State Farm vs. Travelers Auto Insurance 2025 (Which is Best?)

Compare State Farm vs. Travelers auto insurance to find the best fit for your needs. Both offer comprehensive coverage options starting at $33/month. State Farm provides a user-friendly mobile app and the best local agents, while Travelers is known for their proactive safety programs and flexible policies.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsDiscover the right choice for you by exploring State Farm vs. Travelers auto insurance, offering extensive coverage options starting at $33 per month.

We’ll examine the best insurance providers along with their competitive rates, extensive benefits, and claims processing efficiency.

Learn the strategies for evaluating options, enabling you to assess discounts, coverage rates for drivers with a DUI, and customer satisfaction, helping you make a well-informed decision that fits your needs and budget.

State Farm vs. Travelers Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.3 | 4.4 |

| Business Reviews | 5.0 | 4.5 |

| Claim Processing | 4.3 | 4.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.2 | 4.3 |

| Customer Satisfaction | 4.1 | 4.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.9 | 4.0 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.8 | 4.1 |

| Savings Potential | 4.3 | 4.3 |

| State Farm Review | Travelers Review |

Before starting this State Farm vs. Travelers comparison, enter your ZIP code to find free auto insurance quotes in your area.

- State Farm has lower rates than Travelers

- Travelers is rated better than State Farm by A.M. Best

- Travelers have fewer complaints than State Farm

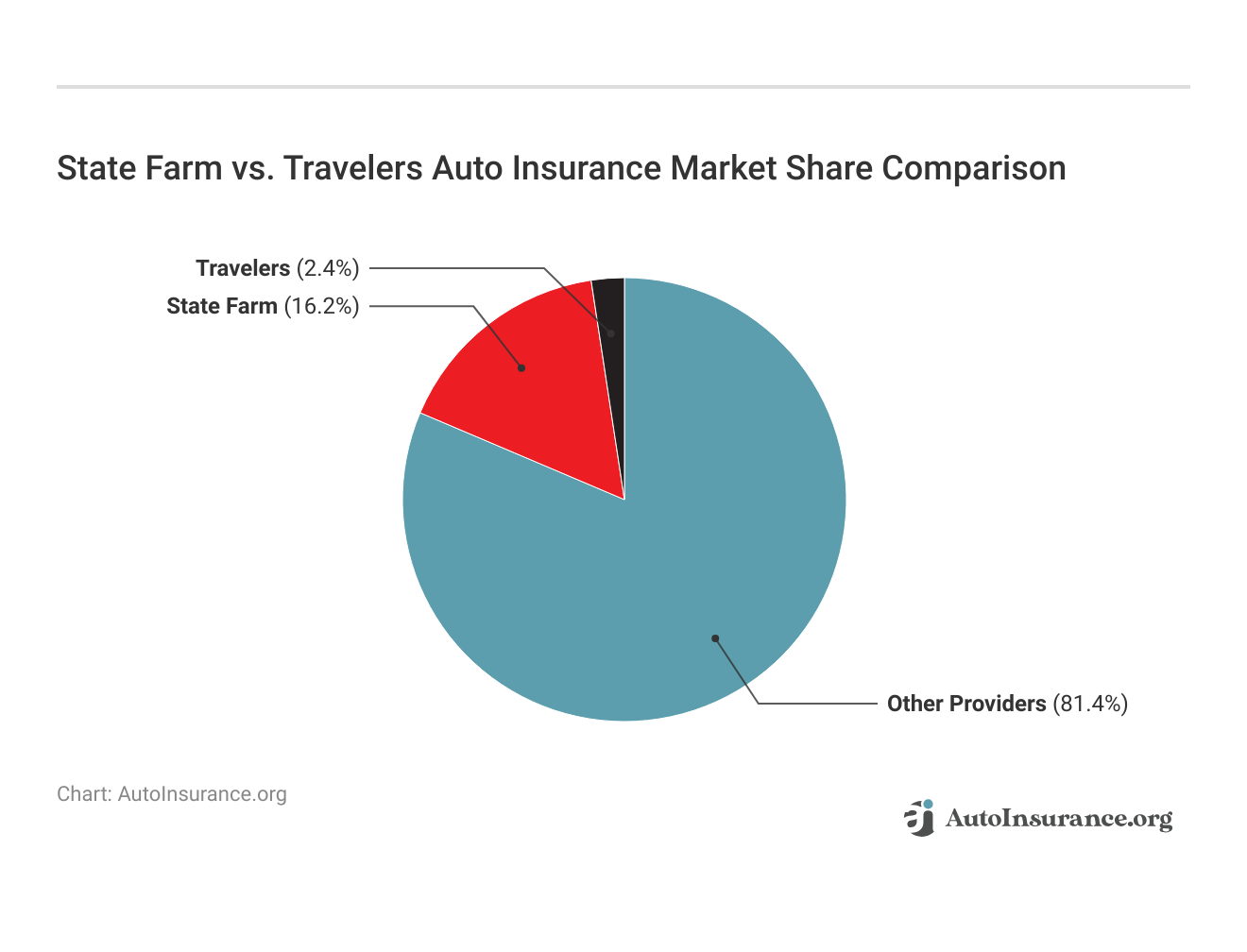

Travelers vs. State Farm Vehicle Insurance Rates

This table shows the full coverage auto insurance rates from State Farm and Travelers categorized by age and gender. They also show fairly marked differences in rates between teenagers and seniors across the insurers. This information helps to simplify the choice to save money depending on demographics, that is, to get high-quality insurance at the lowest possible price relative to age and gender.

State Farm vs. Travelers Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $311 | $719 |

| Age: 16 Male | $349 | $910 |

| Age: 30 Female | $94 | $99 |

| Age: 30 Male | $103 | $108 |

| Age: 45 Female | $86 | $98 |

| Age: 45 Male | $86 | $99 |

| Age: 60 Female | $76 | $89 |

| Age: 60 Male | $76 | $90 |

State Farm and Travelers have their own strengths. If you have teens, State Farm is a cheap option as rates are lower for young drivers. Travelers are more expensive for teens but competitive for adults and seniors. When choosing the best insurer, the age, budget, and coverage needs of a person are to be considered.

How auto insurance companies check driving records plays a crucial role in setting these rates, as even minor infractions can lead to significant price differences. Use this table to see how each company’s rates change depending on your driving record, from a clean history to more serious offenses like DUI.

