American Family vs. Geico Auto Insurance in 2025 (Compare Costs Side by Side)

Check out our American Family vs. Geico auto insurance, where Geico offers lower rates at $30/month, and American Family starts at $44/month. American Family’s Teen Safe Driver program helps young drivers, while Geico wins with discounts for multi-car policies and anti-theft devices.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Dec 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

2,235 reviews

2,235 reviewsCompany Facts

Minimum Coverage

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 19,116 reviews

19,116 reviewsCompany Facts

Minimum Coverage

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsAmerican Family and Geico auto insurance offer unique perks for different types of drivers, from teens to those with DUIs.

American Family stands out with its Teen Safe Driver program, which helps young drivers build better road habits. At the same time, Geico offers discounts for things like anti-theft devices and insurance for multiple cars. Geico offers teen males rates about 23% cheaper than American families and holds more substantial financial ratings.

American Family vs. Geico Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.1 | 4.5 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 4.8 | 4.8 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 3.9 | 5.0 |

| Coverage Value | 4.0 | 4.4 |

| Customer Satisfaction | 4.0 | 4.5 |

| Digital Experience | 4.5 | 5.0 |

| Discounts Available | 5.0 | 4.7 |

| Insurance Cost | 3.7 | 4.4 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.4 | 4.1 |

| Savings Potential | 4.1 | 4.5 |

| American Family Review | Geico Review |

Meanwhile, the American Family auto insurance review highlights its forgiving nature for drivers with a DUI, offering competitive rates despite a rough driving history. See how American Family vs. Geico compare in discounts, reviews, and more.

Enter your ZIP code to compare premiums from highly-rated insurers in your area.

- Both American Family and Geico have high satisfaction and low complaints

- Geico has the highest possible financial strength rating from A.M. Best

- American Family has better rates for drivers with a poor driving record

Age-Based Rate Comparison: American Family vs. Geico

So, is American Family car insurance cheaper than Geico insurance? Age is one of the most significant factors in determining your auto insurance rates, and rightfully so — as we age, we drive more, so we become more practiced, aware, and safer behind the wheel.

Take a look at a comparison of American Family insurance rates and Geico insurance rates based on age, gender, and marital status.

American Family vs Geico Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $414 | $298 |

| Age: 16 Male | $509 | $312 |

| Age: 30 Female | $116 | $90 |

| Age: 30 Male | $137 | $87 |

| Age: 45 Female | $115 | $80 |

| Age: 45 Male | $117 | $80 |

| Age: 60 Female | $104 | $73 |

| Age: 60 Male | $105 | $74 |

Most auto insurance companies will charge more for male drivers, especially teens. Geico is an excellent choice over AmFam when comparing auto insurance by age, particularly if you have a teen (specifically male) driver in your household.

At Geico, auto insurance rates for teen males are 23% cheaper than American Family, and rates for single 25-year-old males are 16% cheaper.

Overall, American Family vs. Geico auto insurance rates are competitive for other age and gender groups.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Driving Record Impact: American Family vs. Geico Rates

If you have a record of infractions such as speeding tickets, accidents, or DUIs, it doesn’t matter what company you choose; you will always pay higher rates than drivers with a clean record. Be sure to look into discounts to offset your high rates.

American Family vs Geico Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $117 | $80 |

| Not-At-Fault Accident | $176 | $132 |

| Speeding Ticket | $136 | $106 |

| DUI/DWI | $194 | $216 |

American Family auto insurance quotes are around $30 higher than Geico auto insurance rates for those with a speeding ticket or accident on their record. However, the American Family Insurance Company quote is more forgiving for drivers who incur a DUI.

Geico auto insurance quotes increase more dramatically with more severe infractions. This is because Geico was originally for government employees, so naturally, there are more significant penalties for breaking laws.

Compared to a driver with a clean record, Geico penalizes drivers who cause an accident, resulting in a 50% increase in rates. Drivers with Geico who get a DUI will pay well over double what a driver with a clean record pays. See Geico’s auto insurance review to learn more.

Auto Insurance Costs by Credit: American Family vs. Geico

Regrettably, car insurance companies believe that drivers with poor credit are more prone to committing accidents. A silver lining is that a customer’s credit score cannot determine car insurance prices, thanks to legislation passed in multiple states.

Does Geico use credit scores? How about the American Family? How American Family Insurance Company and Geico handle drivers with good, fair, and poor credit scores.

Monthly Auto Insurance Rates for American Family vs. Geico by Credit Score

| Credit History Summary | ||

|---|---|---|

| Good Credit | $224 | $203 |

| Fair Credit | $264 | $249 |

| Poor Credit | $372 | $355 |

Generally, Geico insurance quotes are less expensive than American Family car insurance when looking at credit scores. However, Geico tends stricter about rate differences for drivers with fair or poor credit ratings.

