American Commerce Auto Insurance Review (2025)

American Commerce auto insurance primarily offers insurance through independent agents in 18 states. The average auto insurance rates are $372.66/mo. They are a part of larger insurance company MAPFRE Insurance.

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Feb 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

American Commerce Insurance Company

Average Monthly Rate For Good Drivers

$119A.M. Best Rating:

AComplaint Level:

LowPros

- The MAPFRE website is excellent, giving you significant amounts of information in an easy-to-use format

- A.M. Best gives MAPFRE an A rating on financial stability

Cons

- MAPFRE requires you to contact an independent agent to get a quote

If you feel that doing business with an independent agent is the best choice, purchasing a policy from American Commerce/MAPFRE may be worth your time. Ask your agent for a quote and if they know of other products that might better fit your needs.

If you want online quotes for multiple companies, use our FREE tool below to save money on auto insurance today.

What You Should Know About American Commerce Insurance Company (Mapfre)

MAPFRE tends to be a little more expensive than its competitors, but they have excellent rankings in most categories that have shown improvement over time.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

When should you cancel your MAPFRE Auto Insurance policy?

Before you cancel your MAPFRE auto insurance, ensure you have a new policy in place. Canceling auto insurance without new coverage could leave you with a gap in coverage, which could also increase your rates for your new policy.

Once you have a new policy in place, you will need to think about the questions below:

Is there a MAPFRE Insurance Cancellation Fee?

The MAPFRE website doesn’t specify if there is a cancellation fee for terminating your policy. Given that each state has different rules and regulations when it comes to insurance, you may or may not be required to pay a cancellation fee.

You may also be required to pay a processing fee, depending on your location and how you pay your bill. Paying directly through their site or a third-party vendor can impact whether or not you will be charged a processing fee.

Is there a refund?

The answer to this question is similar to the statement above regarding cancellation fees.

The laws and rules vary from state to state, so customers in some places may be entitled to a refund while others may not or may only be entitled to a partial refund.

If you have insurance through MAPFRE, you should contact your independent agent who arranged your policy and find out whether or not you will receive a refund.

How do I cancel my MAPFRE insurance policy?

Your first step should be reaching out to your independent agent and letting them know you want to cancel your policy. If you used them to purchase a new policy, they may have already put things in motion to cancel your policy through MAPFRE without any additional work on your part.

You may also find that your new insurance company will take care of your cancellation, so make sure to ask when setting up your new policy if you are still responsible for canceling your previous coverage.

If you don’t want to reach out to your agent, you can call the MAPFRE customer service department in your state, and they can connect you to someone who can help you cancel your policy.

When can I cancel?

Most states allow you to cancel an auto insurance policy at any time if you have a new policy to replace it to prevent a coverage gap. However, some states may have different rules, so check with your state’s insurance website or your independent agent to make sure you know when you can cancel your policy.

Policies typically go into effect at midnight and are terminated effective 11:59 p.m. This is the best way to guarantee you are never left with a coverage gap.

How do I make a MAPFRE Auto Insurance Claim?

MAPFRE offers several methods whereby individuals can make an auto insurance claim for the first time. The company prefers that you contact the appropriate claims office for your region directly.

Their website provides phone numbers for both claim centers; that information should also be included in your policy documents and your individual identification cards.

The second option is to contact your local agent and allow him or her to file your auto insurance claim. If you use this option, keep in mind that you’ll ultimately have to deal with MAPFRE at some point in order to complete your claim.

Your local agent will be able to take all the necessary information, fill out some of the paperwork for you, and get you in touch with a representative at your regional claims center.

The third option is to file an online claim form, which can be found on the MAPFRE website. This claim form is a six-step process that can be used either by existing customers filing a claim against their own policy or non-customers filing a claim against a current policyholder.

The company website offers detailed information and tips and advice for expediting a claim in the claims section. Customers are urged to read this information thoroughly before making a claim.

