Best Shreveport, Louisiana Auto Insurance in 2025

The best cheap auto insurance in Shreveport, LA comes from USAA, with rates averaging $335 per month or $4,030 annually. However, only military personnel are eligible to use USAA. State Farm offers the next best Shreveport car insurance rates and is available to everyone. You must buy Shreveport, LA auto insurance that meets the Louisiana state minimum requirements of 15/30/25 for liability coverage. Secure your best premiums by comparing Shreveport auto insurance quotes online.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Sep 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Sep 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- The best cheap auto insurance in Shreveport, LA is from USAA.

- Louisiana auto insurance laws and high rates of uninsured motorists in your state impact your Shreveport car insurance costs.

- Auto insurance in Shreveport costs less than in other major Louisiana cities, like New Orleans and Baton Rouge.

Louisiana auto insurance rates are notoriously high compared to other parts of the country. With our guide’s help, we can teach you to secure cheap auto insurance in Shreveport, LA.

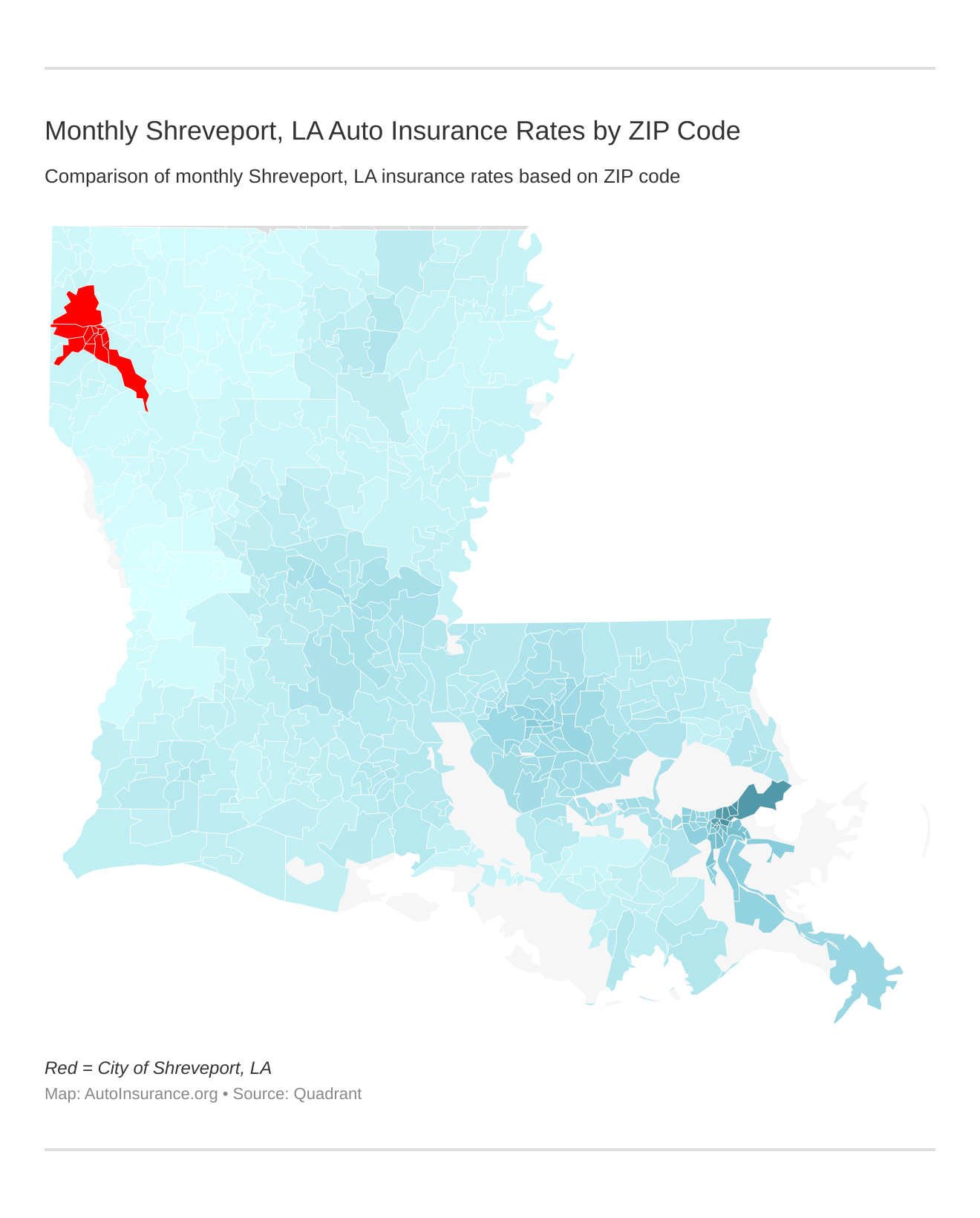

Monthly Shreveport, LA Car Insurance Rates by ZIP Code

Find more info about the monthly Shreveport, LA auto insurance rates by ZIP Code below:

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

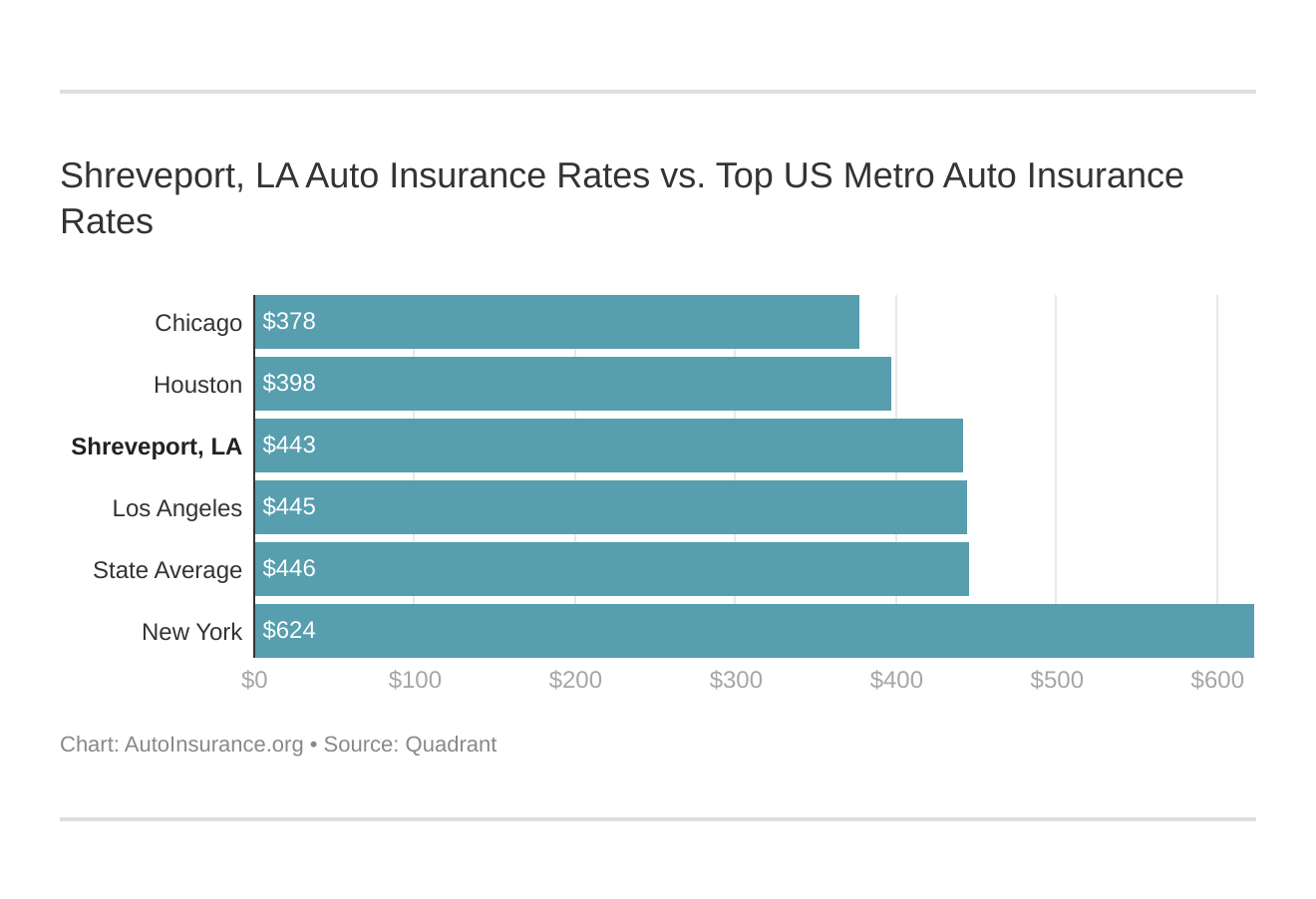

Shreveport, LA Car Insurance Rates vs. Top US Metro Car Insurance Rates

Which city you live in will have a major affect on car insurance. That’s why it’s vital to compare Shreveport, LA against other top US metro areas’ auto insurance rates.

Start comparing affordable Shreveport, LA auto insurance rates for free by entering your ZIP code into our quote tool above.

