Best Fort Lauderdale, Florida Auto Insurance in 2025 (Top 10 Companies Ranked)

Obtain the best Fort Lauderdale, FL Auto insurance coverage starting at $63 per month from top providers like State Farm, Geico, and Allstate. Fort Lauderdale car insurance is higher than average, but State Farm offers the cheapest rates. Compare quotes online to find the best coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Fort Lauderdale FL

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Fort Lauderdale FL

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Fort Lauderdale FL

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews

State Farm, Geico and Allstate rated as the top choices for the best Fort Lauderdale, Florida auto insurance, with coverage starting at $63/month. Finding cheap auto insurance in Fort Lauderdale can be challenging due to high regional risk factors and the city’s population density.

Fort Lauderdale car insurance rates often reflect these complexities, leaving drivers frustrated. This article simplifies your search by highlighting the best Fort Lauderdale, Florida auto insurance options.

Our Top 10 Company Picks: Best Fort Lauderdale, Florida Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 18% B Customer Service State Farm

#2 15% A++ Competitive Rates Geico

#3 10% A+ Local Agent Allstate

#4 12% A+ Online Tools Progressive

#5 13% A Coverage Options Liberty Mutual

#6 22% A+ Comprehensive Coverage Nationwide

#7 20% A++ Military Families USAA

#8 11% A+ Rental Reimbursement Farmers

#9 9% A++ Extensive Options Chubb

#10 8% A++ Accident Forgiveness Travelers

We’ll explore why it’s so hard to find cheap auto insurance coverage and provide insights to help you secure the best rates without compromising on essential protection. Get started on comparing full coverage auto insurance rates by entering your ZIP code above.

- Find out why State Farm’s ranked as the top provider in Fort Lauderdale

- Learn Fort Lauderdale, IL insurance cost factors

- Traffic and thefts in Fort Lauderdale, IL raise auto insurance costs

Comparison of Auto Insurance Companies in Fort Lauderdale, FL

Sunshine and savings await in the Venice of America. Dive into our comparison of car insurance quotes in Fort Lauderdale, where coastal living meets competitive coverage. From the bustling Las Olas Boulevard to the serene beaches, find the perfect policy to protect your ride.

Fort Lauderdale, Florida Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $72 $165

Chubb $75 $175

Farmers $71 $160

Geico $65 $150

Liberty Mutual $74 $170

Nationwide $69 $155

Progressive $70 $160

State Farm $68 $155

Travelers $70 $160

USAA $63 $145

Whether you’re cruising down A1A or navigating the Intracoastal, knowing how to manage your auto insurance policy is key. Use this table as your compass to navigate Fort Lauderdale’s insurance landscape and steer towards the best combination of coverage and affordability for your South Florida adventures.

Florida’s auto insurance rules might surprise you. Unlike most states, the Sunshine State doesn’t require bodily injury coverage. Why? We’re in no-fault territory here.

The minimum auto insurance required in Florida is:

- $10,000 in personal injury protection (PIP) coverage

- $10,000 for property damage liability (PDL)

This means your insurance covers your damages and injuries, regardless of who caused that beach boulevard bumper bash. It’s a unique system that can be as confusing as navigating the city’s canals.

Should you opt to include bodily injury coverage, it is requisite to maintain coverage amounts of $10,000 for a single individual and $20,000 for two or more individuals.

When hunting for the best auto insurance in Fort Lauderdale, Florida, do more than just glance at the overall ratings. Look deeper. Compare how they treat people your age. Find a provider who knows you, who prices your life fairly.

