Best Mercedes-Benz GLE 350 Auto Insurance in 2025 (Compare the Top 10 Companies)

State Farm, USAA, and Geico offer the best Mercedes-Benz GLE 350 auto insurance, with rates at $60/month. State Farm excels in overall service, USAA provides significant military savings, and Geico is known for its affordable rates, ensuring excellent protection for your Mercedes-Benz GLE 350.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Apr 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe top pick overall for the best Mercedes-Benz GLE 350 auto insurance are State Farm, USAA, and Geico, offering comprehensive coverage at about $60/month. State Farm excels in overall service, USAA provides significant military savings, and Geico is known for its affordable rates. Check out our guide “Geico Auto Insurance Discounts.”

These companies offer the best rates considering multiple factors such as coverage options, discounts, and customer satisfaction. Discover why these providers are the best choices for your Mercedes-Benz GLE 350 insurance needs.

Our Top 10 Company Picks: Best Mercedes-Benz GLE 350 Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A++ | Reliable Service | State Farm | |

| #2 | 10% | A++ | Military Savings | USAA | |

| #3 | 25% | A++ | Affordable Rates | Geico | |

| #4 | 12% | A+ | Customizable Coverage | Progressive | |

| #5 | 25% | A+ | Comprehensive Options | Allstate | |

| #6 | 25% | A | Flexible Coverage | Liberty Mutual |

| #7 | 20% | A+ | Vanishing Deductible | Nationwide |

| #8 | 20% | A | Personalized Service | Farmers | |

| #9 | 25% | A+ | High Satisfaction | Amica | |

| #10 | 25% | A+ | Senior Benefits | The Hartford |

Mercedes-Benz GLE 350 insurance rates are more expensive per year than the average vehicle. Explore High-risk drivers could save money through policy discounts.

If you’re just looking for coverage to drive legally, enter your ZIP code above to compare cheap auto insurance quotes near you.

- State Farm offers the best Mercedes-Benz GLE 350 auto insurance

- Comprehensive coverage for the Mercedes-Benz GLE 350 at $60/month

- Discounts and safety features help lower Mercedes-Benz GLE 350 insurance rates

#1 – State Farm: Top Overall Pick

Pros

- Reliable Service: State Farm is known for its reliable service, ensuring that Mercedes-Benz GLE 350 owners receive consistent and dependable support.

- Comprehensive Coverage: State Farm auto insurance review highlighted that this company excels in providing comprehensive coverage options for the Mercedes-Benz GLE 350.

- Low Monthly Rates: State Farm offers competitive monthly rates at $70 for the Mercedes-Benz GLE 350 with minimum coverage.

Cons

- Limited Multi-Policy Discount: The multi-policy discount from State Farm is not as high compared to some competitors for the Mercedes-Benz GLE 350.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels, potentially affecting Mercedes-Benz GLE 350 owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Military Savings: USAA offers exclusive rates and discounts for military personnel insuring their Mercedes-Benz GLE 350.

- Superior Claims Service: USAA is known for its exceptional claims service, ensuring Mercedes-Benz GLE 350 owners get quick and fair settlements.

- Comprehensive Coverage Options: USAA auto insurance review provides extensive coverage options for the Mercedes-Benz GLE 350, including roadside assistance and rental reimbursement.

Cons

- Limited Eligibility: USAA insurance is only available to military personnel and their families, restricting access for other Mercedes-Benz GLE 350 owners.

- Higher Minimum Coverage Rates: Despite discounts, USAA’s minimum coverage rates can be higher compared to other providers for the Mercedes-Benz GLE 350 at $60 per month.

#3 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico offers some of the most affordable insurance rates for the Mercedes-Benz GLE 350, starting at $65 per month for minimum coverage.

- Easy Online Management: As mention in Geico auto insurance review, Geico provides an easy-to-use online platform for managing Mercedes-Benz GLE 350 insurance policies and claims.

- Discounts and Savings: Geico offers a variety of discounts, such as good driver and multi-vehicle discounts, for Mercedes-Benz GLE 350 owners.

