What does standard auto insurance cover?

You might be wondering what standard auto insurance covers. Basic car insurance covers minimum state liability limits, collision, and comprehensive coverage, which averages $119/mo altogether. Learn more about standard vs. non-standard auto insurance and whether 250/500 liability insurance is worth it below.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated December 2024

The best auto insurance companies offer policies in adherence with each state DMV. All drivers must carry automobile insurance to comply with state auto insurance laws. But what does standard auto insurance cover?

Standard types of auto insurance provide personal liability coverage after an accident to pay for damages you cause. Full coverage auto insurance pays for damages to your vehicle after an accident and is part of standard auto insurance if you add it to your policy.

Standard and non-standard auto insurance provide the same coverage, but non-standard rates are more expensive. Keep reading to learn more about basic auto insurance coverages explained, what standard auto insurance covers, and what kind of car insurance policy you might need.

- Understanding Auto Insurance

- If someone breaks into your car, does insurance cover it?

- Does car insurance cover earthquake damage?

- Does car insurance cover a hit-and-run?

- Does car insurance cover hurricane damage?

- Does car insurance cover storm damage?

- Does car insurance cover hitting a deer?

- Does car insurance cover hail damage?

- Does auto insurance cover vandalism?

- Do you need auto insurance to drive someone else’s car?

- Does auto insurance cover vehicle theft? (Can’t-Miss Details for 2026)

- Is auto insurance active during a state of emergency?

- Does auto insurance cover engine failure? (2026)

- Does auto insurance cover hitting a pole? (2026)

- Do you need auto insurance to be towed? (What You Should Know for 2026)

- Does auto insurance cover key replacement?

- How many tires does auto insurance cover? (2026)

- Does my auto insurance cover rental cars? (2026)

- Does auto insurance cover flat tires?

- Does auto insurance cover car wash damage?

- Does auto insurance cover shopping cart damage?

- Does auto insurance cover towing a boat?

- Who is covered on my auto insurance?

- Does auto insurance cover private property?

- Does auto insurance cover someone else driving my car?

- Does auto insurance cover you when driving abroad?

- Does auto insurance cover towing a trailer?

- Does auto insurance cover bullet holes? (2026)

- Does auto insurance cover putting in the wrong fuel?

- Does auto insurance cover transmission repair? (2026)

- Does auto insurance cover arson? (2026 Coverage Details)

- Does auto insurance cover bumper damage?

- Does auto insurance cover tire theft? (2026 Coverage Details)

- Does auto insurance cover hydrolock?

- Does auto insurance cover water leaks? (2026)

- Does auto insurance cover broken side mirrors?

- Does auto insurance cover a clutch? (2026)

- Does auto insurance cover interior damage? (2026)

- Does auto insurance cover lightning strikes?

- Does auto insurance cover slashed tires?

- Does auto insurance cover falling asleep at the wheel?

- Does auto insurance cover riot damage?

- Does auto insurance cover battery replacement? (2026)

- Does auto insurance cover rodent damage?

- Does auto insurance cover car seats?

- Does auto insurance cover my child under my policy?

- Does auto insurance cover stolen vehicles? (2026)

- Does auto insurance cover a second driver when renting a car? (2026)

- Does auto insurance cover cracked wheels? (2026)

- What Does Auto Insurance Cover?

- Auto Insurance Coverage for Windshields

- Does car insurance cover windshield damage or replacement?

- Best Windshield Replacement Coverage in Florida (2026)

- Does Progressive auto insurance cover windshield replacement?

- Best Windshield Replacement Coverage in Illinois (Top 10 Companies Ranked for 2026)

- Best Windshield Replacement Coverage in Oklahoma (Our Top 10 Picks for 2026 )

- Best Windshield Replacement Coverage in Oregon (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in Nebraska (Top 10 Companies Ranked for 2026)

- Best Windshield Replacement Coverage in Maryland (Top 10 Companies Ranked for 2026)

- Best Windshield Replacement Coverage in Colorado (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in Connecticut (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in Texas (Top 10 Companies Ranked for 2026)

- Best Windshield Replacement Coverage in Arizona (Top 10 Companies for 2026)

- Best Windshield Replacement Coverage in Arkansas (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in Virginia (Top 10 Companies for 2026)

- Best Windshield Replacement Coverage in Indiana (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in Wyoming (Top 10 Companies Ranked for 2026)

- Best Windshield Replacement Coverage in South Dakota (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in Vermont (Top 10 Companies for 2026)

- Best Windshield Replacement Coverage in Washington (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in Minnesota (Top 10 Companies in 2026 )

