Geico vs. Progressive Auto Insurance in 2026 (Side-by-Side Review)

When comparing Geico vs. Progressive auto insurance, Geico is usually cheaper. Geico’s rates start at just $43 per month, while Progressive drivers pay at least $56. However, Progressive offers more coverage options and better digital tools, like Snapshot and the Name Your Price tool.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated November 2025

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,285 reviews

13,285 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsWith Geico vs. Progressive auto insurance, you’ll find Geico’s starting rate of $43 per month is cheaper than Progressive’s $56.

Geico might be a bit cheaper, but Progressive offers more coverage options and better digital tools.

Geico vs. Progressive Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.4 | 4.3 |

| Business Reviews | 4.5 | 4.0 |

| Claim Processing | 4.8 | 3.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.4 | 4.2 |

| Customer Satisfaction | 2.3 | 2.1 |

| Digital Experience | 5.0 | 4.5 |

| Discounts Available | 4.7 | 5.0 |

| Insurance Cost | 4.5 | 4.4 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 4.1 | 5.0 |

| Savings Potential | 4.5 | 4.6 |

| Geico Review | Progressive Review |

However, the best company for you depends on several factors. For example, Geico offers the best auto insurance for federal employees.

- Geico is cheaper than Progressive, with rates as low as $43/mo

- Progressive offers more coverage options than Geico

- Both companies have similar ratings, but Progressive receives more complaints

Read on to see if Geico or Progressive is right for you. Then, enter your ZIP code into our free comparison tool to see which company has the best rates for you.

Geico vs. Progressive Auto Insurance Rates

While many factors that affect auto insurance rates, both Geico and Progressive are known for their affordable prices. However, Geico tends to be a bit cheaper than Progressive in most states. The good news is that, no matter which company you want to shop with, they both make it easy to get online quotes.

You can explore more specific averages below, but you can get an idea of how much you might spend with Geico and Progressive below.

Geico vs. Progressive Auto Insurance: Monthly Full Coverage Rates

| Age & Gender | ||

|---|---|---|

| 16-Year-Old Female | $425 | $1,144 |

| 16-Year-Old Male | $445 | $1,161 |

| 30-Year-Old Female | $128 | $187 |

| 30-Year-Old Male | $124 | $194 |

| 45-Year-Old Female | $114 | $159 |

| 45-Year-Old Male | $114 | $150 |

| 60-Year-Old Female | $104 | $131 |

| 60-Year-Old Male | $106 | $136 |

When you compare Progressive vs. Geico, you’ll see that Geico has cheaper rates for every age group. However, Geico isn’t always the cheapest option for every driver.

Continue reading to compare Progressive vs. Geico auto insurance rates based on factors like where you live and what your driving record looks like.

Geico vs. Progressive Rates by State

It’s simple — where you live can have a tremendous impact on what you pay in premiums. When looking at auto insurance rates by state, several factors come into play.

In a head-to-head comparison, who has the cheapest rates? Is Geico cheaper than Progressive? Here’s a breakdown of average rates by state:

