Best Auto Insurance for Amputees in 2025 (Our Top 8 Picks)

The winners for the best auto insurance for amputees are Progressive, Geico, and State Farm. On average, the monthly cost for auto insurance for amputees hovers around $92. Progressive distinguishes itself as the favored choice, offering a budget-friendly monthly rate of only $109 and customized coverage options.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Jan 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Monthly Rates:

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Monthly Rate

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe best auto insurance for amputees are Progressive, Geico, and State Farm, averaging a monthly cost of just $92. Progressive stands out with a budget-friendly $109/month rate and customizable coverage.

The top auto insurance companies offer the same coverage to all drivers regardless of disabilities. In fact, insurance companies aren’t allowed to offer disability car insurance at all. To learn more, read our cheap auto insurance for disabled drivers review.

Our Top 8 Company Picks: Best Auto Insurance for Amputees

| Insurance Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Customized Coverage | Progressive | |

| #2 | 25% | A++ | Competitive Rates | Geico | |

| #3 | 17% | B | Personalized Service | State Farm | |

| #4 | 25% | A+ | Accident Forgiveness | Allstate | |

| #5 | 10% | A++ | Military Members | USAA | |

| #6 | 15% | A | Roadside Assistance | AAA |

| #7 | 20% | A+ | Extensive Network | Nationwide |

| #8 | 25% | A | Various Discounts | Liberty Mutual |

Auto insurance for an amputee is the same as coverage for anyone else. However, higher rates for pricier vehicles may apply.

Compare multiple companies to find the best coverage with the lowest rates by entering your ZIP code now to compare free auto insurance quotes.

- Car insurance for disabled adults has the same standard coverage and rates

- Car insurance companies aren’t allowed to charge higher rates for amputees

- Drivers can utilize discounts and telematics for cheaper auto insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Progressive: Top Choice Overall

Pros

- Customized Coverage: Progressive offers customized coverage options that may include coverage for modified vehicles and adaptive equipment, catering to the specific needs for disability car insurance.

- Variety of Discounts: Progressive provides a wide range of discounts that could help amputees save on their insurance premiums, including discounts for safe driving habits and vehicle safety features. You can learn more about Progressive’s discounts in our Progressive auto insurance review.

- Online Tools and Resources: Progressive offers online tools and resources that may be particularly convenient for amputees, allowing easy management of policies and claims without the need for extensive physical mobility.

Cons

- Limited Physical Locations: Progressive primarily operates online and through phone support, which may be a drawback for amputees who prefer in-person interactions or need assistance beyond what can be provided remotely.

- Coverage Limitations: While Progressive offers customized coverage options, there may still be limitations or exclusions in their policies that could affect amputees, requiring careful review and consideration before purchasing.

#2 – Geico: Best for Competitive Rates

Pros

- Competitive Rates: Geico is known for its competitive rates, which could be advantageous for amputees looking to save on the best insurance for prosthetics.

- Flexible Coverage Options: Geico offers flexible coverage options that can be tailored to the specific needs of amputees, including coverage for adaptive equipment and modifications. You can learn more about Geico’s coverage options in our Geico auto insurance review.

- 24/7 Customer Service: Geico provides 24/7 customer service support, ensuring that amputees can get assistance and support whenever they need it.

Cons

- Complex Claims Process: Some customers have reported that Geico’s claims process can be complex and time-consuming, which may pose challenges for amputees dealing with the aftermath of an accident or incident.

- Limited Local Agents: While Geico has a large network of agents, they may not have as many physical locations as some other insurance companies, potentially limiting accessibility for amputees who prefer in-person assistance.

#3 – State Farm: Best for Personalized Service

Pros

- Personalized Service: Is State Farm better than Progressive? State Farm is known for its personalized service, including the availability of local agents who can provide tailored guidance and support to amputees.

- Comprehensive Coverage Options: State Farm offers comprehensive coverage options that may include medical payments coverage and uninsured/underinsured motorist coverage, providing added protection for amputees like mobility car insurance coverage (read more: Comprehensive Auto Insurance Explained).

- Strong Financial Stability: State Farm has a strong financial stability rating, which can provide peace of mind to amputees knowing that their insurance provider is financially secure. Read more in our State Farm auto insurance review.

