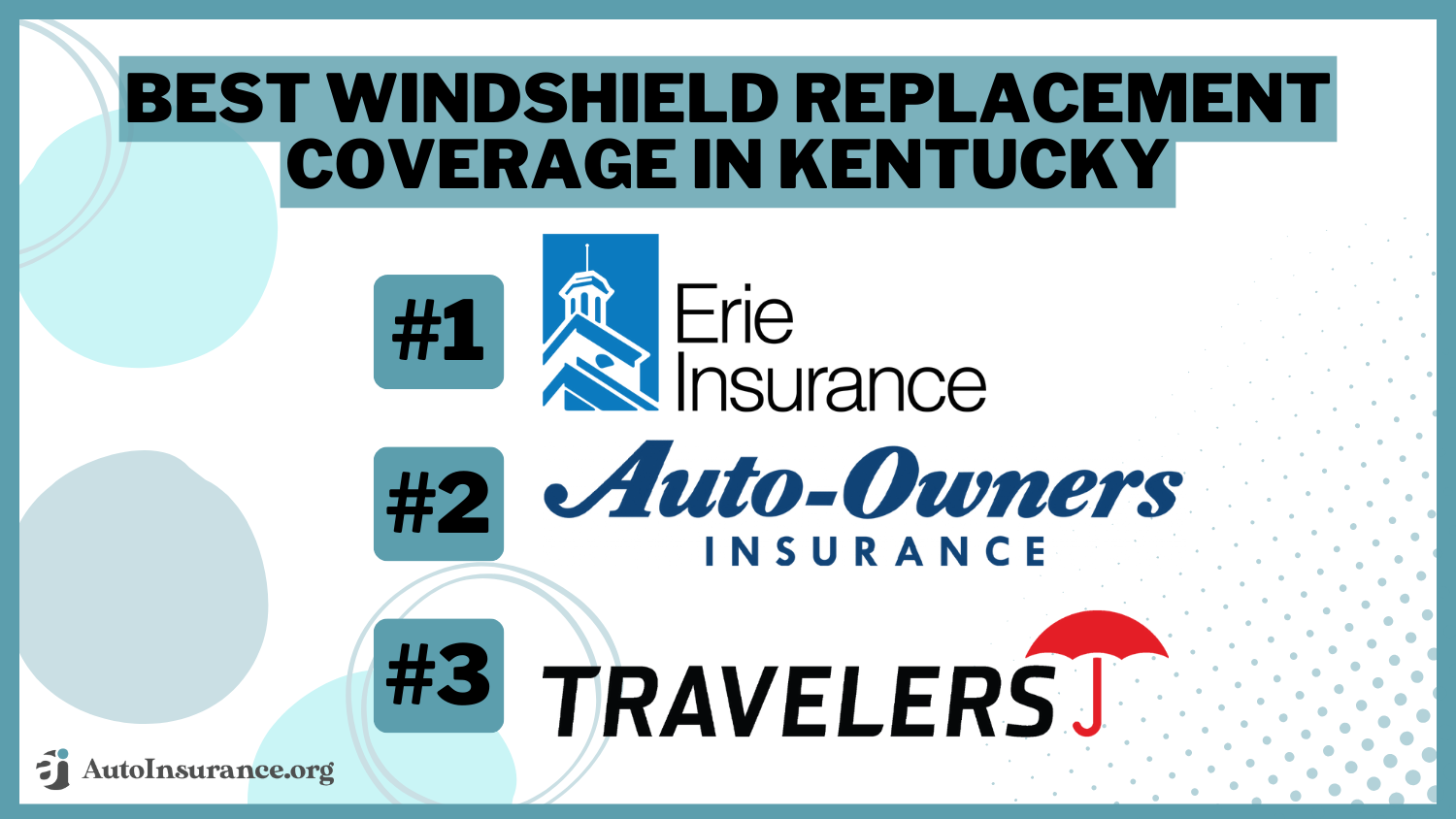

Best Windshield Replacement Coverage in Kentucky (Top 10 Companies in 2025)

Erie, Auto-Owners, and Travelers offer the best windshield replacement coverage in Kentucky, with monthly premiums beginning at just $65. We aim to assist you in comparing quotes from these insurers, helping you secure the most suitable coverage and personalized discounts for your vehicle.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Full Coverage Windshield Replacement in Kentucky

A.M. Best

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 563 reviews

563 reviewsCompany Facts

Full Coverage Windshield Replacement in Kentucky

A.M. Best

Complaint Level

Pros & Cons

563 reviews

563 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage Windshield Replacement in Kentucky

A.M. Best

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews- Erie offers competitive rates starting at $65 per month

- Major insurance companies provide various options for windshield replacements

- Several discount opportunities are available for windshield replacement coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Erie: Top Overall Pick

Pros

- Competitive Rates: Erie offers windshield replacement coverage at competitive rates, starting at just $65 per month. Read more through our Erie auto insurance review.