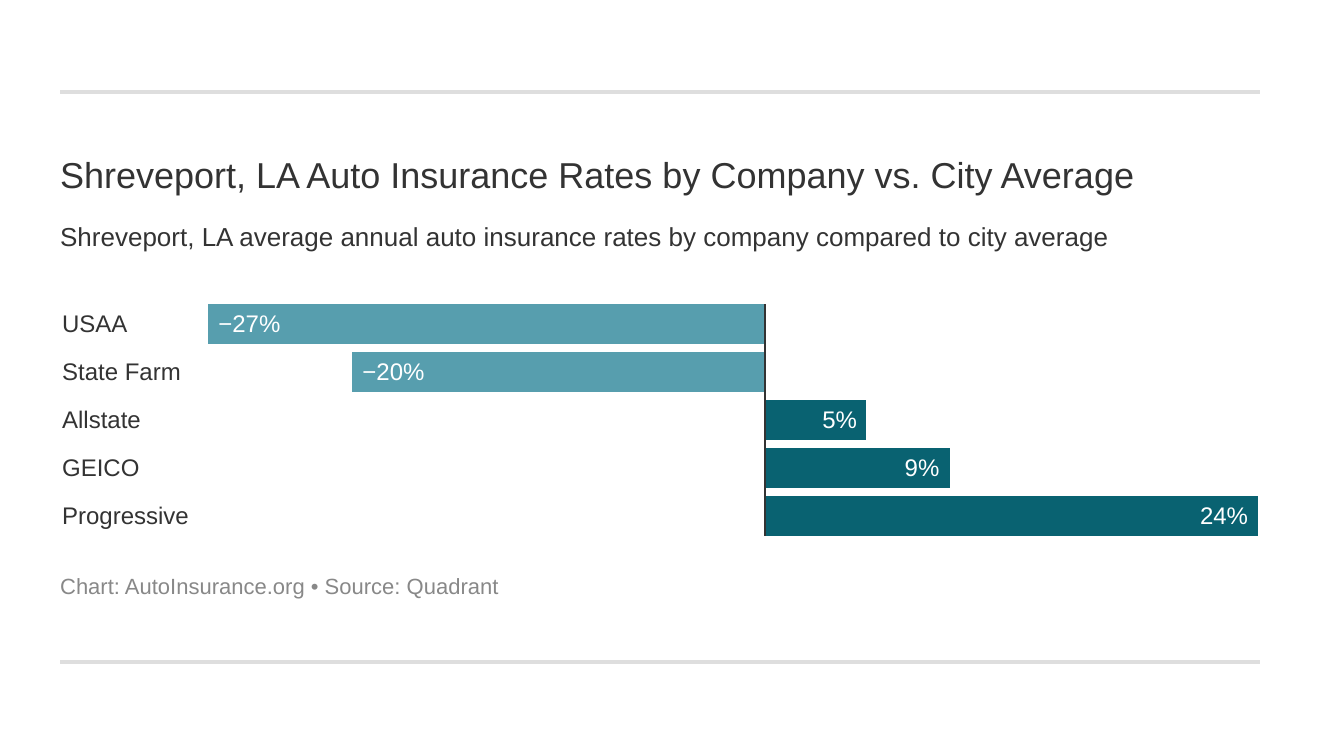

What is the cheapest auto insurance company in Shreveport, LA?

The cheapest average Shreveport, LA auto insurance quotes come from USAA. Most folks pay around $335 per month or $4,030 annually; however, rates vary per person.

Only active or retired military personnel are eligible to use USAA’s services. Therefore, the best Shreveport, LA auto insurance company for civilians is State Farm.

The cheapest Shreveport, LA car insurance company can be discovered below. You then might be asking, “How do those rates compare against the average Louisiana car insurance company rates?” We cover that as well.

Below, see a list of the top insurance providers in your city from cheapest to most expensive:

- USAA – $4,030.60

- State Farm – $4,348.76

- Allstate – $5,584.40

- Geico – $5,801.55

- Progressive – $6,797.69

Your quotes from these companies will look different depending on your age, driving record, and the level of coverage you require. Compare rates from multiple providers to secure your best prices.