Cons

- Potentially Higher Rates: While State Farm offers extensive coverage options, their rates may be higher compared to some other insurance companies, which could be a drawback for amputees on a tight budget.

- Limited Online Tools: State Farm’s online tools and resources may not be as robust as those offered by some other insurance companies, potentially making it less convenient for amputees who prefer managing their policies online.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Extensive Coverage Options

Pros

- Extensive Coverage Options: Allstate offers a wide range of coverage options, including personal injury protection (PIP) and roadside assistance, which may be particularly beneficial for amputees. Learn more in our Allstate auto insurance review.

- Accessibility Features: Allstate provides accessibility features such as a mobile app and online account management tools, making it easier for amputees to manage their policies and claims remotely.

- Accident Forgiveness: Allstate offers accident forgiveness programs that may help amputees avoid premium increases after their first at-fault accident (read more: What is accident forgiveness?).

Cons

- Higher Premiums: Some customers have reported that Allstate’s premiums can be higher compared to other insurance companies, which could be a concern for amputees looking to minimize their insurance costs.

- Mixed Customer Service Reviews: While Allstate offers various customer service channels, including agents and online support, some customers have reported mixed experiences with their customer service, which could be a drawback for amputees seeking reliable support.

#5 – USAA: Best for Military Members

Pros

- Specialized Coverage: USAA offers specialized coverage options tailored to military members and their families, which may include provisions relevant to amputees such as adaptive equipment coverage. Read more about USAA’s coverage options in our USAA auto insurance review.

- Exceptional Customer Service: USAA is known for its outstanding customer service dedicated to serving the unique needs of military personnel and veterans, providing comprehensive support and assistance.

- Financial Stability: USAA has a strong financial stability rating, ensuring that amputees can trust the company to fulfill its obligations and provide reliable coverage.

Cons

- Limited Eligibility: USAA’s eligibility is restricted to military members, veterans, and their families, excluding non-military individuals from accessing its services, which could be a barrier for some amputees.

- Limited Availability: USAA has a relatively limited physical branch network compared to some other insurance companies, which may pose challenges for amputees who prefer in-person interactions or need local support.

#6 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA offers roadside assistance services as part of its auto insurance coverage, providing valuable support in case of emergencies such as vehicle breakdowns, which could be particularly helpful for amputees.

- Customizable Policies: AAA provides customizable policies that may include coverage options suitable for amputees, such as medical payments coverage and rental car reimbursement.

- Membership Benefits: AAA offers additional membership benefits beyond auto insurance, including discounts on travel and retail services, which could provide added value to amputees. Learn more about AAA’s membership benefits in our AAA auto insurance review.

Cons

- Membership Fees: AAA requires membership for access to its auto insurance services, which involves annual fees that could add to the overall cost for amputees, potentially making it less affordable compared to other insurance providers.

- Regional Availability: AAA’s auto insurance services are primarily available in specific regions, which may limit access for amputees living outside those areas, reducing their options for coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Extensive Network

Pros

- Nationwide Network: Nationwide has a vast network of agents and resources across the country, providing widespread accessibility and support for amputees in various locations.

- Coverage Options: Nationwide offers a variety of coverage options that may benefit amputees, including medical payments coverage and optional roadside assistance, ensuring comprehensive protection. Read more in our Nationwide auto insurance review.

- Financial Strength: Nationwide has a strong financial strength rating, indicating its ability to meet financial obligations and provide reliable coverage for amputees.

Cons

- Potentially Higher Premiums: Some customers have reported that Nationwide’s premiums can be higher compared to other insurance companies, which could be a concern for amputees seeking more affordable coverage.

- Mixed Customer Reviews: Nationwide has received mixed reviews regarding its customer service, with some customers reporting dissatisfaction with responsiveness and claims processing, which could be a drawback for amputees requiring efficient support.

#8 – Liberty Mutual: Best for Various Discounts

Pros

- Customizable Policies: Liberty Mutual offers customizable policies that may include coverage options relevant to amputees, such as optional medical payments coverage and rental car reimbursement.

- Discounts and Savings: Liberty Mutual provides various discounts and savings opportunities that could help amputees reduce their insurance premiums, potentially making coverage more affordable. Read more about Liberty Mutual’s discounts in our Liberty Mutual auto insurance review.

