How to Check if a Vehicle Has Auto Insurance Coverage in 2025 (Step-by-Step Guide)

To check if a vehicle has auto insurance coverage, follow these steps, collecting the required details like the vehicle's VIN, use a reputable insurance verification service and contact the DMV for assistance. Around 13% of drivers may be uninsured, so verifying is essential to avoid legal issues.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Dec 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The way you check if a vehicle has auto insurance coverage it involves gathering necessary details, verifying insurance, contacting the DMV, and reviewing your own insurance, which is essential to avoid legal and financial risks, especially with uninsured drivers reaching 13%.

Check with insurance companies, the DMV, and police for verification. Compare quotes from top providers to find the best rates and coverage.

If you’re just looking for coverage to drive legally, enter your ZIP code above to compare cheap auto insurance quotes near you.

- Step #1: Collect Required Details – Gather essential information

- Step #2: Reputable Insurance Verification – Trusted insurance status check

- Step #3: Contact the DMV – Inquire about vehicle details

- Step #4: Check Your Insurance – Verify your insurance coverage

Confirm Valid Car Insurance in 4 Steps

Step #1: Collect Required Details

When checking if someone else’s car is insured, you will need to gather the relevant information from the other driver. You will need to know the following information when checking car insurance validity:

- Basic Contact Information of the Driver: Essential personal details such as the driver’s name, address, and phone number.

- Driver’s License Number: A unique identification number assigned to a driver by the state or country issuing their driver’s license.

- Insurance Company, if Applicable: The name of the company providing auto insurance coverage for the vehicle, if known.

- License Plate Number of Car: The unique alphanumeric code displayed on the vehicle’s license plate, used for identification and registration.

- Vehicle Identification Number (VIN): A unique 17-character code assigned to every vehicle by the manufacturer, used for identifying and tracking the vehicle.

Without this information, you won’t be able to find out if a car has insurance or not. In cases where you can’t gather information after an accident, especially in cases of hit-and-runs, it is best to call the police and have a crash report on hand when filing claims. Learn more: How To File an Auto Insurance Claim

To verify a vehicle's insurance coverage, check directly with the insurance provider or use state DMV resources for the most accurate information.Jeff Root Licensed Insurance Agent

This will help ensure your claim is approved by adding validity to your claim, even if you don’t have the other driver’s information. Have all driver and vehicle information ready before calling an insurance company to verify coverage. This will streamline the process and prevent delays. Check the next section for verification options.

Step #2: Reputable Insurance Verification

There are several methods available for verifying auto insurance coverage on another person’s vehicle. Here are the various sources you can use to confirm a car’s insurance status:

- Contact the Police. If you are in an accident and the other driver isn’t willingly offering their information, you should call the police to come and record the driver’s information and check insurance coverage, as this will help your claim.

- Department of Motor Vehicles (DMV). You can ask the DMV to verify insurance coverage, but bear in mind you will need a police report of the crash to prove you have a valid reason to check another driver’s coverage. For more details, see our guide “Full Coverage Auto Insurance.”

- Insurance Company. If you have the insurance company’s name, you can call them and ensure that the driver’s insurance is still active.

Verifying insurance coverage using reputable sources is crucial for ensuring that you or others are protected legally and financially. Whether you’re checking coverage for your own vehicle or another driver, these methods will help you obtain accurate information.

If you need to explore new insurance options or get quotes, make use of online comparison tools to find the best rates and coverage for your needs.

Step #3: Contact the DMV

To check a vehicle’s insurance status, contact your local DMV using their website for phone numbers or email addresses. Have the vehicle’s license plate number, VIN, and owner’s name ready. Call or email the DMV to request insurance verification.

Contact your DMV with the license plate, VIN, and owner’s name to confirm a vehicle’s insurance status.

If the DMV directs you to another department or needs more time, follow up as needed. Keep in mind that while the DMV can confirm if a vehicle is insured, they might not provide detailed policy information. To learn more, explore our comprehensive resource on insurance titled “Vehicle Registration Fees by State.”

Step #4: Check Your Insurance

When shopping for auto insurance, it’s essential to compare rates across different providers and coverage levels to find the best deal. The following table highlights monthly rates from major insurance companies, offering a quick overview of costs for both minimum and full coverage plans.

Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $70 | $165 | |

| $40 | $95 | |

| $65 | $140 | |

| $47 | $110 | |

| $40 | $93 | |

| $160 | $385 |

| $44 | $105 | |

| $30 | $70 | |

| $72 | $155 |

| $30 | $70 |

This table shows monthly auto insurance rates for minimum and full coverage. State Farm and USAA offer the lowest rates, starting at $30, while Liberty Mutual has the highest at $160 for minimum coverage. Other providers like Geico, American Family, and Progressive offer competitive pricing.

