Hallmark Auto Insurance Review (2025)

Hallmark auto insurance is offered through agents working with companies including Erie Insurance, Travelers, and Progressive. They are a Virginia-based agency serving seven states.

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Hallmark Insurance

Average Monthly Rate For Good Drivers

$86A.M. Best Rating:

A-Complaint Level:

LowPros

- Hallmark Insurance Group is located in Virginia but serves other states as well

- Hallmark Insurance Group offers insurance products for both commercial and personal use

- Hallmark Insurance Group auto policies include the standard coverage of property, liability, and medical

Cons

- None to mention

Choosing a small, local insurance agent for your insurance needs often has many benefits. For one, these agents often act as brokers, meaning that they have more leeway when it comes to working with various insurance companies to customize a policy that is right for you.

Smaller companies are often more personalized regarding customer service, as well. The auto insurance market is very competitive, and reputation is one thing that smaller companies can use to their advantage since they can provide service on a more personable level.

What You Should Know About Hallmark Insurance Company

For the convenience of customers, Hallmark Insurance Group has website access available in English and Spanish. You can file an insurance claim online or call the claims number. You can also have your Hallmark insurance agent log in to the system to report the claim.

Watch the video below to understand what you can expect during the claims process.

Hallmark Insurance Group provides all the necessary forms and information for you to adjust your auto insurance policy directly on the website.

The website indicates 24-hour customer service, but this is related to the forms. The actual hours of operation are Monday through Friday, 9 a.m.–5 p.m. Anything outside of that time requires an appointment with an agent.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

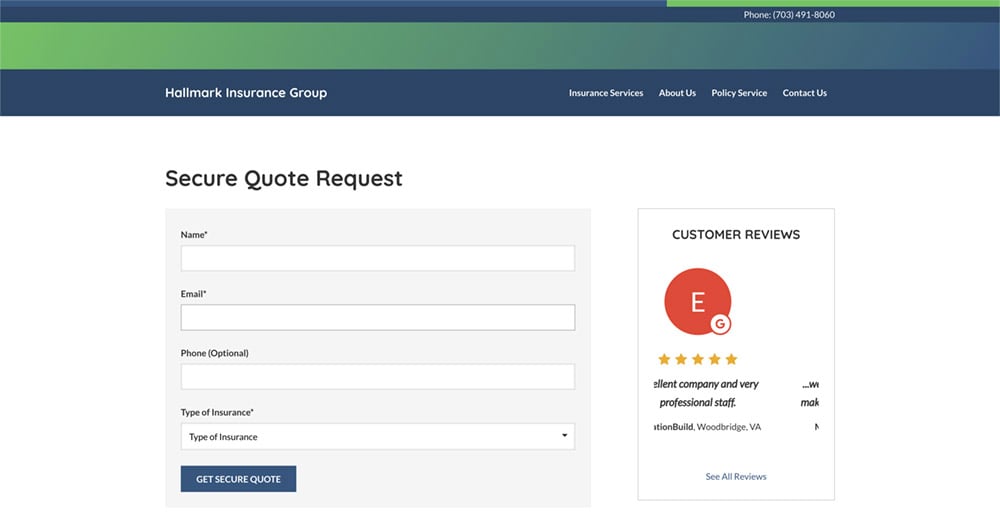

How to Get an Auto Insurance Quote Online with Hallmark

The Hallmark Insurance Group makes getting an auto insurance quote relatively easy. You can start the request online by visiting their website and clicking on the “Get Secure Quote” button.

Once you have done this, enter your information into the online form, and you will be contacted by an agent to discuss which auto insurance rates are available to you.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Hallmark: Auto Insurance Ratings

The Hallmark Insurance Group is an independent insurance agent located in Woodbridge, Virginia. Being a small company, it does not have listed ratings with major insurance rating systems like AM Best.

You can take a look at the video below to see how different groups rate auto insurance providers and find out which groups you can go to to find reputable rating information, such as JD Power, &P Rating, and the Better Business Bureau.

The Hallmark Insurance Group website does offer its own review system where customers can rate the company. Based on this review, the company rates 4.9 stars out of a possible five stars based on 11 rated reviews. You can check out what their customers have to say by visiting the company website.

There is information available regarding the various products on the agency’s website, as well. This information is not comprehensive, however.

If you are interested in insurance products through the Hallmark Insurance Group, you may need to call to have any details or questions answered by an agent.

