Best Auto Insurance Companies That Don’t Use the CCC Car Value in 2025 (Our Top 10 Picks)

State Farm, Geico, and Progressive stand out as the best auto insurance companies that don’t use the CCC car value, offering more accurate car insurance valuations. With rates starting as low as $43 per month, these companies ensure fair settlements and customer satisfaction.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: May 22, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 22, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 563 reviews

563 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

563 reviews

563 reviewsThe top picks for the best auto insurance companies that don’t use the CCC car value are State Farm, Geico, and Progressive. These providers offer more accurate car valuations, ensuring fairer compensation for totaled vehicles.

This article explores how these companies differ from those using CCC’s methods, helping you avoid lowball offers.

Our Top 10 Picks: Best Auto Insurance Companies That Don't Use the CCC Car Value

| Company | Rank | Good Credit Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 22% | A++ | Many Discounts | State Farm | |

| #2 | 21% | A+ | Filing Claims | Erie |

| #3 | 20% | A++ | Add-Ons | Auto-Owners | |

| #4 | 19% | A+ | Dividend Payments | Amica | |

| #5 | 16% | A+ | Agent Network | Allstate | |

| #6 | 16% | A | Teens | AAA |

| #7 | 13% | A+ | Usage-Based Discount | Progressive | |

| #8 | 13% | A | Discount Selection | Farmers | |

| #9 | 12% | A++ | Customer Service | USAA | |

| #10 | 10% | A++ | Cost Savings | Geico |

Discover why choosing these insurers can provide better settlements and peace of mind.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

#1 – State Farm: Top Overall Pick

Pros

- Many Discount Options: State Farm has various discount options, including Bundling Policies and High Low-Mileage Discount.

- Wide Coverage: State Farm offers various coverage options tailored for different needs.

- Strong Customer Service: Known for excellent customer service and support.

- Extensive Network: Large network of local agents for personalized service. Learn more in our “State Farm Auto Insurance Discounts.”

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Cost Savings

Pros

- Competitive Rates: Geico offers some of the lowest rates in the industry.

- Extensive Discounts: A wide range of discounts for various drivers and situations.

- Strong Online Tools: User-friendly website and mobile app for easy policy management.

- Good for High-Risk Drivers: Competitive rates for drivers with less-than-perfect records.

- 24/7 Customer Service: Available anytime for claims and support.See more details on our “Geico Auto Insurance Review.”

Cons

- Limited Coverage Options: Geico may not offer as many coverage options as other insurers.

- Service Limitations: Some customers report difficulties in customer service and claims processing.

#3 – Progressive: Best for Usage-Based Discount

Pros

- Snapshot Program: Usage-based discounts through the Snapshot program can lead to significant savings.

- Comprehensive Online Tools: Excellent online resources and mobile app for policy management.

- Extensive Coverage Options: Wide variety of coverage options and add-ons.

- Multi-Policy Discounts: Significant savings when bundling auto with home or other insurance.

- Customizable Policies: Flexible policy options tailored to individual needs. More information is available about this provider in our “Progressive Auto Insurance Review.”

Cons

- Customer Service Concerns: Some customers report issues with Progressive’s customer service.

- Coverage Limitations: Progressive’s policies may not offer as much coverage as other insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Comparative Monthly Rates for Non-CCC Car Value Insurers

The table provides a clear comparison of monthly rates for minimum and full coverage among various auto insurance companies. Geico stands out as the most affordable option for both minimum ($90) and full coverage ($180), making it a strong contender for budget-conscious consumers.

Auto Insurance Monthly Rates by Coverage Level & Providers That Don’t Use the CCC Car Value

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $87 | $228 | |

| $65 | $215 | |

| $47 | $124 | |

| $32 | $83 |

| $76 | $198 | |

| $43 | $114 | |

| $56 | $150 | |

| $47 | $123 | |

| $32 | $84 |

USAA offers competitive rates as well, with $95 for minimum coverage and $185 for full coverage, catering specifically to military families. State Farm and Erie also present balanced rates, each providing minimum coverage at $100 and full coverage at $200 and $190, respectively.

These rates demonstrate that while some companies offer lower costs, others may provide additional benefits or services justifying slightly higher premiums.

When you were first shopping for the safest family cars, you may have used a resource like Kelley Blue Book to ascertain the value of the vehicles you were interested in.However, after an accident, your insurance company will use another system to estimate the value of your car. See more details on our “Motorcycle vs. Car Accident Statistics.”