American Family car insurance quotes and rates increase by 18%—66% if someone’s credit score drops. On the other hand, Geico’s rates rise between 23% and 75% for people with fair or bad credit scores.

Geico is often a superior choice, regardless of your credit score. You should anticipate a sharp increase in your premiums if you decide to use Geico and suffer from financial distress. Switching businesses might be a smart move if that occurs. Discover more auto insurance companies that don’t check credit.

Auto Insurance Discounts Breakdown: Geico vs. AmFam

Our data source shows only three discounts offered by American Family auto insurance. Geico car insurance offers 14 discounts and a more significant discount for having airbags, the only discount American Family and Geico share.

American Family vs. Geico Auto Insurance Discounts

| Discount Name | ||

|---|---|---|

| Anti-Lock Brakes | X | 5% |

| Anti-Theft | X | 25% |

| Claim Free | X | 26% |

| Daytime Running Lights | X | 1% |

| Defensive Driver | 10% | X |

| Driving Device/App | 40% | X |

| Emergency Deployment | X | 25% |

| Federal Employee | X | 8% |

| Good Student | X | 15% |

| Military | X | 15% |

| Multiple Policies | X | 10% |

| Multiple Vehicles | X | 25% |

| Passive Restraint | 30% | 40% |

| Safe Driver | X | 15% |

| Seat Belt Use | X | 15% |

| Vehicle Recovery | X | 25% |

If you’re considering Geico and have a bad driving record or a poor credit score, you should rely heavily on Geico auto insurance discounts. Some of Geico’s highest discounts are for anti-theft devices, vehicle recovery, claim-free insurance, multiple vehicles, and urgently deployed military members.

There are two American Family auto insurance discounts that Geico does not offer: 1) a discount for completing a defensive driving course and 2) a discount for using the American Family mobile app or device to track your driving habits.

Before you get your American Family or Geico quote, call American Family or Geico customer service at the Geico or American Family car insurance phone number to ask if there are any extra discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

User Experience with American Family and Geico Apps

Most of the more prominent auto insurance companies have two different types of apps. One is a general app that shows electronic coverage verification, pays your bill, or adjusts your coverage levels. Before making adjustments, understand the different types of auto insurance coverage.

The other is a driving app that records your driving habits using your mobile phone. Alternatively, the company may request that you install a device in your car. This is called usage-based auto insurance.

One thing to note: Geico was the last of the top auto insurance companies to design and implement a usage-based driving app, so be aware that they may still be working out the bugs. See the Geico DriveEasy review to learn more.

Your American Family login or Geico login will likely be the same in both the general app and the driving app.

Financial Ratings and Customer Feedback: Geico vs. AmFam

Getting the best auto insurance rates is worth celebrating, especially if you can take advantage of a discount with the cheapest auto insurance companies.

However, looking at these companies’ financial strength, customer satisfaction with the American Family and Geico claims processes and customer complaints is critical. The following three credible and trustworthy agencies shine a light on these factors:

A.M. Best scores companies based on their ability to meet their ongoing insurance obligations, such as balancing premiums collected and claims paid. The highest score A.M. Best awards is Superior A++.

Insurance Business Ratings & Consumer Reviews: American Family vs Geico

| Agency | ||

|---|---|---|

| Score: 831 / 1,000 Avg. Satisfaction | Score: 857 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Great Business Practices |

|

| Score: 78/100 Positive Customer Feedback | Score: 74/100 Good Customer Satisfaction |

|

| Score: 0.77 Fewer Complaints Than Avg. | Score: 0.55 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A++ Superior Financial Strength |

Consumer Reports collects annual data from its subscribers regarding customer satisfaction with the claims process, step by step. The National Association of Insurance Commissioners (NAIC) calculates a complaint ratio based on the total number of customers vs. the total number of Geico and American Family insurance claims and complaints.

Customers who successfully complete the claims procedure and handle consumer concerns give both American Family and Geico positive reviews.

Drivers with DUIs can find more forgiving rates with American Family, which offers competitive options for high-risk drivers.Daniel Walker Licensed Auto Insurance Agent

Is Geico a good insurance company? Additionally, Geico’s ratings compared to American Family insurance ratings show that the financial future of both companies is strong, but Geico carries the highest rating possible from A.M. Best.

