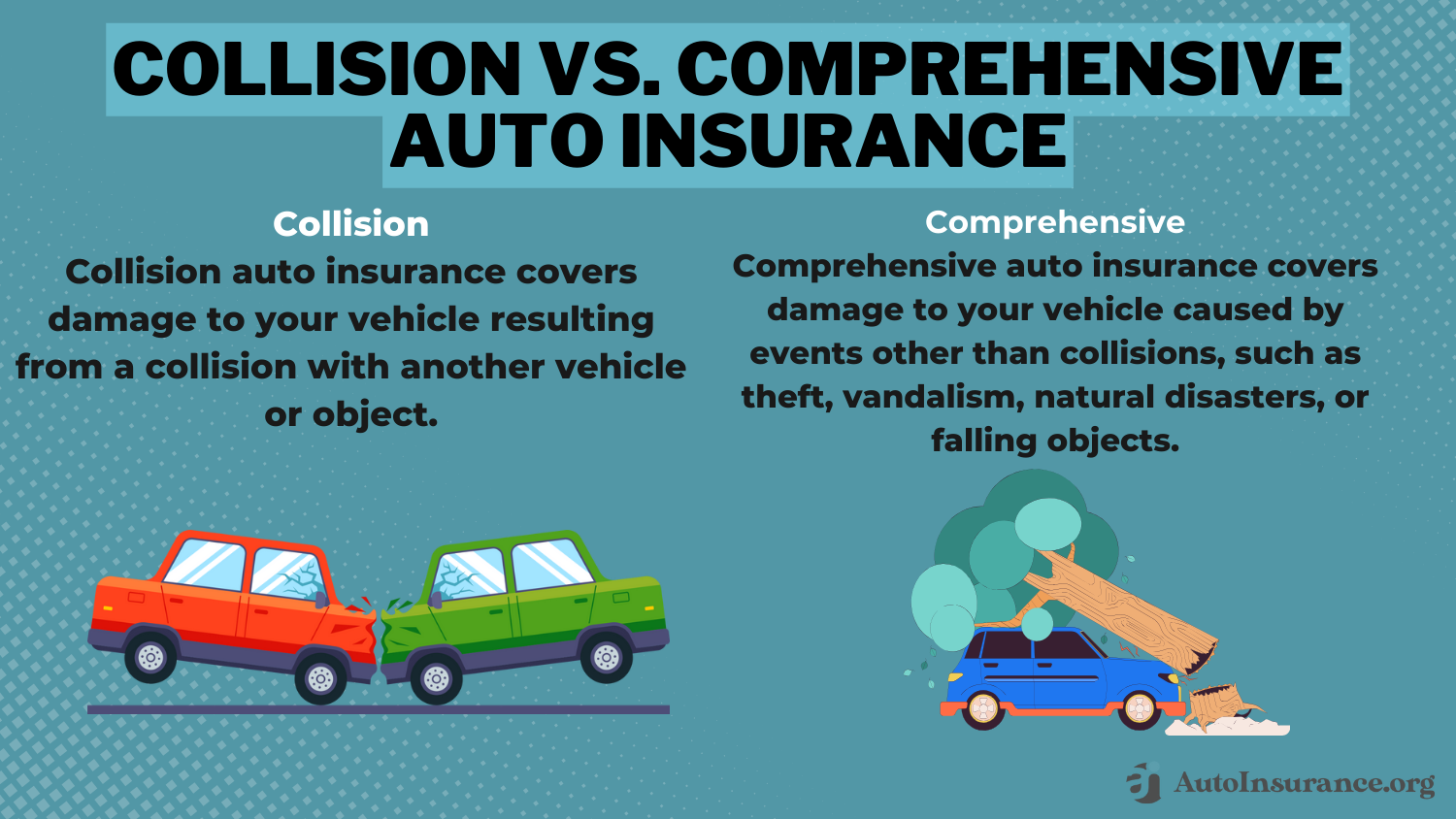

Both Amica and Travelers offer the standard auto insurance coverage you’d expect—liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage. Liability covers damage or injuries you cause to others, while collision and comprehensive take care of your vehicle if it’s damaged in an accident, stolen, or hit by something like hail.

If you’re financing or leasing, your lender will usually require these. Where the real differences show up is in the add-ons. Amica offers a few extras you don’t always see, like full glass coverage, interior vehicle coverage, and identity fraud monitoring through its Platinum Choice Auto program.