Sometimes drivers want to verify coverage on their own vehicles if they are worried their coverage has lapsed. If your coverage has lasped, make sure you check out our list of the best auto insurance companies that don’t penalize for a lapse in coverage. Verifying your own auto insurance coverage is much easier than checking someone else’s and applies to comprehensive policies as well.

To verify auto insurance on a car you own, you can either call your insurance company or sign into your online account and verify that your insurance coverage is still active. If you are calling, you will need your basic information, as well as your policy number. If you are logging in, you will just need your login information.

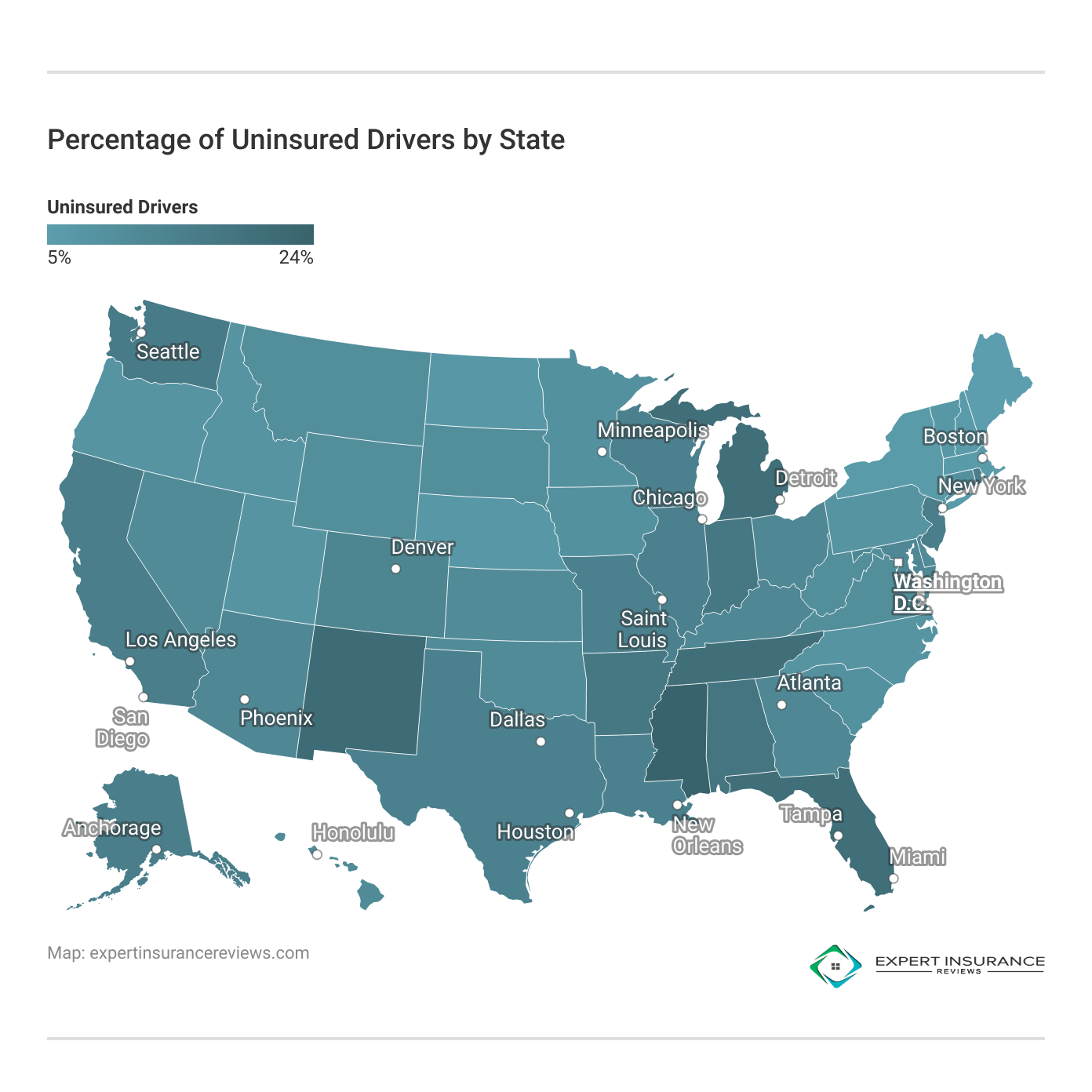

This map shows the percentage of uninsured drivers by state across various major cities in the U.S., including Washington D.C., Los Angeles, New York, and Houston. The percentages range from 5% to 24%, highlighting the significant variance in the number of uninsured drivers across regions.