Geico vs. Progressive Auto Insurance: Monthly Full Coverage Rates by State

| State | ||

|---|---|---|

| Alabama | $109 | $138 |

| Alaska | $118 | $149 |

| Arizona | $126 | $183 |

| Arkansas | $91 | $117 |

| California | $157 | $207 |

| Colorado | $139 | $178 |

| Connecticut | $85 | $182 |

| Delaware | $103 | $171 |

| Florida | $119 | $205 |

| Georgia | $83 | $156 |

| Hawaii | $72 | $94 |

| Idaho | $98 | $91 |

| Illinois | $79 | $125 |

| Indiana | $77 | $145 |

| Iowa | $99 | $107 |

| Kansas | $91 | $155 |

| Kentucky | $97 | $135 |

| Louisiana | $163 | $187 |

| Maine | $103 | $136 |

| Maryland | $248 | $222 |

| Massachusetts | $52 | $134 |

| Michigan | $141 | $217 |

| Minnesota | $160 | $180 |

| Mississippi | $137 | $150 |

| Missouri | $97 | $163 |

| Montana | $118 | $243 |

| Nebraska | $104 | $48 |

| Nevada | $86 | $157 |

| New Hampshire | $131 | $136 |

| New Jersey | $72 | $91 |

| New Mexico | $106 | $133 |

| New York | $123 | $117 |

| North Carolina | $139 | $104 |

| North Dakota | $98 | $121 |

| Ohio | $82 | $119 |

| Oklahoma | $148 | $149 |

| Oregon | $134 | $111 |

| Pennsylvania | $109 | $238 |

| Rhode Island | $125 | $116 |

| South Carolina | $130 | $171 |

| South Dakota | $66 | $122 |

| Tennessee | $100 | $118 |

| Texas | $164 | $188 |

| Utah | $113 | $146 |

| Vermont | $113 | $99 |

| Virginia | $54 | $258 |

| Washington | $97 | $78 |

| Washington, D.C. | $118 | $105 |

| West Virginia | $88 | $133 |

| Wisconsin | $102 | $135 |

| Wyoming | $112 | $107 |

In reviewing these figures, here’s what we quickly discovered — when it comes to the lowest overall rates, Geico takes a clear lead over Progressive.

In most categories, you’ll find that Geico has cheaper overall rates compared to Progressive. However, that’s not always the case. If you want the cheapest insurance possible, make sure to compare quotes with both Progressive and Geico before you make a decision.

While Geico is almost always a cheaper choice, Progressive has lower rates in states like New York and North Carolina.Kalyn Johnson Insurance Claims Support & Sr. Adjuster

So, why are rates so different across the country? Many factors impact your insurance rates, but the main things providers look at are traffic rates, accidents, vehicle crime rates, and how many claims are filed in your ZIP code.

Geico vs. Progressive Rates With a Speeding Ticket

Car accidents, speeding tickets, and driving under the influence are all serious infractions that can hike your car insurance rates. As drivers continue to rack up tickets and violations, insurers will consider them to be higher risks and charge them higher rates.

Speeding tickets are among the most common traffic violations American drivers receive. Although speeding is usually relatively harmless, driving too fast is a common factor in fatal accidents. For this reason, insurance companies charge drivers more when they have speeding tickets on their records.

Compare Progressive auto insurance vs. Geico quotes for drivers with a speeding ticket below.

Geico vs. Progressive Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $114 | $142 |

| Speeding Ticket | $138 | $121 |

| At-Fault Accident | $145 | $98 |

| DUI | $186 | $75 |

| Not-At-Fault Accident | $120 | $125 |

| Reckless Driving | $200 | $160 |

| License Suspension | $175 | $150 |

| Driving Without Insurance | $190 | $170 |

Keep in mind that the surcharge insurers decide to tack on to your annual car insurance premium can vary depending on the nature of your ticket. For instance, someone ticketed for going 10 miles over the speed limit may face a lower increase than a driver ticketed for going 25 miles over the speed limit.

Geico vs. Progressive Rates With an Accident

Having a car accident on your record, particularly if you were found at fault, can also have a tremendous bearing on your bottom line. In terms of annual car insurance rates, we can once more see a significant difference between Geico and Progressive.

Geico vs. Progressive Full Coverage Auto Insurance Monthly Rates With an Accident

| Age & Gender | ||

|---|---|---|

| 25-Year-Old Female | $110 | $145 |

| 25-Year-Old Male | $115 | $150 |

| 30-Year-Old Female | $123 | $148 |

| 30-Year-Old Male | $128 | $153 |

| 40-Year-Old Female | $135 | $160 |

| 40-Year-Old Male | $140 | $165 |

| 50-Year-Old Female | $150 | $175 |

| 50-Year-Old Male | $155 | $180 |

When it comes to Progressive versus Geico rates after an accident, Geico is the cheaper option on average. How long auto accidents stay on your driving record depends on where you live, but they usually last about three years. You’ll see higher rates until any accidents you’ve caused drop off your record.

Geico vs. Progressive Rates With a DUI

Without a doubt, the impact of having a DUI conviction on your driving record is severe. A DUI will not only remain on your record for several years, but it will also cause your car insurance rates to skyrocket.

If your insurer is willing to keep you as a customer, you can be certain that your annual car insurance rates will go up exponentially, as you are now considered a high-risk driver. In this instance, Progressive has the lower figures.