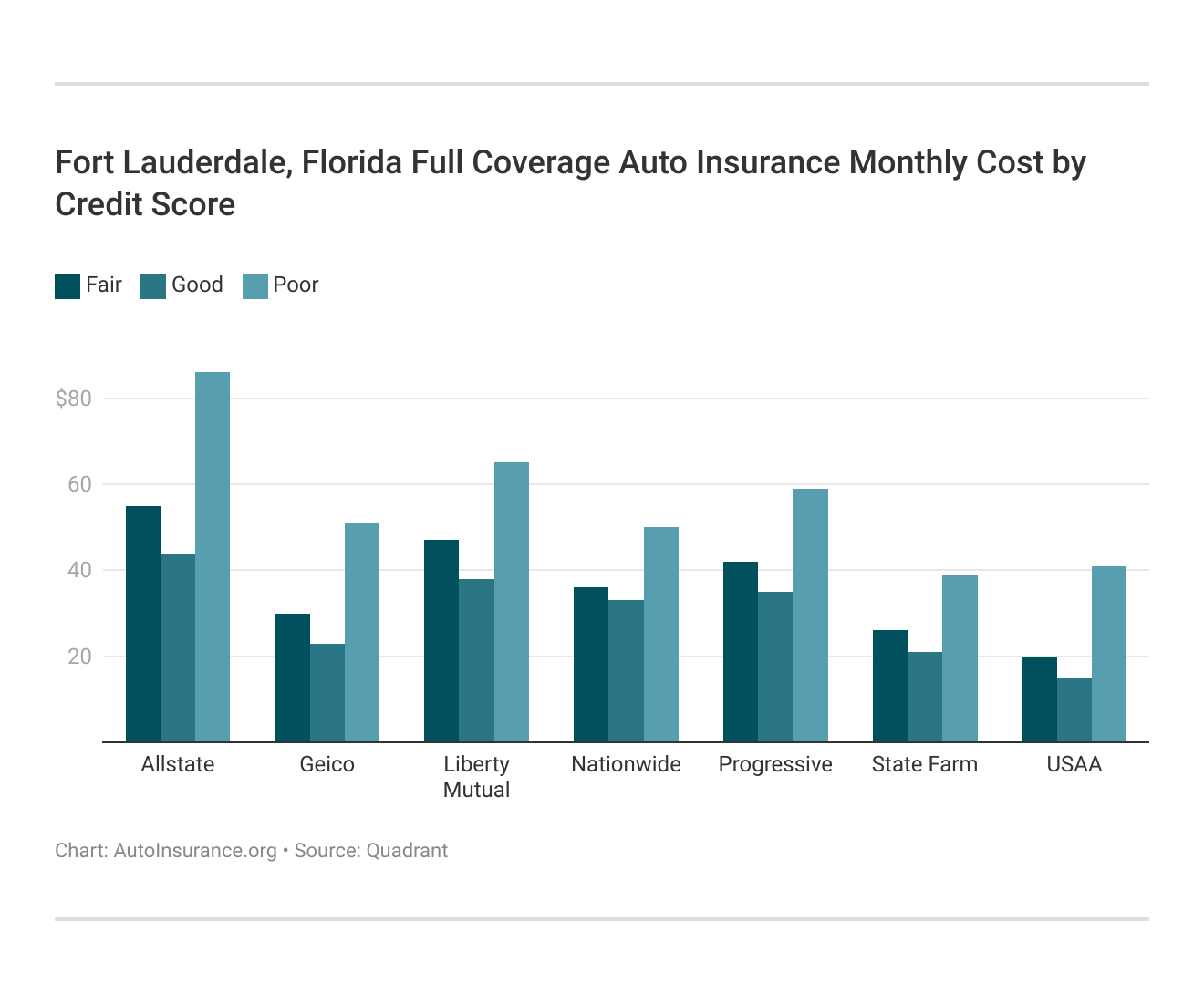

The table below illustrates how your financial standing can substantially influence your premiums among leading insurers, potentially resulting in considerable savings on the most competitive auto insurance options in Fort Lauderdale, FL.

