Erie vs. Travelers Auto Insurance in 2026 (Side-by-Side Review)

Our review of Erie vs. Travelers auto insurance found Erie has lower rates starting at $32 per month with Rate Lock and fewer complaints. Meanwhile, Travelers starts at $53 per month, and stands out for its 30% IntelliDrive discount, better A++ A.M. Best rating, and robust coverage add-ons.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated July 2025

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviewsOur in-depth Erie vs. Travelers auto insurance reviews break down how each company delivers value in very different ways. Erie shines with low rates, but Travelers is available in more states.

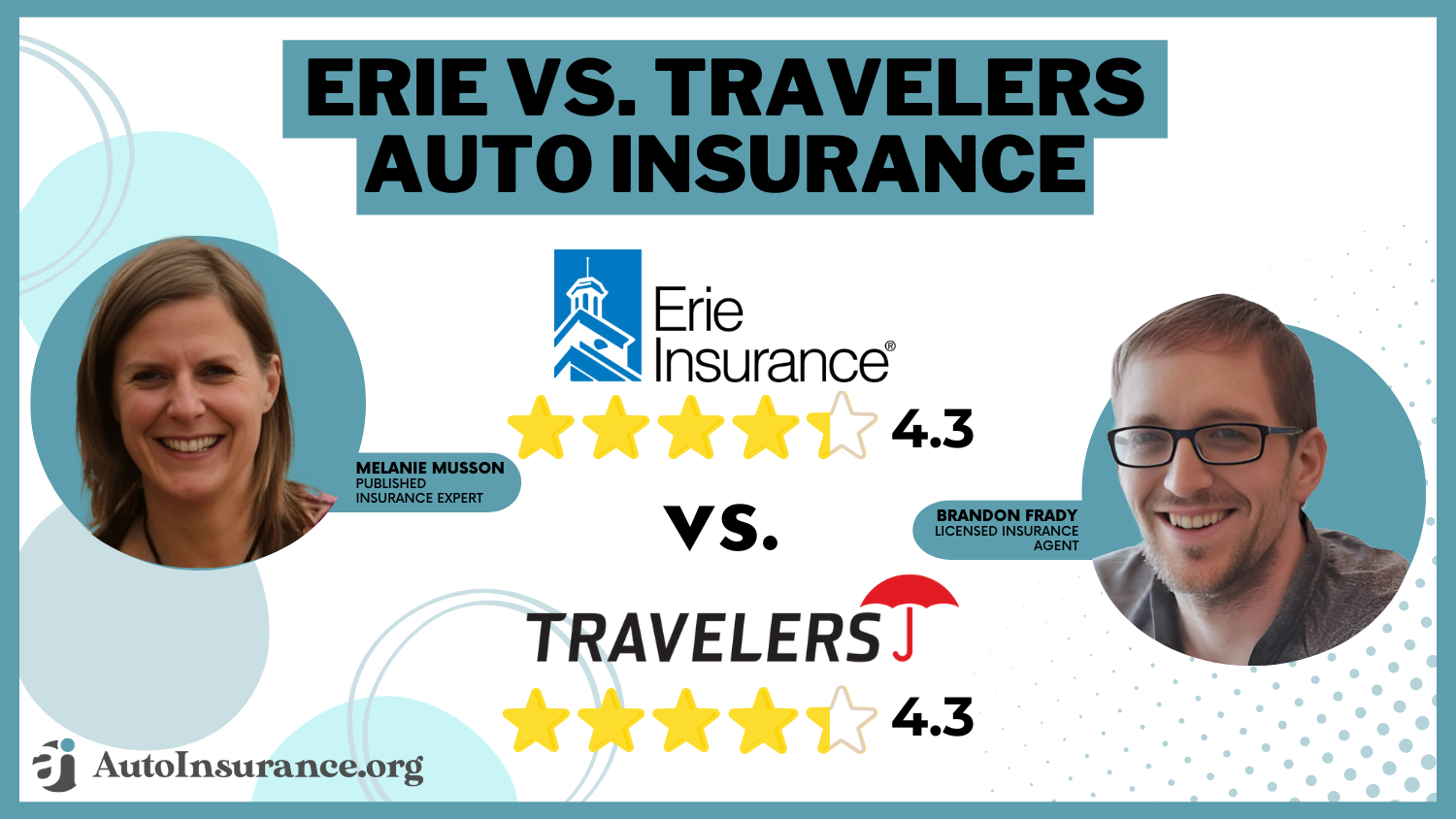

Erie vs. Travelers Auto Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 4.3 | 4.3 |