Geico vs. Progressive Full Coverage Auto Insurance Monthly Rates With a DUI

| Age & Gender | ||

|---|---|---|

| 25-Year-Old Female | $186 | $75 |

| 25-Year-Old Male | $186 | $75 |

| 30-Year-Old Female | $186 | $75 |

| 30-Year-Old Male | $186 | $75 |

| 40-Year-Old Female | $186 | $75 |

| 40-Year-Old Male | $186 | $75 |

| 50-Year-Old Female | $186 | $75 |

| 50-Year-Old Male | $186 | $75 |

Although Geico is usually cheaper, you’ll see Progressive has lower average rates when you compare Geico vs. Progressive car insurance after a DUI. This is why it’s so important to compare rates with as many companies as possible — you never know which company will have cheap auto insurance after a DUI without checking.

Geico vs. Progressive Rates by Credit Score

The state of your credit matters and can have a lasting impact on your major purchases in most states. That includes buying a home, qualifying for a loan, and even purchasing car insurance.

As providers set rates, they will often look to what is called your credit-based score, or insurance score. Although this is not the same as your credit score, it’s largely based on your credit history, which includes the following factors:

- Your payment history

- Total debt

- The length of your credit history

- The pursuit of new credit

- A mix of credit

When it comes to auto insurance and your credit score, drivers with better scores will usually have better rates. With that in mind, here’s a look at what Geico and Progressive charge customers with good, fair, and poor credit.

Geico vs. Progressive Minimum Coverage Auto Insurance Monthly Rates by Credit Score

| Credit Score | ||

|---|---|---|

| Good (670–739) | $95 | $98 |

| Fair (580–669) | $115 | $118 |

| Bad (Below 580) | $135 | $138 |

We can see that Progressive customers are paying higher rates across the board, whether they have good, fair, or poor credit. However, where the rates between Geico and Progressive are closest are for those with poor credit.

Geico vs. Progressive Rates by Annual Mileage

For many drivers, more miles tend to translate into higher rates. The rationale? The more you drive, the more likely you are to get into an accident.

When we compared what Geico and Progressive customers are paying according to their average annual mileage, we discovered that once more, Geico has the advantage:

Geico vs. Progressive Full Coverage Auto Insurance Monthly Rates by Annual Mileage

| Commute | ||

|---|---|---|

| 6,000 miles | $264 | $336 |

| 12,000 miles | $272 | $337 |

However, what should be noted among both insurers is that the difference between what customers are paying for 10-mile or 25-mile commutes is minimal, particularly among Progressive customers.

If you put fewer than 10,000 miles on your car annually, you may qualify for a low-mileage car insurance discount. Geico doesn’t offer this sort of savings, but Progressive does offer one of the best low-mileage auto insurance discounts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Geico vs. Progressive Auto Insurance Coverage Options

No matter where you shop, understanding the different types of car insurance is integral to picking the right policy. As two of the largest insurance companies on the market, Geico and Progressive offer a variety of coverage options to meet the needs of most drivers.

For some, it’ll be a matter of simply carrying basic coverages. For others, the distinguishing factor will be in the extras. This is why we’re breaking down Geico and Progressive’s coverage options below. When it comes to basic car insurance coverages, you can count on both Geico and Progressive to have what you need:

- Liability Insurance: This covers injuries or property damage resulting from an accident that you caused. Of the two, Geico usually offers the cheapest liability-only auto insurance plans.

- Collision Insurance: Collision insurance covers damage to your car as a result of a collision with another car, or a stationary object like a tree.

- Comprehensive Insurance: If your car is damaged outside of an accident, comprehensive auto insurance may cover the repairs. Comprehensive typically covers damage from events like bad weather and theft.

- Medical Payments/Personal Injury Protection: Regardless of who was at fault, medical payments and personal injury protection (PIP) insurance cover medical expenses for everyone in your car.

- Uninsured Motorist/Underinsured Motorist: Uninsured/underinsured motorist coverage helps cover costs if you’ve been involved in an accident with an at-fault driver who doesn’t have car insurance.

If you’d like to add additional coverage beyond the basics, Geico and Progressive offer a good selection of add-ons. Both companies offer the following types of coverage:

- Accident forgiveness

- Rental car reimbursement

- Rideshare insurance

- Roadside assistance

Keep in mind that not all types of insurance are available everywhere. For example, Geico rideshare insurance is only available in 40 states.

It may be the cheaper option, but Geico auto insurance reviews often mention the lack of coverage options this company offers. Here are the additional coverages that Progressive offers, but Geico does not:

- Gap Insurance: If a car that you’re financing or leasing is totaled or stolen, gap insurance covers the difference between what your car is worth and what you owe.