State Farm vs. Travelers Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $86 | $99 |

| DUI/DWI | $112 | $206 |

| Not-At-Fault Accident | $102 | $139 |

| Speeding Ticket | $96 | $134 |

State Farm and Travelers both have their own perks when it comes to full coverage rates, depending on your driving history. Car insurance rates from State Farm are favorable for safe drivers or those with only a few minor issues. On the other hand, Travelers might be a bit more expensive, but it could be worth it if you’re looking for extra service options and coverage features.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

State Farm Coverage vs. Travelers

Auto insurance companies allow customers to choose the types of coverage they want on their policies. State Farm and Travelers offer the basic coverages that most auto insurance companies provide.

Coverages provided by State Farm and Travelers Insurance include:

State Farm vs. Travelers Auto Insurance Coverage Options

| Coverage Type | ||

|---|---|---|

| Collision | ✅ | ✅ |

| Comprehensive | ✅ | ✅ |

| Gap Insurance | ✅ | ✅ |

| Liability | ✅ | ✅ |

| Medical Payments (MedPay) | ✅ | ✅ |

| Personal Injury Protection (PIP) | ✅ | ✅ |

| Rental Reimbursement | ✅ | ✅ |

| Rideshare Driver | ✅ | ✅ |

| Roadside Assistance | ✅ | ✅ |

| Uninsured/Underinsured Motorist | ✅ | ✅ |

You can also obtain Travelers and State Farm windshield coverage so you can file a claim if you suffer glass damage to your vehicle.

State Farm vs. Travelers Insurance Roadside Assistance

You might be wondering if State Farm or Travelers auto insurance offers a roadside assistance option. If you’ve ever broken down on the road and had no one to call, you know how important roadside assistance can be.

State Farm and Travelers both provide dependable roadside help. State Farm is known for getting to you fast. Travelers, on the other hand, offer more services, including coverage for when your trip is cut short.Michelle Robbins LICENSED INSURANCE AGENT

State Farm offers roadside assistance for $12 per year. Customers who choose this option can receive various services, such as:

- Towing

- Battery service

- Fuel delivery

Travelers offers two levels of roadside assistance. The basic level includes:

- Towing up to 15 miles

- Battery service

- Fuel delivery

- Tire change

- Locksmith service

The premium level includes everything from the basic plan and trip interruption reimbursement, providing up to $200 per day for a rental car.

Read More: Best Auto Insurance Companies for Roadside Assistance

If you choose roadside assistance as an add-on policy, it will increase the price of your State Farm or Travelers auto insurance quotes.

Travelers vs. State Farm Auto Insurance Discounts

Insurance companies offer various car insurance discounts that lower your monthly rates. Comparing State Farm vs. Travelers auto insurance company discounts will help you find the company with the most savings opportunities.