- Digital Tools: Liberty Mutual offers digital tools and resources for managing policies and filing claims, providing convenience and accessibility for amputees who prefer online interactions.

Cons

- Complex Claims Process: Some customers have reported challenges with Liberty Mutual’s claims process, citing delays and difficulties in resolution, which could be frustrating for amputees dealing with the aftermath of accidents or incidents.

- Limited Specialization: While Liberty Mutual offers customizable policies, it may not have specialized coverage options specifically tailored to the needs of amputees, potentially requiring additional endorsements or modifications for adequate protection.

Understanding Auto Insurance Costs for Amputees

Will auto insurance pay for hand controls is a common question among amputees navigating the complexities of car insurance. When considering loss of limb insurance and amputee insurance, it’s crucial to understand your coverage options thoroughly.

There are no specific auto insurance companies for amputees. Insurance companies aren't allowed to discriminate based on disabilities.Daniel Walker Licensed Auto Insurance Agent

Auto insurance for the disabled has the same rates and coverages as auto insurance for those without disabilities. Drivers can also still take advantage of discounts and other ways to save (read more: Cheap Auto Insurance for SSI Recipients).

Amputees Auto Insurance Monthly Rates

Insurance Company Term Policy

$39

$30

$33

$61

$22

$32

$44

$68

However, auto insurance rates for disabled drivers may still be a little higher than average.

One of the factors that affect auto insurance rates is the cost of your vehicle.

Additionally, many wonder, can amputees drive with ease, especially with advancements such as hand controls and prosthetic legs. Exploring options for cars for amputees becomes essential for ensuring both safety and independence on the road.

Every auto insurance company offers different coverages to protect your vehicle and any modifications. While amputee quotes may vary depending on several factors, including the type of prosthesis you use and your driving history, finding the best insurance for prosthetics is paramount for peace of mind.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

