Collision vs. Comprehensive Auto Insurance Explained in 2025 (Key Points Outlined)

Regarding collision vs. comprehensive auto insurance, both play an important role in protecting your vehicle. Collision covers vehicle collisions, while comprehensive covers animal collisions, weather incidents, and more. Collision and comprehensive coverage can be added to your policy for an average of $24/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Figuring out the difference between comprehensive and collision insurance can be tricky since they both involve damage to your vehicle. In this guide, we’ll break down comprehensive vs. collision insurance so you know if you should add either or both to your policy.

Collision car insurance coverage pays for damages to your vehicle from a collision. On the other hand, comprehensive auto coverage pays for damages unrelated to an accident, like fire, theft, vandalism, and floods. Adding collision and comprehensive insurance to your policy is usually affordable, with rates starting at just $24 per month.

Keep reading to learn more about comprehensive coverage vs. collision coverage and see if you should have them. To find affordable collision and comprehensive insurance, enter your ZIP in our free quote tool.

- Collision coverage pays for damages resulting from a collision with another vehicle

- Comprehensive coverage covers damage from fire, theft, and vandalism

- Both collision and comprehensive require you to pay a claims deductible

Difference Between Collision and Comprehensive Coverage

There are many types of auto insurance coverage, and knowing what you need can get confusing. For example, while most states require drivers to carry liability coverage, no state requires comprehensive and collision insurance, so adding comprehensive or collision coverage is up to the driver.

Typically, adding both coverages costs less than $2 a day. Take a look at the different rates for the two coverages at top companies.

Collision and Comprehensive Auto Insurance Monthly Rates by Provider

| Insurance Company | Collision | Comprehensive |

|---|---|---|

| $25 | $13 | |

| $20 | $10 | |

| $28 | $15 | |

| $18 | $9 | |

| $30 | $17 |

| $22 | $12 |

| $27 | $14 | |

| $21 | $11 | |

| $26 | $14 | |

| $16 | $8 |

So, what is the difference between a comprehensive vs. collision deductible? Comprehensive and collision insurance are two types of coverage that can be included in an auto insurance policy. The main difference between a comprehensive and collision deductible is the type of damage they cover.

Both comprehensive and collision auto insurance cover the insured vehicle for damage, but how the car is damaged makes a difference. Collision auto insurance covers accident damage, while comprehensive auto insurance covers damage from acts of nature.Dani Best Licensed Insurance Producer

Typically, drivers add both coverages to their insurance policies to cover all types of damage. Additionally, many insurance companies offer them as a package.

When deciding if you need to file a comprehensive vs. a collision claim, consider how the damage to your car occurred. You won’t be able to file both, so file a collision claim if you were in an accident and a comprehensive auto claim for most other damages.

Is comprehensive and collision coverage the same as full coverage? Full coverage auto insurance includes collision, comprehensive, liability, and other state-mandated coverages. Keep in mind that states requiring insurers to cover broken windshields and glass also require drivers to carry full coverage to get the benefit.

What Collision Auto Insurance Covers

What does collision car insurance cover? Collision coverage is insurance that pays for damage to your vehicle from an accident. However, it doesn’t cover damage from other sources, such as fire, theft, or vandalism.

According to the Insurance Information Institute, collision coverage pays for damages from:

- Collisions With Vehicles and Stationary Objects

- Someone Hitting Your Vehicle

- A Hit-and-Run

- A Single-Car Rollover Accident

- Hitting a Pothole

About 75% of drivers choose to carry collision coverage. However, collision only covers your vehicle. It won’t pay for injuries from an accident. You’ll need personal injury protection and/or medical payments coverage to handle injury costs.

So, does insurance cover hydroplaning or driving into a pothole? You can file a collision claim for damages to your car from accidents such as hydroplaning and hitting a tree, breaking a rim from a pothole, or someone hitting your parked car and leaving.

Wondering who pays if someone else damages your car? Although collision coverage pays for damage to your car that you cause, you may also be able to use it if someone else damages your car.

If another driver damages your car, you will file a claim on their liability coverage. However, if you cannot file with the other insurance company, you can file a claim with your insurer under your collision coverage.

Your claim would be subject to your deductible, and your car insurance rates may increase after filing the claim. If possible, file your accident claim with the other insurance company. Although dealing with another insurer may be more challenging, you’ll avoid paying a deductible and keep your rates low.