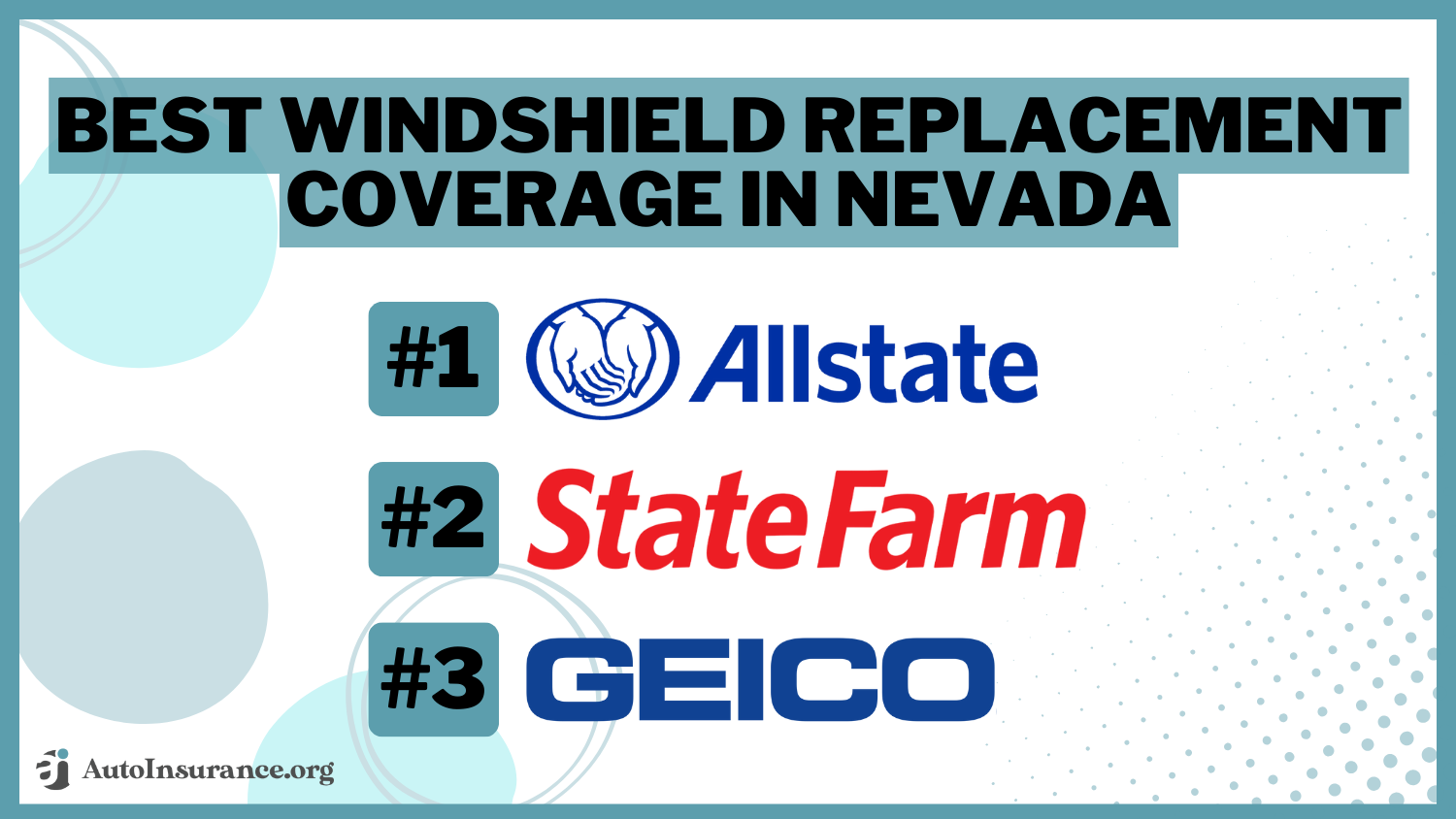

- Best Windshield Replacement Coverage in Nevada (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in North Carolina (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in Iowa (Top 10 Companies Ranked for 2026)

- Best Windshield Replacement Coverage in Kansas (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in Kentucky (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in Louisiana (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in Massachusetts (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in California (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in Delaware (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in Idaho (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in Alabama (Top 10 Companies Ranked for 2026)

- Best Windshield Replacement Coverage in Alaska (Top 10 Companies Ranked for 2026)

- Best Windshield Replacement Coverage in Utah (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in New Mexico (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in New Hampshire (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in Mississippi (Top 10 Companies for 2026)

- Best Windshield Replacement Coverage in Rhode Island (Top 10 Companies Ranked for 2026)

- Best Windshield Replacement Coverage in South Carolina (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in Pennsylvania (Top 10 Companies in 2026)

- Best Windshield Replacement Coverage in Maine (Top 10 Companies Ranked for 2026)

- Best Windshield Replacement Coverage in Missouri (Top 10 Companies Ranked for 2026)

- Best Windshield Replacement Coverage in Montana (Top 10 Companies Ranked for 2026)

- Best Windshield Replacement Coverage in Georgia (Top 10 Companies Ranked for 2026)

- Best Windshield Replacement Coverage in Hawaii (Top 10 Companies for 2026)

- Does auto insurance cover broken car windows?

