Best Auto Insurance for Dealerships in 2025 (Top 10 Companies Ranked)

The best auto insurance for dealerships starts at $54 per month, offered by State Farm, Nationwide, and Liberty Mutual. These providers offer dealership-specific coverage like garage liability, fleet insurance, and garagekeepers protection, making it ideal for inventory, service bays, and customer vehicles.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Jun 18, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 18, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Dealerships

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Dealerships

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Dealerships

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviewsState Farm, Nationwide, and Liberty Mutual offer the best auto insurance for dealerships, with rates at $54 per month, making it the most affordable option for minimum and full coverage auto insurance.

Our Top 10 Company Picks: Best Auto Insurance for Dealerships

| Company | Rank | Fleet Discount | A. M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | A++ | Coverage Options | State Farm | |

| #2 | 15% | A+ | Commercial Insurance | Nationwide | |

| #3 | 15% | A | Business Vehicles | Liberty Mutual |

| #4 | 13% | A+ | Small Businesses | The Hartford |

| #5 | 12% | A+ | Combining Discounts | Progressive | |

| #6 | 12% | A | Customizable Policies | Farmers | |

| #7 | 10% | A++ | High-Value Vehicles | Chubb | |

| #8 | 10% | A++ | Safety Features | Travelers | |

| #9 | 10% | A+ | Agent Network | Allstate | |

| #10 | 8% | A++ | Cost Savings | Geico |

These top companies offer tailored policies with essential protections, such as garage liability, fleet insurance, and dealer open lot coverage.

Whether you’re a small used car lot or a large franchise, requesting an auto dealer insurance quote from these providers can help you save while securing the right coverage.

- State Farm is the top pick for affordable, customizable dealership coverage

- The best auto insurance for dealerships includes garage, fleet, and lot protection

- Tailored policies help cover service bays, inventory, and customer vehicle risks

Understanding how insurance works can feel complicated, but finding affordable rates doesn’t have to be. Enter your ZIP code to find the best auto dealership insurance rates in your area.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Dealership Auto Insurance Rates

Dealership auto insurance rates vary notably depending on the provider and level of coverage, with minimum coverage options ranging from $54 to $95 per month and full coverage from $148 to $220 per month.

Dealership Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $62 | $160 | |

| $95 | $220 | |

| $68 | $172 | |

| $54 | $148 | |

| $70 | $180 |

| $60 | $158 | |

| $58 | $165 | |

| $55 | $150 | |

| $72 | $182 |

| $61 | $155 |

Geico offers the cheapest full coverage auto insurance at $148 a month, with minimum coverage starting at just $54 a month, followed by State Farm and Progressive. Chubb ranks highest in monthly cost at $95 for minimum and $220 for full coverage, while Farmers, Nationwide, Travelers, and Allstate fall into the mid-range pricing tier.

Dealership insurance rates vary. Raising your deductible can cut costs. For example, a higher lot coverage deductible lowers your premium.Jeff Root Licensed Insurance Agent

Such differences provide dealerships with a range of plan options, allowing them to select one that suits their budget and the coverage needed in relation to cost and protection.

Essential Insurance Coverage for Auto Dealerships

Auto dealerships face unique risks that require specialized insurance to protect their operations, employees, and inventory. Below are five key coverages every dealership should have for full protection and compliance.

- Garage Liability Insurance: Liability insurance for car dealers covers injury and property damage from test drives or service work and is required in most states for licensing.

- Garagekeepers Insurance: Garagekeepers insurance covers customer vehicles in your care from fire, theft, vandalism, or collision while on dealership property.

- Dealer’s Open Lot (Physical Damage) Coverage: Physical damage coverage protects inventory from theft, vandalism, and more, with per-vehicle auto insurance deductibles.

- Workers’ Compensation Insurance: Required in most states, this coverage protects employees by covering work-related injuries, medical costs, and lost wages.

- Surety Bond: A surety bond isn’t insurance, but it is required in most states to license dealers. It ensures compliance with laws and offers compensation if obligations aren’t met.