What Comprehensive Auto Insurance Covers

Comprehensive insurance does not cover a collision with another car or object but does cover a stolen vehicle, hail, or vandalism damages. So, what does comprehensive insurance mean?

When it comes to car insurance, comprehensive vehicle insurance pays for damages from:

- Fire, Terrorism, and Riots

- Theft and Vandalism

- Falling Debris

- Natural Disasters

- Animal Collisions

Since comprehensive coverage pays for damages from unforeseen circumstances usually out of a driver’s control, almost 80% of drivers add it to their policies.

Insurance covers your car in the event of an accident, but what about vandalism or bad weather?😱That’s where comprehensive coverage comes in! At https://t.co/27f1xf131D, we want to help you decide if this coverage add-on is worth it! Learn more here👉: https://t.co/ii0sdamcEp pic.twitter.com/BSMBfTAaIx

— AutoInsurance.org (@AutoInsurance) May 31, 2023

Wondering does my comprehensive insurance cover stolen cars? A stolen car is covered if you have comprehensive coverage. Although, on average, almost two cars are stolen every minute in the U.S., major cities have a much higher theft rate than rural areas.

While comprehensive insurance pays if your car is stolen, it’s generally cheaper and easier to prevent theft in the first place. Keep your doors locked, add anti-theft devices like alarms, and consider adding devices that keep your car from starting, like a kill switch.

In addition, many GPS devices are available that track your vehicle and make recovery easier. Although some cars have features like On-Star, it’s easy to add aftermarket devices to keep your vehicle safe.

Comprehensive car insurance does have its limits, too. For example, comprehensive covers a stolen vehicle, but items stolen from your car are not covered. Your homeowners’ or renters’ insurance may cover things like phones and laptops stolen from your vehicle.

However, comprehensive car insurance coverage pays for damages from a variety of causes. For example, you can file a comprehensive claim if you hit a deer, a tree falls on your car, or your car is stolen.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cost of Comprehensive and Collision Auto Insurance

