Best Auto Insurance for Social Workers in 2026 (Top 10 Companies Ranked)

The best auto insurance for social workers starts at just $32 per month with Nationwide, Progressive, and State Farm. These providers offer car insurance for social workers that includes commercial use coverage for home visits and non-owned vehicle protection, ideal for client transport and field-based duties.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated August 2025

3,071 reviews

3,071 reviewsCompany Facts

Social Worker Full Coverage

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 13,285 reviews

13,285 reviewsCompany Facts

Social Worker Full Coverage

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 18,157 reviews

18,157 reviewsCompany Facts

Social Worker Full Coverage

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsNationwide, Progressive, and State Farm offer the best auto insurance for social workers. These companies are known for their cheap car insurance premiums with excellent coverage.

Our Top 10 Company Picks: Best Auto Insurance for Social Workers

| Company | Rank | Federal Employee | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | A+ | UBI Availability | Nationwide | |

| #2 | 12% | A+ | Snapshot Program | Progressive | |

| #3 | 10% | A++ | Financial Strength | State Farm | |

| #4 | 10% | A+ | Local Agents | Allstate | |

| #5 | 10% | A | Accident Forgiveness | Liberty Mutual |

| #6 | 9% | A++ | Military Members | USAA | |

| #7 | 8% | A++ | Many Discounts | Geico | |

| #8 | 7% | A | Occupational Discounts | Farmers | |

| #9 | 6% | A | Loyalty Rewards | American Family |

| #10 | 5% | A++ | Safety Features | Travelers |

As a social worker, your job requires you to be on the move, so having the right auto insurance coverage is essential to ensure you’re protected in case of an accident.

Among the many options available, these top 3 insurers deliver strong coverage options and exceptional customer service tailored to the unique needs of social workers who spend a lot of time on the road.

- Covers work-related driving needs like client transport and home visits

- Offers protection for social workers using personal or non-owned vehicles

- Nationwide ranks as the top pick for affordable and flexible coverage options

Do you work for a social work foundation and want to secure coverage from the cheapest auto insurance companies? Explore further details below and use our tool to compare rates.

Auto Insurance Rates for Social Workers

Social workers can choose among multiple auto insurance quotes by provider and coverage level. USAA, with ties to the military, offers the lowest premiums at $32 for minimum coverage and $84 for full coverage.

Geico and State Farm also stand out by offering full coverage auto insurance for under $125, making them strong options for affordability and professional driving needs.

Social Worker Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

Nationwide and Progressive provide competitive mid-range rates with full coverage between $150 and $164, plus discounts tailored for social workers. On the higher end, Liberty Mutual and Travelers offer rates up to $248 a month, often including features like accident forgiveness.

Auto insurance rates vary by coverage level. For example, raising your deductible can lower monthly premiums while maintaining key protection.Jeff Root Licensed Insurance Agent

When choosing social workers’ insurance, consider both cost and key coverages like non-owned vehicle use and commercial driving protection to stay protected during client visits and fieldwork.

Social Worker National Statistics

| Total number of social workers in the U.S. | Over 700,000 |

| Average monthly auto insurance rates | 135 |

| Average annual auto insurance rates | 1,620 |

| Average annual salary | $55,350 |

| Average age of social workers | 42.5 years |

| Percent of social workers by gender | 82% Female, 18% Male |

There are over 700,000 social workers in the U.S., with an average age of 42.5 years and a workforce that is 82% female. The average annual salary is $55,350, while average social worker insurance costs for top policies typically run around $135 per month or $1,620 per year, reflecting the generally low-risk driving profiles associated with the profession.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

