Best Auto Insurance for Nurses in 2025 (Save 25% With ANA Discounts)

USAA, Allstate, and Progressive offer the best auto insurance for nurses. USAA offers the lowest minimum coverage rates for nurses at $32 a month. Nurses can also get a discount if they're a member of the American Nurses Association (ANA).

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Jul 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Nurses

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Nurses

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Nurses

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsUSAA, Allstate, and Progressive offer the best auto insurance for nurses, with premiums starting at $32 a month.

Although nursing and other healthcare specialties are known as stressful careers, car insurance for healthcare workers tends to be lower than the national average.

Our Top 8 Picks: Best Auto Insurance for Nurses

| Company | Rank | Employee Discount | Occupation Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | 10% | Military Nurses | USAA | |

| #2 | 10% | 15% | Safe Driving | Allstate | |

| #3 | 15% | 8% | Custom Policies | Progressive | |

| #4 | 15% | 7% | Forgiveness Program | Nationwide | |

| #5 | 10% | 11% | Coverage Options | Farmers | |

| #6 | 10% | 9% | Nurse Perks | Liberty Mutual |

| #7 | 8% | 10% | Budget Rates | Geico | |

| #8 | 5% | 12% | Local Agents | State Farm |

Healthcare workers can also take advantage of various auto insurance discounts to reduce their costs.

- USAA offers the lowest full coverage rate at $207 for 6,000 miles

- Federal employee nurses may qualify for up to 18% discounts

- More savings are available through the American Nurses Association (ANA)

Read below to explore options for cheap car insurance for nurses, including our top companies offering a car insurance discount for nurses. Then, enter your ZIP code above to compare quotes from the top providers for nurses.

Nurse’s Average Auto Insurance Premiums in the U.S.

If you’re wondering, “Do nurses get cheaper car insurance?” Nurses tend to see slightly lower auto insurance rates than most drivers. Check below to see cheap auto insurance for nurses from the biggest insurance companies in America.

Auto Insurance Monthly Rates for Nurses by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $32 | $84 |