Hallmark: Auto Insurance History

The Hallmark Insurance Group has been doing business in Woodbridge for 25 years. The owner and insurance agent for the company, Mike Goldberg, has over 30 years of experience in the industry. Hallmark insurance careers appear to be long-lasting.

How is Hallmark’s online presence?

The Hallmark Insurance group does provide its customers with a website where they can request a quote, file a claim, and do a variety of other insurance-related tasks.

You can also use the Hallmark website to request an ID card, a certificate of insurance, or a policy change. It is important to note, however, that all policy changes must be confirmed in writing.

Is Hallmark involved in the community?

The Hallmark Insurance Group prides itself on putting its customers and community first.

Hallmark Insurance Group is an independent insurance agency in Woodbridge, VA, with the customer in mind. They have relationships with many insurance companies, allowing you to get the right coverage with the best price.

The company is active in the community, with most of its charitable work and donations going to the Knights of Columbus. It is also a member of the Independent Insurance Agents of Virginia.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Hallmark Insurance Company Insurance Coverage Options

Hallmark Insurance Group offers insurance products for both commercial and personal use. Commercial insurance products include auto and liability insurance. Hallmark Financial commercial auto may be offered through different companies.

Worker’s compensation insurance is available, as well as other commercial products. More details can be found by contacting a Hallmark Insurance agent.

Personal products available through Hallmark Insurance Group include auto, homeowners, health, and life insurance. There is also insurance available for motorcycles, renters, and recreational vehicles.

Hallmark Insurance Group auto policies include the standard coverage of property, liability, and medical.

Property coverage consists of both collision and comprehensive insurance coverage. Collision handles damage that occurs if you were to have an accident with another vehicle or object. Comprehensive takes care of damages that result from anything other than a collision. Since both of these are wrapped into the package, it is unknown if you would be able to have collision or comprehensive without having both.

Liability auto insurance coverage protects you if you are at fault in an accident that causes damage or bodily harm to another driver. The insurance company covers the medical and property damage that occurs to the other party.

Medical coverage handles your medical expenses that come as a result of an accident. This may also include rehabilitation and funeral expenses. Hallmark also offers medical malpractice insurance as well.

What programs are available from Hallmark?

The Hallmark Insurance Group offers a wide variety of services. You can look at the table below to see the services available from the company based on the insurance policy type.

Hallmark Insurance Group Policies by Type

| Insurance Type | Available Insurance Policies |

|---|---|

| Auto, Home, and Personal Insurance | Auto Insurance, Boat and Marine Insurance, Condominium Insurance, Flood Insurance, High Net Worth Coverage, Homeowners Insurance, Motorcycle Insurance, Pet Insurance, Renters Insurance |

| Business Insurance | Business Interruption Insurance, Business Owners Package Insurance, Commercial Umbrella Insurance, Hotel and Hospitality Insurance, Manufacturers Insurance, Professional Liability (E & O) Insurance, Surety Bonds, Workers' Compensation Insurance |

| Group Benefits | Group Disability Insurance, Group Life Insurance, Group Dental Insurance, Group Long-Term Care (LTC) Insurance, Group Vision Insurance, Flexible Spending Accounts, Health Savings Account |

| Life and Health Insurance | Individual Life Insurance, Affordable Care Act, Individual and Family Health Insurance, Individual Dental Insurance, Individual Vision Insurance, Final Expense Insurance |

Hallmark Insurance Company Insurance Rates Breakdown

You can take a look at the table below to get an idea of what you might pay for auto insurance, depending on how much coverage you decide to buy. The table shows the average annual rates based on coverage levels.

Average Auto Insurance Rates by Coverage

| Coverage Types | Average Annual Auto Insurance Rates | Average Monthly Auto Insurance Rates |

|---|---|---|

| Comprehensive coverage | $150.36 | $12.53 |

| Collision coverage | $299.73 | $24.97 |

| Liability coverage | $516.39 | $43.03 |

| Total Full Coverage Cost | $954.99 | $79.58 |

As an independent insurance agency, Hallmark Insurance Group offers products through Erie Insurance, The Hartford, Travelers, Progressive, and GMAC.

As a consumer, you can shop through these auto insurance companies directly, or you may be able to receive a cheap car insurance quote with an agent or by shopping online right now with our free tool.

Hallmark Insurance Company Discounts Available

Since Hallmark Insurance Group works with various auto insurance providers, your discount options through the company depend on what each provider has to offer, but many discounts are standard throughout the industry.

