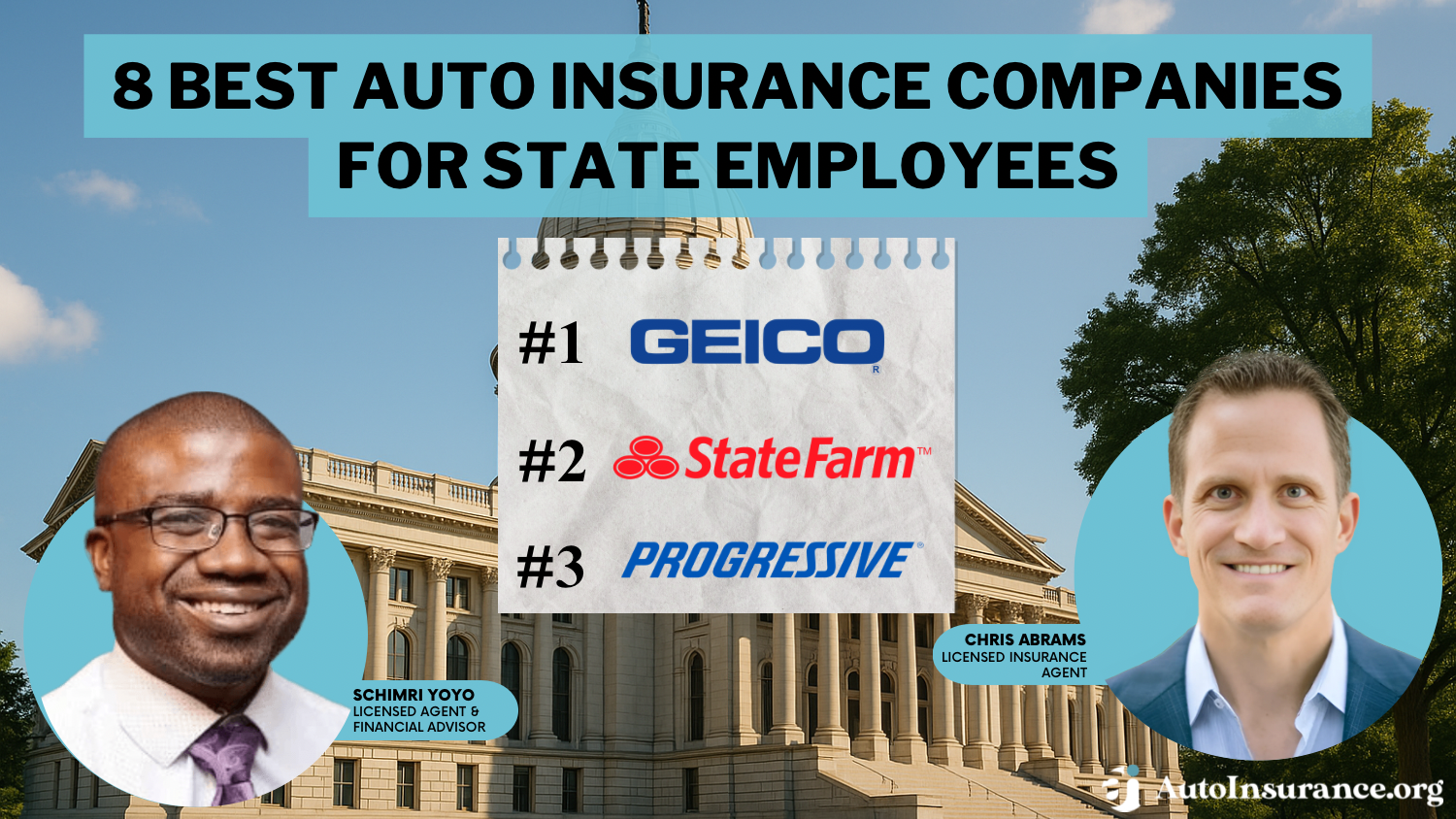

8 Best Auto Insurance Companies for State Employees in 2025

Geico, State Farm, and Progressive are the winners for the best auto insurance for state employees. Geico secures the top spot with its affordable monthly cost of $43 and range of available discounts. Police officers and firefighters can find full coverage rates as affordable as $114 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Apr 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Avg. Monthly Rate for State Employees

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Avg. Monthly Rate for State Employees

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Avg. Monthly Rate for State Employees

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsGeico, State Farm, and Progressive are the winners for the best auto insurance for state employees. Choose Geico, our top recommendation, for state employee auto insurance starting at just $57 per month.