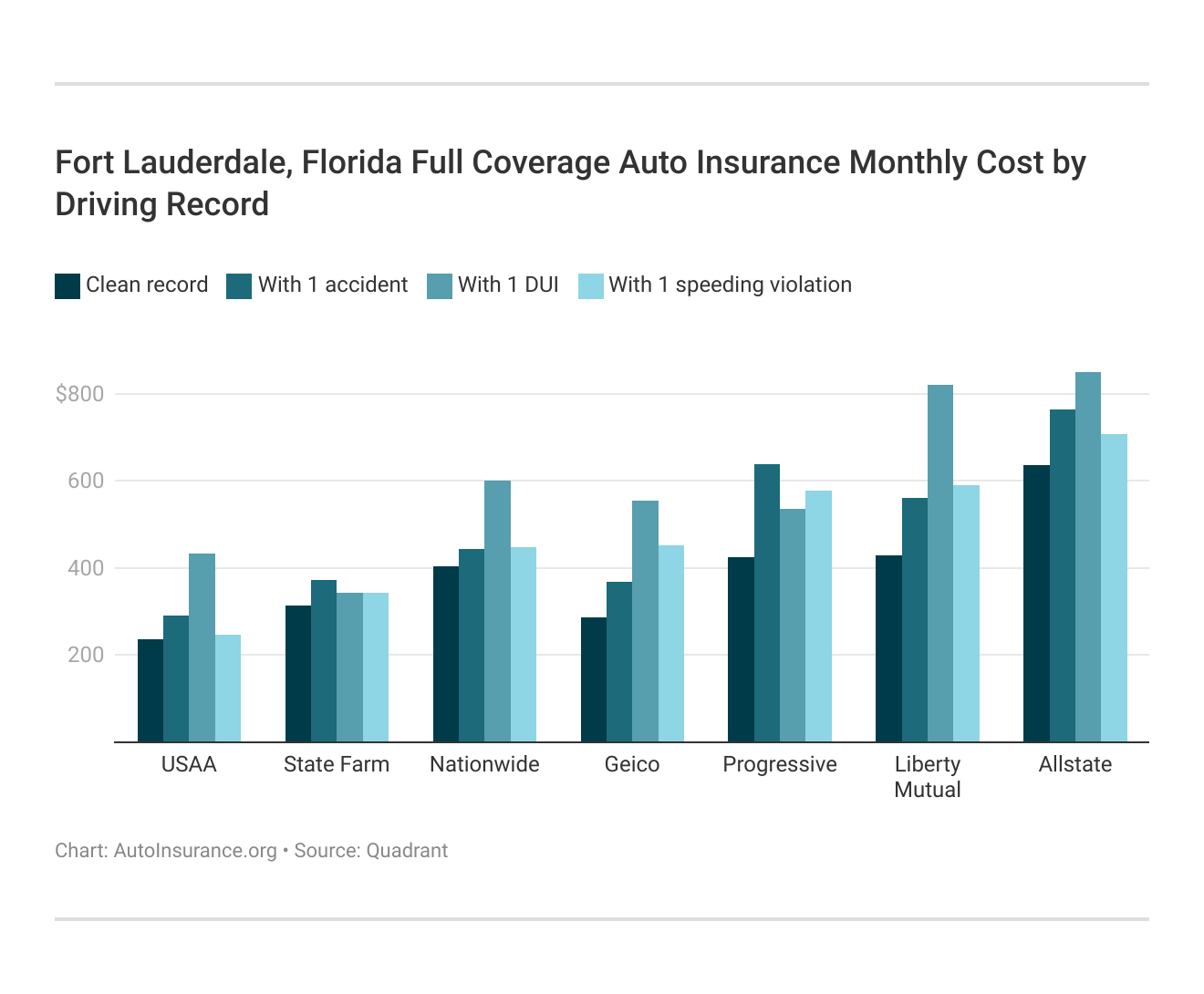

Fort Lauderdale drivers, your past behind the wheel can make or break your insurance rates. A DUI could send your premiums soaring by 40-50%, putting you in high-risk auto insurance territory. See the table below:

Fort Lauderdale drivers, your insurance rates are influenced by a cocktail of factors including your commute, coverage level, driving record (tickets and DUIs), and credit score.

Whether you’re cruising down Las Olas Boulevard or commuting on I-95, this knowledge can help you make informed decisions and potentially save hundreds on your auto insurance.

By seeing how our city's rates measure up, you'll gain a clearer perspective on what constitutes a good deal in our local market.Kristen Gryglik LICENSED INSURANCE AGENT