Cons

- Customer Service Variability: Geico’s customer service can be inconsistent, affecting the experience for some Mercedes-Benz GLE 350 owners.

- Limited Local Agents: Geico relies heavily on online and phone services, with fewer local agents available for in-person assistance for Mercedes-Benz GLE 350 insurance.

#4 – Progressive: Best for Customizable Coverage

Pros

- Customizable Coverage: Progressive allows Mercedes-Benz GLE 350 owners to customize their insurance coverage to fit specific needs and budgets.

- Snapshot Program: Progressive’s Snapshot program can offer additional savings for Mercedes-Benz GLE 350 owners who demonstrate safe driving habits.

- Online Tools: Progressive auto insurance review provides a range of online tools to help Mercedes-Benz GLE 350 owners manage their policies and claims efficiently.

Cons

- Higher Premiums for High-Risk Drivers: Progressive’s rates can be higher for Mercedes-Benz GLE 350 owners with less-than-perfect driving records.

- Complex Discounts: Some discounts from Progressive can be complex and difficult to understand for Mercedes-Benz GLE 350 owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Comprehensive Options

Pros

- Comprehensive Options: Allstate auto insurance review highlighted company’s offers a wide range of coverage options for Mercedes-Benz GLE 350, including accident forgiveness and new car replacement.

- Drivewise Program: Allstate’s Drivewise program rewards safe driving behaviors with discounts for Mercedes-Benz GLE 350 owners.

- Strong Customer Support: Allstate is known for its robust customer support network, providing reliable assistance to Mercedes-Benz GLE 350 policyholders.

Cons

- Higher Rates: Allstate’s insurance rates for the Mercedes-Benz GLE 350 can be higher compared to other insurers at $80 per month for minimum coverage.

- Discount Availability: Some discounts may not be available in all states, limiting potential savings for Mercedes-Benz GLE 350 owners.

#6 – Liberty Mutual: Best for Flexible Coverage

Pros

- Flexible Coverage: Liberty Mutual auto insurance review emphasizes their offers flexible insurance policy options that can be tailored to the needs of Mercedes-Benz GLE 350 owners.

- Accident Forgiveness: Liberty Mutual’s accident forgiveness program can prevent rate increases after an initial accident for Mercedes-Benz GLE 350 drivers.

- Home and Auto Bundle Discounts: Significant discounts are available for Mercedes-Benz GLE 350 owners who bundle their home and auto insurance policies.

Cons

- Higher Premiums: Liberty Mutual’s premiums for the Mercedes-Benz GLE 350 can be higher than average, especially without bundling discounts, at $85 per month for minimum coverage.

- Limited Online Services: Liberty Mutual’s online services may be less comprehensive compared to some competitors, affecting convenience for Mercedes-Benz GLE 350 owners.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide auto insurance review offers a unique vanishing deductible program, reducing the deductible amount for every year of safe driving for Mercedes-Benz GLE 350 owners.

- SmartRide Program: The SmartRide program rewards Mercedes-Benz GLE 350 owners with discounts for safe driving behaviors.

- Strong Financial Rating: Nationwide’s A+ rating indicates strong financial stability, ensuring reliable claims payments for Mercedes-Benz GLE 350 insurance.

Cons

- Limited Availability: Some of Nationwide’s programs and discounts may not be available in all states for Mercedes-Benz GLE 350 owners.

- Higher Rates for Younger Drivers: Nationwide’s rates for the Mercedes-Benz GLE 350 can be higher for younger or inexperienced drivers at $73 per month for minimum coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Farmers offers highly personalized insurance options tailored to the specific needs of Mercedes-Benz GLE 350 owners.

- Strong Local Agent Network: Farmers auto insurance review has a robust network of local agents, providing in-person assistance and personalized service for Mercedes-Benz GLE 350 insurance.

- Discounts for Safe Drivers: Farmers offers substantial discounts for Mercedes-Benz GLE 350 owners who maintain safe driving records.