You can save money on auto insurance for state employees by buying only what you need and taking advantage of auto insurance discounts. One discount that you might find particularly useful on your auto insurance is a state employee discount.

Our Top 8 Company Picks: Best Auto Insurance for State Employees

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Extensive Discounts | Geico | |

| #2 | 17% | A++ | Financial Strength | State Farm | |

| #3 | 10% | A+ | Snapshot Program | Progressive | |

| #4 | 10% | A+ | Local Agents | Allstate | |

| #5 | 10% | A++ | Military Members | USAA | |

| #6 | 25% | A | Accident Forgiveness | Liberty Mutual |

| #7 | 20% | A+ | Multiple Policies | Nationwide |

| #8 | 20% | A | Occupational Discounts | Farmers |

Getting the right auto insurance is integral for state employees, especially since failing to follow state law can actually cost them their jobs.

Below, you can learn more about the best companies for state employees. You can also enter your ZIP code above to compare quotes from the top providers.

- Several companies offer auto insurance discounts for state employees

- State employees usually match the national auto insurance average

- Save on state employee auto insurance, regardless of company discounts

While your choice of career is often a factor in the price of your insurance, it’s not the only thing that companies look at. The cost of auto insurance for state employees will vary depending on where you live and work. The table below shows how insurance rates vary across states.

Cheapest Auto Insurance Providers for SSI Recipients by State

| Insurance Company | State | Monthly Rates |

|---|---|---|

| Alabama | $37 | |

| Alaska | $32 | |

| Arizona | $34 | |

| Arkansas | $38 | |

| California | $51 | |

| Colorado | $42 | |

| Connecticut | $42 | |

| Delaware | $51 | |

| Florida | $40 | |

| Georgia | $33 | |

| Hawaii | $26 | |

| Idaho | $23 | |

| Illinois | $29 | |

| Indiana | $34 | |

| Iowa | $24 | |

| Kansas | $29 | |

| Kentucky | $35 | |

| Louisiana | $44 | |

| Maine | $21 | |

| Maryland | $100 | |

| Massachusetts | $40 | |

| Michigan | $68 | |

| Minnesota | $48 | |

| Mississippi | $36 | |

| Missouri | $48 | |

| Montana | $23 |

| Nebraska | $26 | |

| Nevada | $58 | |

| New Hampshire | $34 | |

| New Jersey | $68 | |

| New Mexico | $33 | |

| New York | $51 | |

| North Carolina | $20 | |

| North Dakota | $24 | |

| Ohio | $32 | |

| Oklahoma | $48 | |

| Oregon | $68 | |

| Pennsylvania | $36 | |

| Rhode Island | $32 | |

| South Carolina | $54 | |

| South Dakota | $11 | |

| Tennessee | $31 | |

| Texas | $29 | |

| Utah | $50 | |

| Vermont | $17 | |

| Virginia | $42 | |

| Washington | $34 | |

| Washington, D.C. | $43 | |

| West Virginia | $36 | |

| Wisconsin | $31 | |

| Wyoming | $18 |

Although state employees can find a discount from several companies, insurance rates are hard to predict because how much you pay for car insurance depends on many factors. Every company looks at different factors, but the following are some of the most common:

- Age: Young drivers are more likely to get into accidents, and older drivers face age-related issues like decreased reaction time.

- Claims history: If you’ve filed multiple claims, you’ll have higher insurance rates.

- Credit score: Credit scores affect your rates. However, California, Hawaii, Massachusetts, and Michigan insurance companies can’t use credit scores as a factor, and there are still insurance companies that don’t use credit scores in other states.

- Driving history: Traffic tickets, accidents, DUIs, and other similar charges will raise rates. Auto insurance companies check your driving record to determine rates.