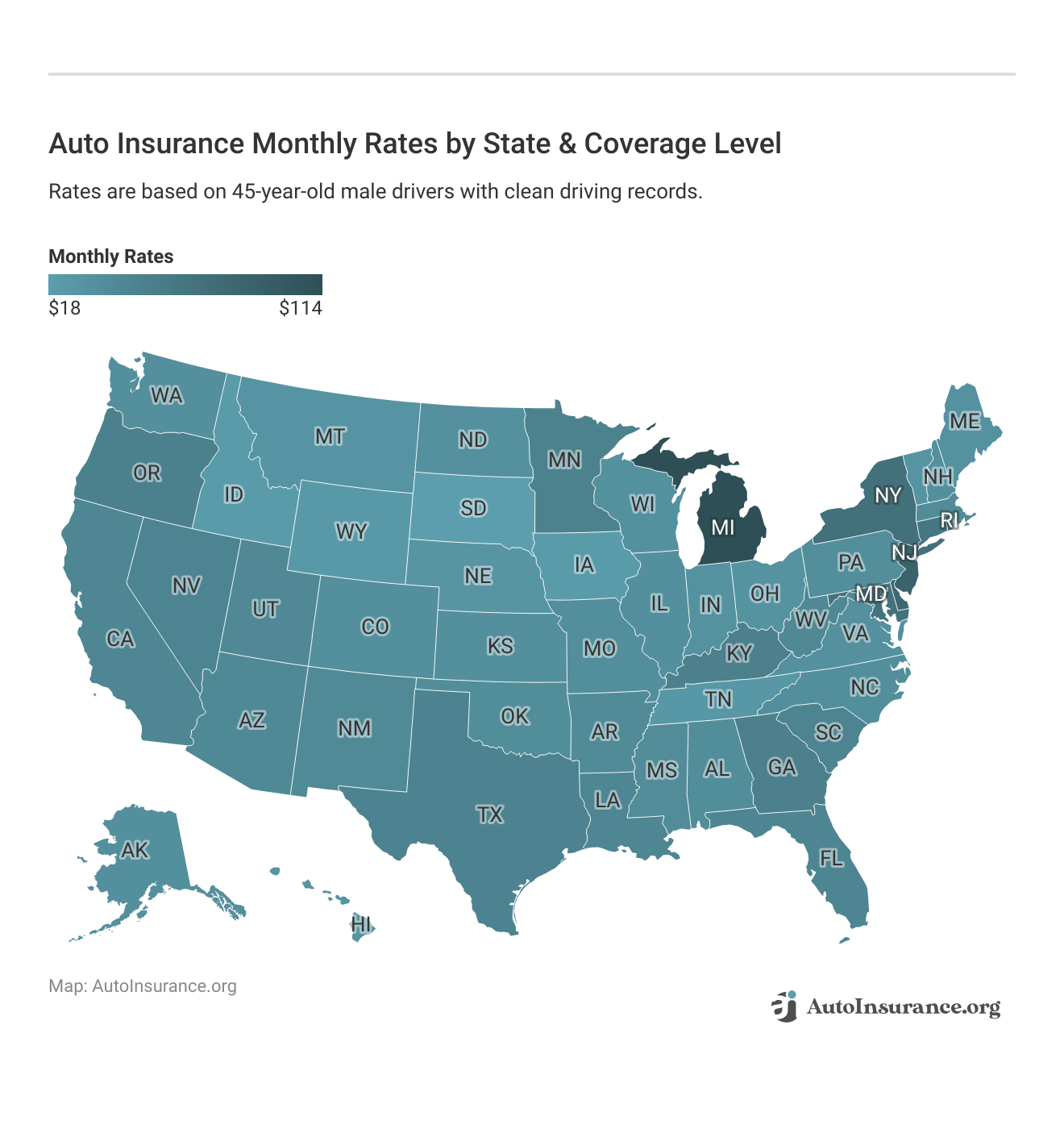

Considering what comprehensive car insurance and collision car insurance cover, the cost is inexpensive. When it comes to comprehensive vs. collision auto insurance, comprehensive is usually the cheaper coverage. Although rates vary from driver to driver and state to state, adding collision and comprehensive auto insurance for full coverage raises your car insurance rates very little.

This map shows average monthly rates for full coverage in each state.

Since rates vary by different auto insurance companies, shop around for affordable coverage by gettting quotes from companies like Geico.

Geico is usually an affordable option, but it’s not always the cheapest auto insurance company. Make sure to compare as many quotes as possible to ensure you get the lowest rates in your area.

Collision and Comprehensive Deductibles

Do you have to pay a deductible for collision and comprehensive coverage? A deductible is the amount of money you have to pay before your car insurance kicks in. While deductibles vary, most range between $500-$1,000. You can choose your comprehensive and collision deductibles, and they don’t have to be the same amount.

It’s essential to consider your deductible when filing a claim. For example, if the damage to your vehicle is $500, but your deductible is $1,000, your insurance won’t cover any of the costs. However, if the damage to your car is $1,000 and your deductible is $500, then your insurance would cover that other $500.

Learn more: What is a good deductible for auto insurance?

Remember that your car insurance rates may rise after filing a claim, so determine if it is worth it. It may be cheaper to pay for repairs yourself and keep your insurance rates low.

Maximum Auto Insurance Payouts

What is the maximum payout for car insurance? If your car is damaged, your car insurance company will only pay so much to repair it. If damages are too extensive, your insurer may consider the vehicle totaled. The maximum payout you receive will depend on the value of your car before it was damaged.

Read more: How to Dispute an Auto Insurance Claim

An insurance company may total your car if repairs don’t make it safe to drive, repairs cost more than the vehicle is worth, or repairs cost more than a high percentage of the vehicle’s worth.

For example, if your car is worth $5,000, but repairs cost $6,000, your insurance company will total your car. Also, some insurers may total the vehicle if repairs cost 75% of the value. Even a new car can quickly reach the threshold. Since technology is so costly, repairs can be expensive for newer cars. In addition, a new vehicle can be totaled if extensive damages are sustained.

Buying Only Comprehensive or Collision Auto Insurance

When it comes to deciding about adding comprehensive vs. collision coverage, many drivers wonder if they can purchase one type without the other. Unfortunately, most insurance companies won’t sell one without the other.

If you want collision and comprehensive auto insurance coverage, insurance companies will likely offer you a full coverage auto insurance policy. That way, you’ll have the comprehensive damage coverage you want with the insurance required by your state.