- Comprehensive Protection: Erie provides comprehensive protection for windshield damage, ensuring policyholders are well-covered in case of accidents.

- Strong Customer Service: Erie is known for its excellent customer service, offering prompt assistance and support to policyholders.

Cons

- Limited Availability: Erie’s coverage may not be available in all areas, limiting options for some customers.

- Potential for Rate Increases: While initial rates may be competitive, there’s a possibility of rate increases over time, affecting long-term affordability.

#2 – Auto-Owners: Best for Trusted Company

Pros

- Trusted Reputation: Auto-Owners has a trusted reputation for reliability and trustworthiness in the insurance industry. Read more through our Auto-Owners auto insurance review.

- Customizable Coverage Options: Auto-Owners offers customizable coverage options, allowing policyholders to tailor their plans to their specific needs.

- Strong Financial Stability: Auto-Owners has a strong financial stability rating, providing assurance that claims will be paid promptly and in full.

Cons

- Higher Premiums: Auto-Owners’ premiums may be slightly higher compared to some other providers, impacting affordability for some customers.

- Limited Online Services: Auto-Owners may have limited online services and digital tools compared to more tech-savvy competitors, potentially affecting convenience for customers.

#3 – Travelers: Best for Policy Bundling

Pros

- Policy Bundling Discounts: Travelers offers discounts for bundling multiple insurance policies, providing potential cost savings for customers.

- Nationwide Coverage: Travelers provides coverage across the United States, offering flexibility and convenience for frequent travelers.

- Extensive Network of Repair Shops: Our Travelers auto insurance review reveals that Travelers has an extensive network of repair shops, making it easier for policyholders to find qualified professionals for windshield replacement.

Cons

- Higher Deductibles: Travelers may have higher deductibles for windshield replacement coverage compared to some other providers, increasing out-of-pocket costs.

- Complex Claims Process: Some customers have reported challenges with Travelers’ claims process, citing delays or difficulties in getting claims processed and approved.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Affordable Premiums

Pros

- Wide Range of Coverage Options: Nationwide offers a wide range of coverage options, allowing customers to tailor their policies to their specific needs. Read more through our Nationwide auto insurance review.

- Affordable Premiums: Nationwide provides windshield replacement coverage at affordable premiums, making it accessible to a broader range of customers.

- Strong Financial Stability: Nationwide has a strong financial stability rating, ensuring that claims will be handled promptly and efficiently.

Cons

- Mixed Customer Service Reviews: Some customers have reported mixed experiences with Nationwide’s customer service, citing occasional delays or difficulties in resolving issues.

- Limited Availability of Discounts: Nationwide may have limited availability of discounts compared to some other providers, potentially reducing opportunities for cost savings for customers.

#5 – AAA: Best for Ticket Forgiveness

Pros

- Excellent Roadside Assistance: AAA offers excellent roadside assistance services, including windshield repair and replacement services, providing added convenience and peace of mind to customers.

- Member Benefits: AAA members may qualify for additional benefits and discounts on windshield replacement coverage and other services, enhancing overall value for members.

- Reputable Name: AAA has a reputable name and a long history of serving customers’ automotive needs, instilling confidence and trust among policyholders.

Cons

- Membership Requirements: AAA membership is required to access insurance products and services, potentially limiting options for non-members. Read more through our AAA auto insurance review.

- Regional Availability: AAA’s insurance products and services may be limited to certain regions, restricting access for customers in areas where AAA is not available.

#6 – State Farm: Best for Broad Accessibility

Pros

- Broad Accessibility: State Farm has a vast network of agents and offices, providing accessibility and personalized service to customers across the country. Find out more in our State Farm auto insurance review.

- Comprehensive Coverage Options: State Farm offers a wide range of coverage options, allowing customers to tailor their policies to their specific needs and preferences.

- Strong Financial Stability: State Farm has a strong financial stability rating, ensuring reliability and prompt handling of claims.

Cons

- Potentially Higher Premiums: State Farm’s premiums may be higher compared to some other providers, impacting affordability for some customers.

- Limited Discounts: State Farm may offer fewer discounts compared to competitors, potentially reducing opportunities for cost savings for some policyholders.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Geico: Best for Digital Experience

Pros

- Digital Experience: Geico offers a streamlined and user-friendly digital experience, allowing customers to manage their policies conveniently online or through the mobile app. Read more through our Geico auto insurance review.

- Affordable Rates: Geico is known for its competitive rates, offering affordable premiums for windshield replacement coverage and other insurance products.

- Strong Financial Stability: Geico has a strong financial stability rating, providing assurance that claims will be handled promptly and efficiently.

Cons

- Limited Personalized Service: Geico’s focus on digital interactions may result in limited opportunities for personalized service and assistance compared to traditional agents.