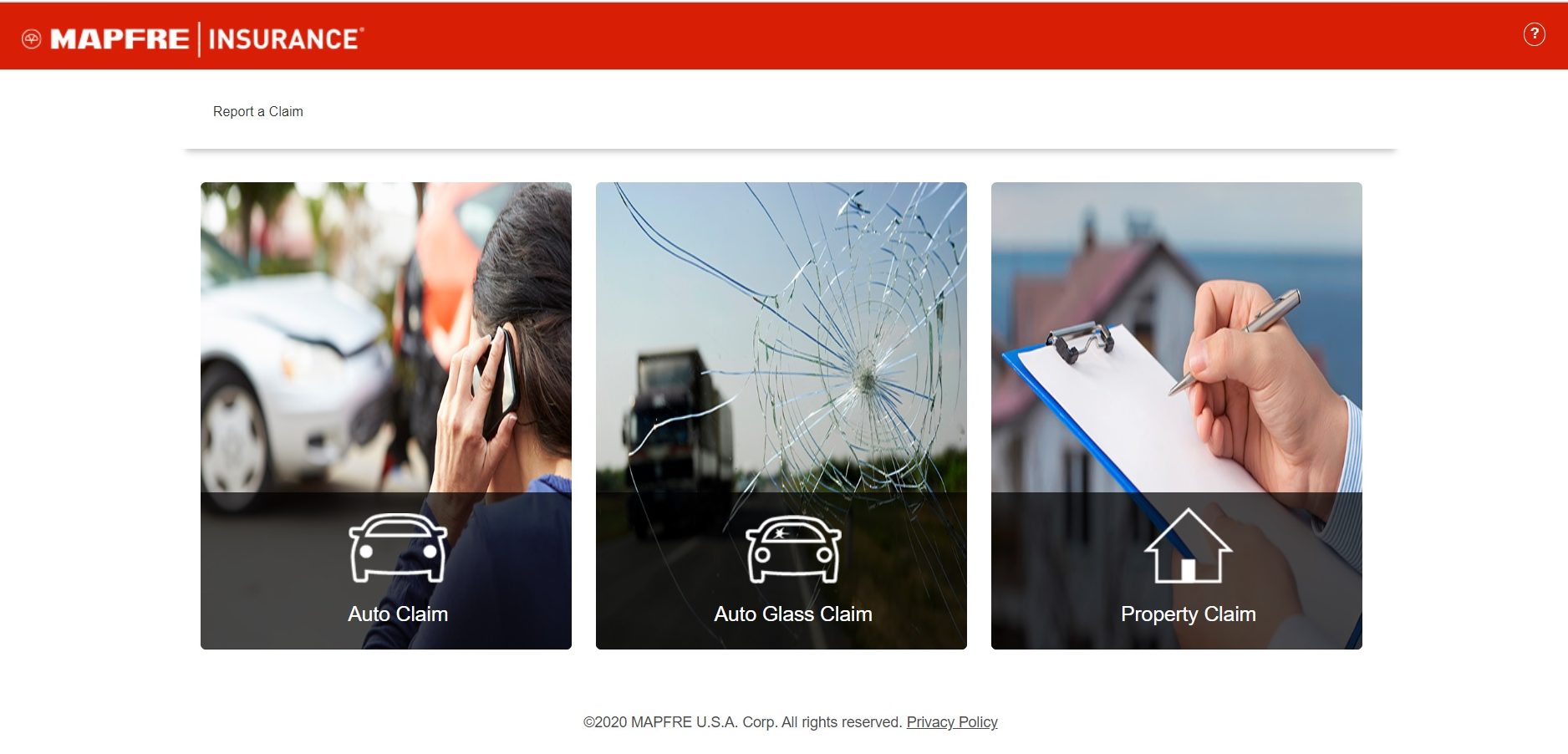

The online MAPFRE insurance claims system is shown below:

Once you select the type of claim you are filing, you will move on to the next screen.