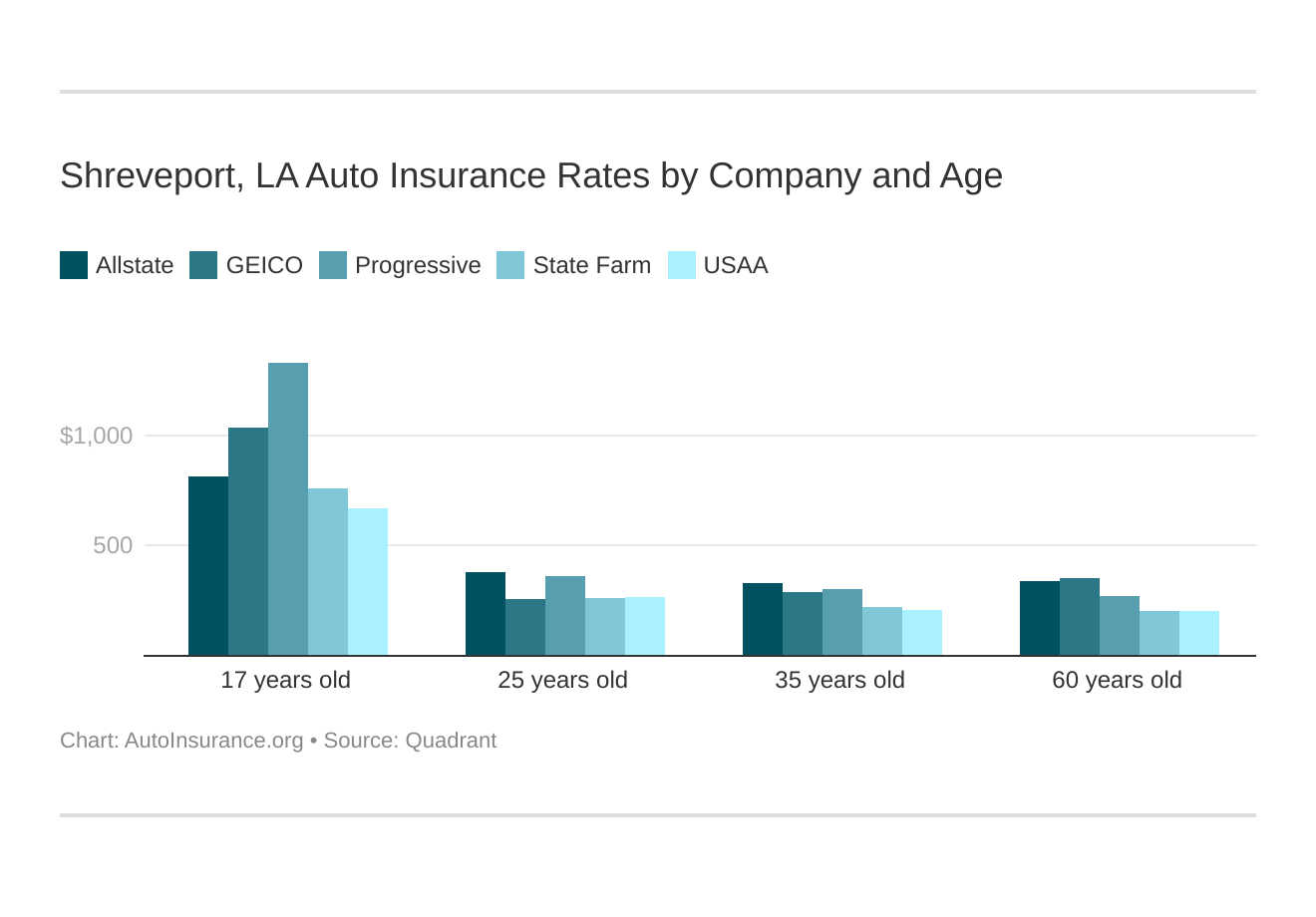

Shreveport, Louisiana car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

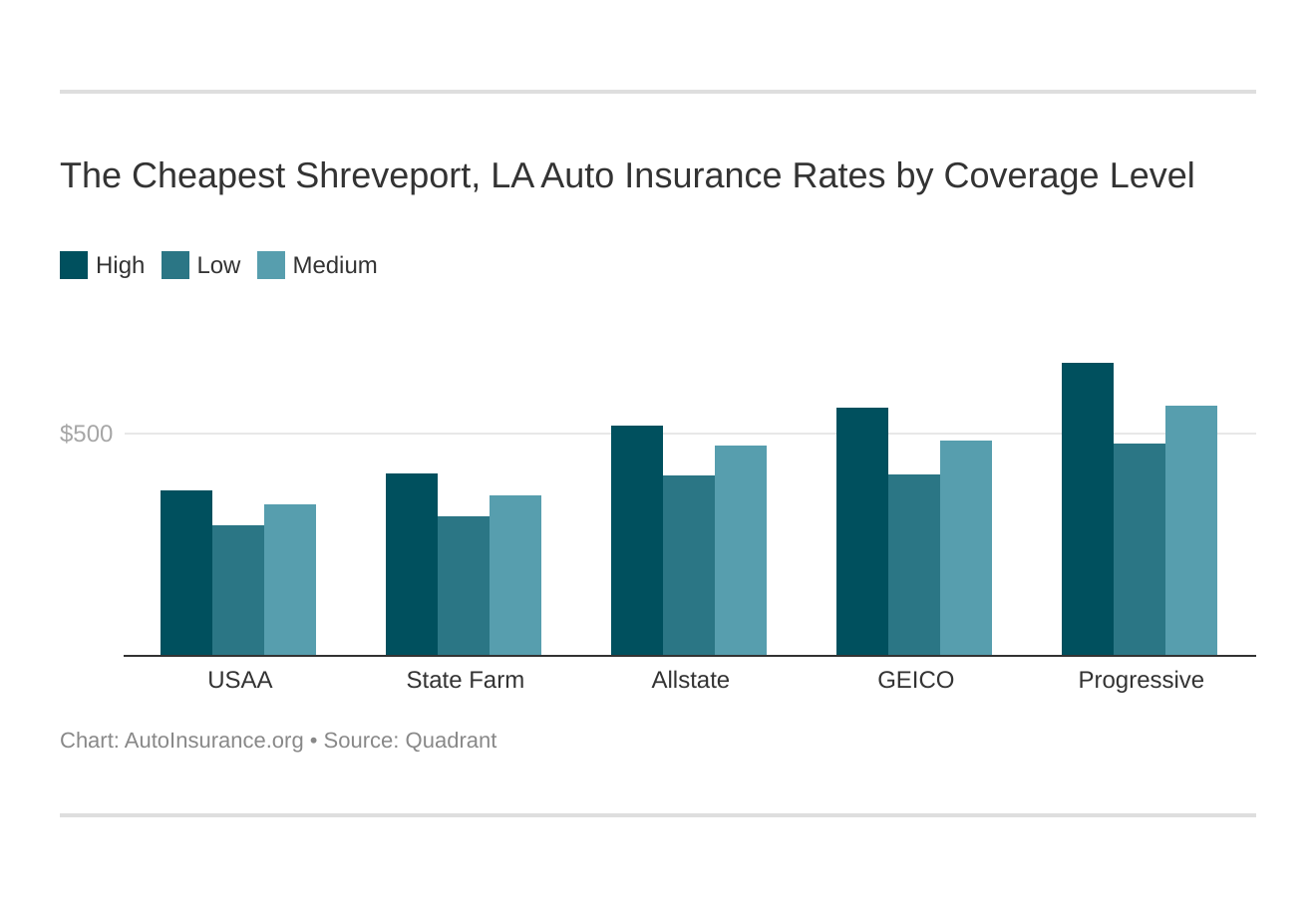

Your coverage level will play a major role in your Shreveport, LA car insurance rates. Find the cheapest Shreveport, LA car insurance rates by coverage level below:

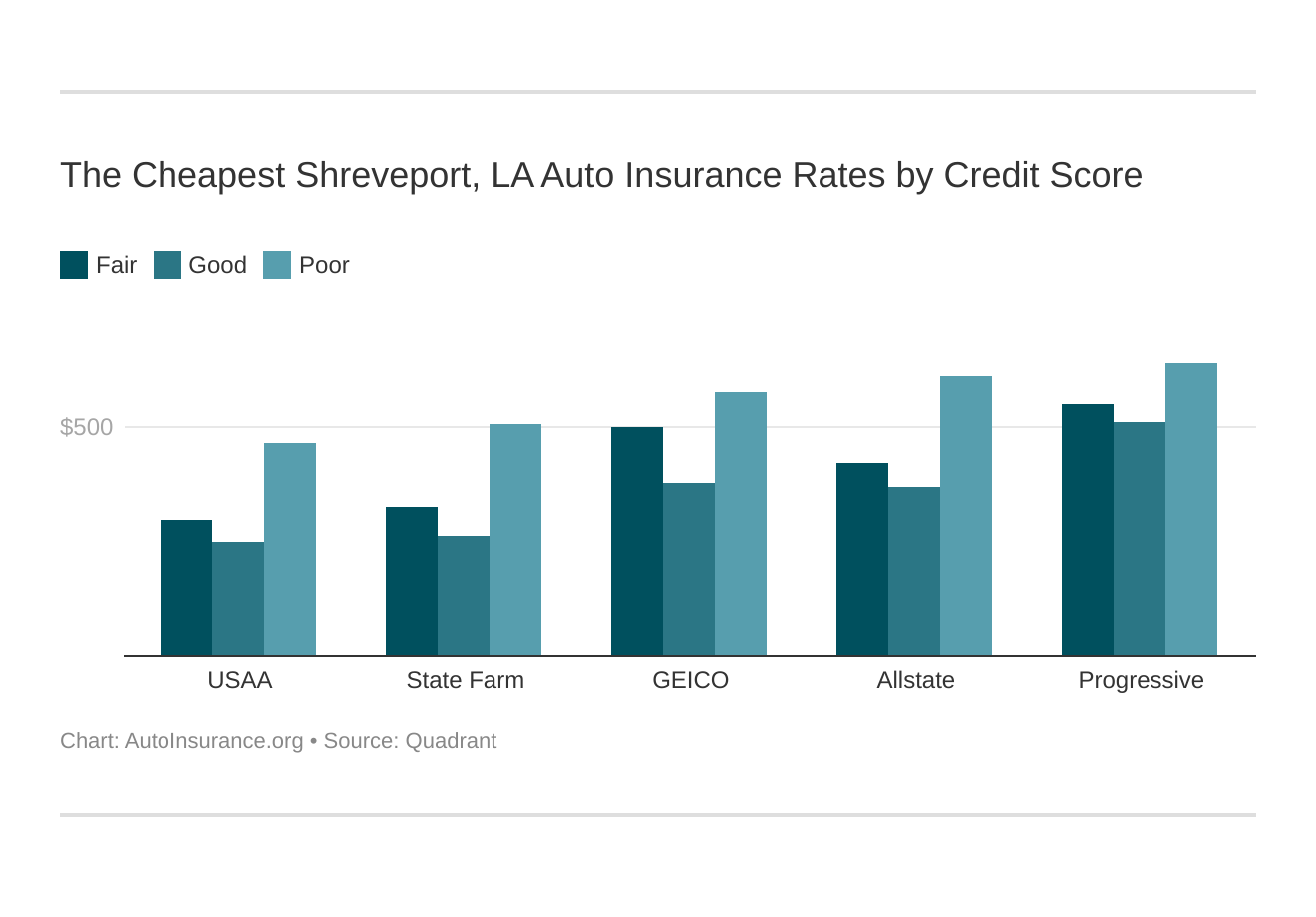

Your credit score will play a major role in your Shreveport, LA car insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Shreveport, Louisiana car insurance rates by credit score below.

