Best Kiln, Mississippi Auto Insurance in 2025 (Find the Top 10 Companies Here)

State Farm, USAA, and Farmers lead as the best Kiln, Mississippi auto insurance, offering comprehensive coverage and competitive rates starting around $41 per month. For the best Kiln, Mississippi auto insurance experience, these companies excel in balancing affordability with extensive coverage options.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Kiln MS

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Kiln MS

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Kiln MS

A.M. Best

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsState Farm, USAA, and Farmers lead as the top best Kiln, Mississippi auto insurance, with rates starting around $41 per month.

State Farm emerges as the leading option, known for its comprehensive coverage options and competitive pricing, making it a top choice among drivers.

These providers not only excel in offering cost-effective and dependable auto insurance but also tailor their services to meet the unique needs of the local community, ensuring a perfect fit for various coverage requirements.

Our Top 10 Company Picks: Best Kiln, Mississippi Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 8% | B | Many Discounts | State Farm | |

| #2 | 12% | A++ | Military Savings | USAA | |

| #3 | 10% | A | Local Agents | Farmers | |

| #4 | 15% | A | Online App | AAA |

| #5 | 5% | A+ | Add-on Coverages | Allstate | |

| #6 | 14% | A+ | 24/7 Support | Erie |

| #7 | 7% | A++ | Custom Plan | Geico | |

| #8 | 18% | A+ | Usage Discount | Nationwide |

| #9 | 9% | A+ | Innovative Programs | Progressive | |

| #10 | 11% | A++ | Accident Forgiveness | Travelers |

Compare your options and find the best fit for your insurance needs today. Before you buy Kiln, Mississippi auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Kiln, Mississippi auto insurance quotes.

- State Farm, USAA, and Farmers offer the best auto insurance in Kiln, Mississippi

- Rates start as low as $41 /mo, making them the most affordable options

- Compare options for affordable and reliable auto insurance tailored to Kiln needs