Securing the right combination of auto dealer car insurance not only helps dealerships stay compliant with state laws but also provides critical financial protection against common risks.

By investing in these essential policies, dealerships can operate with greater confidence, knowing they are prepared for both expected and unforeseen challenges.

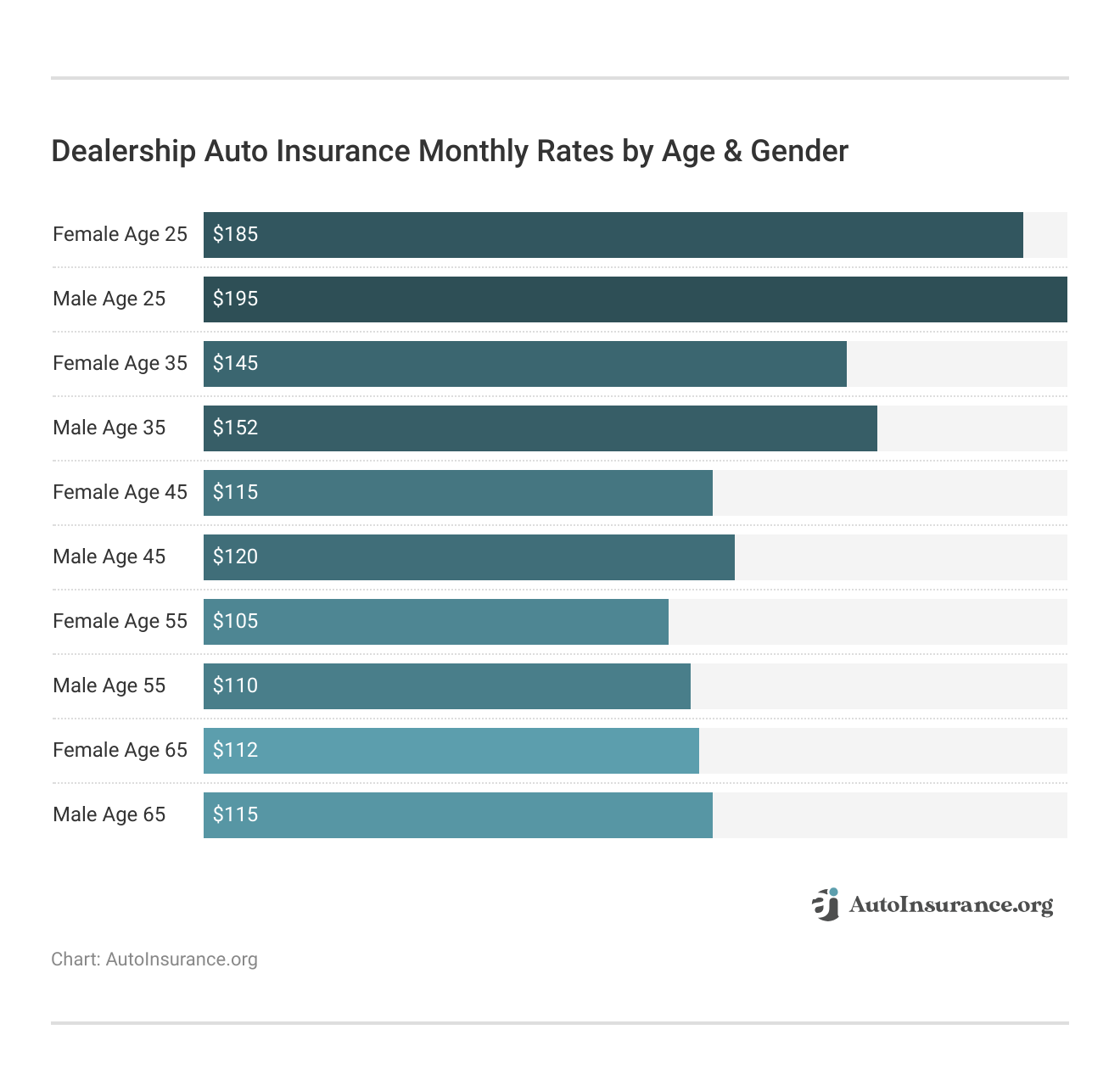

Fleet Insurance and Dealership Rates by Age and Gender

Fleet insurance is a key part of car insurance for dealers. It covers three or more vehicles under one flexible policy. It’s easy to update and customizable to your business.

