Connecticut Minimum Auto Insurance Requirements in 2025 (CT Mandated Coverage)

Connecticut minimum auto insurance requirements are 25/50/25, meaning drivers need at least $25,000 for bodily injury per person, $50,000 for injuries per accident, and $25,000 for property damage. Connecticut car insurance rates average $32/month, but shopping around can help uncover the best deals.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Nov 20, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 20, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

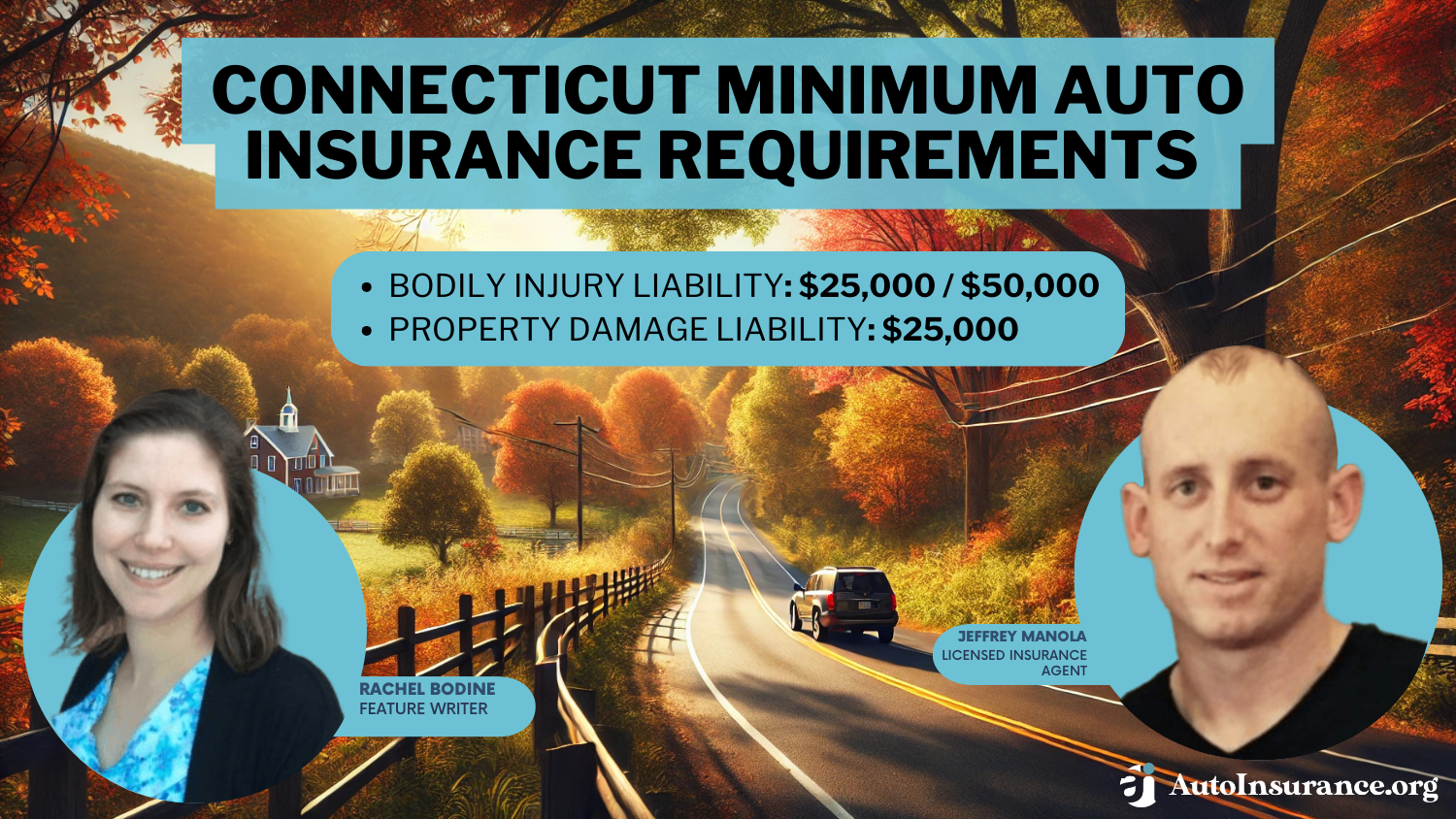

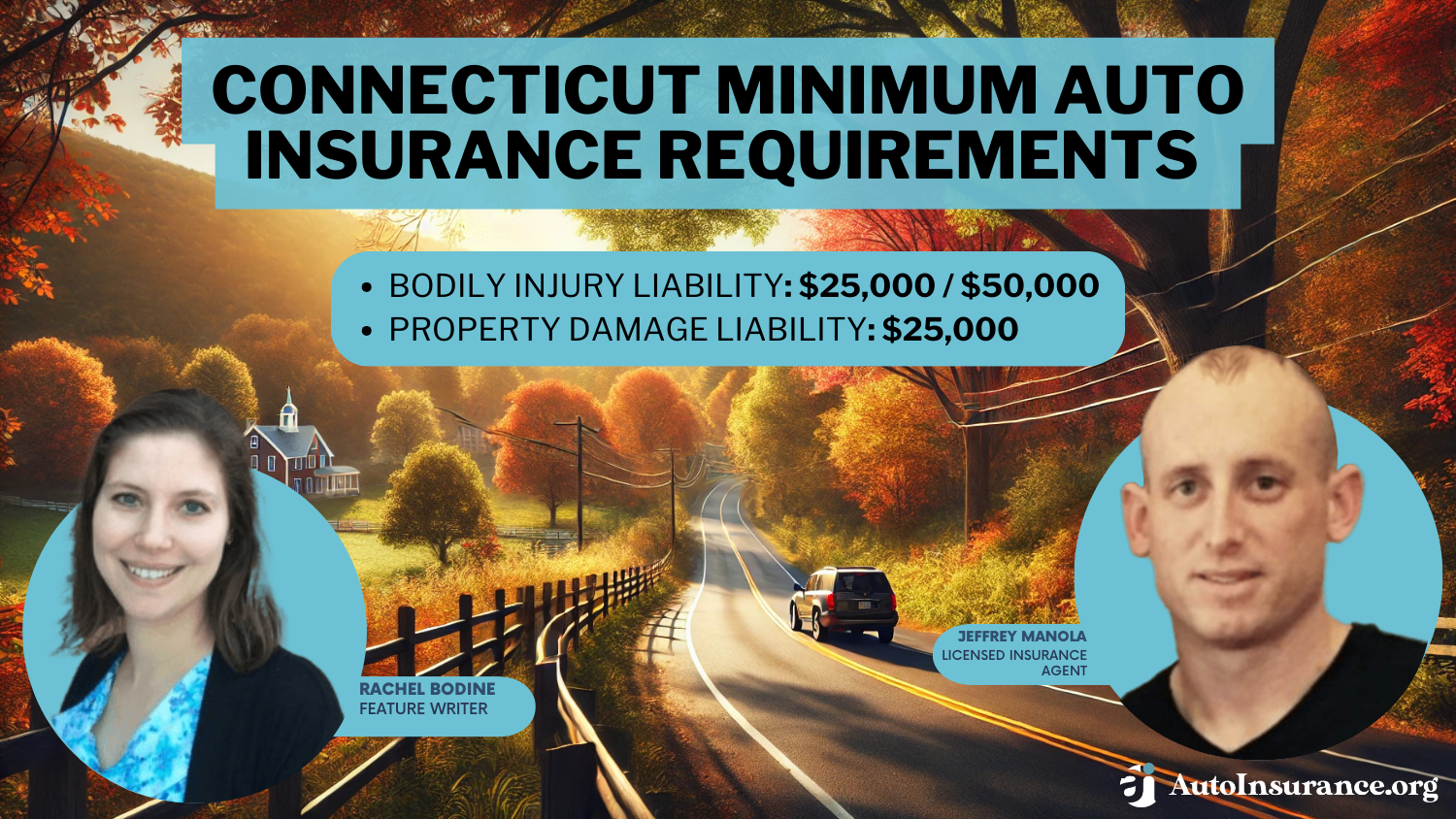

Connecticut minimum auto insurance requirements mandate 25/50/25 liability coverage, which means drivers must have at least $25,000 in bodily injury coverage per person, $50,000 in bodily injury coverage per accident, and $25,000 in property damage liability.

This ensures financial protection in the event of accidents, helping cover medical expenses, legal claims, and property repairs caused by the policyholder.

Connecticut Minimum Auto Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

Geico offers the cheapest rates at $32/month, followed by USAA at $40/month and Travelers at $43/month. Comparing providers can help you secure affordable coverage that meets state requirements and fits your budget.

Stop overpaying for auto insurance. Enter your ZIP code above to find out if you can get a better deal.

- Connecticut minimum auto insurance requires 25/50/25 liability coverage

- Additional coverage can provide better financial protection

- Geico offers minimum coverage rates starting at $32/month

Connecticut Minimum Coverage Requirements & What They Cover

Finding affordable coverage that meets Connecticut car insurance requirements doesn’t have to be difficult. For drivers seeking low rates while staying compliant with Connecticut minimum car insurance requirements, according to the NAIC’s auto insurance database, Connecticut mandates the following minimum coverage for all drivers:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident to cover injuries to others in an accident you cause.