- Gender: Men tend to pay higher rates than females, as statistics show men get into more accidents. However, insurers can’t consider gender in California, Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania.

- Marital status and homeownership: Being married and owning a home are signs of responsibility, so it’s assumed that married homeowners carry less risk. Homeowners can bundle multiple auto and homeowners policies, leading to major savings.

- Level of education: Like marital status and homeownership, the assumption is that people with higher education levels are also more responsible. However, education level only minimally impacts rates.

- Vehicle model and make: When setting rates, insurance companies consider safety ratings, crash statistics, and the vehicle’s overall expense.

- ZIP code: Where you live impacts your rates based on weather, crime rates, living costs, and similar factors. The exception is California and Michigan, where using ZIP codes to calculate rates is prohibited.

The complicated mix of factors is why looking at average rates will only take you so far. It also emphasizes the importance of comparing prices, as one company might give you better prices than another.

However, looking at the average price of insurance isn’t without merit. Knowing which companies tend to offer the lowest rates gives you a great place to start in your search. You can look at the average monthly rates for some of the biggest companies below.

How State Employees Earn Discounts on Auto Insurance

The term “state employee” refers to any of the 19 million people employed by a state organization. That includes state, county, charter, and urban-county government officials. Some state employees are elected to office, while various departments employ others.

Auto Insurance Company Discounts for Policyholders

| Insurance Company | Safe Driver | Good Driver | Multi-Vehicle | Bundling Policies |

|---|---|---|---|---|

| Geico | 26% | 15% | 25% | 10% |

| State Farm | 30% | 30% | 20% | 15% |

| Progressive | 31% | 15% | 12% | 10% |

| Allstate | 22% | 22% | 10% | 10% |

| USAA | 10% | 10% | 15% | 10% |

| Liberty Mutual | 30% | 10% | 12% | 5% |

| Nationwide | 20% | 20% | 25% | 10% |

| Farmers | 10% | 10% | 15% | 5% |

Being a state employee usually comes with some great perks. It depends on the state and job, but state employees usually qualify for more affordable health insurance, reliable retirement plans, and discounts for a variety of services, including insurance.

Daniel Walker

Licensed Auto Insurance Agent

Insurance companies keep careful track of who makes claims, which is how they know the statistical likelihood of different groups.

Insurance companies want to insure drivers who don’t make claims. So to lure them in, they offer a discount. Looking at what discounts a company offers is an integral part of shopping for insurance quotes for that reason — you want to find the company that gives you the most discounts on car insurance for state employees.

Other Ways to Save on Auto Insurance for State Employees

Besides relying on a state employee discount, there are many ways to save money on your car insurance. From other discounts to telematics, you can find options to explore below.

- Take advantage of other discounts. Most companies offer many auto insurance discounts, with the most popular options being safe driver, anti-theft device, paid-in-full, and good student discounts.

- Compare quotes. You have a lot of choices when it comes to car insurance, so you don’t need to settle for the first quote you get. Instead, aim to get quotes from national and local companies.

- Use telematics. Many companies now offer usage-based auto insurance to track your driving habits. Discounts vary, but you might see savings between 10% and 40%.

- Bundle your policies. You can save money by bundling multiple insurance policies from the same company. The most common bundling combinations are home and auto. You can read more in our how to save money by bundling insurance policies guide.

- Choose your coverage carefully. Adding everything to your policy might feel tempting with all the types of auto insurance on the market. However, choosing your insurance coverage frugally can keep your costs down.

There are a lot of factors to consider when it comes to choosing the right auto insurance. You can find the perfect insurance policy with a few easy steps.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Choose the Right Auto Insurance for State Employees

You can find the perfect insurance by following a few simple steps. Most you can do by yourself by looking at customer reviews and using online comparison tools.

Determine How Much Insurance You Need

While full coverage protects your car from most damage, not everyone needs it. Consider the following types of insurance to help you determine what you need:

- Liability coverage: Liability covers damage you cause to other people and their property. Most states require a minimum amount of liability coverage before you can legally drive.