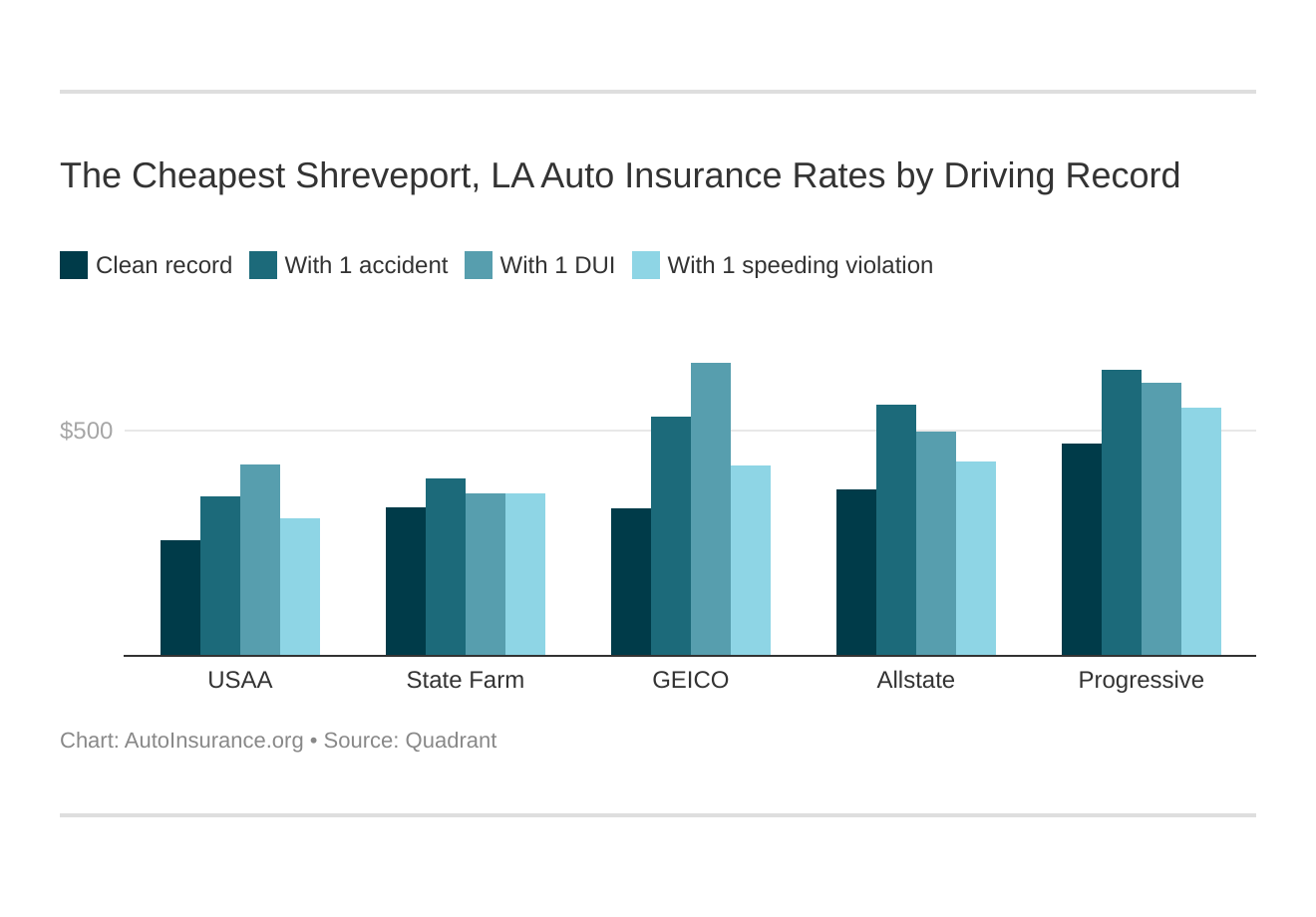

Your driving record will affect your Shreveport car insurance rates. For example, a Shreveport, Louisiana DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest Shreveport, Louisiana car insurance rates by driving record.

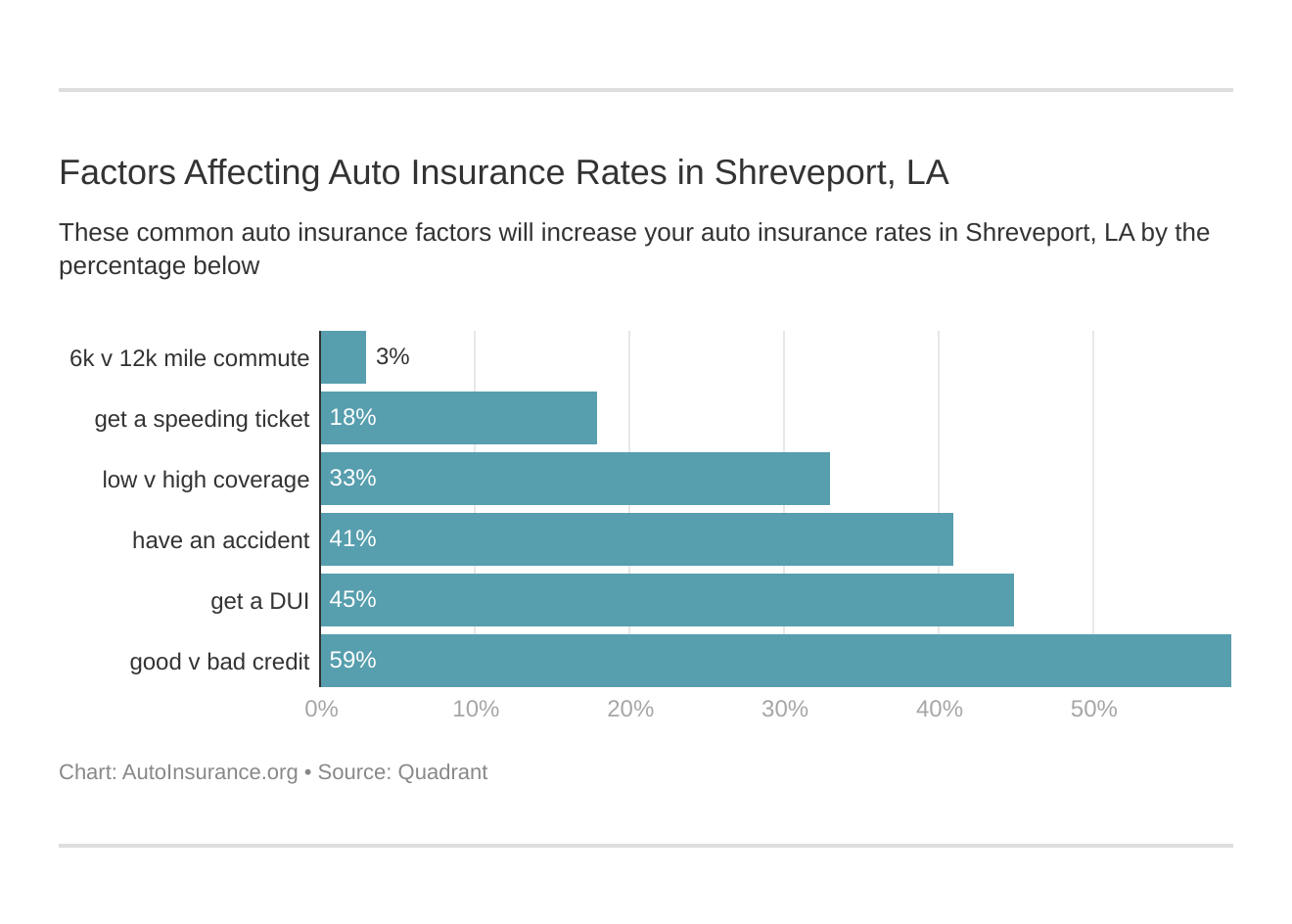

Factors affecting car insurance rates in Shreveport, LA may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Shreveport, Louisiana car insurance.