Cons

- Higher Premiums: Farmers’ premiums for the Mercedes-Benz GLE 350 can be higher compared to other insurers, particularly for high-risk drivers, at $87 per month for minimum coverage.

- Limited Digital Tools: Farmers’ digital tools and online services may not be as advanced as those of some competitors, affecting convenience for Mercedes-Benz GLE 350 policyholders.

#9 – Amica: Best for High Satisfaction

Pros

- High Satisfaction: Amica is renowned for its high customer satisfaction ratings, providing excellent service to Mercedes-Benz GLE 350 owners.

- Dividend Policies: Amica offers dividend policies that can return a portion of the annual premium to Mercedes-Benz GLE 350 policyholders.

- Comprehensive Coverage Options: Amica auto insurance review provides extensive coverage options, including gap insurance and roadside assistance, for the Mercedes-Benz GLE 350.

Cons

- Higher Rates: Amica’s insurance rates for the Mercedes-Benz GLE 350 can be higher than those of some competitors at $78 per month for minimum coverage.

- Limited Availability: Amica’s policies and discounts may not be available in all states, limiting options for some Mercedes-Benz GLE 350 owners.

#10 – The Hartford: Best for Senior Benefits

Pros

- Senior Benefits: The Hartford auto insurance review has offers special discounts for AARP members, benefiting senior Mercedes-Benz GLE 350 owners.

- Lifetime Renewability: The Hartford guarantees policy renewals for Mercedes-Benz GLE 350 owners who meet certain conditions, providing long-term security.

- Strong Customer Service: The Hartford is known for its reliable customer service, assisting Mercedes-Benz GLE 350 owners effectively.

Cons

- Higher Premiums for Younger Drivers: The Hartford’s premiums can be higher for younger Mercedes-Benz GLE 350 owners at $81 per month for minimum coverage.

- Limited Discounts: The Hartford’s discount options may be fewer compared to some other insurers, affecting potential savings for Mercedes-Benz GLE 350 policyholders.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Mercedes-Benz GLE 350 Insurance Cost

Mercedes-Benz GLE 350 Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $80 | $160 | |

| $78 | $158 | |

| $87 | $165 | |

| $65 | $145 | |

| $85 | $170 |

| $73 | $153 |

| $75 | $155 | |

| $70 | $150 | |

| $81 | $162 |

| $60 | $140 |

Minimum coverage rates are also variable, with USAA again being the most affordable at $60 per month and Liberty Mutual the priciest at $85. Specific factors such as deductible amounts, driver risk level, and age also impact these rates.

Mercedes-Benz GLE 350 Auto Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $158 |

| Discount Rate | $93 |

| High Deductibles | $136 |

| High Risk Driver | $336 |

| Low Deductibles | $199 |

| Teen Driver | $577 |

For example, a high-risk driver may pay around $336 per month, and a teen driver might face premiums as high as $577. The average annual insurance cost for a GLE 350 is approximately $1,894, reflecting these varying factors.

Expensiveness of Mercedes-Benz GLE 350 to Insure

The Mercedes-Benz GLE 350 is relatively expensive to insure compared to other SUVs like the Toyota Highlander, Mercedes-Benz GLA 250, and GMC Yukon. With a monthly full coverage cost of $158, the GLE 350 has higher insurance rates across comprehensive vs. collision auto insurance coverages.

Mercedes-Benz GLE 350 Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Mercedes-Benz GLE 350 | $38 | $76 | $31 | $158 |

| Toyota Highlander | $28 | $43 | $33 | $116 |

| Mercedes-Benz GLA 250 | $31 | $60 | $38 | $143 |

| GMC Yukon | $31 | $50 | $31 | $125 |

| Jeep Cherokee | $29 | $52 | $39 | $137 |

| Ford Flex | $28 | $47 | $33 | $121 |

| Toyota Sequoia | $28 | $47 | $33 | $121 |

In comparison, the Toyota Highlander has significantly lower rates, with full coverage costing $116 per month. The GMC Yukon and Jeep Cherokee also have lower full coverage rates at $125 and $137 respectively. The GLE 350’s higher insurance costs can be attributed to its luxury status and potentially higher repair and replacement costs.