| Business Reviews | 4.5 | 4.5 |

| Claim Processing | 4.3 | 4.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 3.5 | 5.0 |

| Coverage Value | 4.6 | 4.3 |

| Customer Satisfaction | 2.2 | 2.1 |

| Digital Experience | 4.0 | 4.5 |

| Discounts Available | 4.7 | 5.0 |

| Insurance Cost | 4.7 | 4.1 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 5.0 | 4.1 |

| Savings Potential | 4.7 | 4.4 |

| Erie Review | Travelers Review |

Erie charges $32 a month and stands out with its Rate Lock feature, keeping premiums the same even after an accident.

It also includes free accident forgiveness, roadside assistance, and a shrinking deductible after three years without a claim.

- Erie auto insurance is sold in 12 states, while Travelers is nationwide

- Erie includes pet injury coverage under its auto insurance policy

- Travelers offers new car replacement within the first five years

Travelers, priced at $53 monthly, uses IntelliDrive to monitor real-time driving habits and can cut your rate by up to 30% for safe performance. Want to find out which wins between Erie vs. Travelers auto insurance? Use our free comparison tool now.

Erie vs. Travelers Auto Insurance Cost Comparison

Age and gender can have a big impact on how much you pay for auto insurance. This table illustrates the rate differences between Erie and Travelers for various driver types.

Erie vs. Travelers Auto Insurance Monthly Rates

| Age & Gender |  | |

|---|---|---|

| 16-Year-Old Female | $121 | $392 |

| 16-Year-Old Male | $136 | $517 |

| 30-Year-Old Female | $34 | $57 |

| 30-Year-Old Male | $35 | $58 |

| 45-Year-Old Female | $32 | $54 |

| 45-Year-Old Male | $33 | $53 |

| 60-Year-Old Female | $30 | $49 |

| 60-Year-Old Male | $31 | $50 |

Erie keeps things affordable across the board, with monthly rates starting at $30 for a 60-year-old female and topping out at $136 for a 16-year-old male. Travelers, by comparison, starts much higher at $49 per month for a 60-year-old female and a steep $517 a month for a 16-year-old male.

The biggest price gaps appear for teen drivers, where Erie is hundreds of dollars cheaper. If you’re looking for consistent pricing across age groups, Erie stands out as the lower-cost option.

The amount of coverage you choose can change what you pay each month. This table provides a clear view of how both companies price their minimum and full coverage options.

Erie vs. Travelers Auto Insurance Monthly Rates by Coverage Level

| Coverage Level |  | |

|---|---|---|

| Minimum Coverage | $32 | $53 |

| Full Coverage | $83 | $141 |

With Erie, moving from minimum to full coverage only adds $51 per month, making it a practical upgrade for drivers who want extra protection without a significant cost increase. Travelers Insurance, however, jumps from $53 to $141 a month — a big leap that might not work for drivers on a tighter budget.

If you’re comparing plans based on how much more you’ll pay for full coverage, Erie Insurance gives you more breathing room between tiers.

Your driving record will follow you to Erie or Travelers. This table illustrates how Erie Insurance and Travelers Insurance adjust their monthly rates following various types of violations.

Erie vs. Travelers Auto Insurance Monthly Rates by Driving Record

| Driving Record |  | |

|---|---|---|

| Clean Record | $32 | $53 |

| Not-At-Fault Accident | $45 | $76 |

| Speeding Ticket | $38 | $72 |

| DUI/DWI | $60 | $112 |

If you’ve had a DUI, Travelers jumps from $53 to $112, while Erie Insurance bumps up to $60—a much smaller hit to your budget.