Dealership auto insurance rates vary by age and gender, with younger drivers generally paying more due to higher risk. For example, 25-year-old females pay around $185 per month, while males pay $195 per month.

Auto insurance rates by age show a steady decrease, hitting the lowest at $55 to $105 for women and $110 for men. At 65, rates rise slightly to $112 for women and $115 for men. Overall, females consistently pay slightly less than males across all age groups.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Dealership Auto Insurance Discounts by Provider

Auto insurance discounts offered by the top carriers also help dealerships reduce their auto insurance costs, which allows them to find cheap car dealer insurance that doesn’t have short coverage. Key savings areas include anti-theft systems, bundling, federal affiliations, fleet size, and new car purchases.

Top Auto Insurance Discounts for Dealerships

| Company | Anti-Theft | Bundling | Federal | Fleet | New Car |

|---|---|---|---|---|---|

| 10% | 25% | 10% | 10% | 10% | |

| 10% | 25% | 8% | 10% | 8% | |

| 10% | 20% | 7% | 12% | 12% | |

| 25% | 25% | 8% | 8% | 10% | |

| 35% | 25% | 10% | 15% | 8% |

| 5% | 20% | 9% | 15% | 15% | |

| 25% | 10% | 12% | 12% | 10% | |

| 15% | 17% | 10% | 15% | 15% | |

| 10% | 5% | 10% | 13% | 5% |

| 15% | 13% | 5% | 10% | 8% |

Liberty Mutual offers the highest anti-theft discount at 35%, while Geico, Liberty Mutual, and Allstate lead in bundling discounts at 25%. Fleet discounts go up to 15% with Liberty Mutual, Nationwide, and State Farm.

Progressive offers the top federal discount at 12%, while Nationwide and State Farm provide 15% off for new cars. If you’re looking for the best auto insurance for federal employees, taking advantage of these discounts can lead to significant savings.

10 Best Auto Insurance Companies for Dealerships

Choosing the right insurer is an important step in safeguarding your dealership’s vehicles, workers, and operations. It provides peace of mind, financial coverage, and assures compliance with accidents or loss.

Here are the best auto insurance companies for dealerships, ranked by adequate auto insurance coverage, affordability, and customer service.

#1 – State Farm: Top Overall Pick

Pros

- Diverse Policy Options: State Farm offers customizable commercial policies, making it easy to tailor auto insurance for car dealerships. See our State Farm auto insurance review for details.

- Local Agent Support: With over 19,000 agents nationwide, dealerships get personalized guidance when setting up auto insurance for dealerships, ensuring compliance with local regulations.

- Tailored Coverage Plans: State Farm offers tailored auto dealers insurance coverage to address operational risks, including garage liability, inventory protection, and employee vehicle use.

Cons

- Price Varies Regionally: Premiums can fluctuate based on location, with urban dealerships paying up to 25% more for auto insurance for dealerships.

- Claims Inconsistency: Claims processing somewhat relies on individual agents, resulting in different experiences for dealers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Commercial Insurance

Pros

- Industry Experience: With 90+ years in commercial auto, Nationwide brings deep expertise to structuring dealership-specific coverage.

- Dealer-Specific Enhancements: Nationwide supports auto insurance for dealerships with optional protections like lot coverage, employee dishonesty, and open-lot endorsements.

- Local Risk Advisors: Over 1,000 commercial agents assist dealerships with compliance, safety programs, and policy optimization. For additional information, see our Nationwide auto insurance review.

Cons

- Longer Quote Turnaround: Dealerships may wait 2–5 business days for customized dealer insurance quotes due to manual underwriting.

- Niche Segment Gaps: Coverage for RV, motorcycle, or boat dealerships is not as comprehensive under Nationwide’s auto insurance for dealerships umbrella.