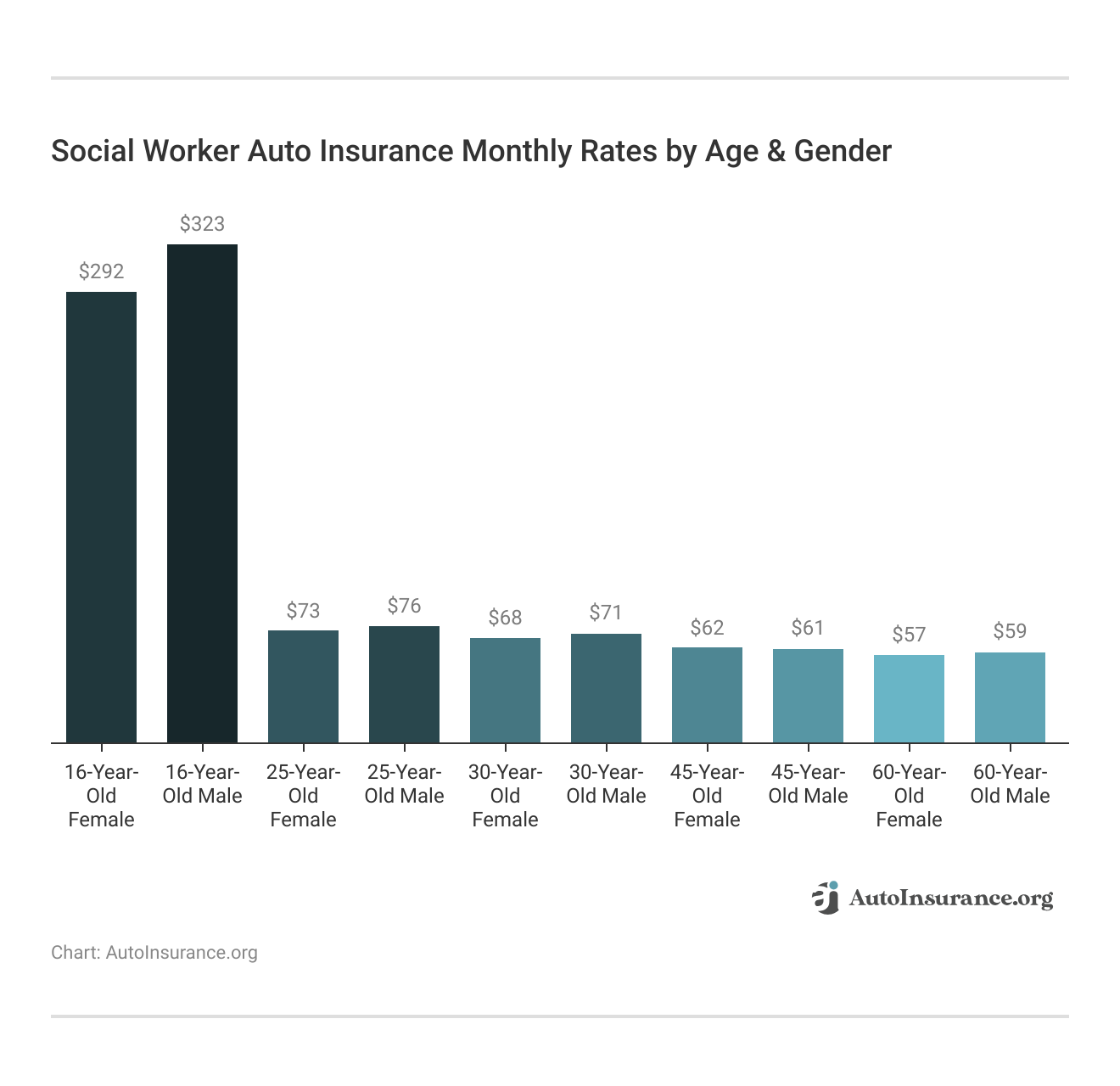

Auto Insurance Rates for Social Workers by Age and Gender

Car insurance for social workers costs widely differ by age, gender, and coverage. The highest premiums are reserved for teenage drivers, as 16-year-old girls pay about $292 a month for the minimum required insurance, and $323 a month for full coverage, 16-year-old boys pay even more because of the perceived added risk.

Auto insurance rates by age decrease substantially as drivers gain experience. By age 25, female social workers pay approximately $73 a month for minimum coverage, while males pay about $76. At age 30, rates continue to improve, with females at $68 and males at $71.

The most affordable rates are seen among older drivers. 45-year-old females pay just $62 a month, and males pay $61, while 60-year-old females and males average $57 and $59 a month, respectively.

These figures reflect lower risk profiles associated with age and driving experience, with females consistently enjoying slightly lower premiums across age groups.

Auto Insurance Discounts for Social Workers by Driving Record

Auto insurance rates for social workers vary based on driving history. USAA offers the lowest rates overall, from $32 a month with a clean record to $58 a month after a DUI.

State Farm and Geico also provide affordable rates, keeping DUI premiums below $120 a month. The average State Farm social worker insurance cost is around $114 per month for a full coverage policy, making it a competitive choice if you need protection both for personal driving and for conducting business on the road.