The one exception to this rule is that you can sometimes purchase comprehensive excluding collision insurance. If you plan to leave your car parked safely in a garage for an extended period of time, you may be able to purchase auto comprehensive insurance without collision.

Full Coverage vs. Comprehensive and Collision Auto Insurance

A common question that arises when drivers are looking at collision vs. comprehensive insurance is if buying both means you have a full coverage policy. While comprehensive and collision car insurance is part of a full coverage policy, that’s not all that’s included.

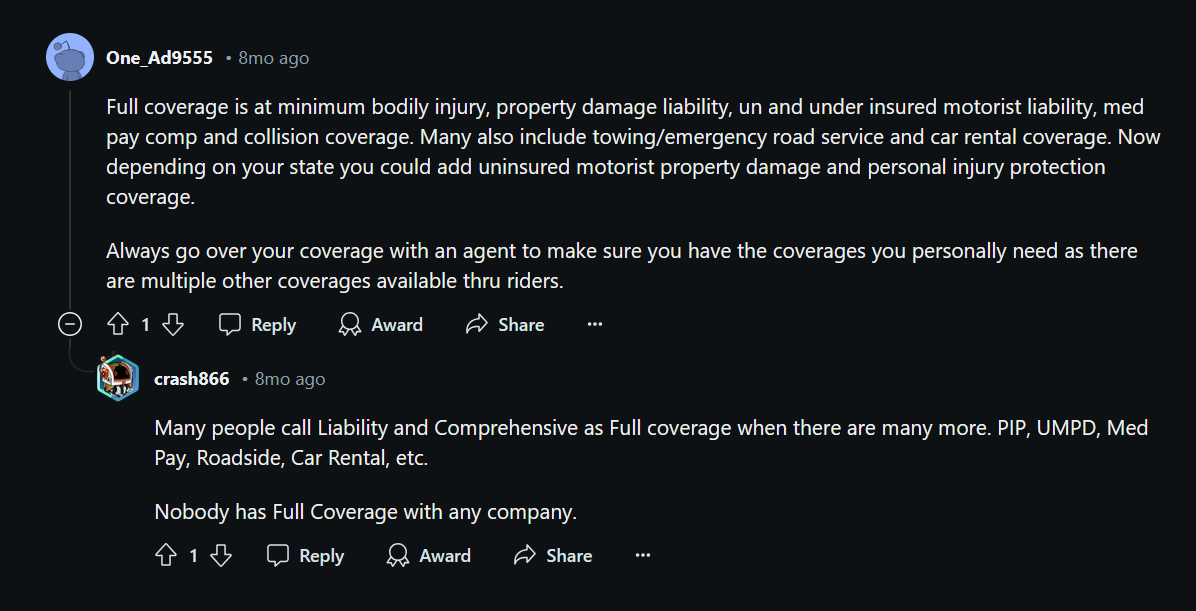

However, figuring out what full coverage means can be confusing. In fact, the meaning of full coverage is often debated, as you can see with these Reddit users asking, “Is comprehensive insurance full coverage?”

While these Reddit users couldn’t agree on a definition, a standard full coverage car insurance policy includes comprehensive car coverage, collision insurance, and the following:

- Liability Insurance: Liability auto insurance is split into two parts: bodily injury and property damage. This coverage pays for damage you cause to other people and their vehicles or property in an accident.

- Uninsured/Underinsured Motorist Coverage: Most states require insurance before you can drive, but that doesn’t mean everyone follows the law. Uninsured/underinsured motorist coverage protects you against drivers with inadequate coverage.

- Personal Injury Protection/Medical Payments: Depending on the state you live in, you can purchase personal injury protection (PIP) insurance or medical payments (MedPay) to cover health care costs after an accident.

When deciding between comprehensive vs. collision insurance, determining if a full coverage policy would be best for you is an important step to take. It costs more than a minimum insurance policy, full coverage offers much better protection.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Deciding if Comprehensive and Collision Insurance Are Right for You

Do I need comprehensive and collision coverage? While collision and comprehensive coverage are inexpensive, some drivers may not want the added expense. For example, you might skip additional coverage if your vehicle is older or not worth much money. However, there are times when you need added protection.