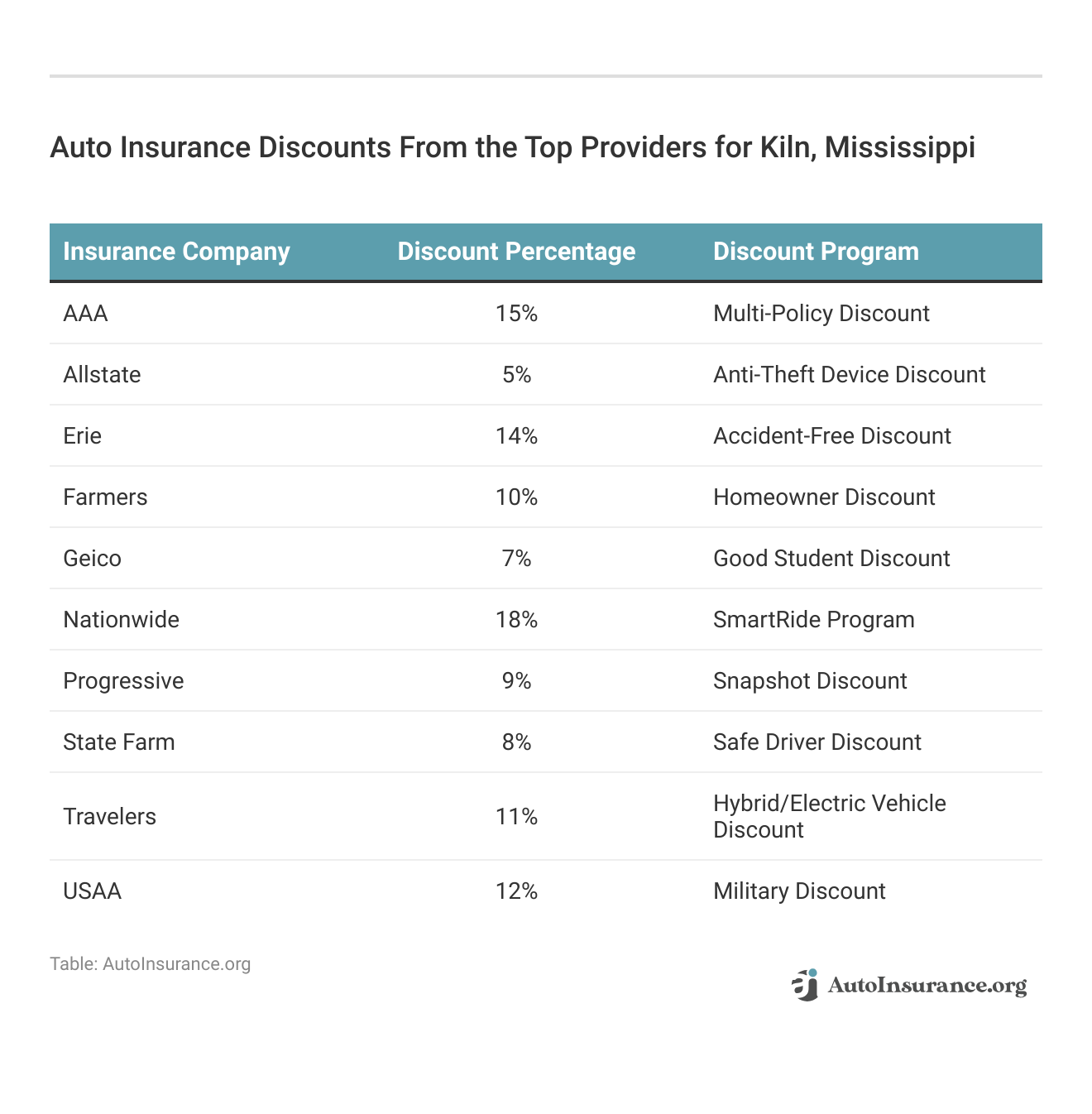

#1 – State Farm: Top Overall Pick

Pros

- Wide-Ranging Coverage: In addition to a large assortment of coverage options, such as responsibility, an accident, and comprehensive protection, State Farm also provides specialty services like roadside assistance and vehicle rental coverage., as highlighted in our State Farm auto insurance review.

- Discount Bonanza: Kiln, Mississippi residents can take advantage of numerous discounts offered by State Farm, which can significantly reduce premium costs. Discounts are available for safe driving records, bundling home and auto policies, and installing safety features in your vehicle, among others. These savings opportunities make State Farm an attractive option for cost-conscious drivers.

- App Accessibility: The State Farm mobile app is a powerful tool for Kiln, Mississippi residents, allowing them to manage their insurance policies on the go. The app provides features such as digital ID cards, claim filing, and access to roadside assistance, making it a convenient option for tech-savvy users who prefer to handle their insurance needs from their smartphones.

Cons

- Premium Price Tag: State Farm is known for its comprehensive coverage and superior service, but this often comes with higher premiums. Kiln, Mississippi drivers, particularly younger or higher-risk individuals, may find State Farm’s rates to be on the expensive side compared to other providers. This could be a deciding factor for those looking to save on insurance costs.

- Rigid Offerings: While State Farm offers a wide array of coverage options, some customers in Kiln, Mississippi might find that the company’s policies lack the flexibility offered by newer, more innovative insurers. State Farm’s discounts and coverage options may lack customization for tech-savvy or younger drivers, potentially limiting its appeal to those demographics.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military-Centric Excellence

Pros

- Military-Centric Excellence: USAA is uniquely tailored to serve military members, veterans, and their families, offering services that cater specifically to their needs. For eligible Kiln, Mississippi residents, USAA’s focus on the military community ensures that every aspect of their experience, s highlighted in our USAA auto insurance review.

- Unbeatable Rates: USAA is known for providing some of the most competitive rates in the industry, especially when military discounts are factored in. Kiln, Mississippi residents who qualify for USAA’s services can benefit from substantial savings on their auto insurance premiums, making it an ideal choice for budget-conscious military families.

- Broad Coverage Spectrum: USAA offers a wide range of coverage options tailored to the unique needs of military members. This includes specialized coverage such as deployment discounts and flexible payment plans, which allow Kiln, Mississippi residents to maintain their coverage even when facing the challenges of military life.

Cons

- Exclusive Membership: USAA’s services are not available to the general public, as membership is restricted to military members, veterans, and their families. This exclusivity means that many Kiln, Mississippi residents won’t have access to USAA’s competitive rates and excellent service, limiting its appeal to a specific group of individuals.

- Sparse Local Agents: Unlike some other insurance providers, USAA has a limited physical presence in Kiln, Mississippi, which may be a drawback for those who prefer in-person service. While USAA excels in providing online and phone-based support, the lack of local agents could be a disadvantage for customers who value face-to-face interactions.

#3 – Farmers: Best for Diverse Discounts

Pros

- Diverse Discounts: Farmers offers a variety of discounts that can help Kiln, Mississippi residents save on their auto insurance premiums. These include discounts for safe driving, bundling multiple policies, and even discounts for being a homeowner. With so many savings opportunities, Farmers is a great option for those looking to reduce their insurance costs without sacrificing coverage.

- Accident Forgiveness Perk: Farmers’ accident forgiveness program is a valuable benefit for Kiln, Mississippi drivers. This feature ensures that your premium won’t automatically increase after your first at-fault accident, providing peace of mind and protecting your wallet in the event of a mishap. For drivers who want to avoid the financial impact of an accident, this is a significant advantage.