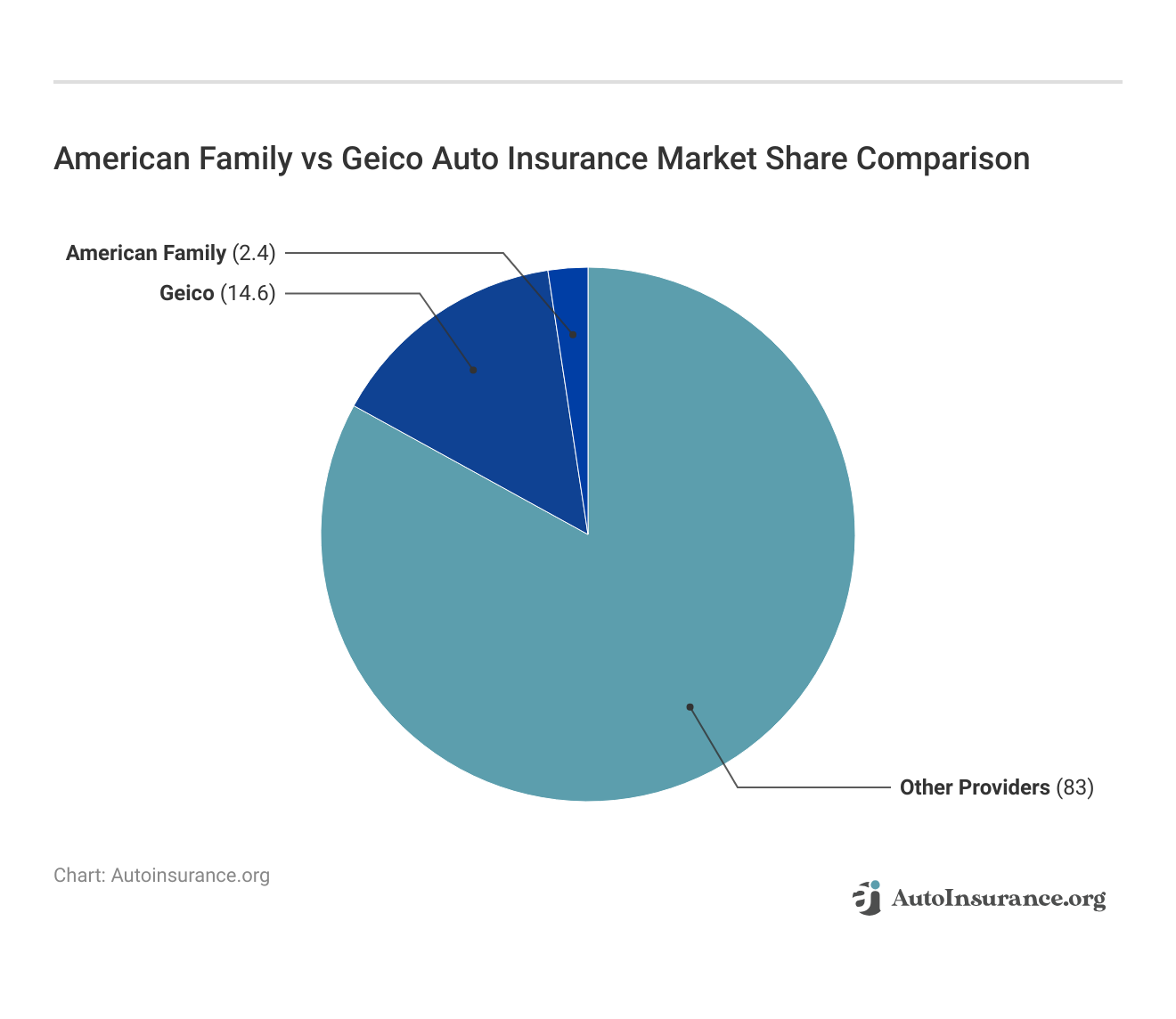

American Family and Geico take different approaches in the auto insurance market, with Geico holding a much bigger slice of the pie. While Geico focuses on reaching as many customers as possible, American Family must lean toward personalized service and niche programs to stand out.

The American Family and Geico comparison shows how different strategies appeal to other drivers. Whether you’re after widespread coverage or a more personalized experience, knowing their market share can help you pick the right fit.

On Reddit, a user compared Geico and American Family after adding a second car, noting that Geico’s premium jumped from $160 to nearly $300, while American Family offered better coverage for a similar price. They questioned whether Geico starts with low quotes and raises them later, debating whether switching was worth it.

Reddit users mentioned that new claims might affect prices and highlighted the difference in how companies manage discounts. Some suggested that American Family could offer better value but warned it is only available in some places, making things difficult if you need to claim while traveling. The conversation highlights the need to look beyond cost when choosing insurance.

American Family Pros & Cons

Pros

- DUI-Friendly Prices: American Family offers affordable rates for drivers with DUIs, which makes it a good choice for people with past traffic violations.

- Teen Safe Driver Program: The American Family KnowYourDrive review discusses this program. It helps young drivers develop safer driving habits, which might make insurance cheaper in the future.

- Personalized Support: Known for its customer-focused service, especially in the Midwest and West, American Family offers a more personal touch.

Cons

- Fewer Discounts: Compared to Geico, American Family has fewer discount options, which could mean fewer ways to save.