- Comprehensive auto insurance: For damage not caused by a collision, there’s comprehensive. This insurance covers damage from weather, vandalism, animal contact, and theft. (Read More: Comprehensive Auto Insurance)

- Collision auto insurance: From multi-car accidents to driving into a tree, collision insurance will help repair your car after an accident, no matter who caused it. (Read More: Collision Auto Insurance)

- Uninsured/underinsured motorist: Required in 14 states, uninsured motorist insurance protects you from drivers without enough coverage. Underinsured motorist coverage covers any gaps when you’re hit by someone who does not carry large enough insurance. You can learn more in our uninsured and underinsured motorist (UM/UIM) coverage guide.

- Personal injury protection (PIP) auto insurance: PIP coverage will help pay for your medical expenses after an accident, including hospital bills, physical therapy, and lost wages. (Read More: Personal Injury Protection (PIP) Auto Insurance)

These five insurance products are primary coverage options, but there are several add-ons you can buy as well.

Everyone needs at least the minimum auto insurance coverage to meet legal requirements in their state (except in New Hampshire). People who don’t own their car outright or have a valuable vehicle should have full coverage.

Compare Auto Insurance Quotes

You can use free comparison tools to see what quotes will look like for your unique circumstances. Remember, the cheapest insurance isn’t necessarily the best — cheap auto insurance rates should be used as a starting point only.

After you have an idea of insurance companies that might interest you, you can look at their financial health. Rating companies like A.M. Best, J.D. Power, and the Better Business Bureau keep careful track of reviews, complaints, and financial strength of insurance providers.

Ideally, you should look for a company with a strong financial presence and satisfied customers.

Ask About Discounts

After you narrow down your choices, the last step you should take before signing the paperwork is to ask about auto insurance discounts.

You’ll need to speak with an agent at this point, but they will comb through your details and find you every discount you’re eligible for. Your insurance agent will be able to tell you the price of your policy before you agree to it.

Find the Best Auto Insurance for State Employees

State employees perform valuable services in their communities, and discounted car insurance prices are among the many perks they enjoy for their work. From Geico to Progressive and most other major companies, you can find an insurance policy that celebrates your position as a state employee.

You can buy car insurance for state employees from a variety of companies, but you should enter your ZIP code below to compare quotes and find the best price possible before you sign up.

Frequently Asked Questions

Who is considered a government employee?

Any person employed by the state government is considered a state employee for car insurance and eligible for discounts with some companies.

Can state employees get group insurance rates for auto insurance?

Some state employers offer group insurance plans that provide discounted rates for various types of insurance, including auto insurance. These group plans can often provide more affordable rates compared to individual policies. It’s recommended to check with your employer or human resources department to see if group insurance options are available.

Are state employees considered lower risk by insurance companies?

State employees are generally considered lower risk by insurance companies due to factors such as stable employment and often having regular work commutes. Insurance providers typically take into account various risk factors when determining premiums, and stable employment can be viewed as a positive factor in assessing risk.

Does auto insurance for state employees cover work-related driving?

Work-related driving is often covered under the employer’s commercial auto insurance policy. However, the specific coverage and conditions may vary depending on the state and employer. It’s important for state employees to clarify with their employer the extent of coverage provided during work-related driving activities.

What factors should state employees consider when choosing an auto insurance company?

State employees should consider their coverage limits, deductible options, liability protection, and any additional optional coverage that may be needed based on personal circumstances.

Is Geico auto insurance for government employees only?

Anyone can buy Geico car insurance, but state employees enjoy lower rates and bigger discounts.

Do government employees qualify for USAA auto insurance?

No, USAA insurance is only available to active and retired military members and their immediate families.

Do Florida state employees get auto insurance discounts?

State employees likely get auto insurance discounts in Florida, but discount amounts and availability will vary by company. Use our free tool above to compare multiple Florida insurance companies at once to find the best discounts.

What auto insurance discounts do government employees get?

Government and state employee auto insurance qualifies for many different discounts, including affinity and occupation-based discounts. They can also earn safe driving and claim-free discounts with a good driving record.

Does Progressive have federal employee auto insurance discounts?

Progressive does not offer any occupation-based discounts to federal government employees.

Do federal employees get a AAA auto insurance discount?

Yes, AAA offers discounts on auto insurance for state and federal employees.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.