- Green Savings: Farmers rewards Kiln, Mississippi residents who drive hybrid or electric vehicles with eco-friendly discounts. These savings not only help reduce your insurance costs but also support environmentally conscious driving habits, making it a win-win for both your wallet and the planet.

Cons

- Steep Rates for High-Risk Drivers: Farmers’ premiums can be higher than average for Kiln, Mississippi drivers who have poor credit, a history of violations, or other risk factors, as noted in our Farmers auto insurance review.

- Complicated Pricing: Farmers’ pricing structure can be complex, with rates and discounts varying significantly based on individual circumstances. This complexity might make it difficult for some Kiln, Mississippi residents to fully understand their insurance costs, leading to potential confusion when comparing policies or making coverage decisions.

#4 – AAA: Best for Beyond Insurance

Pros

- Beyond Insurance: AAA is much more than just an auto insurance provider in Kiln, Mississippi; it offers a suite of additional benefits that add significant value to your policy. These include renowned roadside assistance, travel discounts, and identity theft protection, making AAA a comprehensive option for drivers who want more than just basic coverage.

- Flexible Payments: AAA offers flexible payment plans designed to accommodate various budgetary needs, making it easier for Kiln, Mississippi residents to manage their insurance costs, as detailed in our AAA auto insurance review.

- Abundant Discounts: AAA provides numerous discount opportunities for Kiln, Mississippi drivers, including savings for good driving habits, multi-policy discounts, and discounts for insuring multiple vehicles. These discounts can significantly reduce your insurance premiums, making AAA an attractive option for cost-conscious consumers.

Cons

- Membership Fee: Accessing AAA’s insurance benefits requires an annual membership fee, which adds an additional cost before you can take advantage of their insurance offerings. While the membership comes with numerous perks, the fee might be a deterrent for Kiln, Mississippi residents who are looking to minimize their overall expenses.

- Pricey for the Young: AAA’s premiums tend to be higher for younger drivers or those with less experience behind the wheel. This could make AAA less appealing for young adults in Kiln, Mississippi who are seeking affordable coverage, as they might find better rates with other providers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Innovative Tools

Pros

- Innovative Tools: Allstate offers cutting-edge tools and technology for Kiln, Mississippi drivers, including the Drivewise app, which rewards safe driving habits with potential discounts. This tech-savvy approach not only helps you save money but also encourages better driving practices, enhancing overall road safety.

- Comprehensive Coverage Options: Allstate provides a broad range of coverage options to suit various needs, from basic liability to comprehensive and collision insurance. Kiln, Mississippi drivers can customize their policies to ensure they have the protection they need for different driving scenarios.

- Numerous Discounts: A range of discounts offered by Allstate might assist Kiln, Mississippi residents in reducing the cost of their insurance. There are discounts for, among other things, having specific safety equipment in your car, combining policies, and driving carefully, as mentioned in our Allstate auto insurance review.

Cons

- Higher Premiums: Allstate’s rates can be on the higher side compared to some competitors, particularly for drivers with less-than-perfect driving records. Kiln, Mississippi residents seeking the most budget-friendly options may find Allstate’s premiums to be higher than other providers.

- Mixed Customer Service Reviews: While Allstate has many satisfied customers, some Kiln, Mississippi residents have reported mixed experiences with customer service. Issues can include delays in claims processing and difficulties in reaching agents, which may be a concern for those who prioritize responsive service.

#6 – Erie: Best for Affordable Rates

Pros

- Affordable Rates: Erie Insurance is celebrated for its remarkably competitive pricing in Kiln, Mississippi. Often, it provides lower premiums compared to many rivals, making it a top choice for budget-conscious consumers in Kiln, Mississippi, aiming to trim their insurance costs.

- Comprehensive Coverage Options: Erie offers a broad spectrum of coverage options and unique features in Kiln, Mississippi, such as Erie’s Rate Lock. This feature stabilizes your premium despite accidents or traffic violations, appealing to those in Kiln, Mississippi, seeking extensive coverage.

- Flexible Payment Plans: Erie supports various payment schedules—monthly, quarterly, or annually—in Kiln, Mississippi, giving customers the flexibility to manage insurance expenses according to their financial circumstances.

Cons

- Limited Availability: Erie’s coverage is restricted to just 12 states, including Kiln, Mississippi. This geographic limitation might exclude prospective customers in areas where Erie isn’t available, potentially impacting those in Kiln, Mississippi, as noted in our Erie auto insurance review.

- Fewer Digital Tools: Erie’s online and mobile platforms lag behind some competitors in Kiln, Mississippi, in terms of sophistication, which could be a drawback for users who prefer advanced digital management features for their insurance policies.