- Custom Parts and Equipment: According to the insurer, this form of insurance will repair or replace items that you add to your car (such as a stereo, navigation system, custom wheels, or a paint job).

- Deductible Savings Bank: This coverage allows drivers to subtract $50 from their collision and comprehensive deductibles for every claim-free policy period.

If you’re interested in any of these Progressive auto insurance add-ons, you can always check with a representative to see if they are available in your state.

Geico only sells one type of insurance that Progressive does not — mechanical breakdown coverage, which works like a car warranty.Brandon Frady Licensed Insurance Producer

While add-ons are a great way to protect your car, they will increase your monthly premium. Make sure to only purchase what you need to avoid expensive premiums.

Geico vs. Progressive Auto Insurance Discounts

There’s no question about it — the best auto insurance discounts are a surefire way to get more bang for your buck. At the end of the day, your best bargains will rely entirely on which insurer can most closely meet you where you are. Check below to see some of the top discounts Geico and Progressive offer.

Geico vs. Progressive Auto Insurance Discounts

| Discount | ||

|---|---|---|

| Accident-Free | 22% | 10% |

| Bundling | 25% | 10% |

| Customer Loyalty | 10% | 13% |

| Good Student | 15% | 10% |

| Multi-Vehicle | 25% | 12% |

Both companies offer solid discounts to help their drivers save, but Geico offers a few more than Progressive. However, the best company for you depends on your unique needs.

For example, Geico offers special discounts for military members and federal employees. Progressive, on the other hand, offers unique ways to save for teen drivers. Whatever type of driver you are, both Geico and Progressive will list your best options and rates when you get an online quote.

When you get an online quote from either Geico or Progressive, most discounts you qualify for will automatically apply to your account. However, you may need to submit proof for a few discounts. For example, you’ll need to submit proof of your grades if you want a good student discount.