- Higher Rates for Teen Males: Teen male drivers might find better deals with Geico, as their rates tend to be cheaper for this group.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Geico Pros & Cons

Pros

- Great Rates for Teens: Geico is a top choice for teen male drivers, with rates about 23% lower than American Family’s, making it one of the companies with the best teen auto insurance.

- Lots of Discounts: Geico offers plenty of ways to cut costs, with 14 discount options, such as savings on anti-theft devices and multiple cars.

- Strong Financial Backing: Geico has an A++ grade from A.M. Best, meaning you can trust them for good service and proper claim handling.

Cons

- High DUI Penalties: If you get a DUI, Geico’s rates can increase very much, so it might not be the best choice for drivers with some bad marks on their records.

- DriveEasy App Problems: Although this app, which charges based on usage, can help save money, it still has some issues to fix and might not always work perfectly.

Comparing Rates: American Family vs. Geico

Deciding between American Family and Geico auto insurance comes down to what you need most. Geico might be your go-to if you’re looking for lower rates for teen drivers or tons of discounts.

Switching 🔁auto insurance providers is one thing, but how do you get auto insurance for the first time? It’s not scary👻! You can do it, and our guide will help👉: https://t.co/taBW1ulIVx pic.twitter.com/2noGRWMiiJ

— AutoInsurance.org (@AutoInsurance) October 8, 2024

On the other hand, American Family is great for drivers who need more forgiving rates and cheap auto insurance after a DUI, and it offers unique programs like Teen Safe Driver. Both companies offer a lot, so it’s all about finding what fits your situation best, whether it’s saving money, getting solid coverage, or having better customer support.

See how much you could save on coverage by entering your ZIP code into our free quote comparison tool.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Which is better, Geico or American Family?

Geico offers lower rates starting at $30/month and more discounts, while American Family stands out with unique programs like Teen Safe Driver.

How do American Family and Infinity differ?

American Family focuses on family-oriented programs and better teen driver support, while Infinity specializes in non-standard coverage for high-risk drivers.

What is the difference between Geico and Infinity?

Geico offers more discounts and lower rates for most drivers, while Infinity specializes in non-standard policies tailored to high-risk auto insurance needs.

What is the difference between American Family and Geico?

American Family provides personalized programs for young drivers, whereas Geico offers extensive discounts and lower average rates.

How can I get Geico car insurance quotes?

You can get personalized Geico car insurance quotes online, through their app, or by contacting customer service.

Save on your auto insurance coverage by entering your ZIP code.

What does a Geico quote for auto insurance include?

A Geico auto insurance quotation includes liability, collision, and comprehensive coverage premium estimates, as well as any relevant discounts.

Which is better, Geico or Farmers?

Geico is better for affordability and a wide range of discounts, while Farmers stands out for customizable coverage options and strong customer service.

What information is needed for a Geico auto quote?

You will need information about your car, driving record, and preferred coverage to obtain a Geico auto quotation.

How do American Family and Mercury compare?

American Family excels with family-focused programs like Teen Safe Driver, offering some of the cheapest teen auto insurance options. At the same time, Mercury is known for competitive rates and vital customer service.

Which is better, Nationwide or Geico?

Nationwide offers strong bundling options, while Geico is better for affordability and extensive discount opportunities.

What is the difference between Geico and Amica?

Geico provides a range of discounts and reasonable rates, while Amica is renowned for its dividend policy and outstanding customer service.

How do Geico and Nationwide compare?

Geico offers cheaper rates for most drivers, while Nationwide focuses on customizable coverage and benefits like accident forgiveness.

How fast can I get a Geico quote for auto insurance?

In minutes, you can obtain a personalized Geico auto insurance quote online or through their mobile app. To expedite the process, have your driver’s license, vehicle identification number (VIN), and the physical address where your vehicle is stored ready.

Is Geico or Mercury a better choice?

Geico is better for nationwide affordability, while Mercury specializes in competitive regional rates and strong customer support.

What are the differences between American Family and Safe Auto?

American Family offers comprehensive auto insurance programs for families, while Safe Auto provides budget-friendly minimum coverage policies.

What factors affect a Geico car quote?

A Geico car quote depends on your driving history, vehicle, coverage needs, and location.

Which is better, Amica or Geico?

Amica has excellent customer service; however, Geico is more reasonably priced and offers a broader selection of discounts.

Which insurance company is better, Geico or Progressive?

Geico offers lower rates for young drivers, while Progressive stands out with usage-based auto insurance discounts like Snapshot.

How do I request a Geico quote for car insurance?

Visit Geico’s website or app, or call their hotline to request a Geico quote for car insurance quickly.

How do American Family and Erie differ?

American Family is ideal for families needing forgiving DUI rates, while Erie offers consistent pricing and solid regional service.

Use our free comparison tool to find affordable auto insurance in your area.

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.