Social Worker Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $87 | $103 | $124 | $152 | |

| $62 | $73 | $94 | $104 |

| $76 | $95 | $109 | $105 | |

| $43 | $56 | $71 | $117 | |

| $96 | $116 | $129 | $178 |

| $63 | $75 | $88 | $129 | |

| $56 | $74 | $98 | $75 | |

| $47 | $53 | $57 | $65 | |

| $53 | $72 | $76 | $112 | |

| $32 | $36 | $42 | $58 |

For those with a ticket or accident, Nationwide and Progressive maintain competitive pricing, while Liberty Mutual and Allstate apply the highest DUI surcharges, reaching $152–$178 a month.

Social workers who frequently drive for client visits should aim to maintain a clean record to secure the best rates and minimize premium increases after traffic violations.

Top Auto Insurance Discounts for Social Workers

| Discount | Eligibility |

|---|---|

| Auto-Pay | Set up automatic payments to earn a discount |

| Defensive Driving | Complete an approved course for lower premiums |

| Federal Employee | For federal government social workers |

| Good Student | Student social workers with good grades may qualify |

| Loyalty | Long-term policyholders may receive a discount |

| Multi-Policy | Bundle auto with other policies for savings |

| Occupation-Based | Some insurers offer discounts specifically for social workers |

| Pay-in-Full | Pay the full premium upfront to save |

| Safe Driver | Maintain a clean record for lower rates |

| Safety Equipment | Vehicles with safety features may earn discounts |

Additional savings come from auto-pay, pay-in-full, loyalty programs, and multi-policy bundles. Good student discounts support those pursuing education, and safety equipment in vehicles can further lower premiums.

By combining these discounts strategically, social workers can significantly lower the cost of their auto insurance while maintaining comprehensive coverage.

3 Case Studies: Auto Insurance Realities for Social Workers

Social workers are essential in sustaining society, and they are often required to travel extensively for client visits and outreach programs. All of that activity can make auto insurance even more challenging.

- Case Study #1 – Auto Insurance for Freelance Social Workers: Sarah, a freelance social worker, gets car insurance that fits her counseling practice and unique needs.

- Case Study #2 – Social Workers in High-Risk Areas: In dangerous neighborhoods, social worker David requires full car insurance for safety and vehicle security for workplace hazards.

- Case Study #3 – Auto Insurance for Hybrid Social Work Roles: Maria balances coverage needs and costs while managing office, outreach, and client visits.

These scenarios illustrate the varied situations social workers encounter when searching for the right auto insurance. Whether it’s managing costs, occupational risks, or hybrid role balance, every story highlights the necessity of understanding individual needs and solutions that respond to them.

By knowing the challenges they face and examining the right types of auto insurance coverage, social workers can ensure they have the protection they need while fulfilling their vital roles in the community.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

10 Best Auto Insurance Companies for Social Workers

These top-rated insurers provide affordable auto coverage tailored for social workers, with options for client visits, non-owned vehicles, and mixed personal-professional use.

Many also feature valuable discounts for safe driving, multi-policy bundling, and professional affiliations. Review the highlights below to find the best match for your work and budget.

#1 – Nationwide: Top Pick Overall

Pros

- Bundling Cost Savings: Social workers may save up to 25% by bundling auto and home insurance with Nationwide’s multi-policy discount. See our Nationwide auto insurance review for details.

- Coverage Customization Options: Nationwide offers flexible add-ons like roadside assistance and rental coverage, ideal for mobile social workers with varied needs.

- Strong Claims Support: 94% claims satisfaction ensures social workers get prompt, reliable service in today’s social service insurance markets.

Cons

- Discount Qualification Criteria: Multi-policy savings require strict bundling, which may not suit social workers using separate providers for renters, health insurance, or cyber insurance.

- Strict Commercial Exclusions: Policies may exclude coverage during client transport, requiring social workers to purchase additional commercial auto insurance.

#2 – Progressive: Best for Snapshot Program

Pros

- Driving Behavior Rewards: Social workers with safe driving habits may save up to 30%, per Progressive data on Snapshot user discounts.

- Custom Rate Insights: Snapshot tracks miles and braking, which benefits social workers with predictable daily routes and minimal sudden stops.

- Low-Mileage Benefits: Social workers driving under 10,000 miles/year saw lower premiums, per Progressive’s telematics data. For a complete list, read our Progressive auto insurance review.

Cons

- Privacy Concerns: Tracking includes time of day and hard braking, which may deter social workers who are uncomfortable with constant monitoring.

- Initial Rate Risk: Snapshot can increase premiums for social workers with frequent commutes or inconsistent driving schedules.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#3 – State Farm: Best for Financial Strength

Pros

- Superior Financial Stability: Social workers have access to superior claims support (particularly for work-related accidents) because of State Farm’s A++ A.M. Best rating and top-notch financial stability.