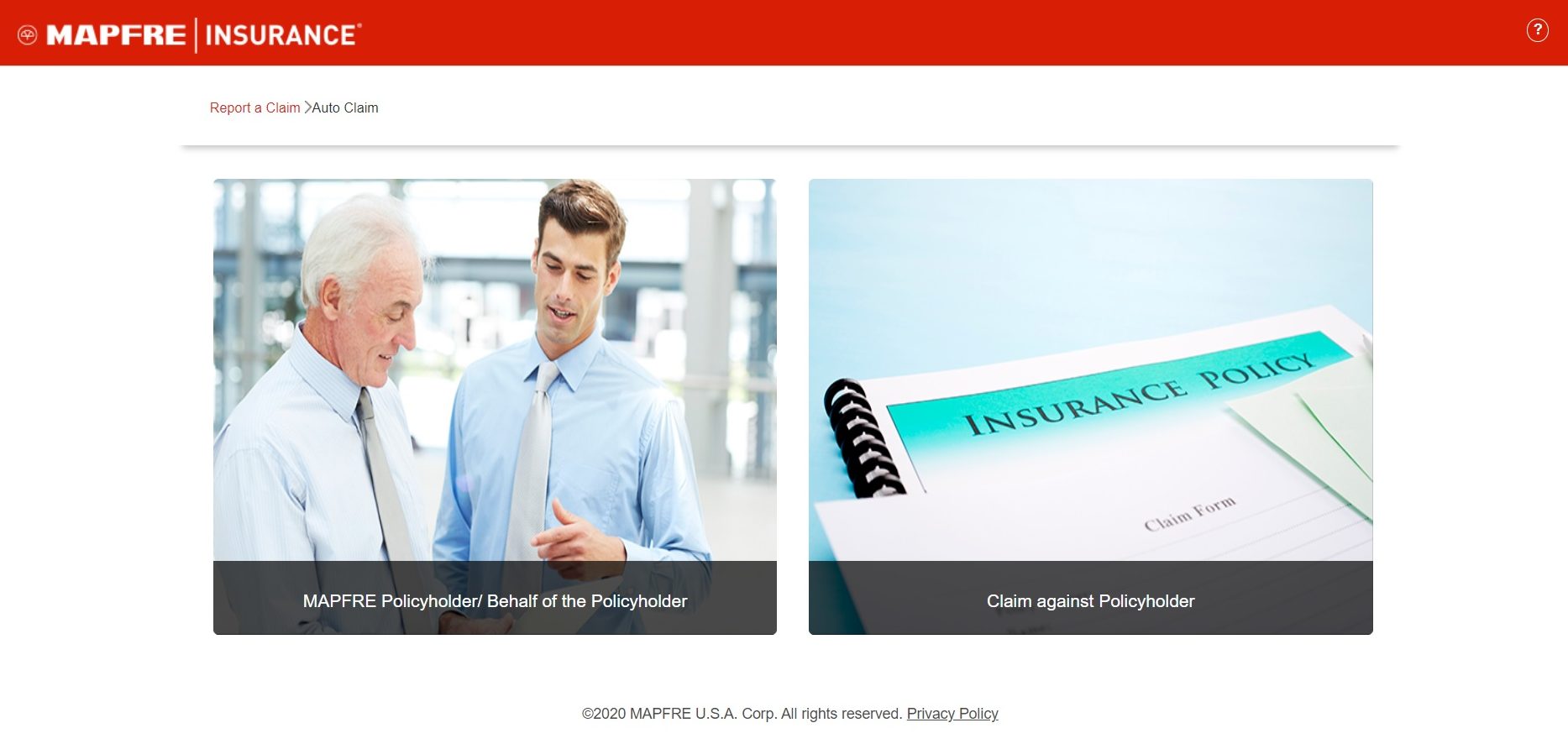

You can use this option to file a claim on your own insurance or to file a claim against another driver.