#7 – Geico: Best for Innovative Features

Pros

- Innovative Features: Geico introduces innovative features like the DriveEasy app in Kiln, Mississippi, which monitors driving behavior and potentially offers additional discounts, and a streamlined online quote system for rapid price comparisons, as highlighted in our Geico auto insurance review.

- Low Premiums: Geico is well-regarded for its exceptionally low premiums in Kiln, Mississippi. Its cost-effective insurance solutions often make it a leading choice for individuals seeking to minimize their insurance expenses in Kiln, Mississippi.

- Discounts: Offering discounts for secure driving, military personnel, and multi-policy bundling, the company offers a variety of benefits in Kiln, Mississippi. Kiln, Mississippi insurance premiums can be considerably lowered overall with these savings.

Cons

- Customer Service Issues: Geico has received mixed reviews for its customer service in Kiln, Mississippi, particularly concerning claims handling and responsiveness. Some customers in Kiln, Mississippi, experience delays and challenges in obtaining effective support.

- Basic Coverage Options: While Geico offers standard coverage options in Kiln, Mississippi, it may lack some of the advanced or specialized coverage choices available from other insurers, potentially limiting options for those with unique insurance needs in Kiln, Mississippi.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Wide Range of Coverage Options

Pros

- Wide Range of Coverage Options: Nationwide provides an extensive selection of coverage plans and optional add-ons in Kiln, Mississippi. Features like accident forgiveness and roadside assistance cater to a variety of insurance needs and preferences in Kiln, Mississippi, according to Nationwide auto insurance review.

- Customized Policies: The insurer allows for extensive policy customization in Kiln, Mississippi, enabling customers to tailor insurance to their specific requirements. Flexible payment options further accommodate diverse financial situations in Kiln, Mississippi.

- Convenient Online Tools: The extensive web platform of Nationwide, located in Kiln, Mississippi, streamlines customer service, claims tracking, and policy management, improving the effectiveness of the management of insurance.

Cons

- Average Rates: Nationwide’s rates in Kiln, Mississippi, may be higher than those of some competitors, particularly in more competitive markets. This can result in less favorable pricing for customers in Kiln, Mississippi, seeking the lowest possible premiums.

- Mixed Customer Service: Customer service experiences with Nationwide in Kiln, Mississippi, can vary by region, with some policyholders reporting issues with claims handling and service quality, which may affect overall satisfaction in Kiln, Mississippi.

#9 – Progressive: Best for Flexible Coverage

Pros

- Flexible Coverage: In Kiln, Mississippi, the insurer offers a wide choice of coverage alternatives and adaptable policies, enabling clients to modify their insurance in accordance with particular requirements and preferences.

- Advanced Tools: Progressive offers innovative tools like the Name Your Price® tool in Kiln, Mississippi, which helps customers find policies that fit their budget, and the Snapshot® program, which can provide additional savings based on driving habits.

- Robust Online Resources: Progressive’s website and app in Kiln, Mississippi, are equipped with extensive resources for managing policies, tracking claims, and accessing customer support, enhancing overall convenience.

Cons

- Inconsistent Customer Service: Progressive has received mixed reviews regarding customer service and claims handling in Kiln, Mississippi, with some customers encountering challenges with the responsiveness and effectiveness of support, as mentioned in our Progressive auto insurance review.

- Complex Policies: The wide range of options and add-ons available in Kiln, Mississippi, can be overwhelming for some customers, making it difficult to navigate and select the most appropriate coverage for their needs.

#10 – Travelers: Best for Broad Coverage Options

Pros

- Broad Coverage Options: Travelers offers a comprehensive range of coverage options and policy add-ons in Kiln, Mississippi. This includes unique protections for scenarios such as antique cars and new car replacement, catering to diverse insurance needs, according to Travelers auto insurance review.

- Discounts and Savings: The insurer provides various discounts in Kiln, Mississippi, including those for bundling home and auto insurance, safe driving, and more. These discounts can help reduce overall insurance costs in Kiln, Mississippi.

- Customizable Policies: In Kiln, Mississippi, Travelers provides a wide range of policy modification choices so that clients can personalize their insurance to suit their needs and interests.

Cons

- Higher Premiums: Travelers’ rates in Kiln, Mississippi, can be higher compared to some other insurers, particularly for younger drivers or those with less favorable driving records. This can make it a less cost-effective choice for some consumers in Kiln, Mississippi.

