Which states have the cheapest auto insurance rates?

The cheapest car insurance states depend on many factors, but the state with the cheapest average auto insurance is Idaho, whose residents paid about $57/month. Find out which states have the lowest auto insurance rates and then compare free quotes online!

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

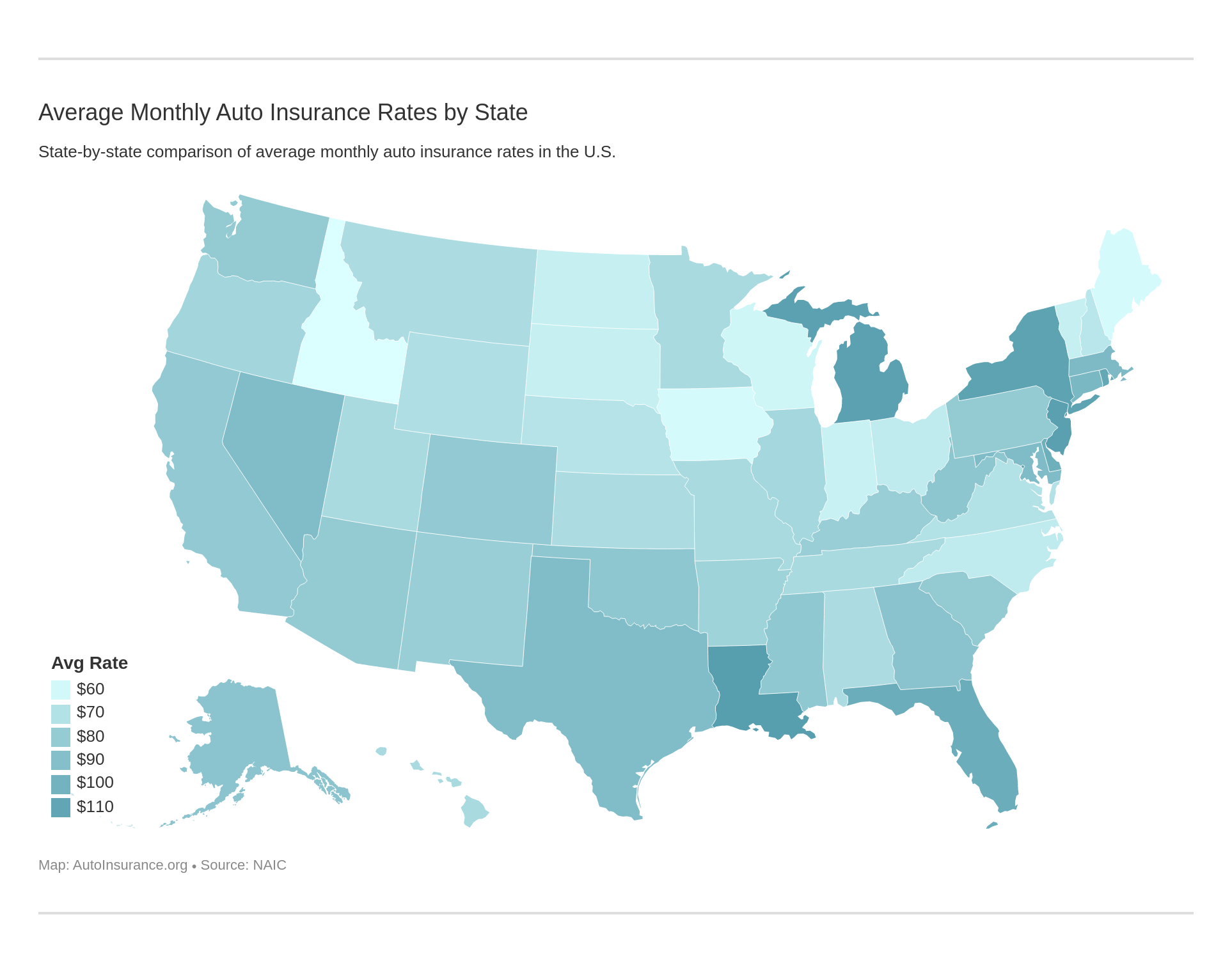

As you probably know by now, each of the country’s 50 states has different regulations regarding car insurance. So determining which states have the cheapest insurance rates requires taking considering different regulations as well as different driving environments.

See the below car insurance rate comparison by state and learn how your state of residence stacks up to the cheapest states for auto insurance costs.

Additionally, adding the safety of individual drivers covered in that state is the final piece of the insurance rate equation.

Because state auto laws and trends among local groups of drivers change so frequently, an annual ranking of insurance companies based on price is different almost on an annual basis.