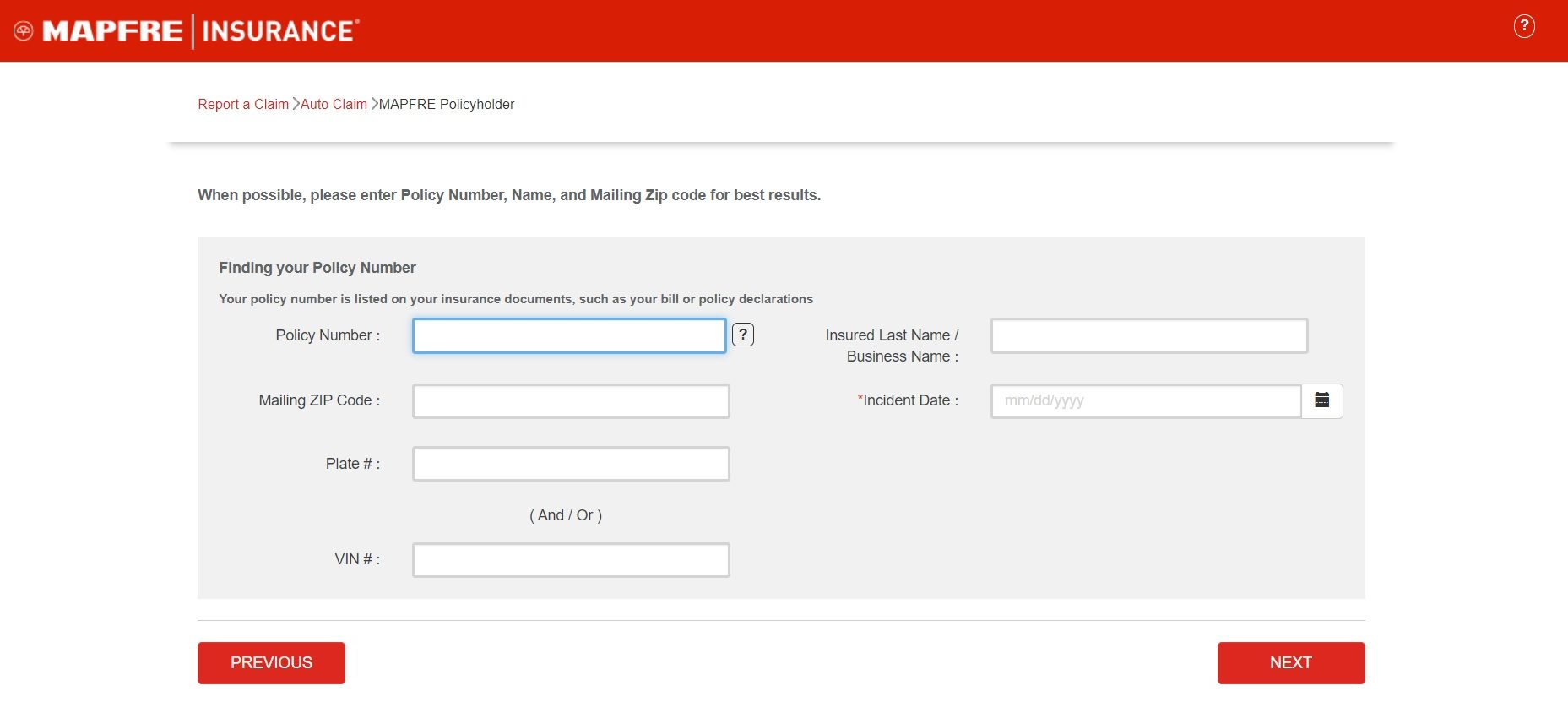

If you file a claim on your policy, your next screen will ask for your policy information.

Once you have filled in your policy information, clicking through the next keys will submit your claim to an adjuster who will contact you within 24—48 hours.

How do I get a MAPFRE Auto Insurance quote?

While many of the largest insurance companies in the country offer online quote systems, MAPFRE requires you to contact an independent agent to get a quote. Read: How can I get an auto insurance agent in my area?

If you have questions about finding an independent agent in your area, you can always search online or use MAPFRE’s website’s find an agent section. However, it is always best to find an agent separate of an insurance company.

Using an independent agent not affiliated with any insurance company is the only way to ensure no conflict of interest.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Is MAPFRE a good insurance company?

Various organizations rate insurance companies on everything from financial stability to customer complaints, making it easier for customers to choose which insurance company is right for them.

The ratings for MAPFRE are as follows:

A.M. Best – As of 2019, A.M. Best gives MAPFRE an A rating on financial stability. Their scale goes from A++ to D, so this is a solid rating but nowhere near the best possible rating for the company.