Travelers, on the other hand, leans into technology with IntelliDrive, its usage-based discount program that tracks your driving habits through an app. Both companies offer roadside assistance, rental reimbursement, and accident forgiveness, but only Amica includes accident forgiveness automatically if you qualify. Travelers make you buy it as an add-on.

If you’re the kind of driver who wants more built-in perks and personal support, Amica’s coverage might feel more complete out of the box. But if you’re looking to save based on your driving habits or want flexibility with what you add on, Travelers has more à la carte options to tailor your policy.

Amica vs. Travelers Insurance Reviews & Complaints

Among the best auto insurance companies, both stand out for financial strength, but Amica’s lower complaint rate and higher customer satisfaction make it the stronger choice for service-focused drivers. Amica Insurance consistently ranks better than Travelers across nearly every major rating agency.

Insurance Business Ratings & Consumer Reviews: Amica vs. Travelers

| Agency | ||

|---|---|---|

| Score: 746 / 1,000 Avg. Satisfaction | Score: 684 / 1,000 Below Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A Good Business Practices |

|

| Score: 85/100 Excellent Customer Feedback | Score: 76/100 Good Customer Feedback |

|

| Score: 0.73 Fewer Complaints Than Avg. | Score: 3.96 More Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength | Score: A++ Superior Financial Strength |

When evaluating the types of insurance of Amica and Travelers, this satisfaction gap also reflects how each company handles claims and service across their auto, home, and umbrella policies.

If you want stable rates and fewer claim issues, Amica’s Platinum Choice Auto may offer better long-term value than usage-based insurance.Daniel Walker Licensed Auto Insurance Agent

J.D. Power rates Amica Mutual Insurance Company at 746/1,000, comfortably above Travelers’ 684/1,000, which falls below the industry average. Consumer Reports also places Amica ahead of Travelers Property Casualty Insurance Company with an 85/100 score based on actual customer feedback.

Looking at complaint volume and issue resolution, Amica is the clear leader. The NAIC score for Amica is 0.73, meaning fewer complaints than average. Travelers Insurance comes in at 3.96, which indicates a significantly higher complaint ratio. Even the Better Business Bureau gives Amica an A+ for business practices over Travelers’ A rating.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of Amica Auto Insurance

Amica auto insurance reviews show how its agents handle customer care, coverage, and claim payouts. If you want a long-term insurer that shares profits with policyholders, Amica stands out.

- Strong Dividend Policy Options: Amica Mutual Insurance Company offers dividend policies that can return up to 20% of your premium.

- High Customer Satisfaction Ratings: J.D. Power, BBB, and Consumer Reports all reflect Amica’s consistent top-tier service.

- Feature-Rich Coverage Options: The Platinum Choice plan includes accident forgiveness, full glass, and Prestige Repair.

So, is Amica the right fit? If you care more about personalized service, generous policy perks, and being with a financially stable mutual company, it’s definitely worth a look.

One Amica customer, pictured above, raves about their 13-year experience with home, auto, and life policies, highlighting smooth claims, easy billing, and unmatched support. That kind of loyalty speaks volumes. Still, there are a few drawbacks to consider before deciding.

- Higher Monthly Premiums: Amica’s $65 minimum and $215 full coverage rates come in higher than competitors like Travelers.

- Limited Market Reach: Amica Property and Casualty Insurance Company has less brand visibility and regional availability.

Amica auto insurance could fit your policy needs if you need additional coverage for new vehicles and prefer to work with an agent for personalized service. Otherwise, Travelers may be the more economical option.

Pros and Cons of Travelers Auto Insurance

Travelers Insurance built its reputation on stability and wide availability, and for many drivers, it strikes a solid balance between affordability and digital convenience.

- Competitive Monthly Rates: With minimum coverage starting at $53 and full coverage around $141, Travelers comes in cheaper than many national providers.

- IntelliDrive Program: Their telematics app can score you up to a 30% discount if you’re a safe driver, and it’s easy to use on any smartphone.

- Robust Discount Options: Travelers offers 15+ discounts, including savings for hybrid vehicles, multi-policies, good students, and homeownership.

Should you go with Travelers? If you’re looking for solid coverage at a good rate (and you’re comfortable with a no-frills experience), it’s a smart, dependable pick. But keep in mind, not every experience is seamless.