Explore the Impacts of Mercedes-Benz GLE 350 Insurance Cost

The Mercedes-Benz GLE 350 trim and model you choose can impact the total price you will pay for Mercedes-Benz GLE 350 insurance coverage. Delve into our evaluation of “Factors That Affect Auto Insurance Rates.”

Age of the Vehicle

Older Mercedes-Benz GLE 350 models generally cost less to insure due to factors such as depreciation, availability of parts, and repair costs. Auto Insurance premiums tend to decrease as the vehicle ages, reflecting lower comprehensive and collision coverage rates.

Mercedes-Benz GLE 350 Auto Insurance Monthly Rates by Model Year & Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Mercedes-Benz GLE 350 | $40 | $77 | $32 | $160 |

| 2023 Mercedes-Benz GLE 350 | $39 | $76 | $32 | $159 |

| 2022 Mercedes-Benz GLE 350 | $39 | $75 | $31 | $159 |

| 2021 Mercedes-Benz GLE 350 | $38 | $75 | $31 | $158 |

| 2020 Mercedes-Benz GLE 350 | $38 | $76 | $31 | $158 |

| 2019 Mercedes-Benz GLE 350 | $37 | $73 | $33 | $155 |

| 2018 Mercedes-Benz GLE 350 | $35 | $72 | $33 | $153 |

| 2017 Mercedes-Benz GLE 350 | $34 | $70 | $35 | $152 |

| 2016 Mercedes-Benz GLE 350 | $33 | $67 | $36 | $149 |

For instance, the monthly comprehensive coverage for a 2024 model is $40, whereas for a 2016 model, it’s $33. Similarly, collision coverage drops from $77 for a 2024 model to $67 for a 2016 model.

The minimum and full coverage rates also show a gradual decline, demonstrating that the older the vehicle, the lower the insurance costs across various coverage categories. This trend highlights the financial benefit of insuring older models.

Driver Age

Mercedes-Benz GLE 350 Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $808 |

| Age: 18 | $656 |

| Age: 20 | $358 |

| Age: 30 | $191 |

| Age: 40 | $158 |

| Age: 45 | $165 |

| Age: 50 | $144 |

| Age: 60 | $152 |

As drivers age and gain experience, rates decrease: 18-year-olds pay $577, 20-year-olds $358, and rates continue to drop with age. By age 30, the rate is $165, and it further declines to $158 at age 40, $150 at age 45, $144 at age 50, and $141 at age 60. This trend illustrates that insurance companies view older, more experienced drivers as lower risk, thus offering them lower premiums.

Driver Location

Where you live significantly affects Mercedes-Benz GLE 350 insurance rates due to varying factors like traffic density, crime rates, and regional regulations. For instance, high-density cities like Los Angeles and New York have higher monthly rates at $274 and $249, respectively, due to increased risk of accidents and theft.

Mercedes-Benz GLE 350 Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $274 |

| New York, NY | $249 |

| Houston, TX | $247 |

| Jacksonville, FL | $229 |

| Philadelphia, PA | $212 |

| Chicago, IL | $208 |

| Phoenix, AZ | $183 |

| Seattle, WA | $153 |

| Indianapolis, IN | $134 |

| Columbus, OH | $131 |

Conversely, cities like Columbus, OH, and Indianapolis, IN, offer lower rates at $131 and $134, reflecting lower risks associated with these locations. Other factors such as local weather conditions and the availability of repair shops also contribute to these variations in insurance premiums.

Your Driving Record

Mercedes-Benz GLE 350 Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $808 | $900 | $1,300 | $860 |

| Age: 18 | $656 | $770 | $1,050 | $680 |

| Age: 20 | $358 | $470 | $720 | $440 |

| Age: 30 | $191 | $240 | $380 | $200 |

| Age: 40 | $158 | $230 | $370 | $195 |

| Age: 45 | $165 | $244 | $295 | $203 |

| Age: 50 | $144 | $210 | $350 | $185 |

| Age: 60 | $152 | $205 | $340 | $180 |

As drivers age, the impact of violations decreases, but any infractions still result in higher premiums compared to those with a clean record. This highlights the importance of maintaining a clean driving history to manage insurance costs effectively. Read thoroughly our guide on how credit scores affect auto insurance rates.