#3 – Liberty Mutual: Best for Business Vehicles

Pros

- Comprehensive Business Auto Coverage: Liberty Mutual has a complete auto policy solution for dealers, including liability and physical damage, and an optional fleet telematics.

- Risk Management Expertise: Liberty’s loss prevention programs turn their dealership auto insurance into a proactive measure in reducing accidents. Read our Liberty Mutual auto insurance review for more.

- Fleet Telematics Integration: Through the IntelliDrive program, Liberty provides enhanced vehicle tracking and data insights to optimize auto insurance for dealerships with large inventories.

Cons

- Lengthy Quote Process: Liberty Mutual requires agent consultation, so to avoid delays, start with a car dealer insurance quote.

- Limited Dealer-Focused Agents: Their specialized agents for auto insurance for dealerships are mostly in urban hubs, leaving rural locations with fewer support options.

#4 – The Hartford: Best for Small Businesses

Pros

- Small Dealership Expertise: The Hartford is known for its focus on small businesses, so it would be a particularly good option for startup and boutique dealers looking for auto insurance.

- Risk Management Services: The Hartford offers dealership-specific safety consultations to reduce workplace incidents and protect assets via auto insurance for dealerships.

- Flexible Billing Options: Dealerships can choose monthly or seasonal billing structures, easing financial management for auto insurance for dealerships. Explore our The Hartford auto insurance review.

Cons

- Higher Rates for Larger Dealerships: The Hartford’s pricing becomes less competitive for high-volume or multi-location operations needing expansive auto insurance for dealerships.

- Longer Application Timelines: Underwriting can take longer, delaying start dates for dealerships needing urgent auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Combining Discounts

Pros

- Accident Forgiveness Benefit: Progressive’s accident forgiveness feature may benefit dealerships, helping them maintain stable auto insurance premiums.

- Dealer-Focused Support Team: Progressive provides agents trained in the unique risks of auto insurance for dealerships. Find more in our Progressive auto insurance review.

- Widespread Availability: Operating in all 50 states, Progressive makes it easy for multi-location dealerships to maintain consistent auto insurance for dealerships across regions.

Cons

- Lacks In-Person Service Depth: While strong online, Progressive has fewer local agents available for face-to-face service on auto insurance for dealerships.

- Inconsistent Claims Experience: Some dealerships report delays or variability in claims handling when using Progressive for auto insurance for dealerships.

#6 – Farmers: Best for Customizable Policies

Pros

- Flexible Policy Design: Farmers is great at providing custom choices that allow you to tailor auto insurance for dealerships by inventory, staff, and location.

- Bundling Opportunities: Farmers enables dealerships to combine auto insurance for dealerships with garage liability, property, and workers’ comp for potential multi-policy discounts.

- Safe Driving Incentives: Dealerships with a clean driving history may receive lower premiums on their auto insurance for dealerships through Farmers’ performance-based discounts.

Cons

- Higher Starting Rates: Farmers’ auto insurance for dealerships often starts at $138 a month, which is about 50% above market leaders like Progressive. Find the full list in our Farmers auto insurance review.

- Coverage Availability Gaps: Some features on auto insurance for dealerships may not be available in all states, potentially limiting customization for multi-state dealers.

#7 – Chubb: Best for High-Value Vehicles

Pros

- Luxury Asset Focus: Policies are designed specifically to protect rare, exotic, and high-performance vehicles under auto insurance for dealerships.

- Agreed Value Coverage: Chubb pays the full insured amount on total loss claims, ideal for luxury auto insurance for dealerships. Check out our Chubb auto insurance review.

- Transport Coverage Included: Protection applies to vehicles in transit, supporting dealerships that ship inventory across the country or globally.

Cons

- Strict Underwriting Rules: Chubb has rigorous facility and security standards, which may disqualify some dealerships from coverage.

- Broker-Based Access: Fewer direct agents means dealerships must go through brokers to access Chubb’s auto insurance for dealerships.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Safety Features

Pros

- Advanced Safety Discounts: Travelers offers up to 15% off on-lot coverage with GPS and anti-theft systems, reducing dealership insurance costs.