Better Business Bureau – The Better Business Bureau rates companies on ethics and consumer complaints by state. While the BBB gives MAPFRE an A+ rating in Massachusetts, MAPRFE insurance reviews on the BBB by consumers on the site only rate the company one star, and there are complaints about it having the worst claim service, so it may be worth your time to do some research before making a purchase.

Moody’s – Moody’s rates companies based on financial aspects, from Aaa to C, with Aaa being the highest rating and C being the lowest. Most recently, Moody’s upgraded MAPFRE from A3 to A2.

Standard & Poor’s – Standard & Poor’s, or S&P, also rates insurance companies based on their financial abilities. On a scale from AAA to D, the company gives MAPFRE an A+ rating in 2019, an improvement from its previous A rating.

JDPower – According to JDPower and Associates, “MAPFRE Insurance ranks highest in the shopping segment, scoring 811. Progressive (803) ranks second, and Erie Insurance (798) ranks third.”

What is the MAPFRE Auto Insurance history?

MAPFRE Insurance originated in Massachusetts as The Commerce Group, Inc., founded in Webster, Massachusetts, in 1972.

MAPFRE provides a full range of insurance products, including coverage for automobiles, homes, motorcycles, watercraft, and businesses. MAPFRE Insurance is part of the MAPFRE Group, a global insurance company on five continents.

MAPFRE employs more than 38,000 people across the globe and services approximately 34 million clients. In 2011, Fortune and Forbes ranked MAPFRE among the “500 Best and Most Admired Companies in the World.”

How is MAPFRE’s online presence?

The MAPFRE website is excellent, giving you significant information in an easy-to-use format.

The only drawback to MAPFRE’s website is that you cannot get a quote online. Because they require you to get a quote from an independent agent, you cannot use their online system to compare prices with other insurance plans.

Does MAPFRE have commercials?

This may seem silly, but not all insurance companies produce commercials, especially if you need an agent to sign up for a policy.

MAPFRE does produce TV commercials for some of its markets.

While commercials are not available for every market, it is safe to assume they are advertising (in some fashion) in all 18 states where they do business in the U.S.

Is MAPFRE involved in the community?

MAPFRE is involved in every community where they sell insurance. They have a corporate volunteer program that allows their employees to get out into their local communities, they sponsor walks for autism and organizations such as Boston Children’s Hospital, and they offer mentoring programs.

Because they have locations all over the world, they have volunteers all over the world, too.

What do MAPFRE employees have to say?

American Commerce maintains four locations around the country; their Massachusetts office, an Ohio office, and two claim centers on either side of the country.

Although business records indicate the Massachusetts office is their primary address, the company website lists the Ohio dress as their main office. For your convenience, we have provided information on the Ohio office here:

American Commerce Insurance Company

3590 Twin Creeks Drive

Columbus, OH 43204

Phone: (800) 848-2945

Employees at these locations and many others have rated their employers on sites like Glassdoor and Payscale.

According to Glassdoor.com, employees rate MAPFRE as three out of five stars when it comes to being a good place to work, and 53 percent of employees would recommend them to a friend as a good place to work.

Seventy-eight percent of employees at MAPFRE approve of the CEO, which can be an important point to consider when applying for a job.

Payscale shows that the company is in line with its competition regarding salary, paying anywhere from $42,000 to $118,000 annually, depending on your job title, experience, and seniority.

How is the design of the MAPFRE website and app?

American Commerce and its fellow MAPFRE subsidiaries are committed to utilizing technology to enhance customer service. Their state-of-the-art claims centers, internet portals, and agent networks all strive to make your experience with them as profitable and convenient as possible.

The corporate website offers customers a wide range of helpful information, from safe driving tips to homeowner advice.

Furthermore, their internet portal allows managing your account and policies completely online. By signing up for an online account, customers can make payments, modify policies, purchase new policies, and learn all there is to know about auto and homeowners insurance.