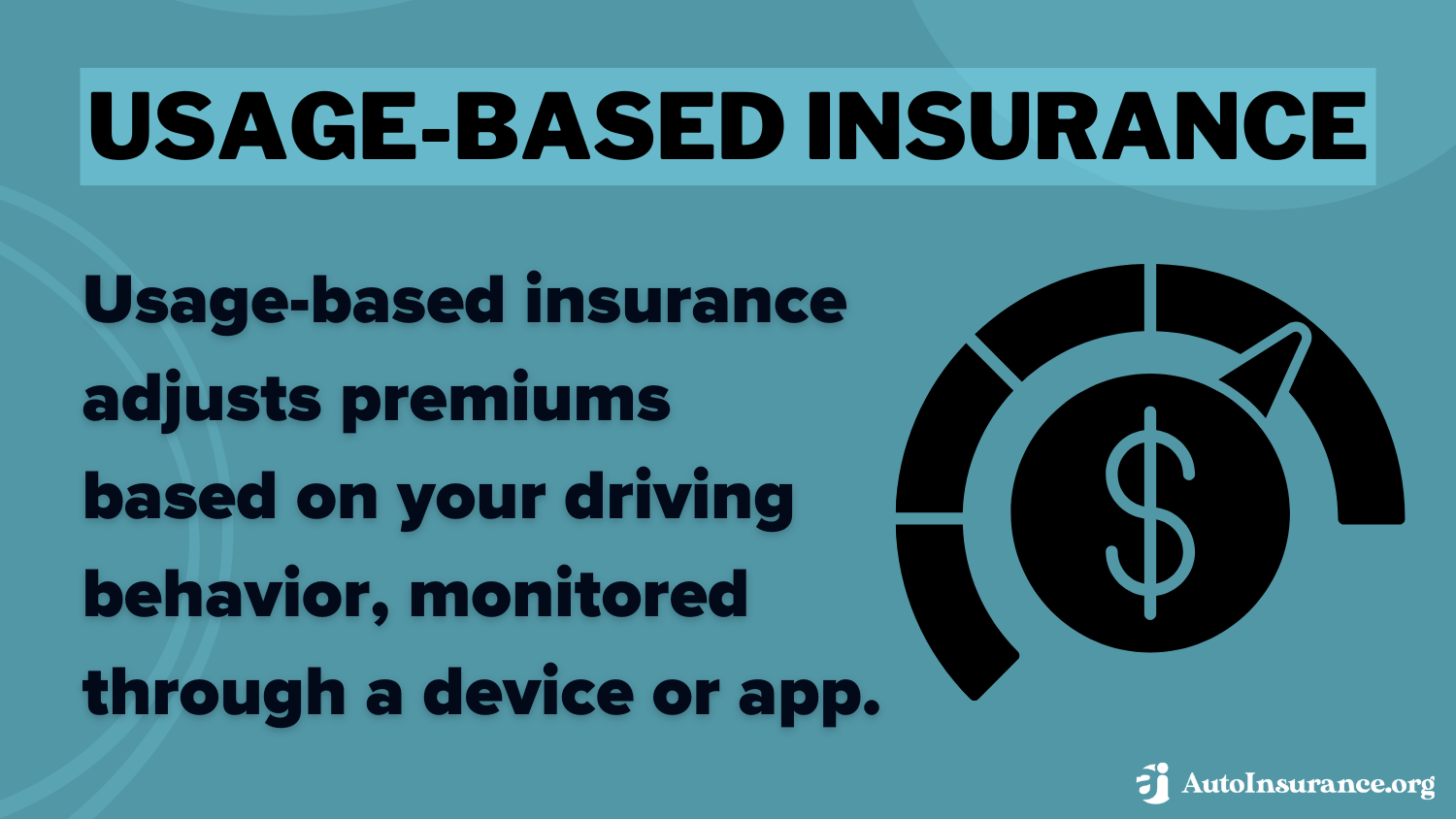

Geico vs. Progressive Usage-Based Insurance

Drivers looking to take advantage of a usage-based insurance (UBI) program have options with both insurers. However, what drivers need to keep in mind is that these programs are vastly different.

If you’re wondering, “Is Geico or Progressive better for UBI savings?”, most drivers agree that Progressive is the best choice. With Progressive, drivers have access to what is commonly known as a pioneer in the UBI market — Snapshot.

Snapshot is an easy-to-use UBI program with options to track your driving through either the Progressive or with a plug-in device. Drivers with the safest habits on the road can save up to 30% on their insurance with Snapshot. You can learn more about this UBI program in our Progressive Snapshot review.

Unlike many UBI programs, enrolling in Progressive's Snapshot can cause your rates to increase if you don't practice safe driving habits.Michelle Robbins Licensed Insurance Agent

Geico’s DriveEasy is relatively new and among the newest players in the UBI space. As of now, Geico’s website promises savings of up to 25% to those who enroll but does not elaborate on any additional savings. DriveEasy is powered by a mobile app, with a focus on developing safer driving habits.

While Snapshot gets positive reviews, there are plenty of other UBI programs to consider. For example, our State Farm Drive Safe & Save review shows that many customers are satisfied with their experience. If you want an opportunity for higher savings, Allstate offers up to 40% off. Make sure to compare companies like Geico vs. Progressive vs. State Farm before you sign up for a UBI program.

Geico vs. Progressive: Customer Reviews & Ratings

When it comes to Geico vs. Progressive customer service, both make the top 10 auto insurance companies with the best customer service. However, Geico is often the more popular choice because it tends to be cheaper. For example, take the experience of this Reddit user, who found much cheaper rates at Geico.

Most of the comments comparing Geico vs. Progressive on Reddit agreed that they found cheaper insurance quotes with Geico.

Although the answer to “Is Progressive cheaper than Geico?” is usually no, Progressive still deserves consideration. Many drivers agree that paying a little extra at Progressive is worth it to access the company’s superior digital tools. Progressive also offers more insurance variety than Geico, so it’s a popular choice for people looking for full coverage.

Of course, not all reviews are positive. For Progressive, customers often complain about unexpected rate increases, even when nothing about their policies had changed.

As for Geico, many customers report problems with the customer service experience. Additionally, if you want to bundle your policies for a discount, Geico home insurance reviews mention that the company doesn’t write its own policies. If you don’t want to buy home insurance from one of Geico’s partners, then you should bundle policies elsewhere.

Insurance Business Ratings & Consumer Reviews: Geico vs. Progressive

| Agency | ||

|---|---|---|

| Score: 692 / 1,000 Above Avg. Satisfaction | Score: 672 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 72/100 Avg. Customer Feedback |

|

| Score: 0.55 Fewer Complaints Than Avg. | Score: 1.11 Avg. Complaints |

|

| Score: A++ Superior Financial Strength | Score: A+ Superior Financial Strength |

As you can see, both companies have similar ratings. However, Progressive has a higher score from the NAIC, which means it receives more customer complaints than Geico.