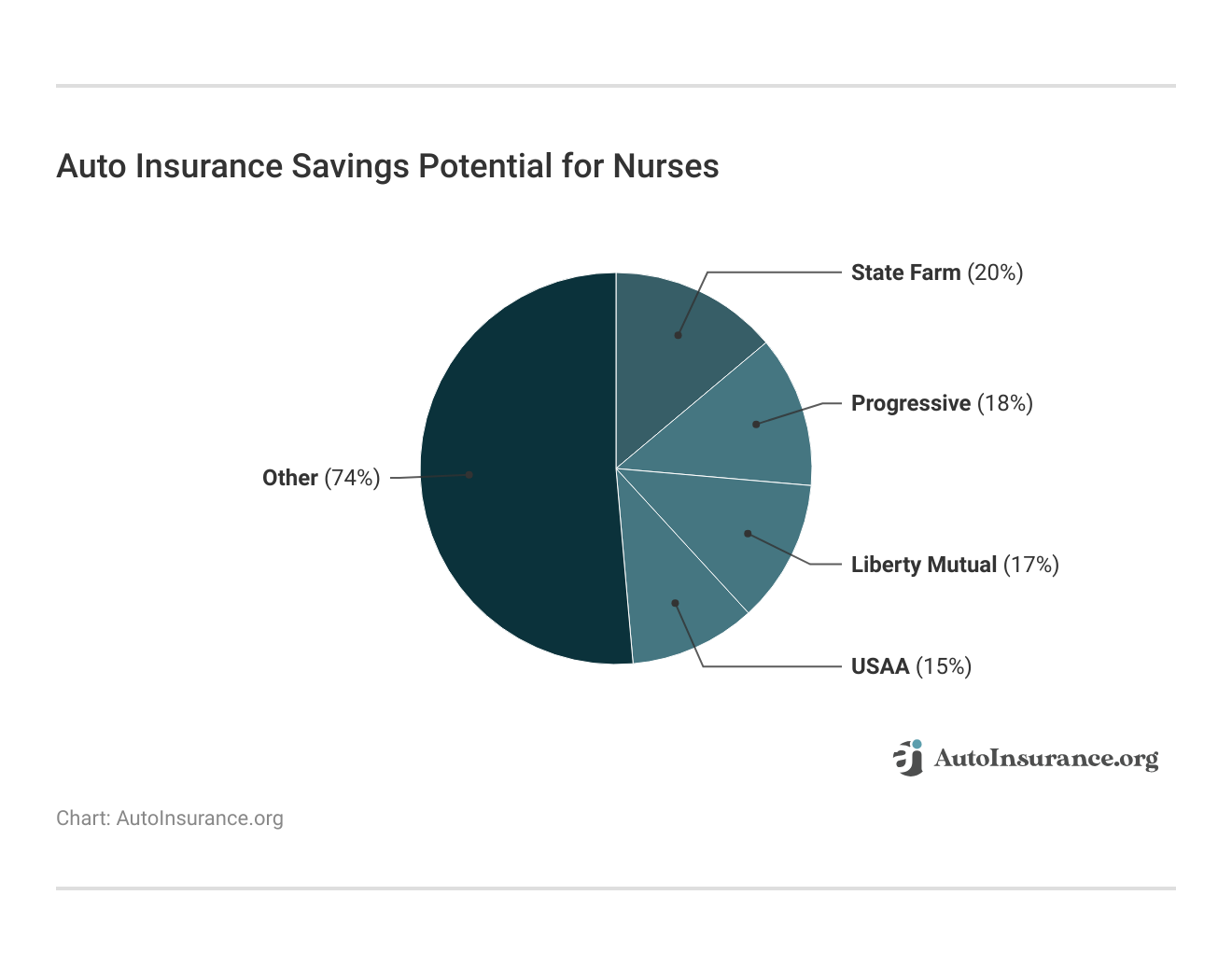

As you can see, Geico, Progressive, and State Farm offer some of the lowest rates for nurses. However, shopping around for car insurance is still important since rates can vary significantly between companies.

Companies consider a variety of factors that affect car insurance rates when crafting quotes, including age, gender, ZIP code, and driving record.

As a result, you might find a different company with better rates for your specific situation, so compare at least three other companies before making your final decision. Enter your ZIP code into our free quote tool to get started now.

Nurse Auto Insurance Rates for Traveling

There are many advantages to working as a travel nurse if you’re afforded the freedom to travel as you earn. However, all of those extra driving miles will certainly cause your car insurance premiums to increase.

Auto Insurance Monthly Rates for Nurses by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $215 | $223 | |

| $157 | $164 |

| $198 | $201 | |

| $139 | $145 | |

| $275 | $283 |

| $162 | $168 | |

| $174 | $176 | |

| $148 | $157 | |

| $189 | $194 | |

| $121 | $128 | |

| U.S. Average | $175 | $190 |

Mileage is a universal rating factor that’s used by all carriers selling auto insurance. It’s statistically proven that your probability of having an accident goes up as your annual mileage goes up. See how annual mileage affects your auto insurance rates here:

Full Coverage Auto Insurance Monthly Rates for Nurses by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $403 | $411 | |

| $348 | $351 | |

| $264 | $272 | |

| $500 | $513 |

| $286 | $289 | |

| $336 | $337 | |

| $265 | $279 | |

| $207 | $216 |

Many carriers will give their clients discounts just for driving under 5,000 miles every year. Some carriers have a restriction of 3,000 miles per year. Your mileage will be noted at your next renewal.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Car Insurance Discounts for Nurses

Insurance companies consider nurses low-risk drivers because they are less likely to drive dangerously, get into accidents, and file claims. Because of this, you’ll see lower overall rates, but there are plenty of options to save more money from insurance companies that give nurses discounts. See the table below:

Top Auto Insurance Discounts for Nurses

| Company | Bundling | Employee | Multi-Vehicle | Occupation | Safe Driver |

|---|---|---|---|---|---|

| 25% | 10% | 25% | 15% | 18% | |

| 20% | 10% | 20% | 11% | 20% | |

| 25% | 8% | 25% | 10% | 15% | |

| 25% | 10% | 25% | 9% | 20% |

| 20% | 15% | 20% | 7% | 12% | |

| 10% | 15% | 12% | 8% | 10% | |

| 17% | 5% | 20% | 12% | 20% | |

| 10% | 25% | 10% | 10% | 10% |

While you may not see discount car insurance for nurses at every company, these are some of the most common ways to save money with nurse car insurance discounts:

- Driver Education: Most providers offer a driver’s ed auto insurance discount if you take a driver’s education class. You’ll need to pass a course approved by your insurance company to qualify.

- Good Student: You might earn a discount on your insurance if you’re a full-time student under 25 and maintain a 3.0 GPA. Find discounts for good students.

- Homeowners: Since homeowners tend to file fewer claims, many insurers provide home insurance discounts for nurses who carry a homeowners policy.