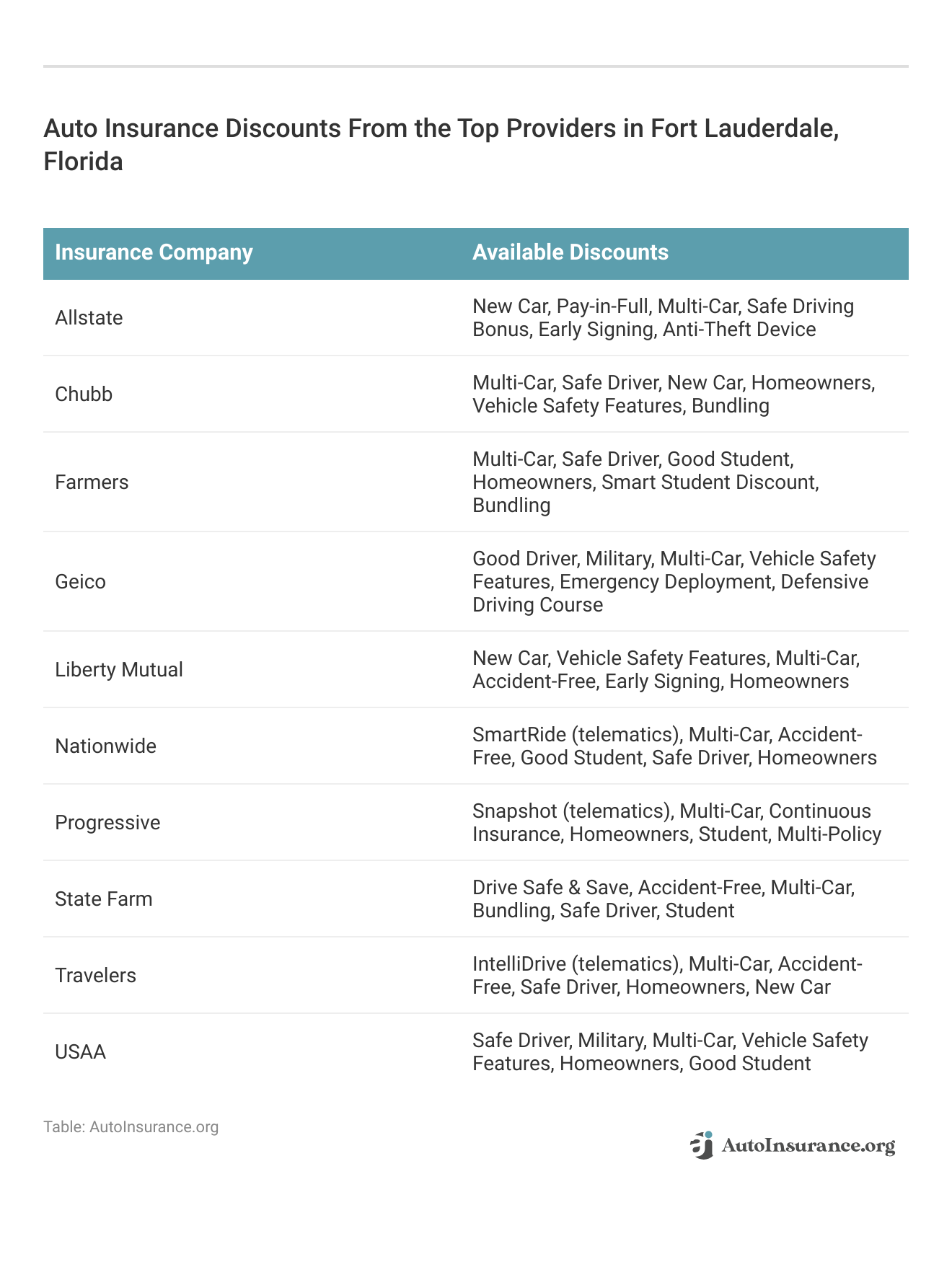

Explore the extensive range of car insurance discounts available from leading providers in Fort Lauderdale, designed to help you reduce your premium costs significantly. Discover how you can take advantage of these offers to make your car insurance more affordable.

Leading insurance companies in Iowa offer substantial discounts, allowing car owners to secure comprehensive coverage at reduced costs. These savings significantly lower overall insurance expenses, helping drivers manage their finances more effectively while enjoying peace of mind on the road.

Factors Influencing Auto Insurance Rates in Fort Lauderdale, FL

Auto insurance premiums in Fort Lauderdale, FL, are notably high due to the city’s unique challenges as part of the Miami area. High traffic congestion, frequent accidents, and elevated vehicle theft rates significantly drive up costs.

With Miami ranking as the 12th most congested U.S. city, Fort Lauderdale commuters face increased risks. Additionally, high crime rates in neighborhoods like Flagler Village further inflate insurance rates, making affordable coverage essential but difficult to find.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Frequently Asked Questions

How can I lower my car insurance rates in Fort Lauderdale, FL?

To lower your car insurance rates in Fort Lauderdale, consider raising your deductible, maintaining a clean driving record, bundling policies, taking advantage of discounts, and shopping around for quotes from multiple providers.

Why is car insurance more expensive in Fort Lauderdale, FL?

Car insurance in Fort Lauderdale is more expensive due to high traffic congestion, frequent accidents, and elevated vehicle theft rates. The city’s location in the Miami metropolitan area contributes to these higher premiums.