The best way to lower your rate is to bundle home and auto policies. Some companies slash premiums by as much as 25%.Michelle Robbins Licensed Insurance Agent

Even something as minor as a not-at-fault accident raises Travelers’ rate to $76, compared to just $45 with Erie. For drivers with less-than-perfect records, Erie’s pricing may feel a lot more forgiving month to month.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Erie vs. Travelers Auto Insurance Discounts

The right discounts can seriously shrink your monthly premium, but not all insurers reward you the same way. This table breaks down how Erie and Travelers Insurance Company apply savings based on how you drive, what you drive, and how you bundle, highlighting where to find the best auto insurance discounts.

List of Auto Insurance Discounts With Erie and Travelers

| Discount |  | |

|---|---|---|

| Anti-Theft | 25% | 15% |

| Bundling | 25% | 13% |

| Defensive Driving | 20% | 20% |

| Good Driver | 23% | 10% |

| Good Student | 15% | 8% |

| Low Mileage | 30% | 20% |

| Military | 12% | 10% |

| Multi-Car | 10% | 25% |

| Safe Driver | 15% | 17% |

| Safety Features | 10% | 13% |

| UBI | 30% | 30% |

If you bundle your home and auto with Erie Insurance Group, you could knock 25% off your bill. Low-mileage drivers also come out ahead with Erie’s 30% discount, which is great if you work from home or don’t commute much.

Travelers offers a strong 25% discount for multi-car households, making it a smart option for families with multiple vehicles. However, in most other categories, such as good driver and good student discounts, Erie offers more. Those bigger savings can add up over time, especially for careful drivers or parents with teens on the policy.

Erie and Travelers Auto Coverage Options

When comparing Erie vs. Travelers car insurance, the most significant differences are evident in how each company structures its coverage. While both offer the standard protections, the details matter, especially when you’re trying to decide what’s worth paying for.

Erie vs. Travelers Auto Insurance Add-On Coverage Options

| Add-On |  | |

|---|---|---|

| Accident Forgiveness | ✅ | ✅ |

| Diminishing Deductible | ❌ | ✅ |

| Gap Insurance | ✅ | ✅ |

| Identity Theft Coverage | ✅ | ✅ |

| New Car Replacement | ✅ | ❌ |

| OEM Parts Coverage | ✅ | ✅ |

| Personal Item Coverage | ✅ | ❌ |

| Pet Injury Protection | ✅ | ❌ |

| Rental Car Reimbursement | ✅ | ✅ |

| Rideshare Coverage | ❌ | ✅ |

| Roadside Assistance | ✅ | ✅ |

| SR-22 Filing | ✅ | ✅ |

| Usage-Based Discount Program | ❌ | ✅ |

| Vanishing Deductible | ❌ | ✅ |

Both insurers offer flexible liability coverage limits. Erie Insurance offers bodily injury protection of up to $250,000 per person, providing peace of mind in the event of a serious at-fault accident. Travelers offers similar flexibility, with easy options to increase property damage limits—a helpful feature in areas with high repair costs.

Collision coverage is available through both, but Erie offers an edge with its new car replacement feature. If your vehicle is totaled within the first two years, Erie replaces it with a new one of the same make and model. Travelers Insurance skips this, but it includes rental car reimbursement, keeping you mobile while your car’s in the shop.

For comprehensive coverage, both companies cover damage from events such as theft, weather, or vandalism. Erie includes glass repairs with no deductible, which can save drivers money on common windshield issues. Travelers covers the same events, but you’ll likely need a separate glass package to avoid a deductible.

Both providers offer medical payments coverage (MedPay) and personal injury protection (PIP), depending on your state. Erie Insurance covers up to $10,000 in MedPay to help with hospital bills and ambulance costs. Travelers offers strong PIP options, covering lost wages and basic household help during recovery.

Erie lets you stack uninsured motorist coverage across vehicles and offers helpful perks, including coverage for pet injuries and personal property protection. Travelers offers up to $500,000 in single-limit coverage and leans into technology with rideshare insurance, a shrinking deductible, and IntelliDrive, which rewards safe drivers with savings of up to 30%.

Erie vs. Travelers Insurance Customer Reviews and Ratings

This table breaks down how Erie Insurance Group and Travelers perform in terms of satisfaction, service, and financial reliability. Erie stands out with stronger feedback from real customers, earning a J.D. Power score of 733 and an 82 from Consumer Reports, meaning drivers generally feel more supported.