- Telematics Integration: With tools like Geotab, Travelers helps monitor driver behavior and fleet usage, reducing liability exposure through safer operations.

- On-Site Risk Assessments: Travelers provides safety consultants to help dealerships tailor auto insurance to real-world risks. Explore our Travelers auto insurance review.

Cons

- High Tech Setup Costs: Implementing safety devices and telematics systems can be expensive, making it cost-prohibitive for smaller operations seeking auto insurance for dealerships.

- Best for Larger Dealers: Many safety-based discounts and auto dealership insurance programs are optimized for larger inventories, limiting benefits for smaller lots seeking auto insurance for dealerships.

#9 – Allstate: Best for Agent Network

Pros

- Strong Agent Presence: Allstate has over 12,000 local agents across the U.S., offering personalized setup and service for dealership auto insurance. Learn more in our Allstate auto insurance review.

- In-Person Claims Support: With an agent model, Allstate provides dealerships hands-on guidance during the claims process, improving the experience for dealership auto insurance.

- Localized Compliance Expertise: Agents help dealerships meet DMV and state-level licensing requirements by structuring compliant auto insurance for dealerships.

Cons

- Slower Policy Changes: Dealerships may face delays since changes to an auto dealer’s insurance policy often require agent approval.

- Higher Premiums with Commissions: Allstate’s agent-based model includes commission costs, potentially raising rates by 5–10% on auto insurance for dealerships.

#10 – Geico: Best for Cost Savings

Pros

- Low-Cost Premiums: Geico is the popular choice when it comes to price, as it beats the national average by as much as 18%, making it a great budget option for auto insurance for car dealerships.

- Fast Online Quotes: Geico specializes in digital sales, and dealers can obtain dealer auto insurance quotes in less than 10 minutes, ensuring a fast, easy process.

- Financial Stability: Rated A++ by A.M. Best, Geico provides dependable coverage security for dealerships with larger vehicle inventories. Discover details in our Geico auto insurance review.

Cons

- Agent Availability Gaps: Unlike agent-heavy providers, Geico relies on a digital service model, which may leave dealerships without personalized guidance.

- Few Specialized Add-Ons: Some key coverages, like floor plan insurance or garage keepers liability, are not as robust under Geico’s default auto insurance for dealerships plans.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Find Affordable Dealership Auto Insurance Rates

The best auto insurance for dealerships is affordable and offers great coverage and service. Major insurers such as State Farm, Nationwide, and Liberty Mutual have policies designed to meet dealership insurance requirements.

Monthly rates can be as low as $54, allowing dealerships to secure quality protection without overspending. Choosing from the best comprehensive auto insurance companies helps them stay compliant, protect assets, and manage risk effectively.

No matter how much coverage you need, you can find the lowest rates by entering your ZIP code into our free comparison tool.

Frequently Asked Questions

How does auto franchise dealerships insurance differ from independent dealership insurance?

Franchise dealerships may have higher-value inventory, brand-specific compliance requirements, and service operations that require broader and more customizable coverage options compared to smaller, independent dealers.

What coverages are included in a standard Florida auto dealer insurance policy?

A standard Florida auto dealer insurance policy typically includes garage liability, dealer’s open lot (physical damage), garage keepers coverage, general liability, and workers’ compensation. Depending on the dealership’s needs, optional add-ons may include cyber liability and false pretense coverage.

Comparing quotes is integral to finding the best rates possible. Enter your ZIP code into our free tool today to see what quotes might look like for you.

Do part-time or seasonal operations lower used car dealership insurance costs?

Yes, if a used car dealership operates only part of the year or on a limited schedule, insurers may reduce premiums to reflect the lower exposure period, potentially lowering the average cost of car insurance for the business.

What types of vehicles can be covered under Ohio auto dealer insurance?

Ohio auto dealer insurance covers new and used cars, including consignment, loaners, and test-drive vehicles. Used car dealer insurance cost varies by inventory, location, and coverage. Fleet policies are available for businesses with three or more vehicles.