On the other hand, Geico has a better score from A.M. Best, meaning it’s a more financially secure company than Progressive. However, both providers have high scores, which is one reason they make the list for the best auto insurance companies for paying claims.

So, is Geico better than Progressive? Not necessarily. More customers have trusted Progressive with their insurance needs over Geico, as you can see in a comparison of each company’s market share below.

With both Progressive and Geico earning similar ratings, you’ll be in good hands no matter which company you pick. The best way to decide which is best for you is to compare discounts, coverage options, and how you’ll manage your policy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Geico vs. Progressive Auto Insurance Rates Today

Geico and Progressive are similar companies in many ways, with the primary difference being rates. Geico is the overall cheaper option, unless you have a DUI on your driving record. However, Progressive offers more coverage options than Geico and a more modern insurance experience.

Thinking about switching up your insurance provider?🤨At https://t.co/27f1xf131D, we’ve broken down the process so you can ensure you’re getting the right coverage, for the best price!💲Check out our in-depth guide on switching companies here👉: https://t.co/QC0Z11pD31 pic.twitter.com/c8qsrP1sAq

— AutoInsurance.org (@AutoInsurance) April 23, 2023

Now that you’ve compared Geico vs. Progressive auto insurance, you’re probably ready to explore how to get auto insurance from one of these companies. Enter your ZIP code into our free comparison tool today to see which company has the best prices for you.

Frequently Asked Questions

Is Progressive better than Geico?

Wondering which is better: Progressive or Geico? It depends on your unique needs. If you want the cheapest insurance possible, Geico is likely the better option. However, if you’re looking for a modern digital experience and more coverage options, Progressive is the better choice.

Is Geico insurance good?

Yes, Geico is generally considered a good car insurance company. The main complaint about Geico tends to be that popular coverage limits are lacking. See if Geico can meet your insurance needs in our Geico auto insurance review.

Is Geico or Progressive cheaper?

While rates depend on your unique circumstances, Geico is typically a cheaper option than Progressive. The only time Progressive is cheaper than Geico consistently is for drivers with a DUI on their record.

Does Geico offer gap insurance?

No, Geico does not sell gap insurance. However, you can purchase a similar type of coverage called loan/lease payoff from Progressive. See all of Progressive’s coverage options in our Progressive auto insurance review.

Is State Farm better than Geico or Progressive?

State Farm is similar to both Progressive and Geico, but tends to be a bit more expensive in some cases. To compare State Farm vs. Geico vs. Progressive rates, enter your ZIP code into our free quote comparison tool today.

Do Geico and Progressive offer roadside assistance?

Yes, both Geico and Progressive offer roadside assistance as an optional add-on to their auto insurance policies. This service can provide assistance for issues like flat tires, lockouts, and towing. Before you sign up for roadside assistance from either company, make sure to compare Geico vs. Progressive vs. AAA. AAA is known as one of the best roadside assistance providers on the market.

Can I bundle my home insurance with Geico or Progressive?

Yes, both Geico and Progressive offer home insurance policies. You can explore bundling options with these companies to potentially save money by combining your auto and home insurance coverage. Make sure to compare Geico vs. Progressive home insurance before you make a decision.

Does Geico or Progressive offer rideshare insurance?

Both Geico and Progressive offer rideshare insurance options. These policies provide coverage for drivers who use their personal vehicles for ridesharing services like Uber or Lyft. Make sure to comapre several companies if rideshare coverage is important to you. For example, comparing Geico vs. Progressive vs. Liberty Mutual is a great option since Liberty Mutual works with Uber to provide coverage.

Is Geico overpriced?

Generally speaking, Geico is not overpriced. In fact, Geico is usually one of the cheapest car insurance options on the market.

Do Geico and Progressive offer rental car reimbursement coverage?

Yes, both Geico and Progressive offer rental car reimbursement coverage as an optional add-on to their auto insurance policies. This coverage helps cover the cost of a rental car while your vehicle is being repaired after a covered claim.

Can I customize my coverage with Geico or Progressive?

Do Geico and Progressive offer discounts for safe driving?

What is Geico’s weakness?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.