- Auto insurance companies offer standard insurance and non-standard insurance

- Standard insurance covers collision, comprehensive, and liability

- Special situations, such as past DUIs and classic cars, may require you to purchase a non-standard insurance policy

Standard Auto Insurance Policies

Auto insurance coverage falls into three major categories:

- Collision: Collision covers damage in the event of a collision between a moving vehicle and another vehicle or stationary object. Payout limits and deductibles determine how much money the insurance company will pay for each claim and how much money the driver must pay out of pocket.

- Comprehensive: This component covers damage that may occur while a vehicle is not in motion, including theft, vandalism, storm damage, or fire. Compare the difference between collision vs. comprehensive auto insurance coverage.

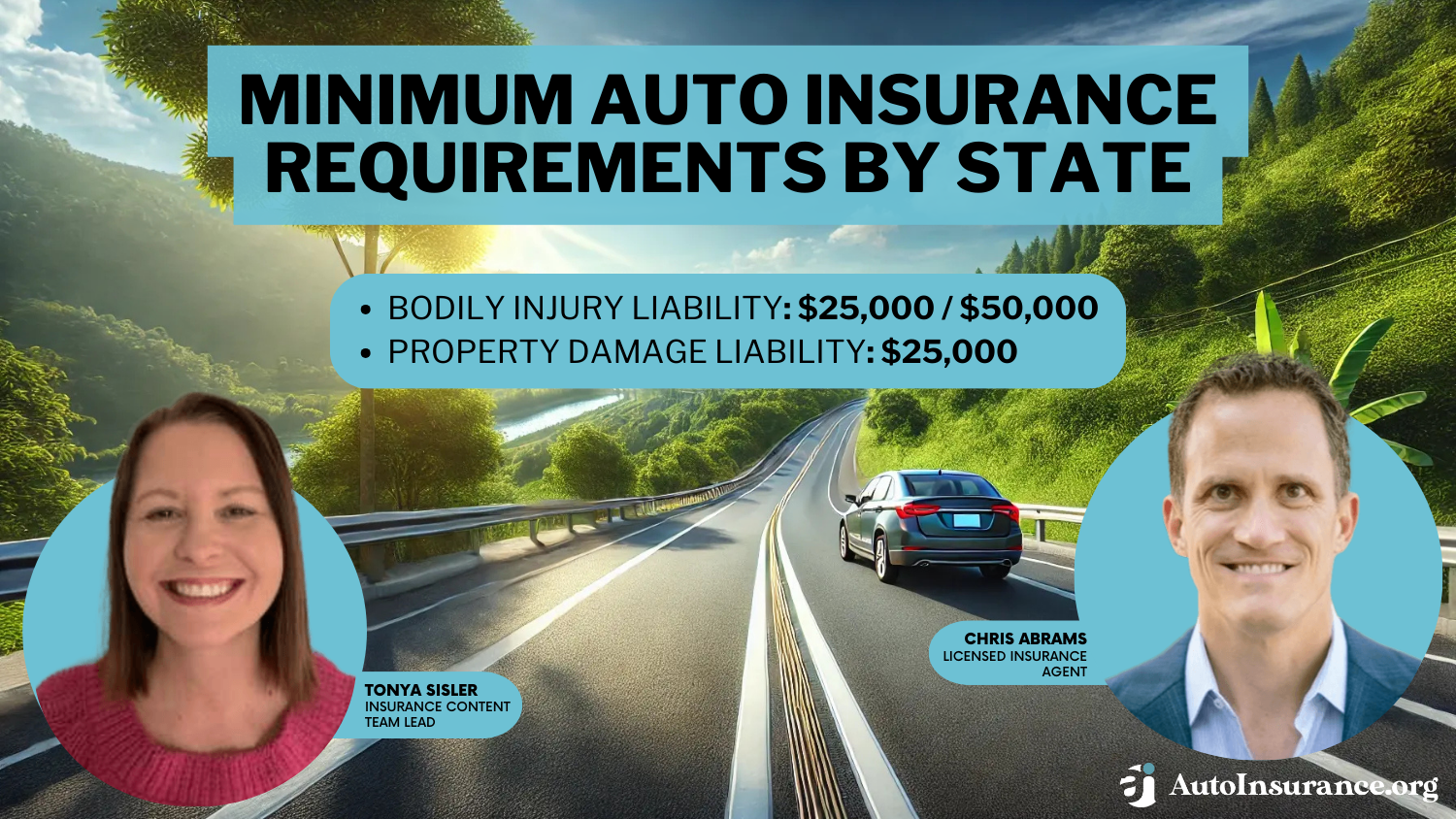

- Liability: Is 250/500 insurance worth it? Many states require 250/500 in bodily injury and property damage liability to cover the other driver in accidents you cause, but most require lower limits, such as 25/50. Either way, 250/500 in liability insurance might be worth it to cover serious injuries or collisions with expensive cars.