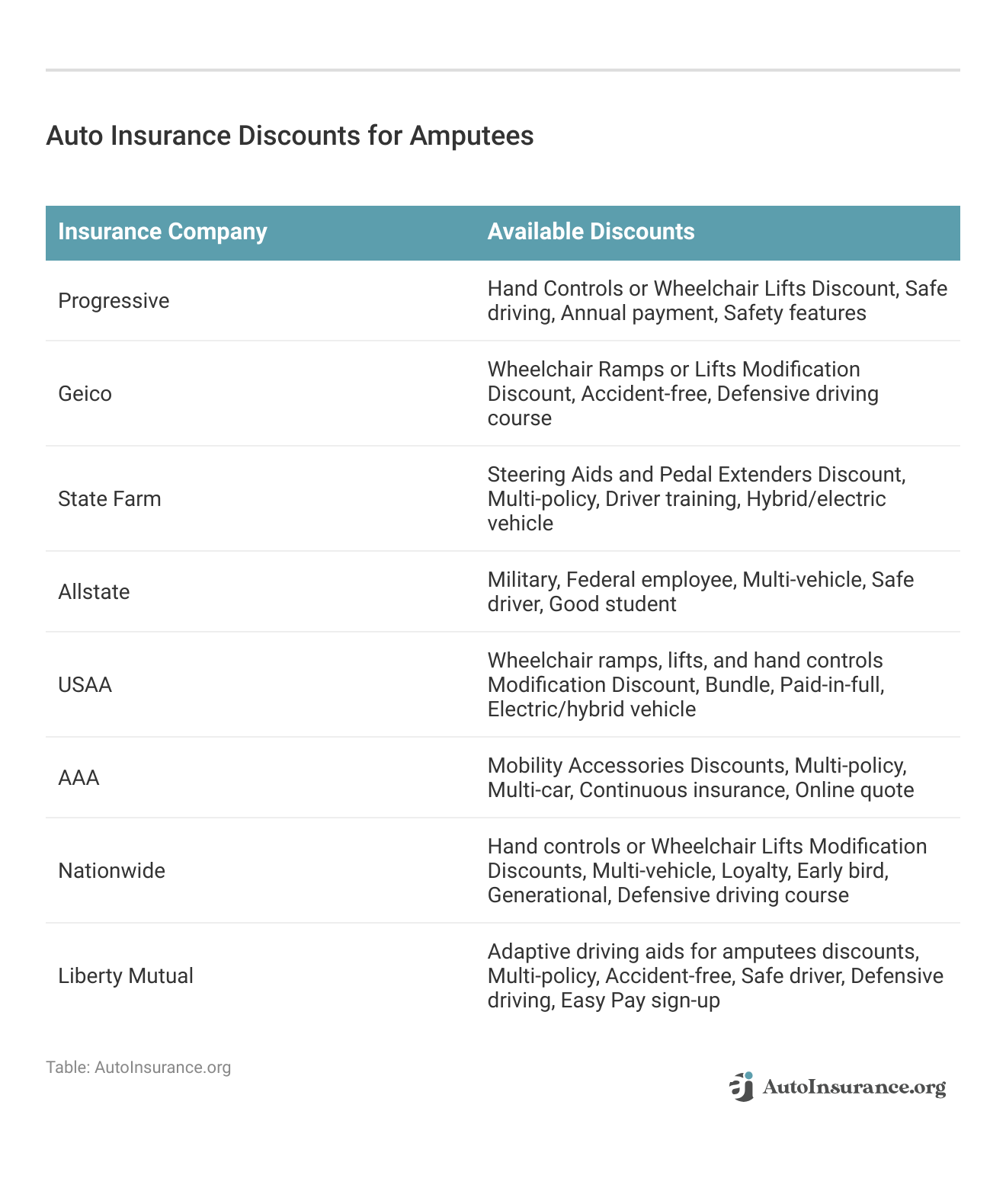

Tips for Disabled Drivers to Save on Auto Insurance

Unfortunately, there isn’t free car insurance for disabled drivers. However, there are great ways to save on car insurance.

First, take advantage of auto insurance discounts. Insurance companies offer discounts based on your driving record, the type of policies you have, and even the safety features of your car.

This table shows you common car insurance discounts from the top insurance companies. The amount of the discount is listed if it is known.

Next, consider taking a defensive driving course. Not only will you get an additional auto insurance defensive driver discount, but you will also learn safe driving skills.

Also, consider a telematics program. Usage-based auto insurance and telematics systems monitor your driving behaviors. Many auto insurance companies give you a discount based on how well you score.

Some car companies, such as Dodge, Ford, and Honda, will help you pay for modifications to your vehicle. Although it doesn’t save you money on your auto insurance, it makes the vehicle cheaper.

Read More: Auto Insurance for Wheelchair-Accessible Vehicles

Key Considerations for Disabled Drivers Regarding Auto Insurance Companies

The most important thing to know is auto insurance companies can’t treat you any differently than other drivers. They can’t charge higher rates or refuse to offer you coverage based on your disability.

The only exception is drivers with conditions that affect their driving ability, such as epilepsy. Read our article “Best Auto Insurance for Drivers With Epilepsy” for more information.

Another thing to be aware of is that auto insurance companies can’t prevent you from driving. Only the DMV in your state can revoke or restrict your driving based on a disability.

Exploring Medicaid and Medicare Coverage Options for Amputees

Does Medicaid cover prosthetic legs? Amputees often face the pressing concern of insurance for artificial legs. Understanding the extent of insurance for amputated legs and other prosthetic needs is crucial for individuals navigating life after limb loss.

For instance, individuals may wonder, “Does Medicare cover prosthetics?” and “How often will Medicare pay for a prosthetic leg?” While Medicaid and Medicare are among the primary insurance providers, the specifics of coverage can vary.

Furthermore, exploring Medicaid coverage options involves understanding the role of insurance providers like the Progressive Corporation in facilitating access to prosthetic devices. Clarifying the extent of coverage and benefits available can alleviate financial concerns and ensure amputees receive the care they require for optimal mobility and quality of life.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Find Cheap Car Insurance for Amputees Today

Car insurance for disabled drivers isn’t any more expensive than for other drivers. Auto insurance companies aren’t allowed to charge higher rates to disabled drivers.

However, you need to let your auto insurance company know if you have a specially modified vehicle since it is more expensive to repair.

Finding the right amputee car insurance can significantly impact the driving experience for individuals with limb loss. Remember, with the right insurance coverage and proper adaptations, the question of “can you drive with a prosthetic leg” becomes less about possibility and more about empowerment.

Before you buy auto insurance for an amputee, shop around. Learn more about how to get multiple auto insurance quotes. Every insurance company will offer different rates, so compare multiple companies to find the best deal for you.