CCC Information Services Inc. is a company that provides reports on vehicle values to many major insurance companies. Unfortunately, this company usually calculates low ball offers for their insurance company clients, leaving drivers with the short end of the stick.

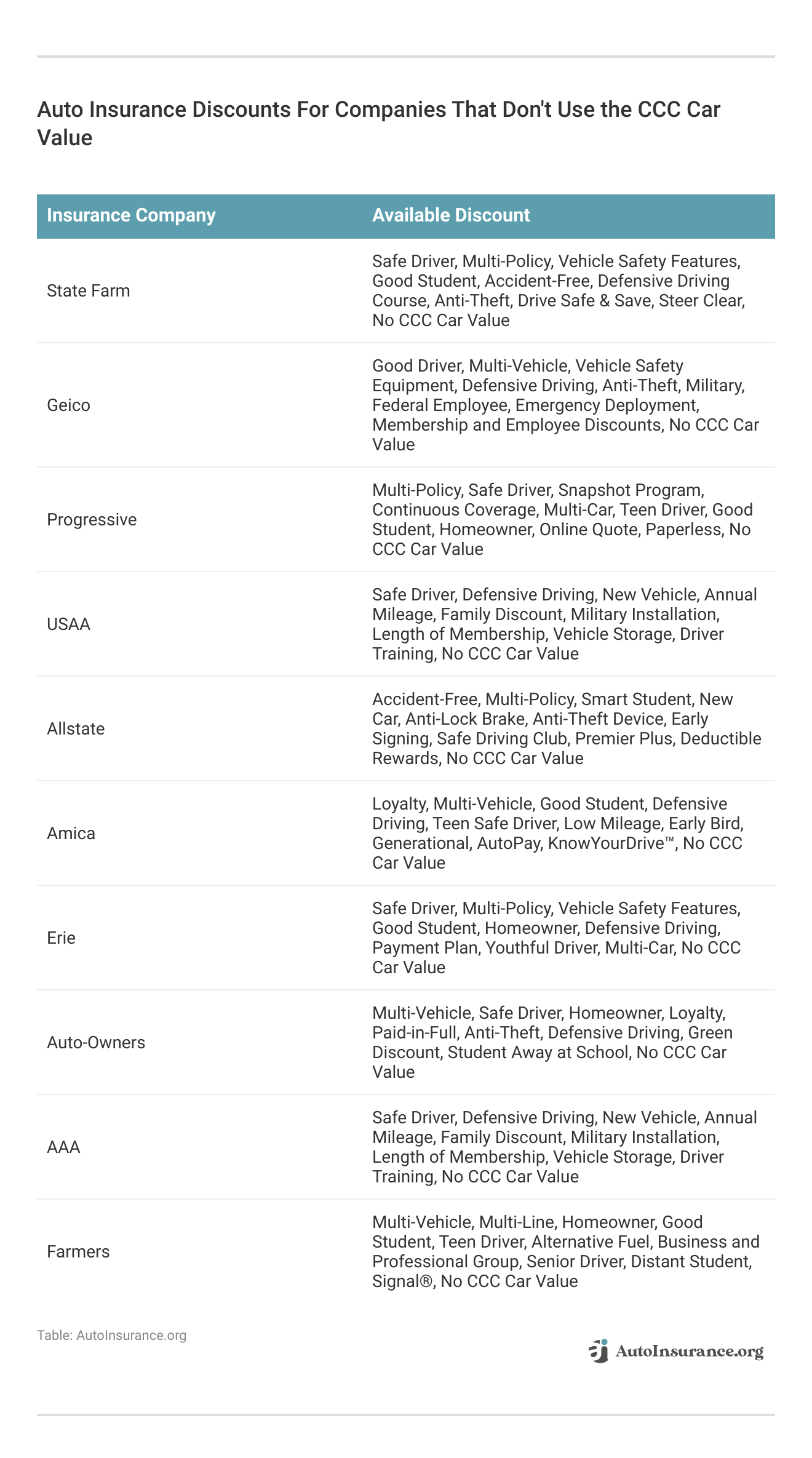

Most insurance companies have found that when it comes to using CCC’s car value reports vs. Kelley Blue Book, CCC can save them money.Access comprehensive insights into our “Auto Insurance Discounts.”

If your insurance company declared your vehicle a total loss, you should hopefully receive a fair offer. Still, auto insurance companies that don’t use CCC’s actual cash value are few and far between.

Don’t be cheated out of a fair offer for your totaled vehicle by a CCC car value estimator. The more information you have on how to combat an unfair offer, the sooner you’ll be able to receive the settlement you deserve. Keep reading to learn more.