- Personalized Agent Support: State Farm’s 19,000+ agents provide social workers with personalized local help for policies and claims, which you can learn about in our State Farm auto insurance review.

- Driving Behavior Savings: Drive Safe & Save offers up to 30% off for safe driving, matching social workers’ typically low-risk driving habits for meaningful savings.

Cons

- No Professional Discount: State Farm does not offer occupation discounts for social workers, whereas some insurers give them to nurses or educators.

- Manual Policy Changes: State Farm requires agent help for policy changes, which can be inconvenient for social workers with unpredictable schedules.

#4 – Allstate: Best for Local Agents

Pros

- Personalized Guidance: Local agents guide social workers in choosing job-relevant coverage, such as when driving to client homes or clinics. Read more in our review of Allstate.

- Tailored Discounts: Local agents can help you get insurance quotes for social workers that include occupation-based discounts often missed in online searches.

- Community Connection: Agents in the same city understand local driving risks for social workers, improving geographic risk assessments.

Cons

- Fewer Digital Tools: Some social workers prefer apps and self-service portals, where Allstate agents may rely on traditional processes.

- Agent Variability: Service quality varies by agent, and inconsistent experiences may frustrate busy social workers who rely on reliable support.

#5 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Career-Based Discounts: According to industry data, social workers may qualify for occupation-specific savings, which could potentially reduce premiums by up to 12%.

- Forgiveness Eligibility: After five accident-free years, Liberty Mutual forgives your first accident, a strong benefit for responsible social workers who spend significant time driving.

- Extended Road Use: Ideal for social workers with personal and work-related driving; supports 20,000+ annual miles without surcharge. Learn more in our Liberty auto insurance review.

Cons

- Usage Disclosure Required: Liberty Mutual requires full disclosure if social workers use vehicles for client visits, which could lead to policy exclusions.

- Online Support Gaps: Customer satisfaction for online tools sits at 3.2/5, making digital servicing less ideal for busy social workers managing schedules.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#6 – USAA: Best for Military Members

Pros

- Military Family Focus: Built for military-affiliated social workers, with 96% satisfaction among veteran policyholders for personalized support.

- Top Claims Service: 90% of USAA members report satisfaction with the claims process, which is covered in our USAA auto insurance review. This is a key benefit for social workers managing tight schedules.

- Family Coverage Options: Multi-policy discount options for families, good for social workers, as you protect the balance of home and work.

Cons

- Eligibility Restrictions: Only military social workers or their families qualify, limiting access for the broader social work community.

- No Occupational Discounts: Unlike competitors, USAA doesn’t offer dedicated social worker discounts outside of military affiliation.

#7 – Geico: Best for Many Discounts

Pros

- Broad Nationwide Access: Geico offers coverage in all 50 states, giving social workers flexibility and policy continuity when relocating or traveling for work. Find out more in our Geico auto insurance review.

- Industry-Leading App: Geico’s 4.8/5-rated app offers quote management, digital ID cards, and real-time claims—ideal for social workers balancing fieldwork and busy schedules.

- Usage-Based Discounts: Geico’s DriveEasy rewards safe driving with up to 22% off, making it well-suited for social workers with short, consistent commutes.

Cons

- Limited Agent Presence: Geico relies on online service, which may be a drawback for social workers who prefer in-person help for work-related coverage needs.

- Higher Full Coverage Rates: Geico’s full coverage averages $145 a month for some, costing more than USAA or Progressive for social workers with clean records.

#8 – Farmers: Best for Occupational Discounts

Pros

- Exclusive Professional Perks: Social workers can access up to 10% savings through Farmers’ occupational discount program, recognizing their low-risk profession.

- Customized Coverage Options: Farmers offers tailored auto insurance for social workers who drive 60%+ for client visits or home assessments. Check out our Farmers auto insurance review.

- Safe Driver Rewards: Over 85% of social workers qualify for safe driver incentives due to low claims frequency, further reducing premiums.

Cons

- Commercial Policy Requirement: Social workers using personal vehicles for client transport 3+ times/week may need to purchase an additional commercial policy.

- Strict Work Use Rules: Policies may exclude coverage if social work driving exceeds 50%, unless a commercial upgrade is added.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#9 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Discount: Social workers can save up to 10% on premiums with American Family’s Loyalty Rewards. Explore our American Family auto insurance review to learn more.

- Multi-Policy Savings: Bundling auto insurance with home or renters insurance can cut costs by an additional 15%, valuable for budget-conscious social workers.

- Occupation Recognition: American Family extends occupation-related discounts for social workers, triggering lower prices as a recognition of their low-risk status.