Insurance Business Ratings & Consumer Reviews: Erie vs. Travelers

| Agency |  | |

|---|---|---|

| Score: 733 / 1,000 Avg. Satisfaction | Score: 684 / 1,000 Below Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A Good Business Practices |

|

| Score: 82/100 Positive Customer Feedback | Score: 76/100 Good Customer Feedback |

|

| Score: 0.60 Fewer Complaints Than Avg. | Score: 3.96 More Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength | Score: A++ Superior Financial Strength |

Travelers doesn’t fare as well, with a lower satisfaction rating and a significantly higher complaint index of 3.96 compared to Erie’s 0.60, which could indicate more frequent service frustrations.

Both companies are financially strong, but Travelers having an A++ rating doesn’t really cancel out the fact that they get a lot more complaints. If you care about how things go after you buy a policy, Erie might give you a smoother, less frustrating experience overall.

Don’t overlook complaint index scores. They reveal how well insurers actually treat customers after you sign the policy.Daniel Walker Licensed Insurance Agent

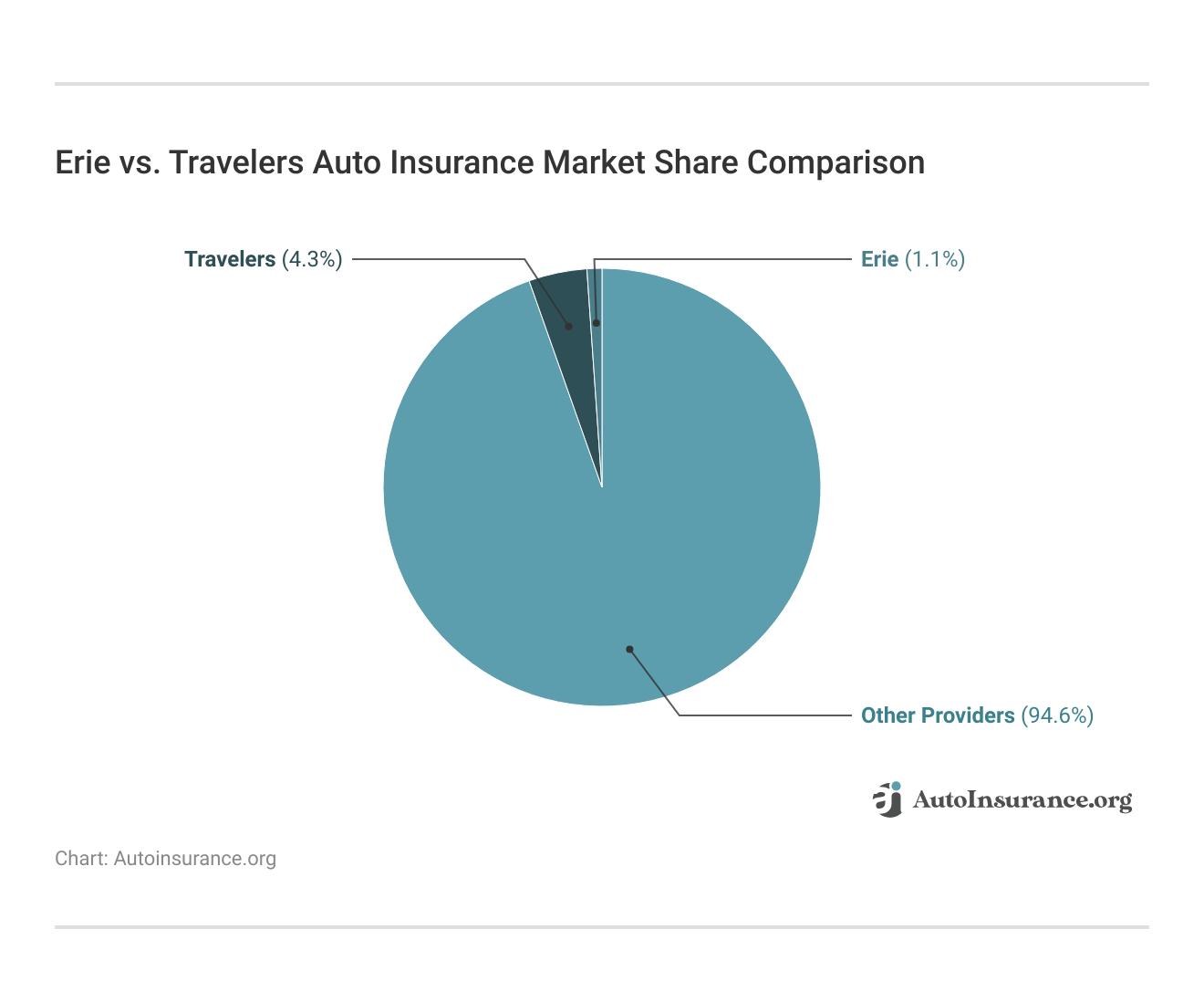

Market share tells you how many drivers choose one company over another, and that can say a lot about how widely available and trusted an insurer is. This chart gives a quick snapshot of how Erie Insurance and Travelers Insurance Company compare when it comes to their slice of the industry.

Travelers holds 4.3% of the market, which means you’re more likely to see its name pop up in national searches or local agent offices. Erie, with just 1.1%, tends to serve a more regional audience, so if you’re outside their core states, availability might be limited. But that smaller footprint can also translate to more personalized service and local expertise.

A Reddit user chimed in on a thread about Erie’s home and auto insurance, saying they’ve stuck with the company for years — and for good reason. They mentioned that Erie had handled their claims smoothly and that bundling their policies kept rates consistently lower than those with other companies they had looked into (Read More: Best Auto Insurance Companies According to Reddit)

Comment

byu/notveryhndyhmnr from discussion

inInsurance

What stood out was the mention of customer service being handled in-house rather than outsourced, which they felt made a significant difference in how issues were resolved. The only caveat they noted was that Erie isn’t available everywhere, so it depends on where you live.

Pros and Cons of Erie Insurance

If you’re someone who hates surprise price hikes and prefers straightforward coverage, Erie Insurance might be exactly what you’re looking for. This Erie auto insurance review highlights how the company focuses less on flashy features and more on stable pricing and long-term value:

- Predictable Pricing for Cautious Drivers: Erie reduces rate volatility by avoiding sudden premium hikes for drivers with steady records, helping long-term customers avoid unexpected cost increases during renewal periods.

- Better Deals for Students and Military: If you’re a full-time student with good grades or an active-duty military member, Erie offers stronger discounts than most big-name competitors.

- Focused Policy Structure With Minimal Upselling: Unlike some insurers that push optional add-ons, Erie keeps its core auto policies tightly packaged with practical features like rental reimbursement and travel expense coverage included by default.

Still, while Erie has clear benefits, there are a few limitations to consider, especially for tech-reliant or mobile-first policyholders:

- Minimal Telematics Customization: Erie’s usage-based discount program lacks driver feedback and transparency in tracking, which may leave data-conscious users wanting more control.

- Limited Support Outside Business Hours: Unlike larger insurers with 24/7 digital and phone service, Erie’s customer support is primarily routed through local agents, which can delay response times outside standard business hours.

Erie stands out for its 30% low-mileage discount, first-accident forgiveness, and consistently high J.D. Power and Consumer Reports scores, and it offers more long-term value than insurers that focus solely on technology or national reach.

Pros and Cons of Travelers Insurance

If you’re a careful driver or part of a multi-car household, Travelers Insurance might be worth a closer look. This Travelers auto insurance review highlights how the company emphasizes performance-based savings and offers solid, family-friendly discounts that can pay off when you drive responsibly and bundle your policies.

- Flexible Usage-Based Insurance Program: Travelers uses a telematics system that tracks activities such as hard braking, sharp turns, and late-night driving. The better your habits, the bigger your discount—up to 30%—based on how you drive, not just your history.

- Bundled Family Value: Travelers gives some of its best discounts when you combine auto with renters or homeowners insurance, especially if you have more than one vehicle on the policy. It’s a great setup for families trying to keep everything under one roof and cut costs at the same time.

- Reliable Claim Support Network: With a strong team and ample availability across the U.S., Travelers makes it easy to handle standard claims, such as cracked windshields or minor fender benders, with minimal hassle.

Still, Travelers isn’t perfect. It’s better suited for people with clean records and a little patience for tech that isn’t always the most modern.