You should get comprehensive or collision car insurance if:

- You can’t afford to repair or replace your vehicle out of pocket

- You have a car loan or lease

- You live in an area with severe weather, a large traffic volume, or high theft rates

Most lenders require you to use collision and comprehensive coverage to protect their investment. However, once your loan is paid off or your lease is over, you can drop comprehensive and collision coverage if you like. Additionally, you may drop comprehensive coverage if you can pay to repair or replace your vehicle out of pocket.

Read more: Cheap Auto Insurance for Older Vehicles

Should I get collision and comprehensive insurance? If you cannot pay to replace or repair your car, adding collision and comprehensive coverages to your policy is inexpensive and will provide the protection you need. If you need help deciding between comprehensive vs. collision car insurance, an insurance representative can help.

Rental Car Insurance

Does my car insurance include rental cars? Your insurance coverage usually extends to a rental car, but it doesn’t pay for the rental itself. So, if you’re in an accident in a rental car, your personal car insurance may cover the damages. But the cost of renting the car isn’t covered.

If your car is in the shop from a covered claim and you need a rental car, you need rental car reimbursement to cover the costs. Rental car reimbursement is a benefit you must add to your policy and costs extra.

However, there is a limit to what your insurance covers. For example, it may pay $25 a day for 30 days for a rental car. You would pay anything over that cost.

Comprehensive Car Insurance vs. Collision Car Insurance: The Bottom Line

Collision and comprehensive coverages are often purchased together. Both comprehensive and collision coverage cover damages to your vehicle. However, collision covers accidents, and comprehensive covers damage unrelated to an accident.

Although no minimum auto insurance requirements by state require collision or comprehensive, the additional coverage is inexpensive and provides more protection than just liability. Consider adding comprehensive and collision coverage if you can’t afford to repair or replace your vehicle yourself. Additionally, most lenders require both coverages if you have a car loan or lease.

Most drivers find the added benefits and peace of mind that come with collision and comprehensive coverage far outweigh the increased car insurance rates. Shop for affordable collision and comprehensive car insurance today by entering your ZIP code into our free quote tool.

Frequently Asked Questions

What is collision and comprehensive auto insurance?

Collision auto insurance is a type of coverage that helps pay for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or object, regardless of who is at fault. The meaning of comprehensive is auto insurance coverage that helps pay for damage to your vehicle that is not caused by a collision.

What does collision insurance cover?

Collision auto insurance typically applies to accidents such as hitting another car, colliding with a tree or building, or flipping your vehicle. It may cover you if you’re the victim of a hit-and-run, too, but you’ll need to check with a representative.

What does comprehensive car insurance cover?

So, what is covered under comprehensive auto insurance? Comprehensive auto insurance provides coverage for damage to your vehicle that occurs due to incidents other than collisions. It typically covers events such as theft, vandalism, natural disasters, falling objects, fire, and animal collisions, such as hitting a deer (learn more: Does hitting a deer affect auto insurance rates?).

Comprehensive coverage is often optional, but it can provide valuable protection for your vehicle. Shop for affordable comprehensive insurance today by entering your ZIP in our free quote tool.

Do I need both collision and comprehensive coverage?

The need for collision and comprehensive coverage depends on your individual circumstances and the value of your vehicle. If you have a newer or more expensive car, having both coverages can provide better protection. However, if you have an older vehicle with low value, you might consider the cost of the coverage compared to the potential benefit when deciding whether to purchase both or just one.

What is the difference between collision and comprehensive insurance?

Collision insurance covers damages resulting from accidents involving other vehicles or objects, regardless of fault. It focuses on repairs or replacement of your vehicle. On the other hand, comprehensive insurance covers a broader range of events, such as theft, vandalism, or natural disasters, but excludes collision-related damages. It provides coverage for various incidents that can cause damage to your vehicle, excluding collision accidents.

Are collision and comprehensive insurance required by law?

In most states, collision and comprehensive auto insurance are not required by auto insurance laws. However, if you finance or lease your vehicle, your lender or leasing company may require you to have comprehensive and collision coverage until you fully own the car. Additionally, some states may require these coverages if you have a history of accidents or violations.

Will collision or comprehensive insurance cover medical expenses or liability claims?