What Are the Best Auto Insurance Companies That Don’t Use CCC’s Actual Cash Value

While it may be difficult to find auto insurance companies that don’t use CCC’s actual cash value, working with such a company could give you some peace of mind knowing that you’re more likely to get a fair offer for a totaled vehicle.

The two car insurance companies do not use CCC’s services are The General and SafeAuto. As you can see, CCC has quite a hold on the insurance market.

To increase your chances of avoiding a company that uses CCC’s actual cash value, shop online to find local, independent insurance agencies in your area. You can also ask a prospective insurance company if they use CCC and how they evaluate claims. More information is available about this provider in our “Auto insurance made clear.”

Which Auto Insurance Companies Use CCC Information Services

Finding auto insurance companies that don’t use CCC’s actual cash value could be difficult. CCC has a tight grip on quite a few major insurance companies.

Here are just a few of the auto insurance companies that use CCC’s actual cash value: Nationwide, Geico, Allstate, Commerce, Amica, Liberty Mutual, Farmers, and USAA. While most of these larger auto insurance companies offer competitive rates, they may not offer you fair compensation if you total your vehicle in an accident.

If you drive a newer or classic car, you may want to shop for quotes from smaller car insurance companies that don’t use CCC’s actual cash values. Check out insurance savings in our complete “How to Get Auto Insurance?“

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Does CCC Information Services Value Your Vehicle

Insurance companies use certain criteria to estimate the value of a totaled car. Typically, if the cost to repair your vehicle is more than the cost of the car itself, or if the vehicle is unsafe to drive, your vehicle is considered totaled.

With these parameters, drivers and insurance companies can usually agree when a vehicle is totaled. But what insurance issues are there when a car is totaled?

Receiving an accurate settlement for your totaled vehicle is when things can get tricky, especially if you unwittingly decided to buy insurance from an auto insurance company that uses CCC’s actual cash value.

State Farm ensures fair compensation for totaled vehicles, providing peace of mind for policyholders.Chris Abrams Licensed Insurance Agent

How do insurance adjusters determine the value of a vehicle? CCC uses an internal valuation method that doesn’t appraise your car but instead appraises a mythical vehicle.

First, CCC assesses the condition of your vehicle. However, the appraisal is subjective and may vary between appraisers. Next, CCC compares your car to others like it. Instead of just finding three other vehicles that are comparable to yours, CCC gathers information on as many cars that are the same year, make, and model as it can.

Finally, CCC looks at the price of similar vehicles. But the company asks sellers what the lowest price is the they would take for the car. That price is then used to help determine your insurance payout instead of using fair market value. Then, after discarding any vehicles that CCC has determined were oversold, an average is run to determine the cash value of your vehicle.

However, most buyers won’t be able to replace their vehicle for the lowest price a seller is willing to take. As a result, many drivers won’t get enough insurance money to replace their totaled vehicle.

Can I Dispute an Unfair Auto Insurance Settlement Offer

With CCC, insurance companies have a way to save money on totaled vehicles. However, the actual cash value offered by CCC may not be fair.

If you have an insurance policy with any company that uses CCC’s actual cash value and you think you were offered an unfair settlement for your totaled vehicle, you should not be afraid to fight it. Learn more in our “How do insurance adjusters determine the value of a vehicle?“

According to WBUR News, the Massachusetts Division of Insurance began investigating CCC after allegations that drivers were facing intense financial losses due to their valuation method.

You can take these steps to fight for the settlement you deserve: Reject the first offer, Request all the valuation documents, Study the vehicles used in the valuations to ensure there are no low-priced outliers, and Demand that your vehicle is used in the valuations process, especially if you improved the car after purchasing it.

You can negotiate with your insurance company to get a fair settlement. However, remember that cars rapidly depreciate, so you probably won’t get a large enough payout to replace your vehicle without out-of-pocket expenses.

What You Need to Know about Insurance Companies That Don’t Use CCC’s Actual Cash Value

Now that you’re armed with the knowledge of how many major insurance companies value totaled vehicles, you’ll be able to fight back against an unfair settlement offer. Discover more about offerings in our “What is a fair settlement for an auto accident?“

Most large auto insurance companies use CCC to determine the value of your totaled car, but the price is seldom fair. This is because CCC uses several different methods that lower the value of your vehicle significantly.If you receive a low offer for your totaled car, try negotiating with your insurance company. You may be able to get a better offer.