- Paid-in-Full: Splitting your car insurance policy into monthly payments makes it easier to pay, but you can save a small amount if you pay for everything at once.

- Anti-Theft: Installing anti-theft devices in your vehicle qualifies you for an anti-theft insurance discount and helps keep your car safe from thieves.

Depending on the company you shop with, you’ll probably find additional discounts. Most nurses’ car insurance discounts will be applied to your policy when you get a quote, but you can also check with a representative to ensure you save as much as possible.

American Nursing Association Auto Insurance Discounts

Both nursing students and professional licensed nurses can join the American Nursing Association (ANA). This organization plays a huge role in advancing the nursing profession by helping registered nurses stay skilled and ethical in their choices.

Being a member of the ANA offers huge benefits, including the following discounts for nurses:

- If you’re a professional member of the ANA, you’ll get nurse discount car insurance from organizational affiliates that work closely with the organization.

- Some auto insurance providers will offer benefits like special group rates to nurses. When a carrier charges a client a group insurance rate, your rates are calculated by considering the risk to you and the individuals who fall within the group.

As a nurse and member of the ANA, insurers will offer you membership auto insurance discounts because members tend to fall into a better risk class.

Not everyone is eligible for group rates. Many people think that the only time they can get a group rate is to buy employer-sponsored health insurance coverage, but that’s not always the case.

There are other ways to qualify for lower group insurance rates when buying auto insurance as long as the carrier has an affinity program.Schimri Yoyo Licensed Agent & Financial Advisor

If you’re a nurse with an ANA membership, you’ll have to identify which companies currently have nursing affinity programs.

How to Get the Cheapest Auto Insurance for Nurses

Discounts provide lower auto insurance rates for nurses, but it doesn’t guarantee cheaper rates. Why? Factors that determine auto insurance could raise rates by hundreds of dollars.

Read More: Factors That Affect Auto Insurance Rates

A 5%-10% decrease can be helpful, but it may not eliminate auto insurance rates that are out of your budget. Continue reading to learn five ways you can save on auto insurance rates for nurses.

Bundle Your Policies

Do you own a home? If you happen to be a homeowner, you can save money on auto insurance if you bundle your policy with a homeowners insurance policy. Even bundling with renters insurance can save you at least 12% on auto insurance.

Read More: Best Companies for Bundling Home and Auto Insurance

Use Telematics

Telematics is the monitoring system auto insurance companies use to track your driving habits. Common driving behaviors such as speed, hard braking, travel time, and the number of miles are recorded each day you drive.

Telematics is common in usage-based car insurance (UBI) programs. Some companies will provide a Bluetooth beacon that connects to your smartphone. All of these devices send information to your auto insurance company. Your driving habits are graded over time and translated into savings.

Top Usage-Based Auto Insurance (UBI) Programs

| Company | Program Name | Savings | How It's Tracked |

|---|---|---|---|

| Drivewise® | 40% | Mobile App | |

| KnowYourDrive | 20% | Mobile App |

| Signal® | 30% | Mobile App | |

| DriveEasy | 25% | Mobile App | |

| RightTrack® | 30% | In-Vehicle Device |

| SmartRide® | 40% | Mobile App / In-Vehicle Device | |

| Snapshot | 30% | Mobile App | |

| Drive Safe & Save™ | 30% | Mobile App / In-Vehicle Device | |

| IntelliDrive® | 30% | Mobile App | |

| SafePilot | 30% | Mobile App |

With UBI auto insurance, you can save hundreds in addition to the discounts you already have.

Choose the Coverage You Need

Manage your coverage options at the beginning of your policy. If you already own a vehicle, you can enroll in the state’s minimum requirement, which is liability auto insurance.

However, a car that you’re leasing or financing will require full coverage.

Full coverage is simply collision and comprehensive coverage added to your auto insurance policy. You can save money by choosing the lowest coverage level.

Avoid Making Small Claims

Getting into an accident will increase your auto insurance rates, but some accidents may not require you to make a claim. Small scratches and minor dents don’t need a claim.

However, you’re welcome to file a claim. When you file an auto insurance claim, your provider will add that to the risk and possibly increase your rates.

Compare Multiple Companies and Shop Around

One of the best methods is comparing car insurance quotes for nurses from multiple companies to find the best auto insurance for healthcare workers.

You’re not entitled to go with the first quote you receive. It might require you to share some personal information, but you can get direct quotes from companies and compare their rates. The best auto insurance company is the one that meets your needs.