Mercedes-Benz GLE 350 Safety Ratings

The Mercedes-Benz GLE 350 boasts impressive safety ratings, which positively impact its insurance rates. It has received a “Good” rating across various categories, including small overlap front (both driver and passenger sides), moderate overlap front, side impact, roof strength, and head restraints and seats.

Mercedes-Benz GLE 350 Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

These high safety ratings reflect the vehicle’s robust design and advanced safety features. The GLE 350 is equipped with numerous safety technologies, such as Electronic Stability Control (ESC) with Crosswind Assist, ABS and driveline traction control, multiple airbags including side, curtain, and knee airbags, Blind Spot Assist, PRE-SAFE, PARKTRONIC with Advanced Parking Assist, and a back-up camera.

These features not only enhance passenger protection but may also qualify the driver for insurance discounts, further reducing the cost of coverage.

Mercedes-Benz GLE 350 Crash Test Ratings

The Mercedes-Benz GLE 350 consistently receives excellent crash test ratings, with a perfect 5-star score in overall, frontal, and side impact categories, and a commendable 4-star rating in rollover tests from 2016 to 2024.

Mercedes-Benz GLE 350 Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Mercedes-Benz GLE 350 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Mercedes-Benz GLE 350 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Mercedes-Benz GLE 350 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Mercedes-Benz GLE 350 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Mercedes-Benz GLE 350 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Mercedes-Benz GLE 350 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Mercedes-Benz GLE 350 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Mercedes-Benz GLE 350 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Mercedes-Benz GLE 350 | 5 stars | 5 stars | 5 stars | 4 stars |

These high safety ratings significantly impact insurance rates for the GLE 350, as insurers often offer lower premiums for vehicles with superior crash test performance, reflecting their reduced risk of injury and damage in accidents. This consistent safety record makes the GLE 350 an attractive option for buyers seeking both luxury and peace of mind regarding vehicle safety. Check out our guide “Do you need medical payment coverage on auto insurance?”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