- Mixed Customer Service Reviews: Some customers have reported mixed experiences with Geico’s customer service, citing occasional difficulties in reaching representatives or resolving issues.

#8 – Progressive: Best for Customizable Premiums

Pros

- Customizable Premiums: Progressive offers customizable premiums, allowing customers to adjust their coverage and deductible options to meet their budget and needs.

- Advanced Technology: In our Progressive auto insurance review, Progressive utilizes advanced technology and tools, such as the Name Your Price® tool, making it easier for customers to find affordable coverage options.

- Flexible Policy Management: Progressive provides flexibility in policy management, offering options for online account management, mobile app access, and 24/7 customer support.

Cons

- Potential for Rate Increases: Progressive’s premiums may increase over time, particularly for customers who file claims or experience changes in their driving history.

- Limited Coverage Options in Some Areas: Progressive may have limited coverage options or availability in certain regions, restricting choices for customers in those areas.

#9 – American Family: Best for Customer Ratings

Pros

- High Customer Ratings: American Family has received high customer ratings for satisfaction and service, reflecting its commitment to providing excellent customer experiences.

- Renewal Rates: American Family offers competitive renewal rates, rewarding loyal customers with continued affordability over time. Read more through our American Family auto insurance review.

- Diverse Coverage Options: American Family offers a diverse range of coverage options, including windshield replacement coverage, allowing customers to customize their policies to their unique needs.

Cons

- Limited Availability: American Family’s coverage may not be available in all areas, limiting options for some customers.

- Potentially Higher Premiums for Some: While American Family offers competitive rates, premiums may be higher for certain demographics or regions, impacting affordability for some customers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Amica: Best for Renewal Rates

Pros

- Renewal Rates: Amica offers competitive renewal rates, providing long-term affordability and value for loyal customers. Read more through our Amica auto insurance review.

- Exceptional Customer Service: Amica is known for its exceptional customer service, with high ratings for responsiveness and satisfaction.

- Financial Stability: Amica has a strong financial stability rating, ensuring reliability and prompt handling of claims.

Cons

- Limited Availability: Amica’s coverage may not be available in all areas, restricting options for some customers.

- Potentially Higher Premiums: While Amica offers competitive rates, premiums may be higher compared to some other providers, impacting affordability for some customers.

Kentucky Windshield Replacement Law

Comprehensive Auto Insurance Coverage

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kentucky Windshield Insurance with no Deductible

Windshield Repair in Kentucky: The Bottom Line

Frequently Asked Questions

Does auto insurance in Kentucky cover windshield replacement?

In Kentucky, windshield replacement is typically covered under comprehensive auto insurance coverage. Comprehensive coverage helps pay for damages to your vehicle that are not caused by a collision, such as theft, vandalism, or a cracked or shattered windshield.

Do I need to have comprehensive coverage to get windshield replacement coverage?

Yes, windshield replacement coverage is usually included as part of comprehensive coverage. If you have comprehensive insurance, it is likely that windshield replacement will be covered, subject to the terms and conditions of your policy. Enter your ZIP code now to begin.

What does windshield replacement coverage typically include?

Is windshield replacement coverage required in Kentucky?

No, windshield replacement coverage is not required by law in Kentucky. However, having comprehensive coverage, which includes windshield replacement, can provide valuable protection and help cover the costs of windshield repairs or replacements.

How do I file a windshield replacement claim in Kentucky?

If you need to file a windshield replacement claim in Kentucky, you should contact your insurance provider as soon as possible. They will guide you through the claims process and provide instructions on how to proceed. Be prepared to provide details about the damage, such as when and how it occurred, and any necessary documentation or evidence. Enter your ZIP code now to begin.

Will filing a windshield replacement claim affect my insurance rates?

Can I choose any windshield replacement service provider?

In many cases, insurance companies have partnerships or preferred providers for windshield replacement. They may recommend or require you to use a specific network of service providers. It’s important to check with your insurance company to determine if they have any preferred providers or if you have the flexibility to choose your own service provider.

What are the key factors influencing windshield replacement coverage in Kentucky, and how do they impact insurance options and costs?

The key factors influencing windshield replacement coverage in Kentucky include state laws mandating zero-deductible full glass coverage for windshield repair or replacement under comprehensive policies, as well as the specific coverage options and costs offered by insurance providers. Enter your ZIP code now to start.

How does Kentucky law mandate zero-deductible full glass coverage for windshield repair or replacement, and what are the implications for policyholders?

What are the top three insurance providers in offering the best windshield replacement coverage in Kentucky, and what specific benefits and coverage options do they offer?

The top three insurance providers offering the best windshield replacement coverage in Kentucky are Erie, Auto-Owners, and Travelers. These providers offer competitive rates starting at just $65 per month, comprehensive protection tailored to meet specific driving needs, and affordable options for policy bundling, among other benefits.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.