This data is sourced from AutoInsurance.org and underscores the importance of understanding local insurance coverage rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

When to Check Your Auto Insurance Coverage

Understanding when to verify auto insurance coverage is essential for protecting yourself and others on the road. Whether you’re borrowing a car, managing a fleet of company vehicles, dealing with a divorce, or driving students, ensuring that the vehicles involved are adequately insured is crucial.

- Borrowing Car: If you are borrowing a car, check to ensure it has the required auto insurance coverages before driving.

- Business Owners With Fleet Vehicles: If employees are driving company cars, you must ensure they have car insurance coverage.

- Getting Divorce: If you are splitting the cars after a divorce, make sure you keep an auto insurance policy on whichever car you have.

- Driving Students: If a parent is driving students, you must check that they have auto insurance coverage.

- Accident With Another Driver. If you are in an accident with another driver, you must verify each other’s car insurance coverage. Read more: Whose insurance do I call after an accident?

In each scenario, checking auto insurance coverage ensures safety and compliance. Whether borrowing a car, managing business vehicles, dividing assets after a divorce, or transporting students, proper insurance helps reduce risks and offers peace of mind.

Always check insurance coverage before driving or managing vehicles to stay protected and responsible on the road.

Verify Auto Insurance Coverage: Essential Steps to Stay Protected

Verifying car insurance coverage requires gathering driver and vehicle information and using a reputable site. Auto insurance verification can be useful to get the police involved if you want to do an insurance check on cars because you were in an accident with other drivers. Check out our ranking of the top providers: Cheap Auto Insurance After an Accident

Check insurance with the provider or a trusted site; use our tool for the best new coverage rates.

If you are checking your car insurance coverage, you can simply call your insurance company or sign into your online account. If you are looking for new car insurance coverage to protect you out on the road, use our free quote comparison tool. It will help you find the best auto insurance rates in your area.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Frequently Asked Questions

How can I verify if my own car insurance policy is active?

To verify your policy, log in to your insurance provider’s online portal or app. You can also call your insurance company directly using the customer service number on your policy documents.

Can I check if a vehicle has insurance through a mobile app?

Some insurance companies and DMV apps offer coverage verification features. Check if your state or insurance provider has a mobile app with this functionality.

Start comparing affordable insurance options by entering your ZIP code below into our free quote comparison tool today.

What should I do if I suspect a vehicle is uninsured after an accident?

If you suspect a vehicle is uninsured, contact the police to file a report. They can help gather information and assist with insurance verification. You can also follow up with your insurance company to process your claim.

See our list of top providers: Best Uninsured and Underinsured Motorist

Are there national databases for checking vehicle insurance coverage?

In the U.S., there is no single national database, but many states have their own insurance verification databases accessible by the DMV and law enforcement.

What information do I need to check a vehicle’s insurance status online?

Typically, you need the vehicle’s license plate number and VIN. Some services may also require the owner’s name.

How can I check if a vehicle’s insurance coverage has lapsed?

Contact the insurance company directly or check with the DMV. They can inform you if the coverage has expired or if there are any issues with the policy.

Explore our detailed resource titled “How to Manage Your Auto Insurance Policy” for a deeper understanding of insurance coverage.

Is it possible to check a vehicle’s insurance status if I don’t have the VIN?

It’s more challenging, but you can still try using the license plate number. Some verification services and DMV departments may accept alternative identifiers.

What should I do if the DMV cannot provide insurance details for a vehicle?

If the DMV is unable to provide the information, you might need to reach out to the insurance company directly or involve law enforcement if it’s related to an accident.

Can insurance companies provide confirmation of coverage for a vehicle I’m interested in buying?

Yes, insurance companies can confirm coverage for a vehicle you’re considering buying. You may need to provide the vehicle’s details and possibly have the seller’s consent.

For detailed information, refer to our comprehensive report titled “How Vehicle Year Affects Auto Insurance Rates.”

What is the difference between verifying insurance coverage and getting an insurance quote?

Verifying insurance coverage checks if a vehicle currently has an active policy. Getting an insurance quote involves obtaining an estimate for purchasing or renewing a policy based on specific coverage needs and personal details.

Then, enter your ZIP code below into our free comparison tool to see which companies have the cheapest rates in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.