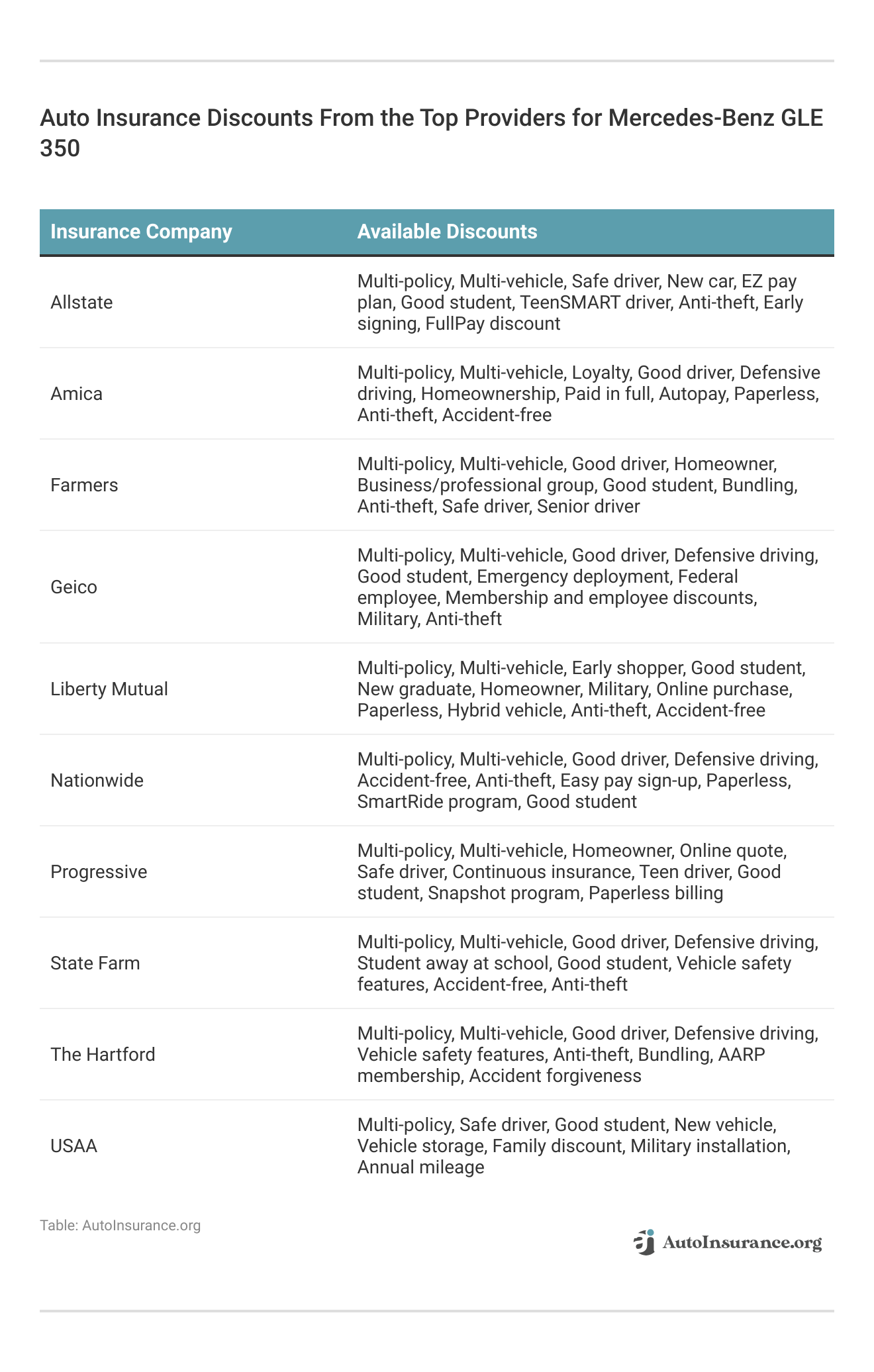

Ways to Save on Mercedes-Benz GLE 350 Insurance

Top Mercedes-Benz GLE 350 Insurance Companies

The best auto insurance companies for Mercedes-Benz GLE 350 insurance rates will offer competitive rates, discounts, and account for the Mercedes-Benz GLE 350’s safety features. The leading providers based on market share include State Farm, Geico, and Progressive, which hold the highest premiums written at $65.6 million, $46.1 million, and $39.2 million respectively.

Top 10 Mercedes-Benz GLE 350 Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | $65.6 milllion | 9% | |

| #2 | $46.1 milllion | 7% | |

| #3 | $39.2 milllion | 6% | |

| #4 |  | $35.6 milllion | 5% |

| #5 | $35 milllion | 5% | |

| #6 | $28 milllion | 4% | |

| #7 | $23.4 milllion | 3% | |

| #8 | $23.3 milllion | 3% | |

| #9 | $20.6 milllion | 3% | |

| #10 |  | $18.4 milllion | 3% |

Other notable companies include Liberty Mutual, Allstate, and Travelers, which also provide substantial coverage options. USAA, Chubb, Farmers, and Nationwide round out the top ten, offering tailored insurance solutions that benefit GLE 350 owners by leveraging the vehicle’s robust safety features to potentially lower premiums.

Compare Free Mercedes-Benz GLE 350 Insurance Quotes Online

Comparing free Mercedes-Benz GLE 350 insurance quotes online is a straightforward and efficient way to find the best coverage options for your needs. By utilizing a convenient online comparison tool, you can quickly gather and compare quotes from multiple insurance providers. Check out our guide “Where to Compare Auto Insurance Rates.“

This process not only saves time but also ensures you receive competitive rates tailored to your specific requirements. Additionally, comparing quotes allows you to evaluate different coverage options, helping you make an informed decision and potentially save money on your Mercedes-Benz GLE 350 insurance premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Case Studies: Best Mercedes-Benz GLE 350 Auto Insurance

To illustrate the advantages of choosing the best Mercedes-Benz GLE 350 auto insurance, we examine three case studies.