State Farm offers reliable auto insurance valuations without relying on the CCC car value system.Michelle Robbins Licensed Insurance Agent

If you’d like to avoid dealing with CCC’s cash value estimator altogether, look for auto insurance quotes from local companies that don’t use CCC Information Services. Check with an insurance company before you sign up for coverage to be sure they don’t use CCC to determine your car’s value.

Find cheap car insurance quotes by entering your ZIP code below.

Frequently Asked Questions

What is the CCC Valuation Report in auto insurance?

The CCC Valuation Report is a commonly used tool in the auto insurance industry to determine the value of a vehicle that has been involved in an accident or deemed a total loss. It provides an estimate of the vehicle’s worth based on factors such as its condition, age, mileage, and market value.

For additional details, explore our comprehensive resource titled “Auto Insurance Rates by Age.”

Are there any auto insurance companies that don’t use the CCC Valuation Report?

Yes, there are auto insurance companies that do not rely on the CCC Valuation Report for determining the value of a vehicle. Instead, they may use alternative methods or sources to assess the worth of a car.

Why would an insurance company not use the CCC Valuation Report?

Insurance companies may choose not to use the CCC Valuation Report for various reasons. Some companies may have their own in-house valuation systems or prefer to rely on other industry-standard reports. Additionally, certain insurers may opt to use independent appraisers or conduct their own investigations to determine a vehicle’s value.

How can I find out if my auto insurance company uses the CCC Valuation Report?

To determine whether your auto insurance company utilizes the CCC Valuation Report, you can reach out to your insurance agent or contact the company’s customer service department directly. They should be able to provide you with information on their valuation methods.

Can you provide a list of auto insurance companies that don’t use the CCC Valuation Report?

Unfortunately, as insurance company practices and policies can change over time, it’s challenging to provide an up-to-date list of all the companies that do not use the CCC Valuation Report. It’s best to consult directly with your insurance provider or research different companies to understand their specific valuation processes.

To find out more, explore our guide titled “How to Choose an Auto Insurance Company.”

What is the difference between CCC car value vs Blue Book?

CCC car value often results in lower estimates compared to Blue Book values, which are widely accepted by consumers and dealers for fair market prices.

What does CCC valuation mean in auto insurance?

CCC valuation refers to the method used by CCC Information Services to determine the actual cash value of a totaled vehicle based on various data points and market research.

How is CCC car value calculated?

CCC car value is calculated using an internal valuation method that considers the vehicle’s condition, comparable sales, and seller’s lowest acceptable prices.

What are the flaws in the CCC One Market Valuation Report?

The CCC One Market Valuation Report can be flawed by undervaluing vehicles through selective comparisons and not reflecting true market prices, leading to lower payouts.

To learn more, explore our comprehensive resource on “Compare Auto Insurance Rates by Vehicle Make and Model.”

How can I fight a CCC valuation report?

To fight a CCC valuation report, gather independent appraisals, present comparable vehicle sales data, and negotiate with your insurance company for a fairer settlement.

How does the CCC One car value calculator work?

The CCC One car value calculator works by analyzing the condition of the vehicle, comparing it to similar vehicles in the market, and adjusting based on seller feedback and low-end price points.

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

What should I know about CCC insurance company practices?

CCC insurance company practices often involve using the CCC valuation to determine claim settlements, which may result in lower payout offers compared to other valuation methods.

Are there any lawsuits related to CCC One?

Yes, there have been lawsuits related to CCC One, primarily concerning disputes over the fairness and accuracy of their vehicle valuation methods used in insurance claims.

Learn more by reading our guide titled “How to File an Auto Insurance Claim.”

How does CCC handle auto appraisals?

CCC handles auto appraisals by evaluating the vehicle’s condition, comparing it to similar vehicles, and determining its value based on their proprietary data and market analysis.

What is involved in CCC auto estimating?

CCC auto estimating involves calculating repair costs and vehicle values using their software, which incorporates data from multiple sources to generate detailed estimates for insurance claims.

How do you pass CCC?

By grasping the exam syllabus, getting acquainted with the exam format, and reviewing commonly asked questions, you can effectively prepare to excel in the CCC exam. Make sure to practice with mock tests and utilize online resources to enhance your knowledge and build your confidence.

What does CCC stand for?

CCC stands for the Civilian Conservation Corps.

Access comprehensive insights into our guide titled “How to Compare Auto Insurance Quotes.”

What do CCC solutions do?

CCC provides top-tier estimatics, valuation, and workflow software solutions. They collaborate with over 24,000 repair facilities and more than 350 insurance companies to handle the majority of auto repair estimates in the U.S.

What is CCC in the Great Depression?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.