How do auto dealer insurance companies determine premium rates?

Premiums from auto dealer insurance companies are calculated based on several factors, including dealership size, number of vehicles on the lot, location, claims history, employee count, and selected coverage limits and deductibles. Customizations like fleet policies or additional liability can also affect rates.

Are there used car dealer insurance companies that specialize in small dealerships?

Yes, several used car dealer insurance companies offer tailored policies for small or independent dealerships. These plans often align with minimum auto insurance requirements by state and include flexible payments, minimal coverage, and affordable premiums for businesses with limited inventory or staff.

Do I need Colorado auto dealer insurance if I only sell a few cars per year?

Yes, even part-time or wholesale dealers in Colorado are typically required to carry minimum auto dealer insurance to comply with licensing regulations and protect against liability.

Can car dealer insurance companies provide proof of coverage for DMV licensing?

Yes, licensed car dealer insurance companies can issue a certificate of insurance, which the DMV often requires as proof of financial responsibility before a dealership license can be approved.

How much do auto dealer insurance programs typically cost?

Auto insurance premiums for dealer programs vary based on factors like dealership size, location, inventory value, claims history, and coverage limits. Monthly premiums can range from as low as $54 to over $200, depending on your business profile and specific auto insurance premium requirements.

Is it possible to bundle policies with an auto dealer insurance company?

Many auto dealer insurance companies allow policy bundling, such as combining commercial auto, property, workers’ comp, and liability insurance. Bundling often results in discounts and simplified policy management.

Are auto dealership insurance quotes different for used and new car dealerships?

Yes, car dealership insurance quotes can vary between used and new car dealerships. Used car lots face higher risks from older inventory, while new car dealerships need higher coverage for valuable stock. New car dealer insurance helps protect this inventory with tailored, comprehensive coverage.

How do I choose the right dealer’s insurance company for my car lot?

When selecting a dealer’s insurance company, consider factors like pricing, reputation, claims handling, and whether the company offers the best auto insurance discounts and coverage options tailored to your dealership’s size and vehicle types.

Do used car dealer insurance programs cover vehicles in transit?

Yes, many used car dealer insurance programs offer optional or included coverage for vehicles being transported between locations, auctions, or test drives, ensuring protection during transit under dealer plates or third-party carriers.

How much does auto dealer insurance in California cost per month?

The cost of auto dealer insurance in California varies based on dealership size, location, and coverage needs, with premiums typically ranging from $80 to $250 per month. Rates can differ significantly depending on the auto dealers’ insurance providers, as each offers different policy options, risk assessments, and discount opportunities tailored to dealership operations.

What factors influence the used car dealership insurance cost per month?

Several factors impact car dealer insurance costs, including business size, location, and types of auto insurance like garage liability or dealer’s open lot, plus vehicle count and services offered.

Who is eligible for the Kentucky auto dealers’ insurance program?

Eligibility is typically limited to licensed auto dealerships operating within Kentucky, including new and used car dealers, wholesale dealers, and sometimes service or repair shops that sell vehicles as part of their business.

Is commercial insurance for a used car dealership required by law?

Yes, in most states, used auto dealer insurance is required to obtain and maintain a dealer license. This commercial insurance typically includes essential coverages such as garage liability and surety bonds, with specific requirements varying by state regulations.

How long does a drive-away insurance from a dealer typically last?

Most drive-away insurance policies from dealers last 7 to 30 days, giving buyers enough time to secure a permanent policy and consider adding guaranteed auto protection (GAP) insurance to cover the difference between the car’s value and loan balance if it’s totaled.

What kind of insurance does a car dealership need for employee injuries?

A dealership must carry workers’ compensation insurance to cover medical expenses and lost wages if employees are injured on the job.

Do dealerships have insurance on their cars while they’re on the lot?

Yes, dealerships typically carry dealer’s open lot or physical damage coverage, which insures vehicles against risks like theft, vandalism, fire, and weather damage while they’re on the lot.

See which companies have the cheapest rates for you by entering your ZIP code in our free comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.