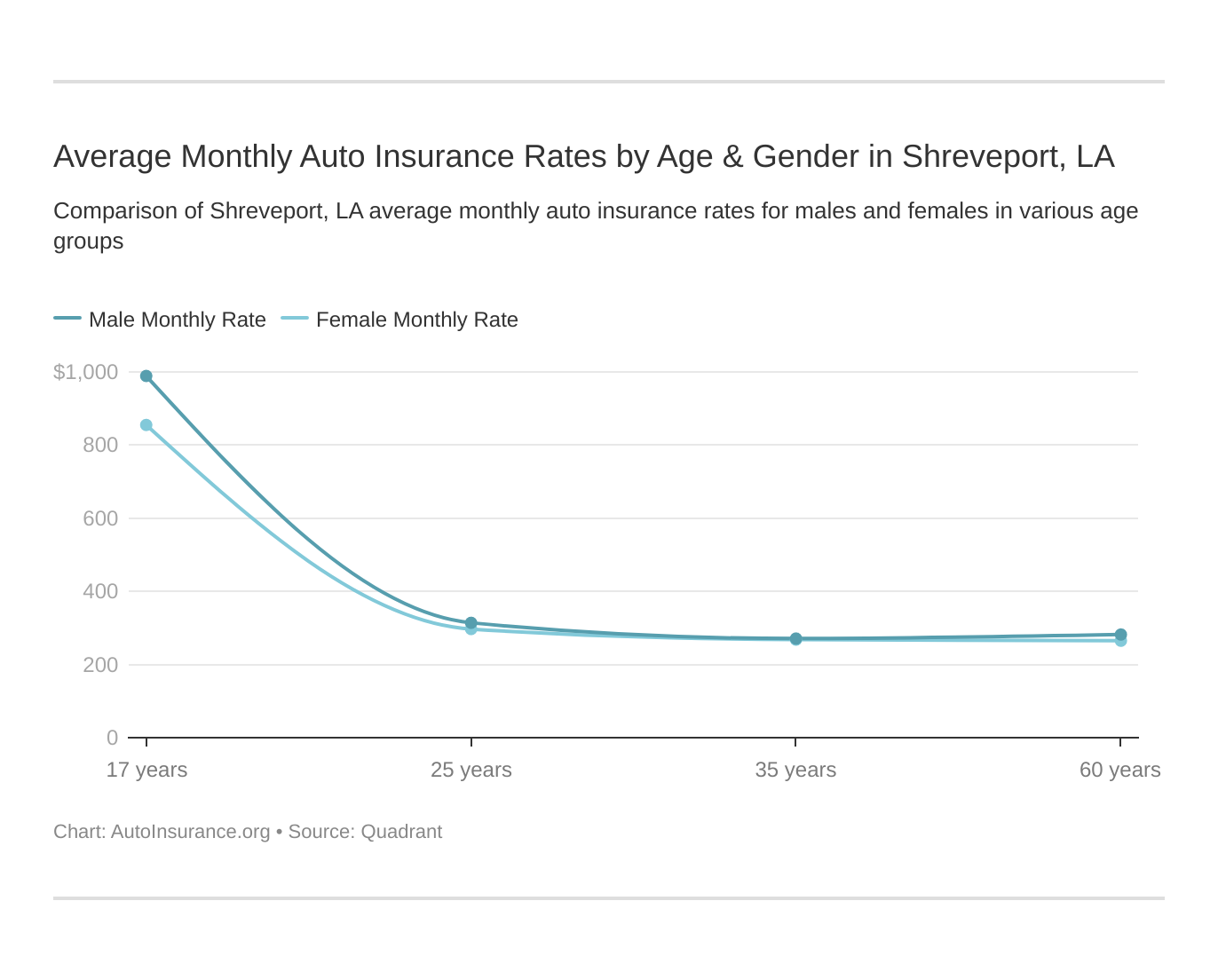

These states no longer use gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a large factor because young drivers are considered high-risk drivers in Shreveport. LA does use gender, so check out the average monthly car insurance rates by age and gender in Shreveport, LA.

What auto insurance coverage is required in Shreveport, LA?

Legally, Shreveport residents must carry the Louisiana state minimum auto insurance requirements.

Louisiana requires the following coverage limits:

- $15,000 per person and $30,000 per accident in bodily injury liability.

- $25,000 per accident in property damage coverage.

What is liability auto insurance coverage? If you cause an accident, it pays for damages to the other vehicle and driver.

Louisiana is an at-fault state, meaning whoever is responsible for causing an accident is also responsible for paying for any associated costs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What affects auto insurance rates in Shreveport, LA?

Car insurance rates in Louisiana are higher than in other states due to a high percentage of uninsured motorists on the roads. An estimated 13 percent of people are driving without insurance in your state.

However, Shreveport rates are lower than in other parts of the state due to minimal traffic congestion.

There is no traffic report from INRIX for the city of Shreveport. The next closest city data available, Texarkana, TX, is the 266th most congested city in America.

According to City-Data, the average commute time for Shreveport residents is 19.1 minutes, shorter than the national average of 26 minutes.