8 Best Insurance Companies for Nurses

USAA, Allstate, and Progressive have the best and cheapest car insurance for nurses. Check out our pros and cons to see why these top providers offer quality coverage for healthcare professionals:

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – USAA: Top Pick Overall

Pros

- Great Fit for Military Nurses: Excellent rates for military-affiliated individuals. You can learn more about USAA’s rates in our USAA auto insurance review.

- Bundling Discounts: Additional savings for nurses and other eligible members when combining auto insurance with other policies.

- Excellent Customer Service: USAA is known for its top-notch customer service for nurses.

Cons

- Limited Eligibility: Available only to military members, veterans, military nurses, and their families.

- Restricted Coverage Options: Compared to other providers, USAA may offer fewer coverage choices for nurses, potentially limiting customization.

#2 – Allstate: Best for Safe Driving

Pros

- Ideal for Responsible Drivers: Allstate offers nurses rewards and lower rates for clean driving records. You can learn more in our Allstate auto insurance review.

- Claim Forgiveness Feature: Protection against premium increases after the first at-fault accident, especially helpful for nurses.

- Multi-Policy Discounts: Nurses get discounts for bundling multiple insurance policies.

Cons

- Pricier Than Competitors: Nurses might pay more in premiums compared to some other providers.

- State-Specific Limitations: Some nurse discounts might only be available in certain states.>

#3 – Progressive: Best for Customizable Policies

Pros

- Customized Premiums: The Name Your Price tool allows nurses to choose flexible pricing options to suit individual budgets.

- Progressive’s Nurse Discount: Multi-car and multi-policy discounts encourage nurses’ comprehensive coverage. You can learn more about healthcare worker car insurance discounts in our Progressive auto insurance review page.

- On the Go: A user-friendly mobile app provides nurses with convenient access to policy management.

Cons

- Post-Claim Premium Increase: Rates may increase for nurses after an accident.

- Additional Cost: Some coverage options may be pricier for nurses, with select features coming at an extra cost.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best Forgiveness Program

Pros

- Forgiveness Benefits: Nurses benefit from Nationwide’s accident forgiveness, which helps protect rates after a first at-fault accident.

- Vanishing Deductible: Deductible decreases for every safe-driving year, which is especially beneficial for nurses.

- Personalized Coverage: Nationwide’s On Your Side helps nurses personalize their coverage. You can learn more about coverage options in our Nationwide auto insurance review.

Cons

- Higher Rates for Some: Rates may be higher for nurse drivers.

- Mixed Customer Service Reviews: Some nurses report mixed experiences with customer service.

#5 – Farmers: Best for Coverage Options

Pros

- Diverse Range of Coverage Add-ons: Additional coverage options for enhanced protection. Nurses can learn more in our Farmers auto insurance review.

- Flexible Payment Plans: Farmers give nurses flexible payment plans that work with their hectic and changing schedules.

- 24/7 Claims Support: Farmers has got your back 24/7, so nurses can get help whenever they need it, even during those crazy busy shifts.

Cons

- State-Specific Limitations: Some discounts may not be available for nurses in all states.

- Average Customer Ratings: Farmers receive mixed reviews for customer satisfaction from nurses.

#6 – Liberty Mutual: Best for Nurse Perks

Pros

- Better Car Replacement: Liberty Mutual provides nurses with a brand-new vehicle if their vehicle is totaled.

- 24-Hour Roadside Assistance: Available around the clock, ideal for nurses on the go and those needing reliable traveling medical professional auto insurance.

- Accident Forgiveness: Protection against rate increases after nurses’ first accident. (Read More: What is accident forgiveness?)

Cons

- Region-Specific Premiums: Premiums for nurses may be higher in certain regions. You can learn more in our Liberty Mutual auto insurance review.

- Limited Local Agents: A potential drawback for nurses who prefer in-person assistance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Geico: Best for Budget Rates

Pros

- Bundled Coverage: Multi-policy discounts are available for nurses, enhancing savings. Visit our page titled “Geico auto insurance review’ to learn more about the best auto insurance discounts for nurses.

- Budget-Conscious Healthcare Professionals: Competitive rates for nurses, offering tailored pricing.

- Quick & Efficient Assistance: Geico provides dedicated support tailored for nurses.

Cons

- Face-to-Face Consultations: Limited local agents for in-person support pose a potential challenge for nurses.

- Geographical Location: For nurses, some discounts may vary by state, with availability contingent on.