- Property Damage Liability: $25,000 per accident to cover damage to another person’s property.

- Uninsured/Underinsured Motorist Coverage: $25,000 per person and $50,000 per accident to protect you if the at-fault driver lacks sufficient insurance.

Understanding Connecticut auto insurance requirements is key to ensuring you have adequate protection. The CT state minimum auto insurance includes 25/50/25 liability coverage, and failing to meet these auto insurance CT requirements can result in penalties.

While minimum coverage is budget-friendly, drivers may want to explore higher limits or additional protections outlined in this Connecticut auto insurance guide to fully safeguard against unexpected expenses.

Geico offers the best value for Connecticut drivers, with minimum coverage starting at just $32 per month.Scott W. Johnson Licensed Insurance Agent

These requirements apply to private-use vehicles but may differ for specialized or non-standard vehicles, such as commercial trucks or classic cars not regularly driven on public roads.

Read more: What are the recommended auto insurance coverage levels?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Connecticut

If you’re looking for affordable car insurance in Connecticut, Geico stands out as the top choice with rates starting at $32 per month for minimum auto insurance coverage in Connecticut. USAA offers the second most affordable option at $40 per month, and Travelers follows closely with rates beginning at $43 per month. Learn more through our comprehensive guide, Travelers auto insurance review.

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Connecticut

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in Connecticut

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage in Connecticut

A.M. Best

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsComparing quotes from these top providers can help you find the best policy to match your budget and ensure compliance with CT car insurance requirements. Whether you’re new to driving or seeking to lower your premiums, understanding Connecticut car insurance laws and using our free comparison tool will guide you toward the right coverage.

Penalties for Driving Without Insurance in Connecticut

Driving without insurance in Connecticut is a serious violation of Connecticut car insurance laws, and the penalties are strict to ensure compliance with CT auto insurance requirements. According to the Insurance Information Institute (III), one in eight drivers is uninsured, highlighting the importance of maintaining proper coverage.

If you are caught driving without insurance, you will face an immediate fine of $200. Additionally, the state may assign you an insurance policy, which often comes at a higher cost. If you fail to provide proof of minimum insurance coverage in CT, such as a valid policy meeting Connecticut auto insurance requirements, you will be required to attend a hearing.

Monthly Minimum Auto Insurance Rates from Top Providers in Connecticut

| Insurance Company | Monthly Rate |

|---|---|

| $100 | |

| $125 | |

| $115 | |

| $85 | |

| $105 |

| $110 |

| $95 | |

| $90 | |

| $120 | |

| $80 |

At the hearing, you risk having your vehicle’s registration or driver’s license revoked or suspended, which can lead to further inconvenience and costs. To avoid these penalties, ensure you meet CT state minimum auto insurance coverage and regularly review your policy with a trusted provider.

With rates as low as $80/month from USAA or $85/month from Geico, finding affordable coverage that complies with Connecticut minimum auto insurance coverage is within reach. Gain more information by browsing our guide, USAA vs. Geico auto insurance.

Other Coverage Options to Consider in Connecticut

Auto insurance can be seemingly complicated to many drivers, and you understandably may feel confused about how to read auto insurance requirements in Connecticut. If you do not know how to read car insurance requirements, you cannot be sure that you are in compliance with state requirements or understand how protective your coverage is.

These are descriptions of some of the more common types of optional and required auto insurance that are available to Connecticut drivers.

- Personal Injury Protection (PIP) / Medical Payments: Personal injury protection insurance is required in some states, but it is not required in Connecticut. This optional coverage pays for your own medical expenses for accident-related injuries. Keep in mind that it may supplement your health insurance.

- Collision: Some lenders require customers to buy collision insurance, but it is not a state requirement. Collision insurance pays for vehicle repairs or a full replacement if it is damaged in a collision only.

- Comprehensive: Some lenders also require comprehensive insurance, but this coverage is also not required by law in Connecticut. While collision insurance pays for damages related to a collision, comprehensive insurance pays for damages from a full range of events, such as bad weather, a fire, theft, flooding, and more.

When you read through CT minimum insurance requirements and policy terms, you will likely see these terms above listed with a dollar amount next to them. The dollar amount usually indicates the upper limit that the auto insurance company will pay for that specific type of auto coverage. If your actual expenses exceed the coverage limit in your policy, you will need to pay them on your own.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Minimum Required Auto Insurance vs. Recommended Coverage in CT

While meeting CT auto insurance requirements is essential, many drivers in Connecticut mistakenly believe that carrying only the minimum insurance coverage in CT is sufficient. According to Connecticut auto insurance laws, the Connecticut minimum auto insurance coverage is designed to ensure basic financial protection but may not fully cover all expenses in the event of a severe accident.