Auto theft rates can also impact insurance costs. The Federal Bureau of Investigation (FBI) recorded 884 auto thefts in Shreveport in 2017. That’s a rate of 455 thefts for every 100,000 residents.

Shreveport, LA Auto Insurance: The Bottom Line

Shreveport, Louisiana is a more affordable city for car insurance than both New Orleans and Baton Rouge. For example, auto insurance in Baton Rouge, LA costs $5,824/yr ($485/mo) on average.

While Louisiana insurance costs are higher than other parts of the country, comparing quotes online and asking about auto insurance discounts will help you save money.

Find affordable Shreveport, LA auto insurance by entering your ZIP code into our free quote comparison tool below.

Frequently Asked Questions

What is auto insurance, and why is it important in Shreveport, LA?

Auto insurance is a contract between a vehicle owner and an insurance company that provides financial protection in case of accidents, theft, or damage to the insured vehicle. In Shreveport, LA, auto insurance is crucial because it is required by law to have a minimum amount of liability coverage to drive legally. Additionally, having auto insurance helps protect you financially in the event of an accident, covers medical expenses, and provides coverage for property damage.

What are the minimum auto insurance requirements in Shreveport, LA?

In Shreveport, LA, the minimum auto insurance requirements are set by the state. Currently, the minimum liability coverage limits are as follows:

- $15,000 bodily injury liability per person

- $30,000 bodily injury liability per accident

- $25,000 property damage liability per accident

These are the minimum coverage limits, and it’s generally recommended to consider higher coverage levels to ensure better financial protection.

Are there any additional auto insurance coverages that I should consider in Shreveport, LA?

Yes, in addition to the minimum liability coverage, there are several optional coverages you may want to consider for your auto insurance in Shreveport, LA. These include:

- Collision coverage: Covers the cost of repairs or replacement of your vehicle in case of an accident, regardless of fault.

- Comprehensive coverage: Provides coverage for non-collision incidents, such as theft, vandalism, fire, or natural disasters.

- Uninsured/underinsured motorist coverage: Protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage to pay for damages.

- Medical payments coverage: Helps cover medical expenses for you and your passengers in the event of an accident.

What should I do after an accident in Shreveport, LA?

After an accident in Shreveport, LA, it’s important to take the following steps:

- Ensure your safety and the safety of others involved. Move to a safe location if possible.

- Call the police to report the accident, even if it seems minor.

- Exchange information with the other driver(s) involved, including names, contact details, insurance information, and license plate numbers.

- Take photos of the accident scene, damage to vehicles, and any visible injuries.

- Notify your insurance company and provide them with all the necessary details.

- Seek medical attention if needed, even for seemingly minor injuries.

- Cooperate with your insurance company and provide them with any requested information or documentation. Can I use my personal auto insurance for business purposes in Shreveport, LA?

Can I use my personal auto insurance for business purposes in Shreveport, LA?

Generally, personal auto insurance policies do not provide coverage for vehicles used for business purposes in Shreveport, LA. If you use your vehicle for business activities such as deliveries, transporting goods, or providing services, you may need a commercial auto insurance policy. It’s important to check with your insurance provider to understand their specific guidelines and coverage options for business use.

Does auto insurance in Shreveport, LA cover rental cars?

Auto insurance policies in Shreveport, LA may provide coverage for rental cars, but it depends on your specific policy. Some policies extend coverage to rental vehicles, while others may require you to purchase additional coverage, such as a rental car insurance rider. It’s recommended to review your policy or contact your insurance provider to understand the extent of coverage for rental cars and consider any additional coverage options you may need.

Can I get auto insurance coverage if I have a poor driving record in Shreveport, LA?

Yes, even if you have a poor driving record, it is possible to obtain auto insurance coverage in Shreveport, LA. However, having violations or accidents on your record may result in higher insurance premiums. Some insurance companies specialize in providing coverage to high-risk drivers. It’s advisable to contact insurance providers, including those that cater to high-risk drivers, to explore your options and find the best coverage available to you.

Does auto insurance in Shreveport, LA cover theft or vandalism?

Yes, auto insurance in Shreveport, LA can provide coverage for theft or vandalism, but it depends on the type of coverage you have. Comprehensive coverage, which is an optional coverage, typically includes protection against theft, vandalism, fire, and other non-collision incidents. It’s important to review your policy or consult with your insurance provider to confirm the extent of coverage for theft or vandalism and any deductible or limitations that may apply.

Can I add additional drivers to my auto insurance policy in Shreveport, LA?

Yes, you can usually add additional drivers to your auto insurance policy in Shreveport, LA. Insurance companies typically allow you to list other household members or regular drivers of your vehicle on your policy. However, it’s important to provide accurate information about the additional drivers, including their driving history, as it can affect your premiums. Failure to disclose additional drivers or providing false information could result in coverage issues or claims being denied.

Can my auto insurance policy be canceled or non-renewed in Shreveport, LA?

Yes, in Shreveport, LA, auto insurance policies can be canceled or non-renewed under certain circumstances. Insurance companies may cancel a policy for reasons such as non-payment of premiums, misrepresentation of information, or a driver’s license suspension. Non-renewal may occur when the insurance company decides not to extend the policy beyond its expiration date. Reasons for non-renewal can include an increased risk profile, numerous claims, or the insurer’s decision to discontinue coverage in a particular area. It’s important to review your policy terms and contact your insurance provider to understand their cancellation and non-renewal policies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.