Use our free comparison tool below to see what auto insurance quotes in Fort Lauderdale, FL look like in your area.

Can I get car insurance coverage if I have a bad driving record in Fort Lauderdale, FL?

Yes, you can still get car insurance coverage in Fort Lauderdale with a bad driving record, but your premiums may be higher. Shopping around and considering high-risk insurance providers can help you find more affordable options. For more information, read our article titled “Cheap Auto Insurance for a Bad Driving Record.”

Is auto insurance mandatory in Fort Lauderdale, FL?

Yes, auto insurance is mandatory in Fort Lauderdale, FL, as it is in the entire state of Florida. The state requires drivers to carry minimum liability coverage to ensure that they can cover the costs of damages or injuries they may cause in an accident.

What is personal injury protection (PIP) coverage?

Personal injury protection (PIP) coverage is a type of insurance that covers medical expenses, lost wages, and other related costs resulting from injuries sustained in a car accident, regardless of who was at fault.

What does property damage liability (PDL) coverage cover?

Your vehicle’s property damage liability (PDL) coverage pays for any property damage it causes. It includes repairs to other vehicles, buildings, fences, or any other property damaged in an accident where you are at fault.

Read More: What are the recommended auto insurance coverage levels?

What are the minimum auto insurance requirements in Fort Lauderdale, FL?

In Fort Lauderdale, FL, drivers must have a minimum of $10,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage.

Are there any additional auto insurance coverage options in Fort Lauderdale, FL?

Yes, in addition to the minimum requirements, drivers in Fort Lauderdale, FL, can opt for additional coverage options such as bodily injury liability (BIL) coverage, uninsured motorist (UM/UIM) coverage, comprehensive coverage, and collision coverage.

Read More: How to Manage Your Auto Insurance Policy

What is bodily injury liability (BIL) coverage?

Bodily injury liability (BIL) coverage covers the medical expenses, pain and suffering, and other damages you may be liable for if you cause an accident that injures someone else.

What does uninsured/underinsured motorist (UM/UIM) coverage cover?

uninsured/underinsured motorist (UM/UIM) coverage protects you if you are involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

What is the best way to compare car insurance quotes in Fort Lauderdale?

To find the best car insurance quotes in Fort Lauderdale, start by using online comparison tools to review rates from multiple providers. This approach helps you find the cheapest car insurance in Fort Lauderdale by comparing different coverage options, such as collision and comprehensive plans.

Be sure to consider factors like deductibles, coverage limits, and customer reviews to identify the best policy for your needs.

How can I find cheap car insurance in Fort Lauderdale, FL if I am a young driver?

Young drivers can find cheap car insurance in Fort Lauderdale, FL by seeking discounts for good grades, taking defensive driving courses, or being added to a parent’s policy. Exploring options with multiple car insurance companies in Fort Lauderdale and choosing a policy with higher deductibles can also help reduce premiums.

Additionally, comparing quotes for cheap auto insurance Fort Lauderdale will ensure you find the most affordable rates available.

Are there any car insurance companies in Fort Lauderdale that specialize in high-risk drivers?

Yes, several car insurance companies in Fort Lauderdale specialize in providing coverage for high-risk drivers. These companies offer specialized auto insurance coverage in Fort Lauderdale, FL, which may include policies designed for drivers with past accidents, DUIs, or traffic violations.

Shop around and compare car insurance quotes in fort Lauderdale, FL to find the best rates and coverage options tailored to your specific situation.

How do local factors affect car insurance rates in Fort Lauderdale, FL?

Local factors, such as traffic congestion, crime rates, and weather conditions, significantly impact car insurance rates in Fort Lauderdale, FL. For example, areas with higher crime rates or frequent weather-related incidents may see increased premiums.

To find the cheapest car insurance in Fort Lauderdale, it’s advisable to compare rates across different neighborhoods and consider both liability and comprehensive coverage options.

What are the benefits of bundling home and auto insurance in Fort Lauderdale, FL?

Bundling home and auto insurance in Fort Lauderdale, FL, can lead to significant savings on your premiums. Many car insurance companies in Fort Lauderdale offer discounts when you combine multiple policies, such as auto insurance and homeowners insurance.

This approach not only provides financial benefits but also simplifies managing your insurance needs with a single provider, offering the best car insurance rates Fort Lauderdale has to offer. Read our article titled “How to Save Money by Bundling Insurance Policies” for more information.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.