The table below shows some of the most common auto insurance discounts available, an estimate of how much each can save you, and the companies that offer the discount.

Standard Auto Insurance Discounts Offered by Major Companies

| Discounts Offered | Average Savings | Available With |

|---|---|---|

| Low mileage/Low usage discount | Up to 20% | State Farm, Allstate, Travelers, Nationwide, Progressive |

| Defensive driving discount | 10%–15% | State Farm, Geico, Allstate, Travelers, Nationwide, Progressive, Farmers |

| Safe driver discount | 10% | State Farm, Geico, Allstate, Travelers, Nationwide, Progressive, Liberty Mutual, State National |

| Military and federal employee discount | 8%–15% | Geico, Esurance, USAA |

| Good student discount | 5%–25% | State Farm, Geico, Allstate, Travelers, Nationwide, Progressive, Liberty Mutual, State National |

| Senior/Mature driver discount | 5%–10% | Geico, Allstate, Liberty Mutual, State National |

| Homeowner discount | 3% | State Farm, Geico, Allstate, Travelers, Nationwide, Progressive, Farmers |

As you can see, it is always a good idea to check with your insurance provider to see what types of discounts you qualify for, as they can save you a lot of money on your auto insurance.

What are Hallmark’s bundling options?

Many auto insurance providers that the Hallmark Insurance Group works with offer different bundling options. Bundling your insurance refers to purchasing multiple policies from the same company.

For example, you can purchase your auto insurance policy and your life insurance from the Hallmark Insurance Group if you choose. Most insurance companies offer a discount of anywhere from 5 percent to 25 percent if you choose to bundle.

Many companies offer multi-car discounts, also. You can think of this as a way of bundling, but in this case, you are buying auto insurance for multiple vehicles. Auto insurance companies offer up to a 25 percent multi-car discount on combined policies.

Frequently Asked Questions

Does the Hallmark Insurance Group offer SR-22 insurance?

You may be considered a high-risk driver if you have had more than your fair share of traffic citations, automobile accidents, and/or auto insurance claims. Normally, high-risk drivers are required to purchase SR-22 insurance, which is unavailable through all companies, so it may take some looking around to find coverage.

Progressive and Geico, two companies that offer auto insurance coverage through the Hallmark Insurance group, offer SR-22 auto insurance. There may also be other companies that do, so it would be best to contact Hallmark Insurance Group directly to see what rates they offer.

Is Hallmark good for commercial auto insurance?

Hallmark offers a range of options for commercial coverage, but the right company for you depends on a lot of factors. Rates will vary from company to company, and Hallmark loss runs done by each company may impact rates on business insurance. Talk to an agent for details.

Does Hallmark Auto Insurance offer coverage in all states?

Hallmark Auto Insurance may not be available in all states. Their coverage options may vary by region, and some states may have specific regulations or restrictions. It’s advisable to check with Hallmark or consult their website to verify if they offer coverage in your state.

Can I cancel my Hallmark Auto Insurance policy?

Yes, you can cancel your Hallmark Auto Insurance policy. The process and any associated fees or refunds may vary depending on the terms and conditions of your policy. It’s best to contact their customer service to initiate the cancellation and discuss the specific details.

Does Hallmark Auto Insurance offer any discounts?

Yes, Hallmark Auto Insurance provides various discounts to eligible policyholders. These discounts may be based on factors such as your driving record, vehicle safety features, completion of defensive driving courses, multi-policy discounts, and more. It’s recommended to inquire about available discounts during the quote process.

Can I manage my Hallmark Auto Insurance policy online?

Yes, Hallmark Auto Insurance offers online policy management options. Through their website or mobile app, you can view and update your policy details, make payments, access your documents, and communicate with their customer service team.

Can I customize my auto insurance policy with Hallmark?

Yes, Hallmark Auto Insurance allows policyholders to customize their coverage to some extent. You can typically choose the coverage types and limits that best suit your needs and budget. Additionally, you may have the option to add extras such as roadside assistance or rental car reimbursement to your policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Esther_

A dissatisfied customer

Marcos9400

Beware, they target foreign and minorities

bubbles4me16

great company

joannabrito

Great company!

195077

Thieves

mandasman_71749

The Best Insurance In Town!

shawndra

Hallmark

Georgiegirl928

Be careful with Hallmark

09876unknown0

Hallmark Review!

kelleyuuo

Money