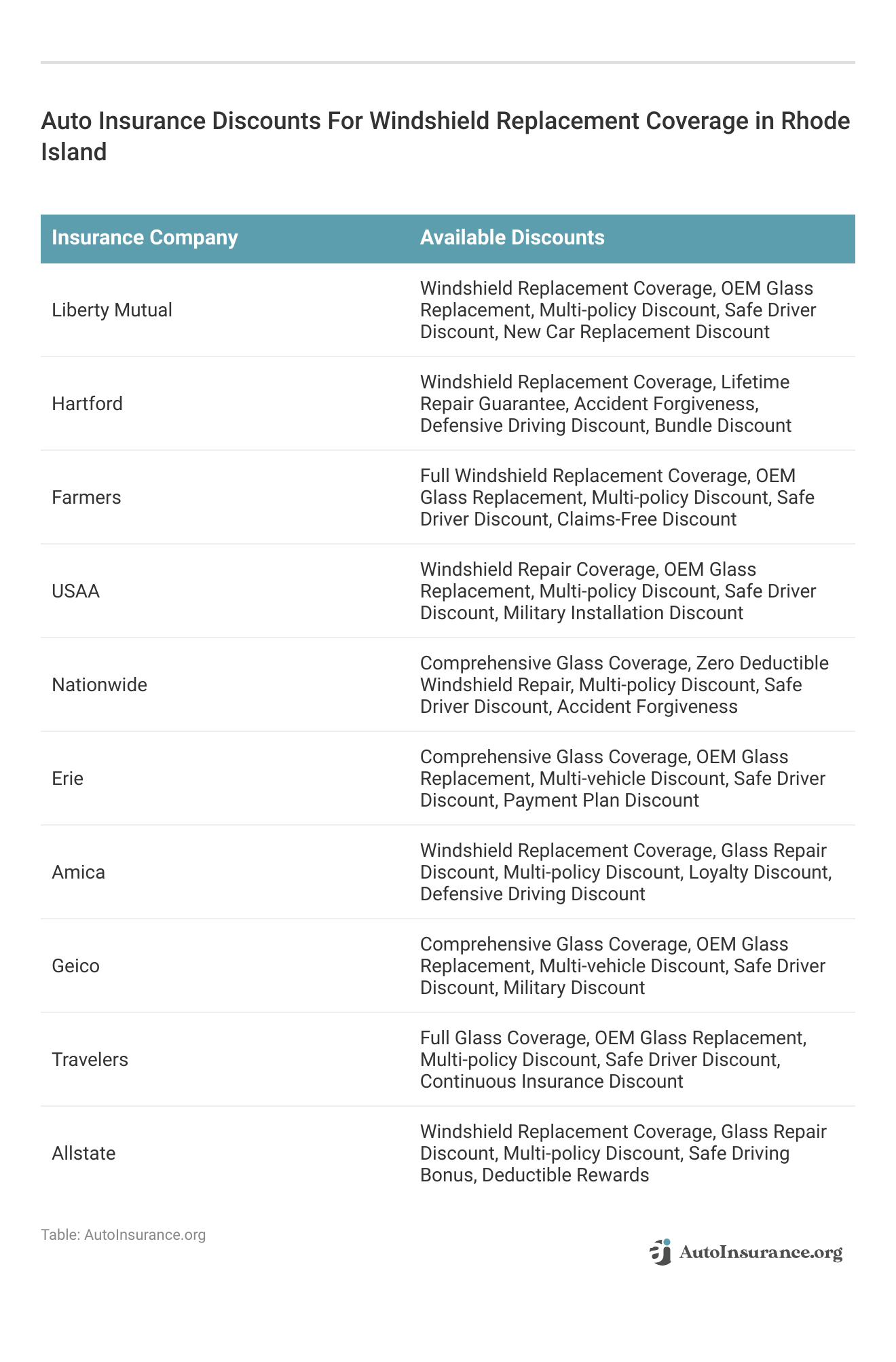

Best Windshield Replacement Coverage in Rhode Island (Top 10 Companies Ranked for 2025)