The minimum car insurance coverage in CT includes liability limits of 25/50/25, which covers bodily injury and property damage caused to others but does not address your own vehicle or personal medical bills.

Drivers should consider exceeding the CT state minimum car insurance to better protect themselves financially. Upgrading your policy can include additional options such as comprehensive auto insurance, which covers theft or weather damage, and collision coverage to repair your own vehicle.

Adding extras like towing, rental car reimbursement, or uninsured/underinsured motorist coverage provides added peace of mind, especially in scenarios where damages exceed the auto insurance in Connecticut requirements.

Connecticut Min. Coverage Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Bridgeport | $146 |

| Danbury | $104 |

| East Hartford | $108 |

| Hartford | $144 |

| Manchester | $91 |

| New Britain | $101 |

| New Haven | $144 |

| Norwalk | $111 |

| Stamford | $120 |

| Waterbury | $114 |

Ultimately, while the car insurance in CT requirements set the legal baseline, the right level of coverage depends on your personal financial situation and risk tolerance.

A robust policy that goes beyond the car insurance in Connecticut requirements can prevent you from bearing significant out-of-pocket expenses in case of a major accident. Evaluating your needs carefully will help you choose a policy that balances affordability and comprehensive protection.

Meeting Connecticut Minimum Auto Insurance Requirements

Understanding and meeting Connecticut’s minimum auto insurance requirements ensures you stay compliant with state laws while protecting your finances in the event of an accident.

While the mandated 25/50/25 coverage provides basic protection, exploring higher coverage options can safeguard you against unexpected expenses. Comparing rates from top providers like Geico, USAA, and Travelers is the easiest way to find affordable coverage that fits your budget.

If you’re looking for cheap auto insurance in Connecticut, don’t miss out on our free comparison tool below. Just enter your ZIP code and compare rates now.

Frequently Asked Questions

Is liability coverage the only requirement in Connecticut?

Yes, liability coverage is the primary requirement in Connecticut. It ensures that you have financial protection in case you cause injury or property damage to others while operating a vehicle. However, it’s important to note that liability coverage only covers damages to others, not your own vehicle. See our guide to compare the cheapest liability-only auto insurance companies.

What are the minimum auto insurance requirements in Connecticut?

In Connecticut, the minimum auto insurance requirements include liability coverage. The minimum liability coverage limits are as follows:

- $25,000 bodily injury liability coverage per person

- $50,000 bodily injury liability coverage per accident

- $25,000 property damage liability coverage per accident

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Are there any additional coverage options beyond the minimum requirements in Connecticut?

While liability coverage is the minimum requirement, Connecticut drivers have the option to purchase additional coverage to enhance their protection. Some common optional coverage options include collision coverage, comprehensive coverage, uninsured/underinsured motorist property damage coverage, and medical payments coverage. These coverages provide added financial protection in various scenarios.

How much is car insurance in Connecticut?

The cost of car insurance in Connecticut depends on factors such as age, driving history, and coverage levels. On average, rates start at around $32/month for minimum coverage, with full coverage costing more.

Are there penalties for driving without insurance in Connecticut?

Yes, driving without insurance in Connecticut can result in penalties. These penalties may include fines, license suspension, vehicle impoundment, and the requirement to file an SR-22 auto insurance form (proof of financial responsibility) with the Connecticut Department of Motor Vehicles (DMV).

What happens if I don’t meet the CT auto insurance requirements?

Failing to meet CT auto insurance requirements can result in penalties such as fines, suspension of your registration or license, and mandatory hearings to resolve compliance issues.

Is minimum car insurance coverage in CT enough?

While minimum car insurance coverage in CT meets legal requirements, it may not be sufficient to cover significant accident costs. Additional coverage can protect your finances in major accidents.

How can I prove my insurance coverage in Connecticut?

In Connecticut, you can provide proof of insurance coverage through various means, including:

- Insurance ID card issued by your insurance company

- Digital proof of insurance on your smartphone or other electronic device

- Documentation of coverage provided by your insurance company

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Can I choose higher coverage limits than the minimum requirements in Connecticut?

Yes, you can opt for higher coverage limits for greater financial protection. This is particularly useful if you want to cover potential damages that exceed Connecticut car insurance minimums.

How does Connecticut enforce car insurance laws?

Auto insurance Connecticut requirements are enforced through random checks, penalties for uninsured drivers, and the requirement to show proof of insurance during vehicle registration or traffic stops.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.