- Mixed Customer Reviews: The satisfaction of customers may be impacted by uneven feedback from clients on Travelers in Kiln, Mississippi, since there have been differing experiences with the service they received and the claims procedure.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

A Breakdown of Kiln, Mississippi’s Minimum Car Insurance Laws

Refers to the most basic level of liability insurance that all drivers are legally required to carry to lawfully operate a vehicle on the roads and highways of Kiln, Mississippi. Explore our detailed analysis on “What is auto insurance?” for additional information.

Kiln, Mississippi Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $41 | $91 |

| Allstate | $51 | $103 |

| Erie | $50 | $101 |

| Farmers | $48 | $96 |

| Geico | $46 | $95 |

| Nationwide | $43 | $93 |

| Progressive | $49 | $97 |

| State Farm | $44 | $94 |

| Travelers | $50 | $99 |

| USAA | $50 | $98 |

This minimal coverage ensures that drivers have a basic financial safeguard against damages or injuries they may cause in an accident, promoting accountability and safety on the road. By mandating this coverage, the law aims to protect both the driver and others, ensuring financial responsibility and reducing the risk of significant financial losses from accidents.

In order to provide minimal protection against monetary losses in the case of an at-fault collision, the state of Mississippi requires this minimum insurance coverage to cover particular liability levels.

The breakdown of these mandatory coverages is as follows:

- $25,000 for bodily injury per person: This sum is intended to cover medical expenses resulting from a single person’s injuries in an accident in which you have reached fault.

- $50,000 for bodily injury per accident: Up to the policy limit, this amount pays the total medical costs for all wounded parties in a single accident.

- $25,000 for property damage per accident: This clause protects you if you cause harm to someone else’s property—like their car—in a collision for which you are at fault.

These minimal criteria provide drivers with a basic safety net by guaranteeing that they can pay for a portion of the expenses incurred in an accident that they cause, but they may not be adequate in the event of serious collisions or substantial property damage.

Therefore, in order to create a more substantial financial safety net, it is usually advisable to think about purchasing insurance policies with higher limits and other protections—such as comprehensive and collision insurance or uninsured/underinsured motorist coverage.

Cheap Insurance in Kiln, MS by Age and Marital Status

The variable landscape of vehicle insurance prices in Kiln, Mississippi is examined in Cheap Insurance in Kiln, MS by Age and Marital Status, where a driver’s age and marital status are important factors influencing affordability.

These demographic factors are carefully evaluated by insurers to determine risk levels, which frequently results in notable variations in premiums. Get more insights by reading our expert “Companies With the Cheapest Teen Auto Insurance” advice.

Kiln, Mississippi Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $250 | $239 | $223 | $229 | $1,013 | $1,080 | $284 | $292 |

| Geico | $257 | $243 | $232 | $216 | $644 | $602 | $431 | $207 |

| Liberty Mutual | $232 | $251 | $185 | $208 | $858 | $956 | $246 | $258 |

| Nationwide | $177 | $181 | $159 | $168 | $365 | $463 | $203 | $219 |

| Progressive | $259 | $236 | $213 | $205 | $950 | $1,060 | $263 | $271 |

| State Farm | $164 | $164 | $147 | $147 | $483 | $609 | $183 | $207 |

| Travelers | $143 | $145 | $137 | $137 | $666 | $1,062 | $150 | $172 |

| USAA | $124 | $122 | $116 | $117 | $316 | $374 | $151 | $166 |

Young drivers, especially those under 25, usually have higher insurance premiums because of their higher statistical risk of accidents and relative lack of driving experience. On the other hand, because they are thought to have more driving experience and a decreased tendency to engage in risky behavior, older drivers—those over thirty, for instance—typically enjoy lower rates.

This calculation is made more difficult by the fact that married drivers typically receive lower rates than single drivers because of a statistical trend of fewer claims and an image for greater responsibility. Therefore, knowing how age and marital status affect insurance rates can enable Kiln, MS drivers to obtain the most affordable coverage alternatives that fit their particular needs.

Inexpensive Auto Insurance for Teens in Kiln, Mississippi

Affordable Teen Auto Insurance in Kiln, Mississippi is a term used to describe low-cost auto insurance plans designed especially for teenage drivers in the Kiln area, usually those between the ages of 16 and 19. Teen drivers frequently pay higher insurance rates because they lack driving expertise and have a statistically higher chance of being involved in accidents.

Kiln, Mississippi Teen Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| Allstate | $952 | $1,196 |

| Farmers | $884 | $1,439 |

| Geico | $549 | $557 |

| Liberty Mutual | $498 | $534 |

| Nationwide | $948 | $1,048 |

| Progressive | $547 | $657 |

| State Farm | $605 | $751 |

| Travelers | $583 | $666 |

| USAA | $458 | $460 |

On the other hand, teens who maintain outstanding grades, finish driver education courses, or are added to a parent’s policy may qualify for discounted rates from some insurers.