- Significant Rate Swings After Incidents: If you get a ticket or file a claim, your rate can go up fast, especially if you’re under 25 or already have a violation on your record.

- Less Intuitive Online Tools: The website and app don’t always offer the smoothest experience, and some policyholders say it takes a few extra steps to find what they need.

If you’re a safe driver who doesn’t mind giving up a little tech polish for better pricing, Travelers Insurance makes a strong case. Just know that one slip-up behind the wheel could end up costing you.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing Between Erie and Travelers Auto Insurance

When comparing Erie vs. Travelers auto insurance, Erie Insurance is great if you want steady pricing, while Travelers is better if you’re confident in your driving habits. Erie also offers Erie travel insurance, which includes practical perks like trip cancellation and baggage protection, which is beneficial for existing policyholders looking to streamline coverage.

With Erie, you can save by bundling your auto and home policies for 25% off or driving less to qualify for a 30% low-mileage auto insurance discount. The Travelers Companies, Inc. helps lower your bill through IntelliDrive, which tracks your driving and offers up to 30% off, plus a 25% discount if you insure more than one car.

Erie Insurance stands out with a low 0.60 complaint index, showing strong customer satisfaction. The Travelers Companies, Inc. leads when it comes to customizing your price based on how you drive. To get the best deal overall, enter your ZIP code and compare a few quotes online.

Frequently Asked Questions

Is Travelers insurance better than Erie?

Travelers suits telematics-savvy drivers who want up to 30% off with IntelliDrive, while Erie appeals to cautious drivers who value price stability and fewer premium fluctuations.

Is Erie a good auto insurance company?

Yes, Erie consistently ranks above average in J.D. Power and Consumer Reports for customer satisfaction and starts at just $32 a month for minimum coverage.

Is Travelers Insurance a good auto insurance company?

Travelers is a solid option for families with multiple vehicles, offering up to 25% in multi-vehicle auto insurance discounts, and boasts strong financial strength with an A++ A.M. Best rating.

Why is Erie insurance so expensive?

Erie’s rates may increase if you live outside their primary service regions or have a history of prior claims, but bundling discounts (up to 25%) and low-mileage savings (up to 30%) can help lower your costs.

Is there a cancellation fee for Erie insurance?

No cancellation fee is typically charged. However, check with your Erie agent for your state’s terms and policy-specific provisions.

Is Erie Insurance high risk?

No, Erie typically targets low-risk drivers, so if you’re looking for cheap auto insurance after a DUI, you may face limited eligibility or much higher premiums.

Does Erie Insurance pay claims well?

Yes, Erie has a low 0.60 NAIC complaint index and scores 82/100 on Consumer Reports, indicating reliable and timely claims handling.

Is Travelers good at paying claims?

Travelers handles basic claims quickly, such as glass and fender benders, but users report mixed satisfaction with more complex issues, like total loss settlements.

What is the difference between State Farm and Travelers auto insurance?

State Farm has broader agent accessibility and a more substantial brand presence. At the same time, Travelers stands out in customizable savings through niche bundling options and its telematics program, as highlighted in our Travelers IntelliDrive review.

Is Erie auto insurance better than State Farm?

Erie car insurance outperforms State Farm in customer satisfaction and offers 30% low-mileage savings, along with built-in perks like trip interruption coverage at no extra cost.

How do you lower auto insurance in Erie?

Is Erie cheaper than Allstate auto insurance?

How does Erie Insurance handle claims?

How much will my insurance premiums increase after an accident with Erie Insurance?

Do Travelers and Erie customers plan to renew?

How do Travelers and Erie score in terms of policy offerings?

Does Erie Insurance have a deductible?

What additional types of insurance does Travelers offer?

Can I buy Travelers auto insurance online?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What other types of insurance does Erie Insurance Group offer?

Travelers suits telematics-savvy drivers who want up to 30% off with IntelliDrive, while Erie appeals to cautious drivers who value price stability and fewer premium fluctuations.

Yes, Erie consistently ranks above average in J.D. Power and Consumer Reports for customer satisfaction and starts at just $32 a month for minimum coverage.

Is Travelers Insurance a good auto insurance company?