Some states require standard auto insurance policies made up of various coverages that some drivers may be unfamiliar with, including:

- Medical payments coverage: Do you need medical payments coverage on auto insurance? Medical payments helps cover medical bills sustained by the auto insurance policyholder in an accident regardless of fault. This policy also covers passengers in the policyholder’s vehicle.

- Uninsured motorist coverage: In the case of an accident, policyholders may encounter drivers that don’t have insurance. Uninsured motorist coverage will cover the cost of the other driver.

Multiple factors affect standard auto insurance rates, including coverage type, accident statistics, repair statistics, prices for replacement parts, driving records, and car prices.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Non-Standard Auto Insurance Policies

Some insurance companies can refuse to underwrite a standard auto insurance policy. You might need to buy non-standard auto insurance if you have a:

- High incidence of claims: Drivers with a significant number of auto insurance claims can be denied coverage from standard auto insurance companies

- Serious accident: A driver who caused an extremely serious accident through negligence will find the search for auto insurance coverage very difficult. Insurers can refuse to underwrite a policy based on your driving record

- DUI: People always want to know if it is possible to find cheap auto insurance with DUI violations. Some insurance companies may refuse to underwrite auto insurance policies for anyone with a DUI conviction.

- Custom-built car: Vehicles with custom features are not underwritten through standard auto insurance policies.

- Classic car: Collectible and classic cars do not depreciate like standard vehicles and often will not be covered through standard auto insurance.

Fortunately, you can look for insurance quotes without providing a Social Security number or driver’s license. Compare rates from the best auto insurance companies for high-risk drivers to find the best price on a non-standard policy.

Auto Insurance Discounts On Standard and Non-Standard Policies

Auto insurance discounts are available to drivers who demonstrate responsible driving habits. It is important to know what discounts are offered and know which ones you qualify for, such as:

- Driving record: Insurance companies rely on past performance as an indicator of future risk. A clean driving record can lower your premiums. Typically, your past three to five years influence annual premiums. Read more about how auto insurance companies check driving records.

- Driver profile: Age, location, and claims history are tracked closely to create statistics for each insured class. All these factors will affect the cost of your premiums.

- Vehicle features: Some cars are more expensive to repair or replace than others. The value of your car will also affect the cost of your insurance rates.

- Driver education: Driver training courses reduce the number of claims that are filed by drivers. Significant discounts on standard insurance policies are awarded to drivers who are willing to complete these courses.

Automobile insurance companies cover a wide variety of drivers and vehicles through standard car insurance policies.

What You Need to Know About Standard Auto Insurance Coverage

Most state minimum auto insurance requirements include liability, which is a type of standard car insurance coverage. You can add full coverage with collision and comprehensive insurance to any standard policy, but your rates will increase. Rates are also higher for non-standard car insurance, but those types of policies typically provide the same type of coverage. Read more about what non-standard auto insurance companies offer.

Enter your ZIP code into our free quote tool to compare standard and non-standard auto insurance costs from multiple companies online to get the best deal.

Frequently Asked Questions

What does a standard auto policy cover?

Standard auto insurance covers bodily injury and property damage liability in at-fault accidents. It also covers your injuries and damages if you have full coverage.

How much car insurance do I need?

Most states require at least 25/50/25 worth of liability insurance, or basic car insurance coverage. However, contact your insurance company to learn how much car insurance you need.

What is standard insurance coverage?

The standard parts of auto insurance are liability coverage, collision coverage, and comprehensive coverage.

What should I do if I have an accident?

Ensure safety, contact the police, exchange information, document the accident, and notify your insurance company.

What factors affect auto insurance rates?

Factors include driving record, age, location, vehicle type, mileage, credit history, and coverage choices.

How can I save money on auto insurance?

You can save by maintaining a good driving record, bundling policies, using available discounts, choosing a higher deductible, and comparing quotes.

Can I customize my auto insurance coverage?

Yes, you can customize your standard insurance policy with additional options, such as roadside assistance coverage or rental car reimbursement.

What is comprehensive insurance?

Comprehensive insurance covers non-collision damage to your vehicle, like theft or natural disasters. Learning auto insurance coverages explained and what standard car insurance includes is vital to finding the best basic insurance policy.

What is collision insurance?

Collision insurance covers damage to your vehicle after you collide with other vehicles or objects.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.