Finding cheap auto insurance for teenagers in Kiln, Mississippi, entails researching rates from several companies, taking advantage of any available savings, and choosing a plan that strikes a compromise between affordability and sufficient protection for inexperienced drivers.

Budget-Friendly Car Insurance for Seniors in Kiln, Mississippi

Cheap auto insurance alternatives created especially for senior drivers in the Kiln area are referred to as inexpensive insurance policies for seniors in Kiln, Mississippi. Seniors may be eligible for lower premiums because they are typically viewed as lower risk drivers and have a lot of driving experience.

Kiln, Mississippi Senior Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| Allstate | $246 | $246 |

| Farmers | $251 | $251 |

| Geico | $169 | $169 |

| Liberty Mutual | $214 | $207 |

| Nationwide | $323 | $304 |

| Progressive | $172 | $204 |

| State Farm | $293 | $293 |

| Travelers | $241 | $239 |

| USAA | $193 | $193 |

Discounts from insurance companies may be given for a variety of reasons, including driving record, safety equipment installed in the car, and completion of defensive driving school. Seniors in Kiln can compare quotes from several insurers, look for age-related discounts, and investigate policy alternatives that provide appropriate protection at a reasonable price to get the best offers.

Cheap Kiln, Mississippi Auto Insurance by Driving Record

This refers to affordable car insurance options in Kiln that are influenced by a driver’s history of traffic violations, accidents, and claims. Continue reading our full “How Auto Insurance Companies Check Driving Records” guide for extra tips.

Insurers often assess driving records to determine risk and set premium rates, with drivers who have clean records typically qualifying for lower rates due to their lower perceived risk.

Kiln, Mississippi Full Coverage Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Allstate | $380 | $432 | $448 | $545 |

| Geico | $221 | $353 | $334 | $508 |

| Liberty Mutual | $282 | $397 | $454 | $464 |

| Nationwide | $194 | $214 | $247 | $313 |

| Progressive | $369 | $433 | $497 | $429 |

| State Farm | $238 | $260 | $293 | $260 |

| Travelers | $285 | $311 | $298 | $412 |

| USAA | $144 | $161 | $185 | $252 |

Conversely, those with a history of violations or accidents may face higher premiums. To find cheap auto insurance in Kiln, Mississippi, drivers should maintain a clean driving record and compare quotes from various providers to secure the most cost-effective coverage based on their driving history.

Cheap Kiln, Mississippi Auto Insurance Rates After a DUI

It can be difficult to find affordable auto insurance in Kiln, Mississippi following a DUI because of the increased risk involved. Compare the annual premiums for DUI insurance from several companies to get the best offer.

Kiln, Mississippi DUI Auto Insurance Rates

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $545 |

| Geico | $508 |

| Liberty Mutual | $464 |

| Nationwide | $313 |

| Progressive | $429 |

| State Farm | $260 |

| Travelers | $412 |

| USAA | $252 |

Seek out insurance companies that provide special programs or discounts to drivers who have improved their driving record or finished rehabilitation. The most economical coverage is still available to you in spite of the DUI if you carefully compare quotes and consider your options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cost-Effective Car Insurance in Kiln, Mississippi Based on Credit Score

It involves locating cheap car insurance quotes in Kiln that take a driver’s credit history into account. For more information, explore our informative “How Credit Scores Affect Auto Insurance Rates” page.

Credit scores are a common determinant of premium costs for insurers; higher credit scores are generally associated with lower rates because of the perception of financial responsibility and less likelihood of filing a claim.

Kiln, Mississippi Auto Insurance by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| Allstate | $369 | $463 | $522 |

| Geico | $226 | $303 | $534 |

| Liberty Mutual | $275 | $351 | $572 |

| Nationwide | $212 | $231 | $283 |

| Progressive | $389 | $418 | $489 |

| State Farm | $180 | $230 | $379 |

| Travelers | $307 | $302 | $369 |

| USAA | $138 | $165 | $253 |

On the other hand, drivers with worse credit can pay more for their insurance. Kiln residents must keep a high credit score in order to obtain affordable auto insurance. They should also check quotes from several insurance companies in order to determine which ones are most affordable given their credit history.

Kiln, Mississippi: Best Auto Insurance Rates by ZIP Code

It can be difficult to navigate Kiln, Mississippi’s vehicle insurance market, particularly when looking for the best deals. Expand your understanding with our thorough “Minimum Auto Insurance Requirements by State” overview.

The ZIP code can have a big impact on insurance rates because it reflects local factors like risk profiles and coverage needs. You can obtain the most economical coverage in your area by being aware of how your particular ZIP code affects your insurance costs.