Travelers is a solid option for families with multiple vehicles, offering up to 25% in multi-vehicle auto insurance discounts, and boasts strong financial strength with an A++ A.M. Best rating.

Why is Erie insurance so expensive?

Erie’s rates may increase if you live outside their primary service regions or have a history of prior claims, but bundling discounts (up to 25%) and low-mileage savings (up to 30%) can help lower your costs.

Is there a cancellation fee for Erie insurance?

No cancellation fee is typically charged. However, check with your Erie agent for your state’s terms and policy-specific provisions.

Is Erie Insurance high risk?

No, Erie typically targets low-risk drivers, so if you’re looking for cheap auto insurance after a DUI, you may face limited eligibility or much higher premiums.

Does Erie Insurance pay claims well?

Yes, Erie has a low 0.60 NAIC complaint index and scores 82/100 on Consumer Reports, indicating reliable and timely claims handling.

Is Travelers good at paying claims?

Travelers handles basic claims quickly, such as glass and fender benders, but users report mixed satisfaction with more complex issues, like total loss settlements.

What is the difference between State Farm and Travelers auto insurance?

State Farm has broader agent accessibility and a more substantial brand presence. At the same time, Travelers stands out in customizable savings through niche bundling options and its telematics program, as highlighted in our Travelers IntelliDrive review.

Is Erie auto insurance better than State Farm?

Erie car insurance outperforms State Farm in customer satisfaction and offers 30% low-mileage savings, along with built-in perks like trip interruption coverage at no extra cost.

How do you lower auto insurance in Erie?

Is Erie cheaper than Allstate auto insurance?

How does Erie Insurance handle claims?

How much will my insurance premiums increase after an accident with Erie Insurance?

Do Travelers and Erie customers plan to renew?

How do Travelers and Erie score in terms of policy offerings?

Does Erie Insurance have a deductible?

What additional types of insurance does Travelers offer?

Can I buy Travelers auto insurance online?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What other types of insurance does Erie Insurance Group offer?

Travelers is a solid option for families with multiple vehicles, offering up to 25% in multi-vehicle auto insurance discounts, and boasts strong financial strength with an A++ A.M. Best rating.

Erie’s rates may increase if you live outside their primary service regions or have a history of prior claims, but bundling discounts (up to 25%) and low-mileage savings (up to 30%) can help lower your costs.

Is there a cancellation fee for Erie insurance?

No cancellation fee is typically charged. However, check with your Erie agent for your state’s terms and policy-specific provisions.

Is Erie Insurance high risk?

No, Erie typically targets low-risk drivers, so if you’re looking for cheap auto insurance after a DUI, you may face limited eligibility or much higher premiums.

Does Erie Insurance pay claims well?

Yes, Erie has a low 0.60 NAIC complaint index and scores 82/100 on Consumer Reports, indicating reliable and timely claims handling.

Is Travelers good at paying claims?

Travelers handles basic claims quickly, such as glass and fender benders, but users report mixed satisfaction with more complex issues, like total loss settlements.

What is the difference between State Farm and Travelers auto insurance?

State Farm has broader agent accessibility and a more substantial brand presence. At the same time, Travelers stands out in customizable savings through niche bundling options and its telematics program, as highlighted in our Travelers IntelliDrive review.

Is Erie auto insurance better than State Farm?

Erie car insurance outperforms State Farm in customer satisfaction and offers 30% low-mileage savings, along with built-in perks like trip interruption coverage at no extra cost.

How do you lower auto insurance in Erie?

Is Erie cheaper than Allstate auto insurance?

How does Erie Insurance handle claims?

How much will my insurance premiums increase after an accident with Erie Insurance?

Do Travelers and Erie customers plan to renew?

How do Travelers and Erie score in terms of policy offerings?

Does Erie Insurance have a deductible?

What additional types of insurance does Travelers offer?

Can I buy Travelers auto insurance online?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What other types of insurance does Erie Insurance Group offer?

No cancellation fee is typically charged. However, check with your Erie agent for your state’s terms and policy-specific provisions.

No, Erie typically targets low-risk drivers, so if you’re looking for cheap auto insurance after a DUI, you may face limited eligibility or much higher premiums.

Does Erie Insurance pay claims well?