Their smartphone app, GO MAPFRE, is available through the Google Play store, but the reviews are not good. Most app reviews are only one star, with an average rating of 2.8.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

American Commerce Insurance Company (Mapfre) Insurance Coverage Options

Does insurance pay for towing? What if you are hit by an uninsured driver? Like most companies, MAPFRE offers a variety of types of auto insurance coverage, including:

Liability auto insurance– Liability insurance protects your financial well-being by paying for damages to the other person’s vehicle if you are at fault in an accident. It also covers medical bills in the event of bodily injuries someone else sustained in an at-fault accident.

Uninsured Motorist Coverage – Uninsured motorist coverage, often called UM, is mandatory in some states and optional in others. It covers you at the same levels as your liability coverage if you are in an accident where an uninsured driver was at fault.

Collision auto insurance– Collision insurance protects you by paying for damages to your vehicle if you are at fault in an accident, whether you hit another vehicle or a stationary object, such as a wall or mailbox. If you have a loan on your car, you may be required by the lender to have collision insurance on your policy.

Comprehensive auto insurance – Comprehensive insurance covers damage to your car that isn’t caused during an accident. Some examples of what might be covered under a comprehensive policy are hail damage, theft, and vandalism. It will also cover you if your car is stolen.

Medical Payments – Medical payments cover necessary medical and funeral costs for yourself and your passengers in the event of an accident.

AutoMaster® Package Endorsement (ACIC states) – According to the MAPFRE website, AutoMaster coverage includes:

- Bail Bonds: Personal Belongings

- Loss of Earnings: Seat / Belt Air Bag Death Benefit

- Transportation: Expense Waiver of Collision Deductible

- Cellular Phone: Replacement Digital Media Device Replacement

- Laptop Computer: Replacement New Car Replacement Coverage

Substitute Transportation – If you need a rental car because of an accident, substitute transportation coverage will cover that cost.

Towing and Labor – When it comes to tow trucks or basic repairs on the side of the road, towing and labor coverage would help cover the cost of those services.

American Commerce Insurance Company (Mapfre) Insurance Rates Breakdown

| Insurer | MAPFRE | Geico | Allstate |

|---|---|---|---|

| Average Annual Premium | $4,472 | $3,546 | $4,949 |

| Complaints Score (lower is best) | 3.0 | 0.84 | 0.88 |

Although MAPFRE is higher than Geico, it’s lower than Allstate, so it’s worth looking at their coverage when comparing rates if they are available in your area.

The table below shows average liability rates by state.

Average Annual Liability Auto Insurance Rates by State

| State | Average Annual Liability Auto Insurance Rates |

|---|---|

| Alabama | $372.57 |

| Alaska | $547.34 |

| Arizona | $488.59 |

| Arkansas | $381.14 |

| California | $462.95 |

| Colorado | $477.10 |

| Connecticut | $633.95 |

| Delaware | $776.50 |

| District of Columbia | $628.09 |

| Florida | $845.05 |

| Georgia | $490.64 |

| Hawaii | $458.49 |

| Idaho | $337.17 |

| Illinois | $430.54 |

| Indiana | $372.44 |

| Iowa | $293.34 |

| Kansas | $342.33 |

| Kentucky | $518.91 |

| Louisiana | $727.15 |

| Maine | $333.92 |

| Maryland | $599.48 |

| Massachusetts | $587.75 |

| Michigan | $722.04 |

| Minnesota | $439.58 |

| Mississippi | $437.38 |

| Missouri | $399.41 |

| Montana | $387.77 |

| Nebraska | $349.07 |

| Nevada | $647.07 |

| New Hampshire | $393.24 |

| New Jersey | $865.55 |

| New Mexico | $462.21 |

| New York | $784.98 |

| North Carolina | $357.59 |

| North Dakota | $282.55 |

| Ohio | $376.16 |

| Oklahoma | $441.57 |

| Oregon | $553.43 |

| Pennsylvania | $495.02 |

| Rhode Island | $720.06 |

| South Carolina | $497.50 |

| South Dakota | $289.04 |

| Tennessee | $397.73 |

| Texas | $498.44 |

| Utah | $471.26 |

| Vermont | $340.98 |

| Virginia | $413.12 |

| Washington | $568.92 |

| West Virginia | $501.44 |

| Wisconsin | $359.84 |

| Wyoming | $323.38 |

| U.S. Average | $516.39 |

Here’s a look at average rates for collision coverage across the U.S.