Liberty Mutual, The Hartford, and Farmers offer the best windshield replacement coverage in Rhode Island, starting at only $55 per month. We aim to help you compare quotes from these providers, ensuring you obtain the most appropriate coverage and personalized discounts for your vehicle.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,792 reviews

3,792 reviewsCompany Facts

Full Coverage Windshield Replacement in Rhode Island

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 765 reviews

765 reviewsCompany Facts

Full Coverage Windshield Replacement in Rhode Island

A.M. Best

Complaint Level

Pros & Cons

765 reviews

765 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage Windshield Replacement in Rhode Island

A.M. Best

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews- Liberty Mutual provides economical rates starting at $55 per month

- Leading insurance companies offer options for windshield replacements

- There are numerous opportunities to save on coverage for windshield replacement

#1 – Liberty Mutual: Top Overall Pick

Pros

- Comprehensive Coverage: Liberty Mutual offers comprehensive coverage options, including windshield replacement, providing peace of mind for Rhode Island drivers.

- Competitive Rates: With rates starting at $55 per month, Liberty Mutual offers competitive pricing for their windshield replacement coverage.

- Personalized Discounts: Liberty Mutual offers personalized discounts, allowing drivers to potentially save more on their premiums based on their driving habits and history.

Cons

- Limited Availability: Liberty Mutual’s coverage may not be available in all areas of Rhode Island, limiting options for some drivers. Find out more through our Liberty Mutual auto insurance review.

- Claim Processing Time: Some customers have reported longer-than-average claim processing times with Liberty Mutual, leading to delays in getting windshield replacement coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – The Hartford: Best for Exclusive Benefits

Pros

- Exclusive Benefits: The Hartford offers exclusive benefits to policyholders, such as additional perks and services beyond standard coverage. Find out more through our The Hartford auto insurance review.

- Excellent Customer Service: The Hartford is known for its exceptional customer service, providing support and guidance throughout the claims process.

- Flexible Policy Options: The Hartford offers flexible policy options, allowing drivers to customize their coverage to suit their individual needs and preferences.

Cons

- Higher Premiums: The Hartford’s premium rates may be higher compared to some other providers, potentially making it less affordable for budget-conscious drivers.

- Limited Availability: Similar to Liberty Mutual, The Hartford’s coverage may not be available in all areas of Rhode Island, limiting options for some drivers.

#3 – Farmers: Best for Great Add-ons

Pros

- Wide Range of Coverage: Farmers, as mentioned in our Farmers auto insurance review, offers a wide range of coverage options, including comprehensive coverage for windshield replacement, ensuring drivers have adequate protection on the road.

- Discount Opportunities: Farmers provides various discount opportunities for policyholders, making it possible for drivers to save money on their premiums.

- Quick Claim Processing: Farmers is known for its efficient claim processing, allowing drivers to get their windshield replaced promptly after filing a claim.

Cons

- Higher Deductibles: Some policyholders may find Farmers’ deductible amounts for windshield replacement to be higher compared to other providers, resulting in higher out-of-pocket costs.

- Limited Policy Customization: Farmers’ policy options may be somewhat limited compared to other providers, potentially limiting flexibility for drivers who require specific coverage needs.

#4 – USAA: Best for Military Drivers

Pros

- Exceptional Customer Service: USAA is renowned for its outstanding customer service, providing support and assistance to policyholders throughout the claims process.

- Competitive Rates: USAA offers competitive rates for windshield replacement coverage, ensuring affordability for its members. Find out more through our USAA auto insurance review.

- Membership Benefits: USAA offers various membership benefits beyond insurance, including financial services and discounts on other products and services.

Cons

- Membership Eligibility: USAA membership is limited to military members, veterans, and their families, excluding a significant portion of the population from accessing its insurance products.