- Case Study #1 – Comprehensive Service Excellence: John, a 35-year-old driver from California, chose State Farm for his Mercedes-Benz GLE 350 auto insurance. He found that State Farm’s excellent customer service and comprehensive coverage options provided him with peace of mind and financial protection. The $60/month premium was competitive, and the additional discounts reduced his costs.

- Case Study #2 – Exceptional Military Savings: Sarah, a military veteran living in Texas, opted for USAA due to their outstanding military discounts and tailored coverage for service members. USAA’s policies not only offered her a $60/month rate but also provided unique benefits like deployment coverage. Sarah appreciated the personalized support and significant savings she received as a veteran.

- Case Study #3 – Affordable Rates for Budget-Conscious Drivers: Mike, a 28-year-old driver from Florida, needed affordable insurance for his Mercedes-Benz GLE 350. Geico stood out for its budget-friendly rates and easy online management tools. With a $60/month premium, Mike found Geico’s policy both affordable and comprehensive, giving him the coverage he needed without breaking the bank.

These case studies highlights the benefits provided by State Farm, USAA, and Geico, demonstrating the varied benefits of the best Mercedes-Benz GLE 350 auto insurance providers. Dive into our guide “Best Auto Insurance for Military Families and Veterans.”

State Farm offers unparalleled service and comprehensive coverage, making it the top choice for Mercedes-Benz GLE 350 auto insurance.Michelle Robbins Licensed Insurance Agent

Whether you prioritize customer service, military savings, or affordable rates, top providers offer tailored solutions to meet your specific needs and provide substantial savings. Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Frequently Asked Questions

Can I insure a leased or financed Mercedes-Benz GLE 350?

Yes, insurance coverage is common and often required for leased or financed Mercedes-Benz GLE 350 vehicles. Learn more on our guide “How to Get an Anti-Theft Auto Insurance Discount.”

How often should I review my Mercedes-Benz GLE 350 insurance policy?

It’s recommended to review your policy annually or when significant changes occur. See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Can I obtain Mercedes-Benz GLE 350 insurance directly from the dealership?

While possible, it’s recommended to shop around and compare insurance rates from different companies for the best coverage and rates (Read more: How to Compare Auto Insurance Quotes).

Should I purchase comprehensive coverage for my Mercedes-Benz GLE 350?

Whether to purchase comprehensive coverage depends on your needs and the value of your vehicle. Explore our guide titled “How Auto Insurance Companies Check Driving Records.”

Can I save money on Mercedes-Benz GLE 350 insurance through policy discounts?

Yes, good drivers can save up to $781 per year through policy discounts.

How much more do teenage drivers typically pay for Mercedes-Benz GLE 350 insurance?

Teenage drivers may pay up to $6,923 per year or $577 per month for Mercedes-Benz GLE 350 insurance.

What factors affect the cost of Mercedes-Benz GLE 350 insurance?

Factors include the driver’s age, location, driving record, and the vehicle’s age and safety features. Check out our guide “Why You Should Take a Defensive Driving Class.”

What are the average insurance rates for a Mercedes-Benz GLE 350?

On average, Mercedes-Benz GLE 350 insurance costs around $1,894 per year or $158 per month.

Which companies offer the best Mercedes-Benz GLE 350 auto insurance?

State Farm, USAA, and Geico are top providers offering comprehensive coverage at competitive rates.

What discounts are available for Mercedes-Benz GLE 350 insurance?

Discounts may include safe driver discounts, multi-policy insurance discount, and discounts for vehicles equipped with advanced safety features.

Is Mercedes-Benz GLE 350 insurance more expensive than other SUVs?

Yes, the Mercedes-Benz GLE 350 insurance rates are generally higher compared to average SUVs due to its luxury status and repair costs. You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.