Cons

- Discount Caps: Total discounts combined might not exceed 25–30%, disallowing social workers a chance to see deeper discounts.

- Eligibility Conditions: Loyalty discounts require maintaining social work insurance coverage for at least 1–2 years, which may not suit mobile or newer social workers.

#10 – Travelers: Best for Safety Features

Pros

- Real-Time Driving Feedback: Social workers benefit from IntelliDrive’s mobile app, which provides real-time feedback—drivers who improve their behavior can save up to 30% on premiums.

- Data-Driven Discounts: Using 90 days of tracked behavior, IntelliDrive rewards safe-driving social workers with average discounts of up to $148 annually.

- Mileage-Based Savings: Social workers with fewer work miles may earn low-mileage discounts, with Travelers offering up to 15% off. Read our Travelers auto insurance review for more.

Cons

- Short Evaluation Window: The 90-day tracking period may penalize social workers who experience irregular driving patterns during client emergencies or heavy caseload weeks.

- No Retroactive Adjustment: If driving improves after the 90-day period, social workers cannot receive updated discounts—locked-in pricing may not reflect long-term safe habits.

How to Find Affordable Auto Insurance for Social Workers

The best auto insurance for social workers helps offset risks from frequent driving for client visits, home visits, and fieldwork. After an accident, explore cheap auto insurance after an accident to stay protected at a lower cost.

With rates starting at $32 per month, top companies like Nationwide, Progressive, and State Farm offer affordable insurance for social workers with flexible discounts for safe driving, multi-policy bundling, and professional affiliations, helping social workers manage both coverage needs and evolving driving costs.

Uncover cheap auto insurance rates for social workers from top providers by entering your ZIP code.

Frequently Asked Questions

What does social use on car insurance cover?

Social use covers driving for personal reasons, such as visiting friends, shopping, or going on leisure trips—but does not cover commuting to work or business-related driving, which may require a business owner’s policy for proper coverage.

How affordable is Progressive insurance for social workers?

Progressive’s rates for social workers are competitive, with full coverage starting around $150 a month, depending on driving record, location, and coverage needs.

Stop overpaying for auto insurance. Enter your ZIP code to find out if you can get a better deal.

Does Nationwide insurance compensation for social workers include liability coverage for client transport?

Yes, with the right policy adjustments, Nationwide can provide liability auto insurance coverage for transporting clients, a crucial benefit within Nationwide insurance compensation for social workers.

Does State Farm offer specific auto insurance discounts for social workers?

While not explicitly listed, State Farm for social workers may offer occupation-based or safe driver discounts that social workers often qualify for. Bundling policies can also enhance savings.

Can social workers get a discount on auto insurance through Preferra Insurance NASW?

Yes. Many Preferra Insurance NASW members are eligible for exclusive auto insurance discounts through participating insurance partners. These discounts vary by state and provider.

How does the average social worker’s salary in Tennessee affect auto insurance rates?

With an average salary of $52,000/year, Tennessee social workers can access occupation-based discounts and should explore the best auto insurance discounts to maximize savings.

Is Geico insurance for social workers cheaper than other major providers?

Geico insurance for social workers often ranks among the most affordable options. For example, full coverage averages $114 a month, making it a competitive choice for budget-conscious drivers.

Can social workers bundle home and auto insurance with Farmers?

Yes, Farmers Insurance for social workers supports bundling auto and home or renters insurance, which can yield multi-policy discounts and simplify account management.

What factors impact an Esurance insurance rate for social workers?

Key factors affecting Esurance rates for social workers include driving record, coverage, vehicle type, credit score, and DriveSense. Always compare auto insurance rates by vehicle make and model to find the best deal.

What types of injuries are covered under workers’ compensation for social workers?

Workers’ compensation insurance for social workers covers injuries like car accidents during client visits, slips, strains, and work-related emotional trauma. However, adding the best liability insurance for social workers helps protect against claims tied to professional duties and third-party injuries.

Is car insurance for SSI recipients different from standard auto insurance?

Does Esurance insurance for social workers include non-owned vehicle coverage?

Which companies for social workers offer the best loyalty rewards?

How does driving for client visits impact liability insurance cost?

Does gender impact social workers’ car insurance rates?

Do social workers need Geico livery insurance for client transport?

Is social work liability insurance required by law?

Does auto insurance cover medical malpractice claims for social workers?

How much does insurance cost for social workers in different states?

Is employer coverage enough for a social worker’s car insurance?

How do I get social worker insurance for personal auto use?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.