- Limited Availability: USAA’s coverage is not available to everyone, as it caters specifically to its eligible members, potentially limiting options for non-military individuals.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Multi-Policy Savings

Pros

- Nationwide Network: Nationwide boasts a vast network of approved auto glass repair shops, making it convenient for policyholders to find a reputable technician for windshield replacement.

- Customizable Policies: Nationwide offers customizable policy options, allowing drivers to tailor their coverage to meet their unique needs and preferences.

- Multi-Policy Discounts: Nationwide offers multi-policy discounts, enabling policyholders to save money by bundling their auto insurance with other insurance products.

Cons

- Average Customer Service: Some customers have reported average or mixed experiences with Nationwide’s customer service, citing issues with responsiveness and communication.

- Policy Limitations: Nationwide’s policies may have limitations and exclusions that could affect coverage for windshield replacement, requiring careful review by policyholders. Learn more through our Nationwide auto insurance review.

#6 – Erie: Best for Personalized Policies

Pros

- Affordable Rates: Erie is known for offering affordable rates for auto insurance coverage, including windshield replacement, making it an attractive option for budget-conscious drivers. Read more through our Erie auto insurance review.

- Flexible Payment Options: Erie offers flexible payment options, allowing policyholders to choose payment plans that best suit their financial situation.

- Strong Financial Stability: Erie has a reputation for financial stability and reliability, providing reassurance to policyholders that their claims will be handled efficiently and effectively.

Cons

- Limited Availability: Erie’s coverage may be limited to certain regions, potentially excluding drivers in areas where the company does not operate.

- Fewer Discounts: Erie may offer fewer discounts compared to other providers, limiting opportunities for policyholders to save money on their premiums.

#7 – Amica: Best for Dividend Payments

Pros

- High Customer Satisfaction: Amica consistently receives high marks for customer satisfaction, with policyholders praising its responsive claims handling and personalized service. Find out more through our Amica auto insurance review.

- Dividend Payments: Amica policyholders may be eligible for dividend payments, allowing them to receive a portion of the company’s profits back as a reward for their loyalty.

- Flexible Coverage Options: Amica offers flexible coverage options, allowing drivers to customize their policies to meet their specific needs and preferences.

Cons

- Higher Premiums: Some drivers may find that Amica’s premiums are higher compared to other providers, potentially making it less affordable for budget-conscious individuals.

- Limited Availability: Amica’s coverage may be limited to certain states or regions, restricting options for drivers outside of its service area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Geico: Best for Cost Savings

Pros

- Cost Savings: Geico is known for offering competitive rates and discounts, helping drivers save money on their auto insurance premiums, including windshield replacement coverage. Read more through our Geico auto insurance review.

- Convenient Online Tools: Geico provides convenient online tools and resources, making it easy for policyholders to manage their policies, file claims, and access information.

- Strong Financial Stability: Geico is backed by the financial strength of its parent company, Berkshire Hathaway, providing policyholders with confidence in the company’s ability to fulfill its obligations.

Cons

- Average Customer Service: Some customers have reported average or mixed experiences with Geico’s customer service, citing issues with responsiveness and communication.

- Limited Coverage Options: Geico may offer fewer coverage options compared to other providers, potentially limiting choices for drivers who require specialized coverage.

#9 – Travelers: Best for Low-Mileage Drivers

Pros

- Wide Range of Coverage: Travelers offers a wide range of coverage options, including comprehensive coverage for windshield replacement, ensuring drivers have adequate protection on the road. Learn more through our Travelers auto insurance review.

- Discount Opportunities: Travelers provides various discount opportunities for policyholders, making it possible for drivers to save money on their premiums.

- Flexible Policy Options: Travelers offers flexible policy options, allowing drivers to customize their coverage to suit their individual needs and preferences.

Cons

- Higher Premiums: Some drivers may find Travelers’ premiums to be higher compared to other providers, potentially making it less affordable for budget-conscious individuals.