You may find the most affordable alternatives specific to your area by comparing vehicle insurance quotes in Kiln, Mississippi, by ZIP code. Finding the best rates and protection for what you need can be accomplished by comparing quotes from several ZIP codes. Make sure you receive the greatest deal on your auto insurance by using this information to guide your decisions.

Kiln, Mississippi: Low-Cost Car Insurance by Commute Distance

Commute length and annual mileage play a crucial role in determining auto insurance rates in Kiln, Mississippi, creating a dynamic interplay that influences premiums in significant ways. Insurance companies meticulously assess these variables, where extended commutes and elevated annual mileage often trigger higher costs due to the increased risk of accidents.

Kiln, Mississippi Auto Insurance Monthly Rates by Provider & Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $451 | $451 |

| Geico | $353 | $355 |

| Liberty Mutual | $399 | $399 |

| Nationwide | $242 | $242 |

| Progressive | $432 | $432 |

| State Farm | $256 | $269 |

| Travelers | $326 | $326 |

| USAA | $180 | $191 |

A longer drive to work inherently boosts the likelihood of encountering mishaps, which insurers factor into their pricing models. To uncover the most cost-effective auto insurance options in Kiln, you must scrutinize annual premiums across different commute scenarios.

By comparing diverse quotes and understanding how both your daily drive and yearly mileage shape your insurance expenses, you can pinpoint the most budget-friendly policies that align with your specific commuting patterns and financial goals. Read our extensive guide on “How to Get a Good Driver Auto Insurance Discount” for more knowledge.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cost-Saving Car Insurance in Kiln, MS by Coverage Level

Finding the right mix between coverage and price can be difficult when shopping for auto insurance in Kiln, Mississippi. Your choice of coverage level has a big influence on your insurance costs.

You can locate the most affordable insurance solutions that meet your needs by being aware of how different coverage levels impact your prices. Learn more by visiting our detailed “What are the recommended auto insurance coverage levels?” section.

You can obtain inexpensive protection by making educated judgments about how coverage levels affect Kiln, MS auto insurance prices. You can find the greatest deal and make sure you’re getting the most out of your insurance policy without going over budget by comparing different coverage alternatives.

Best Value: Affordable Auto Insurance in Kiln, Mississippi

In order to find the greatest value for your needs, you must navigate a number of options in order to find affordable car coverage in Kiln, Mississippi. For further details, check out our in-depth “Where to Compare Auto Insurance Rates” article.

Knowing where to get the best insurance for the least amount of money could assist you make an informed choice because there are many companies and levels of coverage available. To assist you in obtaining the best bargain, this guide identifies the most cost-effective solutions for affordable vehicle insurance.

Cheapest Kiln, Mississippi Auto Insurance Providers by Driver Profile

| Driver Profile | Insurance Company |

|---|---|

| Teenagers | USAA |

| Seniors | USAA |

| Clean Record | USAA |

| One Accident | USAA |

| One DUI | USAA |

| One Ticket | USAA |

It is possible to have complete protection without going over budget if you compare several insurance and providers. Make an informed decision using this knowledge to save costs and ensure that you have enough insurance.

Lowest Premium Auto Insurance Companies in Kiln, Mississippi

Discovering the lowest premium auto insurance companies in Kiln, Mississippi, can lead you to significant savings while ensuring you get the coverage you need. Discover our comprehensive guide to “Auto Insurance Premium Defined” for additional insights.

By exploring the most cost-effective providers in the area, you can compare rates and find affordable options that fit your budget without sacrificing essential protection. This guide highlights the top companies offering the best deals on auto insurance premiums, helping you make an informed choice and secure the most economical coverage for your vehicle.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Key Drivers of Auto Insurance Costs in Kiln, Mississippi

There are numerous explanations for why Kiln, Mississippi vehicle insurance quotes differ from those in other cities. They include the volume of traffic and the quantity of car thefts in Kiln, Mississippi. Kiln auto insurance premiums are subject to numerous local circumstances. For further details, check out our in-depth “Where to Compare Auto Insurance Rates” article.

The Kiln Travel Time

The cost of auto insurance is typically greater in cities where drivers travel for longer periods of time. City-Data reports that the average travel time in Kiln, Mississippi is 28.1 minutes.

Reviewing Auto Insurance Quotes in Kiln, Mississippi

Reviewing vehicle insurance estimates in Kiln, Mississippi, is critical for obtaining the greatest coverage at the most affordable prices. By comparing quotes from several providers, you can determine which policy best meets your requirements as well as your financial situation. Get more insights by reading our expert “Comparing Auto Insurance” advice.