#8 – State Farm: Best for Local Agents

Pros

- In-Person Support: Robust local agent network for accessible in-person support for nurses.

- Safe Driving Discounts: Rewards nurses for responsible driving habits with additional discounts. You can learn more about State Farm’s nurse discount in our State Farm auto insurance review.

- Malpractice Coverage Option: Nurses may also benefit from State Farm malpractice insurance for nurses, offering added protection beyond auto policies.

Cons

- Premium Variations: Nurses in certain demographic groups may face higher premiums.

- Reduced Accessibility: Limited online quote options for nurses.

Get the Affordable and Best Auto Insurance for Nurses

Finding the best car insurance for nurses isn’t usually challenging since companies consider them low-risk drivers. USAA, Allstate, and Progressive have the best auto insurance coverage for nurses, starting at $32 per month.

While some companies offer special discounts for nurses, you can do plenty of other things to find affordable coverage.

Nurses can find the lowest rates for auto insurance by asking for discounts, choosing minimum coverage limits, and comparing quotes.Laura Kuhl Insurance Content Team Lead

Enter your ZIP code below to compare quotes from as many companies as possible and find the best price for your needs.

Read More: Cheapest Auto Insurance Companies

Frequently Asked Questions

Why do nurses need auto insurance?

Nurses often use their personal vehicles for commuting to and from work, visiting patients, running errands, or making home visits. Auto insurance is necessary to protect nurses financially in case of accidents, theft, or other incidents that may occur while using their vehicles for work-related purposes.

Ready to see what you could pay? Enter your ZIP code to get personalized insurance quotes tailored to your needs and budget.

Is personal auto insurance for nurse practitioners enough?

Personal auto insurance may not be sufficient for nurses who use their vehicles for work-related purposes. It’s important to inform your insurance provider about your profession and the extent of your vehicle use for work. Depending on your insurance company’s policies, you may need to add additional coverage or consider commercial auto insurance.

Are there any specific auto insurance discounts available for nurses?

Some insurance companies will offer a specific nurse car insurance discount. To take advantage of these discounts, nurses should inquire with their insurance provider about any available offers for healthcare professionals.

What are occupation-based auto insurance discounts?

Occupational discounts are separate from affinity discounts because the carrier doesn’t have to be affiliated with a group association or organization to offer special car insurance discounts to its customers.

Does Geico give auto insurance discounts for healthcare workers?

Yes, Geico awards nurses with occupation-based discounts and additional affinity-based discounts if they’re members of the ANA or the Association of Women’s Health.

Can nurses be covered under their employer’s auto insurance?

Some employers may provide auto insurance coverage for nurses while they are performing work-related duties. It’s important for nurses to check with their employers to determine if such coverage is available. However, it’s recommended to have personal auto insurance in addition to any coverage provided by the employer to ensure comprehensive protection.

Are there any additional considerations for auto insurance as a nurse?

Nurses should consider additional coverage or commercial policies if transporting patients, as driving habits and records can impact auto insurance premiums.

Are there any specific auto insurance considerations for home care workers?

Nurses who provide home healthcare services should consider additional coverage options such as professional liability insurance or malpractice insurance. These coverage options protect nurses in case of allegations of negligence or errors in patient care.

Enter your ZIP code into our free quote comparison tool to find cheap auto insurance for home care workers in 2 minutes or less.

Can nurses add their personal auto insurance premiums as a tax deduction?

In some cases, nurses may be able to deduct a portion of their auto insurance premiums as a business expense on their tax returns if they use their personal vehicles for work-related purposes.

However, tax laws can vary, so it’s recommended to consult with a tax professional or accountant for guidance on deductibility and specific eligibility criteria.

Do I have to be a member of the American Nurses Association to get auto insurance discounts as a nurse?

You don’t have to get personal auto insurance through a company with an affinity program for nurses to find discounts. You also don’t have to be a member of the ANA. Some companies offer occupational discounts to nurses just because of their chosen profession.

Do travel nurses get auto insurance benefits?

Travel nurses may be eligible for insurance benefits depending on how often they drive and where they work. Likewise, an employer can provide coverage or an insurance stipend, but insurance benefits will vary from company to company.

What type of insurance should independently practicing nurses hold?

Nurses who independently practice should carry a commercial or business car insurance policy if they use their personal vehicle for work purposes. They may also want to consider personal liability coverage to protect themselves financially in the event they are sued for negligence.

Read More: Cheapest Liability-Only Auto Insurance

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.