Yes, Erie has a low 0.60 NAIC complaint index and scores 82/100 on Consumer Reports, indicating reliable and timely claims handling.

Is Travelers good at paying claims?

Travelers handles basic claims quickly, such as glass and fender benders, but users report mixed satisfaction with more complex issues, like total loss settlements.

What is the difference between State Farm and Travelers auto insurance?

State Farm has broader agent accessibility and a more substantial brand presence. At the same time, Travelers stands out in customizable savings through niche bundling options and its telematics program, as highlighted in our Travelers IntelliDrive review.

Is Erie auto insurance better than State Farm?

Erie car insurance outperforms State Farm in customer satisfaction and offers 30% low-mileage savings, along with built-in perks like trip interruption coverage at no extra cost.

How do you lower auto insurance in Erie?

Is Erie cheaper than Allstate auto insurance?

How does Erie Insurance handle claims?

How much will my insurance premiums increase after an accident with Erie Insurance?

Do Travelers and Erie customers plan to renew?

How do Travelers and Erie score in terms of policy offerings?

Does Erie Insurance have a deductible?

What additional types of insurance does Travelers offer?

Can I buy Travelers auto insurance online?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What other types of insurance does Erie Insurance Group offer?

Yes, Erie has a low 0.60 NAIC complaint index and scores 82/100 on Consumer Reports, indicating reliable and timely claims handling.

Travelers handles basic claims quickly, such as glass and fender benders, but users report mixed satisfaction with more complex issues, like total loss settlements.

What is the difference between State Farm and Travelers auto insurance?

State Farm has broader agent accessibility and a more substantial brand presence. At the same time, Travelers stands out in customizable savings through niche bundling options and its telematics program, as highlighted in our Travelers IntelliDrive review.

Is Erie auto insurance better than State Farm?

Erie car insurance outperforms State Farm in customer satisfaction and offers 30% low-mileage savings, along with built-in perks like trip interruption coverage at no extra cost.

How do you lower auto insurance in Erie?

Is Erie cheaper than Allstate auto insurance?

How does Erie Insurance handle claims?

How much will my insurance premiums increase after an accident with Erie Insurance?

Do Travelers and Erie customers plan to renew?

How do Travelers and Erie score in terms of policy offerings?

Does Erie Insurance have a deductible?

What additional types of insurance does Travelers offer?

Can I buy Travelers auto insurance online?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What other types of insurance does Erie Insurance Group offer?

State Farm has broader agent accessibility and a more substantial brand presence. At the same time, Travelers stands out in customizable savings through niche bundling options and its telematics program, as highlighted in our Travelers IntelliDrive review.

Erie car insurance outperforms State Farm in customer satisfaction and offers 30% low-mileage savings, along with built-in perks like trip interruption coverage at no extra cost.

How do you lower auto insurance in Erie?

Is Erie cheaper than Allstate auto insurance?

How does Erie Insurance handle claims?

How much will my insurance premiums increase after an accident with Erie Insurance?

Do Travelers and Erie customers plan to renew?

How do Travelers and Erie score in terms of policy offerings?

Does Erie Insurance have a deductible?

What additional types of insurance does Travelers offer?

Can I buy Travelers auto insurance online?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What other types of insurance does Erie Insurance Group offer?

How does Erie Insurance handle claims?

How much will my insurance premiums increase after an accident with Erie Insurance?

Do Travelers and Erie customers plan to renew?

How do Travelers and Erie score in terms of policy offerings?

Does Erie Insurance have a deductible?

What additional types of insurance does Travelers offer?

Can I buy Travelers auto insurance online?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What other types of insurance does Erie Insurance Group offer?

Do Travelers and Erie customers plan to renew?

How do Travelers and Erie score in terms of policy offerings?

Does Erie Insurance have a deductible?

What additional types of insurance does Travelers offer?

Can I buy Travelers auto insurance online?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What other types of insurance does Erie Insurance Group offer?

Does Erie Insurance have a deductible?

What additional types of insurance does Travelers offer?

Can I buy Travelers auto insurance online?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What other types of insurance does Erie Insurance Group offer?

Can I buy Travelers auto insurance online?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What other types of insurance does Erie Insurance Group offer?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.