- Limited Availability: Travelers’ coverage may not be available in all areas, limiting options for some drivers outside of its service area.

#10 – Allstate: Best for Infrequent Drivers

Pros

- Name Recognition: Allstate is a well-known and established insurance provider, offering a range of coverage options, including windshield replacement, to drivers in Rhode Island.

- Bundle Discounts: Allstate offers discounts for bundling multiple insurance policies, such as auto and home insurance, providing opportunities for policyholders to save money.

- Online Tools and Resources: Allstate provides online tools and resources, allowing policyholders to manage their policies, file claims, and access information conveniently. Use our Allstate auto insurance review as your guide.

Cons

- Mixed Customer Service: Some customers have reported mixed experiences with Allstate’s customer service, citing issues with responsiveness and claims handling.

- Policy Limitations: Allstate’s policies may have limitations and exclusions that could affect coverage for windshield replacement, requiring careful review by policyholders.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Windshield Damage

Rhode Island Windshield Insurance

Filing a Rhode Island Windshield Insurance Claim

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Auto Insurance for Windshield Replacement in Rhode Island: The Bottom Line

Frequently Asked Questions

Does auto insurance in Rhode Island cover windshield replacement?

Yes, in Rhode Island, auto insurance policies typically cover windshield replacement. However, the extent of coverage may vary depending on your specific policy and its terms and conditions.

What type of auto insurance coverage includes windshield replacement in Rhode Island?

Comprehensive auto insurance coverage is the type of policy that typically includes windshield replacement in Rhode Island. Comprehensive coverage helps protect against damage to your vehicle caused by non-collision incidents, such as theft, vandalism, falling objects, and natural disasters, including damage to your windshield. Enter your ZIP code now to begin.

Is windshield replacement covered under liability insurance in Rhode Island?

No, liability auto insurance, which is required in Rhode Island, does not typically cover windshield replacement. Liability insurance covers damages you may cause to others in an accident, not damages to your own vehicle, including windshield damage.

Do I need to pay a deductible for windshield replacement in Rhode Island?

It depends on your auto insurance policy. Some policies have a deductible, which is the amount you must pay out of pocket before your insurance coverage kicks in. If your policy has a deductible, you’ll likely need to pay it before your insurer covers the cost of windshield replacement. However, some policies offer a separate deductible for windshield replacement, which may be lower or even waived.

Are there any specific requirements for windshield replacement to be covered by insurance in Rhode Island?

Generally, to have your windshield replacement covered by insurance in Rhode Island, the damage must be significant enough to warrant a replacement rather than a repair. Additionally, the replacement work should be performed by a qualified and reputable auto glass repair shop. Enter your ZIP code now to start comparing.

Can I choose any auto glass repair shop for windshield replacement in Rhode Island?

Will filing a windshield replacement claim affect my insurance rates in Rhode Island?

In general, filing a windshield replacement claim should not directly impact your insurance rates in Rhode Island. Windshield replacement claims are typically considered “no-fault” claims and are not seen as an indicator of higher risk. However, it’s always a good idea to check with your insurance provider to understand their policies and any potential impact on your rates.

What should I do if my windshield gets damaged in Rhode Island?

If your windshield gets damaged in Rhode Island, you should contact your insurance provider as soon as possible to report the damage. They will guide you through the process and let you know what steps to take, including providing you with information about approved repair shops and any documentation required for the claim. Enter your ZIP code now to begin.

How do the windshield replacement coverage options from Liberty Mutual, The Hartford, and Farmers compare in terms of pricing and coverage benefits?

What are the specific requirements and considerations for filing a windshield replacement claim in Rhode Island, and how do different insurance providers address these requirements?

The article outlines specific requirements for filing a windshield replacement claim in Rhode Island, including the need for comprehensive coverage and the importance of choosing an approved glass technician. Different insurance providers address these requirements through various policy options and claim processing procedures.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.