Enter your ZIP code to compare car insurance costs for disabled drivers for free.

Frequently Asked Questions

Will having an amputated limb affect my ability to obtain auto insurance?

Having an amputated limb should not prevent you from obtaining auto insurance. Insurance companies typically focus on factors such as driving record, vehicle type, and location when determining premiums. However, it’s important to disclose your condition to the insurance provider to ensure accurate coverage and potential discounts for adaptive vehicle modifications.

Will my auto insurance rates be higher due to my amputated limb?

Insurance rates are primarily influenced by factors such as driving record, age, location, and the vehicle you drive. While having an amputated limb may not directly impact your rates, if it affects your ability to operate a vehicle safely, your premiums may be higher. It’s important to discuss any limitations or adaptations you have made to your vehicle with your insurance provider to ensure proper coverage.

Are there any specific auto insurance requirements for individuals with amputated limbs?

There are typically no specific auto insurance requirements for individuals with amputated limbs. The general insurance requirements remain the same for all drivers. However, if you have made adaptive modifications to your vehicle, such as installing hand controls or a prosthetic limb for driving, it’s crucial to inform your insurance provider to ensure appropriate coverage (read more: How to Get Auto Insurance).

Can I receive any discounts on auto insurance due to my amputated limb?

Some insurance companies offer discounts for adaptive vehicle modifications or for drivers with disabilities, including those with amputated limbs. These discounts can vary, so it’s recommended to inquire with your insurance provider about any available discounts. Additionally, organizations and associations related to disabilities may offer resources or discounts on auto insurance. Researching such options can help you find potential cost savings.

Should I inform my insurance provider about my amputated limb?

Yes, it’s crucial to inform your insurance provider about your amputated limb. Full disclosure of any relevant information is essential for accurate coverage. By informing your insurance provider, you can ensure that any adaptive modifications to your vehicle are included in the policy, and you may also be eligible for specific discounts or coverage tailored to your needs.

Can auto insurance cover adaptive modifications made to my vehicle due to my amputated limb?

Auto insurance may cover adaptive modifications made to your vehicle due to your amputated limb. These modifications could include hand controls, wheelchair lifts, or other specialized equipment. However, coverage can vary among insurance providers and policies. It’s advisable to review your policy or consult with your insurance provider to understand the extent of coverage for adaptive modifications. Learn more in our “Best Auto Insurance Companies for Modified Cars” article.

Will I need any documentation or proof of my amputated limb for auto insurance purposes?

Insurance providers generally don’t require specific documentation or proof of your amputated limb. However, if you have made adaptive modifications to your vehicle, your insurance provider may request documentation or receipts as proof of the modifications. It’s recommended to keep records of any modifications made and consult with your insurance provider regarding their documentation requirements.

Can I be denied auto insurance coverage due to my amputated limb?

Insurance companies typically cannot deny coverage solely based on having an amputated limb. Insurance providers evaluate risk based on various factors, such as driving history and the vehicle you drive. However, if your amputated limb significantly affects your ability to drive safely, an insurance company may determine that providing coverage is not feasible. It’s advisable to consult with multiple insurance providers and explore your options to ensure you find coverage that meets your needs.

How much is auto insurance for amputees?

Auto insurance for amputees averages a monthly cost of $92. Progressive particularly shines with its affordable rate of $109 per month and customizable coverage options.

How can disabled drivers save money on auto insurance?

Disabled drivers can save money on auto insurance by exploring discounts for good driving records, bundling policies, and opting for vehicles with safety features. Read more in our comprehensive guide titled “How to Get a Good Driver Auto Insurance Discount.” Additionally, comparing quotes from multiple insurers can help find the most affordable coverage.

What should disabled drivers know about auto insurance companies?

Disabled drivers should be aware that auto insurance companies are not allowed to discriminate based on disabilities. They should also know that they can qualify for standard auto insurance coverage like any other driver. Additionally, some insurers may offer discounts or specialized services for disabled drivers, so it’s worth exploring different options to find the best fit for their needs. Enter your ZIP code below to find the best auto insurance for amputees near you.

Is State Farm better than Progressive?

State Farm has cheaper rates, but Progressive stands out for its customized coverage and many discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.