With its extensive network of local agents and strong financial stability, State Farm is a top choice for reliable auto insurance.Justin Wright Licensed Insurance Agent

This approach ensures that you get the greatest value for the money you spend while also providing reliable security for your vehicle. Spending the time to research and compare these rates will allow you to make a knowledgeable choice about your vehicle’s insurance policy.

Before you buy Kiln, Mississippi auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code below to get free Kiln, Mississippi auto insurance quotes.

Frequently Asked Questions

What is the average cost of auto insurance in Kiln, Mississippi?

Auto insurance premiums in Kiln, Mississippi, typically hover between $66 and $100 monthly for standard coverage. However, these figures are far from fixed and can swing widely based on factors like the driver’s age, driving history, and the specific type of vehicle being insured.

What is the best car insurance in Kiln, Mississippi?

Determining the “best” car insurance in Kiln, Mississippi, is a subjective endeavor, heavily dependent on individual preferences and requirements. Among the top-rated contenders, State Farm, Geico, and Allstate shine for their competitive rates and diverse coverage offerings.

What type of car insurance is required in Kiln, Mississippi?

In Kiln, Mississippi, the law mandates drivers to maintain liability insurance with minimum coverage limits: $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $25,000 for property damage.

Discover our comprehensive guide to “Cheapest Liability-Only Auto Insurance” for additional insights.

Who is the best insurance provider in Kiln, Mississippi?

The best insurance provider in Kiln, Mississippi, can vary dramatically depending on what you’re looking for in an insurer. USAA, Progressive, and State Farm often receive high marks for their stellar customer service and reasonable rates.

What is the penalty for not having auto insurance in Kiln, Mississippi?

Failing to carry auto insurance in Kiln, Mississippi, can result in steep penalties, including hefty fines, suspension of your driver’s license, and even vehicle impoundment. Repeat violations might lead to even steeper fines and more severe legal repercussions.

Which insurance company has the most cars insured in Kiln, Mississippi?

State Farm typically insures the most cars in Kiln, Mississippi, with Progressive and Allstate not far behind. Their popularity stems from their extensive coverage options and competitive pricing models.

For further details, check out our in-depth “How to Evaluate Auto Insurance Quotes” article.

What is the most important car insurance in Kiln, Mississippi?

In Kiln, Mississippi, liability insurance stands out as the most crucial form of coverage, given its legal requirement. However, for those seeking more extensive protection, uninsured motorist and comprehensive coverages are highly advisable.

What is the best insurance for car accidents in Kiln, Mississippi?

For coverage related to car accidents in Kiln, Mississippi, comprehensive and collision coverages are generally the go-to options, as they cover a wide array of damages. Geico and Progressive are frequently praised for their efficient accident claims processes.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

How much is the monthly car insurance cost in Kiln, Mississippi?

On average, the monthly cost for car insurance in Kiln, Mississippi, falls between $70 and $100 for basic liability coverage. However, rates can fluctuate significantly based on various elements such as your driving history, age, and the type of vehicle you drive.

Learn more by visiting our detailed “What does standard auto insurance cover?” section.

Can you register a car without insurance in Kiln, Mississippi?

No, it’s not possible to register a car in Kiln, Mississippi, without proof of insurance. The state requires all drivers to present valid proof of insurance at the time of vehicle registration to comply with legal standards.

Can I insure a car not in my name in Kiln, Mississippi?

Yes, you can insure a vehicle that is not registered in your name in Kiln, Mississippi, though the process can be intricate. Insurance companies usually require the policyholder to have an insurable interest, meaning a legitimate connection to the vehicle’s ownership or use.

What is the most expensive age for car insurance in Kiln, Mississippi?

The priciest age bracket for car insurance in Kiln, Mississippi, is typically drivers under 25 years old. This demographic tends to attract higher premiums due to their relative inexperience and statistically higher likelihood of being involved in accidents.

Read our extensive guide on “Auto Insurance Coverage” for more knowledge.

What is the least expensive vehicle to insure in Kiln, Mississippi?

The least costly vehicles to insure in Kiln, Mississippi, are usually mid-sized sedans or cars known for their high safety ratings and low repair costs, such as the Honda Accord or Toyota Camry.

What is the best type of vehicle insurance in Kiln, Mississippi?

Comprehensive coverage is widely regarded as the best type of vehicle insurance in Kiln, Mississippi, as it covers a broad spectrum of risks, including theft, fire, natural disasters, in addition to basic liability and collision coverage.

What is the best type of car insurance to get in Kiln, Mississippi?

The optimal car insurance policy in Kiln, Mississippi, generally involves a mix of liability, comprehensive, and collision coverages. The specific choice largely hinges on personal needs and the value of the insured vehicle.

Expand your understanding with our thorough “Collision Auto Insurance Defined” overview.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.