For example, in 2009 the cheapest auto insurance could be found in Vermont and Ohio. But for 2010 Maine took the top spot, bumping Vermont and Ohio down one spot each.

To understand this, let’s take a look at some of the factors involved. Find the cheapest auto insurance by using our FREE tool above!

How do regulations affect which states have the cheapest auto insurance rates?

All 50 states require some type of auto insurance; whether it’s from a licensed insurance company or sufficient proof of the ability to self-insure.

In addition, each state defines a minimum level of coverage required by all drivers who live there. This minimum coverage is usually expressed using a three-number system. For example, the minimum requirements in Alaska are 50/100/25.

For example, the minimum requirements in Alaska are 50/100/25. As a general rule, those three numbers represent, in order: bodily injury limit per-person, total bodily injury limit per accident, and total property damage per accident.

In states where coverage for uninsured/underinsured drivers is required, the three-number representation might be slightly different.

Regardless, if we compare Alaska’s minimums to some other states, we find cases like Delaware (15/30/5) where the minimums are significantly lower. That’s the first factor in differing rates from state to state.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Does population affect which states have the cheapest auto insurance rates?

The auto insurance game is based solely on the idea of risk versus reward.

In other words, the insurance company is taking a risk of financial loss in agreeing to write a policy for you. The premiums that you pay equals money in their pocket; money which they can invest to earn a profit.

The question then becomes, is that reward (profit) greater than the risk (a claim) they are assuming?

Considering this, it’s easy to see that a state’s population factors into how much your car insurance costs.

In largely rural states like Kansas or Iowa, with miles and miles of farmland and very few people, the likelihood of a car accident is much less when compared to a densely populated state like California.

The range of insurance rates can also range among local counties and municipalities. Where there are fewer people, there tend to be lower insurance rates as well.

A “hidden” part of this equation has to do with how often you drive your car and in what geographical locations. This is why an insurance agent will ask questions about your daily commute during the quote process.

If you are someone who must commute to downtown L.A. every day, you’re at a higher risk than someone who works from home in the middle of Montana. The L.A. commuter will have higher insurance rates because he or she poses a higher risk.

What else goes into determining which states have the cheapest car insurance rates?

In addition to state regulations and population density, state taxes also play a big part that very few people pay attention to.

The idea of state taxation when it comes to insurance escapes most people because the word “tax” usually doesn’t appear on your declaration pages or your bill. But make no mistake about it, most states still tax insurance policies.

It’s easy to spot a state tax if you know what to look for. Words like “surcharge” or “fee” are dead giveaways. So in New York State, for example, the typical declaration page shows several state surcharges added to the policy, in addition to the insurance company’s regular price.

Whether the New York State government cares to admit it or not, their surcharges are still taxes. Heavily taxed states tend to have higher insurance rates than others.

In conclusion, it must be stated that while different states can see different insurance rates based on the factors previously discussed, the single most important factor in keeping the car insurance rates low is your own performance behind the wheel.

When it comes down to it, you are the one most responsible for the risk you pose to your insurance company.

To find and maintain the cheapest car insurance rates requires that you drive safely, responsibly, and legally. If you do so, you will get some of the best rates in the industry for the car you drive.

Compare auto rates now, by using our FREE online tool below!

Frequently Asked Questions

Which states have the cheapest auto insurance rates?

The state with the cheapest average auto insurance rates is Idaho, where residents paid about $57 per month. However, the cheapest car insurance states can vary based on various factors. It’s recommended to compare free quotes online to find the lowest auto insurance rates in your specific state.

How do regulations affect which states have the cheapest auto insurance rates?

Each state has different regulations regarding car insurance, including the minimum coverage required. The minimum coverage is usually expressed using a three-number system, representing bodily injury limits per person, total bodily injury limits per accident, and total property damage per accident. Variations in these requirements among states contribute to differing insurance rates.

Does population affect which states have the cheapest auto insurance rates?

Yes, population density plays a role in determining auto insurance rates. In states with lower population and fewer vehicles on the road, the likelihood of accidents is generally lower, leading to lower insurance rates. Densely populated states tend to have higher rates due to increased accident risks.

What else goes into determining which states have the cheapest car insurance rates?

Besides regulations and population density, state taxes can also impact insurance rates. Some states impose surcharges or fees on insurance policies, which can increase the overall cost. Heavily taxed states often have higher insurance rates. Additionally, individual driving habits and performance are significant factors. Safe, responsible, and legal driving can help maintain lower insurance rates.

How can I find and maintain the cheapest car insurance rates?

To find the cheapest car insurance rates, it’s important to compare quotes from different insurance companies. This allows you to explore various options and select the most affordable coverage. Additionally, maintaining a good driving record, driving safely, and adhering to traffic laws are crucial for keeping insurance rates low.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.