State Farm vs. Travelers Auto Insurance Discounts by Savings Potential

| Discount Name | ||

|---|---|---|

| Continuous Coverage | 12% | 15% |

| Defensive Driver | 5% | 10% |

| Driving Device/App | 50% | 30% |

| Family Plan | 7% | 8% |

| Good Student | 25% | 8% |

| Loyalty | 6% | 9% |

| Multi-Policy | 17% | 13% |

| New Car | 40% | 10% |

| Safe Driver | 15% | 23% |

Standard discounts offered by State Farm include those for safe driving, bundling your policies, and vehicle safety features, making it fairly accessible to cost-conscious drivers.

Meanwhile, Travelers offer more discounts for things like hybrid cars, replacing new vehicles, and programs for drivers who want specific savings based on their driving habits.

State Farm vs. Travelers: Customer Service and Financial Ratings

If you’re on the hunt for the right insurance provider, it’s a good idea to check out State Farm and Travelers. This table is a handy way to kick off your comparison, focusing on things like customer satisfaction, business practices, and financial strength. By looking at the pros and cons of each company, you’ll be better equipped to pick the insurance provider that fits your needs best.

Insurance Business Ratings & Consumer Reviews: State Farm vs. Travelers

| Agency | |||

|---|---|---|---|

| Score: 877 / 1,000 Above Avg. Satisfaction | Score: 860 / 1,000 Above Avg. Satisfaction | ||

| Score: C- Below Avg. Business Practices | Score: A+ Excellent Business Practices | ||

| Score: 75/100 Positive Customer Feedback | Score: 76/100 Good Customer Feedback | ||

| Score: 0.78 More Complaints Than Avg. | Score: 1.12 Avg. Complaints | ||

| Score: B Fair Financial Strength | Score: A++ Superior Financial Strength |

State Farm and Travelers have their own strengths and weaknesses. Customer satisfaction ratings are very high for State Farm, at 877 out of 1,000 from J.D. Power, and Consumer Reports rates it 75/100. It struggles with business practices, however, earning a C rating and has a higher than average complaint index at 0.78, as well as a fair financial strength rating from A.M. Best of B.

On the flip side, Travelers is differentiated by an A+ in business practices, a fantastic A++ in financial strength, and good customer feedback (76/100). Still, its average complaint index is 1.12, with a slightly lower satisfaction score of 860 in J.D. Power ratings.

State Farm vs. Travelers Auto Insurance Customer Service Reviews & Complaints

The Better Business Bureau (BBB) and the National Association of Insurance Commissioners (NAIC) allow customers to file complaints about insurers. These complaints help gauge service quality.

Travelers announces Stay-at-Home Auto Premium Credit Program – personal auto insurance customers will receive a 15% credit on April and May auto premiums. pic.twitter.com/88YWduIcHS

— Travelers (@Travelers) April 8, 2020

State Farm complaints totaled 1,302 at the BBB over three years, with an NAIC complaint index of 1.45, indicating more complaints than similarly-sized competitors. Travelers have had 427 BBB complaints over three years and an NAIC complaint index of 1.29. This indicates fewer total complaints and better overall customer satisfaction compared to State Farm.

Read one of our customers’ verdicts on their experience with Travelers Insurance, listed below. Let’s take a look at what they had to say:

Comment

byu/tubercularskies from discussion

inInsurance

Travelers get a lot of love for its solid reputation and how easy it is to file claims. It just goes to show that hearing from people who’ve actually dealt with insurers can really help you make a smart choice.

Claims Satisfaction

With a 90% satisfaction rate, State Farm usually wins out regarding how happy customers are with claims processing. They have an easy-to-use mobile app and a wide network of agents. Meanwhile, Travelers auto insurance claims now rate 79% satisfaction with a solid online claims system.

State Farm is top-notch when it comes to customer service, with friendly agents and personalized support. Travelers provide reliable service, but people have had mixed reviews about their wait times.

Travelers Insurance vs. State Farm Mobile Apps

State Farm and Travelers have mobile apps that are accessible on any mobile device. These apps allow you to access digital ID cards, request roadside assistance, manage your auto insurance policy, and make payments.

If you prefer to speak with a representative to pay your bill, you can call the Travelers auto insurance phone number at (800) 842-5075. To reach the State Farm pay bill department, call (800) 440-0998.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

State Farm Insurance Pros & Cons

Pros

- High Claims Satisfaction: State Farm’s claim handling earns a satisfaction rate of 90%. This tells you they care for their customers and want to resolve things swiftly.

- Extensive Agent Network: With agents spread across the country, customers find help close at hand. They receive services tailored to their needs, making it simple to get assistance when they require it.

- User-Friendly Mobile App: Easy claims filing and tracking is one of the things the State Farm mobile app lets customers do without hassle.

Cons

- Higher Premiums: State Farm’s comprehensive auto insurance coverage options may come with higher premiums compared to some competitors, which could be a drawback for budget-conscious customers.