No, collision and comprehensive insurance do not typically cover medical expenses or liability claims resulting from an accident. They primarily focus on providing coverage for damages to your vehicle. To cover medical costs or liability claims, you would need to have separate insurance policies such as personal injury protection (PIP) or bodily injury liability insurance.

What is the basic difference between liability insurance and collision insurance?

Liability insurance covers damage you cause to other people’s vehicles or property in an accident where you are at fault. It does not cover damage to your own vehicle.

Collision insurance covers damage to your own vehicle that occurs as a result of a collision, regardless of fault.

Which is better, collision or comprehensive insurance?

Whether it is better to have collision or comprehensive depends on your needs. If you want coverage for damage to your own vehicle from collisions, collision insurance is necessary. If you want coverage for a broader range of risks, including theft, vandalism, and natural disasters, comprehensive insurance may be more suitable (read more: How much car insurance do I need?).

What is the difference between collision, liability, and comprehensive auto insurance?

Collision insurance covers damage to your vehicle from collisions with other vehicles or objects. Liability insurance covers damage you cause to others in an accident where you are at fault. Comprehensive covers damage to your vehicle from non-collision incidents such as theft, vandalism, and natural disasters.

Is hitting road debris covered under comprehensive insurance?

Yes, hitting road debris is typically covered under comprehensive insurance, as it is considered damage resulting from a non-collision incident.

Does comprehensive cover a hit-and-run accident?

Yes, comprehensive insurance can cover damage to your vehicle resulting from a hit-and-run accident, as it falls under non-collision incidents (read more: Does car insurance cover a hit-and-run?).

What does comprehensive deductible mean?

A comprehensive deductible is the amount of money you agree to pay out of pocket before your comprehensive insurance coverage kicks in to cover the cost of repairs or replacement for damages.

What falls under comprehensive auto insurance?

Non-collision incidents, including theft, vandalism, fire, natural disasters (such as hail or floods), falling objects, and collisions with animals (like hitting a deer).

What is a comprehensive claim for car insurance?

A comprehensive claim for car insurance is a claim made to your insurance company for damages to your vehicle that are covered under your comprehensive insurance policy (learn more: How to File an Auto Insurance Claim).

How does liability insurance differ from comprehensive or collision insurance?

Liability insurance covers damages you cause to others in an accident where you are at fault. Comprehensive insurance covers damages to your vehicle caused by non-collision incidents. Collision insurance covers damages to your vehicle resulting from collisions with other vehicles or objects.

If my car is hit while parked, is it comprehensive or collision insurance that covers the damage?

If your car is hit in a parking lot, you should know whether collision or comprehensive covers the damage. So, if the at-fault driver leaves the scene, it is typically covered under your comprehensive insurance policy (learn more: Hitting a Parked Car, Auto Insurance Implications).

Is a pothole covered under collision or comprehensive?

Damage from hitting a pothole is typically covered under collision insurance since potholes are considered road hazards.

What are the benefits of comprehensive car insurance?

Comprehensive car insurance provides financial protection against a wide range of risks that may not be covered by other types of insurance.

Is collision insurance worth it?

Whether collision insurance is worth it depends on factors such as the value of your vehicle, your driving habits, and your financial situation. Collision insurance can be valuable if you drive a newer or luxury car, as it helps cover the cost of repairs or replacement in the event of a collision (read more: Best Auto Insurance for Luxury Cars).

Is collision or comprehensive more important?

Both collision and comprehensive insurance serve different purposes. If you want coverage for damages to your vehicle resulting from collisions with other vehicles or objects, then collision coverage may be worth it. If you want coverage for other risks, such as theft, vandalism, and natural disasters, comprehensive coverage may be a better choice.

Is hitting a pedestrian covered under collision or comprehensive?

Hitting a pedestrian is covered under liability insurance, which is a separate coverage from collision or comprehensive insurance. Worried about your safety as a pedestrian? Check out our guide to the safest states for pedestrians.

Is comprehensive car insurance worth it?

Comprehensive car insurance can be worth it if you want coverage for damages to your vehicle from non-collision incidents.

How long does it take to repair a car?

There is no set time for car repairs. While the national average is around 11 days, the time it takes to get your car repaired varies depending on your area and how extensive the damage is. For example, if you live in a large city and your car is severely damaged, it may take weeks to repair your vehicle. In addition, if your car requires specialty parts, your wait time increases.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.