One Yelp reviewer ran into trouble when their truck camper was misclassified, and the claim never got paid. It’s a good heads-up to ask the right questions and make sure everything’s clearly listed before you sign off on your policy. Here’s where Travelers might fall short for other drivers:

- Mixed Customer Reviews: The Travelers Indemnity Company scores lower than average in J.D. Power’s claims satisfaction rankings.

- Fewer Perks for Loyal Drivers: Unlike Amica, Travelers doesn’t offer dividend policies or loyalty-driven benefits that pay you back.

You’re looking at a company with deep roots and over 160 years in the market, with fantastic financial ratings. However, Travelers auto insurance reviews reflect poor claims service and customer support. If you want better service, consider Amica.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Comparing Amica and Travelers Auto Insurance

Amica vs. Travelers auto insurance comes down to service and savings. Amica Mutual Insurance Company delivers personalized coverage with its Platinum Choice Auto program, strong claims support, and consistently high customer satisfaction. It’s member-owned, returns dividends, and handles fewer complaints.

Travelers, backed by The Travelers Indemnity Company, focuses on lower prices and usage-based savings with IntelliDrive, making it a better fit for cost-conscious drivers. As you evaluate auto insurance quotes, consider whether you value long-term service or upfront savings to choose the better fit.

Compare Amica and Travelers by what matters most. Amica for service, and Travelers for lower rates through usage-based savings.Alexandra Arcand Insurance and Finance Writer

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code into our comparison tool today.

Frequently Asked Questions

Is Amica better than Travelers for auto insurance?

Amica Mutual Insurance Company stands out for customer satisfaction, claim handling, and dividend perks. Travelers, backed by The Travelers Indemnity Company, typically wins on price. Choose Amica for long-term service and Travelers for affordability.

Is Amica a good auto insurance company?

Yes. Amica Mutual Insurance Company consistently ranks at the top for customer satisfaction and reliability. It has an A+ A.M. Best rating, fewer complaints than the national average, and offers unique benefits like dividend policies that refund up to 20% of premiums annually.

What rank is Travelers Insurance in the U.S. auto market?

Travelers Insurance ranks among the top 10 U.S. auto insurers, holding 4.3% of the market share. It’s one of the largest national providers, offering broad availability, competitive pricing, and usage-based discounts through Travelers IntelliDrive.

Why choose Amica auto insurance over Travelers?

Drivers choose Amica Mutual Insurance Company for its exceptional claims support, low complaint volume, and added perks like accident forgiveness, dividend payouts, and flexible repair options. Although it may cost more upfront, it often delivers better long-term value. Find the best auto insurance company near you by entering your ZIP code into our free quote tool.

Which offers better coverage between Amica vs. Travelers home insurance?

Amica Property and Casualty Insurance Company provides personalized coverage, excellent claims support, and fewer complaints. Travelers Property Casualty Insurance Company generally offers lower premiums and more discount bundling options. Amica excels in service; Travelers leads in price and availability.

Why is Amica more expensive than Travelers auto insurance?

Amica’s average full coverage rate is $215 per month, while Travelers offers it for $141 per month. Amica charges more because of premium features like Platinum Choice Auto, accident forgiveness, and a lower complaint ratio. If you’re wondering why auto insurance for new cars is so expensive, these added protections and service perks often drive up the cost.

Who offers wider geographic coverage between Amica Insurance vs. Travelers Insurance?

Travelers, through Travelers Commercial Insurance Company, is licensed in all 50 states and has a larger agent network. Amica operates in fewer states and has a more regional focus, although it still provides a strong national reach for auto policies.

How much does insurance go up after an accident with Amica?

Rates with Amica can rise by 20%–40% after an at-fault accident. However, policyholders with Platinum Choice Auto may be eligible for accident forgiveness, which can keep premiums stable if you’ve been claim-free prior to the incident.

Where does Amica auto insurance rank in customer service?

Amica Insurance Company ranks near the top across multiple rating agencies. It received 746 points from J.D. Power, an 85/100 from Consumer Reports, and an A+ from the Better Business Bureau, placing it among the auto insurance companies with the best customer service for policyholders who value strong support and satisfaction.

How do I cancel Travelers Insurance?

To cancel a Travelers policy, contact customer service at 1-800-842-5075. You’ll need your policy number and cancellation date. Travelers doesn’t charge a cancellation fee and will refund any unused premium.

Is Travelers a good insurance company?

What does a Travelers umbrella policy cover?

What does an Amica umbrella policy cover?

Who offers the cheapest auto insurance rates, Amica Insurance or Travelers Insurance?

Does Travelers have accident forgiveness?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.