Collision Auto Insurance Monthly Rates by State

| State | Monthly Rates |

|---|---|

| Alabama | $25 |

| Alaska | $30 |

| Arizona | $22 |

| Arkansas | $25 |

| California | $30 |

| Colorado | $22 |

| Connecticut | $29 |

| Delaware | $25 |

| District of Columbia | $37 |

| Florida | $21 |

| Georgia | $27 |

| Hawaii | $25 |

| Idaho | $17 |

| Illinois | $24 |

| Indiana | $20 |

| Iowa | $17 |

| Kansas | $21 |

| Kentucky | $21 |

| Louisiana | $33 |

| Maine | $21 |

| Maryland | $28 |

| Massachusetts | $30 |

| Michigan | $32 |

| Minnesota | $18 |

| Mississippi | $25 |

| Missouri | $22 |

| Montana | $21 |

| Nebraska | $19 |

| Nevada | $24 |

| New Hampshire | $23 |

| New Jersey | $30 |

| New Mexico | $22 |

| New York | $30 |

| North Carolina | $22 |

| North Dakota | $19 |

| Ohio | $21 |

| Oklahoma | $25 |

| Oregon | $18 |

| Pennsylvania | $26 |

| Rhode Island | $31 |

| South Carolina | $21 |

| South Dakota | $17 |

| Tennessee | $24 |

| Texas | $28 |

| Utah | $21 |

| Vermont | $23 |

| Virginia | $22 |

| Washington | $21 |

| West Virginia | $27 |

| Wisconsin | $17 |

| Wyoming | $23 |

| U.S. Average | $25 |

Below you can see state averages for comprehensive coverage.

Comprehensive Auto Insurance Monthly Rates by State

| State | Rates |

|---|---|

| Alabama | $12 |

| Alaska | $12 |

| Arizona | $15 |

| Arkansas | $15 |

| California | $8 |

| Colorado | $13 |

| Connecticut | $11 |

| Delaware | $9 |

| Florida | $9 |

| Georgia | $13 |

| Hawaii | $8 |

| Idaho | $9 |

| Illinois | $10 |

| Indiana | $10 |

| Iowa | $14 |

| Kansas | $19 |

| Kentucky | $11 |

| Louisiana | $17 |

| Maine | $8 |

| Maryland | $12 |

| Massachusetts | $11 |

| Michigan | $12 |

| Minnesota | $14 |

| Mississippi | $16 |

| Missouri | $14 |

| Montana | $17 |

| Nebraska | $17 |

| Nevada | $10 |

| New Hampshire | $9 |

| New Jersey | $10 |

| New Mexico | $14 |

| New York | $13 |

| North Carolina | $10 |

| North Dakota | $19 |

| Ohio | $9 |

| Oklahoma | $17 |

| Oregon | $7 |

| Pennsylvania | $11 |

| Rhode Island | $10 |

| South Carolina | $14 |

| South Dakota | $19 |

| Tennessee | $11 |

| Texas | $16 |

| Utah | $9 |

| Vermont | $10 |

| Virginia | $11 |

| Washington | $9 |

| Washington, D.C. | $19 |

| West Virginia | $16 |

| Wisconsin | $11 |

| Wyoming | $19 |

| U.S. Average | $12 |

You must contact a MAPFRE insurance agent to get a quote for their policies.

Is MAPFRE the same as Commerce Insurance? To clarify, MAPFRE owns American Commerce, which operates as a subsidiary. So they are the parent company, and American Commerce sells insurance under that name. MAPFRE also operates under a few different names and locations, including MAPFRE Insurance of New York, MAPFRE Florida, and Citation Insurance Company.

Typically, smaller insurance companies or companies requiring independent agents have higher rates than larger insurers. Still, they may offer unique products or stellar customer service to make up for the difference. If these things are important to you, contact an independent agent in your area to learn more.