- Limited Availability of Certain Discounts: State Farm has many discounts to offer. But not all of them are available in every state. This can limit the savings for some people.

The Travelers Companies, Inc. Pros & Cons

Pros

- Customizable Policies: Travelers allow customers to tailor their policies with a variety of coverage options and add-ons, enabling them to create a plan that best suits their specific needs and circumstances.

- Diverse Coverage Options: With several options to cover, from customizable policies to suit the different needs and preferences of customers, Travelers can offer you a broad range of coverage.

- Proactive Safety Programs: Travelers provide several programs for safety and risk management. They provide resources for safe driving and home protection. It helps lower the risks for customers and even their premiums.

Cons

- Mixed Customer Service Reviews: Customer feedback on Travelers’ service ranges on the spectrum, including issues with wait times, which may cause some auto insurance policyholders frustration.

- Lower Initial Premium Competitiveness: Travelers offers broad coverage, but its initial premiums aren’t competitive enough with those of other insurers to appeal to price-conscious customers.

State Farm vs. Travelers: Deciding the Best Option

Finding the right auto insurance matters. It guards your finances and gives you peace. State Farm is known for its extensive network of agents and exceptional customer service, while Travelers excels with a variety of coverage options and competitive rates.

Take a closer look at our State Farm auto insurance review and Travelers auto insurance review for a detailed understanding of what these providers offer.

👀 In the market for a new auto insurance provider? Compare insurance rates quickly on our site https://t.co/27f1xf131D for FREE. Speaking of insurance rates, have you ever wondered if State Farm is there when you need them🤝? We have a review for you https://t.co/twfTgnzp74. pic.twitter.com/wHg3Xpll5h

— AutoInsurance.org (@AutoInsurance) March 10, 2023

Once you have these resources, you will be able to choose a policy that suits you and your pocket. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What is a good customer rating index for State Farm?

A good customer rating index for State Farm typically reflects strong customer satisfaction, often scoring above 80% in various surveys and reviews. This indicates that customers appreciate their services, claims handling, and overall support.

Why is Travelers insurance so cheap?

Travelers insurance is often considered affordable due to its competitive pricing models, various discount opportunities, and efficient claims processes, which help to lower operational costs. Also, the company offers flexible coverage options that allow customers to tailor their policies according to their budget and needs.

Does State Farm have travel insurance?

State Farm does not offer travel insurance as a standalone product. However, they provide travel-related coverage options within some of their other insurance products, such as travel accident insurance. It’s best to consult with a State Farm agent to explore available options that may meet your travel insurance needs

What does Travelers roadside assistance cover?

Travelers roadside assistance covers a range of services to help you when your vehicle breaks down. This includes towing to the nearest repair facility, battery jump-starts, flat tire changes, fuel delivery, and lockout assistance, ensuring you get back on the road quickly and safely.

Use our free comparison tool below to see what auto insurance quotes look like in your area.

What factors influence State Farm auto insurance quotes?

State Farm auto insurance quotes are influenced by various factors, including your driving history, the type of vehicle you drive, your location, and the coverage options you choose. Providing accurate information will help you receive the most accurate quote tailored to your needs.

How does Travelers rideshare insurance work?

Travelers rideshare auto insurance is designed to provide coverage for drivers working with rideshare companies like Uber or Lyft. It fills gaps in your personal auto insurance, ensuring you’re protected during the time you have passengers in your vehicle. This coverage activates when you are logged into the rideshare app and provides liability, collision, and comprehensive protection, depending on your policy.

What should I consider when comparing Travelers Insurance or State Farm?

When comparing State Farm or Travelers insurance, consider factors such as coverage options, pricing, discounts available, customer service reputation, and claims handling efficiency. State Farm typically provides personalized service through a large network of agents, while Travelers may offer competitive rates and innovative coverage options.

Read More: Progressive vs. Travelers Auto Insurance

What is included in Travelers personal insurance?

Travelers personal insurance typically includes options for auto, home, renters, and umbrella insurance. Their policies often feature customizable coverage options, ensuring that customers can tailor their plans to fit their specific needs and preferences.

What are the differences in coverage between Travelers vs. State Farm home insurance?

State Farm vs. Travelers home insurance policies can vary in terms of coverage options, pricing, and discounts. Travelers often provide unique features like enhanced home protection and optional identity theft coverage, while State Farm may offer a wider range of local agents and personalized service. It’s essential to compare quotes and coverages to find the best fit for your needs.

Read More: Does auto insurance cover vehicle theft?

Is Travelers insurance good?

Yes, Travelers insurance is known for its comprehensive coverage options and reliable customer service. It consistently receives favorable reviews for its competitive pricing and extensive policy offerings, making it a popular choice for many drivers.

Start comparing total coverage auto insurance rates by entering your ZIP code below.

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.