American Commerce Insurance Company (Mapfre) Discounts Available

Some companies offer discounts for good driving records, high grades for student drivers, hybrid vehicles, and many more. MAPFRE has several available auto insurance discounts, including:

- AAA Member Discounts – members of this auto group are entitled to a discount through MAPFRE,

- Multi-line discounts – If you have multiple insurance plans through MAPFRE, they will give you a discount for bundling your coverage. Learn how to save money by bundling insurance policies.

- Welcome Back credit (when prior Loyalty applies) – Former MAPFRE customer? You may be entitled to a discount.

- Paid-in-Full discount – If you pay your bill simultaneously rather than month-by-month, you’ll receive a discount on your insurance.

- Good Student discount – B average or higher? That’ll earn young drivers a discount.

- Student away from home discount – Going to college away from home? You may be entitled to a discount for that. Check with an agent to determine American Commerce’s definition of qualifying students.

- Annual Mileage discount – If you drive less, you pay less.

- Smart driver discount – Get a discount for letting MAPFRE track your driving behavior with an app or a device.

- Multi-Car discount – Insure two or more vehicles receive a multi-car discount.

- Green discount – Hybrid or other environmentally friendly vehicles are entitled to the Green discount.

These are not the only discounts available, so be sure to ask your agent about other possible discounts if you choose to sign up for a plan with MAPFRE.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What is American Commerce Auto Insurance?

American Commerce Auto Insurance is an insurance company that offers auto insurance coverage for vehicles. They provide various policies to protect drivers and their vehicles against potential risks.

What types of auto insurance coverage does American Commerce Auto Insurance offer?

American Commerce Auto Insurance offers a range of coverage options, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, personal injury protection (PIP), and more. The specific coverage options may vary based on the policy and state regulations.

How can I contact American Commerce Auto Insurance?

To contact American Commerce Auto Insurance, you can reach out to their customer service department through phone, email, or other contact methods provided on their official website or policy documents.

How can I file a claim with American Commerce Auto Insurance?

To file a claim with American Commerce Auto Insurance, you can contact their claims department directly. They will guide you through the claims process, provide the necessary forms, and assist you in gathering any required information. It is important to report accidents or incidents promptly to initiate the claims process.

Does American Commerce Auto Insurance offer roadside assistance?

American Commerce Auto Insurance may offer optional roadside assistance coverage as an add-on to their policies. Roadside assistance can provide services such as towing, jump-starts, fuel delivery, and lockout assistance in case of emergencies or breakdowns while on the road. The availability of this coverage may vary based on the policy and state regulations.

Can I manage my American Commerce Auto Insurance policy online?

Yes, American Commerce Auto Insurance typically provides an online portal or mobile app that allows policyholders to manage their policies. This may include tasks such as making payments, viewing policy documents, updating personal information, and accessing digital ID cards.

How are American Commerce Auto Insurance premiums determined?

American Commerce Auto Insurance calculates premiums based on several factors, including the driver’s age, driving history, location, type of vehicle, coverage options selected, and other relevant factors. Premiums can vary from person to person based on these factors.

Does American Commerce Auto Insurance offer discounts?

American Commerce Auto Insurance may offer discounts to eligible policyholders. These discounts can vary but commonly include safe driver discounts, multi-policy discounts, good student discounts, and discounts for certain safety features installed in the vehicle. The availability and specifics of discounts may vary based on the policy and state regulations.

Can I cancel my American Commerce Auto Insurance policy?

Yes, policyholders generally have the option to cancel their American Commerce Auto Insurance policy. However, the specific terms and conditions related to cancellations may vary. It’s advisable to review the policy documents or contact the company directly to understand the cancellation process and any applicable fees or penalties.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Honey717

Great Company

Pat41rogers

Horrible company. They try to scam you

musclecars

Great Company if you Never File a Claim

nicollai

American Commerce review

sbrodeur92

Car Insurance

WhyThisWTF

Insurance that works

mine88

great company

929sunshine

American Commerce Insurance is Outstanding

luiss

Greats

Agentmeow

Precautions in adding a vehicle